Data out of BEA today shows 2% q/q SAAR growth in Q3 – but all of it can be accounted for by the 2.7% contribution from inventories. Jim will be presenting his views on the Q3 release later today.

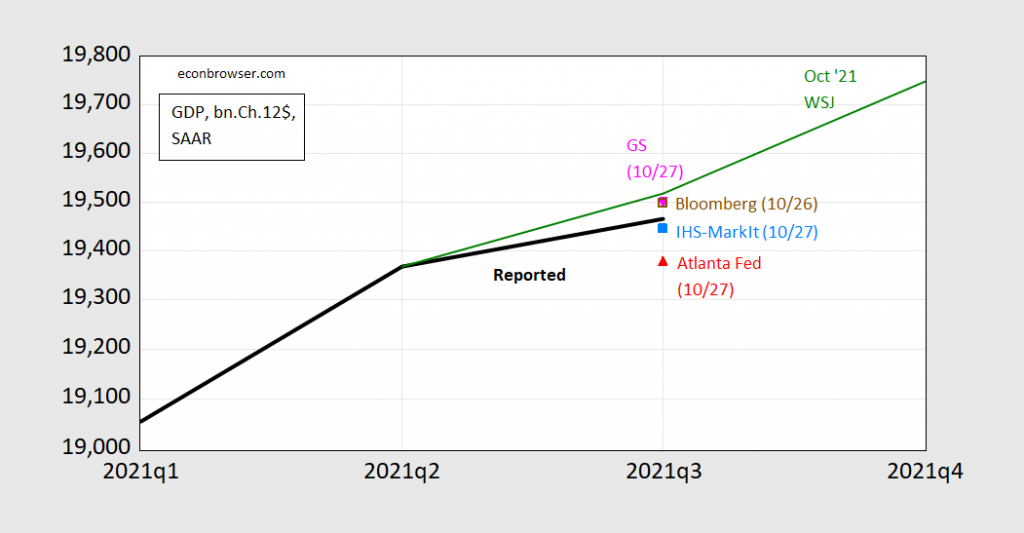

Updated Figure 1: GDP, 2021Q3 advance release (black), implied GDP from Atlanta Fed 10/27 nowcast (red triangle), IHS-MarkIt 10/27 (sky blue square), Bloomberg consensus 10/26 (brown square), Goldman Sachs 10/27 tracking forecast (inverted pink triangle), and mean forecast from WSJ October survey (green line). Levels calculated using reported growth rates and latest GDP for Q2. Source: Atlanta Fed, IHS-Markit, Bloomberg, Goldman-Sachs, WSJ October survey, and author’s calculations.

Atlanta Fed nowcast cut from 0.4% to 0.2% q/q SAAR, Goldman Sachs from 3.25% to 2.27%. This revises the graph in yesterday’s post.

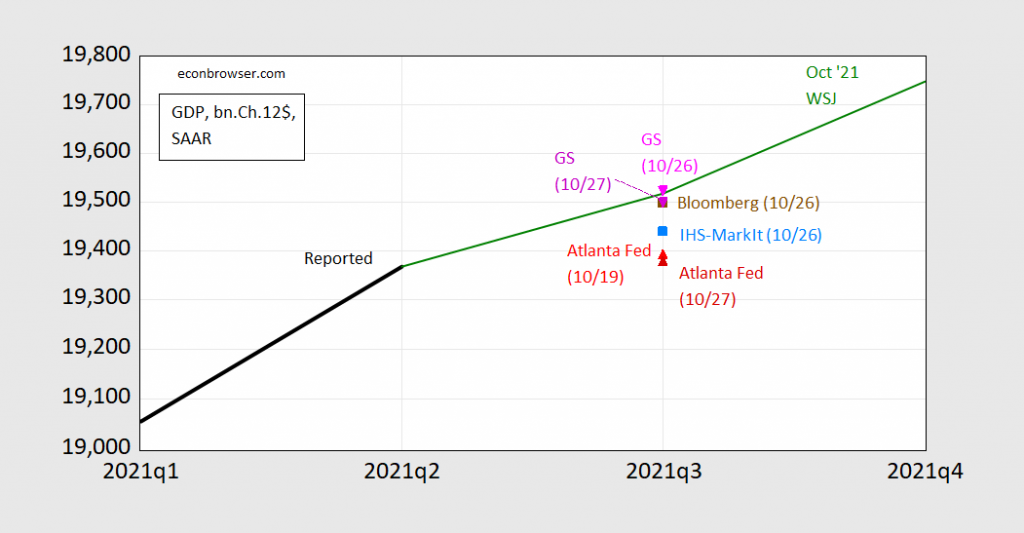

Figure 1: GDP (black), implied GDP from Atlanta Fed 10/19 nowcast (red triangle), 10/27 nowcast (dark red triangle), IHS-MarkIt (sky blue square), Bloomberg consensus (brown square), Goldman Sachs 10/26 tracking forecast (inverted pink triangle) 10/27 tracking forecast (inverted dark pink triangle), and mean forecast from WSJ October survey (green line). Levels calculated using reported growth rates and latest GDP for Q2. Source: Atlanta Fed, IHS-Markit, Bloomberg, Goldman-Sachs, WSJ October survey, and author’s calculations.

The Bloomberg consensus of 10/26 was not changed, while the IHS-MarkIt nowcast rose from 1.5% to 1.6% q/q SAAR – small enough I did not plot the new implied level.

Yesterday NakedCapitalism had a post about the supply chain disaster at US ports. Today there’s a post about oil prices: “A Global Oil Shortage is Inevitable.”

https://www.nakedcapitalism.com/2021/10/a-global-oil-shortage-is-inevitable.html

How much head wind can the economy take? Nonetheless I expect that the Fed along with many economists will continue to whistle a happy tune, because they know what will happen if interest rates must be raised and are horrified at the prospect.

You are the one who seemingly talks endlessly about the less palatable parts of American capitalism but turns around and quotes websites that have garbage ads and unethical sponsors splattered all over the website?? Hosted by a woman who used to work at Goldman Sachs and now wants to lecture banks about ethics. “Oh, she’s found Jesus!!!!! Now click this ad from our sponsors.”. Wow, talk about a village idiots comment section with worshipful adoration to its leader. It’s 1/2 step away from a cult.

Wow! A real hit below the belt. I doubt that Yves Smith gets to choose the ads on her site. And TSVETANA PARASKOVA does liberally quote presumably reputable analysts, though the company they work for may behave in a very self-interested manner.

And Andrew Ross Sorkin had to really dig the knife deep into TBTF bankers’ ribs to get sit down interviews for “exclusives” in his book. “No promises were made” to those bank executives by Sorkin beforehand. Dude, I know you have good intentions about wanting a better society and I respect you for that, but you are a laugh riot.

It’s only just begun.

You get the economy you deserve – good and hard.

T.Shaw: So, when GDP plunged 9% in 2020Q2 q/q (not annualized), we deserved that?

2020 q2 gdp plunge was what we called in the orderly room ‘shooting himself in the foot.’

in an election year! was it krugman or reich said ‘saving grandma is worth gutting gdp.’ here!

how many grandmas saved or lost is debatable.

recent observed surge in non covid er visits is a feature of 2020 q2 decline. the grossly under counted vaers (vax adverse events) on the mandated vaccines is another feature.

no one read the great barrington declaration

your comment makes no sense.

DIdn’t really know where to put this, so arbitrarily decided to put it in one of the shorter threads. I thought this was a nice story, and worthy of a read:

https://www.nytimes.com/2021/10/28/us/michelle-wu-boston-election.html

We’re often told of the “evils” of the big city. No doubt there are some truths there. But I would be curious to know, how many cities/towns with say a population under 80,000, and not a suburb of a large city, have an Asian Mayor, or a female Asian mayor. I’d be interested to see those numbers (absolute amount or percentage rate of those under 80k with Asian Mayor) if those numbers have been published/noted somewhere.

My argument being, they are much more apt to happen in large cities, or well-educated suburbs near any city. With the possible exception of “college towns” that sometime have characteristics of a suburb (higher education levels) but not always located near a major city. Madison is an obvious example of a semi-long national list of this type of a USA college town (although they are above my litmus test of 80k population, with 250k) that might have a higher probability of having an Asian or East Indian mayor, but still, under 80k would be interesting to see those numbers,