It was a fun day to be a macroeconomist, don’t you think?

The Wall Street Journal has created a cute interactive graphic that allows you to watch the carnage in international equity markets– Australia down 2.9% Monday and another 7.3% Tuesday, China down 4.8% Monday and another 7.7% Tuesday, and so on– as the economic fears marched around the globe, and arrived at the doorstep of the United States Federal Reserve this morning. What the U.S. market might have done had the Fed not dropped its target interest rate 75 basis points before markets could open we will never know.

The data thus come to us a little contaminated this time, since U.S. markets today were responding both to the earlier international developments as well as the news from the Fed. Still, it’s interesting to take a look at where things stood here once the dust all settled.

|

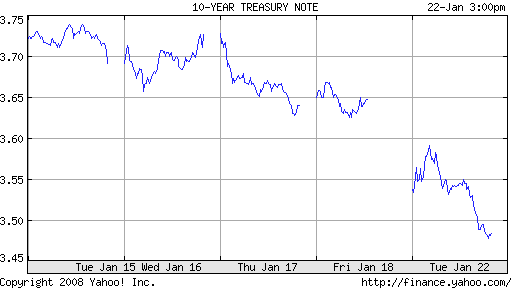

The 10-year nominal Treasury yield fell 15 basis points, suggesting that investors see the Fed lowering even more, economic growth declining, and still no worries of resurging inflation. The latter in particular will encourage the Fed to go further– I think the Fed will continue to cut as long as prospects for real economic activity look so bleak and there remains no sign of life at the long end of the yield curve. Which, if you’re serious about the adage “don’t try to fight the Fed,” suggests to me that you’re better off at this point putting your money into TIPS rather than standard long-term Treasuries.

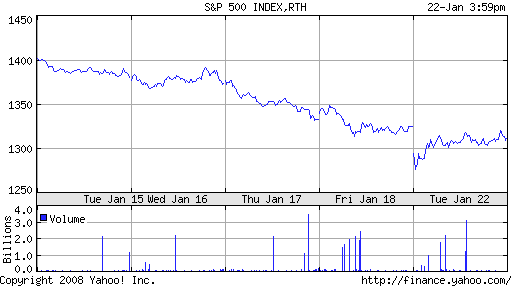

Declining long-term yields reflect two forces pulling stocks in opposite directions. Lower yields on bonds make the discounted present value of a given flow of future earnings higher, a factor that by itself should boost stock prices. But the growing recognition of dismal real economic activity of course means those future earnings aren’t going to be as rosy as some people thought last Friday, driving stocks down. In the event, U.S. stocks were down about 1%– not bad, considering.

|

All of which invites the question, What’s left for the Fed to do at their regular meeting still scheduled for next week? Futures market participants, whom we left on Friday in the belief that a 75-basis-point cut by the end of January was more likely than a 50-basis-point cut, roared out of the box today, bidding the February fed funds futures contract up to 96.95, implying an expected fed funds rate of 3.05%. That sounds like an additional 50-basis-point cut at the meeting coming up next week, or, if not, a good chance of another intermeeting move in February.

|

So now I guess we have an idea what Bernanke meant when he said

we stand ready to take substantive additional action as needed to support growth and to provide adequate insurance against downside risks.

Technorati Tags: macroeconomics,

economics,

Federal Reserve,

subprime,

interest rates,

fed funds rate,

fed funds futures,

Bernanke,

recession

Can someone explain why the weaker dollar does not invite inflationary risks (or why Bernanke thinks so) ?

Great analysis, but I think you forgot the exchange rate information.

I bet the ECB will keep constant.

Hence if you are right and the Fed lowers more then the interest rate gap between USA-EU will widen, hence… what should happen to the dollar/euro?

Exactly the opposite that it happened today (dollar appreciated)

We will look back in a year or 2, when inflation has worsened from its current 4%, & think those people buying 10yr Tres notes yielding 3.5% were really puddin’ heads.

Jim wrote: “The 10-year nominal Treasury yield fell 15 basis points, suggesting that investors see the Fed lowering even more, economic growth declining, and still no worries of resurging inflation.”

Not so fast, professor. I read that the yield on the 10-year TIPS dropped 20 basis points today — which means the breakeven rate has widened. While I usually don’t take the daily movements of the breakeven rate seriously, today’s movements are very unusually: TIPS are typically less volatile than the nominal treasuries, and therefore, the breakeven rate usually NARROWS when nominal yields fall so much. So maybe investors are worried about the implications to inflation?

10 year is at 3.31% as we speak.

Cut faster, please.

Just for point of comparison, I took a look at what rates are now with my lender, and compared them to what I got back in August (when the 10 year T-bill was more than 5%).

I got a 6% 5 year ARM. My lender is publishing a 5 year ARM rate of 5.125%.

So mortgage rates are dropping nicely, but nowhere near what the 10 year has dropped.

I think that this is a win-win situation. The lenders have increased their risk premium to hopefully more realistic levels. They should be more profitable as a result.

And borrowers like me are still getting some nice rates. Truth be told, I was pretty happy at 6%. If I can get a longer ARM (more than 5 years) or maybe a 30 year with a rate of 5% or less, I’m going to refinance.

There is a story making the rounds about Bernanke. Story goes that he has said thinks in private that are far less upbeat about the economy than what he says in public – recession likely, recovery weak. There is no way to know if the story is true, but it would be consistent with the behavior of past policy makers. Unless you are a member of the Bush campaign back in his first run, you don’t talk down the US economy, so there can be a gap between public statement and private view. Just look at the White House trying to talk its way into a stimulus without a recession.

The point to this is to say that the stock slide may simply have been the straw that broke the camel’s back. Bernanke and the doves may have been looking for an excuse to take action. If slow recovery is anticipated, the lag won’t matter so much – timing of yesterday’s ease is still good.

Can someone explain why the weaker dollar does not invite inflationary risks (or why Bernanke thinks so) ?

I don’t think Bernanke thinks this — he has acknowledged that this linkage exists. He does believe that the effect is relatively small.

The notion that Bush “talked down” the economy in the 2000 campaign is a canard. The market had begun to fall in early 2000 and GDP growth was sputtering. The economy was already weak – noting that fact was realism.

Contrast the current situation where the MSM has been salivating at the prospect of a recession. Some, like Nouriel Roubini and Paul Krugman, have been predicting it for years.

The Global Correction

This is a very cool look at the market carnage of the last few days geographically from the Wall Street Journal. You can go from one day to the next and watch how the markets in various places rose and fell*. Hat tip: James Hamilton (who has interestin…

To Buzzcutt’s “win-win situation”, permit me to add this perspective. From the view of the saver, that disappearing American, the Fed’s habitual response to economic weakness is to screw the saver. By creating fresh money, the Fed lowers the rate the saver can get on a bond or CD and (via the eventual price inflation the added quantity of money generates) deviously reduces the real value of the yield the saver does receive.

Maybe the most interesting development is within the market with financials and retailers now doing much better and oils starting to underperform. Retailers are an interesting sector. One, they are typically one of the first sectors to buy in a new bull market, rational since their relative performance has a roughly 0.75 correlation with the market PE. But on the other hand retailers also have a strong seasonal pattern — they generally outperform from Feb to June and underperform from July to January with December and January usually being their worse month. Classic buy the rumor, sell the fact behavior. So are the retailers outperforming a signal that the Fed rate cuts are finally kicking in and we are starting to see a rising pe more then offset weakening earnings or is it just the normal seasonal pattern kicking in.

Although banks relative performance actually has a strong positive correlation with interest rates but most other financials do well in a falling rate environment.

Algernon, good point. VERY good point.

I don’t think that it is a coincidence that the savings rate in this country peaked in the early ’80s, when interest rates peaked. And the savings rate fell along with interest rates throughout “The Great Moderation”.

I was actually hopeful that the higher interest rates earlier in the year would spark increased savings rates.

Bernanke may well believe there are inflationary risks but they are offset by the risk of a liquidity trap. Krugman had a post on this recently…