The U.S. recovery is underway. But so far it doesn’t look as strong as we had been hoping.

< |

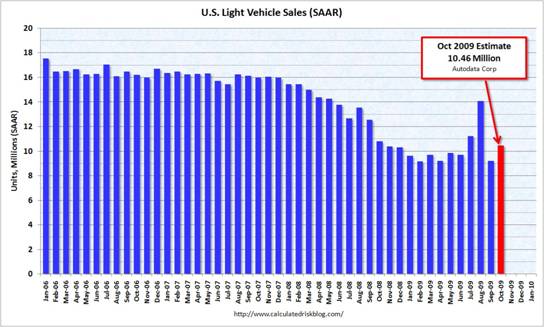

U.S. light vehicle sales last month were up slightly from September and about the same as October 2008. Given how dismal those comparison months were, that’s not saying much. Last month’s sales were 3.5% below the average level of April through June, which, because sales usually decline a bit more than that in the fall, counts as a modest seasonally-adjusted improvement. We seem to be past the bottom for autos, but climbing back painfully slowly at this point.

|

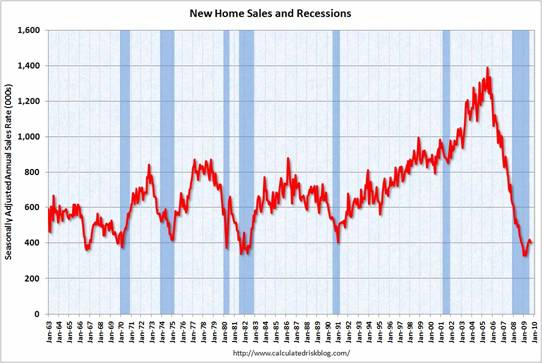

The same might be said of new home sales, which despite a slight setback in the most recently reported month (September), have definitely been gaining from the lows reached in March. But there’s still a long way to go before new home sales would reach the average levels seen in the 1980s.

|

Existing home sales, which don’t contribute directly to GDP but which do help absorb some of the overhang of distressed properties for sale, have been growing more solidly, and NAR’s pending home sales index is up 12.5% over the last two months.

|

Other new indicators have also been mixed. The Manufacturing ISM PMI, an index summarizing the responses of managers answering their survey, registered its third consecutive month above 50, indicating more respondents said that conditions were improving than said things were getting worse.

|

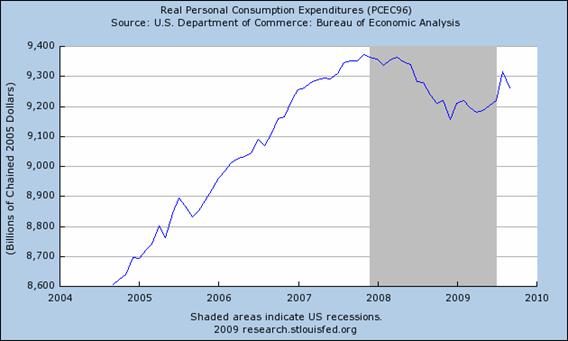

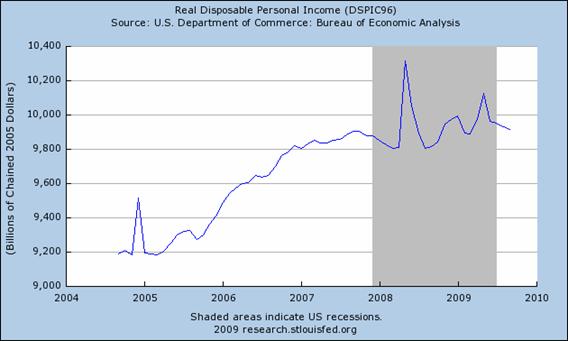

On the other hand, real personal consumption expenditures and real disposable personal income both dipped back down in September.

|

|

I remain convinced that the key indicator for a normal recovery will be a resumption of growth in U.S. employment. Unfortunately, ADP is estimating that the U.S. lost 203,000 private-sector jobs in October on a seasonally adjusted basis.

Bill McBride says we are a long way from normal. And I say, don’t bet against Bill McBride.

Let’s hope the BLS suprises us on the upside…

Fortunately, the macroeconomics profession was able, last January and February, to project a shining beacon to lead us out of the forest.

Looks like a typical post-recession recovery from the early 90’s/early 00’s downturns onward.

The main difference is this contraction was deeper(way deeper than 2001) than those. We have not even caught up to the GDP before the contraction. It may be another year before the “real” recession ends and how many years before the recovery is complete. It may collapse again even before we make those points.

This economic crisis has been built on cynism,attempted to be cured through the same that is immorality.A model for philosophers not for a society.

Shall we really expect improvements in data finesse, when the core is quiet rough?

Government housing and car programs have muddied the statistical waters. For example, I would imagine that cash-for-clunkers brought forward not only September, but also a reasonable number of October, sales. The charts do not, in any event, make a compelling case for government intervention in these markets. There does not seem to be any appreciable permanent impact.

Nice presentation, though. The story is neatly unfolds through the progression of charts.

Always one to add context, Barry Ritholtz helps us understand why ANY prognostications or after the fact reviews by economists should be taken cum grano salis.

http://www.ritholtz.com/blog/

See “The Hubris of Economics”

Despite all that, however, as a non-economist I still enjoy Econobrowser. Maybe it’s because everyone is so clever!

Footwedge

PS

I miss DickF (although I think I occasionally note his acerbic but insightful comments from some other nom d’plumes)

So the good news is that October car sales were up slightly. The bad news is they were still about 35% under the 2004-2007 average.

Something tells me that the domestic auto industry has not cut enough capacity.

It is hard to see that any of those indicators – positive or negative – send any signal that exceeds noise. We certainly know that they were generally wildly inaccurate during the last two years and we haven’t fine-tuned them since… so it seems to me that claims that the recession has ended are simply expressions of hope.

I can’t argue with the statement “I remain convinced that the key indicator for a normal recovery will be a resumption of growth in U.S. employment.” As far as I’m concerned that is close to the most unrecognised understatement possible relative to the current recession. I’m really amazed that so many pundits, talking heads, and other assorted experts keep telling us employment is a lagging indicator.

Historically gains in employment tend to signal the end of a recession. In seven of the last ten recessions the unemployment rate actually started falling at, or near, the end of the recession. Only in the last two recessions did we see a significant deterioration in the employment situation after the recession ended and after the recession of December 1969 – December 1970 the unemployment rate basically drifted sideways for about a year before significantly improving.

In reality a truly normal recovery requires gains in employment.

http://jpetervanschaik.googlepages.com

Why don’t we just keep stimulating since the multipliers are so high? Why not have a stimulus package once per month?

JDH wrote:

I remain convinced that the key indicator for a normal recovery will be a resumption of growth in U.S. employment. Unfortunately, ADP is estimating that the U.S. lost 203,000 private-sector jobs in October on a seasonally adjusted basis.

Professor, you are very wise. If you look at the newspapers during the 1930-32 period you will fing all kinds of stories of why the decline was over while unemployment continued to rise, but Hoover just couldn’t stop himself from making mistakes. Obama is doing the same.

Remember 1933 was a long way from 1929. Let’s see how things are in 2012. All we need is for the Democrats to push out massive spending on social programs (can you say health care and cap-and-trade) then push through massive tax increases (can you say health care and cap-and-trade twice) and you have Hurbert Hoover reincarnate.

Yes, overspending is dangerous now as it will ignite too fast recovery and provide source for next downturn in 2011. If that is short, then overspending was not too big.

If 2011 spring downturn is big, there are all chances for 2012 to be likened to 1933. And after that its not anymore mostly economic problem.

WASHINGTON (Reuters) – U.S. employers cut a deeper-than-expected 190,000 jobs in October, government data showed on Friday, driving the unemployment rate to 10.2 percent, the highest in 26-1/2 years.

The Labor Department said the unemployment rate was the highest since April 1983. It revised job losses for August and September to show 91,000 fewer jobs lost than previously reported.

But net result is 76 000 better than analysts expected, over 3 months, 10% less jobs lost than people were thinking earlier.

Last year when unemployment was at 5.6% I stated that by the 4th quarter of this year unemployment would be at double digits. A lot of smart people in the Obama administration, especially Christina Romer, said that with the stimulus plan unemployment would not exceed 8%. Surprise! October 2009 unemployment – 10.2%

But more shocking is U6 now at 17.5% unemployed. U6 is closer to the measure of unemployment used during the Great Depression. That means that current unemployment is higher than the unemployment of the FDR era.

We are in serious trouble and those brilliant people in Washington DC look like confused children. Government jobs programs and increased unemployment payments will only make the problem worse, but they have no other solutions.

RicardoZ

“We are in serious trouble and those brilliant people in Washington DC look like confused children. Government jobs programs and increased unemployment payments will only make the problem worse, but they have no other solutions.”

FDR’s government jobs programs resulted in more than 3 million jobs being created, many of them very productive ones. These programs, along with others, reduced unemployment (which was in the low 20s, not the teens) by more than 10%.

Bank reform, finance reform in general and the stock market in particular, safety net reform and expansion: All programs of FDR in his first two years.

These are the solutions, RicardoZ. The private markets are on their backs and not producing enough real investment opportunities.

Government is the solution in times like these.

There isn’t any economic recovery underway in the United States. There is a take-back of the acute phase of our industrial collapse. And also, there is recovery in the rest of the world primarily outside of the OECD. But here in the States we are suffering, and will continue to suffer, a more permanent and long lasting state of depression as a result of our failure to build a sustainable economy, and the amount of debt we took on to build the economy we did choose–the wrong one. The wrong economy was of course the Housing, Automobile, and FIRE economy.

Indeed, there are indications in Friday’s report that the employment situation is worsening.

We would have a chance to escape the present situation were three conditions different than they are today: 1. If we had significantly lower levels of private debt. 2. If we had significantly lower levels of public debt. 3. If we has cheap energy inputs on the order of, say, oil at 10 dollars a barrel.

To the last point, during the pre-peak oil phase the US was always able to depend on a significantly lower oil price (ex OPEC politically motivated embargos) to recapture operating leverage during recession. Now, during the current Depression, oil is of course above 75.00. That is crushing.

There is no outcome now that is short of disaster for the US economy. A best case scenario would be 10 years of Japan style malaise. We should be so lucky. Because even with the Japan model, we do not have a high rate of savings nor do we have a powerhouse manufacturing base from which to export stuff to a robust global economy–as Japan did in their first lost decade.

G

This is what you wrote on Oct. 29:

“Based on the 2009:Q3 GDP numbers just released, the value that the algorithm assigns to the second quarter of 2009 is 84.6– based on currently available data, it looks like the economy was still in recession as of the second quarter of this year. We’ll declare the recession to be over when the index falls below 33”

Is this consistent with the first sentence of this post: “The U.S. recovery is underway”?

Anantha Nageswaran: There is no contradiction between saying that the economy was probably in recession in 2009:Q2 and is probably in recovery now in 2009:Q4.

Also, just as members of the NBER Business Cycle Dating Committee have been saying things like, “the recession is probably over, but we will not issue an official declaration of that until much later”, I take the same basic position.

Gregor,

While we are reconstructing the economy, may I suggest we diminish the importance of “consumer confidence” (i.e. live beyond your means) or at least include a category for consumer saving? Spending is why “The wrong economy was of course the Housing, Automobile, and FIRE economy.”

And, from where do the $$ come in order to express “confidence” if not from the wrong economy? It is the perspective that is wrong not the source.

These charts indicate the anemic sales of new houses and car sales. I’d like to see some consumer credit charts. See there still is demand for new homes, but no banks are financing without 20%-50% down. And for the average couple in California for a $700,000 house for example. The bank is asking for $140,000 down (20% of $700,000) and not many have that sort of cash saved up. The true difference between the peak of the bubble in 2007 to recession today of 2009 is that banks are not lending money like they did before since there is no surplus of cash from China. If the banks somehow manufactured a way to allow more credit the economy would regulate itself. The only problem is what do you do about all the foreclosures and default on credit?