Today’s statement from the FOMC, the decision-making body for the Federal Reserve, basically said that, yes, the economy has worsened since the FOMC’s previous meeting, but no, they’re not going to do anything about it. At least, not right now.

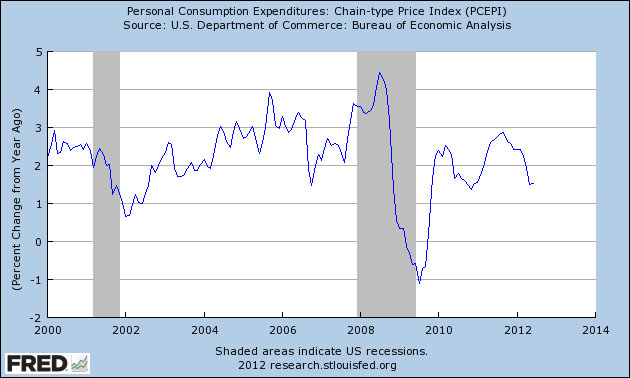

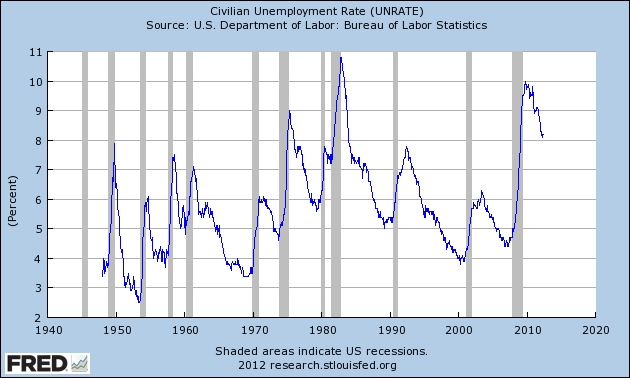

Over the longer run, the Fed says it is aiming for an inflation rate of 2% and an unemployment rate below 6%. Normally, the policy decision involves a short-run tradeoff between those two objectives. For example, if unemployment is much higher than the long-run target (as is the case right now), the Fed might tolerate inflation above target for a while in hopes of bringing unemployment down more quickly. But, as the numbers have been coming in for 2012, inflation is below target and unemployment is way above. That would seem to suggest the Fed would opt for more stimulus, end of story.

|

|

And in today’s statement, the Fed acknowledged that the economy has weakened relative to where it had been (which itself was no rosy scenario). In those subtle changes in wording that Fed-watchers pore over, the Fed changed its statement to acknowledge directly that “economic activity decelerated somewhat over the first half of this year,” and “household spending has been rising at a somewhat slower pace.”

So why no new stimulus coming out of today’s meeting? If we were talking about the historical operating environment in which the policy decision is whether the Fed should raise or lower the fed funds rate by another 25 basis points, there would be no question– today the Fed would have delivered additional easing. But it is clear that the Fed sees the tools that it actually has available, namely more big purchases of Treasury or mortgage-backed securities, as measures that would have only modest stimulative effects but entail significant other risks.

Suppose we grant that assessment. Standard decision theory would still say the Fed should weigh those concerns, and operate at a point where the marginal benefit of additional easing equals the marginal cost. If the Fed had been operating at exactly such a point in June, and if changes in July brought inflation lower and unemployment higher than the Fed had been anticipating as of a few months ago, then they’d want to recalibrate at this time.

But the Fed has an additional policy objective– it wants to be very predictable about shooting its loud if not terribly effective guns. For purposes of that objective, waiting until the next meeting accomplishes two things. First, it gives FOMC members time to go on the road to send clear policy signals so that everybody knows what’s coming. Such a communication strategy also gives the Fed a chance to see the reaction in key markets such as sensitive commodity prices. Second, waiting another 6 weeks allows a little more data to come in to confirm how serious the summer slowdown really is.

It should become clear in the speeches we hear from FOMC participants over the next several weeks whether that’s the correct interpretation of today’s announcement.

I think we can all agree that we wish the economy were performing much better. However, with 10-year Treasures already down to 1.5% after QE1, QE2, and Operation Twist, I’m not sure how effective additional Fed stimulus would be. It’s not like businesses aren’t investing and people aren’t buying houses because interest rates are too high. I just don’t think more Fed action would do much good.

“marginal benefit of additional easing equals the marginal cost”

Shouldn’t it exceed the cost? Otherwise wouldn’t the whole exercise be a NOOP?

Dear Ben: Thank You, and for God’s sake, please take a long vacation.

It looks fractal at the surface but looking through; it is more homogeneous than thought.

http://www.federalreserve.gov/releases/cp/

Commercial Paper Outstanding (COMPOUT)

http://research.stlouisfed.org/fred2/series/COMPOUT

The ECB press release” monetary development” as of June may draw interest.

“Turning to the main counterparts of M3 on the asset side of the consolidated balance sheet of Monetary Financial Institutions (MFIs), the annual growth rate of total credit granted to euro area residents stood at 1.4% in June 2012, compared with 1.5% in the previous month. The annual growth rate of credit extended to general government increased to 9.4% in June, from 9.1% in May, while the annual growth rate of credit extended to the private sector was more negative at -0.4% in June, from -0.2% in the previous month”

One may be inclined to conclude, that a Central Bank balance sheet expansion is a negative signal from the economy as it is a reflection of the ongoing financial markets impairments. One may be inclined to conclude that balance sheets recession is an impossibility scenario since government expenditures are financed by the private sector and refinanced by the Central Banks, but the equities markets may think otherwise:

Ironman found a late correlation between quantitative easing and equities performances as opposed to equities markets and dividends expectations.

“We’ve observed that stock prices rose 10-15% above what those levels would otherwise have been in the Fed’s earlier rounds of quantitative easing”

Not to miss as well “Should you rob a Bank”.

One may have to wait for the next statistical analysis dealing with the threshold amount and when and how, robbing a Bank is assorted with better freedom expectation and lower probability of being caught.

http://politicalcalculations.blogspot.com/

Meanwhile the efficient markets hypothesis is still an academic subject.

I received the following forwarded email from a reader at my site:

Bernanke Is Bluffing: Fed Powerless to Avert Recession

Peter Morici

Twitter @pmorici1

Today the Federal Reserve indicated it will take further steps as necessary to promote a stronger economic recovery. Sadly, the Fed’s bullets are spent, and the U.S. economy is skidding as a result of Administration missteps.

The economy is growing at less than 2 percent. Unemployment holds steady at 8.2 percent only because so many folks have quit looking for work and are no longer counted in the official tally of joblessness.

Consumer spending has slowed substantially, because Americans are pessimistic that President Obama’s economic policies will fix the economy and are hunkering down for a long siege. They are simply not convinced Governor Romney offers sufficiently effective alternatives and the personal qualities to be President.

The Federal Reserve Open Market Committee stated it “will closely monitor incoming information on economic and financial developments and will provide additional accommodation as needed to promote a stronger economic recovery and sustained improvement in labor market conditions…”

Unfortunately, the Federal Reserve has already pulled all the levers that might make a difference. Short-term interest rates-such as the overnight bank borrowing rate and one-month and one- year Treasury Bill rates-are already close to zero.

When the Federal Reserve Open Market Committee met in June more bond purchases to push down long-term Treasury and mortgage rates were already on the table. However, over the last several months, investors have moved cash from risky European government and corporate securities to U.S. bonds. The 30-year Treasury and mortgage rates are now near record lows, preempting the effectiveness of any additional Fed measures.

A statement that the Fed intends to keep short rates near zero beyond 2014 would have little impact on investor and home buyer psychology-already, few expect the Fed to push up interest rates in the foreseeable future.

Central bank policy can help dampen inflation when the economy overheats and lift borrowing and home sales a bit when it falters, but it can’t instigate faster growth when the President and Congress fail to address structural problems.

Demand for U.S. products is burdened by huge trade deficits on oil and consumer goods with China. Both result from government inaction.

President Obama has significantly curtailed production of oil offshore and in Alaska, and refused calls from economists across the ideological spectrum to force China to stop manipulating its currency. Together, reversing those actions would create at least five million jobs.

Now conditions in Europe threaten to pull down an economic recovery, made needlessly fragile by policy missteps beyond the purview of the Federal Reserve.

Lacking better policies from the Oval Office, there is little the Federal Reserve can do.

Peter Morici is an economist and professor at the Smith School of Business, University of Maryland, and widely published columnist.

Peter Morici

Professor

Robert H. Smith School of Business

University of Maryland

College Park, MD 20742-1815

703 549 4338

cell 703 618 4338

pmorici@rhsmith.umd.edu

http://www.smith.umd.edu/lbpp/faculty/morici.aspx

GNE/CNI Vs. Total Global Public Debt

GNE = Global Net Oil Exports*

CNI = Chindia’s Combined Net Oil Imports

*Top 33 net oil exporters in 2005, total petroleum liquids, BP Data + Minor EIA data

In my opinion, oil importing OECD countries are trying desperately to maintain their “Wants” based economies, when a more likely scenario in my opinion is that we will be lucky to maintain a “Needs” based economy.

Note that from 2002 to 2011, the absolute value of the rate of increase in Total Global Public Debt (8.5%/year) is about the same as the absolute value of the rate of decline in the GNE/CNI ratio (8.1%/year).

If the GNE to CNI ratio were to hit 1.0, China & India would be consuming 100% of Global Net Exports of oil.

At the 2005 to 2011 rate of decline in the GNE/CNI ratio, in the year 2030, 18 years from now, the ratio would hit 1.0. Of course, I don’t think this will actually happen, but on the other hand the rate of decline in the ratio accelerated from 2008 to 2011, versus 2005 to 2008.

The decline in the GNE/CNI ratio, which is an indication of the percentage of GNE that will be available to importers other than China & India, will make it increasingly difficult, and probably impossible, to repay, at least with currencies with close to current values, the debts incurred trying to keep some semblance of Business As Usual going in oil importing OECD countries.

However, we are seeing denial on a global scale regarding the reality of global net exports of oil.

I define ANE as GNE less Chindia’a combined net imports. At the 2005 to 2011 rate of decline in the GNE/CNI ratio, I estimate that perhaps as much as half of the total post-2005 Cumulative supply of ANE may have already been consumed. This would be the total post-2005 cumulative supply of net exported oil that will be available to about 155 net oil importing countries, i.e., net importers other than China & India.

Following is a graph of the GNE/CNI ratio versus total global public debt:

http://i1095.photobucket.com/albums/i475/westexas/GNEvsDebt.jpg

Debt Data:

http://www.economist.com/content/global_debt_clock

The Fed needs the fiscal cliff to motivate them.

Gas prices have gone up quite a bit. Any new insights?

Here’s my pet theory:

When ever the economy starts to improve, gas prices go up and that’s hailed as sign of a booming economy. In last ditch effort to boost confidence, the Fed, Congress, and the administration has instructed speculators to drive up gasoline prices.

🙂

(prices here in MI seem up 50 cents over the last two or so weeks.)

Peter Morici wrote:

Lacking better policies from the Oval Office, there is little the Federal Reserve can do.

Professor Morici comes to the right conclusion for the wrong reasons.

But the primary problem is not in the Oval Office. The primary problem is on Capital Hill. There are over 300 bills waiting Senate action but the Senate is more concerned with Olympic uniforms being made in China. Sen. Reed has acknowledged that we have serious problems but then he has told us that he will not allow any spending bills to come before the Senate before October. Sen. Leahy comes before the cameras to inform us that we are facing disaster in January 2013 then he says but nothing will be done until after the election.

We need to clean out the Senate, the old stale Democrats and Republicans. If it was that the Senate was just doing nothing we could live with that; we are the ones who make the economy work. But the Democrat House and Senate engineered a tax reduction with President Bush that is a ticking time bomb that keeps being reset so the detonation date is pushed out.

We do not have the luxury of allowing the Senate to do nothing. As Menzie has warned us Januray 2013 will bring us to the “fiscal cliff” with the current Senate driving we don’t have much hope.

I am hearing two things about the FED decision. First, the FED the market has not declined enough for additional QE. Second, the FED is waiting for the ECB to move first. It appears that they may be their wish on both before their next meeting.

Bruce,

Perhaps Obama read the following:

NEW YORK (CNNMoney) — “A newsflash to the legislators in Washington who suddenly want to act tough against China for currency manipulation: Have you looked in the mirror lately?”

“How can anyone with a straight face declare that China needs to be punished for keeping the yuan artificially low when the United States is also aggressively trying to devalue the dollar with its monetary and fiscal policies?”

“The righteous indignation and holier-than-thou attitude is comical at best. The Federal Reserve, through two rounds of quantitative easing and now Operation Twist, has helped push the dollar lower.”

(Paul Lamonica)

And maybe you might remember that the “Currency Wars” were predicated on a concern that QE would devalue the dollar while having the opposite effect on the currencies of developing nations.

Perhaps someone could demonstrate for me the “debasement” of the currency. Since by casual observation it appears nowhere in the actual exchange rate data. See the broad trade weighted dollar index from the St. Louis Fed (FRED) here.

http://research.stlouisfed.org/fred2/series/TWEXBMTH?cid=95

the outlook is always uncertain. policy always has risks. so far, risks of previous QE have not materialized.

One thing we do know is that the Fed has consistently over-optimistically predicted growth and under-predicted inflation, and used the uncertain outlook and ephemeral risks as an excuse not to act.

One thing I do know is that FOMC members do not get paid 6 figures to sit on their hands and do nothing in the face of consistent forecast error.

@Aaron:

http://hallofrecord.blogspot.com/2012/08/like-clockwork-refinery-woes-boost-gas.html

oh, and ” Such a communication strategy also gives the Fed a chance to see the reaction in key markets such as sensitive commodity prices. ”

The Fed should be single-mindedly focused on *domestically produced* inflation, not import or oil prices. The only way to hold down import prices is by increasing unemployment. Focus on an inflation measure heavily influenced by oil prices explains why it seems as though we are on a defacto gold standard: the ECB and the Fed are essentially targeting oil/commodity prices at the same time (to a lesser extent, the BoE as well). That also explains the similar “transmission” of unemployment across countries. Someone needs to break the cycle.

The bottom line is that QE doesn’t work. It inflates “bad” asset prices (commodities) right along with “good” asset prices (stocks). So while it makes the rich feel richer for a little while, it sticks the average American with the bill in the form of higher gas/grocery prices. Just look at what has happened EVERY TIME the Fed has started dropping QE hints. Risk premiums come down, stocks go up … but so do gas prices, copper prices, silver prices, corn prices, etc. So it’s ultimately self-defeating. Or in plain English, there is NO MORE BERNANKE PUT – at least not one that will actually accomplish anything for the real economy (vs. asset markets)

RPL,

Debasement is not necessarily one currency against another since all currencies can debase together. Take a look at a graph of the CPI and it might help you understand the “debasement” of the currency.

Ricardo,

A) That is one of the more bizarre statements I have ever read, even in this web site’s comments section and

B) Did you look at the graph Hamilton opened the post with?

” The bottom line is that QE doesn’t work. It inflates “bad” asset prices (commodities) right along with “good” asset prices (stocks).”

thats called higher demand. there is no way to raise demand, lower unemployment, without higher oil and copper prices. i hope you are not suggesting we consign 15 million people to underemployment just so you can have cheap gas.

Jim Hamilton:

“But it is clear that the Fed sees the tools that it actually has available, namely more big purchases of Treasury or mortgage-backed securities, as measures that would have only modest stimulative effects but entail significant other risks.”

which links here:

https://econbrowser.com/archives/2012/05/should_the_fed_3.html

without making any note that that particular post drew comments from Nick Rowe, Bill Woolsey, Andy Harless and Joe Gagnon.

It also caused Brad DeLong:

http://delong.typepad.com/sdj/2012/05/a-nice-piece-by-jim-hamilton-on-the-fed-but-with-one-flaw-risk-spread-vs-expected-inflation-effects-of-qe-at-the-zlb-depar.html

and Scott Sumner to respond with posts:

http://www.themoneyillusion.com/?p=14166

Thus he felt it necessary to respond with another post:

https://econbrowser.com/archives/2012/05/yes_the_fed_cou.html

in which he concluded with:

“Notwithstanding, I agree that there is room for the Fed to look for a more expansionary objective.”

So why now does he link to the initial post to justify his current argument without even a mention of all the controversy it drew then?

Here’s a opposing point of view to that expressed by Jim Hamilton:

“Some of my colleagues still talk of the possibility of a liquidity trap, in which the central bank supposedly has no power even to cause inflation. Their theory is that interest rates fall so low that when the Fed buys more T-bills, it has no effect on interest rates, and the cash the Fed creates with those T-bill purchases just sits idle in banks.

To which I say, pshaw! If the U.S. were ever to arrive at such a situation, here’s what I’d recommend. First, have the Federal Reserve buy up the entire outstanding debt of the U.S. Treasury, which it can do easily enough by just creating new dollars to pay for the Treasury securities. No need to worry about those burdens on future taxpayers now! Then buy up all the commercial paper anybody cares to issue. Bye-bye credit crunch! In fact, you might as well buy up all the equities on the Tokyo Stock Exchange. Fix that nasty trade deficit while we’re at it! Print an arbitrarily large quantity of money with which you’re allowed to buy whatever you like at fixed nominal prices, and the sky’s the limit on what you might set out to do.”

Who said that? Jim Hamilton, in 2008:

https://econbrowser.com/archives/2008/10/deflation_risk.html

It sounds to me like the aliens snatched his body sometime between 2008 and 2012:

http://www.youtube.com/watch?v=L-jzblCbsuA

But the Fed has an additional policy objective– it wants to be very predictable about shooting its loud if not terribly effective guns. For purposes of that objective, waiting until the next meeting accomplishes two things. First, it gives FOMC members time to go on the road to send clear policy signals so that everybody knows what’s coming. Such a communication strategy also gives the Fed a chance to see the reaction in key markets such as sensitive commodity prices

Sorry, but I just don’t find this very convincing. I’m afraid you’re bending over backwards and excusing the inexcusable. Two weeks ago you made a very coherent and well argued case as to why the Fed would take action with their 2 August meeting. Well, the Fed didn’t do what you so cogently argued they should and would do. But today we get another argument trying to explain away the Fed’s disappointing inaction. The rationalizations just seem too cute by half. If the Fed really wanted to create time to give clear policy signals, then why didn’t they start this messaging campaign months ago? Well, actually, I thought they did. The Fed had you convinced two weeks ago. And the Fed had Tim Duy on board as well. I thought the point of your earlier post was that the Fed had in fact already laid out the case for QE3 and all we were waiting for was the calendar to turn to 2 August. And how does today’s non-announcement help the Fed send clear signals? The signals two weeks ago were loud and clear. And the second reason for delay is even less convincing. The Fed is engaging in magical thinking if it believes that there is any chance in hell that 6 weeks from now the economic data will look better than it does today. What today’s non-announcement really tells us is that the Fed is more concerned about trying and failing than they are in actually doing what they know needs to be done. The Fed is deadlocked about QE3 and Bernanke is just waiting for Godot.

Another possible explanation for the Fed’s sitting on the sidelines: the Fed hopes that 6 weeks from now they will have a clearer picture of how the November elections are likely to go. Bernanke needs to know if it will be safe for him to travel to Texas.

It might be time to bet against the Fed.

Mark, I think you might still be thinking in terms of Keynsian stimulus.

Congress needs to rein in spending, and great at a way to facilitate money movement to bubble borrowers, to facilitate structural change when it eases.

Things are a lot different now than 2008 (well, not much differnt, but different in important ways). We’ve been spending at stimulus levels for four years, mostly during an expansion.

Buying treasuries, now and then, would only fuel congress’s appetite. The fed would need assurances that congress would control spending.

” I’m afraid you’re bending over backwards and excusing the inexcusable. Two weeks ago you made a very coherent and well argued case as to why the Fed would take action with their 2 August meeting. Well, the Fed didn’t do what you so cogently argued they should and would do.”

I 2nd that sentiment. Many economists seem willing to excuse the Fed even though its consistently missing its own forecasts, waiting for more data, dragging its feet. The younger generation is far more clear minded: Evan Soltas has so eloquently noted here http://esoltas.blogspot.com/2012/08/the-fed-as-little-orphan-annie.html

There is always uncertainty. Where are these mysterious costs of QE?

Meanwhile we have some probably otherwise decent economists signing on to a fantasy http://finance.yahoo.com/news/romney-promises-12-million-jobs-223400906.html

250k jobs per month? really? Is that because the entire right wing on the Fed will suddenly drop the structural unemployment argument and step on the gas?

So sad, Mankiw actually argued for a higher inflation target back in 2009. Even sadder, Bernanke has done some nice things bringing transparency to the Fed – now we know with what little wisdom they rule. Unfortunately his legacy, like Arthur Burns, will be failed monetary policy – failed because he did not even follow his own advice.

RPL,

a) So you do not believe that currencies world wide can all be debased? So you haven’t looked at world currencies after Nixon took us off of the gold standard?

b) Yes, I looked at the professor’s graph. Did you look at the graph of CPI? So you don’t believe that currency debasement and price increases are related?

Aaron,

“Mark, I think you might still be thinking in terms of Keynsian stimulus.”

The liquidity trap is a Keynesian justification for fiscal stimulus. Hamilton clearly was skeptical of the existence of the liquidity trap in 2008.

Aaron,

“We’ve been spending at stimulus levels for four years, mostly during an expansion.”

Total government consumption and investment spending just dropped for the eigth consecutive quarter in real terms:

http://www.bea.gov/iTable/iTableHtml.cfm?reqid=9&step=3&isuri=1&903=1

As a percent of potential GDP it was 18.6% last quarter down from 25.0% in 1953, and has rarely been lower in post-WWII history:

https://research.stlouisfed.org/fred2/graph/?graph_id=83201&category_id=0

Aaron,

“Buying treasuries, now and then, would only fuel congress’s appetite. The fed would need assurances that congress would control spending.”

I don’t see how QE could further enable Congress’ appetite for spending. For example, as part of Operation Twist since October the Fed has reduced its holdings of Treasury-Bills (1 year or less maturity) by over $120 billion. This has nearly doubled the flow of T-Bills into the market. In spite of that fact 1-year T-Bills still pay less than 0.2%:

http://www.treasury.gov/resource-center/data-chart-center/interest-rates/pages/TextView.aspx?data=yield

I advocate more QE but it’s not from its ability to lower interest rates. The massive market demand for Treasuries already ensures we are in ZIRP territory. This implies to me that there is a huge shortage of Treasuries.

This implies to me that there is a huge shortage of Treasuries.

Exactly. You’d think that some of the folks who claim to worship at the alter of free markets might stop and ask themselves what it means in terms of supply and demand when the price of Treasuries is so high that it drives real yields into negative territory. In the alternate reality of Tea Partyland prices must go up when there is excess supply and prices must go down when there is scarcity.