Amazingly, gasoline futures on the New York Mercantile Exchange today ended back where they were before Hurricane Katrina struck with all its fury. Retail prices will likely follow that lead. But what about the Fed?

The October gasoline futures contract closed today at $1.87 a gallon. This is more than a dollar a gallon below the lofty height to which the September futures price had ascended in the hectic August 31 trading. As the chart below shows, this puts the October futures price essentially back where it was before Katrina threatened New Orleans.

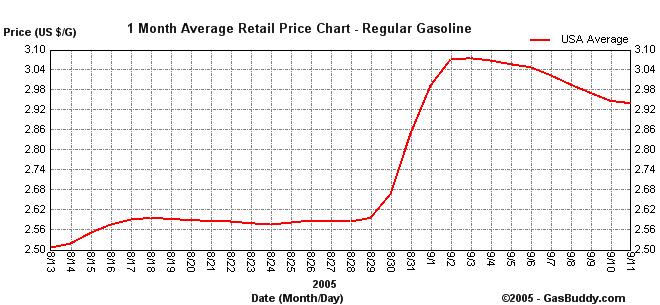

Remember that this contract corresponds to a bulk price, so you’d add about 70 cents a gallon in taxes and the wholesale and retail markups to get a number comparable to the one you pay at the pump. The chart below plots the average national retail price for the last month. This has come down significantly from the September 1 highs, but still displays a substantial kick from Katrina. Today’s NYMEX results mean that the retail price could easily drop another 30 cents a gallon in the next few weeks.

It’s been a roller coaster ride for Fed watchers as well. The chart below plots the latest data from Macroblog for the probability (background here) that the Federal Reserve will set the target for the fed funds rate at one of the indicated values at its November 1 meeting. Prior to Katrina, the market had been very confident that we’d see the target bumped from its present 3.5% up to 3.75% on September 20 and 4.0% on November 1. The damage from Katrina to energy supplies caused many analysts to believe that a recession had become much more likely, which prospect would make the Fed substantially less likely to keep moving interest rates higher.

As news of the past week has revealed the economic damage from Katrina to be less severe than originally feared, the prospect that the Fed would continue with its rate-hiking ways correspondingly went back up. On September 1, a 3.5% fed funds target for November was the single most likely outcome. Today, 4.0% is the single most likely outcome.

It looks like you’ll be paying less for gasoline and more for your adjustable rate mortgage in the near future. And these two developments seem to be related.

Technorati Tags: Federal Reserve, Katrina,

gasoline prices, gas prices

Something to watch now is the planned simultaneous blockade of petrol depots across Europe to force governments to lower taxes.

In 2000 this stopped the UK cold in 3 days. The protesters are gearing up for a real fight (farmers, independent road haulers). It will crystalise discontent at Blair’s govt on a number of levels.

Interesting to see how the markets react: the papers this morning are already full of stories of panic buying of petrol.

“…gasoline futures on the New York Mercantile Exchange today ended back where they were before Hurricane Katrina struck with all its fury. Retail prices will likely follow that lead.”

Don’t tell the IRS. It just added 8 cents per mile to the standard mileage rate for deducting business driving (to 48.5 cents from 40.5) through the end of the year, due to the post-Katrina gas price rise.

At 20 miles per gallon 8 cents per mile is a deduction increase of $1.60 per gallon. While from the chart up there it looks like prices never actually rose more than about 50 cents per gallon.

So for those who were musing about tax relief on the cost of gasoline, there you are.

As an aside, they raised the cents per mile rate for medical expense and moving deductions by only 7 cents. I guess gasoline costs less for them. And they raised the rate for charitable driving not at all.

There is always talk about “tax simplification”. But the gov’t can’t even settle on a uniform cents-per-mile rate for deducting the cost of driving a car — or even on uniform rate just for the cost of gasoline used for driving for different purposes.

There will never be tax simplification.

I’m surprised that the markets are taking this back-to-normal stance. From the reports I have read there is substantial damage to the Gulf coast infrastructure and to the oil production rigs and undersea pipelines. Gasoline refineries are not expected to be back up to full capacity for months.

As far as the claim that high prices are driving down demand, yes, but then if prices fall demand will rise. If prices fall all the way back to what they were, demand will go back to what it was. And we won’t have enough gasoline and oil to meet that demand due to Katrina’s destruction.

I would expect prices to stabilize considerably higher than they were post-Katrina in order to keep demand suppressed to the point that the diminished supply can handle it. I wonder why the markets expect otherwise.

One wonders just how much SPR oil was actually released into the commercial markets?

Also note that natural gas us trending down too. Monday it closed at $11.03 after nudging $12 last week.

Ah! The wonderful world of futures market dynamics. Whenever there is a run-up in market prices there are always some longs that decide to take some profits home. However, every sale requires a purchaser. Those purchasers that buy near the peaks then are faced with maintaining a cash balance to cover their position. Thus, new entrants into the market face calls when there is any dip, and the long term holders become more convinced they should take profits creating more sellers. The market is always irrational in the short term.

Bill

Paid $2.73 today.

Get a Prius, doubles gas mileage (60 mpg city) = halves yr. gas price.

I love all your info. I am going in the Elk Point, AB Sciencefair. I needed Chart and this is exactly what I needed.