Could be better, could be worse.

Dismal sales for automobiles and parts were the main reason for the dreary fourth-quarter GDP figures. According to the “advance” estimates of GDP that were released January 27, U.S. real GDP grew at only a 1.1% annual rate in the fourth quarter of 2005. Motor vehicle and parts made a -2.06% contribution to this advance estimate, meaning that, had autos held steady, BEA would have reported 2005:Q4 growth of 3.2% rather than 1.1%.

| Company | Feb only | First two months |

|---|---|---|

| DaimlerChrysler | +4.3% | + 4.5% |

| Ford | -4.2% | -1.5% |

| GM | -2.6% | +1.5% |

| Total all companies | +0.6% | +3.8% |

The updated “preliminary” 2005:Q4 estimates released Tuesday were slightly more encouraging, showing 1.6% real growth (a 50 basis point improvement) with autos now contributing only -1.93% (a 13 basis point improvement– see BEA Table 1.5.2). In other words, according to the new figures, GDP would have grown at a healthy 3.5% rate had autos held their own.

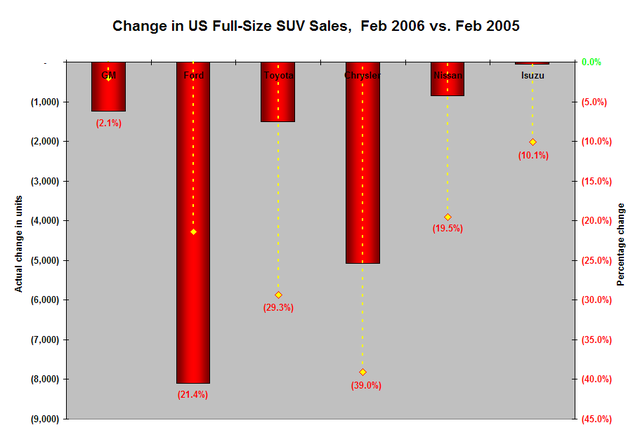

2006 auto sales are weak but nowhere near as bad as last fall. GM and Ford both sold fewer vehicles in February 2006 compared with February 2005, though if you add January and February together, GM at least is slightly ahead. DaimlerChrysler and the foreign automakers have been doing reasonably well. The graph below shows that consumers continue to be less enthused about the full-size SUV’s. By itself, this is hardly enough to produce a repeat of 2005:Q4 in terms of the GDP statistics.

I continue to believe that housing is the key sector to watch at this point, and still find it hard to read the trends. Prices continue to rise [1], [2], though with the number of new homes being sold coming down and the number of new homes being brought to the market going up, something has to give.

Everybody except me seems certain that Bernanke will take the funds rate to 5.0% by May. If he does, I’m thinking the outlook for housing may become a lot more clear.

|

It will be interesting to see if yellow gas caps are enough to stem the tide.

Our GM sales results for Feb were slightly up from last year, as was January. We have a two month waiting list for the new Escalade, and Tahoe sales of both leftover 2006 and new 2007s were brisk in Feb. Gas prices haven’t fluctuated that much in the last several months, and have at least temporarily taken a back seat to other vehicle priorities. Fear and uncertainty drive purchase behavior more than a few extra bucks at the pump.(same reason people choose all-inclusive vacation packages even if they may cost more when scrutinized) If we see a big fuel price spike it will no doubt hammer SUV sales again, but if prices keep drifting around current state it doesn’t seem that radical shifts in vehicle preference are likely.

Year on Year, or even 6 month gains look good in housing. But the snippets of data I’ve looked at in the past couple weeks indicate to me that price increases have largely flattened out and that we’re starting to see some drops in many different parts of the country, in particular the go-go areas like Boston and metropolitan areas of California, Florida, and Hawaii. I think potential price declines in these areas could increase buyer’s caution in other parts of the country as well.

My intution based on qualitative reading of housing data led me to call a top in the housing market last november. The data I’ve been looking at in the past couple of weeks makes me strongly believe we’re on the downslope now, with downward pressure in prices as additional volume comes on line, speculative players step to the side, and the feedback from decreased building and decreased home equity extraction, and increased energy prices, increases caution and skepticism of buyers still in the housing market–of which there obviously still a lot, since sales volume is still strong though dropping.

Nice chart, Jim.