Today’s July trade release was a little bit of a surprise, due to oil [0]; Haver covers the numbers. Calculated Risk discussed the release, and actually took the outcome as a fairly positive, albeit with some anxiety about whether exports will keep up the robust growth necessary to continue shrinking the deficit.

I want to focus on a couple of other aspects of the release which seem to make me worry a bit more.

First, let’s confirm that the non-oil deficit is shrinking rapidly in nominal terms, and certainly as a share of GDP.

Figure 1: Monthly trade balance (blue) and trade balance ex oil imports, in millions of USD, seasonally adjusted. NBER defined recession dates shaded gray. Source: BEA/Census, July Trade release, September 11, 2008, and NBER.

Where is the gain coming from? As Figure 2 illustrates, goods exports are rising rapidly, as are total goods imports, while goods imports ex oil are trending upward much more slowly.

Figure 2: Log monthly goods exports (blue) and goods imports (red), and goods imports ex-oil (green), in millions of USD, seasonally adjusted. Source: BEA/Census, July Trade release, September 11, 2008.

The series are graphed in log terms, so that a constant growth rate shows up as a straight line.

Nominal values are important, particularly in regard to the trade balance. That’s because the trade balance, which roughly equals the current account balance, is what has to be financed by capital inflows. Always something to keep in mind when one ponders the desirability of dollar denominated assets as the US financial system is buffeted by shock after shock. For now, flight to safety is supporting flows into risk-free dollar assets. What will happen in the future as other dollar assets begin to look riskier and riskier is something else.[1]

But what I want to stress here is the real magnitudes. And that’s because these are what matter in terms of contributions to US GDP growth, in an accounting sense.

Figure 3: Log monthly real goods exports (blue) and goods imports (red), and goods imports ex-oil (green), in millions of Ch.2000$, seasonally adjusted. Linear trend for 2003.01-08.07 (black) Source: BEA/Census, July Trade release, September 11, 2008, and author’s calculations.

What is interesting to me is that exports are growing at a pretty constant rate of 8% per annum (log terms), which is only slightly above the rate 7.5% recorded since the end of the last recession. The jump in the total value of export is to some degree a function of the prices of US exports. Imports on the other hand are coming down. Of course, this is exactly why GDP and Gross Domestic Purchases have diverged. (And declining import quantities reminds us that the 3.1% contribution of net exports to the 3.3% GDP growth in 2008Q2 was about half and half driven by import compression and export expansion [2]).

Figure 4: Log price of goods exports (blue) and goods imports (red), goods imports ex-oil (green), and goods exports ex-agricultural commodities. Source: BLS, August import/export price release, September 11, 2008.

What Figure 4 demonstrates is that the jump in the nominal value of exports is substantially due to price effects particularly over the past year (remember, these are logged prices). The fact that the total goods export price index is below the ex-agricultural commodities index reflects the commodity boom. Hence, my key question: What happens if food prices follow energy prices? Then it’s a race, with both the value of total goods and value of total goods exports coming down (one tends to think oil imports must be overwhelmingly larger than agricultural exports and other commodities the US exports. Through July, combined US imports of food and industrial supplies is about $530 billion, and combined exports about $300 billion). In any event, the ex-oil goods trade deficit will probably evidence less improvement over time if commodity prices come down rapidly. Figure 5 shows IMF forecasts (left panel) and futures prices (right panel) for some commodity categories and commodities, respectively.

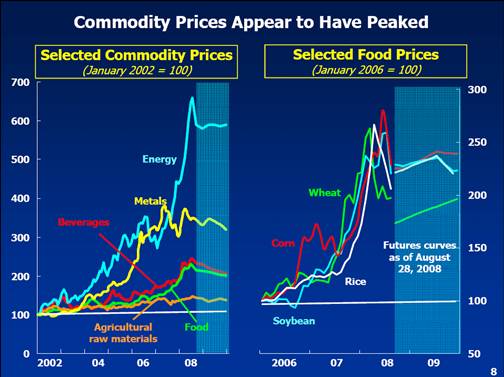

Figure 5: Commodity prices and projections/futures prices. Source: IMF DMD Lipsky presentation (9/9/08).

While futures do not indicate a sharp drop in agricultural commodity prices, I think the sharp drop in oil prices should give us all pause for thought.

A final observation is that the recent disjuncture between GDP and gross domestic purchase price deflators [3] is not entirely due to oil. Prices of manufactured imports are also rising — in particular in prices of imports sourced from the NICs and China. Here, we seem to have achieved what our policymakers have been asking for.

Figure 6: Log price of goods imports from Newly Industrializing Countries (blue) and goods imports from China (red). Source: BLS, August import/export price release, September 11, 2008.

Is there any bottom line from this survey? If there is, it is that there are two reasons to worry about the sustainability of improvement in the ex-oil trade deficit. The first is the one Calculated Risk highlights (will faltering rest-of-world growth hamper export growth?). The second one involves the trajectory of prices of some of our exports, in particular agricultural commodities.

[Updtate: 9/13, 8:45am] Additional commentary: Brad Setser.

Menzie wrote:

Prices of manufactured imports are also rising — in particular in prices of imports sourced from the NICs and China. Here, we seem to have achieved what our policymakers have been asking for.

Menzie, based on a mercantilist framework this is not bad analysis.

Sadly, your comment above is correct. Our policymakers have been asking for an increase in the price of imports, but what that means is that domestic US prices increase for consumers and producers. Increased prices mean reduced purchases, reduced savings, reduced disposible income and reduced profit margins, leading to reductions in employment and production.

Contrary to those policymakers who see this as a good thing (mercantile theory) since it gives the appearance of an increase in exports they celebrate while the US consumer suffers and the general economy declines.

How much this increase in the price of exports has contributed directly to the recent increases in unemployment is difficult to measure, but what we can see is that once again government intervention has a negative impact on the US economy, but because they achieved their goal they celebrate.

Sorry, Anonymous above is me.

I am in awe of anyone who has the material at hand to produce these kind of details about the composition of U.S. trade only one day after new data appears. Amazing! And useful.

A bottom line? I am interested in the value perspective for viewing these data. All would agree that incresed exports are good, whatever their reasons for existing. But is decreased imports equally good? It seems that imports decreased chiefly because of higher prices. Since these higher prices were produced by market forces, they are acceptable and therefore, the decrease in imports is acceptable.

I reject that view. Either higher prices for imports are good or they are bad, regardless of whether produced by international market forces or by actions of the U.S. government.

I favor direct intervention by the U.S. government in the international market for both U.S. imports and U.S. exports.

If reduction in the U.S. trade deficit helps the U.S. economy, the U.S. government has a moral obligation to help reduce the U.S. trade deficit.

One must adopt some kind of value perspective before a bottom line can be drawn.

DickF-

Mercantilism, as rejected by Adam Smith, was the view that gains in trade exist for a nation ONLY when exports are in excess of immports. Smith showed that trade can produce benefits for both parties without a trade surplus existing. The implication of this analysis that is ignored by people like DickF is that equal trade is the condition under which both parties benefit from trade.

Smith also believed that a trade deficit was not harmful to a nation. Did any of those who follow Smith in this regard read his defense of this notion? It is totally unpersuasive. I marvel that Smith’s perspective is taken as gospel.

Smith was a polemicist and a damm good one. He inveiged against “the doctrine of balanced trade” because he wanted to retain the possibility that the nation with the most effecive manufacturing sector (England) would be able to create a trade surplus without being labelled as unfair. He also was determined to undermine the ability of “merchants and businessmen” to presuade legislators to impose tariffs that protected their own business, while pretending to serve the public interest. They argued that protective tariffs were need to restore a proper balance of trade for England. Smith argued that trade statistics were so bad no one really knew who had an “unfavorable” balance of trade.

To sum up, a favorable balance of trade helps a domestic economy (exports in excess of imports). An unfavorable balance of trade harms a domestic economy. An equal balance of trade helps both domestic economies. Therefore, an equal balance of trade should be the goal sought by U.S. policy makers. Neither surplus makers nor deficit accepters be.

I apologize for plugging up the flow of comments. Was it because of my misspelling of several words, or because the subject of values and possible errors made by Adam Smith is in bad taste?

I work alone, without anyone to react to my ideas. I had hoped to get some feedback. Please ignore what I wrote and get on with reaction to the excellent material presented by Professor Chinn.

How much of this analysis is backwards looking? Point of fact, the yen peaked at 96 to the dollar months ago. It is now back at a more comfortable (for the Japanese) 107, and was 110 briefly a few weeks ago. I don’t think that the Japanese are losing any sleep at 110 to the dollar.

Despite all the chaos in the financial markets over the summer, conditions DID seem to be fixing a lot of our structural problems: higher interest rates to get people saving, crazy high oil prices to get people to conserve and consider alternatives, and a weak dollar to get our manufacturing sector back on its feet.

OTOH, maybe the easing since then has put us on a more sustainable footing. We don’t want commodity inflation such that people invest in them rather than, say, the next computer chip plant or whatever.

DickF — Respectfully, I think you have this wrong.

China has been pursuing the classic mercantilist policy; rather than trading goods for gold (or oil) that it hoards, it is trading goods for treasuries and agencies. But the effect is the same. Less mercantilism means higher import prices sure; that is what happen when a subsidy is withdrawn. But it also means a more market based global trade and financial system.

Cheap imports that are the product of a distorted exchange rate are the product of government intervention, not unhindered trade.

And I would think that most people would worry both about the scale of of the growth in the foreign assets of China’s state (see the FT) and the long-term sustainability of paying for imports with IOUs rather than goods and services.

Menzie — good analysis, as usual.

Good stuff.

Import prices fell by more than 3% in August, led by sharp declines in oil prices, but export prices also fell by nearly 2%, led by a double-digit drop in agricultural export prices.

The US trade balance in agricultural goods has improved by roughly $5bn a month since the start of 2007, but that only explains about a third of the improvement in the non-oil deficit over the same period. It’s also fairly modest compared with the $25bn jump in the cost of imported oil.

Menzie-

I have a couple of comments about your graphs:

Secondly, I have to admit some prejudice to economists’ tendency of segregating out food and energy to produce a CORE CPI or plotting trade balances ex-oil. I believe that the proliferation of this segregation is contributing to America’s complacence in its current account deficit.

Third, if I’m interpreting weighting correctly, only 10% of US exports involve agricultural commodities (heavily influenced by the oil price), but 29% of our imports involve oil products. As the recession digs deeper, I expect that all prices will decline. However, prices for necessities (food and fuel) will decline slower than manufactured items. Consequently, America will likely experience a deterioration in its trade deficit during the recession (depression) unless Herculean efforts are made to limit petroleum imports (either by tariffs, taxes, or domestic energy production and utilization).

ReformerRay- Thanks for interjecting the thumbnail sketch of Adam Smith’s economic philosophy and how it influences current thought. I agree that in the long run, trade balance must occur in order for both parties to prosper.

Please make the first graph also in a ‘percentage of GDP’ version.

If you do, I’ll submit it to Instapundit for consideration for a link.

ReformerRay wrote:

To sum up, a favorable balance of trade helps a domestic economy (exports in excess of imports). An unfavorable balance of trade harms a domestic economy. An equal balance of trade helps both domestic economies. Therefore, an equal balance of trade should be the goal sought by U.S. policy makers. Neither surplus makers nor deficit accepters be.

Ray,

This illustrates the problem with government intervention. The balance of trade depends on economic conditions within a country. The government should neither seek a surplus nor a deficit, but neither should the government seek equality of trade. The market must determine the balance of trade, should you import more raw materials or export more finished goods? The answer to that question should not depend on the decision of a bureaucrat. Only the market can sort it out without economic dislocation.

Do you guys ever do informal straw polls? I have two votes for the proposition that “in the long run, trade balance must occur for both parties to prosper”. Any others?

MarksS: Re your point 2, the log operation is a monotonic transformation. Up is still up, and down is still down, even after logging.

I think we are already seeing the effect of the slowdown on the trade balance, that is a reduction in the deficit. This occurs because the income elasticity of imports is so high.

GK: Thanks for the offer, but I’d have to generate a monthly GDP series, or select a monthly series (and there are several). If you want the same essential story, see Figure 2 in this post.

You don’t like governmental intervention. I do. So what. Regardless of our predispositions, a trade deficit’s impact upon the growth of GDP is what it is. Our problem is to figure out what the impact is. If a trade deficit does not aid the growth of GDP, that reality is not changed by our policy preferences. Know, however, that Germany and Japan believe that their government has the duty to aid the growth of their GDP by supporting exports.

Economic dislocations have been suffered by Japan for decades because they protect their agriculture. They are able to prosper, despite the economic dislocations, because of their manufacturing prowess developed with government help is strong enough to enable them to pay for this cost.

I want th4e U.S. to learn from the rich countries that are successful in the global economy – Germany and Japan. But the governmental intervention needed in the U.S. must not be just a carbon copy of what some other country does.

Menzie – In general, you should always do a net exports chart in relation to GDP, as that is truly the full picture, more so than nominal dollars.

The good news is, the US now has almost no trade deficit outside of oil. The problem, while still large, has ben simplified greatly.

GK: Thank you for your advice. I agree, but on a monthly basis, this requires making not easily replicable graphs (because I have to either interpolate quarterly GDP data, or use proprietary GDP data, at which time the selection of which can yield substantially different pictures). But as you say, in this case, the quarterly data using NIPA series tells the same story.

Menzie, you touched glancingly on the following, but it should be front-and-center in the analysis: the US was probably the first into recession, with Europe about to enter and Asia perhaps to follow later. As world economic activity falls, one expects American exports to fall. But because there is not synchronization, imports have fallen here, while exports are yet to fall.

Improving the trade balance due to recession is not a good thing, nor is it likely to be sustained as the recession ends.

Charles says:

“Improving the trade balance due to recession is not a good thing, nor is it likely to be sustained as the recession ends”.

Just wanted to repeat words of wisdom.

I am not quite sure that it is right to say the US doesn’t have a problem if it doesn’t have a non-oil trade deficit. if oil stabilizes at 100, it will still have a hefty oil import bill. if the us economy resumes growing and us interest rates normalize, both non-oil imports and interest payments on us external debt will rise. and there are some countries that pay for imported oil with a non-oil surplus, not by borrowing money — and it isn’t inconceivable that the us might need to move in that direction, especially if the income balance deteriorates over time (as it should if rates normalize).

Bsetser wrote:

Less mercantilism means higher import prices sure; that is what happen when a subsidy is withdrawn. But it also means a more market based global trade and financial system.

Brad,

Thanks for the respectfull disagreement, but I am not sure there is much disagreement here. I am not sure how you can say that mercantilism breeds a more market based global trade. Mercantilism by its very nature is government control not market control. Your example of China is a good example.

Cheap imports that are the product of a distorted exchange rate are the product of government intervention, not unhindered trade.

With this I totaly agree, but I think your implication is that China is distorting the exchange rate. I would hold that the US distorted and is still distorting the exchange rate. This was clearly exposed when the US cried foul because the yuan was fixed to the dollar. That breast beating could only be because the US was attempting to gain an advantage by manipulating the exchange rate. An international currency system (gold) would resolved this problem.

And I would think that most people would worry both about the scale of the growth in the foreign assets of China’s state (see the FT) and the long-term sustainability of paying for imports with IOUs rather than goods and services.

Once again I totally agree and this supports my contention above that mercantilism does not breed a more market based global trade or financial system. I believe this is a serious problem that China must address. Their mercantalist policies will catch up with them. The sooner they deal with them the less will be the pain. We should have learned this lesson from Benjamin Strong and Montagu Norman in the 1920s.

W. Raymond Mills wrote:

You don’t like governmental intervention. I do. So what. Regardless of our predispositions, a trade deficit’s impact upon the growth of GDP is what it is. Our problem is to figure out what the impact is. If a trade deficit does not aid the growth of GDP, that reality is not changed by our policy preferences. Know, however, that Germany and Japan believe that their government has the duty to aid the growth of their GDP by supporting exports.

You are correct that our problem is to figure out the impact of trade deficits or surplus on GDP, as a matter of fact this problem is so great as to be impossible. If the economy is crying for imports but the bureaucracy determines we should support exports and manipulates the money supply to support exports the result will be destructive as is true of the opposite situation. But if we have a stable currency and let imports and exports simply support production and distribution we will optimize the balance of trade. It is extreme hubris to believe that the bureaucracy is smarter than the market.

DickF – The most important part of your exchange with Bester is that both you and him agree that the imports coming into the U.S. are not a product of “unhindered trade”. Discussion of international trade must begin with the reality of a market in which most nations intervene. All the discussion about the benefits of an ideal market are irrelevant, except as a hypothetical ideal. When we talk about good trade policy for the U.S. we should talk about the world that exists.

An equally important issue is your assertion that some bureaucrat must make decisions about winners and losers (which industries to favor with restrictions on imports). That assumes that old fashioned protectionism is the only alternative to free trade.

Germany uses a value added tax system to favor exports over imports. But they favor ALL exports. No bureaucrat needs to decide which exports to favor because all are favored.

I have proposed for the U.S. a system of tariffs to be applied to ALL imports into the U.S. coming from the five countries that were responsible for 60% of the U.S. trade deficit in 2005. These countries are China, Japan, Germany, Canada and Mexico. The are selected soley on the basis of the numeric size of their trade surplus with the U.S. in 2005.

Neither proposal requires any bureaucrat to make any decision. Both require the U.S. Congress to make a decision that they are no longer going to sit idly by and watch continued outflow of U.S. financial assets to foreign nations plus continued destruction of the manufacturing base in the U.S.

Congress must learn to be selfish at the right time and place. When we get to equal trade, it will be time to change national trade policy. When any of the five nations penalized gets near to equal trade with the U.S. it will be time to remove that country from our proscribed list.

DickF says: “our problem is to figure out the impact of trade deficits or surplus on GDP, as a matter of fact this problem is so great as to be impossible”. I disagree.

Beginning with a hypothetical country with no foreign trade, that country must increase its GDP over what is needed to serve the domestic population, if it produces anything that can be sold on the international market (Adam Smith’s argument). Thus exports always increse GDP by the size of the export. Current writers note that incresed exports from the U.S. has been the main bright spot sustaining U.S. GDP in recent months.

Imports are more complicated. If the item imported is so new that it does not substitute for any domestically produced item, then imports have no direct impact on GDP. They do, however, require shipment of financial assets overseas to pay for the exports. If these financial assets would otherwise be unemployed, this financial transfer will have no impact upon current GDP. If however, the assets transferred overseas could have been used to produce something in the U.S. that could have found a market either in the U.S. or overseas, then imports indirectly reduce GDP.

If imports substitute for domestic production and the resources displaced by imports can find alternative employment producing goods that sell either domestically or overseas, equal in value to the imports, then imports will have no impact on the size of GDP.

If imports substitue for domestic production and the resources displaced cannot find alternative employment producing goods that sell either domestically or overseas, of value equal to the imports, then imports reduce GDP. If the product produced can be sold only in the U.S., imports reduce the Net International Investment Position of the U.S.

Equal trade is the ideal form of international trade because the larger the trade, the more each nation must increase its exports and its GDP. And the larger the trade, the more imports each nation must absorb, thus increasing their level of living. Both nations gain both by imports and exports. Equal trade requires that the resources displaced by imports find alternative employment producing a product that can be sold overseas.

Menzie- Sorry for my mistake…

… Unless your audience knows that the BLS Price Index is based on 100 in year 2000, and that the natural logarithm of 100 is 4.6, they would have no idea whether prices were actually increasing or declining in these two graphs.

I meant to say that by posting the log values of price indexes, the reader would have difficulty knowing whether the price index had actually increased or decreased since the base period. Thanks for correcting me.

Kudos to W. Raymond Mills! His opinions are both erudite and stylish.

Raymond,

Thanks for two very reasonable posts and for the reasonable dialogue.

You wrote:

All the discussion about the benefits of an ideal market are irrelevant, except as a hypothetical ideal. When we talk about good trade policy for the U.S. we should talk about the world that exists.

It is important to talk about a hypothetical ideal because the closer we come to that ideal the more prosperous we become. There is an implied assumption in your statement that government manipulated trade can be better than free trade; I infer this because you state that government manipulated trade is necessary to maintain our trade position. I respectfully disagree.

Our nation replaced the UK as the strongest economy by growing faster and this was during a time when we had much less economic leverage than we have today. This happened because our nation was less mercantilist than was the UK.

Though we did not have perfectly free markets our markets were more free and so allocated resources and established prices more efficiently. Free markets are not an all or nothing situation but are relative, China being a prime example today.

An equally important issue is your assertion that some bureaucrat must make decisions about winners and losers (which industries to favor with restrictions on imports). That assumes that old fashioned protectionism is the only alternative to free trade.

Germany uses a value added tax system to favor exports over imports. But they favor ALL exports. No bureaucrat needs to decide which exports to favor because all are favored.

An equally important issue is your assertion that some bureaucrat must make decisions about winners and losers (which industries to favor with restrictions on imports). That assumes that old fashioned protectionism is the only alternative to free trade.

But what about favoring importers over exporters? That is also dislocating to the more equitable free market distribution. You still have bureaucrats (in this I include members of congress) picking winners and losers.

Some industries need imports to produce for domestic consumption. Some industries need no imports to support their export business.

We have come closer to agreement though. I do believe that our federal government should return to being financed by only an equal across-the-board tariff eliminating domestic wedges to production and consumption, but this tariff should only be to raise the necessary funding for our federal government. This was the original intent of the writers of the US Constitution. They had great foresight in seeing the economic mess we have today. And this tariff should not be used for bureaucratic social or economic engineering.

Our government should have a higher respect for economic and personal freedom. It is our ideal of freedom and liberty that makes the United States great both personally and economically. If we lose this and we are just another declining empire.

W. Raymond Mills wrote:

Equal trade is the ideal form of international trade because the larger the trade, the more each nation must increase its exports and its GDP. And the larger the trade, the more imports each nation must absorb, thus increasing their level of living. Both nations gain both by imports and exports. Equal trade requires that the resources displaced by imports find alternative employment producing a product that can be sold overseas.

Raymond,

First let me second Mark’s comment.

Here is the crux of our disagreement. Progress and prosperity do not come from equality. An absurd example just to illuminate my point: If the government spreads capital equally between a baker and an automobile producer we will have an excess of bread and a shortage of automobiles.

Markets move toward equilibrium not equality. All that you have said in this post implies that bureaucrats will make these decisions about imports and exports better than the free market. I disagree. It is impossible for individuals to make these decisions because they are not omni-present nor are they omniscient. The market reaches to suppliers of transportation, distribution, and consumption that are not seen in direct production. The market deals with these unseen costs, costs a bureaucrat simply has no way of evaluating. Because of this the market will always distribute resources more efficiently.

Some nations are rich in natural resources and labor while others are rich in capital; some will prosper from exports some from imports, but only the market can determine the most efficient distribution.

DickF – Thank you for your consistent position. You obviously believe what you say.

I believe our fundamental difference is that you place highest value on efficient distribution of resources.

I place highest value on trying to rescue the U.S. from the economic mess we have created. Trade is not the only problem. However, in my view, it is the problem most easily addressed because the sacrifice needed to go from free trade to balanced trade (exports and imports equal) is much less than that required to go from a federal budget deficit to a federal budget surplus.

Two of your points are of especial interest. You say: “Our nation replaced the UK as the strongest economy by growing faster and this was during a time when we had much less economic leverage than we have today. This happened because our nation was less mercantilist than was the UK”. (I cannot make this sentence bold -sorry).

This change in economic leadership happened between 1869 and 1925. During that time, U.S. exports exceeded imports (Douglas Irwin, Free Trade under Fire, 2002, pg 8). During that time the U.S. tariff rate on duitable imports was around 40%, except for a brief period around 1920 (Irwin, pg. 147). Your view of how the U.S. displaced GB at the strongest economic in the world is at variance with the facts. We became strong because we had undeveloped resources plus inventors,strong governmental support for “internal improvements” to get farm products to market, plus other factors. U.S. trade policy protected domestic production by high tariffs on imports.

Second issue: “Here is the crux of our disagreement. Progress and prosperity do not come from equality”.

Equality of exports and imports is one thing – equality of income is another thing – equal treatment before the law is another thing. My only point is that balanced trade refers only to the statisical results when the total of export imports are added up at the end of the measurement period. Equal trade may not produce the most rapid growth in progress or prosperity. What equal trade does is establish a stable trading system from which all countries can benefit. I seek not the most rapid growth but the most stable and beneficial trading system. I would like all nations to benefit from that system but my main interest is in preserving for my Grandchildren a United States that is surving and still creating wealth for its citizens.

I am extremely appreciative of the opportunity to participate in this discussion. As you can imagine, it is difficult to think through all the implications of a novel perspective and it is difficlt to find a place to expose the ideas to criticism. Although I write with conviction, I will not trust my perspective until it has been critiqued.

MarkS: Oh, I see. I forgot to include the base year date in the description to the figure; my mistake. The base year is 2000.

DickF – Perhaps we should discuss efficient distribution of resources. When talking about efficient distribution of resources involving international trade, I envision a system where perfect competition exists, no nation interfers with the flow of goods, services or money between nations. My inclination is to agree that that kind of system, if it existed, would produce a larger volume of goods and services for the world to enjoy than we get with the current system.

When I look at the world as it exists, it is far from that ideal. The countries most successful in increasing their wealth via trade today are China, Germany and Japan. All three focus on improving their ability to export to other nations. They are not interested in the total volume of goods and services available to the world. They are interested in both current and future stream of goods and services available to the citizens of their country.

The U.S. should embrace the same concern.

Swan Song

The impact of the trade deficit on the U.S. economy is of first importance, especially because of the size and growth of that number (the trade deficit) since 1997. Conventional models and assumptions are ill suited to that task.

Paul Samuelson, in an article a few years ago, led me to believe that standard models of trade are not suited for dealing with a trade deficit because they assume away the problem by assuming equal trade. In another instance, the assumption that savings controls the level of investment plus the trade balance is off-putting because it lead to the conclusion that the trade deficit is needed to supply the funds for U.S. domestic investment. I could not believe that the richest nation on the earth would require funds from abroad to fund doomestic investment. The argument that the trade deficit is a dependent variable, dependent upon financial activities, is inconsistent with the notion that export and import levels in each country are controlled by market forces as they exist at the point of sale in each country.

I am convinced that U.S. economist need to invent some new models for dealing with the impact of the trade deficit on the U.S. economy. Whether my solution (exogenous and causal variables on the right side of the equation defining GDP) is the best is not yet know.

I obviously revel in the opportunity to present my heritical ideas to a compotent audience and to get some positive feedback. I look forward to receiving additional critiques at wrmills@wideopenwest.com. And I greatly appreciate the opportunity to discuss issues that are simplier than the issues usually addressed here. I could not create an econometric model if my life depended upon it.

I apologize for my spelling. I am not competent to spell survival without help.

Raymond,

Once again thoughtful posts. Thank you.

It is difficult to compare policy of the 19th Century with that of the 20th Century because of the income tax and the growth of government. I will grant you that tariffs were higher in the 19th Century but that was necessary to fund the government. I will also grant that there were protectionist tariffs, especially by Republicans, but as the Civil War demonstrated tariffs that were good for one section of our country could be devastating to another. I do not believe that the growth of the US economy in the 19th Century was due to tariff policy.

You are also correct that during this time exports exceeded imports. Understood this makes my point. For most of the 19th Century the US was a provider of raw materials to an industrialized Europe. This is normal for a natural resource rich developing country with more limited manufacturing.

As manufacturing grew in the US the balance of payments began to change. A country that is mostly manufacturing or service will realize greater imports than a country that is supplying the world with raw materials and commodities. I will not go into why raw material exports are less in a manufacturing economy because it should be obvious.

Once again I believe that this supports allowing the market to determine the balance of trade. Consider oil producing countries as an example. Would you expect their balance of trade to be one of exports or imports? Now compare that to an economy like that of Japan, highly populated with limited natural resources. Would you expect their balance of trade to be one of exports or imports?

A optimal balance of trade is dependent on the economy of the country not arbitrary equality.

Thanks again for the discussion.

DickF. I like conducting an exchange with you. You are clear and what you say is sensible, from one perspective.

I agree with you that tariffs played a minor role in the growth of the U.S. economy after the civil war. The productivity of the U.S. economy grew because the labor force changed from agriculture to manufacturing. This change happened primarily before 1925. After WW II, the change was from manufacturing to service.

A manufacturing- service economy does not necessarily imply or require a trade deficit (more imports than exports). Japan and Germany are current examples of manufacturing-service economies that have a large trade surplus. Those countries have adopted national policies that lead to a trade surplus. The U.S. has adopted national policies that lead to a trade deficit.

Oil companies do have a natural tendency to create an surplus. Japan and Germany do not have a natural tendency to create a trade surplus. Their economies would operate just fine with balanced trade. If the U.S. would eliminate its trade deficit with those countries, we would discover that both Japan and Germany can prosper in a world in which the size of their trade surplus with the world is decreased. With more imports, both countries would have a higher level of living.

I do not believe that the U.S. should aim to dictate to any other country what trade policies they should embrace. I do believe that the U.S. must take control of its own trade so as to reduce its trade deficit to as low a number as is possible.

The market as it currently exists requires the U.S. to send around 800 billion dollars of U.S. financial assets overseas. Why should we tolerate that? True, it helps domestic consumers. But I place the strength of the U.S. manufacturing sector as of greater importance than the marginal gain to consumers of having desirable foreign created products available to them. The choice is, in my mind, a value choice. Economic stability and growth versus consumer benefits. The balance is tipped to the economy because it is fundamental and marginal consumer gain is not.

If we can compare the two (maginal consumer gain versus GDP), it is clear that the marginal difference between two competitive products (one produced overseas and one produced locally) cannot be 100% of the cost of the respective products, yet the loss to GDP of the decision to purchase an item produced overseas versus an item produced in the U.S. is 100% of the cost of the U.S. produced item. Consumer indulgence is reducing GDP. Present trade policy is irrational, from the perspective of U.S. citizens, present and future.

The agriculture sector of the U.S. economy grew in productivity after the civil war because the U.S. manufacturing sector invented and produced tools that they could use to increase their productivity in producing food and tools that could be used to get the product from the farm to the market. Productivity increased, not just from converting from farm to manufacturing, but also by using manufacturing to increase the productivity of the farm sector, thereby releasing workers to be employed in manufacturing.

You are also right that the past provides no real, direct guidance as to what should be done in 2008. But it does show us that high tariffs are not a hinderance to growth, if other factors exist to simulate invention and new products that can improve total productivity. I recognize that high tariffs are a hinderance to growth if the nation has not the opportunities for internal growth that existed in the U.S. in 1969.

Raymond wrote:

I place the strength of the U.S. manufacturing sector as of greater importance than the marginal gain to consumers of having desirable foreign created products available to them.

Raymond,

Concerning your comment above it is essentially a fiscal problem rather than a tariff or monetary problem. US manufacturing has been driven offshore because of a combination of corporate taxes and government regulations, not to mention law suits violations of property rights.

In the rest of your post we are actually pretty close to agreement, but that is because we drifted into a discussion of tariffs rather than monetary policy driving trade policy.

Monetary policy is the worst way to influence trade policy for a whole host of reasons for example the weakened dollar hurts the poor because they are more cash oriented than the rich, it discourages saving because saving loses in inflation, it creates malinvestment as price signals are distorted (as are consumption signals), on and on.

Sorry Raymond. That is me above.

Tariffs are not monetary policy – they are additions to the price of imports, unless the exporter absorbs the tax.

You obviously do not believe that the current trade system is bad for the U.S.

The excess of immports over exports is bad for reasons discussed above in the various scenarios defining under what condtions imports either reduce GDP or have no impact on GDP. Under no scenario do imports increase GDP. Since our goods trade deficit remains large (around 39% of goods imports)either we are not selling enough exports OR the imports are displacing domestic production, thereby dragging down GDP. It is clear that the existing trade balance produces a GDP much less than what would be produced with equal trade.

Market solutions we have today. The results have harmed the U.S. economy. The U.S. does not have an “optimal” balance of trade, cannot have an optimal balance of trade so long as the trade deficit is higher than it could be if the U.S. acted to defend its own economy.

It is clear that the U.S. Congress and the President have the ability to adopt a version of the German value-added tax system or tariffs on imports from selected countries.

Raymond,

I believe that our current trade system is bad for the US, but not in the way you mean this. Currently our trade is driven by bad monetary and fiscal policy, not tariff policy.

I do not totally reject GDP as a measure, but we must realize that it is a manmade best guess and that simply improving elements that make it up do not automatically make for a stronger economy.

For example if there is a sudden injection of cash into the system to allow the government to finance a war you will see an increase in government spending and you will see an increase in consumption, an increase in GDP, but this injection has not at all created more goods and services. As a matter of fact it will dislocate the goods and services demanded by citizens to military spending.

Now there are those who would say, “See spending on military is good.” Others would say, “This proves that GDP does not measure well being.” I would say there is not enough information to make a decision and so simply looking at an increase in GDP does not tell us the whole story.

Because one component of GDP is exports-imports the measurement is biased toward exports. Your statement is correct that equal trade would increase GDP more than a deficit in trade, but that is a mere tautology.

As you have stated the real question is how do we defend our economy? I hold that the best defense of our economy is to maintain its freedom and not allow government intervention to interfere with the allocation of resources and the demand of consumers. When the government changes the rules of exchange it weakens the economy (either the natioally or the world). This is as true of trade policy as it is of wage and price controls.

Once again I come down on the side of freedom of exchange because I see it as benefiting both parties to the exchange while any interference by government harms one or the other.

Concerning international trade, yes, our government can harm other countries at the benefit of our country because of the size of our economy, but there are consequences greater than trade. The very reason you believe that our government should act to change our balance of trade is to counter just such actions by other countries, so you do recognize the harm done by such policies. I hold that you cannot overcome evil with evil. The US economy is so large that it drives most of the world economies. If we have honest money and fair and free trade we will drive the world economy toward prosperity benefitting all.

DickF –

You are as stubborn as me. You say “Your statement is correct that equal trade would increase GDP more than a deficit in trade, but that is a mere tautology”.

It is true by definition of terms. My argument is that it is also true because the formula adopted by BEA accurately reflects the way the total volume of goods and services created by the U.S. economy is produced. It is a valid causal statement IND ADDITION TO BEING A TAUTOLOGY.

You don’t believe that. But you provide no evidence showing that economic growth consists of elements outside of the formula. Money spent in the U.S. increases GDP but it impacts one of these elements in the formula as the way in which money increases GDP.

You say “Once again I come down on the side of freedom of exchange because I see it as benefiting both parties to the exchange while any interference by government harms one or the other”.

I see freedom exchange harming the rich country who no longer has the most efficient, most productive manufacturing sector in the world.

I see freedom of exchange benefiting those countries who have been able to create a trade surplus, whether through having cheap labor or a government that helps the country achieve a trade surplus.

What I see is real. What you see is theory. I admit the validity of your vision as a dream, an ideal. But it is dangerous to propose that U.S. trade policy be guided by an ideal that has been shown to produce bad results for the U.S.

DickF You say: “For example if there is a sudden injection of cash into the system to allow the government to finance a war you will see an increase in government spending and you will see an increase in consumption, an increase in GDP, but this injection has not at all created more goods and services”.

Wrong. In time of war, the tanks and machine guns are precisely the kind of goods needed by the country, not civilian goods. And tanks and guns are correctly counted as output of the manufacturing sector of the domestic economy.

Why are both of us so stubborn? Becaause a very important issue is at stake. Was Ronald Reagan right when he said government is the problem? Unless the U.S. can come to recognize the falacy of that statement, we will continue to decline as a nation. Our government is the means of reconciling differences between citizens. That is becoming an incresingly difficult problem. Good govenment is the only hope of recovery from our current economic and political problems.

The fact that our expectations of what government can do exceeds its achievements should lead to the recognition that our only option is to reduce our expectations and increase our achievements. All beliefs should be open to change as conditions change. Markets have their uses but they are only tools, not goals, and they should be viewed as failable instruments that can be improved.

I see freedom exchange harming the rich country who no longer has the most efficient, most productive manufacturing sector in the world.

Raymond,

I agree that our manufacturing base has declined but I believe that is because of government intervention, especially regulations and to some extent taxation.

One interesting thing. Recently I have had discussions with leaders from various companies and they say that labor rates are not why companies are moving offshore. It is more environmental roadblocks, regulations, and insecurity due to fickle government antitrust actions (Microsoft, other) that cause business to move to more secure environments.

Raymond,

Understand that with the Military Industrial Complex not all military spending is benificial to our economy. This is why I said there is not enough information to actually determine if the expenditure on military equipment is valid. Be aware that this is coming from someone who strongly supports the War on Terror.

Our government is the means of reconciling differences between citizens. That is becoming an incresingly difficult problem. Good govenment is the only hope of recovery from our current economic and political problems.

And you said I am the idealist?! 🙂

I consider James Madison as one of the greatest of the Founding Fathers. In Federalis No. 10 he talks about factions (special interests) and that they will always be with us. His solution as embodied in the US Constitution was to make the system such that it would limit concentrations of power in a way that would prevent factions from gaining control.

This is the concept that Reagan was talking about. Obviously he did not believe that we could live without government, he was President BTW. What he was saying is that when government injects itself too much into our lives it becomes the problem (run by factions).

For example, we all believe that we have a problem today with lobbyists. This is actually a more modern phenomenon. In the 19th Century, before government assumed fascist control of business, there was no real lobbying problem. The lobbying problem we have today is two fold. First, lobbyists attempt to protect their clients from government abuse and second, lobbyists attempt to influence government to abuse their client’s competition. But the common element is the abuse of government power as it releates to business.

From my comment above you should understand that I know business invites this abuse, but the business class and the political class engage in this collusion at the expense of the average citizen.

My goal is an ideal but my process is practical; disseminate power so that no faction can gain control (James Madison). When power becomes concentrated in the hands of a faction all suffer (think 1930s Italy, the birthplace of Fascism).

Finally, good government does not bring people together; that is propaganda from the political class. What brings people together is the freedom of exchange where both parties walk away more satisfied that when they came together. That is what the grocery store, the babysitter, and the movie theater are all about.

Government intervention for environmental purposes are extensive in Germany and Japan. Why can they create a surplus and the U.S. cannot?

An unregulated economy is a dream just like a world in which unions don’t exist.

I will agree that industrialists seek the country where opportunities are best for them. One of their requirements, usually, is ability to sell products produced overseas in the U.S. That ability should be controlled by the U.S. government in a way that reduces the trade deficit and increses competition among EVERYBODY that sells a product in the U.S. I love competition but I want competition structured so that the citizens of the U.S. benefit from the sales in the U.S. The marginal gain to consumers from free trade are not worth giving up control over access to the U.S. market.

Industrialist are free to move to any country they want. But they should not be able to count on selling in the U.S., without penalty, unless they are operating from a country that is willing to buy from the U.S.

The U.S. has become a complex system of interdenpendent people and regulation is the way we try to accomodate as many legitimate interests as possible. Regulation is not perfect, just as our court system is not perfect. I say this country must survive by better regulation and better courts and better government.

“Other people are the source of our greatest disappointments and our most intense pleasures” (summary of research of psychology studies).

Also applies to the Federal government. It looms big in our public and economic life. It cannot be wished away. Libertarians should learn from the Amish – find a niche where they will be bothered as little as possible. But the rest of us should try to improve our government, not make is smaller or bigger, but adequate to the task of taking care of those problems that cannot be solved by one individual – including trade.

I would rephrase this.

…the rest of us should try to improve our government, not make is smaller or bigger, but adequate to the task of taking care of those problems that cannot be solved by one individual – including trade.

the rest of us should try to improve our government by limiting it to the task of taking care of those problems that cannot be solved by the market and/or the individual – including trade.

The US Constitution was not written to enumerate rights (see the amendments 9 and 10) but to limit government in the spirit of the Magna Carta.

Free exchange will only take place if both parties to the exchange consider themselves better off after the exchange than before the exchange. If one considers he will be worse off no exchange will take place.

The previous post is absolutely correct for the parties to the exchange. Exchange is between individuals and firms. But the trade deficit is recorded between countries. Adam Smith thought that what was true for an individual is also true for the nation.

This is a logical fallacy. There are many examples of behavior that benefits a member of a group but harms the group as a whole – such as refusing to pay taxes or register for the draft in times of war. This example is from trade. Selection of an imported item because it is marginally better than the domestically produced item benefits the consumer but harms the GDP of the nation. The domestically produced product that is not sold because of that choice reduces U.S. GDP by 100% of the value of the domestic product. The consumer benefit is marginal – likely lesss than 20% of the value of the domestic product.

Selection of the imported product benefits the person doing the selection and harms the nation as a whole by reducing GDP.

We must clear our minds of the errors produced by Adam Smith. This fallacy of composition, as it is labelled by Thomas Sowell, is one of his worst mistakes.

“The US Constitution was not written to enumerate rights (see the amendments 9 and 10) but to limit government in the spirit of the Magna Carta”.

So says some thinkers. I had the idea that the people gathered in Philadelphia because the Articles of Confederation were unsatisfactory. They were unsatisfactory because power resided in the states. The conclusion was to form a new government, with more power at the center. The problem, in constructing a Constitution that all states would ratify, was to create a centralized power with enough strength to defend the nation as a whole while retaining enough states rights to get the constitution ratified.

Pragmatism carried the day. I look forward to a return of pargmatism in controlling U.S. governmental decisions. Today, on Sept. 19, 2008. we are witnessing the triumph of pragmatism when a serious problem can no longer be ignored.

Addendum to previous post.

The distribution of power between the central government and the states that was necessary to get the constitution ratified is not necessarily the balance that will maximize life in the U.S. today. Also, distribution of power between the central government and individuals appropriate to a nation of farmers may not be appropriate today.

In 1790, the external threat had to be meet with a Navy. Today, the external threat must be meet with better laws to control trade. Different times call for different responses. We are definitely in competition for economic srength with other nations.

We should look backward for inspiration and admiration for the skill used to navigate the problems of their day. We should not look back for solutions to today’s problems.