People who bought long-term Treasuries at 4.3%, that’s who.

|

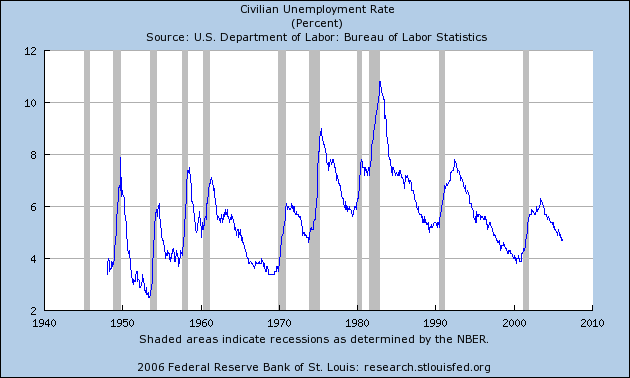

The week ended with a very positive March employment report. The unemployment rate is back down to 4.7%, a full percent below its average value over 1990-99. 211,000 new jobs in March continues a solid trend, and the rise in the fraction of Americans employed was enough to make even an Angry Bear say, and I quote, “YEA!”. As always, Dave Altig does an excellent job of summarizing other reactions to the news, which were generally pretty positive.

If the news is so good, then why did stocks have such a bad day Friday? The answer is the rise in long-term interest rates. By raising the discount rate, this depresses the present value of the claim to a given stream of corporate earnings, so that, even though the economic outlook looks better, the value of stocks can tumble.

And why did long-term yields go up? The 10-year nominal Treasury was up 8 basis points, and the 10-year inflation-indexed Treasury was up 5 basis points– the primary story remains a rise in real interest rates rather than new inflation fears. And the fact that such big interest rate moves coincided with the release of the strong employment report confirms my interpretation that increased optimism about economic growth has been the big factor driving the bond market over the last month.

I think it signals the beginnings of a more substantial move out of low-yielding long term US debt. Why own 10s or 30s at 4.x% in an overvalued dollar scenario when the overnight will soon be 5%?

“increased optimism about economic growth”..? No way. I doubt anyone but the Kudlow permabulls would dare predict much more than current growth rates in a 5% Fed funds rate environment, a bubbled housing market and record debt levels.

So “increased optimism” doesn’t make a lot of sense.

PaulO, if I say that “I’m more optimistic than I was a month ago” (which I personally am), that’s not the same thing as saying “I’m more optimistic than Kudlow” (which I personally am not).

I’m more optimistic than I was a month ago because I have reduced the probability I assign to an economic recession during 2006. Because I (and presumably other investors) have changed those probabilities, our valuation of securities has changed as well.

For what it’s worth, I still think there is a greater than 20% risk of a downturn during 2006. But I was even more pessimistic in 2005:Q4.

JDH:

I’m curious to know what you make of the critique of the unemployment rate from John Williams (the Shadow Statistics guy):

http://www.gillespieresearch.com/cgi-bin/bgn/article/id=341

Do you think these distortions are important or can be safely neglected?

Stuart, the concerns raised by Williams are certainly valid, though not, in my mind, reasons to completely disregard any particular BLS measures.

On the issue of the household versus the payroll survey, my position is that one should pay attention to both; Menzie has some more on this.

The “discouraged worker” issue is of course one that has been debated a great deal, and to which it would be hard to do justice no matter how much I said here. Perhaps the main point I would make is that the measured unemployment rate, warts and all, has well-established co-movements with a number of other, separately measured macroeconomic magnitudes of interest. That by itself is sufficient reason in my mind to pay close attention to it.

“the main point I would make is that the measured unemployment rate, warts and all, has well-established co-movements with a number of other, separately measured macroeconomic magnitudes of interest” JDH

Isn’t the unemployment rate a lagging indicator, i.e. it reflects previous economic conditions as opposed to upcoming economic conditions? I like Joseph Ellis’s analysis of forecasting business and market cycles. The following quotes are from a discussion of Ellis’s book at John Mauldin’s place

Daniel, Anticipating JDH’s response, I believe the unemployment rate is usually considered a coincident indicator, though maybe a little more lagging than some others. In any case it certainly contains some new information about the current state of the economy. For example, if you are trying to guess the GDP number, which will be released (very preliminary) later this month, then the lower-than-expected unemployment rate should raise your guess.

I personally think the unemployment rate is given too much credence, especially by the Fed, as a measure of slack. The econometricians took Milton Friedman’s idea of a natural rate and just ran with it, a lot farther than he intended. But unemployment is still an important part of the mosaic.

PaulO, I don’t buy the overvalued dollar explanation. The dollar probably is overvalued, but if that were driving interest rates, then the dollar would be falling now (which it has not, on a trade-weighted basis, since the beginning of the year, and it actually rose on Friday). Otherwise, people are saying, “I think the dollar is going to collapse, but I’m confident it is not going to happen in the next few months.” If one thinks the dollar is overvalued, the only reason for this short-term confidence would be an expectation of real growth (which could keep short-term rates high and thereby prop up the dollar temporarily).

You mean like the 3.9 rate December 2000 eh(smile), we know what happened around the corner.

It is a lagging rate. When the economy cooled off in the second half of 2000, the unemployment rate actually fell October-December to 3.9 before rising in January of 2001 to 4.2 and slowly rising as the recession progressed.

I would argue, the news isn’t that big of deal. So we got fairly good(not historically good) job growth, boo ha. We should at this stage of the game. Of course, I also predict this will be the shortest expansion of the last 3, so the crest may be near. If the economy can pump out 4.0-4.5 quarterly growth rates and 300000+ jobs a month for a few quarters, then I will jump for joy, the 90’s are here again!

Carnival of the Capitalists

Welcome to this week’s edition of the Carnival of the Capitalists. My name is Dane Carlson, and I’ll be your host today. This is my fourth time hosting the Carnival (the previous 1, 2 and 3) and it just keeps getting better.

There were…

Johnson, I think you’re asking for too much from a coincident indicator. In fact, unemployment did trough before the recession began and finished its major run-up before the recession ended. The leading indicators peaked in April 2000 and were in a clear downtrend by December. All other things being equal, the low unemployment rate was positive news, but all other things were not equal, and by the time the December number came out, everyone knew that.

Also, I don’t think it makes sense to compare employment and production growth rates with those from the 90s, when the prime working-age population was growing more quickly than it is today.

Well, professor, I think you got an answer to your question.

JDH –

Understood. I just differ a hair in subscribing to the premise is all.

Thanks for the good work.

knzn –

Interesting logic. So in your opinion are higher because there’s an expectation of greater growth rates moving forward? I’ve read very little compelling analysis that expects accelerating GDP numbers too much higher than current levels. Close to, yes, but not a big leap.

Also, arguably in that scenario we’d see a stock market pop as money left bonds for equities. But that hasn’t happened. The only thing that’s moved much is gold, silver et. al. Do you see any connection there? Though our esteemed host doesn’t think much of gold as an investment, others clearly do. This could in theory play ever more widely.

PaulO, I pretty much agree with JDH, more growth (and maybe temporary inflation, which the Fed is expected to quell successfully) in the immediate future compared to what people previously thought. This doesn’t necessarily mean more growth than in the immediate past. The reason the stock market doesn’t go up is that, while earnings expectations would rise, so would the rate at which it discounts those earnings.

None of this explains why gold is rising. If it were inflation expectations, you’d think TIPS would do better compared to nominal bonds. And the expectation of higher growth, with higher real interest rates, ought to make the opportunity cost of holding gold higher and thus reduce demand for gold. Possibly gold is a proxy for the additional raw materials that will be demanded by a stronger US and world economy. Or possibly the real explanation for rising rates is that central banks are shifting, or are expected to shift, some of their dollar reserves into gold. (I’m not clear on why they would choose gold rather than other currencies, on which they could earn interest.) Fear over political tensions in the middle east (Iran nukes, Hamas victory, Iraq civil war, etc.) might also explain increased demand for gold.