That’s the title of a fascinating new paper with important policy implications.

This paper evaluates the popular view that quantitative easing exerts greater international spillovers than conventional monetary policies. We employ a novel approach to compare the international spillovers of conventional and balance sheet policies undertaken by the Federal Reserve. In principle, conventional

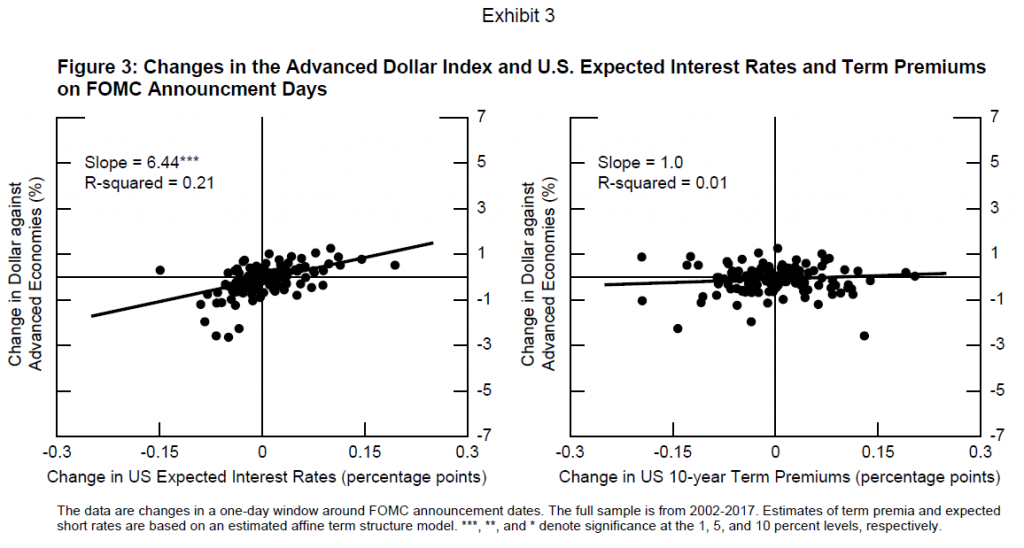

monetary policy affects bond yields and financial conditions by affecting the expected path of short rates, while balance-sheet policy is believed act through the term premium. To distinguish the effects of these two types of policies we use a term structure model to decompose longer-term bond yields into expected short-term interest rates and term premiums. We then examine the relative effects of changes in these two components of yields on changes in exchange rates and foreign bond yields. We find that the dollar is more sensitive to expected short-term interest rates than to term premia; moreover, the rise in the sensitivity of the dollar to monetary policy announcements since the GFC owes more to an increased sensitivity of the dollar to expected interest rates than to term premiums. We also find that changes in short rates and term premiums have similar effects on foreign yields. All told, our findings contradict the popular view that quantitative easing exerts greater international spillovers than conventional monetary policies.

Ever since Brainard’s speech in 2017 (highlighted in this discussion by Brad Setser), I’ve been wondering how to differentiate between short term interest rate and term premium effects on exchange rates. In this paper, the authors obtain the following estimates.

In one sense, this makes sense, since the term premium is a liquidity/inflation risk term, which does not necessarily map to the exchange risk premium which might depend on very different things that determine the term premium. Short term interest rates on the other hand are phenomena most directly linked to the first moments of monetary policy, which should matter the most for nominal exchange rates. But that’s conjecture on my part…

Is this well established? “balance-sheet policy – in particular, purchases of longer-maturity bonds – is believed to act by altering the supply/demand balance in the bond market and thus affecting the term premium.”

I think people like Rousseff were merely reacting to what seemed to happen to the value of the dollar when QE was initiated. When the Fed bought dollar-denominated securities, many of the sellers might have just replenished their stock by buying foreign securities, leading to dollar decline. Does the authors’ method really contradict this story?

Wondering if this isn’t common sense, to a degree. If Fed discount window rate changes domestically have a larger impact (relatively speaking when you talk about how much fed bond purchases have to be made to change the rate) than quantitative easing does, wouldn’t it be screamingly obvious the same would hold true for how that impacts foreign markets?? I guess the focus here is the term premia?? But still some of this seems obvious just through speculation or supposition in “your” mind.

It seems so obvious to me, I feel I must be totally missing something here. Honestly when I watch the QE moves, it seems to benefit the banker/dealers who have cozy relations with the fed more than anyone else. The banker dealers are the ones who have the cash after the bonds are taken off the market, and they also have the transaction fees that result from the ensuing increased market transactions. The effect on main street of QE is MUCH less than is supposed or imagined (or propagandized??) by the FED. It’s usually the large banks the QE mainly benefits. And we can see how much guys like Stanley Fischer “care” about main street, when they have absolutely jackshit to say about main street getting relief from mortgage cramdowns. Which BTW, our great “middle class hero” President Obama spent all of about 2 minutes half-heartedly stumping for. Then all the Dems like Hillary (who also had NOTHING to say about mortgage cramdowns) sit around wondering why they got their butt kicked in 2016.

https://baselinescenario.com/2009/04/30/bankruptcy-cramdowns-defeated-in-senate/

“Strange” how so few white rural women went out to vote for Hillary, when Hillary the Great had a chance to swing the bat for them on mortgage cramdowns, they were screaming for relief as they were losing their jobs and their homes, and all the great feminist Hillary could hear was crickets chirping.

A President at the time who had a 68% approval rating, but couldn’t get his LAZY ass out there to middle America and stump for legislation that would have been more helpful to middle America than ANY damned QE. Well, donald trump can get out there and stump for his wall in Montana etc. But having “great hero for the middle class” President Obama spread canvas for mortgage cramdowns and Hillary “I’m too royal lineage to campaign in Wisconsin and Michigan” Clinton get her fat lazy butt out there to stump for mortgage cramdowns was just too damned much to ask.

isn’t it fascinating how important “contract law” is to Republican legislators, and “the rule of law”, when middle class peoples’ homes are being possessed (some illegally) by large TBTF banks. but when Wells Fargo creates fee producing accounts magically out of thin air, Wells Fargo gets a mild slap on the wrist for newspaper headlines, and we just all go on like nothing happened.

https://money.cnn.com/2017/08/31/investing/wells-fargo-fake-accounts/index.html

https://www.wsj.com/articles/wells-fargos-sales-scandal-tally-grows-to-around-3-5-million-accounts-1504184598

When presented with two options, conventional policies or quantitative easing, I lean toward the both/neither rather than the either /or. (This from a career listening to the light is a wave, light is a particle). The absolute necessity is a negative feedback, positive feedbacks are chaotic. Both policy options are deeply suspect. We were lost at the closing of the gold window. It has been an interesting ride.

I found this on Mark Thoma’s site. Since Professor Thoma is an ultra-responsible person I’m going to assume the interview is legit:

http://acemaxx-analytics-dispinar.blogspot.com/2019/01/interview-prof-ashoka-mody-princeton.html

Still haven’t finished Ashoka’s book yet.