The stock market has looked scary. But economic indicators suggest U.S. growth is continuing.

Last week the Federal Reserve Bank of Chicago released its National Activity Index, which summarizes the common tendency of a large number of indicators previously reported for August. The 3-month average of this index now stands at -0.28. We’ve seen this number that bad in 26% of the months since 1967. 59% of the time when the CFNAI was this bad or worse, the economy was already in a recession.

|

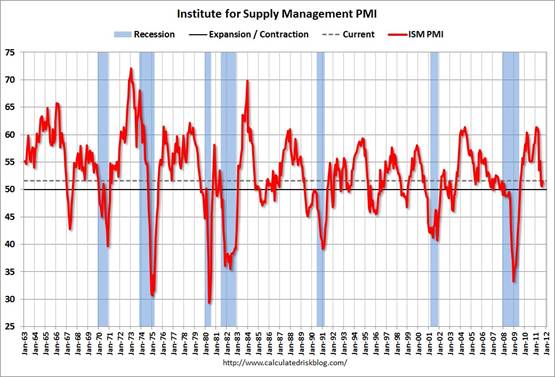

But the indicators coming in so far suggest that September was a little better than August. The ISM survey of managers of manufacturing facilities

resulted in a value for their PMI index of 51.6 for September, up from 50.6 in August. A value above 50 indicates that more responders reported improvements than reported deteriorations. Still, we should see a majority reporting improvements if the economy were growing, and the average historical value for this index is 52.7. The September PMI is thus consistent with the conclusion that growth picked up a bit from the very disappointing August, but remains below average. The ISM non-manufacturing index for September was reported today to be 53.

|

U.S. auto sales also suggest some improvement. The number of light vehicles sold in September was up 9.8% from September 2010, and down only slightly from August, significantly improving on the usual seasonal drop-off.

|

Sales of domestically manufactured light trucks were up 16.9% over September 2010 and even up slightly over August 2011. In part because of where we started out the year, the domestic auto sector has so far avoided a big hit to demand. This is one of the features that led me to conclude that the oil price increases earlier this year would not be enough by themselves to bring about a recession.

|

The most important indicator for September will be the employment report due Friday. ADP estimated today on the basis of the 23 million employees whose payrolls it maintains that nonfarm private business sector employment increased by 91,000 workers on a seasonally adjusted basis between August and September. If true, that would be disappointing, since we should get about 45,000 jobs added back in from settlement of the Verizon strike alone. In addition, public sector cutbacks will likely continue to put a drag on total employment.

My biggest worry continues to be developments in Europe. The fiscal cutbacks and uncertainty will be enough to reduce growth significantly on the continent. And the possibility of disruption of interbank and private lending remains quite serious. I’m having a hard time seeing how the sovereign debt story will have a happy ending.

Thanks for this. Very informative.

I think your stats correctly capture the state of the economy. But with Lakshman Achuthan of ECRI making a clear recession call yesterday, and given my own horse in the race, I will hold with the recession call I made several months ago.

But you’re right, something else has to fall over to push us off the cliff. There is another seemingly exogenous event which must occur to bring on recession full force, I think.

This is how I see near future in economy, especially the USA:

1) defaults and recession starts in Europe in q4 2011, or q12012, EUR goes down, inflation (3% today) holds or moves up. Same for UK. USD moves up vs almost every currency.

2) recession start in the USA in q1 2012, and is DEFLATIONARY since USD being reserve currency, no one has guts nor ability to inflate it as issuance of more USA debt is crucial for funding USA but also for creditor nation political regimes who does not want to see default.

3) recession -debt deflation in the unfortunately pegged USD (reserve currency) – continues in 2012-2014, perhaps even 2015. During that time the debt gets so obviously unsustainable that creditors ( including own USA citizens) lose their trust MORe than they fear the consequences of default, especially, since, USA, with deflation can fund by this debt also military actions in PREPARATION for default and its geopolitical consequences ( e.g. OIL must be secured before default). Some countries may not like continuing financing such USA military activities AGAINST them.

4) in early 2015 or latest , late 2015 , USA defaults on its debt, haircutting perhaps 30% ,perhaps 50% of it both internationally and nationally. USD starts to devaluate, and , only then, inflation appears, giving some hope for recovery, but also in a world with immense geopolitical tensions where USA is still THE military power, however, outstretched to the limit and with very few allies left as everyone has got a haircut, some has got military intervention;

5) the fact that the USA will be in deflationary recession for 3 years will not be obvious to everyone, as it is not now, since option of default and inflation with FED easings will allways look very close- but it will not be – for the reasons I mentioned above- in recession, USA needs to borrow even more than ever, and creditors will initially have no choice but go along as restructuring reserves from USD to WHAT else (?) will be damagingly costly and take time and preparation.

6) so, in 2016 new regime begins. EUR/USD parity is expected during 2015.

The annual change of price-adjusted private per-capita economic activity is already contracting, along with further negative deceleration of the 10-yr. avg. rate.

The net compounding interest claim to avg. term of US total credit market debt owed is now near 100% of GDP (and 160% of private GDP), with total credit market debt having grown 4-5 times private GDP since ’00-’01, resulting in total debt of $5.5 to $1 of private GDP. Total credit market debt owed (assets owned, including equities) will contract 50% hereafter. As large as that sounds, note that total credit market debt owed increase by $22 trillion from ’01 to ’08-’09 to date.

The US gov’t borrowed and spent an equivalent of 50% of private GDP since ’08 just to keep the nominal GDP flat and private economic activity from contracting an additional 10-15%.

Growth of medical spending has exceeded private GDP growth for 25-30 years, growing 40% faster from ’80 to ’00 and over twice the rate since ’00-’01. The avg. rate of growth to the pct. of household spending on medical services (including medical insurance premia and coinsurance) is subtracting ~0.5%/yr. from household income in addition to the hit from higher energy costs, occurring with flat to negative growth of real household income.

By no later than ’13-’14 (and as soon as this year), the cumulative differential rate of growth of medical spending to private GDP will reach the critical order of exponential magnitude and cease growing at all, requiring a contraction of at least 30% and 50% in real per-capita terms in the decade thereafter.

Global debt/asset deflation (liquidation) is inescapable, as are persistent secular drag effects on economic activity for a debt-based financial system and economy.

Further gov’t deficit spending and central bank reserve printing will only push commodities prices higher at the margin (until recession again causes another crash in commodities prices) and reduce profit margins, household spending, and real per-capita GDP that much more.

Even though most economists, corporate CEOs, politicians, and financial media influentials have yet to internalize the reality or discuss it publicly, growth of private per-capita economic activity is no longer possible.

IMF global growth forecasts are hovering around 4%,number considered to be close to recessionary.

Financials corporations are living in autarky,nothing of a deterrent since money markets lendings are not rewarding when bearing a very thin spread that is not reflecting unknown risks.

Any additional liquidity requirement is the reflection a dynamic,assets quality deterioration.

Restructuration are rare,assets sales seldom, capital increase can only be performed when sustained by reliable accounts,meanwhile it is trust with mutual suspiscion.

Thanks for the charts.

I just saw your publication “Calling Recessions in real time”. Interesting.

Markets appear to be preparing for a second global financial crisis. If that’s what we get, markets could get worse. If the debt issues can be merely converted into a controlled slowdown, then that might provide a positive surprise.

If it’s not officially a recession, it’s definitely malaise.

Ivars, your scenario conforms quite closely to what I expect, including the S&P 500 falling as low as the 400s (US$ par) to 500s-600s (US$ constant), the U rate reaching 13-15% to 18% (and U-6 at 25-30%), and fiscal deficits approaching 80-100% of receipts.

Economists constantly tell us that we’re not that other place across the Pacific that has experienced now the beginning of the third “lost decade”, and they say that “it” can’t happen here; however, “it” has been occurring since ’00-’01.

The Philly Fed also has this: http://www.philadelphiafed.org/research-and-data/real-time-center/business-conditions-index/

the next update is Oct 6.

IMO, slow growth until HH’s get their balance sheets in order. Anything that raises home prices and/or pension accounts will help HH’s feel more wealthy, which in turn, will increase consumption growth.

Firms have no reason to hire until they see a permanent increase in HH spending.

Further rounds of temporary fiscal stimuls will do little to improve the HH balance sheet and will certainly add to the deficit.

Bernanke is doing about all he can to improve the HH balance sheet. We just need to realize the government or the FED cannot fix every economic calamity in a timely fashion.

Ivars, your scenario makes sense to me, with some caveats. Yes, european defaults start this year, but only with Greece. Next year is unlikely to see major countries default, certainly not the scary ones (Spain, Italy, France). Much depends on the global response, but I see it more likely than not that the major EU countries will avoid defaults altogether.

But the biggest concern I have is with your boundless optimism regarding the US. Only Greece is as indebted as the US (in terms of government debt versus government income). I can’t imagine that the US default would take until 2015, even with the huge advantage of being the “home turf” for most of the financial world. Political issues are most likely to cause a technical default in 2012. A more pervasive default follows the election of the Republican candidate who will claim that it’s Obama’s fault.

So says my crystal ball 😉

Hi, I’m James Hamilton, and I’m obsessed with the numbers on car sales and GDP. The entire purpose of an economy is to get our economic numbers to where they were in 2005.

Satisfaction of human wants, sustainable modes of production … forget all that crap. People are just supposed to blindly buy, buy, buy. Consume, consume, consume.

I don’t care if they have a better use for their money than buying a new car every 18 months. Our entire economic greatness is predicated on whether people will keep going deeper and deeper and deeper into debt to “support consumer spending”. You see, as a fundamental invariant of reality, 70% of “the economy” is consumer spending. Therefore, it naturally follows that if consumers aren’t rabidly buying crap like they were in 2005, we have a bad economy, and we need some stimulus action to get that fixed up.

Frankly, those people who save for the future instead of spending every dime they have are committing the economic equivalent of terrorism. People shouldn’t save their money. That’s for the rich. If you go through hard times, you’re supposed to rely on the state for welfare. Trying to avoid the state dependency undermines the whole system.

The way it works is, we get money in your pocket, and you SPEND that money at the dinosaur banks and car companies we in the government have propped up. And if you don’t? Well, it would be a shame if we found some problems with your tax return, wouldn’t it?

Buy. Buy. Buy.

Consume. Consume. Consume.

Slow growth may have happened through September.

But ECRI has already called a recession as starting.

It could even be severe.

tj While I agree with some of what you said (even though I think you overestimate the wealth elasticity), I’m afraid you’re simply flat wrong here: Further rounds of temporary fiscal stimuls will do little to improve the HH balance sheet and will certainly add to the deficit.

In order to improve balance sheets households must save a larger portion of discretionary income. Since there is no private investment demand for that extra saving, it’s up to the government to be the borrower of last resort. If the government doesn’t do the borrowing, then the extra saving represents a permanent and nonrecoverable leak from the income flow model. In other words, incomes will shrink all around. True, households will still have savings accounts with numbers indicating the number of claims those households have on pieces of paper with pictures of dead Presidents, but future income shrinks by more. So increased household saving without a corresponding increase in the willingness of counterparties to borrow makes everyone worse off, not better off. It’s perfectly rational for households to want to save and repair balance sheets; but this is ultimately a self-defeating exercise unless government is willing to soak up that extra saving. The problem savers face today is that there aren’t enough financial assets out there to meet demand, so the price of those assets is bid up, lowering the interest rate. Right now increasing the size of the deficit over the short to medium term is probably the only way out of this mess.

While not as harsh as Silas Barta, I do agree that car sales is not as perfect of a metric as it is presented as. This is because :

1) It does not account for someone who might have bought a $50,000 car instead opting for a $20,000 car. Why so much interest in units when the ASP is not mentioned?

2) It does not account for the fact that car technology is getting better, which means cars are lasting longer. This is a good thing, but can make unit sales look low.

Silas –

I think you are too harsh by a margin. This blog is about economics–not fashion or happiness–both of which are legitimate topics in their own right, but not here.

Jim is looking for metrics which provide timely and useful insight into levels of and trends in economic activity. He is not making a moral case to buy a pick-up. You could as easily complain that all cardiologists are interested in is pulse and blood pressure. It’s true, but that’s what they do.

Last night, I was riding the subway back with some of the Wall St. protesters, nurses in this case. They wore t-shirts on which was written “Jobs, social security, healthcare.”. Now, mundane bread-and-butter issues may not matter much to you, but clearly they were important enough to the protesters to bring them out to Wall St.

operation twist is a failure. The Fed needs a committment to a nominal GDP target, and unconditional action until we get there. Maybe in 20 years.

Car sales are not the only positive indicator.

Have you seen gas prices? They’re down, but nowhere near where I’d expect them to be considering the time of year and the price of crude.

Something is keeping gasoline prices up. It’s called demand.

2slugs,

Theoretically your arguement makes sense. Let government borrow at low rates and spend the borrowed funds rather than have those funds sit as excess reserves in the banking system.

However, HH’s shifted future consumption to the ‘present’ (ie the last decade(s)) by borrowing beyond their means. Now you are proposing that we solve the resulting consumption problem with public borrowing, which by definition will shift future public spending to the present. There is a big IF to make all this work. What happens if we are still in a slow/no growth state 5+ years down the road? The point is that there are any number of scenarios that could leave HH’s with slow/no income growth (=> slow/no tax revenue growth) but with an ever increasing amount of public debt. The elephant in the room is the inability of the U.S. government to make good on its obligations in a future environment where tax revenue growth is 0 or

If you calculate the pre-recession trend in auto sales a continuation of that trend would imply that auto sales should now be about 17 million. But auto sales are actually 13.1 million. This 4 million difference should account for many factors, including the point with improved durability of new cars that the average ago of the auto fleet is and should be higher.

In the per-bankruptcy era the three US car companies required sales of some 15-16 million for them to be profitable in the US. Now they can be profitable in the US with domestic sales of some 12 million. That makes a big difference in how we evaluate auto sales.

There is a big preoccupation with growth as a measure of the health of an econnomy. But other factors might be considered. One of those is the reduction in private debt. Fed stats show that consumers are returning toward the past mean of debt relative to income. This naturally subtracts from GDP.

Only after consumers have a more manageable debt load can they resume more normal consumption. Even then they might try to save a little more for a rainy day.

Since it is clear that long-term growth cannot happen if consumers are crippled by debt, why not include progress in this regard in a holistic measure of the economy instead of focusing on immediate growth as our single yardstick?

including the point with improved durability of new cars that the average ago of the auto fleet is and should be higher.

Yes. And this is a good thing. See my comment above.

There are times when productivity gains are not aligned with GDP increases, and this is one of them.

Bruce:

1)DJIA to 6000-6500 in q1 2012 in nominal USD, howering around that level ( up to 7500, than down again) for at least till the end of 2014.

2) It will happen in the USA, and Japan will be finally forced to follow.

endorendil:

1) USD being world reserve currency, USA will not default even with recession in 2012-2014 earlier than 2016- both the USA will need increased debt to finance anything as tax receipts fall even more, and domestic environment is debt deflationary

2) creditors will support this to be able to continue selling goods and avoid losing value of USD reserves as long as USD maintains/INCREASES its value against most other currencies. However , I strongly suspect China will move to silver standard in October 2012, when also Eurozone will shed a bunch of its weak members- to protect themselves from inflation caused by strong USD and commodities prices in USD.

3) What ever politicians do, who ever is presidents, which ever party controls House and senate, USD debt has passed sustainability limit in 2006, and default is imminent.

My analysis here:

http://saposjoint.net/Forum/viewtopic.php?f=14&t=2626&start=620#p34423

Suggest that default will happen in end of 2015- early 2016, USA debt will stand at 21 trillion USD, and the haircut within next 2 years ( 2017-2018) will be in the range of 50-75%. Hence inflation in the USA will be on average 25% in 2017-2018..