Just when you thought it was safe to go back in the water, oil closed back up above $63 a barrel today. I earlier expressed the opinion that demand pressure would prevent an oil price collapse. But the news driving the market this week seems not to be demand but instead new concerns about supply.

|

So what’s up? Two developments deserve mentioning. In Iraq, oil exports in December were at their lowest levels since the war began. Sabotage in the north and bad weather in the south brought oil exports last week temporarily to a halt.

|

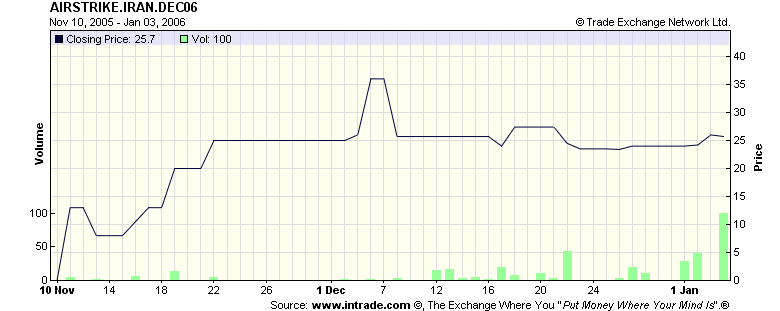

And then there’s the little matter of Iran. How seriously should we take the saber rattling? Kevin Hassett (hat tip: Institutional Economics) suggests looking at the TradeSports contract that pays $1.00 if there’s an overt air strike by the U.S. or Israel against Iran by December of this year. The price has now moved up to suggest a significant probability of that event.

Dave Altig offers a list of things you could worry about for 2006, but concludes with the statement

If real trouble arrives, it will come from a place that’s not even on the radar at the moment.

I notice that Iran didn’t seem to be on Dave’s radar screen at the moment.

Technorati Tags: oil prices,

oil, Iraq,

Iran

I don’t share significant concerns over Iraq crude oil exports. Iraq is still net importer of refined petroleum products, and has been since the most recent Iraq war. Iraq didn’t have surplus crude in November, for example.

The global outlook for 2006 may not be as bleak as some expect. EIA DOE certainly isn’t projecting any major problems.

U.S. Petroleum Products Demand Growth Projection

http://www.eia.doe.gov/emeu/steo/pub/gifs/Slide10.gif

Gulf crude oil refinery capacity is almost back to normal – should be by March 2006

http://www.eia.doe.gov/emeu/steo/pub/gifs/Slide7.gif

U.S. Gasoline Inventories are expected to be in very good shape by May 2006

http://www.eia.doe.gov/emeu/steo/pub/gifs/Slide11.gif

Annual U.S. Petroleum Supply and Demand: Base Case – 1992-2006

http://www.eia.doe.gov/emeu/steo/pub/a5tab.html

International Petroleum Supply and Demand: Base Case

http://www.eia.doe.gov/emeu/steo/pub/3tab.html

OPEC Oil Production (December report)

http://www.eia.doe.gov/emeu/steo/pub/3atab.html

Global Oil Spare Production Capacitiy

http://www.eia.doe.gov/emeu/steo/pub/gifs/Slide9.gif

* Projected 2006 share capacity should readily exceed share capacity available during 2003, 2004, or 2005; on par with 1991-1997 average spare capacity.

Shut-in Federal Offshore Crude Oil Production

http://www.eia.doe.gov/emeu/steo/pub/gifs/Slide5.gif

Other projections:

Short-Term Energy Outlook

http://www.eia.doe.gov/emeu/steo/pub/contents.html

Others may not have confidence in the EIA projections, but I’ll stick with them until proven to be considerably inaccurate.

I took a stroll through a Volkswagen, Audi and Honda dealer recently. My anecdotal observation was that “small” cars such as Honda Civics and VW Jettas were redesigned for 2005 or 2006 to be a little bit bigger and less fuel efficient. It may take auto mfrs a long time (years?) to bring the new models to market, so I am not sure high fuel prices were fully considered in 2006 auto designs. However, this is very guestimatish and not based in empirical data.

A Mercedes McLaren looked like fun.

There are two nice posts at TOD:

http://www.theoildrum.com/story/2006/1/4/24729/30210#more

http://www.theoildrum.com/story/2006/1/2/19364/13876#more

The last one is “The Extraction of Exhaustible Resources” and it is a nice piece showing that can be not a good idea have confindence at the EIA predictions. By the way, it is good start to think that the “market” is not SO rational as some economists say it is.

The first one is “Can Acts of God and Bush Explain the Plateau?” and it is a good piece that show that some lurking supply problem isn’t being showed by the radar screen. I guess that Simmons can be right…

Housing slowdown could produce an interesting effect on the economy with lessened effect on unemployment due its high illegal content.

I’m willing to take the other side of the crude oil supply situation for 2006.

Let’s say that global crude oil production falls by 10% in 2006. Can the nations and populations handle that?

My opinion is yes. Without considerable difficulty.

The loss of available refined gasoline in the U.S., for example, would have to exceed a 10% loss to have much of an effect on the population. Whether through price increases or general conservation, the U.S. demonstrated last fall that it’s population can reduce general demand by 8% without considerable strain.

So, what level of global loss of crude oil supply should we be concerned about if predicting gloom and doom? I suggest that the figure has to larger than 10%.

Movie Guy:

You have to be pretty careful to extract out seasonal factors. Taking account of that, there’s no way gasoline demand dropped 8% for any appreciable period of time in falll 2005. Monthly miles driven never dropped by more than 1.6% on a year-on-year basis (which was done in October). A 10% loss is in the range of oil shocks in 1973, 1978, 1980, and 1991. All of those had pretty noticeable and unpleasant effects on the economy.

Of course, someone might want to discuss the level of fuel pricing (all types) that could lead to a general recession.

I’m more concerned about shortfalls in natural gas supply.

Stuart,

How did you arrive at the monthly miles driven figure? I’ve seen that reported somewhere, perhaps EIA, but I don’t know they determine that number.

The traffic volume fell off enough that gasoline demand did drop 8% for a while. That’s not to say that it didn’t recover, but the refined gasoline demand was off considerably for a while.

You really don’t think that Americans can save 10% of gasoline fuel consumption? Diesel is another matter, which is why I focused on gasoline.

If gasoline prices go north of $3.00 again across the nation, I expect that we will see a general reduction in gasoline consumption. Along with a larger move to smaller vehicles.

Movie Guy:

The source for the 1.6% year on year decline in VMT claim is:

http://www.fhwa.dot.gov/ohim/tvtw/05octtvt/index.htm

I’m not saying gasoline demand didn’t drop, I’m pointing out that you have to take account of seasonal effects. The last three years in a row, miles driven dropped between 5-6% from August to September – that’s most of your 8% right there and it has nothing to do with price, hurricanes or anything but seasonal patterns of behavior change. There’s around a 20% difference between peak driving in June or July and the lowpoint in January each year. You’ve got to account for these seasonal effects before you can make useful claims about what’s going on.

More commentary from me here:

http://www.theoildrum.com/story/2005/12/23/31611/546

and from Jim Hamilton here:

https://econbrowser.com/archives/2005/12/prices_and_ener.html

I think the more interesting question is how consumers react to a perceived long term rise in gas prices. Last fall common perception was that the hurricanes caused a temporary price spike. People clearly had the discretionary funds available to absorb the pain in the short run. Other than a drop in SUV sales, no really dramatic changes in behavior occurred. If 2006 brings widespread belief that higher fuel prices are here to stay, how will consumers respond?

Stuart,

Good references. Nice post at TOD. I forgot about the Federal Highway Administration traffic monitoring data.

It strikes me that a correlation between miles driven and gasoline gallons consumed should be a measurement that should be determined in order to arrive at a figure that represents the potential fuel savings arising from seasonal patterns and fuel price increases (and perhaps a conservation move).

Note this data from EIA:

http://www.eia.doe.gov/emeu/mer/pdf/pages/sec1_17.pdf

http://www.eia.doe.gov/emeu/mer/pdf/pages/sec9_6.pdf

Of course, the FHA isn’t focused on mpg, but those figures (average mpg) should be taken into account when comparing fuel consumption (gasoline gallons) with miles driven.

The point is that there isn’t a one-on-one correlation.

I am suggesting that a 10% reduction in gasoline consumption is very much within reach whether due primarily to gasoline pricing, fuel conservation, improved fuel economy vehicles, or any combination thereof. Moreover, a 10% drop in gasoline consumption wouldn’t necessarily represent a 10% drop in miles driven.

RE Iran, a curved-ball in left field?

I think that the nuclear weapons issue is likely only a ruse and pretext to sell a conflict to the public as a real threat to the US dollar hegemony is the Tehran Oil Bourse set to launch in March 21, 2006. The petro-euro could become a reality with perhaps more devestation to the USA than any 3rd world nuclear program ever could.

So, how much of threat would be an international commodities exchange transacting and setting prices in euros? Some say that Iraq was serverly punished for selling its oil in euros.

As for Iran’s nuclear program, it goes back to the 1970s when it was established (with US support and encouragement)to provide nuclear power to Iran and allow oil (and since then natural gas) to be exported rather than burned for electricity.

Of course the current Iranian president appears to be doing a good job of shooting himself in both feet (from a Western perspective), I suspect that his squawking is well placed to win support in the arab and persian middle east.

Rick,

They are going to consolidate trips, for starters. Then they will decide whether to buy a more fuel efficient vehicle when they replace their existing vehicles.

I believe that trip consolidation will become more of a factor in the short run.

Once gasoline prices stick over $3.00/gallon, then the race is on to drive more fuel efficient vehicles in all classes of usage. Of course, justifying an early vehicle replacement due solely to fuel prices isn’t the smartest move in the world, considering the payout term.

Movie Guy:

Turnover of the vehicle fleet is less than 10% a year. So even if you replace all retired vehicles with ones twice as efficient, you can’t even get to 5% a year increase in fuel efficiency, which is only 1/2% a month in round numbers. So fuel efficiency is not very important in short term (months) changes in demand. It is important in long term changes.

Trip consolidation would show up in VMT numbers. All the indications are that VMT is very inelastic.

Stuart, the turnover of vehicle fleet statistic may be a bit misleading. One of the things we look at in auto retail is the amount of vehicles per household (in order to try to maximize our share) This number has grown consistently through the years (at least in our area). Many of these vehicles are not primary transportation necessities, yet still factor into the total fleet numbers. Anecdotally I hear of customers parking the Suburban when gas prices rise in favor of driving the kids car!(Usually smaller, better mileage) Some people can replace their fleet from within.

Rick:

I’ve heard of this, and it is true that particular behavioral adaptation doesn’t show up in VMT stats. My suspicion is that the transmission probability for those anecdotes is a lot higher than the probability that an individual household actually does them (given how little traction other behavioral conservation possibilities seem to get in practice). However, there’s no easy way to measure the effect – the only way to get at it that I can think of is to model the deployed fleet mileage (corrected for poorer mileage with aging of vehicles, congestion, etc), and then use VMT statistics and gas consumption statistics to extract out an average behavioral fuel efficiency multiplier that gets at this effect. Not a trivial effort.

I think it a common error to overate the effect of energy prices on the economy predicate the 70’s crisis. In the 70’s we were still an industrial nation. Of the say one-hundred industrial account I had then, no more than ten still are in business and no business has replaced those gone. Then it was common to see owners purchase large fuel tanks, diesel generator sets, etc. Loss of power meant lots of people standing around drawing wages and no production. Today, higher energy impinges most on transportation and building environments.

Just to elaborate on the point that miles driven and gasoline consumption may not correlate, according to a Federal Trade Commission study cited by the Pennsylvania State Police, driving at 65 mph instead of 55 mph increases fuel consumption by 20%. Driving 75 instead of 65 raises consumption by a further 25%. The moral of the story is that it is quite simply to save fuel just by slowing down to something closer to the posted speed limit. The only investment required is just a little extra time. Most people tend to overlook the fact that the gas pedal connects with the fuel guage as well as the speedometer.

Tim:

I think the “most people tend to overlook” part dominates in practice over the “quite simple to” part in theory (until the heavy hand of government regulation is applied, anyway).

Stuart,

I don’t believe that the Federal Highway Administration captures many of the consolidated shopping trips with its existing system. FHA is principally drawing its data from 4,000 monitoring points nationally. It’s unlikely that those locations capture very much of the local shopping runs by families.

The simple way to track this potential is to watch for drops in gasoline consumption. If we see such movements, it is important to acknowledge that we’re observing such with an increasing overall private ownership vehicle fleet. As such, this will be a significant shift in vehicle usage beyond the normal B&F work travel by employees.

While you’re correct that new vehicle sales do not presently account for 10% of all registered vehicles, this obscures the early movement in trends to shift to more fuel efficient vehicles as prime movers. Rick’s point is dead on as well.

If gasoline prices move beyond the $3.00 mark and stay there, we will see major shifts in vehicle purchase patterns as well as significant changes in B&F shopping/recreational travels by households.

There should little question that long term $3.00 and $4.00 per gallon of gasoline will bring about changes in private vehicle ownership and usage practices. While the purchasing pattern since 2000 has been a continued growth in truck and SUV sales, representing over 50% consistently, it is likely that the strength of sales will shift back to cars.

I’ve polled a wide group of friends and associates over the past few months. With the exception of a small number, they are making fewer nonwork related trips. And none are considering purchasing new vehicles that do not deliver improvements in fuel economy.

It’s just not hard to save 10% in one’s gasoline purchases in my judgment. If fuel prices pop back up above the $3.00 mark, there is no question that I will be saving at least that much in gasoline volume purchases.

I think there is a controlled experiment for demand adjustment: Europe. We have gasoline prices well over 3 usd/gallon due taxation. Yet European societies remained fundamentally car based, the per capita oil consumption is say 25%-40% lower than in the US. The main differences are the car fleet: much smaller cars, a high share of diesel (the tax in diesel is usually smaller than on gasoline despite the fact that diesel is more polluting so it is partly a distortion) and considerably lower miles driven per person, which is due to the lifestyle and the layout of cities: I take public transport to work and buy my stuff at the small grocery in the corner instead of driving to a faraway mall. And by the way I (and most Europeans) enjoy a resonable standard of living, a 5 usd/gallon price is not necessarily a disaster. If (when) oil is depleting and prices rise, the US will adopt as well, in car fleet city layout and lifestyle. Of course it takes decades, especially lifestyle, so you must hope that price increases will be gentle

Laszlo

Does anyone know what percent of US fuel consumption is due to automobiles?

Higher fuel prices don’t cause recessions per se. Last year we saw a considerable growth of crude supply and demand was high in an environment of rather robust global economic growth. It is normal that commodities prices rise during recoveries and nobody wonders why there is no recession although prices are high. It is both supply and demand and their relationship. Oil is no different from this viewpoint.

On the other hand, energy supply is crucial for economic growth. It is not price, but physical supply, that matters. There was no real supply crisis last year, so no oil-caused recession. Why might have a supply crisis in the near future, but is not necessary seen in oil price, if we have a deep recession and corresponding lower demand.

And on the third hand, it is not oil, but total energy, that really matters. So natural gas is now a bigger problem and no Priuses will help here.

And on the fourth hand, it is not only the total energy supply, but exactly the global energy supply, that is really important. Fuel can be exported and imported, but we are not trading with outer space. The present economic recovery has been largely fuelled by the rapid growth of the Chinese coal production. Watch that. It is definitely on my radar. It seems likely that the growth rates of the present years are not sustainable. A drop to 5% level will be felt in the world economy, through a slowing down Chinese economy.

And watch European (North Sea) natural gas, and Russian oil production. The increase in the Russian oil production has been the the other really important factor that has made the recent global recovery possible. Now the time of rapid Russian oil production growth seems to be over. Will the production decline this year? Quite possible. So put that on your radar, too.

Another variable that’s not easy to quantify statistically is how various socio-economic classes deal with rising fuel costs. Measurements show higher income households tend to average more annual miles driven than lower income households. Spikes in fuel costs may not result in immediate conservation efforts as high income households absorb, and low income households drive less anyway. Affluent households have the recources necessary to adapt to long term price increases by changing vehicles, moving closer to work, installing high energy furnaces etc. Perhaps there will be an enhanced economic opportunity for furnace, metro real estate agents, and car salesman, no? 🙂

I’m just floored at this thread – in past threads (months ago), both Movie Guy and Rick were positive that declining American vehicle sales and the rise in efficient car sales were just evidence of a ‘fad’. What happened?

Hi M1EK. I don’t think that I’m guilty of any contradictions. I still contend that fads come and go. SUVs were “The Thing” when gas was cheap. Now crossovers and hybrids are “The Thing”. I’ve never claimed to be brilliant prognosticator, perhaps I should consult with you when I have questions about the future. I have defended GM(I am a GM dealer after-all) primarily on the basis that GM still sells a lot of vehicles including and other than SUVs. 2005 total US GM sales 4,454,386. 2005 total US Toyota sales 2,260,296. If all you read are news headlines you’d think GM had all but collapsed. My point now, as then, is that we’re still selling many, many vehicles(our numbers are strikingly similar to ’03 and ’04), and GMs troubles are far more complicated than just a loss of some SUV sales.

Hey, M1EK.

Glad to see you on this thread.

If we do see continued high crude oil prices as Jim is signaling alert for, then more consumers will move fuel efficiency up their list as they evaluate new vehicles. Obviously, the recent shift in purchasing patterns suggests that such consideration is already in play.

The auto manufacturers need to be improving their fuel efficiency in all of their drivetrains and existing vehicle models.

I don’t know if all hybrid plus vehicles will fit within the group of answers that consumers will be searching for, but generally improved fuel efficiency will be a selling point along with cost and other factors. Those manufacturers which bring pure hybrids and hybrid plus vehicles to market at reasonable costs may do very well with those models if the mpg performance measures up to expectations. Otherwise, the focus will shift back to vehicle models that already offer reasonably good fuel efficiency or models which offer improved fuel efficiency.

I suspect that reasonably consistent $3.00 and $4.00 gasoline prices in the next year would change the automobile landscape.

Heck, I might be willing to buy a Prius pickup truck…if it has any torque and hauling capacity. But first they have to build one.

The invisible hand is at work. All the concern about fuel costs driving the economy to recession is a strong indication that it will not happen. Recessions tend to sneek up on you. The more concern there is the more quickly the market will adjust. It can’t happen over night but power forces are at work.

In recent days, there have been significant oil gushers in the Gulf and off the coast of Brazil; coal miners around the globe are doing double duty to substitute as much coal as possible for diesel fuel. Supplies are tight but the pace of exploration picked up 3 years ago. New supplies are on the way.

Rick has a good point about consumer reaction.

The interesting part of their reaction is NOT how they can compensate–they certainly will as best they can–but in how they deal with their fear that oil supplies may be peaking or, worse, in decline.

The markets will not treat this idea lightly.

The full ramifications of people’s response may have more dimensions than we can easily imagine.

To elaborate a bit further, I would suggest that we set aside the “rational” response–more fuel efficient cars, consolidation of trips, etc–and look for a moment at the psychological impact.

JB

About 60% of US oil consumption is transport related. About 2/3rds of that is private automobiles, so about 40% of total US oil consumption (or around 7.2m b/d) is therefore car related.

While predicting the future is fraught with peril, early recognition of behavior changes in response to a perceived new set of circumstances offers opportunites to capitalize. That’s what I don’t understand about all the gloom and doom folks predicting nothing but negatives as we seek energy alternatives. It seems to me new markets will be created with whole new sets of providers, distributors, and consumers. Every time I’ve been lucky enough to hit a retail trend early, the rewards have been considerable.

About Iran: Not so sure we will risk that one! We have become Numero Uno Tigre Papel.

On the other hand, if we leave Iraq, then what will the Kurds do? And will Turkey allow it?

Try this one on for size.

http://www.miami.com/mld/miamiherald/news/13497060.htm

The consequences of the Bush follies have no end in sight.

muhandis,

The theory that the Iranian Oil Bourse and fear of Euro pricing of dollars is a driver for war and a major threat to the US role in the world gets solidly debunked whenever it is brought up. Here are two good discussions on the topic:

http://www.dailykos.com/storyonly/2005/12/27/115725/53

http://www.theoildrum.com/story/2005/12/27/232238/03

(scroll down)

I would also like to hear Professor Hamilton or other economists deal with this, but I don’t expect they take it too seriously.

Remember those high prices for natural gas?

Wasn’t it just a few weeks ago that we were enduring demagogues’ calls for governmental intervention in regard to increasing oil and gas prices? Well, continuing a trend noted in this post from a week ago, the natural-gas contract for…

Jack:

I can’t say that Iranian Oil Bourse angst is solidly debunked. Although there are some interesting discussions suggesting that such an exchange will have no bearing on the role of the US dollar, I am not yet convinced. In the Persian press, I noticed mention of training courses for Arab traders wanting to use the new Bourse — whether it is Arabic-Farsi translation or intent to broaden the market coverage of the Bourse, I don’t know.

(as a note, Al-Jazeera.net is a Qatari based company, Al-Jazeera.com is a British company.)

http://business.guardian.co.uk/story/0,3604,1239644,00.html

http://www.iranmania.com/News/ArticleView/Default.asp?NewsCode=28176&NewsKind=Business%20%26%20Economy

http://www.atimes.com/atimes/Global_Economy/GH26Dj01.html

http://english.aljazeera.net/NR/exeres/C1C0C9B3-DDA9-42E2-AE9C-B7CDBA08A6E9.htm

http://www.aljazeera.com/cgi-bin/review/article_full_story.asp?service_ID=9752