Finally we’re starting to see some convincing indications of economic recovery.

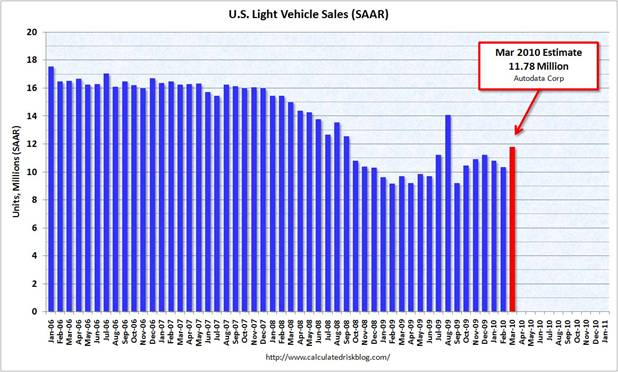

U.S. light vehicle sales in March were up 24% from the previous year, the first impressive year-over-year improvement in quite some time, and the best month we’ve seen since August 2008, if you don’t count the cash-for-clunkers August of 2009 (and I don’t). If you’re looking for something to gripe about, you could still complain that March 2010 remains 21% below the level of March 2008 and 31% below March 2007. But I’ll take what I can get.

|

Even with the U.S. gains, GM still sold more cars in China in March than in the U.S. Here’s how the numbers look seasonally adjusted.

< |

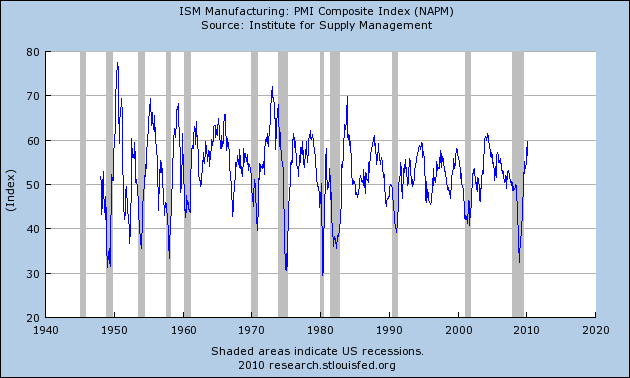

The Institute for Supply Management PMI manufacturing index also looked great, rising to 59.6 for March. This means that managers reporting improvements outnumbered those reporting declines by the highest margin seen since 2004. Improvements in PMI numbers are also being reported around the world; see the Wall Street Journal for a nice tabular summary.

|

And perhaps the biggest news was the March employment report from the BLS, whose establishment survey estimated that U.S. employment increased by 162,000 workers in March on a seasonally adjusted basis. I was surprised that Mark Thoma, Dave Altig, and Dean Baker found this disappointing. Certainly it was better than ADP’s estimate that seasonally-adjusted private-sector employment had fallen by 23,000 in March, and received confirmation from the separate BLS household survey estimate that March employment grew by 264,000 workers, as well as from the 55.1 reading for the employment component of the ISM manufacturing report. True, 48,000 of the 162,000 new payroll jobs represented temporary Census positions. But those people are nevertheless now working rather than unemployed, and earning a salary with which they can buy goods and services or avoid bankruptcy and foreclosure. It’s also true that another 40,000 of the March gain came from temporary help services, but that’s often where employment growth first shows up. And I acknowledge that 162,000 isn’t enough to bring the unemployment rate down, which remained stuck at 9.7% for March. Even so, this is enough better than what we’ve been seeing and than we could have seen that I personally am quite relieved. For a mix of the range of other optimistic and pessimistic takes on the employment numbers, see Phil Izzo’s usual nice summary.

Or if you prefer a purely objective read, note that this was enough to lift the Aruoba-Diebold-Scotti Business Conditions Index most of the way out of negative territory.

|

Until China bubble break (Sep 2010 – Jun 2011) , things look good.

These are good signs. I worry about the level of oil prices going forward. It would be interesting to hear from you on that.

In spite of all the good news, housing starts and mortgages still seem to be on the brink of “yuck” and “horrible”. Then there is the steep increase in personal bankruptcies filed in March.

These two issues will haunt us for a bit I believe.

This is very good news. I am wondering if this will bring about a continued strenghtening of the U.S. Dollar which will bring down the prices of oil, gold, etc. That would have an effect on the stock market too.

I fully support efforts by all parties to promote entrepreneurship and business activity in the United States. We should at the same time interpret business data within a reasonable context. Vehicle sales appear to be moderately improving, with net business sentiment positive since about December, and the free-fall in employment seems to have abated. We should balance these positive developments against a $1.4 Trillion Federal Fiscal deficit in 2009, $0.4 Trillion in current account deficit, and $1.2 Trillion in free liquidity supplied by the FED. In total, there was $3 Trillion of unsustainable stimulus injected in 2009 (28% of the civilian economy).

It doesn’t take a rocket scientist to realize that if it takes a 28% liquidity-inflation rate for the economy to essentially tread water, that the USA will be in for some tough times when these supports are no longer feasible. I am pleased however, that these stimuli have been managed to prevent a massive speculative bubble. I am displeased that regulatory management has perpetuated fictitious marking of distressed securities and has not tackled the (now sleeping) 1000 pound gorilla: an unregulated financial derivatives market.

Mr. Hamilton,

Before you get to carried away in your cheering for the economy based on light vehicle sales, you may want to qualify that data, as opposed to simply quantifying it. The jump in light vehicle sales was predicted by automotive analysis Edmunds.com (~12 million SAAR for March) due to the large incentives given by the automotive makers, especially in response to Toyota trying to regain market share.

The problem going forward is that inventories are not high enough to justifying continuing the incentives over the long run–and it wouldn’t be too profitable to step up production simply to continue the incentive program (this is about trying to gain market share with existing inventory that companies are already stuck with; and they are reluctant to step up the production process only to get stuck with a large inventory over hang).

Sorry, but growth is going to fall off during the 2nd half of 2010 and the next RE debt wave is coming in 2011. The chance of not getting a “NBER” recession is small.

Just to much private debt and little being done to combat that than massive borrowing for the invester class.

Improvements are noticeable and much more, when looked at through the prism of liberty, equality, fraternity.

On liberty (the list is far from limitative)

See Occ report P3,P10 and further pages.

http://www.occ.treas.gov/ftp/release/2010-33a.pdf

May be an other visit to the ECB monthly bulletin P51,P52

ttp://www.ecb.int/pub/pdf/mobu/mb201003en.pdf

To be supplemented by the March 2010 IMF report on Germany providing as well an outlook on European banks assets profiles and profit?

http://www.imf.org/external/pubs/ft/scr/2010/cr1085.pdf

On equality (In econometricians parlance,there are noises and crowding out to be perfected)

Annual Income Variance Analysis

INSEE study, April 2010 (very high incomes earned more than others between 2004 and 2007, mostly in capital gains)

Shadow government statisitics

http://www.shadowstats.com/article/income-variance

On fraternity.

Among others, an other visit to the ECB above mentioned monthly bulletin and the household savings subsidising the financial industry and ultimately states bonds.

Total Borrowings of Depository Institutions from the Federal Reserve

http://research.stlouisfed.org/fred2/series/TOTBORR

Happy with the analysis, with the exception of that first part, on vehicle sales. The surge in sales was bought with lower prices of one form or another. It was just enough to keep the 3-month average steady, which strongly suggests catch-up buying by people who’d have bought cars earlier if not for Toyota’s screw-up.

We have seen before what happens when the blandishments of auto makers (and the government) are withdrawn. This is truly a case of “too soon to tell” with cars.

Brian notes that inventories don’t justify continued sales incentives. Note that Toyota declined to say whether it would extend incentives – rather odd behavior, suggesting that Toyota sees what Brian sees. There are also suggestions that auto output may have reached a temporary peak.

I wouldn’t mind a bit on oil either. Personally, if I were the Obama adminstration, I would consider using the strategic oil reserve to defend the $80 mark (an idea you had floated some time ago), and I would be leaning on the Saudi’s to open up the spigots a bit, for at least the next six months or so to see if we could get unemployment down.

A recovery is under way but is it sustainable with the current pace of jobs being recovered. With a new influx of students and MBA’s coming back out into the world we need to find more industries that are sustainable long term (note look at all the former mortgage brokers and realtors, flippers, inspectors, etc…) that can help propel us out of the great recession that will help the march 2009 bull market sustainable past the next gdp report. Agreed?

An aspect of the oil price issue, which I agree with some is one of the items out there that has a bigger chance than most of derailing this recovery, is the forex rate between the US dollar the Chinese yuan/rmb. We have all these people in the US, including even Obama, yapping about wanting the Chinese to revalue/appreciate their currency, even though they ran a trade deficit last month reportedly. Yes, that might help US exports some and cut back on some Chinese import competition, but another effect of such a yuan/rmb appreciation, especially if it were to be serious enough to actually impact the trade balance, would be to put much more upward pressure on the dollar price of oil as the abiliity of the Chinese to buy oil in global markets would increase. This would be dark side of this supposed outcome that so many are making such fools of themselves crying out for.

Two thoughts/insights I had about the recent employment nubmers were:

1) While unemployment remained the same, underemployment rose. While some money is better than no money, I’m not sure how much this will help people avoid bankruptcy (and that it may be a sign of people’s unemployment benefits ending).

2) Where are all the Census workers? In March 2000 the Census hired approximately 154,000. Why only 48,000 this time?

Always knew the November 2010 election deadline would pamper our economy (or at least the media concert about it), yes we can- paradise is near.

Cheers James, just sold my Goldman Sachs shares at 170 ! (bought at 60, after Warren B. bought at 70): You know its time to look for cover, when famous economists speak like “looks good to me”.

The disappearing middle class, unemployment levels remain the same, underemployment rising, bank buddies bonus ultra rising, I guess …

Of course, the unemployment rate is likely to remain high even as the employment to working-age-population ratio starts rising as discouraged workers re-enter the labor force. It should be kept in mind that during the mid-1980s we had a period of nearly three years when the unemployment rate was stuck at almost exactly 7% while the latter ratio more or less steadily rose (except for a hiccup in 1986).

Steven Koptis wrote: I wouldn’t mind a bit on oil either. Personally, if I were the Obama adminstration, I would consider using the strategic oil reserve to defend the $80 mark (an idea you had floated some time ago), and I would be leaning on the Saudi’s to open up the spigots a bit, for at least the next six months or so to see if we could get unemployment down.

Fiddling with the strategic oil reserve strikes me as a bad idea. For one, it should be reserved primarily if not exclusively for the armed forces and massive civilian emergencies. It sends the wrong signal; it contradicts what ought to be national policy goal of cutting oil per capita consumption by near 50%.

Want oil prices to back off? Increase taxes on common oil-derived fuels. Announce a schedule of increases that starts in two years.

As for arm-twisting the Saudis into opening up the spigots, the USA can try, again, but I doubt pleading on bended knee will change anything. For one, by all accounts the current global oil market is well supplied. For, two, I think the memories of Gaza, late 2008, and recent Israeli intransigence will make squeezing special favours out of the Saudis all the more difficult.

Frankly, I have to ask if OPEC solidarity could have worked at all if it were not for the American-backed Israeli occupation of the remaining bits of the Palestinian mandate since 1967, and now the US invasion and occupation of not one but two Muslim nations. Israel did after all hand President Obama a most interesting inauguration gift in the form of somewhere near 1,000 dead Gazan civilians, and has recently continued to saliently defy American diplomacy.

Colonialism is not cheap.

Late 1982 and in January 1983 and onward, Reagan signed tax hikes and employment grew steadily.

In 1990 in the middle of a recession Bush signed a tax hike, and again in 1993 Clinton signed a tax hike, with employment rising to the highest rate in post agrarian America in the longest US expansion.

In March, Obama signed the first tax hike, (about a trillion dollars), since 1993, with March employment increasing.

As I look to US employment history, tax cuts represent an attempt at a free lunch, having it all without any sacrifice, economic growth and high employment and rising wages without paying for it. It seems to permeate society, looking to “create wealth” through pump and dump, promoted by low short term capital gains. Labor is for fools, for buying low and selling high a week later is the essence of conservative capitalism.

Hiking taxes requires admitting there is no free lunch, no matter what Reagan or Bush promised.

GM did forecast the “new normal” for vehicle sales to be 12m annual units, so we are about there.

Companies are supposed to hire back some workers they laid off just due do excessive cutbacks. Maybe we are starting that now.

As far as the census goes, they made it much too easy. All I had to do was fill out a bar code friendly form and mail it back in. You’d think a personal visit by a pair of census workers carrying stone tablets and chisel, or at least parchment and pen, would have made for more a robust employment program. And why not every year instead of only every ten?

So we have seen what kind of numbers $3 trillion in fiscal deficits and monetary stimulus can buy us, but no problems have been solved yet.

We haven’t got to the part about higher taxes yet, because, um, we can’t afford them.

We can’t move banks back from mark-to-make-believe for the same reason.

Looks like Big Banking is liking oil again as the preferred way to intermediate our ZIRP savings, CD and checking accounts. Strong car sales in China must give them some confidence in oil demand.

Green Energy was one (and maybe only) nominee for Next-Big-Thing industry driver for US growth and employment. We are now doing Cash for Appliances, so US retailers can flip more Chinese stuff. One small step for an energy independent America. Still no word on a National Strategic CO2 Reserve.

So the Fed and the USG tell us that interest rates will stay extraordinarily low for an extended period of time, the same for GDP and employment, and the opposite for the fiscal deficit.

Whatever they say.

I think that these signs have been around for awhile. The business conditions index indicated that the economy started to increase after about February, along with the PMI. However, I don’t think light vehicle sales are a very useful indicator of economic health. I think this blog post is almost 10 months late, tbh.

March auto sales obviously weren’t indicative, but anyway, reflation is clearly lifting production. The question is, how much of this is economic production and therefore sustainable growth, and how much is uneconomic production and therefore unsustainable growth? Unsustainable growth can be sustained for quite a while before it inevitably collapses, long enough for most critics to join the bubble-cheering crowd.

We are at a crucial juncture for monetary policy, with the Fed finishing its MBS purchases. Not only does that bring more than $1 trillion a year of MBS supply to the private market, it also cuts off the supply of newly created money that was being pumped into the banking system, which has been supporting appetite for Treasuries.

At the tight end of the range of possibilities, the Fed could aggressively drain the $1.1 trillion of excess reserves by selling off its holdings of MBS’s and Treasuries. That would push interest rates up very quickly. On the loose end of the range, the Fed could avoid draining reserves and instead encourage banks to use their excess reserves to buy MBS’s and Treasuries. That would keep rates low but push inflation up very quickly. My sense is that we will see something closer to the loose end of the range.

Johannes and Brishen: My summary assessment of how the economy is doing overall is provided by our Econbrowser Emoticon, which shifted from unfavorable to neutral on August 30, 2009 and remains there today.

I still don’t think we can have a real, sustainable recovery unless real oil prices fall to 2005 levels.