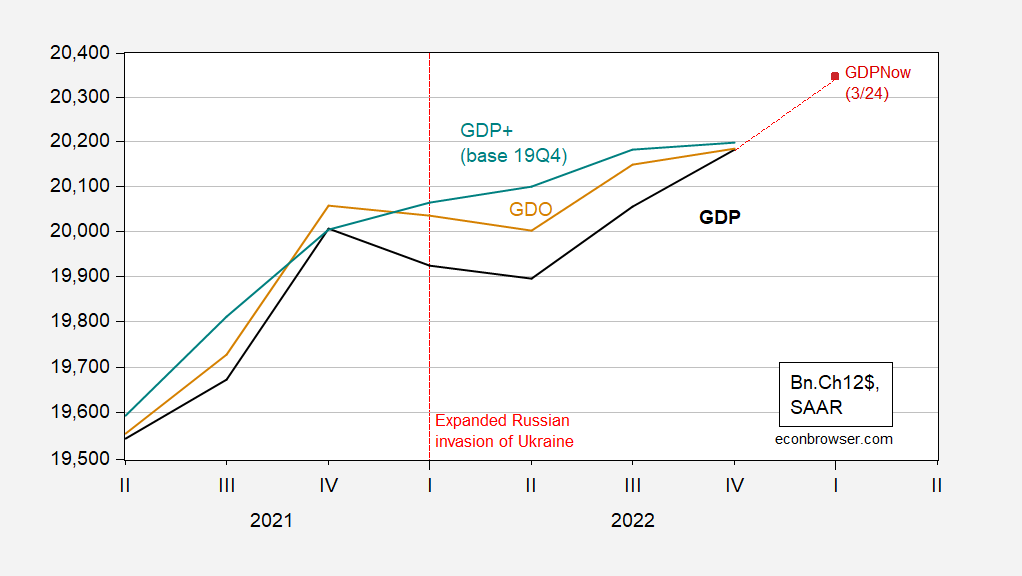

With GDI reported, we no longer have to guess in order to calculate GDO. GDP+ is also reported out. We have the following picture through Q4.

Figure 1: GDP (black), GDPNow of 3/24 (red square), GDO (tan), GDP+ (green), all in billions Ch.2012$ SAAR. GDP+ level calculated by iterating growth rates on 2019Q4 actual GDP. Source: BEA, 2022Q4 3rd release, Atlanta Fed, Philadelphia Fed, and author’s calculations.

It’s interesting to contrast these results with what we thought two months ago; then GDO (setting the net operating component at 2022Q3 levels) was under GDP. On the other hand, GDP+ is below what was originally estimated, and growth in GDP+ is definitely decelerating.

Nonetheless, it is interesting that GDP+ is continously rising throughout 2022H1, suggesting no deceleration in activity that would be consistent with a recession.

Justin Lahart wrote an interesting column in the WSJ on Wednesday,

“Higher Rates Are Coming For U.S Companies.”

He discusses, “interest paid by nonfinancial corporate businesses as a share of their outstanding debt, a proxy for interest rates they are paying.” For 1990 this was 13.3% and by 2021, latest data, it had fallen to 3.6%…lowest since the late 1950s.” He then says, “Over the same period, BAA corporate debt fell from 10.4% to 3.4%. His point is that there are significant maturities in the next few years that will need to be financed with higher rates.

Looking at the Y/Y percent change in interest paid, the percent seems to rise prior to a recession. The Y/Y % was flat for 2021. Using a probit model, if appropriate, the model seemed to say no recession for 2022 and I wonder given the rise in rates if data were presented for 2022, whether the model would forecast a recession for 2023 (I am thinking not). I used annual data from 1947 through 2021, lagging the Y/Y percent by one year. Not certain if the model is just coincidental as Professor Chinn says is the case with many financial indices or whether there is some predictive power.

Nonfinancial Business Corporate Interest Paid Y/Y %

https://fred.stlouisfed.org/graph/fredgraph.png?g=11YSZ

BAA Corporate Debt Rates

https://fred.stlouisfed.org/graph/fredgraph.png?g=11Z0T

VERY interesting find. You have a good eye Sir. Thanks for the share.

AS, I’m still convinced if Obi-Wan Kenobi had ever met you in person he would have told you your midi-chlorian count is exceedingly high.

Market rates predict interest expense with a lag. Market rates are now predicting a rise in interest expense. A sizable rise, I would expect, depending on the maturity schedule of outstanding debt.

https://fred.stlouisfed.org/graph/?g=11ZT5

There is no reason to worry about rising interest rates affecting corporate finances. They’re flush with profits.

If you don’t believe it, Just look at the 4Q profit margin…just off their record high of 16.9%. This is about 25% above the margins of the last decade, double the margins of the 2000s, and 8x the margins of the 1950s-1970s.

https://fred.stlouisfed.org/series/A466RD3Q052SBEA

Like stagnant real wages, this is another statistic that corporate friendly, mainstream economists prefer to gloss over.

This from the person who stood on his head complaining about rising interest rates? NOW you assert they have not risen enough? How many JohnH’s are there? Could you clowns get together and make up your confused little minds? DAMN!

pgl has a good imagination…JohnH complaining about rising interest rates? LOL!!!

Yea – you have so many multiple personalities you can’t keep your whining straight. But I guess THIS JohnH is indeed hoping for a recession.

Where’s the beef, pgl? Show me when I complained about raising rates? For much of the 2010s I was complaining about the Fed’s failure to stimulate growth with its ZIRP policy.

Now, do me a favor and explain to me why you and so many other economists are so reluctant to talk about the downsides of negative real interest rates? Lower interest rates, you’re mantra, doesn’t necessarily work all that well, as we saw a decade ago.

“There is no reason to worry about rising interest rates affecting corporate finances. They’re flush with profits.”

I would love it if Warren Buffett decided to comment on Jonny boy’s latest. I’m looking at the financials of his favorite energy company Berkshire Hathaway Energy which generates $5 million per year in operating profits on about $25 billion a year in revenue. 20% operating margin!!! No need to worry about interest expense – eh?

Oh wait – energy companies are highly capital intensive. The interest expense for his energy company is a mere $2.2 billion a year. Hey Warren – you do not have to worry about higher interest rates – do you?

Mr. Buffett is likely falling on the floor laughing at this utter insanity.

Sorry Warren. That was $5 billion in operating profits. Forgive me as we all know that reading the garbage ala Jonny boy rots one’s brain cells.

Sure, pgl…you can find unrepresentative individual companies that suffer from low interest rates.

As for energy companies, I have to admit that Ukrainian politicians have a lot more guts than Americans: “Kyiv says Big Oil should pay to rebuild Ukraine’s shattered infrastructure…”A lot of energy companies get enormous windfall profits due to the war. So we estimated this at more than $200 billion,” Galushchenko said on a visit to Brussels. “They get this money because we are fighting, because of the war.”

https://www.politico.eu/article/russia-ukraine-war-volodymyr-zelenskyy-close-russian-energy-loopholes-or-face-endless-war-ukraine-warns/

Funny how few American “leaders” and economists here are willing to acknowledge the big winners of this war.

Buffett leads an unrepresentative company? BTW – these financials hold for almost every company in this sector. Look dude – we know you are stupid but DAMN!

pgl simply can’t provide a substantive response, such as the answer to whether anyone has been tracking the recent performance of TIPS BREAKEVEN in forecasting inflation.

Given it’s dismal performance, my guess is no…or maybe its performance is just being ignored. In any case that doesn’t seem to prevent its regular use!

And what’s ‘real’ about a TIPS fixed rate that is established by a herd at auction? Ah, I know, the price is whatever the herd thinks it is. Didn’t Keynes write something about a beauty contest? Personally, I prefer to determine real returns based on measured performance less inflation, not herd behavior.

Regarding beauty contests, maybe they should put the Donald in charge of auctions for treasuries, particularly TIPS. After all, Trump has a lot of experience managing beauty contests!

If Big Oil has to fund the rebuilding of Ukraine – that would be an enormous expense on their income statement. Only a moron like JohnH would say this was a win for Big Oil. BTW Jonny – what was that Fortune 200 company that you helped go bankrupt again? I want to sue their financial auditors for letting someone as dumb as you keep the books.

“The minister noted that a Lithuanian company, Ignitis Group, is already looking to hand over some 10 percent of its profits to help reconstruction in Ukraine and said bigger companies should follow suit.”

Just imagine the pitiful scene at the Krelim when Putin’s pet poodle was told he is not getting a penny of this money. Life is so unfair even when one works as hard as Jonny boy does justifying the mass slaughter of innocent Ukrainians. Poor little Jonny!

Much of Berkshire Hathaway Energy’s business consists of regulated utilities. Again, pgl is taking the experience of a single business sector, trying to generalize it to Corporate America, which is flush with profits and cash and in no danger of being hurt much by rising interest rates. Most large companies will more than pass along the cost of higher interest rates like they did with inflation. Even Buffet’s regulated utilities will do fine as they get approvals to raise rates. Much of their rate cases will be based on higher interest rates.

What’s interesting is that economists love to obsess about interest rates causing a recession but go silent about corporate greed doing the same thing: “ In a January speech, Lael Brainard, former Fed vice chair and current director of the National Economic Council of the United States, expressed worry that a price-price spiral could ultimately tank the economy by turning consumers off from spending.”

https://www.cnn.com/2023/03/29/investing/premarket-stocks-trading/index.html

Why would corporate-coddling mainstream economists ever consider profiteering corporations as a cause of a recession? Except in rare instances, like the one cited, it simply ain’t gonna happen! Better to blame high interest rates and pressure the Fed to lower them…for wealthy investors’ sake!

I did choose a capital intensive sector. Now you provide one where the cost of capital does not matter. Ah yea – basket weaving. Your forte!

“Much of Berkshire Hathaway Energy’s business consists of regulated utilities.”

Actually all of it is. But is TSMC regulated? Don’t think so. But it is capital intensive. So I named two sectors and lazy Jonny boy has named zero. Come on Jonny boy – mansplain to us how basket weaving requires no capital.

You either don’t understand the discussion or are ignoring it to engage in your same-old political rant.

AS made an observation about the leading nature of interest expense in business cycles. I made an observation about the leading nature of interest rates for interest expense.

You told a new version of your same old lie about what economists think. You’re just in the way.

OK we are just corporate coddlers. After all in Jonny boy’s world, the cost of capital is irrelevant. And we thought Princeton Steve was bad at finance!

Ducky, my comment, written before yours was posted, was in response to the lead sentence in AS’ comment “Higher Rates Are Coming For U.S Companies.”

You chose to comment on the business cycle aspect of it. I chose to comment on the concern expressed about potential harm to Corporate America.

Ducky thinks that we’re supposed to respond only to the portion of a comment that Ducky thinks important. IOW this is all about Ducky!

But I’ll defer here to Ducky’s genius. I concede that corporate interest expense may indeed increase. However, corporations are extremely well positioned to take that in stride. Historically, they’re more profitable than ever and are probably sitting on more cash than ever. In addition, corporations are in a better position than ever to pass along the added interest expenses, just as they passed along increases in the cost of supplies (and then some) during the recent inflation. Corporate margins may get dinged a bit, but not enough to either cause or predict a recession. This represents a change so significant that historical analogies are most likely moot.

What may cause a recession, as the CNN article [ibid]suggests, is that consumers get tapped out, causing a decline in consumption. This would be caused by a decline in purchasing power, driven in part by corporate greed–excessive profiteering and exorbitant price increases.

The last paragraph is the part where Ducky tunes out…

Why do you write so much utter gibberish? Oh wait – your hero is the Village Idiot Princeton Steve. So don’t let us interrupt your worthless babbling.

Thanks for providing the FRED data BAA Corporate Debt Rates. Of course the interest rate on long-term government bonds was around 9% in early 1990 but only 1.5% as of late 2021:

https://fred.stlouisfed.org/series/DGS10/

FRED provides a graph on the difference between these two rates, which proxies credit spreads. Our friend Macroduck is all over such spreads to his credit.

We should note that real GDP is only 1% higher than it was in 2021Q4. OK – we may have been pushing past potential output a year ago but now the danger is that the tight monetary policies of the past year or so could push us below full employment. Which is why I would hope the FED ease off and actually lower interest rates.

Most interest rates are negative in real terms, but pgl wants to lower them even more! Wall Street investors will cheer!

Your emotional issues are getting worse by the day. All I did was to note the data and little Jonny boy goes on the attack. Dude – you need to settle down before you hurt yourself.

John, do you want interest rates to increase or decrease?

Jonny boy the gold bug actually thinks weak aggregate demand is good for workers. So yea – he wants higher interest rates as recessions are a good thing in Jonny’s little world.

Grumpy old man comment: Why does the BEA use the word “output” coupled with the word “gross” in two very different senses? We have “gross domestic output”, which is the average of GDI and GDP. But in the BEA’s GDP by industry tables the term “gross output” refers to the sum of GDP (i.e., value of final goods & services) and all intermediate goods & services. It’s very annoying. Okay, I’ll go back to yelling at the television.

To slow the economy real rates need to be positive.

Robert Flood: TIPS 5 yr and 10 yr at 1.26% and 1.21% respectively right now. Add in default risk premium, borrowing rate for corporations must be higher.

Ah – market measures of expected inflation are no longer double digit (they never were) but what about actual inflation. Latest data shows this is also modest:

https://www.bea.gov/news/2023/personal-income-and-outlays-february-2023

Is anyone tracking the performance of TIPS breakeven spreads in relation to CPI? It doesn’t look too good to me. For the past two years it has been pretty much stuck around 2.5 %….13% over five years.

https://fred.stlouisfed.org/series/T5YIE/

Meanwhile the CPI has risen 14% in just the last two years…more than the breakeven spread accumulated over five years! But maybe the Fed’s fairy will wave it’s wand and magically give us 0% inflation for the next 3 years so as to realize those breakeven spreads for those who invested in 5 year treasuries two years ago (guffaw, guffaw.)

Somehow the TIPs fixed rate is supposed to be a proxy for “reality” for people not buying TIPS?

Here’s another, non-speculative way to look at real five year yields. They are the worst they’ve been in the past 65 years. But some think that they’re too high. I mean, what’s wrong with paying the banksters to hold our money?

https://www.crestmontresearch.com/docs/i-rate-10-yr-yield.pdf

Oh boy – Bruce Hall has a new BFF!

I have never heard of your latest guru but maybe you should read this SLOWLY:

Although the average spread for Treasury notes over the inflation rate has been 2%, the average consists of periods that were above the average and periods that were below the average. Specifically, the 1960s reflected fairly modest inflation and a spread of 2.3%. The inflation-infected 1970s surprised bond investors and they were slow to adjust their required returns. By the 1980s, much like a battered insurance company that raises premiums, the inflation spread rose to near 5.0% to adjust to the newly-realized inflation risks

Irving Fisher published something called a Theory of Interest some 116 years ago. I guess you have not read this either. But write on the chalk board 1000 times. Expected inflation v. actual inflation.

Maybe something will sink into your think stupid skull if you do (but I’m not counting on it).

“Although the average spread for Treasury notes over the inflation rate has been 2%, the average consists of periods that were above the average and periods that were below the average.”

That is fine, except for two things…1)we’re at record low real interest rates now and 2) it’s been a long, long time since we’ve seen real interest rates above 2%. The 2% average is achieved only by inclusion of rates from decades ago. It has barely reach 2% any time in this century!

Did pgl ever stop to think, theories aside, that real people get hurt by a protracted period of zero or negative interest rates? For example, 75 million boomers, 20% of the US population, who are retired or nearing retirement, can’t risk putting the majority of their life savings into stocks.

How is this not a serious public policy issue?

“Did pgl ever stop to think, theories aside, that real people get hurt by a protracted period of zero or negative interest rates?”

Did Jonny boy ever stop to read his own graph? A year or two is a protracted period? Like 6 years of weak aggregate demand in the UK under Cameron lowering real wages is a short period. Dude – you are babbling BS as usual.

The real interest rates under Reagan-Volcker were quite high. Now if you think the economic performance of St. Reagan during his first term was all that great – then you are indeed the dumbest gold bug God ever created.

Yea ex post real rates were low in 2022 and ain’t it just horrible that the labor market saw so much employment growth.

You and Stephen Moore should write a macroeconomic text.

So increasing real rates from -2.0 to -0.5 would not slow growth?

Consumption is the main driver of economic growth so if rates have an effect on consumption/growth it is through changes in rates not their absolute level.

General point well taken. But note Dr. Chinn would change your -2.0% to -0.5% into -1.0% to 1.25%.

But of course we have Jonny boy hoping to see real interest rates rising to around 5%. Jonny boy has always been a gold bug who actually thinks recessions are good for workers.

My concern is with Robert’s absolutist statement that: “To slow the economy real rates need to be positive”. I see nothing magic about going across zero to positive numbers. Even an increase in real rates from one negative number to another negative number will slow growth.

Agree 100%!

Concerned to hear about Evan Gershkovich today. Just another sign (like we needed more) that Putin is a sick being.

If you believe in the power of prayer, maybe you can pray for Mr. Gershkovich today/tonight. The only reason we know what is going on in Russia right now is because people like Mr. Gershkovich who risk their own well-being so we can be aware the world around us. It’s important work, and sometimes heroic work.

Amen. I just hope a deal can be struck soon to bring him home.

McCarthy narrowly gets his Drill Baby Drill bill past the House:

https://www.msn.com/en-us/news/politics/house-republicans-pass-marquee-energy-bill-in-rebuke-of-biden/ar-AA19h3Fj?ocid=msedgdhp&pc=U531&cvid=9a3f18bd69304f44a3766952285a8b66&ei=8

Lower Energy Costs? I wonder if they could con 60 Senators with this misleading slogan?

This is how you bring manufacturing back to the US.

https://www.nytimes.com/2023/03/31/business/energy-environment/electric-vehicles-treasury-tax-credits.html

The traitors at Tesla who moved battery manufacturing to China will not get rewarded with tax credits on those cars.

Competence matters. Thank you President Biden.

CoRev and Bruce Hall say more jobs for Americans is “a dirty liberal trick”. The way to “make America great again” is to make domestic products more expensive and to move Harley Davidson manufacturing jobs to Thailand ASAP.

https://econbrowser.com/archives/2018/06/thanks-trump-wisconsin-cheese-and-motorcycle-edition

https://www.theguardian.com/us-news/2019/apr/23/trump-harley-davidson-eu-tariffs-trade

https://www.reuters.com/article/cbusiness-us-harley-davidson-tariffs-idCAKBN1JM1AF-OCABS

Trump initiates tariffs on EU = Harley Davidson moves to Thailand because it loses a huge percentage of sales to EU because Trump tariffs = Trump acts like a child when Harley protects their sales/revenues due to lost EU sales because Trump initiated tariffs = More tariffs = Trump threats to Harley = Functionally illiterate MAGA braindead Bruce Hall and CoRev “Thanks donald trump for killing American manufacturing jobs!!! Trump is ‘on our side’ killing off good paying American jobs!!!”

Rinse, Repeat.

This was the kind of insane trade policy one would expect when clowns like Peter Navarro and Lawrence Kudlow are put in charge.

Yes the Orange disaster had no clue what he was doing – nor did he have the personal security to listen to those who did. He scared away anybody who had expertise with his “I know more than the generals”. Who would want to be chauffeur of a car when the passenger has been known to grab the steering wheel and ram the car into a ditch.

Putting tariffs on raw materials will harm any company using them to make their products, especially if the products are exported. Retaliatory tariffs will almost certainly be targeted to the most vulnerable products – unless your country also has a moron in charge.

“Putting tariffs on raw materials will harm any company using them to make their products, especially if the products are exported.”

The point of Dr. Chinn’s Effective Rate of Protection post that actually preceded the stupid Trump trade war!

https://econbrowser.com/archives/2018/06/term-of-the-day-effective-rate-of-protection#:~:text=An%20effective%20rate%20of%20protection%20%28ERP%29%20calculation%20takes,substantial%20imported%20value%20added%20in%20the%20final%20good.

Dr. Chinn’s classic from June 2018!

Oh my

CoRev

June 26, 2018 at 4:22 am

CoRev made a fool out of himself back in 2018. Same fool today!

Remember that Elon Musk sleeps with Trump who in turn lusts after Xi.

Musk’s decision was probably in large part a bet that China will buy more electric vehicles than the U.S. A business decision – that’s fine. That should be a matter for Chinese policy. The U.S. should not provide subsidies to China. And under this tax credits scheme, we won’t. Yes. Competence.

Colby Hall v. Trump toadie Alan Dershowitz:

https://www.msn.com/en-us/news/politics/mediaite-s-colby-hall-busts-dershowitz-seconds-after-he-claims-there-s-nothing-to-trump-indictment-that-he-hasn-t-seen/ar-AA19jYkV?ocid=msedgdhp&pc=U531&cvid=8a6d3657f9c442e7a754a76a3debba5e&ei=12

Dershowitz also said that Bragg better have a “slam dunk case,” adding that while we haven’t seen the indictment yet, as far as he could tell, “there is nothing there.”

Dershowitz knows there is nothing there before he sees the indictment. Score this one game, set, and match for Colby Hall. How does HARVARD let Dershowitz lecture before the law school students? Have they started giggling during classes?

He was friends with Jeffrey Epstein, and never took his undies off during any Epstein hosted slumber party. NEVER. Ask his wife.

https://nymag.com/intelligencer/2019/07/alan-dershowitz-jeffrey-epstein-case.html

https://www.salon.com/2022/08/27/alan-dershowitz-grilled-on-massages-at-jeffrey-epsteins_partner/

HillTV noted that December 2000 travel records found on Epstein’s plane mentioned a “massage” that was scheduled for “AD.” Dershowitz told HillTV, “That was in my wife’s calendar. My wife scheduled a massage.”

………. it goes on further down…….

When an interviewer started to calmly speak, Dershowitz angrily told him, “Let me finish. Let me finish. Let me finish. Let me finish. I was a visiting scholar at NYU. My wife had a professional masseuse. We have checks, canceled checks proving that the massage occurred, when it occurred, who it occurred with. And I’ve had very, very few massages in my life — one at Jeffrey Epstein’s house by a middle-aged woman who gave me a shoulder and neck massage, which I hated. I called up my wife and complained about it immediately.”

Poor misunderstood mensch.

Anyone who claims there is nothing there without having seen the indictment has declared themselves a political hack.

ALAN used to teach criminal law at HARVARD. But that was many years ago. Now he is nothing more than a carnival barker.

The traitors at Tesla who moved battery manufacturing…

The traitors at Tesla who moved battery manufacturing…

The traitors at Tesla who moved battery manufacturing…

[ Astonishing, terrifying prejudice. ]

victim mentality.

@ ltr

What do you think about the mass murder of Chinese miners, that was ordered by Putin?? And do you think Xi Jinping is proving himself to be a very weak leader by shaking hands and being cozy with a leader~~Putin~~who murders Chinese nationals?? Do Chinese leaders often show deep affection for foreigners who murder Chinese laborers??

https://www.thedailybeast.com/witnesses-accuse-russias-wagner-group-of-killing-9-chinese-miners-in-central-african-republic

ltr, you seem so quiet on this topic, are we to take that to mean you are bored with the thought of many Chinese workers being murdered by foreign hands?? Please get back to us soon here in the comments section. We are worried you may not care about Chinese peoples’ painful deaths at all.

Are you on the payroll of Elon Musk?

The traitors at Tesla who moved battery manufacturing…

The traitors at Tesla who moved battery manufacturing…

The traitors at Tesla who moved battery manufacturing…

[ Astonishing, terrifying prejudice. ]

Are you on the payroll of Elon Musk?

Are you on the payroll of Elon Musk?

Are you on the payroll of Elon Musk?

[ Imagine not even knowing or caring what prejudice is about. Not understanding or caring about prejudice after all these saddening years. ]

Can’t answer a simple question? OK!

I actually don’t remember ltr engaging in direct interaction with anybody here on any issue. Maybe some kind of social disorder, but I am not a doctor – I just play one on social media.

there you go again, ltr, use a word like “prejudice” without even knowing what it means.

I said I was looking at the financials for Berkshire Hathaway Energy and I should note my comment about operating margins and capital intensity. It fixed assets to revenue is a whopping 350% so if it receives a 21% operating margin (which Jonny boy thinks is so obscene that Warren Buffett does not have to worry about the cost of debt). But wait – that is a 6% return to assets.

Half of its assets are debt financed where the cost of debt has risen to around 4.5%. Now that might sound like a bank and not an energy company but those are the facts.

But Jonny boy wants to mansplain to Warren Buffett that the cost of debt does not matter if profits margins are 17% or more. Before Warren rips little Jonny boy’s lack of intelligence, we should warn Warren that little Jonny boy does not understand basic money and banking either.

We learned from Marshall (OK, maybe Aristotle, but Marshall helped a lot) to set the marginal this equal to the marginal that when assessing investment decisions. Johnny insists there is no change to investment incentives when the marginal that changes. Marshall would probably disagree.

Remember – Jonny does not do no stinking economics.

I was writing something on lease to value ratios when it hit me that BFFs JohnH and CoRev might have a rare disagreement over the impact of higher interest rates. Let me explain by noting how the simplest version of lease to value ratios is leasing farm land (no depreciation and operating pays all operating costs so the landowner just collects rent):

2020 FCC farmland rental rates analysis

https://www.fcc-fac.ca/en/knowledge/economics/farmland-rental-rates-analysis.html#:~:text=The%20Rent%20to%20Price%20%28RP%29%20ratio%20is%20a,acre%20Value%20of%20farmland%20per%20acre%20%C3%97%20100

Farmland rental rates are a relevant component of the broad farmland market. The Rent to Price (RP) ratio is a useful tool to assess trends in cash rental rates relative to the price of farmland:

Rent to Price (RP) ratio (measured in %) = Cash rental rate per acre

Value of farmland per acre ×100

The weighted average RP ratio of Canadian cultivated land comes out at 2.7% on average. There is considerable variation in the RP ratio across provinces (Figure 1).

In 2000, long-term interest rates on Canadian dollars dipped below 1%. For risk reasons, land owners that lease their property tend to get a 2% premium hence this data.

Now today the long-term interest rate on Canadian dollar is around 3% lease rates will likely rise 5%.

Now we know CoRev champions farmers I would suspect he would object to the latest from Jonny boy. But you never know. CoRev flip flops even faster than Jonny boy.

But I have a challenge for the dynamic duo … co-author a paper on the economics of higher interest rates and farmer income. This should be a riot.

Wolf Richter has a great piece, which I agree with: “Battle for Deposits: Tired of Getting Screwed by Banks, People Yank their Cash Out, Forcing Banks to Pay Higher Interest Rates.” https://wolfstreet.com/2023/03/27/the-battle-for-deposits-tired-of-getting-screwed-by-banks-people-yank-their-cash-out-forcing-banks-to-pay-higher-interest-rates/

Stiglitz also made wrote a piece called “What’s Wrong with Negative Rates?” He specifically addresses negative REAL interest rates, noting, “A decrease in the real interest rate — that on government bonds — to negative 3 percent or even negative 4 percent will make little or no difference. Negative interest rates hurt banks’ balance sheets, with the “wealth effect” on banks overwhelming the small increase in incentives to lend. Unless policymakers are careful, lending rates could increase and credit availability decline.”

https://www8.gsb.columbia.edu/articles/chazen-global-insights/what-s-wrong-negative-rates

Yet the corporate stooges here, like pgl, are incessant cheerleaders for lower interest rate and try to dismiss and disparage any discussion of the costs of negative interest rates. To them it’s all benefit…and that is most likely literally true–for their stock portfolios.

There are three further problems. First, low interest rates encourage firms to invest in more capital-intensive technologies, resulting in demand for labor falling in the longer term, even as unemployment declines in the short term. Second, older people who depend on interest income, hurt further, cut their consumption more deeply than those who benefit — rich owners of equity — increase theirs, undermining aggregate demand today. Third, the perhaps irrational but widely documented search for yield implies that many investors will shift their portfolios toward riskier assets, exposing the economy to greater financial instability.”

Wolf Street? You are nothing more than a corporate homey if this is your source.

But come on moron – READ what Stiglitz wrote back in the days when aggregate demand was weak. He was saying lower interest rates in a depressed economy might have less aggregate demand stimulus than fiscal stimulus.

Dude – we are talking about a booming economy and the use of higher rates to tamper down excess demand.

BIG DIFFERENCE. But then how would a complete moron like you know the difference?

Capital intensive production is a sector thing moron. Ever heard of TSMC – you used to be their chief cheerleader. Do you have a clue how capital intensive contract manufacturing in the semiconductor sector is?

I didn’t think so. OK idiot – please write more stuff you do not even remotely understand.

Stiglitz, Nobel Prize winner, writes about real rates. But Johnny says economists don’t care about real rates. Somebody is confused…

Stiglitz way back then was talking a depressed economy with the concern that QE could not do more to boost aggregate demand. Jonny the pretend genius thinks this means high interest rates during a booming economy cannot tamper aggregate demand. Yea – Jonny is a little slow.

https://econbrowser.com/archives/2023/03/china-signals-stability-with-surprise-move-to-keep-pboc-governor#comment-295379

March 12, 2023

BTW, where is “ltr”?? Is he drawing the water for Li Keqiang’s bath and prepping his hands for Li’s first post-retirement full-body rubdown?? I mean, I know “ltr” loves China, but this is taking it too far.

— Moses Herzog

[ Such is the fearful pathology of prejudice so well described by Jean Genet. ]

Stiglitz: “Clearly, the idea that large corporations precisely calculate the interest rate at which they are willing to undertake investment – and that they would be willing to undertake a large number of projects if only interest rates were lowered by another 25 basis points — is absurd.”

[ibid]

Ducky, though he has close ties to and affinities with corporate America, has clearly never worked for a non-financial corporation, where hurdle rates and strategic opportunities determine investment. Hurdle rates are set well above any conceivable interest rate. Also, the investment decision is made separately from the financing decision. If a project passes the hurdle, the Treasurer gets to figure out how to finance it, not vice versa, which is how economists mysteriously conclude is what happens. There is no file cabinet full of projects waiting to be approved pending the right interest rate.

This is so odd. I have mentioned hurdle rates in comments here more than oce. Now, Johnny thinks he needs to lecture me about hurdle rates. One wonders where Johnny gets his notions. Johnny apparently also thinks that somehow the use of hurdle rates invalidates marginal analysis. That’s just silly.

Johnny, who lies all the time, has lied again, this time about who I am. Whenever Johnny uses “clearly” it means he has no evidence. When Johnny gets his economics wrong, Johnny changes the subject.

Johnhy, who’s my employer? C’mon, Johnny, who am I affiliated with? Give us my resume, right here. You claim to know. Prove it.

Jonny worked for a Fortune 200 company. He can’t name it. He did not tell us what he did for that company. I guess mopping the bath room floors made him smarter than the CFO.

Since Jonny wants to pretend he is THE expert on hurdle rates, let’s give him a little exercise. What is the hurdle rate for TSMC which seems to be Jonny’s favorite company. Now it is a large company and it has announced that it plans to increase its capacity by $100 billion a year over the next few years. So its hurdle rate has to be on the top of the mind of its CFO.

Now I would put their rate at 10% for reasons I can easily explain. But let’s give little Jonny boy the first shot as he is THE expert. Now Jonny – you are required to show your work. This should be a lot of fun! Come on Jonny boy – dazzle us with your “brilliance”.

“Ducky, though he has close ties to and affinities with corporate America, has clearly never worked for a non-financial corporation”

Gee – I have never seen his resume and neither have you. BTW – the rest of your emotional rant was utter BS. Then again youi worked for a former Fortune 200 company that went bankrupt as it hired idiots like you.

“Hurdle rates are set well above any conceivable interest rate. Also, the investment decision is made separately from the financing decision.”

The CFO of GE just lost his breakfast reading this BS. I guess Jonny boy is referring to market risk premium. Of course they are many potential investment decisions with different divisional costs of capital. Some divisions have a cost of capital equal to 6%, others at 7%, etc. And as the interest rate on government bonds go up, each of these costs of capital go up.

But I get it. This is way beyond the mental abilities for the former janitor of a former Fortune 200 company.

Remember that Elon Musk sleeps with Trump who in turn lusts after Xi.

Remember that Elon Musk sleeps with Trump who in turn lusts after Xi.

Remember that Elon Musk sleeps with Trump who in turn lusts after Xi.

[ Imagine such psycho-sexual imagery. Such is the fearful pathology of prejudice. so well described by Jean Genet:

https://en.wikipedia.org/wiki/Jean_Genet . ]

Oh my Xi! (Xi is ltr’s diety, and I am trying to avoid misunderstanding.)

How cute that you’ve discovered another western writer to appropriate in your effort to peddle propaganda for Xi’s grasping, slave-running, liberty-denying regime. If you worked for someone who honors W.E.B. Dubois, it would be acceptable to quote Dubois. You work for a slaver, so no Dubois for you. In Genet’s case, I understand the effort, but I think you’d have better luck with his elevation of criminals and his fascination with betrayal and with evil – Go, team Xi! – than with sexual imagery.

While we’re linking to Wikipedia pages, how about this one, which outlines China’s official hostility to homosexuality:

https://en.m.wikipedia.org/wiki/LGBT_rights_in_China

Wonder what Genet would say about that.