I was interested to take a look at the trends in receipts and expenditures of the U.S. federal government over the last 40 years.

The top panel in the graph below plots federal expenditures as a percentage of GDP since 1972. There were a few years when this fell below 20%, but it has averaged about 22% over this whole period and for the last 3 years has been above 25%.

|

Federal receipts, in the bottom panel, have rarely been above 20% of GDP, and historically averaged about 19%. The difference (22 – 19 = 3) is the 3% deficit the U.S. has maintained on average over this period. For the last 3 years, receipts have been below 17%.

With expenditures in 2011 3.2% higher as a percent of GDP than average, and receipts as a percent of GDP 2.4% lower than average, we had a federal deficit in 2011 equal to 8.6% of GDP, or 5.6% higher than average.

Next consider breaking spending down into its 3 main components: defense, entitlements, and other. The graph below plots each of these as a percent of GDP, with horizontal lines indicating the historical averages. U.S. defense spending at the moment is right at its historical average of 4.7% of GDP, though at one point it had been as low as 3.0%, a value reached in 2000. Spending on categories other than defense and entitlements is also close to its historical average. From a long-term perspective, all the growth in spending has come from entitlements.

|

In particular, Medicare has gone from 3.6% of all federal spending in 1972 to 15.6% in 2011, Medicaid from 2.0% to 7.6%, and income security, which includes unemployment compensation, Supplemental Security Income, and welfare, has gone from 7.1% to 11.2%. As the population ages and relative medical costs increase, entitlement spending will become even more dominant.

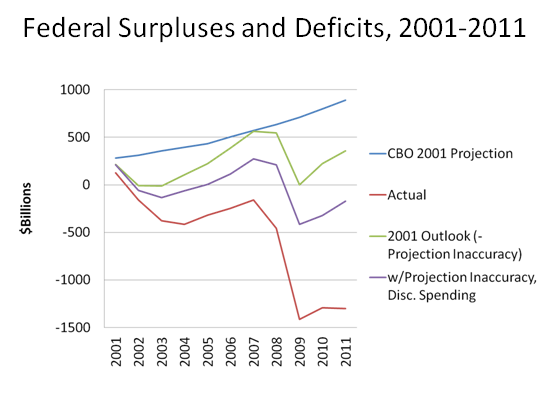

In addition to these long-run trends, it is also interesting to look in particular at the changes over the last decade. Economic Policies for the 21st Century examined what turned the surpluses that the Congressional Budget Office had been projecting in 2001 (the blue line in the graph below) into the actual large deficits (red line). One important factor is that GDP did not grow as fast as CBO had been predicting; the contribution of unanticipated “economic and technical changes” is summarized by the green line. A bigger contribution came from the fact that discretionary spending (chiefly defense) was higher than anticipated by CBO in 2001 (purple line). The tax cuts also made a material contribution.

|

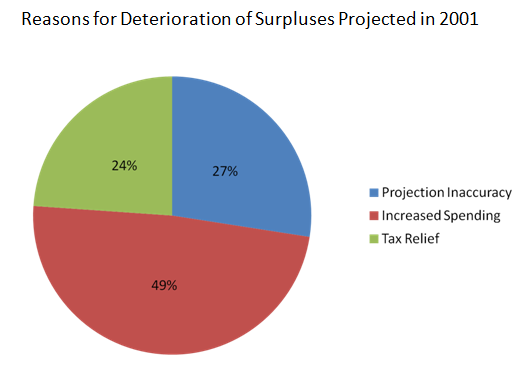

Here is E21’s calculation of the respective contribution of the various factors.

|

The implication of a simple look at the numbers should be obvious to any objective observer. To return to long-run fiscal solvency, the U.S. will need both tax increases, defense cuts and significant entitlement reform.

The fact that I don’t hear more people delivering the same clear message suggests to me that we don’t have enough objective observers.

Do we need tax increases and spending cuts, or do we just need economic growth? I know, easier said than done, but a real economic recovery would do wonders for these numbers.

Buzzcut: We need taxes to be a higher percent of GDP and spending to at least stop growing as a percent of GDP.

The fact that I don’t hear more people delivering the same clear message suggests to me that we don’t have enough objective observers.

Professor Hamilton,

I think the objective observers you’re looking for are the Tea Party. I have a number of friends among the Tea Party activists, and the vast majority would gladly trade higher revenues through closing loopholes and fairer, flatter taxes, and slashing military spending for capping spending at 19% of GDP and balancing the budget.

Please come along to the next Tea Party event. You might find you’re a Teabagger.

Given that taxes were 18.5% of GDP in FY2007 before the financial collapse, I think a bit of growth with a reformed tax system will get us much closer to 20%. The trouble with the tax increases coupled with spending cuts is that the taxes get increased and the spending cuts never happen. Reagan got suckered by the Democrats with a similar deal in the early 80’s.

That’s nice W.C., but as long as you keep voting for Republicans (at least the ones we have now) I think you will get none of those things.

Question: what do your Tea Partiers think of Simpson-Bowles?

ed,

Many Tea Partiers are dissatisfied with the Republicans and voting Libertarian or other third party, but many see Ryan as at least a modest step in the right direction from Obama.

I would take Simpson-Bowles over either the status quo or anything likely to come out of the thoroughly corrupt Congress and Obama Administration, and I suspect many or most Tea Partiers would agree.

JDH wrote:

“The implication of a simple look at the numbers should be obvious to any objective observer. To return to long-run fiscal solvency, the U.S. will need both tax increases, defense cuts and significant entitlement reform.”

Professor,

Your conclusion is in contradiction to your narrative.

“need…tax increases” – You graph of revenue exhibits increases after each tax cut and has the steepest increasing slope after the Bush tax cuts. Obvious to the objective observer is that tax cuts increase revenue as a percentage of GDP.

“defense cuts” – “U.S. defense spending at the moment is right at its historical average of 4.7% of GDP, though at one point it had been as low as 3.0%, a value reached in 2000.” Your second statement makes it obvious to the objective observer that defense spending today, even with men deployed in both Iraq and Afghanistan, is normal as a percentage of GDP but in real terms is below normal since “One important factor is that GDP did not grow as fast as CBO had been predicting…” The implication is that defense spending has declined along with GDP.

“significant entitlement reform” – This does appear to be a consideration, but the increases in entitlement reform to GDP would be much less dramatic if GDP were growing at a reasonable level.

This tells us that “objective observers” would understand that most important to fiscal solvency is economic growth. What is also obvious is that government policies have strangled economic growth since 2006. Without growth policies no amount of raised taxes and cut budgets will be sufficient to have any impact. This is even more obvious when you consider that similar actions have driven the UK into a double digit recession and have France projecting a double digit recession.

Dr,

Your post says “the U.S. will need both tax increases, defense cuts and significant entitlement reform” you say in a reply to a comment “We need taxes to be a higher percent of GDP and spending to at least stop growing as a percent of GDP”. You might want to clarify that in the initial post if it wasn’t your intention to say tax increases. Because, afterall, “tax increases” won’t be interpreted as “taxes to be a higher percent of GDP”……..

I find the bottom graph (pie chart) most interesting. About a year ago, the President and Speaker Boehner had worked out a deal to increase revenues $1 for every $3 in spending cuts. Given the causes of the current defecit shown in the graph, this deal seems like a more than reasonable compromise with a “no new taxes” position. Indeed, the “projection inaccuracy” slice is almost entirely compensated by spending cuts in the Obama/Boehner deal. One might argue that this could have been split 50/50 between revenue increases and spending cuts. But whatever …

As we now know, Beohner couldn’t sell the deal to his caucus. Instead, Congress passed legislation that leaves us staring at the fiscal cliff.

Given last summer’s efforts at compromise and the Tea Party’s intransigence (even when they get 75% of what they want and their own party leader is endorsing the deal) it is proposterous to claim that our current difficulties have anything to do with the President’s unwillingness to work out a solution with the Rs in Congress. An objective observer can only conclude that Tea Party intransigence is the primary barrier to resolving our fiscal difficulties.

There is a lot to admire about the Tea Party. But their seeming unwillingness to work effectively within our legislative system is not one of their good qualities. I hope as they mature into a solid caucus, they become more willing to compromise with the rest of America who does not agree with all of their positions. That would be the patriotic/American thing to do.

Jim, don’t we really need to be using some kind of cyclically-adjusted GDP in the denominator to look at the size of government and revenues relative to the economy? Sure, I want government to be a smaller share of the economy, but I propose achieving that by getting GDP growing robustly with many private-sector jobs, so we don’t have to spend so much on welfare programs. Without controlling for the business cycle, it seems to me that there is too much being “swept under the rug” to be a really useful measure of the economy.

The fact that I don’t hear more people delivering the same clear message suggests to me that we don’t have enough objective observers.

I’m not following this. There are plenty of people making those same points. Virtually all of the denial is coming from one side and one side only. Hint: it’s the same side that denies manmade global warmig; the same side that’s teaching children that Adam & Eve road around on the backs of dinosaurs; the same side that believes tax cuts both increase government revenues and at the same time lead the way for a “starve the beast” strategy. And it’s the same side that listens to Hank Williams, Jr. and Ted Nugent.

It was just last week that Steven Kopits and I had a discussion about how realistic it was to expect future government spending to fall below 22.5%. And I don’t think anyone on the left would disagree that defense spending needs to get scaled back…hey, I work for DoD and I believe it needs to get cut back! Even with entitlements there is general agreement that real per capita growth rates in some programs just cannot be sustained at current levels. Where the entitlements issue gets tricky is that oftentimes things get lumped into one big entitlement program called SocialSecurityMedicareMedicaid. Well, there is no such program. There are three programs and each has its own story. And even within Medicare things are not clear cut. Medicare Advantage has been a disaster…you won’t see liberals whining about cuts to that program. And many of the problems with Medicare Part A could be fixed if we rethought the way we handle end-of-life treatments.

As to taxes, again I don’t see many on the left denying that we need higher taxes…even on the middle class. It would be a bad idea to increase taxes on the middle class right now, but that’s strictly a cyclical issue. Once the economy gets righted middle class tax rates should revert back to the pre-Bush levels. And we will probably need an ad valorem tax of a couple percent. We could also think about some new sources of revenue, such as a carbon tax that could be used to offset some of the income tax burdens. Like I said, just about all of the resistance to responsible fiscal management is coming from the side that where’s funny hats at Tea Party rallies and pretends to be concerned about the debt and deficits.

Total nonsense. Entitlements haven’t contributed a dime to the deficit nor are projected to in the next decade (and a lot longer for SS).

bmz Medicare Advantage contributes to the deficit. Medicaid contributes to the deficit. It’s true that Medicare Part A doesn’t (at least not yet) and it’s true that Social Security never contributes to the deficit unless Congress decides to supplement future benefits with general revenues after the Trust Fund bonds are exhausted. Like I said before, each entitlement has its own story and affects (or doesn’t affect) the deficit in different ways. Part of the problem is that all of the entitlements get lumped into one big pile, and that just ain’t right.

bmz and 2slugbaits: Offsetting receipts from items such as Medicare premiums have already been subtracted out before reporting the “entitlements” figures plotted and cited above. And Social Insurance Taxes are included in the total federal receipts discussed above. Unless it is your position that the latter do not represent part of the net federal burden on the taxpaying public, the classifications and statements above are entirely correct, accurate, and appropriate.

I’m not sure it’s correct to treat defense the same as the others, meaning as a percentage of GDP. The implication is that relationship – 4.7% or some other number – holds at any scale. If GDP were much lower, I would expect we’d spend more as a percentage of GDP. If GDP were $100T, I think it would be insane to expect $4.7T in defense spending. That is unless you are using GDP growth as a straight forward proxy for inflation, which implies no real GDP growth. If there is real GDP growth, then why does defense spending have to grow? Why is it larger per capita? Can a plane with missiles only protect a certain number of people? Our airspace and the world’s airspace hasn’t grown. The seas are not larger so the Naval needs per capita shouldn’t scale up as population grows.

While I am very much in agreement that a combination of tax reform, entitlement cuts and a realistic assessment of defense spending is necessary to return the U.S. to sustainable fiscal footing, I would like to nitpick with the characterization of current entitlement spending; current entitlement spending is better presented as a share of potential GDP (since payments are virtually fixed in anything but the long run) and adjusted for the business cycle when it comes to unemployment insurance and the like. Failure to do so makes the current budget situation look structural, when in actuality the massive structural problems are still a decade or so away.

JDH Unless it is your position that the latter do not represent part of the net federal burden on the taxpaying public,

I don’t think that’s what I said. Or at least I hope that’s not what I said. What I said was that Social Security does not add to the deficit and the debt held by the public:

“Social Security never contributes to the deficit unless Congress decides to supplement future benefits with general revenues after the Trust Fund bonds are exhausted.”

jonathan Unlike Civil War days, today’s military is capital intensive. We put a very high value on the lives of soldiers, so we tend to substitute capital for manpower. That makes defense a progressively more expensive business. The other problem is that, for better or for worse, US defense policy has to cover a lot of allies all over the globe. In effect, other countries have hired us out to be the world’s policeman. Two thousand years ago we would have collected tribute from client states and provinces along the borders with the Vandals, Goths and Parthians. Today, not so much.

The graphs should expand when one clicks on them, but they do not. Makes it difficult to follow the argument.

Chris: If using Firefox, use control+ to make the whole image bigger, control- to make smaller. If using some other browser, figure out how to use your browser. Besides, images have been scientifically pre-sized for optimal viewing. Is this a serious comment?

2slugbaits,

What I said was that Social Security does not add to the deficit and the debt held by the public:

“Social Security never contributes to the deficit unless Congress decides to supplement future benefits with general revenues after the Trust Fund bonds are exhausted.”

… which is exactly what it is scheduled to do on autopilot unless Congress chooses to push Granny off a cliff in a wheelchair.

Social Security and Medicare are insolvent. It’s sad that you choose partisan ostrich-head-in-the-sand tactics when Professor Hamilton tries to start a serious, non-partisan, discussion of such serious issues.

With Medicare expenditures including at least 20% fraud/waste, what is needed is what the bureaucracy simply can’t deliver: good management.

What it will deliver is more fraud/waste with either higher taxes or higher deficits.

This is a Fed problem and the price we pay for low inflation. We will have just as much debt as the Fed wants us to have, and they want us to have lots and lots so they don’t have to do anything. Even as fiscal tightening approaches they sit on their hands waiting for .. Let the tightening occur and put the blame where due.

Bruce Hall:

“At least 20% fraud/waste” in Medicare?

That is wildly inaccurate. More accurate is “no more than 10%.” More accurate still is the current administration has done more to combat Medicare fraud/waste than any other prior administration. And these efforts are yielding positive results.

This Medicare fraud/waste argument is more along the lines of Adam/Eve dinosaur-riding bull crap. Objective observers know that entirely eliminating fraud/waste in Medicare will not solve the program’s fiscal problems.

“Buzzcut: We need taxes to be a higher percent of GDP and spending to at least stop growing as a percent of GDP.”

But as Menzie would say, federal spending and taxation are highly counter cyclical. If we had a strong recovery, things like unemployment insurance would go down, and income tax receipts would go up, probably at rates that would exceed the rate of growth of GDP.

We need a strong recovery. I think Obama himself is the source of all the “uncertainty” in the economy that is holding us back, and as it appears more and more likely that he will lose, the economy will get better and better. This will be the opposite effect of 2008, when every tick up in Obama’s poll numbers caused a tick down in the economy.

2slugs has made the same claim about SS not adding to debt/deficit nor to debt held by the public, but each time it is wrong. The best place to find the actual numbers is in the OMB budget tracking numbers and CBO budget evaluations http://www.cbo.gov/sites/default/files/cbofiles/attachments/2011-03-18-APB-FederalDebt_0.pdf

Any trust fund bond to get converted to cash for spending is sold to the PUBLIC, thus converting it from from the “internal debt” to the “debt held by the public” categories.

W.C. Varones:

“”Social Security never contributes to the deficit unless Congress decides to supplement future benefits with general revenues after the Trust Fund bonds are exhausted.”

… which is exactly what it is scheduled to do on autopilot unless Congress chooses to push Granny off a cliff in a wheelchair.”

—————-

Ummm, no. Current law does not allow SS to be supplemented with general revenues. THat would take additional legislation. ‘Serious discussions’ that rely on falsehoods arent really that serious.

Describing an accurate representation of current policy as ‘head in the sand’ tactics is another sign of a non-serious discussion. Your discussion of this topic is not reality based. Try again.

Nobody cares about Medicare fraud. They elected Rick Scott governor of Florida. And they will likely elect Mitt Romney president. Both of them made oodles of money off Medicare fraud. (We didn’t personally know even though we were the CEOs!!!) Must be a time honored tradition or something.

If Obama is the source of the economic uncertainty holding back economic growth why is employment growth and real business fixed investment showing stronger growth under Obama than under Bush.

Private GDP growth is the same under Obama as under Bush.

What was creating all the uncertainty under Bush that caused such weak growth/

2slugbaits. I found your caricatures of the political opposition quite hilarious and was perfectly content to let them slide but, then you went and brought Hank Jr. and the Motor City Madman into it. Alienating country fans and rock and roll fans is not going to win you any points at election time.

“The implication of a simple look at the numbers should be obvious to any objective observer. To return to long-run fiscal solvency, the U.S. will need both tax increases, defense cuts and significant entitlement reform.

The fact that I don’t hear more people delivering the same clear message suggests to me that we don’t have enough objective observers.”

Or that you’ve been looking too hard for objective observers in the Republican party.

There’s a large constituency in the Democratic party that will accept entitlement reform along with revenues and decreased defense spending in order to restore fiscal solvency. Much of their aversion to moving on entitlement reform comes from the rights insistence that net revenues weakly decrease while defense spending increases. Most of the problem with pushing through the grand bargain last year was that Boehner couldn’t get 50% of the Republican caucus to support it and Cantor was eager to take advantage of that discord to reach for the Speakership.

There’s no way a first-term Romney will compromise on taxes. There’s no way a first-term Romney would cut defense. There’s no way that a first-term Romney will claim ownership for the end of Medicare. Romney wants to do the exact opposite of what you claim to be obviously necessary and, if he doesn’t want to end up like GHW Bush, would need to do so to avoid upsetting his base.

Really, if you want a compromise-based solution, you want a second term for Obama. Without reelection hanging over his head and with a Republican hold (but not strangle-grip) on the legislature, it might actually be possible to make progress on these issues. To secure his place in history, a second term Obama would readily embrace a grand bargain of this sort.

JDH –

Any thoughts on how the falloff in labor force participation rate impacted revenues? I’ve heard the argument the revenue decline can largely be atrributed to this factor. If so, this then begs the question whether this is a cyclical issue or a demographic issue.

Thanks,

JDK

As a foreign observer, I’m often confused by conclusions (like JDH’s) that this set of facts makes it clear that any solution requires entitlement reform. I’m labouring under the impression that

1) the surpluses projected in 2001 included the projected social security and medicare spending required to service the retirement of the baby boom.

2) “entitlement reform” in current US context means cutting back on the spending that was once clearly affordable. (Yes, I’m ignoring the Medicare Prescription Drug benefit, but people seem to be talking about more than just cancelling that.)

3) Unexpectedly slow growth is not enough to explain why previously affordable entitlements are not longer affordable. According to the CBO analysis, projected surpluses 2002-2011 were $5.6 trillion while the net impact of “economic and technical changes” was $3.2 trillion. The prescription drug benefit was another $0.3 trillion. Unexpected interest on the debt was another $1.4. The sum of these is still not enough to explain the change in the affordability of entitlements.

In contrast, the cummulative change due to legislative measures was $8.5 of the $11.7 trillion change in outlook.

(The figures are available directly from the CBO at http://www.cbo.gov/sites/default/files/cbofiles/attachments/06-07-ChangesSince2001Baseline.pdf)

Hitchiker The Hank Williams, Jr. reference was in regard to his latest antics at the Iowa State Fair. My wife is from Iowa and she likes to go to the Fair each year. I don’t get that, but it’s what she likes. Anyway, Hank, Jr. (probably drunk) told the crowd that Obama hated farmers, Obama hated the military, and that the Muslim Obama hated America, blah, blah, blah. Anyway, a small riot broke out and 60 people were arrested. Hank’s kind of a jerk. He’s also a pretty crappy musician. At least Ted Nugent has some musical talent.

Tudor There’s a large constituency in the Democratic party that will accept entitlement reform along with revenues and decreased defense spending in order to restore fiscal solvency.

Exactly. And while we’re at it, let’s name names. Krugman has called for defense cuts, tax increases and cuts in the growth of Medicare/Medicaid. So has Mark Thoma. So has Brad DeLong. And so have James Kwak and Simon Johnson in their book “White House Burning.” And Menzie also called for defense cuts, tax increases and entitlement cuts in his book. There are plenty of people calling for defense cuts, tax hikes and entitlement cuts. The problem is that none of them are right of center. The “trade space” between those in the center and those on the left is really not very large. Centrists believe government spending should be something like 22%-22.5% of GDP. Those on the left believe government spending should be something like 23%-23.5% of GDP. So we’re not talking about irreconcilable differences here. But those on the right and hard right are all talking about 17%-18% of GDP. A few of the more moderate ones might be willing to go as high as 20%, but no more. Those folks are living in another universe.

We do need entitlement reform. Why? Put aside the rising costs, any program should be examined for reform at any time because no program runs perfectly. At the very least conditions change and you need to adjust.

An example is the projected “cuts” in Medicare. Much of that is reducing the higher payments made to private insurers under Medicare Advantage. The idea was strikingly like that offered again by Ryan & Romney – if you can make sense of their mish-mosh: private insurers would offer Medicare plans and thus private competition would cost less than Medicare. It hasn’t. The experiment is almost 15 years old – and yes that means it was passed under Clinton, which is interesting both because it was a Democrat signing legislation which brought in private insurers and it was a Democratic failure the Democrats are trying to reform. Medicare Advantage costs more. So ObamaCare cuts the payment levels to the government level. That’s a sensible reform. According to what I’ve read, that’s about 30% of the $700B in cuts. Big number. The private plans cost 117% of Medicare.

We should always be looking to reform policies and procedures.

In terms of entitlement reform from the GOP, I’m not seeing anything that will happen but there are no details so everything is guesses. The main question, as I’ve boiled it down, is this: what does the bidding process get you? Does it get you Medicare or the cost of a plan that is less than Medicare, meaning fewer benefits. If it’s Medicare, which was not the case with Ryan’s first plan, then the plan is like ObamaCare: the government would only “spend” that much, same actual target as ObamaCare, so they would pass cost restriction to providers not beneficiaries. If it’s a lesser package of benefits, I believe it won’t pass Congress and if it does those people will be kicked out.

jonathan:

“…any program should be examined for reform at any time because no program runs perfectly.”

I’m wondering how you envision savings or retirement planning to work in such world. Do you think it is desirable for people to save extra on the understanding that entitlements (pensions, welfare, employment insurance, etc.) will not necessarily be available when they need them?

“What was creating all the uncertainty under Bush that caused such weak growth”?

9/11 and two wars? It certainly explains the 2001 through 2003 years.

It’s obvious that the arguement to raise revenue to support an average 22%++ expenditure/GDP ratio as advocated by 2slugs is flawed.

Obamacare is a perfect example. We can use CBO scoring and CBO assumptions to demonstrate that “on average” a given policy mix can bring spending in line with revenue. However, and as 2slugs often points out, we need to consider the tail events.

The point here, is not if, but when we encounter the next “Great Recession”, tax revenue will fall, expenditures will rise and will have a MASSIVE fiscal hole. The larger the “average” level of government expenditure/gdp, the larger the gap that results when gdp growth (and hence tax revenue growth) drops far below average. The MASSIVE fiscal gap that arises will be our ruin.

Given the fragile state of the economy, it is fiscally irresponsible to be discussing tax policies that support levels of government spending that are far above the historical average.

I agree with 2slugs that demographics will increase the fraction of GDP devoted to entitlement spending. The only solution is to reform entitlement spending so that it becomes a smaller piece of the GDP pie, not raise taxes to support status quo entitlement growth.

Obamacare just added another layer of public spending that will be difficult to pay for the next time the economy slows, which may be sooner than the CBO admits. Obama and progressives are compounding our problems, not solving them.

It appears the progressive solution to recession induced tax revenue shortfalls in the future, will be to ask the rich to pay more in taxes. That seems to be their go-to policy move.

When I say programs should be examined for reform all the time, I suggest looking at the history of Medicare Advantage. This is not an area I know much about. I’m relying a lot on some papers, notably “How does risk selection respond to risk adjustment? Evidence from the Medicare Advantage program” by Brown, Duggan, Kuziemko and Woolston (NBER working paper 16977).

The interaction of private plans with Medicare evolves over time. To put aside the complications, the private co’s try to make money using the pool of Medicare people and the government money. That’s natural. They do this by selecting people who cost less than their bids – or who get higher reimbursement for stuff covered under their bids and any other way they can manage their own exposure to loss. The rules keep changing. Began with county level benchmarks set to 95% of regular Medicare but those were changed and benchmarks set above regular Medicare – in the late 90’s, as I noted before, to attract more private “competition”.

Private companies used demographic models to gather the customers they wanted. The government figured out the private companies were sucking off the low cost customers and sticking traditional Medicare with the higher cost people. So the rules changed and kept changing. They were adjusted, for example, in 2000 and then 2004 to make “risk adjustment” better. ObamaCare continues that process.

Why? Because private companies are making money off the government. They bid x and make money off that number because their software allows them to identify the patients who will cost them less than their bids. This doesn’t mean they run Medicare more efficiently at all; their business is built on identifying the patients who won’t use medical services.

This is a big part of the problem with thinking “free markets” in Medicare. The money still comes from the government. You can’t actually provide medical care for less than what Medicare pays because Medicare pays less than private insurance for the same procedures. But you can make money off the pool of people who get Medicare. That’s the tension; there is no “free market”, just how we divvy up the pool of old people. So reforming Medicare Advantage is mostly about how to keep the division of the pool of old people from sucking money out of Medicare and putting it into private hands as profit. Again, their profit comes from identifying cheap customers, not from delivery of cheaper services.

(There is another issue, seen very recently in the huge fine paid by HCA, the hospital company Bain dealt with: to make money, they change the coding of procedures to “maximize” revenue. To translate, they bill more to the government, meaning to Medicare. That’s how a private company makes a profit off the federal government, not by providing cheaper services but by extracting as much money as possible.)

TJ, what is funny about the 2slugs and the progressive agenda is they preach a strange economics, deficit spending when necessary and then during good times reduced spending/(?increased?) taxes. But when taxes and spending are reduced during any of those good/bad times then we hear “tax cuts for the rich” and throwing grandma under bus.

All we can assume is the only things that matter is increased government spending regardless of the revenue stream.

More evidence that the only place where it’s difficult to find objective observers is within the Republican party. From a Reuters article on the fiscal cliff:

“[White House Spokesman Jay] Carney told reporters the president was ready to engage with Republicans once they “demonstrate a willingness to accept that simple proposition that in addition to spending cuts, and in addition to entitlement reforms, revenue has to be part of it.””

Romney is the only candidate campaigning on a promise to lower federal tax revenues, increase defense spending, and making no changes to entitlements that will take effect in the next decade. But then, maybe my liberal world-view has me too stuck in reality and I’m just not dreaming enough. It would be nice if the Republican party stood for fiscal responsibility given how much they like to talk about it, but I just can’t delude myself into believing them anymore.

Simon van Norden I think you need to look at a different CBO report. If you look at the CBO’s long-term budget forecast (i.e., beyond 10 years) from Oct 2000, you will see that CBO was projecting that surpluses would disappear around 2020 even if the Bush tax cuts had never happened and even if GDP had contined at a Clintonian pace. CBO projects that Social Security expenditures remain flat as a percent of GDP, but Medicare and Medicaid entitlements really start to climb and by 2030 things really get bad.

CoRev In an earlier post you completely botched what CBO says about Trust Fund bonds adding to the debt. Try reading your own link. As best I can tell you seem to think “public debt” is synonomous with “debt held by the public.” Note to CoRev: they are two completely different things. SS Trust Fund bonds are part of the public debt, but not part of debt held by the public.

As to your latest comment about my view on deficits, you’re off base on that one as well. I have never supported a policy of sustained structural deficits. Cyclical deficits are desirable if the economy is in recession. And even then running cyclical fiscal deficits is a second best alternative. Normally the policy lever of choice is monetary policy.

Remember, I am not the one who supported Bush’s unfunded prescription drug mandate. I am not the one who supported Bush’s tax cuts during a recovery. I am not the one who supported two simultaneous wars without tax hikes to pay for those wars. I am not the guy who voted for the Veep who told us deficits don’t matter. You are that guy, so I don’t think you have a lot of credibiity on deficits.

And when Obama proposed cutting $716B out of government payments to providers, no one here was screaming “FOUL” louder than you. And while I don’t believe in throwing grandma under the bus, neither do I believe in giving grandma a blank check for unquestioned Medicare services regardless of cost. I’m the guy who supports “death panels,” remember?

Don’cha just luv 2slugs’ attempts to argue points. This is what I said: “Any trust fund bond to get converted to cash for spending is sold to the PUBLIC, thus converting it from from the “internal debt” to the “debt held by the public” categories.” But this is what 2slugs claims I said: ” As best I can tell you seem to think “public debt” is synonomous (sic) with “debt held by the public.””

Al of this was in response to 2slugs’ statement: ” What I said was that Social Security does not add to the deficit and the debt held by the public:

“Social Security never contributes to the deficit unless Congress decides to supplement future benefits with general revenues after the Trust Fund bonds are exhausted.””

But the funniest part of his comment is: ” I’m the guy who supports “death panels,” remember?” Remember? Yup! Too many times have we seen you distort (that’s nicer than saying lie) to make a point.

What I remember is you are the one who cries “tax cut for the rich” whenever there is a REPUBLICAN cut in taxes. You forget who pays taxes, and where any cut would most impact. When it is a DEMOCRATIC tax cut it is a middle class stimulus. Really?

CoRev This is what I said: “Any trust fund bond to get converted to cash for spending is sold to the PUBLIC, thus converting it from from the “internal debt” to the “debt held by the public” categories.”

OMG. It’s even worse than I thought. Public Finance 101: PUBLIC DEBT has two components; intragovernmental debt (what you call “internal debt”) and debt held by the public. To sum up:

PUBLIC DEBT = (INTRAGOVT DEBT) + (DEBT HELD BY PUBLIC)

Trust Fund bonds are INTRAGOVT DEBT.

CoRev When it is a DEMOCRATIC tax cut it is a middle class stimulus. Really?

I am not a big fan of middle class tax cuts. Given my druthers the Obama stimulus package would have included only minimal (if any) tax cuts, but if there had to be tax cuts (and the GOP insisted that there had to be tax cuts), then tax cuts for lower and middle classes was better than tax cuts for the rich. If you had been paying attention you would have noticed that I said taxes need to be increased on the middle class once the recovery is on solid footing. I would argue for an ad valorem tax of 2%-3%. I would also argue for a carbon tax.

What I remember is you are the one who cries “tax cut for the rich” whenever there is a REPUBLICAN cut in taxes.

Well, if the GOP would quit proposing stupid tax cuts for the rich, then maybe I would quit complaining about it.

2slugs, you were the one who introduced the term “public debt”. Not I. That is, BTW, a classic strawman argument. You’ve shifted the argument from what I said, and then started to argue your own shifted argument.

A strawman argument: “based on misrepresentation of an opponent’s position. To “attack a straw man” is to create the illusion of having refuted a proposition by replacing it with a superficially similar yet unequivalent proposition (the “straw man”), and refuting it, without ever having actually refuted the original position.”

You made this point: “What I said was that Social Security does not add to the deficit and the debt held by the public:

“Social Security never contributes to the deficit unless Congress decides to supplement future benefits with general revenues after the Trust Fund bonds are exhausted.””

This is how I refuted your claim: “Any trust fund bond to get converted to cash for spending is sold to the PUBLIC, thus converting it from from the “internal debt” to the “debt held by the public” categories.”

Since this is not our first rodeo, your next gambit is usually, but, but, but your forgetting the “on” and “off” budget categories. Anyone else notice this is just another strawman?

Let’s dispense with the myth of countercyclical policy. When revenues go up, politicians of every kind either raise expenditures or lower taxes. There isn’t a dime of booming revenue that isn’t spent.

In a recession, expenditures are slow and late to fall with revenues.

A budget in a long term equilibrium must have expenditures growing at less than the rate of revenue growth, otherwise revenue volatility will create perpetually growing debt.

High and progressive taxes slow economic growth and increase revenue volatility.

We need to raise taxes on the middle class. I think that would be politically feasible only if it were part of an expenditure reduction plan that sought to eliminate or reduce our debt in a reasonable period of time.

There are too many rewards in our tax and expenditure codes that subsidize idle hands and debt.

Wow, you people simply do not get it. RM, you do not get it. Varones does not get it. tj does not get it. slugs doesn’t get it. Nobody gets it.

Federal spending is high………no it is not. If the US economy returned to its trend speed of the last 100 years, federal spending per capita with GDP would be quite “normal”.

That is what nobody can seem to get. The deficit is about the end of economic growth. The US economy has grown very little over the last 5 years. Nothing more or less. You make rediculously huge cuts, you shrink the economy by more making nominally less spending not changing the % one iota as the economy further contracts.

The only answer is either to let it deflate and potentially prepare to fight or put government spending into a higher percentage to replace the lost demand capital has created for itself with global wage arbitage. Neither sounds good.

The deficit is irrevelant. The real problem is the lack of demand for capital and where it will come from. That is where the “real” crisis since 2001 when the last innovation boom ended. Maybe we will get lucky and another innovation boom will emerge………or we may just say capitalism was a relic of the industrial revolution that survived in the 20th century on the back of increased government purchases and finally computerization(which allowed governments to deleverage in the 1990’s even though actually spending always increased).

The inability to admit to capital’s weakness is what destroys the “libertarian” and Koch Brother racket “tea party” side. Capital is very weak. Very very weak. They still pay executives rediculous sums, can’t seem to get why more purchases aren’t being made and whore over old energy even though it is shrinking.

CoRev you were the one who introduced the term “public debt”.

Wrong. I referred to “debt held by the public.” Go reread my very quote that you just cited. It says “debt held by the public.” So let’s try this one more time. The term “public debt” (which I did not use) is very different than the term “debt held by the public” (which I did use). This is not just a case of semantics. The Treasury specifically defines those terms and they have two very different meanings. I never said SS Trust Fund bonds were not part of the “public debt,” because that would be stupid and unlike you I actually took a few advanced courses in public finance. Wiki has a nice definition of “public debt” and its components:

http://en.wikipedia.org/wiki/United_States_public_debt

This might be a little counter-intuitive for some folks, but the increase in the “public debt” due to the accretion of SS Trust Fund bonds is due to FICA surpluses and not government spending. For most macroeconomic purposes the debt that matters is the “debt held by the public” and not the “public debt.” And if you had read the CBO note at the bottom of your graph you would have known that because referring to Trust Fund bonds footnote (b) specifically says:

…those securities represent internal transactions of the government and thus have no direct effect on credit markets.

In even another effort to save face, 2slugs claims he never introduced the term “public debt”, and claims I was: “Wrong. I referred to “debt held by the public.” Yup! He sure did and that’s when he shifted to the strawman.

But this is his quote: “As best I can tell you seem to think “public debt” is synonomous with “debt held by the public” Note to CoRev: they are two completely different things. SS Trust Fund bonds are part of the public debt, but not part of debt held by the public.

…Posted by: 2slugbaits at August 24, 2012 04:53 PM”

2slugs, your own words contradict your argument about who introduced the term and then the definitional argument about the “public debt”. You probably haven’t noticed I have not refuted your definition. Wonder why?

I went back asnd checked my original reference, http://www.cbo.gov/sites/default/files/cbofiles/attachments/2011-03-18-APB-FederalDebt_0.pdf wondering if inadvertently CBO had used that term. NOPE! It utterly and completely a 2slugs strawman construct.

CoRev 2slugs, your own words contradict your argument about who introduced the term and then the definitional argument about the “public debt”. You probably haven’t noticed I have not refuted your definition.

Okay…right. I see. So I’m the one who used “public debt” rather than “debt held by the public” and you corrected me. Right. You betcha.

Early stages of dementia. The executive function of the brain is the first to go. You should not be voting and you should not be driving.

2slugs finally admits: “Okay…right. I see. So I’m the one who used “public debt” rather than “debt held by the public” and you corrected me.”

In his zeal to best an ole conservative his ego won’t allow him to admit it without sarcasm and ridicule. He can not admit his original statement was incorrect: “… that Social Security does not add to … the debt held by the public:…”, and spun himself into the ground with an erroneous strawman argument.

That level of arrogance/extreme hubris is at or over the edge.

2slugs, don’t feed the troll.

A very different picture would have emerged if you had traced the data back to its 1947 beginning. I can’t conclude as you do without further time depth and decomposition, and probably wouldn’t then, on the last 2 items.

I am a student to macroeconomics. I read most of the comments devoted to the initial posting “Federal and Expenditures” posted August 2012. I was most intrigued when I arrived at the posts of CoRev and 2slugs and how they argued against and towards the others arguments. Either did win or they just got tired. I did enjoy reading the response from Rage though, and it seems to have brought the battle of the former two, to a close. Immaturity captured the debate of CoRev and 2slugs. Fascinating! May be, that they are new students also?