More and more people are concluding that those unbelievable China GDP statistics are, well, unbelievable.

|

Barry Ritholtz writes:

If you think I am skeptical about the BLS data, imagine how I feel about this nonsense from the Red Communists of China’s Central Economic Planning Bureau. (Those guys make the BLS look like Capitalists).

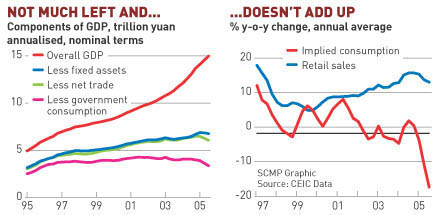

Brad Setser says he’s right, and Simon World has the goods. Consider Simon’s graphs at the right. The first shows the levels of various Chinese GDP components, which might look reasonable at first blush. But when you subtract investment, net exports, and government spending from GDP, you arrive at what should be the sum of consumption spending plus inventory investment, represented by the magenta curve (which Simon helps the color-vocabulary-challenged to identify as “the line in the ugly colour”). Trouble is, this ugly magenta line clearly trends down, and that can’t remotely be explained by inventories. The implausible behavior is even more clear when plotted as growth rates as the red line in the second graph. Simon explains the significance:

It seems from this that in the year to September the man on the street spent 17 per cent less on daily necessities and toys than he did the previous year. But this is not what other official statistics say. They say that retail spending for the year to September was 13.6 per cent greater than it was the previous year (the blue line) and that this retail spending alone was almost twice as great as the remainder number we calculated for all personal consumption spending.

How is it possible? It is not. The latest GDP figures from the mainland simply do not add up.

And then we could talk about those China FDI statistics…

That the numbers are made up was the first thing that I said too, just after their announcement. They have had a goal of ‘under 10% GDP growth’ for a few years now, and hey, what a coincidence, they keep hitting it.

Professor,

Thanks for raising the issue. Nicely done.

The problem with Chinese statistics is that there are probably no reliable data, period. There are at least 3 layers of difficulties: first, even if one can collect data on nominal output, it is very difficult to have a meaningful price measure in a fast changing economy like the Chinese (think of the quality adjustment issues we have here about CPI then multiply them by 100), which means it is difficult to measure the real output. Second, there are huge black and grey markets in China, which means that on the quantity side, lots of economic activity is not measured, and on the price side, many things just don’t have a market price. To measure prices properly, one has to collect the distribution of actual transaction prices and then weigh them properly, which is not practical (black markets by definition, do not allow data to be collected). Third, of course, is fraud. Many observors have commented on incentives of government officials (in every level) to distort data, but the private sector is equally bad. I know quite a few who have worked for private firms as accountants, they all tell the same story: nothing on the book is believable (some of them have quit being accountants for the risk involved, because it is not possible to be a rule abiding accountant and still being employed.) None of them have worked for joint verntures of big multi-nationals, so I don’t know how things are done in these places. Some told me that one can even buy software which can generate 3 sets of data: one for the management, one for tax authority, and one for shareholders, but I can’t verify it. Given all these, it would be a miracle if the official numbers have any consistency at all.

I would take those SCMP graphs with a grain of salt. The fixed investment figure always grows faster than NIPA GFCF.

My guess is that Fixed Asset Investment includes land purchases. With urban land prices rising quickly, growth rates of that series will be higher than NIPA Investment.

It is interesting that China gives statistics that so obviously don’t add up. This is not the first time. What is it they are trying to say? Most seem to agree that the Chinese economic growth has been greater than officially acknowledged. This is of course rare in the world, most countries like to overstate their growth.

I think they don’t try to fool themselves or others. But what it is? May be China is already too big and becoming bigger still. This changes its status and role in global economy and politics.

The export growth rate has already now made it the biggest exporter in the world. A 33% growth doubles its foreign trade in two years. It is probably already now the leading industrial country in the world. A 20% growth doubles its industrial production in about 3 years. If its GDP growth is at the same level it will mean doubling its GDP in 3 – 4 years. Then it will be the real hyperpower at least in the world economy. And it must act like one and be prepared to be treated like one.

The Chinese have preferred to keep a low profile. Soon it wll not be possible. Understating the growth will perhaps say that they want to keep their profile low in the future, too. But there may be other reasons. The present growth rate seems unsustainable, and understating it now may make it easier to cover up a slump. May be.

But what the Chinese are really up at? Is this growth rate really so unsustainable? On point here is that they are growing out of the US trade deficit. If the relative size of their foreign surplus shrinks compared to their GDP and foreign trade they can get out unhurt from the present imbalance system where they are now captive with the Americans.

The Chinese have caused a visible trend break upwards in the world energy production and consumption. This shows clearly in statistics for the last 3 – 4 years. They are now investing 77% more in there coal minining and 41% more in ralroads. They are serious in continuing there growth. May be it cannot go on at 20% pace, but 10% for a few years will do at the present volume. In absolute numbers this would be more than 20% growth five years ago.

China is becoming so big that it is the engine of its own growth. This makes it more independent from the evenomic cycles of the rest of the world. It is still export-oriented but must be less so – there is not enough room for so big an exporter.

Normally it would be reasonable to say that China is grossly overinvesting and we could expect an overcapacity crisis. Probably so, but the question is, who will be hurt? The Chinese are the fittest and in the best position to survive.

China the Roaring Economy – Or Maybe Not

In any grand strategy discussion for the United States, EU, Russia – or any country for that matter – China is seen as the raising power (welcomed or not). Quarter after quarter comes news about its explosive GDP growth and the new buildings sprouting…

Do China’s GDP figures add up?

Econbrowser and Simon World took a look at China’s recent GDP statistics and found that the numbers don’t quite add up:

Given the number of unrecorded and unreported transactions in the Chinese economy, I’m not surprised by shady …

TI — well, Chinese banks are not the fittest, and are not well positioned to survive massive overcapacity that is cleared with very low prices. Hard for Chinese firms to repay their loans in that context, even if production migrates to China to take advantage of all the spare capacity and the like. Plus, in that context (deflationary adjustment in China, China’s real exchange is falling unles US/ world deflate faster) I suspect that the political bargain that sustains Chinese access to US markets really starts to break down. And i have not even mentioned what would happen to China’s reserves and balance of payments, so yes, it is unsustainable.

Dave Cook: I highly recommend the World Bank quarterly, which explains why urban fixed asset investment exceeds NIPA GFCF, typically by 6-8%.

And a lot of chinese data, notably the energy intensity data, would make more sense if China had a higher GDP. If savings are measured better than GDP, higher GDP and the same savings would help make the savings rate a bit more plausible — 60% is just way high, even for East Asia.

Is China’s “Economic Miracle” a Lie?

A growing number of macroeconomists seem to think so:

Of course the Chinese jump through hoops to understate growth. It’s political. It’s a way of deflecting pressure to widen the currency trading range. If they can make a credible argument that through growth slowdown American’s CA deficit will at least stablize then they can continue to justify their mercantile currency policies and deflect Congressional pressure for a real float.

It will probably work, because the Republicans are incredibly incompetent and care not a whit for working Americans. Then there’s a substantial corporate contingent which is salivating to dump as many American workers, pensions, health care as possible before that train has left the station – and the Republicans care ferociously and sincerely about this class of supporters.

Alas, Congress is distracted, as the great Republican ship of state begins to disintegrate and everyone else runs around frantically, trying to dodge the falling pieces. Who is even around to notice the great Chinese tide wiping out huge chunks of the American economy? (What temerity to suggest that the health of America’s working and middle classes constitutes a huge chunk of our economy!) It would be amusing if it didn’t signal so many dismal crises to come.

Having worked in China, I agree that Chinese data is sketchy at best. The vagaries of Chinese economic statistics are due in part to competing and often contradictory incentives/requirements placed on the government officials responsible for gathering and creating the data.

At the central government level there are 2 major competing concerns. The Chinese government needs to provide employment to the millions of under- and unemployed people residing in rural China. Every revolution in China has emerged from the countryside, spurred on by poverty; so the Communist party and government feel compelled to drive economic growth to prevent overthrow. Their rule of thumb is that China will need 10% GDP growth for more than a decade to ensure social stability. Countering this is their desire to control growth for international political purposes, as well as to prevent imbalances due to excess capacity in industries such as steel production and property development. This results in an official target growth rate, currently approx. 9%. The official target is set at the central level, and local officials are expected to meet that target.

For local officials, they receive career rewards for meeting the target growth rate. However, they are also rewarded for driving local economic development in excess of that rate. These rewards consist of above-table recognition and investment opportunities, and below-table financial rewards for luring foreign direct investment. They therefore drive development at double digit growth rates, then officially report growth below 10%.

The last comment above is closer to the money than some of the earlier ones. The conventional view of China hands is that, rather like the old USSR, there has in most years been roughly a 1-2% fudge factor on the growth rate. That is, it was probably about 1-2% lower than officially stated. However, there have more recently been forces pushing in the opposite direction, to understate it. One of those retaining favored status with several international economic organizations (such as the WTO) as a “developing economy.”

The problem of the “correct” exchange rate and also of internal pricing is very much a factor as well, mentioned somewhere above, in the problems of measuring Chinese GDP. There is no country for which the disjuncture between its official per capita income, still less than $1,000 per year, and various estimates of its PPP real per capita income, mostly most recently in excess of $4,000 per year, is so great. These also are the difference between China being about eighth in aggregate real GDP and second in the world, a non-trivial difference.

Wow, a great discussion, my thanks to all. My question, as an investor, is what to make about the phoney numbers. Historically, as our economy moves from recovery to expansion, the far eastern investments do less well and the old line established firms do well, including even Japanese firms. What do you think? The US market is cheap relative to bonds and real estate. Is it time to buy US stocks or is the growth in China an opportunity too good to pass?

What I want to know is how can all of our national corporations rush into bed with China? If dishonesty abounds at all levels, why oh why does any company think that they will be given a fair shake? I’ve also heard that no American company can actually build a factory in China. They need to partner up with a Chinese company, share their technology, and the Chinese company will then make the goods. I guess we will have plenty of time (in 20 years) to reflect on our collective stupidity when we shoot our selves in the foot by selling each other out in the rush for profits today. Any thoughts?

Concerned about those “unbelievable China GDP statistics”?

I would be more concerned about this:

Here is what U.S. citizens are competing against, including U.S. corporate and government decisions related to WTO and U.S. trade policy:

Economic Hydrology Theory

The Future of U.S. Domestic Production versus Offshoring and Outsourcing to Foreign Locations

Once the WTO and national governments improved the opportunities for corporations to invest in the least expensive global production locations, the stage was set. Coupled with continually improving transportation and communications efficiencies, the successes of offshoring and outsourcing corporations which led the way were met by competitive desires of other corporations to also seek new lowest cost production sources. At present, over 450 of 500 top U.S. corporations have operations in China, as an example.

Unimpeded and with regard to available skill levels and technologies, corporations will seek out the lowest cost blue collar and white collar production sources on the planet and will create new production empires in those locations as fit their market needs. Currency manipulations and other foreign and domestic government incentives that improve foreign-based blue collar and white collar production opportunities increase the rate of flow or transference to such locations. The larger concentration of global production in lowest cost production environments results in a convergence of foreign direct investment (FDI) monies targeted toward achieving greater scales of production at these locations. This effort, in turn, minimizes the need for investment and development elsewhere by such corporations which further eliminates the logistical and technical support chains that previously existed for duplicate operations at facility locations in other nations. The results are reduced overall investment costs, reduced production costs, labor substitution, and reduction of related supporting logistical and technical support services and employment in other nations.

China is not the problem. Few simply understand the full implications of the WTO globalization model. Should China’s currency be revalued on the order of 30-40% (if that ever happens), the production shifts to other foreign locations. Alan Greenspan supported my contention on this point a few months ago.

What’s next? More U.S. auto supply operations will be shifted to existing or new production facilities in China. Many more, in fact. Huge transfer of additional production.

I think it is worth the effort trying to find out some truth about the state of the Chinese economy. We might start from the fact that the foreign trade numbers are the best because they can be double-checked (import and export countries) and the currency values are easy to get.

Probably the next best numbers are the investments data. Foreign companies participate, collecting data is easier, especially for the bigger projects, because there is a lot paperwork involved.

The overall GDP is probably very difficult or outright impossible to estimate reliably. This has been stated fairly convincingly in this discussion. The Chinese don’t even know their propulation exactly. Can they estimate their GDP with a 10% error margin? If not, what could the error margin be? Valuation is very difficult. If we use PPP dollars, how is the purchasing parity calculated?

This has a great importance for assessing the sustainability of the Chinese economic growth. If the GDP numbers are understated, the investment and savings rates may be significantly lower, may be at 30% level or even lower. This is not the same as 50%.

After following the discussion I am inclining to think that the Chinese growth is really fairly sustainable at least for the next ten years. China has very good, in fact the best, prerequisites for rapid growth. It has ample, fairly well educated work force, quite good infrastructure (they have invested really a lot in it) and logistics system, very high energy self-sufficiency (94%) and the ability to increase significantly their domestic energy production at a very high absolute level. The Chinese territory is large and they have a lot of mineral resources.

They have a rather stable political and economic system. This is basically same kind as all the small Asian tigers had in their high-growth period and very similar many European countries had during the post WWII high economic growth. The government has a lot of control in the economy and financial system, which is geared to favor high investments and growth. The government has had an important role in building the infrastructure. Some central planning is quite ok here.

China has many of the advantages that the US had a century ago, when it had the high growth period. The Chinese growth is not necessarily more or less unsustainable than the US growth at that time. Now it is China’s turn. Considering this, it is easy to see why production is relocalized in China. And this means also that it will not be easily relocated out of there. Cheap labor can be found almost everywhere but finding energy, infrastructure, technological skill and stability is another matter. And remember the scale! India would be the other option, but it cannot really match.

But we can still see some threat to the Chinese economy. The exports growth of 33% – 35% is unsustainable. Where can it be found enough demand to absorb double the the present supply in just two years? China can probably weather an oil crisis better than most, but those others are its exports customers. This might even mean that we will see more production relocalization to China in this situation. On the other hand a severe recession in the US and Europe might cause a bad exports slump in China and an economic shock. It did have difficulties in the end of the ’90s after the Asian crash. A global recession would be much worse. China could very well recover fast but dropping from 20% – 30% growth rates hurts at first. China has quite likely kept the global economy afloat and played the role of the investments engine for a couple of last years. Is it strong enough to keep the world going if the environments get really rough?

It is very surprising to me that none have checked the data. The data of the fixed investment used includes private and government investment, and the amount of the government consumption is the government spending, which also includes government investment. The fact is that the government investment has been subtracted twice. How can the remainder be equal to the private consumption, when you subtract government investment twice?!

There are other problems with the FDI data. First, a distinction needs to be made between Contracted FDI and Utilized FDI. There is tremendous pressure for local officials to sign FDI agreements, and some of these agreements come to naught.

Also, a large % of total FDI comes from offshore havens including HOng Kong and various Caribbean countries. Various Chinese govt. agencies including the Army have interests in “private” investment vehicles domiciled offshore (as do many private companies). This can further blur the distinction between private and govt investment.

Simon’s calculation is totally wrong and misleading because he doesn’t understand the terminologies used by the Chinese statistical authorities. Investment expenditure he uses in his blog is so-called the completed investment in fixed assets, which is not gross capital formation in the national accounts. Investment in fixed assets involves double accountings. The difference between the completed investment in fixed assets and capital formation is much bigger than that between retail trade and final consumption. The Chinese statistical authority has never released GDP components quarterly, which are only available in yearly figures several months after the year. The problem with China GDP statistics is not “adding up”, which is easy to do, rather is whether they reflect the performance of the Chinese economy. Professor Thomas Rawski from University of Pittsburgh has discussed several issues about China GDP statistics (www.pitt.edu/~tgrawski/papers2001/gdp912f.pdf).

Rawski says bluntly, quoting a Chinese collague, that “nobody believes in the GDP statistics”. He shows that there is indeed no reason to believe. Because the paper is written in 2001, the discussion is mostly about what happened in the end of ’90s.

According the BP statistics (they are not very reliable either), Chinese energy consumption fell 18% from 1996 to 2000. Coal production fell 28% in the same period (coal is 70% of energy production in China). Officially GDP grew briskly at the same time. No way, of course. Rawski gives own estimates of -2% – +2% a year for GDP growth. We could argue that these are too high, also.

But from 2000 to 2004 energy consumption grew 55% and coal production 50%. So very high volatility here. These numbers seem to confirm the big growth rates in recent years.

Rawski doesnt’t give any alternate estimates for the level of the Chinese GDP. This is the most difficult and most important number. How big is the share of the exports sector really? How big is the share of the investments really? To know that we should know the level of the GDP. The exports numbers are the most reliable, of course. At this growth rate exports would be about $1 trillion next year. What size is the economy behind that? Chinese say it is 15 trillion yuans. But this means of course nothing.

If the share of foreign of the economy is huge, the economy is very vulnerable to changes in the external environment. If it is small, it is not.

One hint is what happened in 1996 – 2000 in the energy consumption. This kind of drop would normally have meant a real economic collapse. But Rawski didn’t see that, only near zero growth. This may indicate that the “effective size” of the Chinese economy is fairly large. China has a population of 1.3 billion. Most Chinese are active in the “old”, non-energy-intensive, fairly stable and closed sector. This is the sector most difficult to evaluate. But it is exactly this that might cushion external demand shocks. But this also means that the real overall growth rates cannot be very high.

If the size of the Chinese economy were fairly big this would make it rather stable. CIA factbook gives the Chinese GDP of $7.3 billion PPP in 2004. In an economy of this size the exports sector would be only about 10% and the share of investments in GDP much lower than 50%. This is quite another matter. I have seen quotes from the Chinese authorities that China will reach the US GDP in a few years, may be in ten. This would be possible from the basis of a 7 billion economy.

Jack Miller,

Here is my 2 cents: I don’t know what an investor should do with their money, but I do know that Chinese stock market is for suckers.

Are India and China really the next super powers?

Surely the current threat of India’s IT workers (just a million of them) and China’s manufacturing (less than a third of that of either the US or Japan) is exaggerated. Yale Global online seems to think that China and India’s…

There are a couple of issues in measuring the Chinese economy.

1. The services sector: the sector is very booming in recent years and the growth should have been much faster than the economy, which is not reflected in the statistics. In the first three quarters of 2005, the tertiary industry grew by 8.1%. Firms, private firms in particular, tend to under-report their turnovers to minimize taxes. The size of the services sector should be much bigger than the official number. The services sector has more private firms than other sectors.

2. Capital investment and industry output by state-owned enterprises: provincial and state-owned firm officials tend to inflate their numbers because economic performance is the most important indicator for them to be promoted. This is the reason why adding GDP numbers of all provinces would be much bigger than national GDP and the lowest GDP growth among the provinces is higher than national GDP growth.

3. Prices: measuring prices is always a difficulty for statisticians and is more so in China. Since land is still owned by the state, it is very difficult to measure the value of land for big investment projects. Implicit price deflators for GDP components, gross capital formation in particularly, are varying widely in recent years.

4. Foreign trade: the value of Chinese exports measured by importing countries is always much bigger than what the Chinese has reported, leaving a much bigger net exports.

There are also other issues, such as vast rural areas, the informal sector, the underground economy and etc. The Chinese statistical authority is fully aware of these issues and makes all sorts of adjustment.

Putting these together, I think that Chinese GDP growth numbers are believable, but really nobody knows the true size of the Chinese economy. In terms of Chinese standards, 9% is not a fast one. University graduates have been struggling to find a job in the past few years (it is also an outcome of the fast expansion of Chinese universities). If the Chinese economy grew by 7%, it would be in recession. As after the Asian financial crisis, the Chinese government launched a campaign to boost the economy from sliding below 7%.

My sense is that the Chinese economy is bigger than the official numbers suggest, but the foreign sector is also bigger. Since the foreign sector employs a huge labor force and contributes much value added in the coastal regions, the Chinese economy is still vulnerable to external shocks.

More Unreliable Chinese Economic Data

This time it’s GDP and GDP growth that are dubious, at best. Econbrowser has the goods, so to speak, with the help of several others.

Check out some of the comments too, which indicate collectively that the problem may be a combination of an i…

Jack:

I think Mr. Lee, the ex Prime Minister of Singapore for more than 30 years, in his interview to Das Spiegel a couple of months ago, describes China as rolling over the rest of the world’s economies for the next 10 years…In that context, one should invest in western cos not competing and supplying goods or services to the Chinese economy. Also, IMO a correction to US wages is mandatory, which will occur facilitated by a deterioration of the US dollar…Hence, I expect commodities (oil, copper, gold, etc.) and real estate to be quite attractive in the future.

Movie Guy:

I totally disagree with your premise, WTO or not, the Chinese, India, Russian and East European cheap labor markets –4.0 billion aprrox. and quite well prepared, will attract foreign investments by themselves, capital flows to inexpensive resource areas as water seeks low levels, it’s unavoidable!…You cannot cover the sky with your hands.

Macro China, Micro China

Macro thoughts… * O Philipe trouxe a discussão sobre a qualidade dos números da China para a blogosfera brasileira. Incrível como a imprensa nacional continua ruim quando o assunto é economia. Chego a pensar que mesmo o sucesso de Freakonomics…

Joe, this is not so simple that capital flows to inxpensive resource areas like water. It is true that WTO has not so big significance here. But remember that there was a time when investments flowed to the deveoped countries with expensive resources.

TI,

You have to ask yourself –why is investment moving to these areas now?

Capital always flows to inexpensive resources, –as any rule there are exceptions, –when the risks of losing the investment are too high.

I guess I have to be more precise; resources which allow the final price of a good to be cheaper and where risks are tolerable.

The crux issue is that nowadays this new labor –is capable of manufacturing at lower wages– ever so more sophisticated goods …Dell computer parts come to mind …But the list goes on and on, and seems not to end! And maybe it won’t end, they’re graduating 30,000+ engineers per year!!

So, granted, there are important conditions to consider when analyzing investment flows …Deng Xiao Ping comes to mind.

Great guy, btw, brought 350 million people out of extreme poverty –If memory serves me right, with incomes of less than 1 US dollar per month??

Joe, it is little more complicated than that. Capital seeks higher profits, not cheaper resources nor cheaper goods. The risk factor exists (but the rule is that economic growth brings stability), but the overall cost structure for those goods at the consumer is more important.

A necessary prerequisite for increasing global trade is lower logistics costs. Oil is still cheap, and there has been an enormous build-up of the global logistics system. And it took China a long time to build such a huge domestic infrastructure to support their industry. Earlier that kind of infrastructure existed only in the “rich” countries (that is why they are called “rich”).

It is important to see that main driving force of Chinese industrial development is cheap and abundant energy. The volume level of their domestic energy production (mostly coal) is huge and the growth rate about 10% a year. This is unsurpassed. Only by looking it this way we can understand why China, why India (but at a lower growth rate), why Brazil, why Indonesia. The growth rates of the “new” big industrial countries correspond quite closely the growth rate and scale of their domestic energy production. The lackluster Europe is an example of low growth and lacking domestic energy production.

This way we can predict that it will be China also in the future (not Africa or Bangladesh), India will not catch China, Europe remains a basket case (never stopping wondering what “reforms” they missed and how to “deepen” the integration), Japan has not a very bright future, but the smaller Asian states can prosper with China – and the US? Can the US increase its coal production to match the decreasing domestic natural gas and oil production? Probably not. So no further growth without growing indebtness.

Too simplistic? May be. But look around, this is how it works. Every major economy is trying to counter this with economic policy (even the Chinese try to dampen their growth) – but in vain.

anybody have a graph of saving in china from the past 20 or so years. thanks

oh yeah

Hello everybody, my name is Keith Morris and I’m doing an assessment task in year 12 on Chinas growth due to globalisation and its effects on Australia, and I would like to thank you all for your insightful commentary on what is quite an overwhelming subject.

Could a part of the discrepancy in Chinese national accounts be explained by the “underground” economy? I would imagine that a chunk of unrecorded income would be spent on consumption. Does anyone know of a good source of estimates of such unrecorded income in India and China?

Can someone please explain,

why although GDP in China has increased welfare of some of the population may have fallen.

Plus how to find the percentage increased in China’s GDP.

Thanks a lot….