Mixed signals this week leave Bernanke still needing to earn his pay.

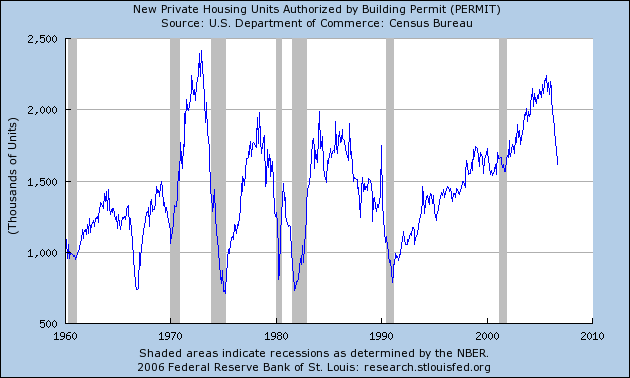

Something for everyone in this week’s data on housing from the Census Bureau. Pessimists will note the alarming 6% plunge during the month of September in seasonally adjusted new building permits. That one-month drop from the already low levels of August leaves them down 28% from September 2005. News this week of rising delinquencies and foreclosures provides more fuel for the pessimists’ fire.

|

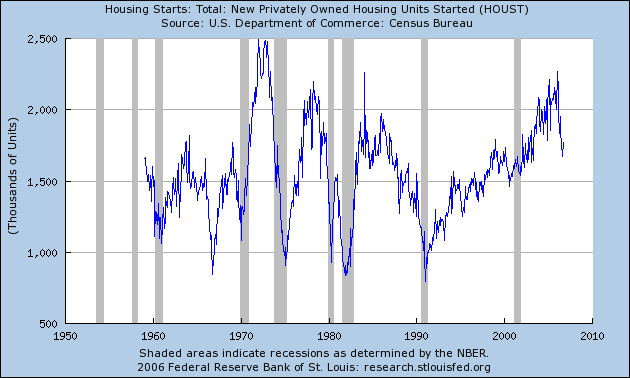

Optimists, on the other hand, might see new evidence that the housing bottom has been reached in the encouraging move in the number of new housing units started. This was up 6% from August to September, though still down 18% year to year:

|

For those of us who were unsure before this week, we’re stuck in the same rut at the end of the week. The effect of this summer’s drop in mortgage rates should start to show up in next month’s home sales, and we’ll have to wait to see if that effect is sufficient to outweigh the possible dynamics from financial distress and rapidly changing expectations.

The optimists seem to be winning the argument as far as commodity markets are concerned. Commodity prices had been battered down as the dismal housing data came in during September. But over the last two weeks, copper, zinc, and aluminum have surged back up dramatically. It may be that the only way these prices will be kept in check is if GDP growth stays below 2% for the coming year.

And although the headline CPI showed a dramatic 0.5% drop within the month of September alone, Dave Altig is none too impressed, noting that more robust measures such as the median CPI are still up 3.5% year-to-year:

|

Mixed (as opposed to really bad) news for housing and “unwelcome” news on core inflation have eroded the likelihood that we will see the Fed cut interest rates by spring. Here’s the recent behavior of the March 2007 fed funds futures contract (subtract from 100 to get the implied interest rate):

|

At the start of this month, traders had been betting on a 5.0% rate (a cut of 25 basis points from the current value) by March. Those hopes have now evaporated, with the current consensus for a prediction of no change.

I’m wondering though whether “no change” might be the least likely outcome at this point. If we start to see some serious financial repercussions develop in housing, I’d look for a rate cut, and wouldn’t worry in that event about commodity prices, since I would expect to see commodities fall sharply on news of a big downturn in economic activity. On the other hand, if instead we have seen the bottom for housing and the core inflation numbers remain this high, I’d look for the Fed to tighten further.

Either way, you might want to exercise some caution before thinking you’ll pick up some homebuilder equities at these bargain prices.

Technorati Tags: macroeconomics,

housing,

inflation,

Federal Reserve

My judgment is definitely short homebuilder and short energies, at least until prices drop or demand increases enough to begin to clear inventories for both crude (GIF) and for-sale housing (PNG).

The next data for the latter come out along with advance GDP on the 27th. I am looking for both reports to be pretty icky. On homebuilders, while not currently short (though I have been recently) I would not even consider a long position until book multiples drop below 1x (the ISE homebuilder index is ~1.4x right now) *and* there have been enough writedowns that you’re confident the denominator isn’t going to drop any more going forward.

It’s one thing to short home building (limited to the U.S.), it is entirely another ball of wax to short energy — where the marginal increase in demand does not rest necessarily with US.

Some homebuilders did reach below 1x book. Though probably not any more. I would not be long home builders either. Terrible operating cash flow. All phantom earnings go into building up inventory — and had been this way for the past three years.

I’m sorry for the simplistic question, but I don’t understood why increasing housing unit starts is always portrayed as good news for the market.

I can imagine that a higher level of starts reflects optimism in future prices, but Econ 101 says that an increase in supply will result in downward pressures on prices. If I want to sell a house in a year but 10 houses get built next door, I may be reassured that the builders seem to think they can make a profit, but regardless I will get a price lower than I would have gotten if those houses were never built.

In the long run why is increasing housing supply considered to be good for the market?

That’s an interesting point, Brian. I guess we’re making an implicit assumption that the builders know what they’re doing, reading starts as a signal of optimism from people closest to ground zero. In the long run, certainly, starts will equal sales, and in the current episode, we’ve been seeing starts and sales fall together. But even from your perspective, I still see no way to interpret the permits and starts data as sending anything but conflicting signals.

OPEC doesn’t cut output because demand is ballooning, nor does crude in storage keep going up when it’s trading at a market-clearing price.

FD: while I have had old-fashioned, naked shorts in the refiner and producer space at times, my exposure now is all delta-negative long-vol.

Why do metals futures appear to be breaking out but spot prices are still flat?

As usual, I probably don’t know what I’m talking about, but that never stops me. So I’ll speculate on the housing permits versus starts. Suppose I’m a builder. I think peak has arrived, i.e. housing volume and/or prices will be decreasing.

Now I’m told that home builders tend to go all out when prices are high–with the caveat of a limited supply in construction workers and materials (inflationary concerns, etc). I’ve heard the builders don’t try to predict the top. They just go all out until the punch bowl runs dry, that they’ll make more money collecting it while the goings good and then, when the peak has clearly arrived, taking either losses or lessor profits on the remaining construction that is underway.

So if that is true, and I’m a builder, I’m going to (a) probably have decided a while back that we’ve reached or passed a peak (b) slow down on permits and (c) start laying off or not continuing contracts with people who might have been building the next set of starts. But I will keep the people building right now.

Since I have the permits, and probably in some cases contracts for materials, I’m going to build at least some of the houses in my plans, but at a slower rate. So starts will slow, until workers finishing up on existing houses (already started) move to new starts.

Now if I am winding down, there would be a period in which the number of starts would decrease significantly, then there would be a blip upwards as people move from existing construction to new construction.

Essentially I’ve slowed down new starts more quickly to offload employees. As employees are let go, new starts suffers until I’ve reached a point at which I think I have the appropriate staff for the new sales climate. Then new starts picks up a bit.

I’m not sure if this makes sense, I’ve not thought it through entirely, could put together an equation or two to look at what this would look like, but I’m either too lazy or don’t care enough, and therefore have inflicted what may be nonsense on whoever reads this.

PS: I would really like to see a post–if we’ve not had one–on the profitability of refining over the past say twenty years. I’m still wondering why gas has been so cheap in comparison the price of crude. When I made the comment in the past, most pointed out the relationship between the two–gas and crude–but I’ve seen that relationship and something still doesn’t seem right. It seems that, given the past relationship between gas prices and oil prices, gas is cheap when considering the price of oil. Perhaps I’m confused here as well.

We took a crack at the “buy homebuilders below book value” argument a while back and walked . . . . . . IMHO, the homebuilders have more raw land and land options on the asset side of their balance sheets than at prior market downturns. The accounting conventions are incredibly liberal so they won’t be forced to write down egregiously overpriced holdings, but economic book value today is substantially below GAAP book value.

In this case, GAAP is CR**P.

If you think the economy is softening and oil and gas prices are coming off (as I do), buy the airlines and hang on for a guaranteed wild and entertaining ride.

I disagree with JDH on the likelihood of a rate cut if housing falters. I don’t think they’ll do it.

By now, they surely know that their short-term rate manipulations do not do much to the long-term rates that structure mortgages. Those are currently in a pullback only because major foreign financiers are still playing ball, which is clearly something the Fed doesn’t control

Besides this, the Fed has been telegraphing in fairly direct terms that its top priority will be responding to core inflation, not recession-type pain in the domestic economy. As evidence look at the renewed, almost-unified hawkish partyline on inflation following the last Fed meeting, or the statements of Lacker and Poole that predated even that.

The market has responded to all of this. But I think it has under-responded, due to still-predominant wishful thinking about a “soft landing” and the naive assumption of an all-powerful Fed that is ready and able to provide a “put” for the market if it gets too uncomfortable (chiefly for the banks).

Regarding energy:

Those who expect to get more of a pullback in energy (and commodities in general) because of a recession will be sorely disappointed. The US isn’t as large a demand locus as is assumed, and elasticity of demand (especially in energy) is very low anyway.

I don’t think recession in the US will have much of a global impact either; no one else has the fundamental weaknesses we do. I expect Europe and probably Japan to continue going strong.

Additionally, energy has probably overcorrected due to the evaporation of hedge-fund sourced speculation. I think the hedge funds actually had the energy bet right to start with… and it is only a matter of time until long speculators wade back into the market.

Those recovered Amaranth positions are going to make JP Morgan a lot of money.

Regarding homebuilders:

Short the hell out of ’em… especially the ones with large land options and sleeper JV liabilities. All of those holdings are essentially worthless now.

You’d have an easier job convincing me to invest in an NHL franchise in Honolulu than the airlines. 😉

As far as the energy correction, the big drop on Friday in the closing November oil contract points toward continued imbalance in the market. We closed with November oil over $2.50 below the December contract, an unusually large differential. This suggests a scramble to close long speculative positions in the closing contract, forcing fire sale prices. This imbalance on the long side likely carries over into December – all that bullishness from earlier in the year has not yet shaken out and we still appear to be in an overbought condition. If so, we can expect continued weakness for at least the next several weeks.

We are also unlikely to see a quick return to the market psychology of earlier in the year, when 5+ years of strong gains, backed by Peak Oil theorizing, gave the impression of an unstoppable trend. Having been burned, and badly in some famous cases, investors are no longer going to view energies as the sure thing they seemed just a few months ago. This change in psychology is further going to limit the market’s upside potential.

The fundamentals for energy may still be present, but as a market play it looks pretty questionable in the near term.

Fed Watch: Reappearing After a Long Absence

Tim Duy has a Fed Watch in anticipation of tomorrow’s rate decision from the FOMC: Reappearing After a Long Absence, by Tim Duy: I have been missing in action for the past few weeks, neglecting Fed watching as I pushed