A reader writes:

If you want to explain the difference between a recession and a depression, or why it took seven years for the economy to regain previous highs after 2008, well, go ahead. I’m all ears.

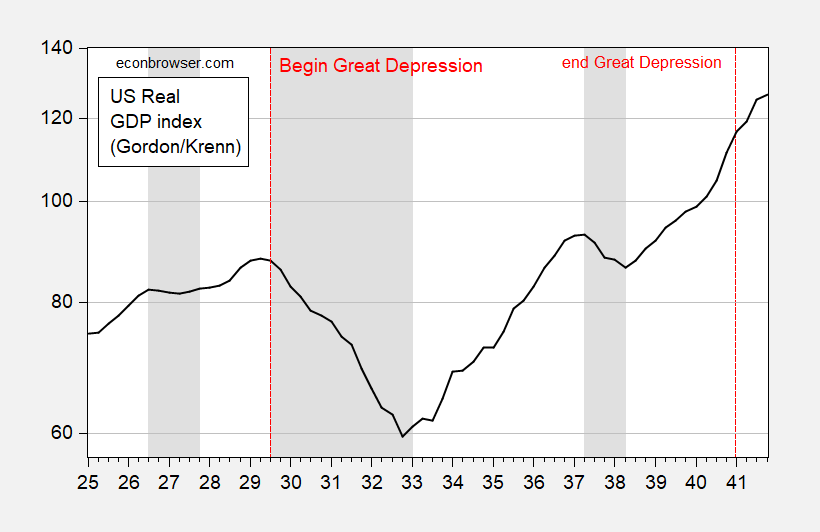

Besides not understanding how long it took to re-attain the pre-recession peak in 2007 (it only took 3 years, not 7), the reader does not seem to understand “depression” does not have a fixed definition in the economics profession. There are two depressions in American economic history lingo, as far as I now, but I am willing to be corrected. Here are pictures of the two I am familiar with. First is the “Great Depression”.

Figure 1: Real GDP index (black), NBER defined recession dates peak-to-trough shaded gray, beginning and end of Great Depression at red dashed lines. Source: Gordon-Krenn (2010), NBER.

Investopedia sets the Great Depression end in 1941, while Wikipedia’s text sets at 1940-41.

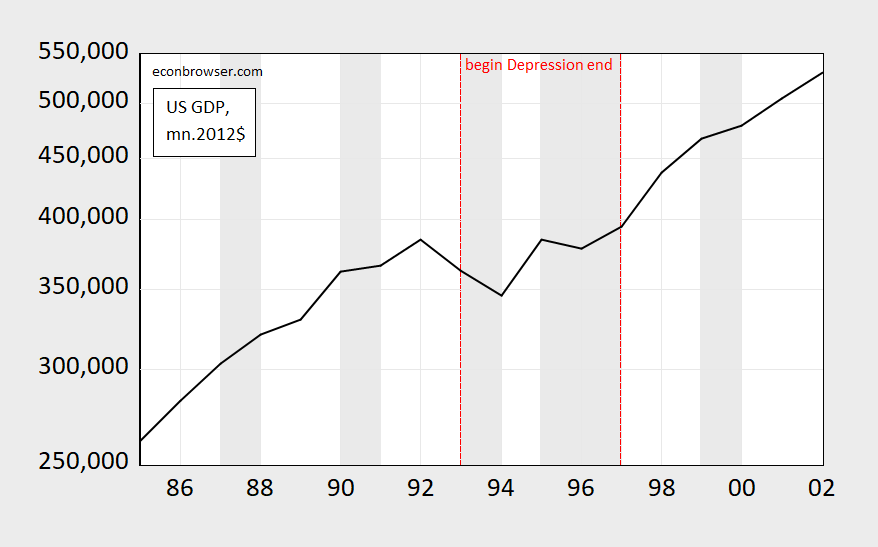

The other “great depression” is that associated with the Panic of 1893.

Figure 2: Real GDP in mn. 2012$ on log scale (black), NBER defined recession dates peak-to-trough shaded gray, beginning and end dates of Depression at red dashed lines. Source: MeasuringWorth, NBER.

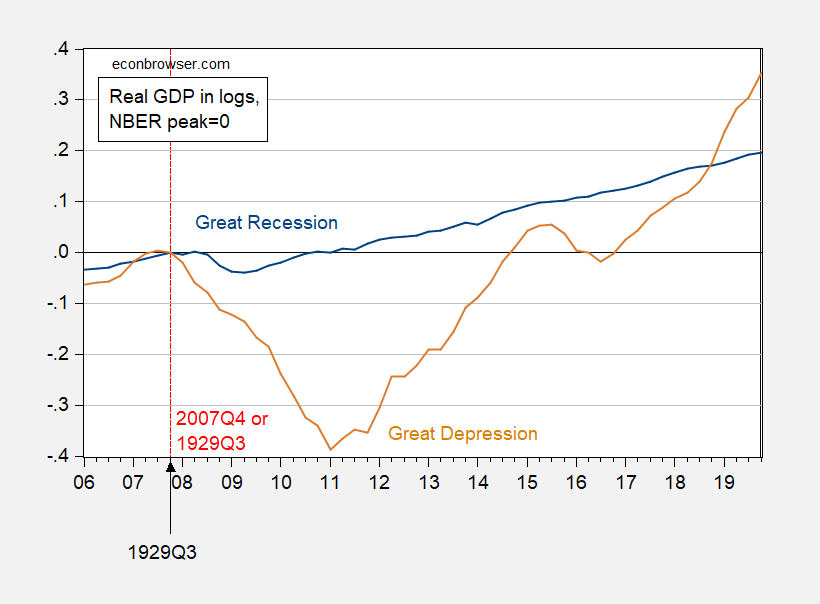

Now, is there any comparison between the Great Recession and the Great Depression? I’ll let the non-visually-impaired reader decide.

Figure 3: Real GDP in logs normalized to 2007q4 peak (blue), normalized to 1929Q3 peak (brown). Source: BEA, Gordon-Krenn (2010), NBER, and author’s calculations. [Brown line dates — refer to trough at 1929Q3, also see scale on Figure 1]

So, at the trough associated with the Great Recession, output was 3.9% below peak (log terms). For the Great Depression, one trough was 38.6% below peak.

I’m going to go out on a limb, and assert that this particular reader has himself a highly idiosyncratic definition of “depression” (I have no idea what he means by “suppression”).

I am constantly amazed how willing some people are to pontificate with extremely little acquaintance with the relevant data.

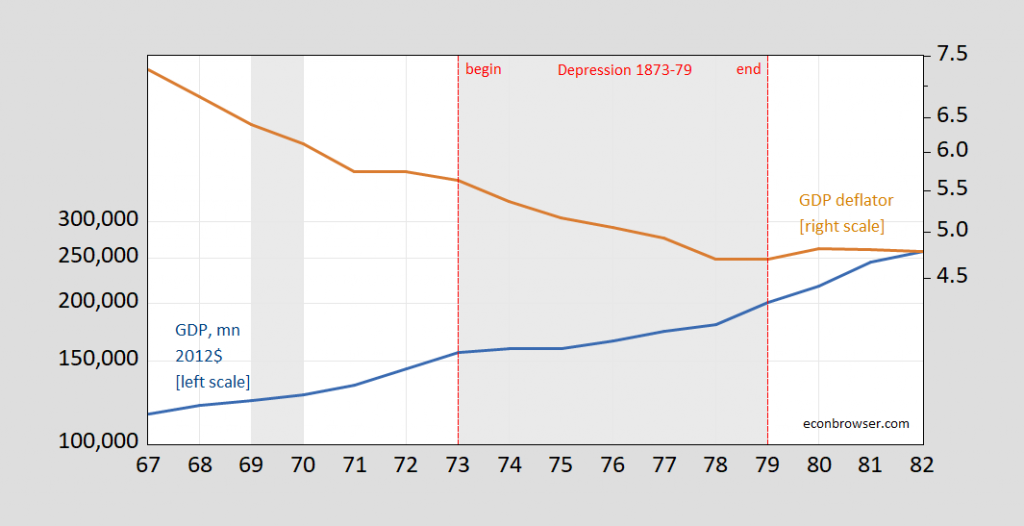

Update, 2/25/2022, 2PM: SecondLook notes there is sometimes called the Long Depression of 1873-1897, but that seems somewhat at odds with “Depression” as we understand it now; however, there is the Depression of 1873-79. which along with the Depression of 1893-97 is sometimes called the Long Depression. Here’s the shorter one.

Figure 4: Real GDP in mn. 2012$ (blue, left log scale), GDP deflator (brown, right log scale). NBER defined recession dates peak-to-trough shaded gray, beginning and end dates of Depression at red dashed lines. Source: MeasuringWorth, NBER.

How can we expect Stevie to understand the data when he has no clue what these words even mean. His only training in macroeconomics come from hanging with the hosts of Fox and Friends.

I have no idea what he means by “suppression”.

Stevie has no clue what it means either but he thinks it sounds scholarly. That is what one gets from learning one’s macroeconomics on the set of Fox and Friends!

“I am constantly amazed how willing some people are to pontificate with extremely little acquaintance with the relevant data.” So pontificates the man who produced a graph with an x-axis denoting quarterly data from 2006-2019 and in the very same graph this bloviator (is that even a word?) displays data from half a century prior.

Econned: Can…you…read…the…legend…Figure 3, …and…see…Figure…1? It’s clear what’s going on, except to someone willfully being dense.

Menzie,

Indeed, “what’s going on” is that your labeled x-axis is misleading and wrong. Just own up to it.

Nothing wrong with the presentation. You should have no problem understanding the data presented, if you are even half intelligent. Seems to be another instance where econned simply wants to whine about prof chinn. Have some more cheese and chill.

He has a lot of problems understanding even basic things. As in this:

‘So pontificates the man who produced a graph with an x-axis denoting quarterly data from 2006-2019 and in the very same graph this bloviator (is that even a word?) displays data from half a century prior.’

Now maybe Econned is ignorant enough to think the Great Depression happened during the 1950’s but the graph clearly noted it started under Herbert Hoover.

Could someone please help Econned’s preK teacher and tutor this troll at deciphering which years were at issue. After all the other kiddies are all laughing at him.

Wrong. Menzie presented two time series within a graph where the x-axis was 2006-2019. One of the time series included in the graph was not during 2006-2019. Seems to be another instance of Baffling not accepting objective reality in order to honor their idol.

econned, I had no problem reading the material and understanding what was presented. either you are not smart enough to read and understand, or you want to whine some more. but we can feed the crybaby some more cheese with his whine.

baffling,

I had no problem understanding what Menzie was *trying* to convey. This is obvious by my comment. This doesn’t excuse Menzie’s awful graphical representation of the data. Stop sticking up for him and just admit he f’d up. He isn’t a saint.

This is his latest?

“Econned

February 25, 2022 at 12:01 pm

So I should’ve said more than half a century. But with this point you can’t ignore my point stands – that is unless the Great Depression occurred in the 2000’s as Menzie’s graph suggested.”

You have this exactly right – Econned is nothing but a whiney little idiot. Although he at times reminds me of a dog chasing its own tail.

econned, you seem to be the only one complaining (whining) on the site. the outlier is you. you need to stop complaining so much, its unbecoming. it will lead you to a lonely old existence.

Econned would have drawn the graph with no legend telling us to figure it out for our selves

Menzie:

Thanks for what you do. I have been enlightened and find your material useful.

Some of your audience are out to play got’ch ya and I wonder why they have so much idle time?

It’s because Menzie does this to others that others do this to Menzie. Pay attention, Eddie!

Do you have quarters data dating back before WW2 IF SO provide it. If not this is your usual dump trolling

You’re a complete idiot. You have no clue what you’re commenting on, just have to type. Tragic clown PaGLiacci has diarrhea of the keyboard yet again.

And you have a clue? Thanks for the side splitting laugh.

The Great Depression did not start in 1956 (half a century before 2006). Dude – please pay attention to basic counting in your preK class. The other kiddies are all laughing at you!

So I should’ve said more than half a century. But with this point you can’t ignore my point stands – that is unless the Great Depression occurred in the 2000’s as Menzie’s graph suggested. Your attempt at grasping straws is pathetic. Pathetic yet expected from you. Pathetic nonetheless. Just pathetic. Pathetic. And hilarious.

Pretty sloppy argument you made. Kind of what you accused prof chinn of doing.

Simple Recession is to depression as banana is ro recession.

It is a common tactic in debate to insist that the other guy explain stuff that doesn’t need explaining – the difference between depression and recession. “Well then why did the milk sour when Granny Wartnose walked by the pasture?”

Why are we so often confronted with cheap debate tactics from the same group of clowns, when there is so much really interesting stuff to discuss? Maybe because in any discussion which doesn’t involve cheap debating tricks, the clowns would have nothing to say.

I thought it was a recession when my neighbor lost his job; a depression when I lost my job.

BTW. FRED has unemployment and GDP data going back to 1949 or a bit earlier. I see national debt from early 1969. Fed total assets first shows up 2003.

Anyhow, Mr. Kopits does oil. You guys do macro. Evidently, never the twain shall meet.

Play nice.

“I thought it was a recession when my neighbor lost his job; a depression when I lost my job.”

you joke. but it appears you may also actually view the world that way. and that is problematic. a lot of selfishness in the world, unfortunately.

I am happy to take theory when it’s available. However, when I can plainly see that situations are not comparable, I ask what the difference is and how that would affect logical linkages. I am not afraid to do theory (one of the lessons of Hungary) if no one else is putting anything useful on the table.

“I am happy to take theory when it’s available.”

Keynes wrote the General Theory back in 1936. Hicks formalized it with IS-LM. Now I get there is a host of economic advancements but maybe you need to go back to the beginning and actually learn basic theory rather continually babbling pure word salad 24/7.

So tell me about its implication for FFR and why the outcomes were different in 2008-2016 and 2020-2021.

I think the problem is that the clowns can say something really stupid and be responded to.

OK, Duckie. Then explain to me why the FFR was pushed to zero twice since 1929, and only twice (prior to the pandemic), and it stayed there in both cases for seven years or more without leading to either inflation or a notable overheating of the economy. Why? Why only on these two occasions, and why didn’t the economy respond, when it essentially did with all the other 20th century recessions?

And why did putting the FFR to zero in 2020 explode housing prices by 30% and push inflation to 7.5% when nothing like that happening in the ’30’s or after the Great Recession? What was the difference?

I am all ears. Enlighten us.

The Federal Funds Rate is the only thing you know about macroeconomics? Macroduck should not waste his time schooling the Village Idiot formerly from Princeton. Please pay attention to your preK attention. DAMN!

Do you have evidence that the zero ffr caused 7% inflation? You claim cause and effect, so prove the link.

So Baffs,

We have two major sources of stimulus: the fiscal payments and the dumping of interest rates. I think we can reasonably expect that the asset price inflation we’ve seen is related to interest rates. The stimulus payments would simply not be enough to increase the value of a house by 30%.

The CPI-related inflation could be mostly due to the stimulus payments. Larry Summers might say so. I certainly think that’s a large part of it, but I don’t know the split. I’d certainly be interested in a more formal analysis.

But I don’t think that changes my point: recessions, depressions and suppressions are different things and should not be treated the same for policy purposes. Policies which work in one case may prove counter-productive in another, and I think the economics profession should clearly distinguish among them.

Ffr was zero after 2007, and housing prices fell. So low ffr must drop the price of housing?

My point is steven, you have made a claim without a shred of quantitative evidence. Show me the true relationship here.

My house has most definitely not gone up 30% in value. So that “fact” you use as evidence is not very strong.

You are arguing my case, Baffs. Some policy, different outcomes.

[ In my best Groucho Marx voice ] I don’t know, but ever since I started taking this Zoloft we haven’t had any economic suppressions. [ rimshot ] Thanks, all of my performances will be around the Borscht Belt.

Is it wrong to take away that war in Ukraine would be good for business?

Well if you business is caskets.

Why doesn’t the Fed buy crude oil calls and pay us gas stimmies with the profits?

rsm,.

Maybe good for the oil and gas business, but not much else.

I was always taught a depression is a drop in output of 10%.

Doesn’t that 10% come from defining a stock market crash? Different issue.

Mate,

Output is not from the stockmarket.

pgl,

Not Trampis is in Australia. Perhaps economics textbooks there provide such a definition. We do not have such in US textbooks or anything I have ever seen.

As it is, in the US indeed a decline of 10% in stock market indices leads to what is called a “correction” for better or worse. Some US stock indices have now declined by about that amount from their peaks, so this term may now be appropriate.

I do not know if that is also what is thought Down Under, but if so, then it may be that N.T. got things confused.

So, the way I think about it, again, is this.

Recession

A recession is an income statement event typically caused by a lag in investment cycles (so a kind of real business cycle theory). The economy could see a demand shock or the pace of demand growth outstripping the ability of the fixed asset stock to respond in real time. This could happen for housing or tankers or drillships or other fixed assets with long order-to-delivery cycles. During this time asset prices will move into bubble territory. As orders are delivered, asset prices will start to fall, companies will start to lay off employees, and demand for assets and other goods will fall. Earlier ordered assets continue to hit the market as they are completed. Prices continue to fall and layoffs continue. This process usually lasts 12-18 months until orders in the pipeline start to peter out. Employment and similar indicators regain their prior peaks typically within 24 months or so. Cutting interest rates is helpful is moving inventory of assets hitting the market.

A variation of this includes a supply shock, almost always an oil shock in the modern era. In such an event, supply of a critical enabling commodity — oil — falls, inducing a recession in oil importing countries, oil consumption falls to a new equilibrium at then begins to grow again from there. This is again a 9-18 month recession with 24 months to prior peak. For a recession, the policy prescription is the garden variety reduction in interest rates and fiscal stimulus essentially through automatic stabilizers.

Depression

A depression is a balance sheet event. The hallmark of a depression is the impairment of collateral, most typically housing values. In the Great Depression and the China Recession (the Great Recession), housing values fell by 17%, in other words, a material decline. This meant that a significant portion of homeowners were under water with the equity in their homes and had to pay down debt to restore equity in the homes. If the debt has to be paid down with real money (ie, not inflated away), this is a slow process, figure 2-3% per year, implying the whole process takes seven years or so. If you take a look at the graph below, and look at the 2008-2016/17 stretch, you can see negative equity withdrawals (ie, net paydown of debt). I would argue that is the hallmark of a depression, and you won’t find it in the historical record except during the Great Depression. Because homeowners cannot borrow, the recovery is sluggish, employment growth is sluggish and everyone is kind of unhappy for a long time. These sorts of events are consistent with the rise of fascism, by the way.

https://www.calculatedriskblog.com/2021/09/the-home-atm-aka-mortgage-equity.html#google_vignette

For a depression, the main objective is to repair balance sheets quickly. That implies inflating the economy and debasing the currency, ie, expropriating lenders to benefit mortgage borrowers in order to revive the borrowing capacity of the economy. The prescription is then unsterilized cash injections into the economy, not QE. Interest rates adjustments will be largely ineffective because the collateral is itself compromised and people cannot refinance without a net repayment to the bank (because their house is not worth what they paid for it). Unsterilized cash injections may not cause significant inflation, at least for a while, due to the high propensity of consumers to pay down debt rather than increase consumption. Plus there should be plenty of spare capacity in the economy.

Note that this is not what any of the Fed or other central banks did. Their policy was largely ineffective at reviving the economy (although not in preventing a horrendously deep downturn). My perspective is more niche than even a minority view, but that’s where I think the analysis takes you. People were calling to help Main Street, not Wall Street, and I think that is in fact correct. Direct, unsterilized payments to households are far more important than putting the FFR to zero, which by the way, is another hallmark of a recession, that is, the FFR or equivalent is set to zero without causing either inflation or a robust recovery of the economy. The FFR will sit at zero for, say, seven years without much to show for it. That’s because it is the value of collateral, not interest rate, which are the problem. Again, the Great Depression and the China Depression have this in common, and only these two downturns in the last century have it in common.

I use the phrase ‘China Depression’ neither as a pejorative or to blame. Rather, we need to distinguish this event somehow from the Great Depression, and I believe the Great Recession was not a recession, but a depression. So what to call it? It is clear that the impetus for the China Depression was the rise of China’s economy in the global order. This is a good thing (assuming we don’t go to war) and lifted more people out of poverty faster than at any other time in human history. It would be fair to call it a near miracle. However, the size of China means that it is ‘large’ by comparison with other systems, including the US economy. Thus, China’s integration represented a major challenge to established economic structures and relations, and the process of integration had far reaching consequences for the global economy. From my perspective, the depression was likely unavoidable, but in any event, the proximate cause was the rise of China, hence the ‘China Depression’.

Suppression

In a suppression, there is fundamentally nothing wrong with the economy, no bubbles, excess inventory or unacceptable inflation. Economic fundamentals remain intact. However, a virus sends everyone to their homes. If the virus ended the next day, everyone would come out of their homes and it would be as though nothing has happened at all. So we’re not talking about an ordinary recession at all, but a kind of outage.

The outage is caused by 1) fear and 2) the government deliberately shutting down the economy, for example, through a lockdown. The government is actively suppressing the economy for public health reasons. The government is then also distributing massive amounts of cash to help people while the government is preventing them from working. This is going to be unavoidable, but we might expect significant inflation as a result, because purchasing power will be sustained (and then some) while supply falls. We would also expect the trade deficit to blow out as consumers turn to foreign supply, and if the stimulus is too large, it could blow up the logistics systems at its weak points, let’s say, the ports of Los Angeles. Here the issue is not whether you might get inflation, but rather how much. As Larry Summers pointed out, Biden’s fiscal stimulus (maybe some Trump stimulus is in here, too) was nearly 13% of GDP on a potential output gap of 3%. Clearly, the stimulus was oversized, leading to the inflation problems we have today. Still, I think the model would suggest some inflation and trade balance deterioration is likely even in a more reasonably sized stimulus, just not necessarily this much.

Note that dumping the FFR to zero, as was the case again here, is a bad, bad idea. Because underlying purchasing power is not impaired, because there is no excess housing inventory, and because the ability to supply incremental housing is potentially impaired, tanking interest rates is likely to lead to a rapid and massive bubble in housing values, as well as in the stock market. And that’s what happened: Powell mistook a suppression for a depression and tanked interest rates to depression levels, when this was not warranted. We’ll have to see how this unwinds, but I would note that we could once again see collateral values impaired, and that means a depression, at least on paper.

https://fred.stlouisfed.org/series/FEDFUNDS

So, from my perspective, recessions, depressions and suppressions are different things and require different policy approaches. For that reason, they should have designations that clearly distinguish one from the other.

On my website here

https://www.princetonpolicy.com/ppa-blog/2022/2/27/recessions-depressions-and-recessions

http://wwwdev.nber.org/cycles/cyclesmain.html

January 15, 2016

Economic contraction began in August 1929 and ended in March 1933: 43 months.

Economic contraction began in May 1937 and ended in June 1938: 13 months.

The Roosevelt administration was almost immediately successful in generating growth.

Economic contraction began in December 2007 and ended in June 2009: 18 months.

https://fred.stlouisfed.org/graph/?g=qVGT

August 4, 2014

Real per capita disposable personal income for United States, 1929-1937

(Indexed to 1929)

https://research.stlouisfed.org/fred2/graph/?g=1PyG

August 4, 2014

Real per capita disposable personal income for United States, 1929-1940

(Indexed to 1929)

http://wwwdev.nber.org/cycles/cyclesmain.html

January 15, 2016

Economic contraction began in October 1873 and ended in March 1879: 65 months.

Economic contraction began in January 1893 and ended in June 1894: 17 months.

Economic contraction began in August 1929 and ended in March 1933: 43 months.

[ The Roosevelt administration was almost immediately successful in ending the banking panic and generating economic growth. ]

Economic contraction began in May 1937 and ended in June 1938: 13 months.

Economic contraction began in December 2007 and ended in June 2009: 18 months.

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=259399

May, 1975

The New Deal and the Great Depression

Rates of Unemployment, 1929-1945

(Percent) *

1929 ( 3.2) Hoover, March

1930 ( 8.7)

1931 ( 15.9)

1932 ( 23.6)

1933 ( 24.9) ( 24.0) Roosevelt, March

1934 ( 21.7) ( 17.0)

1935 ( 20.1) ( 15.2)

1936 ( 16.9) ( 10.1)

1937 ( 14.3) ( 9.2) Recession begins, May

1938 ( 19.0) ( 12.5) Recession ends, June

1939 ( 17.2) ( 11.3)

1940 ( 14.6) ( 9.6)

1941 ( 9.9) ( 6.0)

1942 ( 4.7) ( 3.1)

1943 ( 1.9) ( 1.8)

1944 ( 1.2)

1945 ( 1.9) Truman, April

* Numbers in later brackets correct for employment in New Deal programs.

— Michael R. Darby

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=259399

May, 1975

The New Deal and the Great Depression

Rates of Unemployment

(Percent) *

1929 ( 3.2) Hoover, March

1930 ( 8.7)

1931 ( 15.9)

1932 ( 23.6)

1933 ( 24.0) Roosevelt, March

1934 ( 17.0)

1935 ( 15.2)

1936 ( 10.1)

1937 ( 9.2) Recession begins, May

1938 ( 12.5) Recession ends, June

1939 ( 11.3)

1940 ( 9.6)

1941 ( 6.0)

1942 ( 3.1)

1943 ( 1.8)

1944 ( 1.2)

1945 ( 1.9) Truman, April

1946 ( 3.9)

1947 ( 3.9)

1948 ( 3.8)

* Numbers including employment in New Deal programs.

— Michael R. Darby

https://fred.stlouisfed.org/graph/?g=sZlX

January 30, 2018

Real per capita disposable personal income for United States, 2007-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=tCvm

January 30, 2018

Real per capita disposable personal income for United States, 2007-2021

(Indexed to 2007)

Now do those graphs with:

-house values

– vmt

– airline miles traveled

– remittances to Mexico

– home equity withdrawals

– median income

Let’s see what those show.

I am surprised your list did not include the number of Hispanic families that were separated as a result of racist immigration policies that you endorsed.

So, the Great Recession saw the illegal immigrant population, principally Mexicans, both peak and decline, all the way to 2019. Remittances to Mexico fell and did not recover their prior peak until around 2017-ish (off the top of my head). Thus, the mini-surge border under Obama, the bigger surge under Trump and the huge surge under Biden can be attributed in important ways to the recovery from the Great Recession (which again I prefer to call the China Recession, because I believe the depression was caused by China’s rapid integration into the global labor and goods market). I would guess this is what led Hispanic wage growth to outpace all other ethnic groups from the depths of the Great Recession. That is, fewer illegal immigrants meant higher relative wages for undocumented (and possibly documented) Hispanics.

If you don’t think there was a depression here, then you’re left with a really peculiar narrative, or indeed, no coherent narrative at all. Why did the illegal immigrant population peak and decline, something historically unprecedented? Why did remittances fall and stay down (and why do they look like house values, and vmt, and airline rpm, and home equity withdrawals, and employment levels) if the GR was just a normal recession with GDP recovering previous highs in 2010 or 2011? I challenge anyone to construct an alternative narrative around this data. I am all ears if you have it.

Your narrative, as constructed and presented, is not convincing. You are making some pretty bold claims, without much evidence. I would imagine econned would even agree that your allegations are unsubstantiated, as presented.

“airline miles traveled”

I bet the Village Idiot formerly from Princeton really thinks there were a lot of airline flights back in 1929.

http://www.nytimes.com/2008/11/30/opinion/30leuchtenburg.html

November 30, 2008

Keep Your Distance

By WILLIAM E. LEUCHTENBURG

Chapel Hill, N.C.

ON election night, Nov. 8, 1932, Herbert Hoover, in the company of friends and neighbors at his home on the Stanford campus, sifted through returns that were rendering a verdict on a presidency begun so hopefully on a March day in 1929. As she observed him — his eyes bloodshot, his face ashen, his expression registering disbelief and dismay — a little girl asked, “Mommy, what do they do to a president to make a man look like Mr. Hoover does?”

The campaign had been brutal. Detroit had to call out mounted police to protect the president from the fury of jobless auto workers chanting “Hang Hoover!”

“I’ve been traveling with presidents since Theodore Roosevelt’s time, and never before have I seen one actually booed with men running out into the streets to thumb their noses at him,” said a Secret Service agent. “It’s not a pretty sight.”

Even so, the returns on election night exceeded Hoover’s worst fears. The president suffered the greatest thrashing up to that point in a two-candidate race in the history of the Republican Party, and his opponent, Franklin Delano Roosevelt, became the first Democrat to enter the White House with a popular majority since Franklin Pierce 80 years earlier.

Two features made his defeat especially galling. One was that he knew the outcome was less an expression of approval for the challenger than a rejection of the incumbent. The other was that, despite being a pariah, he was expected to soldier on for nearly four more months — until March 4, 1933. The 20th Amendment, moving Inauguration Day to January, was close to being ratified but would not take effect until 1937. He was fated to be the last lame-duck president of the old order.

Hoover determined to exploit this interim to salvage his presidency. No sooner had the ballots been counted than he invited Governor Roosevelt to confer with him. The overture gave every appearance of being an exceptionally generous offer to share power with the man who had vanquished him. In fact, it was the first step of a scheme to undo the results of the election. Hoover acted, the historian Frank Freidel later wrote, “as though he felt it was his duty to save the nation, indeed the world, from the folly of the American voters.”

On Nov. 22, Hoover welcomed Roosevelt to the White House. Throughout the meeting, he treated his successor as though he were a thickheaded schoolboy who needed drilling on intransitive verbs. He sought to bully the president-elect into endorsing the administration’s policies at home and abroad, especially sustaining the gold standard at whatever cost. Alert to Hoover’s intent, Roosevelt smiled, nodded, smiled again, but made no commitment. A frustrated Hoover later vowed, “I’ll have my way with Roosevelt yet.”

Hoover returned to the attack in February. He sent the president-elect a hectoring 10-page handwritten letter that misspelled Roosevelt’s name (as “Roosvelt”). As a consequence of the flight of gold and runs on banks, Hoover wrote, there was “steadily degenerating confidence in the future.” His wise policies, he claimed, had brought an upturn in the summer of 1932. Since then, though, he said, there had been a sharp decline because the country was unnerved by Roosevelt’s election, for it feared that the new president would embark on radical experiments. Hoover concluded by asking Roosevelt to restore confidence by stating publicly that there would be “no tampering” with the currency and that “the budget will be unquestionably balanced, even if further taxation is necessary.” …

William E. Leuchtenburg is the William Rand Kenan, Jr. professor emeritus at the University of North Carolina at Chapel Hill.

‘Hoover concluded by asking Roosevelt to restore confidence by stating publicly that there would be “no tampering” with the currency and that “the budget will be unquestionably balanced, even if further taxation is necessary.”’

And Hoover wanted FDR to retain the gold standard. One would have thought Hoover had done enough damage even before voters ousted this economic incompetent.

So you’re saying it was a “V” shaped recovery after all. Who knew?

Steven Kopits: No, I’m for reverse radical. But for heck the last one was more “V” than the 2009 recovery.

So you’re saying you and Jim and others were wrong. I don’t think you were. I think you’re wrong now.

I can testify Menzie never said it was a “V”. I can of 85% certainty say that Professor Hamilton never said it was a “V”. I’m not certain when Menzie definitively said he thought it was a reverse radical. What I can testify to with great certainty (Menzie is welcomed and encouraged to correct me if I’m getting this wrong) is that Menzie was leaning strongly to a reverse radical “shaped” recovery, when the issue was still a very heated and disputed topic among some of the economic community.

If one looks at only the second and third quarters of 2020, then it looks like a V absolutely. As one looks at longer time horizons before and after, then it looks more like a reverse radical.

@ Barkley Rosser

It’s good to see you finally admit you were wrong, and that it wasn’t a “V”. We’re so proud of you now. I bet all of the economics profession would be shocked to witness you admitted being wrong. What a special moment.

Oh gag, Moses, I know that this was an issue that you have wasted huge amonts of time going over and over and over again in efforts to report another gotcha. This statement by me is not at all new and reports my longstanding position.. But I am not going to go dredging into past statements to show that. Sorry, but I am too busy to waste time on such idiotic exercises. I shall simply note that the whole time I argued that a V was happening I always said it was going to flatten out shortly, which it did, and it is adding that flattening out part to the V, as well as looking at the part before it started, which makes it look like the “reverse radical” shape Menzie prefers.

How about you admitting finally that if one looks at just the second and third quarters it looks like a V? I think you never did admit that, even though once again it is obviously the case, something others pointed out to you way back then but that you would not admit, having at some point forecast that the shape would look like an “L.” Remember that, Moses? Your obsession with this matter has been truly one of the sickest of your rantings here.

And shall we revisit your perfervid denunciation of me when I reported here that consumption in the month of May, 2020 was growing at an all time high rate? Menzie agreed with me on that one, with I think you in fact at that point having to admit that maybe I was right. It was that tidibit that led me to forecast that the short term shape of the whole economy might look like a V? As it is, I remain correct, and I repeat it: if one looks at just the second and third quarters, GDP looks like a V, as I forecast, always with the note that it would “flatten out” soon after. Do you wish to repeat again your denials that the short term shape looked like a V? It does, even if even now you still cannot accept that, such a loss of face for pathetic you.

Hey, I am perfectly willing to accept that my forecast based on Russian media reports that were acccurately reporting what was bring said by Russian and Belarusian leaderrs that the Russian troops would be taken out at the end of the ecercises turned out to be incorrect. It turned out to be incorrect because V.V. Putin was and is a flagrant liar, a point that is damaging morale in Russian troops in Ukraine now, reportedly (by western media, not Russian).

And do you want ot insist that Ekho Moskvy does not exhibit any indepdendence in its reporting despite the fact that it is partially state owned? Do you wish to deny that it has broadcast statements by prominent Russian figures criticising the invasion? Do you wish to do this? Do you wish to admit that you were dead wrong when you made claime it is not indepdendent, those claims made in enlarged and capitalized and emboldene words using extreme hyperbolic language? You have not recognized that you were wrong on that, as well as on a string of other factual matters here. I am perfectly fine with accepting that I made some inaccurate forecasts based on accurate reporting of things being said by certain people.

You know, all fun and games pushed aside, I side with Menzie on the reverse radical 100%. But I’m gonna contradict myself a little here. I think there are some people who think it was a “K” recovery. Now I don’t agree with that, but I think there’s an argument to be made there. So if someone said they thought it was a “K” recovery, I don’t think I would go in with two shotguns blazing, I might stop and listen and let them try to convince on their “K” argument. I’m very curious what Menzie thinks about the “K” contingent.

Moses,

Are you aware tjat the discussion of whether or not the shape of the recovery was a “K” is separate from that over whether it was a reverse radical or a V or something else? The K discussion involves looking at the impact on different groups in the income distribution and that higher income people did better than lower income groups, which I do not think anybody here ever disagreed with. The latter simply looked at aggregate data

Why is it that you are so patheetic that you must try over and ovet to score gotcha points? Actually, Moses, we know, and I do feel sorry for you, when you are not just being annoying.

No, honestly I wasn’t aware it was a “separate discussion” as in fact I had often heard and read these things discussed together. But see, that’s why you’re here Barkley, to “explain” things to all of us. Like when you told us you were an “expert” on Russia, and then “edified” us on the situation with Russian aggression on Ukraine:

Barkley Rosser said: “Do keep in mind I am the one here with access to Russian media. That has now been blaring for several days that the troops will go home after the exercises are done, and exercises are exactly what they are doing now. This has more recently been reinforced by statements from Putin in press conferences, such as the one just held after the visit of German Chancellor Scholze.

There is not going to be an invasion, even if some of the details of what Zelensky and Ukraine may agree to are not fully settled, and Victoria Nuland has been shooting her mouth off too much, somebody I wish was not part of this administration.”

https://econbrowser.com/archives/2022/02/risk-and-uncertainty-before-the-open#comment-268219

That was exactly 11 days ago. Barkley also wants everyone to know that Putin was “very convincing” about Russian troops “just doing exercises” in Belarus near the northern border of Ukraine. I mean when a boy scout like Vladimir Putin tells you “the army is just doing exercises” by another nation’s border, why would you disbelieve a boy scout and man of religion like Putin?? Certainly an “expert on Russia” wouldn’t doubt him. Errrrr, uh, I guess that’s how Barkley Junior feels about it.

Thanks again for telling us that “K” style recession is not discussed with the other “shapes” of recessions Barkley. You’ve advanced the conversation once again.

My understanding is that prior to the 1930s, economists and the public used “depression”, along with “panic” as the general term to describe any major economic slump. (Why the 1930s downturn was the Great Depression to distinguish it from the lesser ones).

The terminology was changed to use what was a new expression – recession – primarily for social reasons, i.e. recession was introduced as a euphemism.

Just to add another major slump: the “Long Depression” of 1873-1879 when peak to trough was approx 28%.

Also, informally, I would argue that the two recessions at the beginning of the 1980s should be considered as basically one major event – the Long Recession if you will.

My Dad was born in 1927. My mother gave birth to me when my father was well into middle age~~at parent teacher conferences many mistook my Dad to be my grandfather. I can tell you boring stories of how growing up during the Depression affected my Dad’s outlook on life. I’ll keep it abbreviated and say he didn’t like waste, and that when he was growing up he and his sisters thought it was a real treat to get ONE basket of fruit, for the entire family to share, on Christmas. And I’m here to tell you after the economic downturn of the late 1920s and through the ’30s, from that time onward/after nothing else inside the confines of America compares in terms of economic suffering. PERIOD

Second Look,

I agree with all you said here, and I said most of it in a comment in the thread earlier that led to this whole thread.

It remains unclear now, given all this, how to distinguish these two terms, since “recession” was introduced as a mild euphemism in 1937/ No other decline in US history has been as great as the Great Depression, so if it is the standard, well….

The Great Recession did not match it depth or length, as Menzie accurately shows. But it did share characteristics with the Great Depression no other downturn since the Great Depression did, although both the episodes in the 1870s and 1890s did, namely a collapse of the financial system, which led to a much slower recovery than one usually sees from a mere receission, even if the Great Recession recovered more quickly than the Great Depression.

Also, these declines with major financial market collapses tend to be much more widespread internationally, which certainly held for both the Great Depression and the Great Recession, with this financial collapse axpect key to that.

So, let’s look at the post-war recessions at months to recovery of previous employment peaks.

Recession year, months to prior employment peak

1948: 23 months

1953: 28 months

1957: 21 months

1960: 17 months

1970: 15 months

1973: 1 month

1981: 28 months

1990: 35 months

2001: 27 months

2007: 82 months

2020: 23 months and counting

One of these recessions is not like the rest. And yet your graph above and the IMF GDP data say it was nothing more than a garden variety recession. Was it a garden variety recession? If so, why did it take the economy seven years to return to previous highs by any number of measures?

Now, you’re view is that all these recessions are the same and should therefore bear the same name: recession. But then why did putting the FFR in the Great Depression and the Great Recession for seven years do nothing much to housing values, and yet doing the same in 2020 blew up housing values by 30% in the little over one year? Why did putting the FFR to zero and using a huge QE program after 2008 do virtually raise below target inflation, whereas in 2021 it blew inflation to 40 year highs?

If these are all the same phenomena, then similar policy should produce similar outcomes. But clearly they didn’t. Fiscal and monetary policy in 2020 produce an overdose effect, while policy after 2008 was deemed inadequate by the Fed’s own economists.

I stand by what I said: there are differences among recessions, depressions and suppressions, and you do not understand what they are and therefore are not helping your students or your readers distinguish between the policies appropriate to different macroeconomic phenomena.

Gee – I guess we can disband the NBER since you invented your own little metric.

I am happy to hear your interpretation, but as usual you have nothing, do you?

I did suggest you start with The General Theory (1936) and Hicks’ IS-LM paper. I know – remedial reading but a know nothing like you needs to start from the beginning.

Useless. No value added. Again.

“If these are all the same phenomena, then similar policy should produce similar outcomes.”

We have a new winner for the dumbest comment EVER!

Since pgl asked if we intended to hide in our basement during WWIII, it occurred to me that we did indeed hide in our basement during the Russian assault on Budapest from Christmas eve 1944 to April 1945. I think it is a story worth telling.

You can see the scene at this link:

https://www.dailymail.co.uk/travel/travel_news/article-8529213/Before-photos-Amos-Chapple-Budapest-rebuilt-WWII-devastation.html

Look for the picture with this caption: “The archive picture shows Red Army soldiers in front of the destroyed Elisabeth Bridge, which spans the narrowest section of the Danube. It was rebuilt, says Amos, by the ruling Communist part between 1961 and 1964 ‘without flourishes'”

This picture is taken in Pest facing the Elizabeth Bridge on the Danube. My grandparents apartment was about 200 meters up from this location, that is, to the back and left of the photographer on the same street. The house was in the same condition as the one on the left in the photo, ie, bombed out.

The bombing started on Christmas eve 1944, sending everyone to the basement of the apartment house, where they would stay until April 1945. The allies, the Russians and Americans, spent a good deal of this time bombing the bridges on the Danube, with the Elizabeth Bridge shown in the photo. The buildings adjacent to the Danube were heavily bombed and damaged, indeed, many were destroyed. You may wonder why the family chose to stay in their flat so close to the bombing zone. Simple. The Russian soldiers, shown in the photo, were raping all the women in the countryside, and it was therefore deemed safer to stay in town, bizarre as that may seem.

The Russians soldiers came down to the basement and drank my grandmother’s perfume, thinking it was alcohol and not knowing the difference. They also drank from the toilet, never having seen one before. They thought it was amazing you could get clean water from this bowl. These were really primitive men, but there was no particular harassment of my family at that time, at least as known to us (my mother was all of eight years old at the time). But the raping of women in Budapest was endemic, and the family was lucky to get off lightly, or so it seems.

Life in the basement did not seem so bad, per my mother, although there was no water and generally no electricity. They melted snow for drinking water. My great aunt had become an opioid addict (morphine) and could not obtain a supply during the siege. She committed suicide.

My grandfather’s uncle was killed during this period from a shock wave associated with a bomb blast. He was, remarkably, the only family member to die in the war, at least that I know of.

The bombing had blown the front of the house off, and the Christmas tree was hanging over the exposed edge of the apartment floor. Of course, it stayed there for months, prompting my mother to conclude that there was no Santa Claus (actually, this was more complicated, as Jesus brings the trees in Hungary, but that’s another story). In any event, the tree could not be magical because it would not persist there for so long in such a sorry state.

She said the children enjoyed going out when they could. There were plenty of dead horses and destruction. This was really exciting for small children.

After the siege, they moved to the dead uncle’s place in Karolyi utca, about a block away. It was not damaged and, well, he did not need it anymore. They played in the Karolyi kert, a park near the apartment. They were told not to play with the unexploded ordinance, an unexploded bomb and grenades and such. No one was killed or injured. Here is a picture of the park today.

https://www.google.com/maps/place/Budapest,+K%C3%A1rolyi+utca,+1053+Hungary/@47.4918738,19.0590083,187m/data=!3m1!1e3!4m5!3m4!1s0x4741dc44f4d06dc5:0x9b6f88a748f8d906!8m2!3d47.4916751!4d19.0577547

So, our family does actually have some experience in hiding out in basements. That’s what my mother did in the last world war. Compared to what the Poles endured in Warsaw, it was nothing.

We may hide in the basement in the next war. That is what the Ukrainian civilian population is doing as I write this.

So you are now contradicting your previous position that Ukraine offered no means for conducting insurgencies. This may be your first decent comment ever – especially since it undermines your previous serial BS which was an insult to the good citizens of Ukraine. They will fight. They are fighting. Putin will pay a steep price for this aggression.

This is the definition of an insurgency:

An insurgency is a violent, armed rebellion against authority waged by small, lightly armed bands who practice guerilla warfare from primarily rural base areas.

The war in Ukraine is not an insurgency. It is conventional warfare between armies along defended lines.

Do you not even understand what the word ‘insurgency’ means? Barkley had in perfectly defined.

https://en.wikipedia.org/wiki/Insurgency

Different nations may have different forms of insurgency. If you are too dumb to get that – please STFU and spend more time with your preK teacher. BTW – I do not use Wikipedia for my dictionary.

That Wikipedia discussion talked about a lot of different things. You read one sentence and now think you are THE EXPERT on insurgencies. As usual, you are the most arrogant uninformed clown I have ever encountered.

I thought you were going to share stories about the ongoing love affair of Hungary’s current leader with Vladimir Putin. Hiding the juicy stuff from us again.

Check out where Princeton Stevie boy mansplains us what “insurgency” means by taking a single line out of a long Wikipedia discussion. I guess this arrogant troll missed this passage:

‘The so-called kuruc were armed anti-Habsburg rebels in Royal Hungary between 1671 and 1711.’

So he thinks Hungarians are man enough to do insurgencies but Ukrainians are not. His arrogance would be really funny if this was not in the middle of a brutal war.

https://www.marketwatch.com/story/russian-invasion-of-ukraine-appears-to-have-alienated-putins-few-friends-among-the-western-allies-01645735806

Invasion of Ukraine will be a passionate issue for most Hungarians, in case you hadn’t noticed.

I am amazed, though, at how shabby Budapest looks in the photos. In looked the same in October when I was there. The country never recovered from the Great Recession.

Correct me if I’m wrong (I wasn’t there), but wasn’t recession a term coined in the post-war era, because no one wanted to use the term depression after the 1930s?

And, isn’t the main difference between the two the movement in prices over a prolonged period?

Correct me if I’m wrong (I wasn’t there), but wasn’t a recession a term coined in the post-war era, because no one wanted to use the term depression after the 1930s?

And, isn’t the main difference between the two the movement in prices over a prolonged period?

Yes, to your first question. I believe it was first employed deliberately during the late 1930s – but I can’t confirm that off the top of my head.

No to your second. Depression has basically become an archaic term, both within and without the economic profession; Just as we no longer use lunacy for legal insanity.

Yes, as I already pointed out in a very recent thread, the term “recession” was coined to describe the downturn of 1937. Thank you for repeating things I said earlier without attribution, S.L.

Pardon, at 7:22 this morning I first posted about terminology vis depressions, et al. If you posted earlier, I did not see it.

Then, I often skim through postings on threads. A bad habit of mine. more so as I pass out of the autumn of my years.

Now here is an amusing thought that came to my mind.

The last recession could reasonably be called The Covid Panic of 2020.

Hey, if there is an audience for “The Gilded Age”, then why not the resurrection of some colorful terms and phrases?

(I know it would be far too much to expect Veblen to be taken seriously again…)

One surprise I have on Menzie’s post here is that somehow he did not include the 1870s in this discussion. I do not know why he ignored that decade when he argued that only the 1890s was a depression besides the 1930s, although maybe I have misread or imisinterpreted what he wrote.

I note two things on this. One is that there is a long and unresolved debate among economic historians regarding whether the depression of the 1870s, which is what it was called at the time, was worse than the one in the 1890s. If anything I would say that the conventional view in the late 1800s and in textbooks is that indeed the 1870s one was worse than the 1890s one, and second only to the 1930s one for being bad. However, there have been economic historians who have disputed this and argued that the 1890s one was worse. One view, not agreed on fully, is that the 1870s one was longer but that the 189os one was deeper, with the latter one coinciding with the height of the original populist movement in the US.

I note that a major reason why this debate over the 1870s versus the 1890s has to do with the fact that at that time there was no gathering of aggregate macro GDP data, which would not get going until the time of the Great Depression in the 1930s under the influence of the major prof of the major prof of my major prof, Nobelist Simon Kuznets So those debating about the 1870s versus the 1890s involves focusing on the sparse data series that do exist, which were for prices of certain goods and output for an even smaller set of goods. Those scattered data series in fact provide conflicting stories, which is why there has not been a clear resolution of this ongoing dispute.