Here I report on some new data on the intermediate-term prospects for oil supply

|

The Oil Drum notes that Chris Skrebowski has updated his assessment of the major new oilfields that will be in production over the next five years. Skrebowski expects these to provide an additional 15.7 mbd global production by 2010, but says this still won’t be enough. Skrebowski argues that depletion from existing fields will result in a cumulative drop of 26.4 mbd by 2010 and doubts whether production from new smaller fields could bridge the gap as well as satisfy the 10 mbd increase in demand forecast by the International Energy Agency.

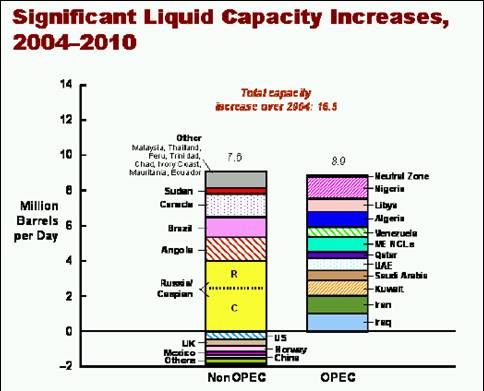

At first blush, Skrebowski’s 15.7 mbd increase might seem comparable to the 16.5 mbd increase forecast by Cambridge Energy Research Associates. However, Skrebowski’s value is the gross increase (which does not include depletion, and this is precisely why he’s concerned), whereas CERA nets out depletion on a country-by-country basis. Furthermore, as the CERA graphic reproduced at the right reveals, there are substantial inconsistencies between the two sets of estimates at a more detailed level. Whereas Skrebowski’s calculations imply a gross increase of only 6.0 mbd from OPEC countries, CERA is predicting an 8.9 mbd net increase. Some of the big differences appear to be that CERA is expecting about 2.5 mbd more production from Libya, Algeria, and Iraq combined, whereas Skrebowski credited only 0.1 mbd to Algeria and nothing to the other two. The Energy Information Agency shares CERA’s assessment about Algeria, expecting it to increase crude production 0.8 mbd by 2010, and notes that Libya has a “goal” of adding 0.4 mbd by 2008-2010 and 1.4 mbd by 2015; there have recently been some promising discoveries. EIA anticipates no major production increases from Iraq over the next 2-3 years but acknowledges that a 2 mbd increase by the end of the decade is possible.

As CERA noted, it should also be remembered that the investments that led to these projects were made at a time when the price of oil, adjusted for inflation, had been in an impressive 20-year decline, with oil selling in 2000 for 1/3 the price (in real terms) that it had commanded in 1980. This real price decline also coincided with a substantial decline in worldwide expenditures on exploration and production which also hit bottom in 2000 (see graph below). Since then, they have been climbing back up. Lehman recently revised their forecast for 2005, now anticipating a 13.4% increase in E&P spending for 2005.

Will these projects prove sufficient to relieve the current pressure on oil prices? Skrebrowski also emphasizes the role of “slippage”, in that projects often take longer to get started than originally anticipated,

Thunder Horse being a prominent recent example. CERA has in fact emphasized the same issue in talking about the “above-ground” risks. On this theme, consider today’s story from Reuters:

Oil exports from Nigeria’s 240,000 barrel-per-day Brass River tanker terminal were suspended on Friday due to a strike by unions, a ship agent said. The industrial action against a joint venture operated by Italian oil company Agip, a unit of ENI, began on Wednesday and has also hit production from some fields, the agent and union sources said.

Add this to the Nigerian

pipeline fire last week and temporary shutdown of two Chevron flowstations there last month, and recall the critical role that Nigeria is supposed to play in both Skrebowski’s and CERA’s accounts. Concerns about “slippage” or “above-ground risk” would seem to be well-grounded.

|

Technorati Tags: oil prices, oil, oil supply

One has only to look at the recorded depletion rates for the North Sea, now running at more than 10%, and set these against the assumed values of 5% that both Skrebowski and CERA use as an underlying average number, to have an increasing sense of discomfort, as more companies switch to the more advanced methods of production which swop long term production for high immediate returns.

I wonder if they also calculate how much bio-oil will come in the picture. Surly it wil start to have an effect

Does anyone have a link , where it shows the current price of petrol (per litre) for all countries ?

Out of curiosty, Chinese price seems to be the half of Indias ? It would be interesting to see other coutries’ as well

Thanks in advance

do not forget the R.A.C. which officially has no oil and actually has more than chad and sudan combined.

Does anyone have a link , where it shows the current price of petrol (per litre) for all countries ?

see the following: (page 7)

http://www.sasol.com/sasol_internet/downloads/FuelPrices_SouthAfrica_calculated_1116589733064.pdf

Trying to predict future worldwide oil production is a complicated multivariate problem. However, if we make some simplifying assumptions we can put some bounds on both limits to both demand and supply growth.

If we assume that the majority of supply increases will come from the projects identified in Chris Skrebowski’s mega-projects analysis with only about 10% of the total increases coming from other projects that are not identified in this accounting. (This is just a guess, but a reasonably educated one); and if we (optimistically) assume that these mega-projects will come on stream as they are currently forecast; we can then make predictions about depletion of the base production and demand growth.

If, as Chris suggests, depletion and decline of the base resource (producing fields already on stream) is as high as 5%, then oil demand will have to decrease every year from now until 2010 (the end of the forecast) to match the available supply (or else some other currently unidentified supply source will have to become available to the market.)

If base decline is 4% then demand must stay approximately flat compared to where it is today. If base decline is 3% then demand can increase 1% without exceeding available supply. If base decline is 2% then demand can increase 2% per year. If base decline is as low as 1% per year, then demand can increase an average of 3% until about 2009 until demand will outstrip the available supply.

I think Chris’ assumption of 5% decline is very pessimistic. On the other hand, I don’t think all these projects will come on as they are currently forecast and that some will slip. My guess is that demand for oil will have to stay somewhere between flat to increasing no more than 2% per annum to stay within the supply constraints.

Oil supply

Check out this post from Econbrowser on the forecast increase in oil supply in coming years. (Hat tip: Ben Cunningham.)…