Quarterly state GDP figures for the second quarter were released yesterday. Estimated Wisconsin GDP is flat relative to 2015Q4; 2016Q1 GDP was revised down by 1.7%.

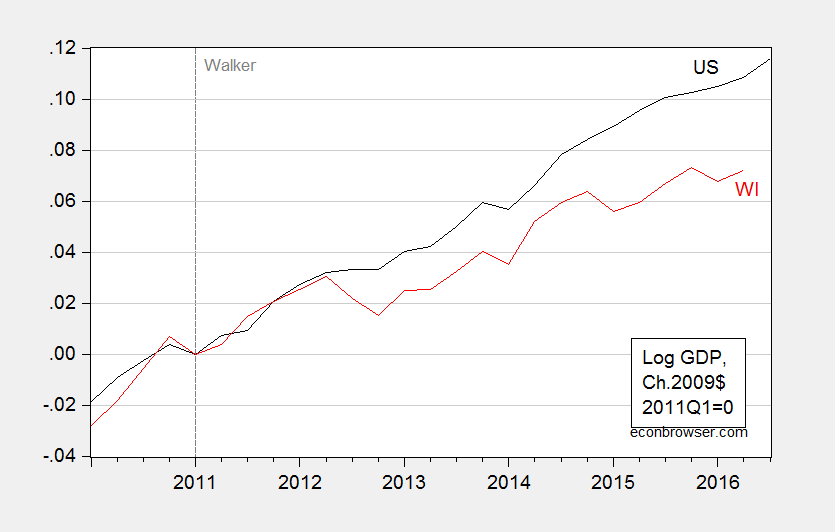

The first point is placed in context in Figure 1.

Figure 1: Log US real GDP (black), and Wisconsin real GDP (red), 2011Q1=0. Source: BEA state GDP release, and BEA GDP, 2016Q3 second release, and author’s calculations.

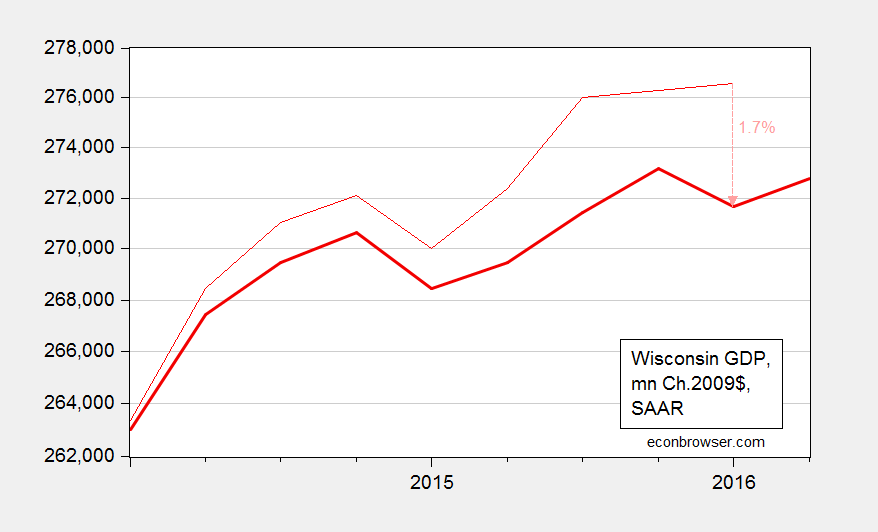

The second point is shown in Figure 2.

Figure 2: Wisconsin real GDP for 2016Q1 second release (red), and for 2016Q2 first release (bold dark red). Source: BEA state GDP releases.

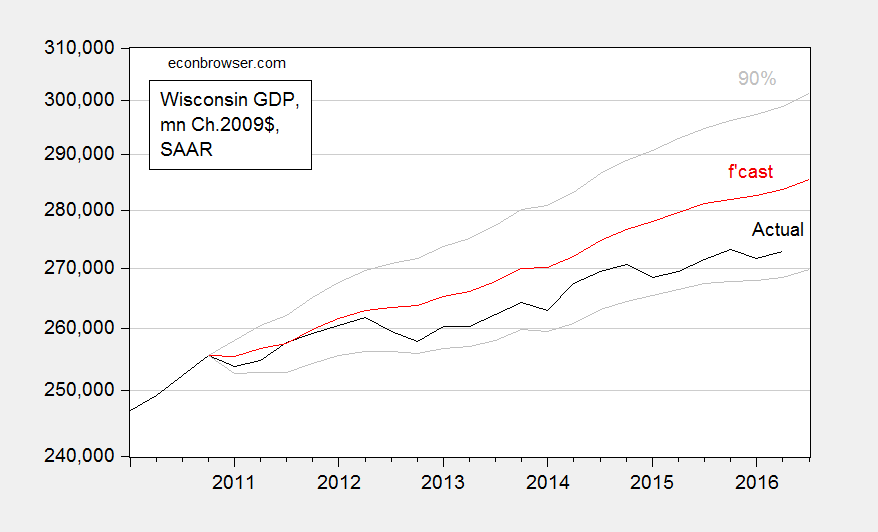

The relevant comparison is where Wisconsin GDP is relative to where we expect it to be. One way to make this comparison is to use historical correlations. I use Wisconsin GDP back to 1988 (interpolated from annual data upto 2004) and US GDP. I run a regression of log first difference Wisconsin GDP on a contemporaneous and lagged log first difference of US GDP over the 1988-2010 period.

Δ yWIt = 0.0007 + 0.665 Δ yUSt + 0.173 Δ yUSt-1

Adj. R2 = 0.38, SER = 0.006, n=92. bold face denotes significance at 5% msl using HAC standard errors. Q(4), Q(8), Q(12) statistics fail to reject null of no serial correlation.

Figure 3 depicts the dynamic forecast (red line) against the actual outcome, along with the 90% prediction interval.

Figure 3: Log real Wisconsin GDP (black), and out-of-sample dynamic forecast (red), and 90% prediction interval. Source: BEA state GDP release, and BEA GDP, 2016Q3 second release, and author’s calculations (see text).

Reported GDP is 3.9% lower than that expected using historical correlations up to 2010.

How does the 2016Q2 level of Wisconsin GDP compare against the Walker Administration’s forecast? I don’t know, since the Administration has ceased to publish the Wisconsin Economic Outlook. The last published forecast from May 2015 forecasted average 2016 GDP 4% higher (in log terms) than actual 2016Q2 levels.

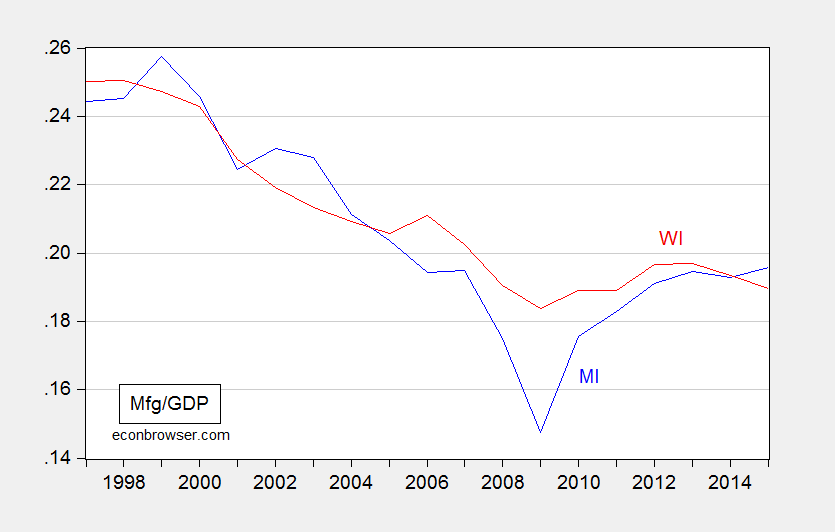

Update, 12/9, 7pm Pacific: Manufacturing as a share of GDP in Wisconsin is about the same as in Michigan, but appears less cyclically-sensitive.

Figure 4: Manufacturing value added share of GDP in Michigan (blue), in Wisconsin (red). BEA and author’s calculations.

Any thoughts on why Minnesota has contracted four of the last five quarters? Looks really fluky.

Neil: Looks like big hit to “real estate and rental and leasing” going from 2015Q4 to 2016Q1.

Perhaps Trump was correct: http://www.epi.org/publication/the-manufacturing-footprint-and-the-importance-of-u-s-manufacturing-jobs/ But I recognize the unwillingness to consider that possibility because state/regional numbers get drowned by national perspectives.

http://data.bls.gov/timeseries/SMS55000003000000001?amp%253bdata_tool=XGtable&output_view=data&include_graphs=true … demonstrates the issue well before Walker.

Wisconsin is more dependent on old-line manufacturing than most states (second to Indiana). As this part of the state’s economy languishes, so does related/support business. A dollar spent in manufacturing does have a multiplier effect; the opposite is true, as well.

Bruce Hall: I am glad to see that you believe in multipliers.

It’s not only government spending that has that effect. 😉

Having worked at Ford from the early 70s, I could see the major impact manufacturing activity had and the rest of the state’s business activity. Wisconsin is even more dependent on manufacturing (as a % of GDP) than Michigan and stuck will some stuck-in-reverse industries such as paper.

Bruce Hall: In 2015, 19.5% of value added in Michigan was accounted for by manufacturing, according to BEA regional data. It was 19.0% in Wisconsin. Hence, I am not sure how you came to your conclusion that Wisconsin was more dependent on manufacturing.

From the link in my first comment (which has a nice interactive map):

* Manufacturing plays a particularly important role in supporting jobs in a core group of states in the upper Midwest (East North Central and selected West North Central) and South (East South Central) states. The top 10 states ranked by manufacturing’s share of total state employment in 2013 are Indiana (16.8 percent, 491,900 jobs), Wisconsin (16.3 percent, 458,400 jobs), Iowa (14.0 percent, 214,500 jobs), Michigan (13.5 percent, 555,300 jobs), Alabama (13.1 percent, 249,100 jobs), Arkansas (12.9 percent, 152,400 jobs), Ohio (12.6 percent, 662,100 jobs), Kentucky (12.4 percent, 228,600 jobs), Mississippi (12.3 percent, 136,700 jobs), and Kansas (11.9 percent, 162,900 jobs).

I incorrectly stated that as % of GDP… and the data was a year old so there could have been some slight shifts. Regardless, the point still holds that Wisconsin is slowed by manufacturing problems in areas such as paper products and heavy construction equipment having taken big hits (although Oshkosh Corp. recent shift into military vehicles has helped) and struggling to return to previous levels. http://data.bls.gov/timeseries/SMS55000003000000001?amp%253bdata_tool=XGtable&output_view=data&include_graphs=true

Michigan is riding the consumer buying spree of trucks and SUVs due to low fuel prices, but that’s a capricious commodity on which to base your fortunes and good times can turn to bad very quickly.

The overall point is that there are opportunities for expanding U.S. manufacturing, but so far there has only been acrimony when the subject is broached. I’m not so sure the U.S. has to throw in the towel simply because of higher labor costs. But I would like to see greater IP protection which has cost U.S. companies and the U.S. government billions or trillions of dollars. It’s certainly a benefit for China to steal U.S. research and then reproduce our products and technology at a fraction of the cost… and then sell it back to us in the form of competing products.

But thanks for the correction.

Bruce Hall: I’ve just added Figure 4. From my perspective, Michigan seems more cyclically sensitive than Wisconsin.

Menzie, I agree completely. Michigan is more cyclically sensitive than Wisconsin. Lower lows and higher highs. Hence my comment about riding high on low gasoline prices, but that being a capricious commodity on which to tie your economic fortunes.

Michigan is looking good in comparison to Wisconsin at present because it is riding one of those highs.

exactly how long should we wait before the bonanza of walker economic policies kick in and bring nirvana to the far north? same question for the brownback nirvana of kansas.

Bruce Hall Perhaps Trump was correct

In what way was Trump correct in a way that others were not? I’m not aware of anyone arguing that the loss of manufacturing jobs was a good thing for those workers who lost their jobs. I’m not aware of anyone who denied that manufacturing jobs have been declining. My sense is that Trump completely misunderstands why the US is losing manufacturing jobs. Trump seems to believe the US is losing manufacturing jobs because of bad trade deals. There’s an old saying that when your only tool is a hammer, all problems look like nails. Well, Trump’s only skill seems to be deal making, so he naturally believes that manufacturing jobs can be recovered with a little more wheeling and dealing. Trump’s thinking seems to be something like the following. Deal making is an important aspect of business. Business is related to economics. Therefore, deal making can solve economic problems. This is flat wrong. Yes, manufacturing jobs are fading; but the loss of manufacturing jobs is almost entirely due to technology, not NAFTA or WTO or whatever. For those workers who still have jobs in manufacturing, they ought to be especially wary of Trump’s choice for Secretary of Labor…assuming he gets past that little wife beating and drunk driving problem during his Senate confirmation.

Blue collar rust belt voters who went for Trump are in for a very rude awakening. Right now they’re enjoying the experience of flipping off “elitist” candidates. But this was a case of cutting off one’s nose in order to spite one’s face. Soon enough reality will set in, as will buyer’s remorse. False consciousness can be very pathetic.

2Slug, perhaps your implication is correct and that if we continue with the present path we will continue to lose manufacturing jobs and if we trust Trump’s intuition? we will continue to lose manufacturing jobs. If that’s the case, no politician is safe.

I’m more inclined to think that we have operated on a set of principles and constraints that have been beneficial to U.S. consumers and detrimental to U.S. producers. The question is whether that is a good long-term strategy. It’s not as if the U.S. is about to collapse because several million actual/potential manufacturing jobs have disappeared. New sectors are evolving and, with adequate intellectual property protection, can keep the economy humming along at 1-2% growth. Plus, we have strong immigration of unskilled laborers who can work in the agricultural jobs that have been automated and the entry level manufacturing jobs that have disappeared.

Certainly, there is almost unlimited potential for bureaucratic growth to oversee the growing need for social justice programs and ensuring that there are plenty of translators to allow employees in these non-jobs to talk with their non-employers. http://www.judicialwatch.org/blog/2016/12/u-s-workplace-english-rules-discriminatory-foreign-language-demands-arent/

“I’m not crazy, my reality is just different than yours”

― Alice In Wonderland

Bruce Hall We will continue to lose manufacturing jobs regardless of who is President, just as farmhands lost their jobs as agriculture became more mechanized, and just as buggy whip manufacturers lost their jobs 100 years ago, and just as middle skill level office workers are losing their jobs today thanks to powerful computers and software. How many offices today have typing pools? Go ahead and make snarky comments about hordes of bureaucrats and translators, but those are the kinds of skills the economy needs to become more productive. I don’t know what you think government workers and bureaucrats do all day, but mainly they do things like make sure your drinking water is safe, make sure employers don’t cheat workers, manage prisons, monitor contracts, gather and analyze data, conduct basic research (including your flu shot), redistribute income, and a million other things you never imagined. Those are also the kinds of services that wealthy countries demand. For example, clean air is a low priority for low income countries, but since clean air is a normal good demand for cleaner air increases with income. Clean air also makes workers more productive, as plenty of recent research has shown (go visit the working papers at nber.org).

with adequate intellectual property protection, can keep the economy humming along at 1-2% growth…

There are two things in that paragraph that struck me as a window into your economic thinking. And both are wrong. First, strong intellectual property rights tend to hurt economic growth. Innovation requires some low level of patent and copyright protection, but the tendency today is towards too much protection. And that hurts economic growth because returns to innovation tend to get trapped as economic rents. The role of non-rivalrous knowledge inputs (ala Paul Romer) is central to contemporary growth theory. The second thing that struck me was your derisive attitude towards immigration. Well, at the end of the day there are only two principal inputs to long-run economic growth: innovation (needed for increasing returns to scale) and population growth. And you seem opposed to both of them. So in your ideal world of strong intellectual property protections and limited immigration, we would be damn lucky to get 1% growth never mind 2%.

2slug, I accept the fact that you have a globalist view of “our economy” as opposed to a national view, therefore, I also understand why you think intellectual property protection is bad for “our economy.” Unfortunately, most of “our economy” that is benefiting from lack of IP protection is China.

Actually, the U.S. needs strong intellectual property protection and limited immigration. Corporations need to recover their costs, earn a profit for risks, and have the incentive and means to create more value for society, including for the free riders. If we had open borders, hundreds of millions of poor people would move here. The U.S. would become much like the countries they came from.

A little know economist said something to the effect that in the long run we are all dead. That will probably be about the time Wisconsin and Kansas policies kick in.

Bruce Hall I also understand why you think intellectual property protection is bad for “our economy.”

First of all, intellectual property is not ours; it’s owned by specific individuals and companies. Patents owned by XYZ Corporation do not benefit you more than some Chinese guy just because you happen to live in the country where XYZ Corporation is headquartered. You can’t use the non-rivalrous technology anymore than the guy in China. It’s only value is to the owner of the patent; and much of that value is in the form of unproductive economic rents. There are very few things that economists agree on, but one thing that they almost universally agree is that excessively long patent and copyright laws hurt productivity everywhere, in both the US and the rest of the world. Intellectual property rights are a form of legalized monopoly, and like all monopolies they discourage output and transfer consumer surplus to the owners of the patent or copyright as economic rents. But what’s worse, they discourage the application of that technology to new technologies; and ultimately that is the source of future productivity growth for American workers. The only economic justification (as well as Constitutional justification…go look up Article 1 of the Constitution) is that the promise of economic rents can spur innovation and risk taking, which is a good thing. So you want some limited intellectual property rights protections, but you don’t want excessively long ones. And you should never want retroactive rights.

Over the years I’ve read enough of your posts to be fairly confident that you don’t have any formal training in economics beyond first year stuff, so you might not understand why current intellectual property right laws are such a disaster for the long run productivity of American workers. But you do visit an economics blog, so at least you show some interest. The trick to thinking like an economist is to assume everything that agrees with common sense intuition is wrong, because it usually is. And here I think you’re relying upon intuition rather than actual economic analysis. If you don’t know why 75 year copyright laws are bad, then ask Santa to bring you a good econ book for Christmas.

2Slug, of course IP protection is for individuals and corporations. But the “economy” is comprised of individuals and corporations. Your contention that “excessively long” periods of protection are harmful to “our economy”, but your globalist position is essentially one that says “if it can be stolen, it should be stolen” because that good for the economy.

“I’m not crazy, my reality is just different than yours”

― Alice In Wonderland

Bruce Hall “if it can be stolen, it should be stolen”

A better way of putting things is “if it can be used, it should be used.” Intellectual property rights are all about restricting use, and that hurts everyone except that holder of the patent or copyright. What’s needed are reasonable copyright/patent lengths. The length should be long enough to encourage innovation, but not so long as to discourage innovation elsewhere. Should that period be 7 years? Should it be 21 years? Reasonable people can disagree about that. What’s clear is that periods of 75 years are ridiculous. And what’s even more ridiculous are retroactive copyright/patent extensions. It’s very hard to see how retroactive rights going back almost a century encourage dead people to innovate more. It’s just an unearned and unproductive windfall for heirs. Gets which political party is arguing for copyright/patent rights that exceed a person’s life expectancy? Go on, guess.

Question: When are going to start making arguments based on textbook market economics instead of these 17th century mercantilist arguments you keep dredging up?

2Slug,

“Intellectual property rights are all about restricting use, and that hurts everyone except that holder ….”

Now simply drop the word “intellectual” and let’s discuss your position. Intellectual property is more than just some thoughts. It is time, money, dedication, risk, effort, research, development, testing, passing countless regulations, and always with the knowledge that without the law your product can be “used” without compensation.

Why should someone’s labor service be protected more than his intellectual service. You can’t just pay someone for one hour’s work and then demand that they continue working without compensation.

If you don’t like IP protection, produce something better to replace the protected property. That’s the incentive for advancement.

bruce, it is much easier to justify ownership of a car than it is an idea. if you take my car, you have actually taken a physical item away from me. if you take my “idea”, i still have the idea. there is no reason i cannot still use my idea. its value, to me, may have declined but the idea can still be used by me. you want to compare “potential” to actual items. this will become a more challenging issue to defend going forward, especially as the world economy moves from a physical asset to a cyber asset world. people are not arguing for no protection, but they are arguing, probably correctly, that you cannot protect that “potential” for the long term.

Baffling,

…”it is much easier to justify ownership of a car than it is an idea. if you take my car, you have actually taken a physical item away from me. if you take my “idea”, i still have the idea.”

But you don’t have the value of the “idea” being yours that is guaranteed under IP protection. What you have is your car, but one that anyone can borrow at any time for their benefit, not yours. It is not the “idea” that is protected, but the products produced as a result of the idea. Hence, patent and copyright protections.

Admit it: you simply want to be able to steal the work product of someone else because… you … want … it. That’s the tried and true Chinese way of doing business.

“Admit it: you simply want to be able to steal the work product of someone else because… you … want … it.”

absolutely wrong. as i have indicated, in agreement with slugs, the real problem is the length of the protection. i have no problem providing a short term protection to assist in recovering ones cost. i have do have a problem providing long term protection to assist in profit. i want you to continue to innovate and work for your profit. this forces you to become more efficient and productive-good things to have happen. you seem to embrace a perspective that encourages rent seekers.

slugs,

i would say both bruce and peak subscribe to the popular conservative view that if one works hard (or was born with a silver spoon) to achieve a certain position in life (or patent, copyright, etc), then they are deserving of the right to maintain that position (or patent, etc) for the remainder of their life without the need to work harder to maintain such a position. in their view, it should be cheaper and easier to maintain their advantage than it was to achieve it in the first place. this is the source of the privileged class perspective on the world and economics. it is an anticompetitive and unproductive way to operate an economy. what they do not realize is in their efforts to rise to the top, they did not want (or were not burdened) by patent or IP rights, but once at the top, feel those are nice features to help them stay at the top. what we should be doing is creating an economy which encourages the younger upstarts to compete directly with those established players. this creates productivity with the upstarts, and keeps established players from resting on their laurels. this is how you push innovation.

there will be those that argue such an approach stifles innovation and hinders risk taking, but they are wrong. you can still innovate and be the first to market with your product. you will make money from such a scenario. you simply cannot sit for a decade and make your money and not face competition. you need to get back into the lab and create another innovation the next day. we should not protect a rent seeking economy.

peak has a common phrase on this site, too much regulation. too much copyright and IP protection is actually very much a government regulation which hinders innovation.

Baffling,

“i would say both bruce and peak subscribe to the popular conservative view that if one works hard (or was born with a silver spoon) to achieve a certain position in life (or patent, copyright, etc), then they are deserving of the right to maintain that position (or patent, etc) for the remainder of their life without the need to work harder to maintain such a position.”

Ah, the old “silver spoon” argument of the progressives. Consider that without IP protection, the “silver spooners” would not bother to create new products. They already have resources and wealth, right? All they would have to do is wait for some poor schmuck progressive to toil away in some dirty, one-room hovel and then quickly steal his idea. Is that your ideal world?

The world doesn’t work the way you believe. Patents are only valuable if someone doesn’t come up with a better solution or product that the market wants… and that happens virtually every second. Ask the cathode ray tube manufacturers. Copyright laws are useful only if no one has better ideas and communicates them. No one, except maybe the odd economics professor, forces you to uses their product or read their ideas. Why should the ownership of a manuscript that you worked on and produced be more temporary than the ownership of a piece of paper entitling you to a piece of property? The manuscript and property can both become worthless for many reasons (ask the people of Detroit).

bruce, i have no problem providing short term copyright and patent protections. but only short term. you want an advantage long term, you need to innovate that advantage.

If you don’t know why 75 year copyright laws are bad, then ask Santa to bring you a good econ book for Christmas.

Well, it will set you back about $300 because of copyright laws.

Most of the world’s largest biotech and pharma firms are American. Investment develops new treatments and cures, creates more competition, and attracts much of the best & brightest to American firms. List of largest biotech firms:

http://www.biotechnologyforums.com/thread-3.html

Peak Trader Corporations need to recover their costs, earn a profit for risks

Maybe Santa should bring you an econ textbook as well. You might want to start with the chapter that explains the difference between economic profits and economic rents.

2slugbaits, you don’t seem to understand a growing new industry has more risks and failures, which justify more than an accounting profit. The biotech industry needs to develop. I’m sure, some firms will eventually become similar to Microsoft. Then, you can worry about economic rent.

Peak Trader I said economic profits were fine. What does that have to do with “accounting profit”? I’m not sure you understand what “economic profits” are.

I’m well aware that some new industries have high risks. Those high risks justify high rates of return; but they don’t justify excessive rates of return. If a firm was willing to take a risk if the expected rate of return was (say) 15% but not 14%, then no one objects to that firm getting a 15% return. But if the return ends up generating a 100% return simply due to the firm’s ability to restrict use, then the difference between 100% and 15% is unproductive economic rent. That creates deadweight loss in the economy overall. Again, ask Santa for an econ textbook.

By the way, the bio-tech industry relies on the US government for a lot of its risky research.

2slugbaits, I have degrees in economics. In an emerging industry, opportunity costs will lead to high economic profit, which may not represent economic rent or excess profit. It just represents expected returns.

peak, 100% of the biotech training is funded by the federal government. there are no private labs that hire workers, educate them, and train them in the practice and art of biomedical research. the research these biotech and pharma companies conduct is heavily subsidized by this federal training of their workforce. not only does the federal government subsidize this workforce, the federal government also subsidizes much of the basic life science research the biotech world builds their final products upon.

2slug,

“If a firm was willing to take a risk if the expected rate of return was (say) 15% but not 14%, then no one objects to that firm getting a 15% return. But if the return ends up generating a 100% return simply due to the firm’s ability to restrict use, then the difference between 100% and 15% is unproductive economic rent. ”

Unproductive for whom? It’s not unproductive for the competitor who has greater incentive to replace the highly profitable product with one of their own. It’s not unproductive for the producer who can use the additional funds for new products and ideas… some of which will fail as always happens in the marketplace. It’s not unproductive for the government which gets a bigger piece of pie to redistribute.

The thing about so-called “rents” is that they are just as much opportunities as they are anchors.

As for the cost of research in pharmaceuticals, I suggest you read https://www.cbo.gov/sites/default/files/109th-congress-2005-2006/reports/10-02-drugr-d.pdf … especially page 33. I selected a CBO report rather than some of those “fake news” sites.

One important consideration:

“Basic research discoveries tend not to be patentable, so

the assignment of property rights has less effect on the

social value that results from basic research than it would

have otherwise. Much of that value instead derives from

academic traditions of scientific openness and the free

flow of ideas. As the Supreme Court’s decision in Diamond

v. Chakrabarty illustrates, however, the scope of

what is patentable can shift over time—and thus the balance

between the social benefits of “open science” and of

property rights and commercial development can change

as well.

Some analysts argue that in addressing such issues, it may

be counterproductive in the long run to further weaken

the institutions of open science, increase the market orientation

of public-sector researchers, or give taxpayers a

greater share of the benefits that private companies derive

from developing ideas generated in the public sector.20

For example, gaining price concessions from drug firms

that benefit from publicly funded research would increase

taxpayers’ current benefits but could reduce their future

benefits. Such concessions would reduce firms’ expected

profits from licensing and developing taxpayer-funded

research and thus would affect their future decisions

about R&D (see Box 4-1).”

When PeakTrader starts off with: “2slugbaits, you don’t seem to understand..”, it’s time to make sure your hands are clean. There’s a facepalm coming