Let’s admit it– the other shoe is not yet dropping.

Yes, I know that yesterday’s announcement that sales of existing homes fell 8.4% in March alarmed a number of observers, including Socratic Gadfly and the Agonist. But the drop in existing home sales was pretty much what I had been expecting, for reasons we discussed last month. The existing home sales data that were released yesterday refer to deals whose escrow closed in March. Many of those March escrows represented the consummation of contracts that were likely signed back in January or February. Since the separate series on new home sales that was released today is based on contracts that were signed in March, the existing home sales series would be expected to follow the new home series by one to two months. We already knew back in February that January contracts on new homes had plunged dramatically. Yesterday’s release of March existing home sales numbers is really just telling us the same thing we already knew.

I therefore take some comfort in the fact that new home sales for contracts signed in March are up 2.6% relative to February, though still down 1.7% from January. Admittedly, the new home sales figures could easily be revised either way, and the existing home sales data that we’ll see in May and June will give us a more reliable read. But I do not see an indication in the latest data of any worsening in the housing market relative to what we already knew was there.

My main concern had been some of the indicators of weakness outside of housing, and here I see clear signs of improvement. Seasonally adjusted new orders for nondefense capital goods (excluding aircraft) had worried me greatly when they fell 6.2% in January and a further 2.3% in February. But today we learned that these regained 4.7% in March. New orders for durable goods, which had dropped an alarming 8.8% in January, were up 2.4% January to February and up another 3.4% February to March.

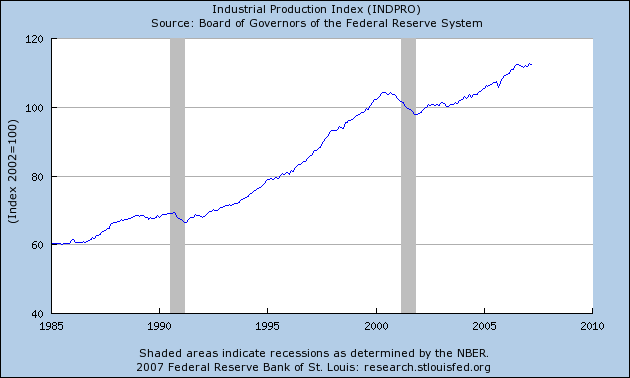

The series that originally prompted my bearish turn was the 6-month decline in industrial production through January. But industrial production then went on to an all-time high in February, and fell only a little below this in March:

|

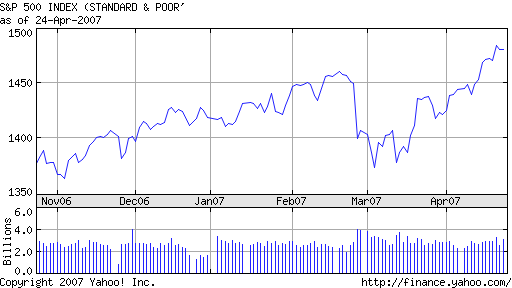

As usual, the stock market seems to be well ahead of me in picking up on these hints of improvement:

|

Let’s be clear. I fully expect the recession in housing to continue, and I remain worried about the potential for widespread mortgage defaults. I’m also anticipating anemic growth rates for GDP for the first half of 2007, which will doubtless be pushing our recession probability index up. But the Econbrowser Emoticon summarizes the data in hand rather than fears in the mind, and I think we have enough now to warrant moving the little face back into neutral  .

.

Besides, if we never changed the little guy’s countenance, it wouldn’t be nearly as exciting to watch, now would it?

Technorati Tags: macroeconomics,

housing

Congratulations on being flexible in your facial expressions!

I notice that the intrade.com betting market has trading on whether the U.S. will go into recession in 2007, and the odds are running now at only about 13%, consistent with the bullish stock market.

I’ll bet we’ll be seeing a hint of a smiley face before long…

“Besides, if we never changed the little guy’s countenance, it wouldn’t be nearly as exciting to watch, now would it?”

The only thing that would be better would be to replace the emoticon with pictures of you making the appropriate expressions!

Now, I am out of my homebuilder shorts, holding a mostly bullish index posture and not too worried about a recession any time too soon. However, the idea that new orders for nondefense capital goods ex-aircraft are rebounding puzzles me. Where do you see it? The noisy, SA month-to-month numbers?

Sorry, I disagree. Things fell apart in April. Get ready for some surprises to the downside and recession calls to resurface.

I heard this game in December.

New Orders for capital goods collapsed in April and consumption fell a good deal after Easter(actually, started to on Easter FWIW). These higher gas prices have not helped.

I do not know what to do. Worst month since January 2003, but we knew better times were ahead and we didn’t worry about the hiccup. This has left us unsure what to do next. Probably wait another month and see if things rebound. If not by June……………..

I think the nominal DOW record has a certain charming influence here.

Just to reinforce the discomfortable impression here:

I therefore take some comfort in the fact that new home sales for contracts signed in March are up 2.6% relative to February, though still down 1.7% from January.

The 2.6 stat would only amount to 1.8 if the previous month were left unchanged, yes? I suppose we are to think that there will be no cancellations next month because by that time the Martians will be here and they can actually afford these houses that mere humans must resort to subprime lending strategies to give them the impression of owning for awhile.

So about the promising “indicators of weakness outside of housing” (capital goods) that lost (6.2 + 2.3) 8.5% since Dec we have gained more than half of it back…somewhat promising but downhill, no?

I’m with dryfly and the JDH of Feb:

As I’ve also been saying on these earlier occasions, if the housing downturn gets no worse, that by itself should not be enough to cause a recession.

JDH,

I agree. There are a number of positive things that have come from the Bush tax cuts to help with this, but one of the most obvious is that depreciation was accelerated twice on new capital investment. This allowed businesses to upgrand and add capacity that they would not have been able to afford otherwise. We are now seeing the production comoing from that investment.

“Current economic conditions improve”

Econbrowser takes a look at some of the new housing and general economic numbers. I like these guys as they seem to be open minded to changing their opinions as changes in the actual data warrant. This seems to be more unsual than one might think…

I don’t get the sense things have really changed from last month. Inflation will still eat away at the ecomomy. I expect food and energy will keep the Fed from dropping rates much, if at all. So, while we may be waiting a long time for the other shoe to drop, let’s not forget the one that has.

Have you heard anyone say, “The US economy is set for bullish expansion?” I think the market has merely rebounded from March/April pessimism. What I’m considering is if it has over-shot its mark or, if its approaching its real value.

Today’s neutral emoticon reflects my own impression of the economy; not ugly and not euphoric, just sideways.

Industrial is not only off by ~7 it’s never regained slope.

>>Today’s neutral emoticon reflects my own impression of the economy; not ugly and not euphoric, just sideways.

But sideways is not bad. It’s moving sideways from a point that is not bad at all.

I too don’t think that rates will be cut anytime soon. Commodity prices are such that rates need to stay where they are. But I don’t expect rates to climb either.

Even with all the crap going on in real estate, you can still get a mortgage for 6%. So there’s still plenty of money out there to fuel expansion.

Combine that with global economic growth that’s hitting on all cylinders, and I don’t see why people are so pessimistic.

Actually, I know why people are pessimistic. I saw gas for $2.99 on the way to work today, up from $2.91 yesterday and $2.89 the day before that. That can rattle you, especially if you’re driving a gas hog, which most people do.

On the other hand, I was REAL happy with Dow 13000. I’ve got wealth effect fever. I can’t wait to get my monthly statement from my broker.

Maybe I can afford a hybrid.

The other shoe I’m waiting to see drop is the corn price debacle foisted upon us by the current administration. Ethanol is a poor substitute for gasoline, yet the President seems to be using it as an appeasement for the ecologically-rabid (does that sound nicer than tree-huggers?). Meat prices keep going up, as well as soft drinks and anything else using HFCS. I hope someone running for office is brave enough to propose wiping out the sugar cartel in this country and reducing the tariffs for this commodity.

“I was on a panel recently with Herb Greenberg from MarketWatch. He asked the panelists, How is anyone supposed to know whats going to happen? You guys all have a different opinion.

Track record, I answered.

And I didnt mean individual track records; I meant the models track record.

The classical model now known as supply-side economics has consistently explained events in ways that other models have not. The stagflation of the 1970s was a mystery to establishment economists, but not to supply-siders Art Laffer and Bob Mundell. The turnaround of the 1980s was impossible according to many, but it happened anyway. And the 1990s proved that Reaganomics works even when its employed by a centrist, Southern Democrat.

And then theres the Bush boom: maligned, denied, attacked. But, in the end, it was predictable.

Dow 13,000.”

Jerry Boywer

Professor, personal consumption looked bad in February: seven of the 14 categories that comprise personal consumption expenditures, representing 44% of the dollar value, were down compared to January.

March retail sales, when deflated, were essentially flat.

I extrapolated March personal consumption expenditures and averaged such with the January and February reported data; and I extrapolated fixed investment, government outlays, and net exports from Q4 06. When I do such, I arrive at an estimate for Q1 07 GDP growth of 1.0%.

We’ll see tomorrow morning.

I think the frowning emoticon is still appropriate!

the financial market dog wags the economy’s tail! it’s all about a credit cycle, not a business cycle. poor corporate results beg for a private equity buyout, for example. when the global stock melt-up fails, due to exhaustion, then perhaps the credit cycle of a lifetime will be forced to take an extended breather. a highly leveraged economy such as in the u.s. will suffer greatly.

Okay, I was wrong: GDP came in at 1.3% growth, not 1.0% growth. I stand corrected (I mistakenly posted as ‘anonymous’).

The bloom is off of the economic rose, and as the news continues to accumulate, the stock and bond markets will soon follow.

jg,

Your prediction is dependent on two institutions, the FED and Congress. Both appear to be more than happy to fulfill your prediction.

Unfortunately, true, Dick (although, I must add, as a Republican, I found the last Congress and Pres. Bush highly disappointing in regard to fiscal restraint).

jg,

I totally agree, but compared to the Democrats…

Here is a transcript of an interesting exchange from Larry Kudlow’s program with Art Laffer and Forbes’ Liz McDonald Thursday night April 26, 2007. Regardless of how you feel about Kudlow the number speak for themselves.

KUDLOW: Here’s another one for the record books. Get this: US tax nonwithheld receipts from individuals hit a record one day $48.7 billion increase on April 24th. The prior record was a year ago at $36.4 billion. This reflects, almost always, capital gains tax receipts from the bullish market at the record low 15 percent marginal tax rate on investment. Did someone say Laffer curve?

This is big stuff. It’s been playing at the top of the Drudge Report all day. $48.7 billion dollars for the April 24th tax date. That is the largest in history, Arthur, the largest in history. It’s almost all from cap gains, nonwithheld.

I did a little math, Art. Since the Bush tax cuts of mid-’03, the fiscal years ’04, ’05, ’06 and we’re almost halfway through ’07, nonwithheld tax receipts up $144 billion, or 59 percent. Now, Art, I know you take a lot of flak in government accounting circles. They say lower tax rates lose revenues. This says lower tax rates increase revenues. Could you comment for us? Could you teach us something here?

LAFFER: Well, I just love these numbers, Larry. And, frankly, the one area where you can really expect to see this type of response is in capital gains, in the nonwithheld areas. I mean, the size of this one day receipt is so much larger than the next largest day’s receipt, it’s amazing. If you look all around this country, I don’t see how people can think that you really should let these tax cuts expire. We’re almost in balanced budget right now. It’s coming very close. Just let this thing keep going. Don’t stop it. I don’t know why these people want to stop it, Larry.

KUDLOW: Liz, I just want to ask you. Last night we ran a segment, Goldilocks and the three bears. Goldilocks being the Bush tax cuts, the three bears potentially being Hillary, Obama and Edwards, who want to reverse the tax cuts. What’s your thought? What Arthur is saying about the cap gains revenue yield, does that link to this bull market in stocks?

LIZ MacDONALD: Absolutely, and I think the world of Art Laffer. I privately call him Saint Art Laffer. Because God bless him, because he’s really shown the way here. And here’s the deal: the capital gains tax is a voluntary tax. In other words, people will sit on it and not pay it if the tax rates are high. When they go low, they will unlock those assets, right? And this is the best noninflationary liquidity that you can bring into the market. So yes, I am worried about the Democratic Congress coming in and removing these very powerful forces that are driving the stock market forward.

jg, a majority of Americans now expect a Democrat to win the Whitehouse in 2008. If the Dems do win then there will be less military spending in Iraq which will help reduce the U.S. budget deficit. However, the Dems could increase other spending which would raise the deficit, and then there are the looming entitlements we will have to face. Here’s an economic letter from the Dallas Fed about the future of the deficit:

http://economistsview.typepad.com/economistsview/2007/04/frb_dallas_the_.html