More confirmation that the slowdown in housing has spilled over to manufacturing.

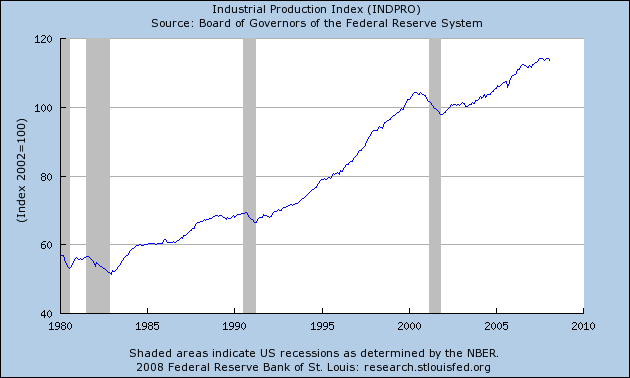

The Federal Reserve Board announced this week that its index of industrial production fell 0.5% between January and February, putting it about back to the level we saw last June.

|

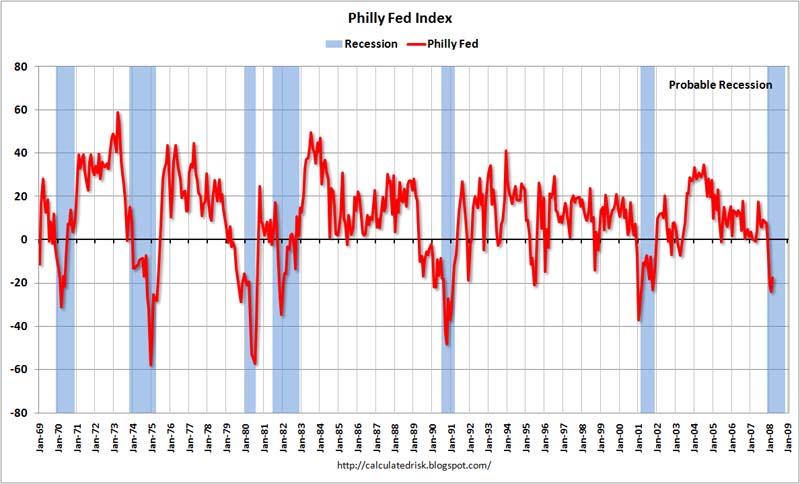

The separate Business Outlook Survey from the Federal Reserve Bank of Philadelphia continued to be strongly negative, meaning that more firms in the northeast reported that March was worse than February compared with the number reporting improvements. I don’t take much comfort in the fact that fewer firms reported a drop from February to March than had reported a drop from January to February.

|

The discussion is increasingly shifting from “are we in a recession” to “how long will the recession last?” The latter question is one that I’m very hesitant to answer. Historically, the average postwar U.S. recession has lasted 10 months, with the longest being 16 months. However, current developments do not look to me like a typical recession, but instead seem to be something without clear precedent in the last 50 years.

Credit markets at the moment are profoundly insecure. The mortgage securitization model looks broken, and it is not clear what is going to replace it. No one is sure how to evaluate the creditworthiness of a huge volume of assets and the institutions that hold them, or what would be the fallout of further big drops in real estate prices and increases in default rates.

There are those who argue that first we need to avert the immediate crisis, namely preventing widespread financial defaults, before we can turn our eyes to needed regulatory reforms. But it may be that until we can establish adequate equity cushions and more transparent accounting standards for financial institutions, the economy will continue to languish.

Technorati Tags: macroeconomics,

economics,

recession,

credit crunch

JDH: “…But it may be that until we can establish adequate equity cushions and more transparent accounting standards for financial institutions, the economy will continue to languish…”

I think the rules are already there, largely, Professor: ‘mark to the lower of cost or market’ is a well-understood and fundamental accounting concept. However, the gutless or complicit folks at Treasury, the SEC, and Federal Reserve appear to be standing by, only, instead of enforcing such.

Same for the ratings agencies (except Egan-Jones): gutless or complicit.

Aggressive action by the SEC using the existing laws is what is called for. Prison time and disgorgement will make the schmucks more attentive to their actions and representations.

http://inflationusa.blogspot.com/2008/03/no-recession-in-2008-and-2010.html

“However, current developments do not look to me like a typical recession, but instead seem to be something without clear precedent in the last 50 years.” -James Hamilton

Independent of the cause of the recession, one might expect duration to be shorter and the recovery quicker in the contemporary digital-information economy. In principle, more and better information helps solve co-ordination problems in the absence of deliberate efforts to obscure and hide the relevant information.

I’m somewhat surprised there have been no salient industry-lead initiatives or proposals to resolve risky loan practices and debt-quality fudging. It does look like top-down regulation by an outside authority will be necessary to fully restore market confidence.

However, if fiscal and monetary policy are called to paper over hegemony-eroding military adventurism in another 30 years from now, the US economy will find itself once again in difficulty.

There are those who argue that first we need to avert the immediate crisis, namely preventing widespread financial defaults, before we can turn our eyes to needed regulatory reforms. But it may be that until we can establish adequate equity cushions and more transparent accounting standards for financial institutions, the economy will continue to languish.

Very well said – this “fix the immediate crisis” and worry about “inflation pressures”, “regulatory reform”, “moral hazard” later is actually THE moral hazard at play at the moment.

-K

The FED should be forceably spoonfeeding the crap into the mouths of the bank. Yeah, it may taste awfull, but for the sake of this country, get it over with.

The longer the Fed does these “games”, the worse it will be. Bernanke will not be back as FED boss IMO. He was to weak.

Here’s an interesting, and quantitative, look by Daniel Amerman at the scale of the subprime problem: Subprime: you ain’t seen nothin’ yet.

The assumptions in his model are very conservative, but the projected losses are nevertheless immense. Considering that the issue of past lending standards is far larger in scope than subprime, that the author doesn’t consider the possibility of high interest rates in combination with deflation instead of inflation, and that system shocks such as is looming in the CDS market are not addressed, the losses would actually be very much larger. This should be a sobering thought.