That’s the title of a new paper, coauthored with Jeffrey Frankel, using data extending back to August 1986.

For four decades economists have been finding that the forward discount is a very biased forecast of future changes in the exchange rate. The carry trade makes money, on average. For just as long, they have been debating the appropriate interpretation of the bias. Is it evidence of an exchange risk premium? Under that interpretation, a currency that sells at a forward discount does so not because it is expected to depreciate in the future but because it is perceived as risky. Using data on survey-based expectations over 32 years across 17 currencies, we reject that interpretation of the forward bias. We find that when investors sell a currency at a forward discount, it is indeed because they expect it to depreciate. But we also find concrete evidence of a risk premium, in that expected return differentials are correlated with the VIX measure of risk — even though the risk premium can’t explain forward bias.

Back in the 1980’s, when Frankel started using survey data on currency expectations (with Kenneth Froot), there was a lot of skepticism of such data (remember, these were the days of rational expectations or bust). Since then, the use of survey data have become more widely accepted, perhaps longest in terms of inflation expectations. In the real world, many of the macro series we think of as the purview of hard-headed real-world macro people are surveys (e.g., PMI, for instance; here’s an entire conference).

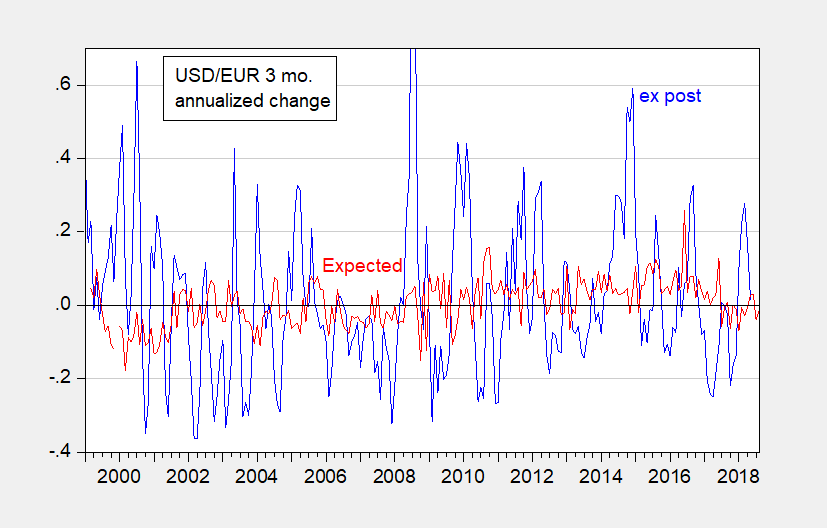

Here are the time series for important variables for the USD/GBP, comparing ex post against survey (ex ante) based. First depreciation.

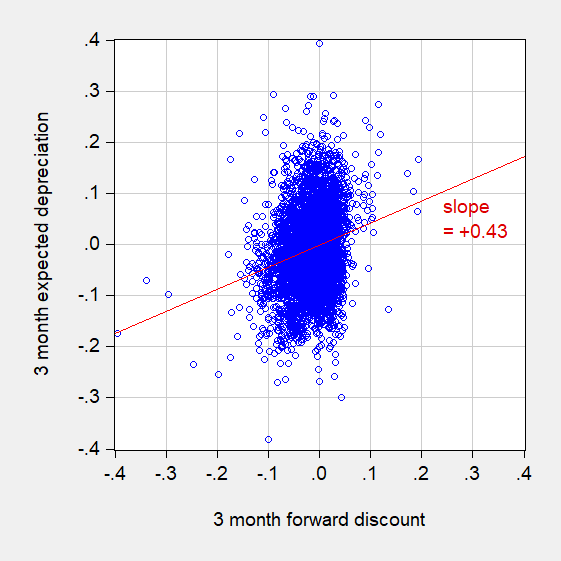

Notice that the two series differ substantially, with the ex ante considerably less volatile. Interestingly, unlike the usual finding, expected depreciation and the forward discount (approximately the interest differential) are positively correlated, across all currency pairs available.

The slope, while positive, is not close to unity. This suggests the existence of an exchange risk premium.

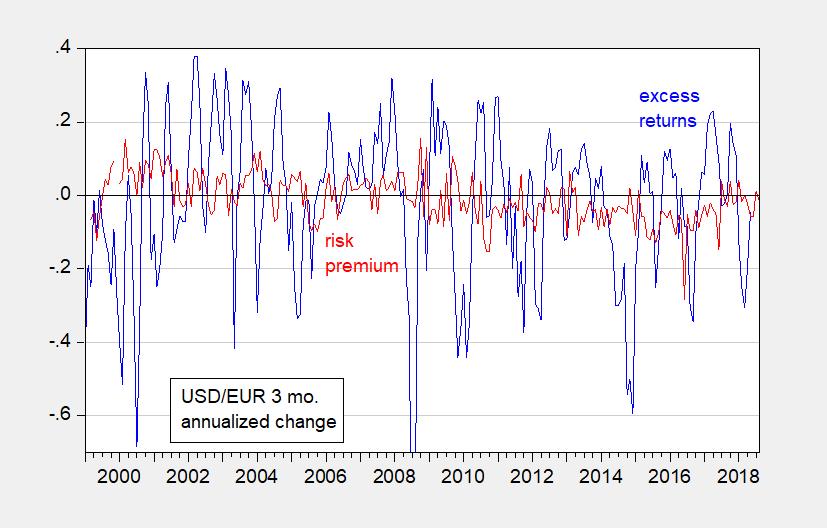

The risk premium defined using survey data naturally appears different than that defined using rational expectations.

The entire paper is here. Our earlier papers on the subject include this 2002 paper, RIE 1993 and JMCB 1994. A paper related to this subject, coauthored with Bussière, Ferrara and Heipertz is here.

Very interesting ans indeed a good followup to all that earlier work going back to Frankel/Froot and Froot/Frankel, which was indeed dismissed by many initially. What strikes me about this as well as so much of that earlier work as well is just how noisy all this data is. This goes all the way back to Meese aand Rogoff, if not earlier. It is a reminder how poorly behaved foreign exchange rates are in terms of the models, especially compared to other macro variables.

Interesting and must read paper. Before I do, I have to note that among all his lies about THE WALL, Trump once again declared that the stock market is 30% higher than it was when he was 1st elected. Let’s see:

https://fred.stlouisfed.org/series/SP500

22.5% is not 30%. He lied about this too!

An interesting question could be: by what does one agent form the expectation of depreciation? *Can* we pinpoint those factors (even at the age of “Big Data”)?

I only have the sense that long-term rate is directed by national institutions and policies, across presidencies, wars and peace, expansion and recession.

Just got around to reading this interesting and important paper. The references section is a nice list of previous work including a lot of papers that Jeff co-authored over the years including two that he co-authored with Menzie. Plus two other papers that Menzie co-authored. An issue hotly debated ever since the early 1980’s!