Was 25, now we have 50. Do I hear 75?

In a widely noted speech, Federal Reserve Chair Ben Bernanke on Thursday described the source of his current concerns about economic and financial stability:

Although poor underwriting and, in some cases, fraud and abusive practices contributed to the high rates of delinquency that we are now seeing in the subprime ARM [adjustable rate mortgage] market, the more fundamental reason for the sharp deterioration in credit quality was the flawed premise on which much subprime ARM lending was based: that house prices would continue to rise rapidly. When house prices were increasing at double-digit rates, subprime ARM borrowers were able to build equity in their homes during the period in which they paid a (relatively) low introductory (or “teaser”) rate on their mortgages. Once sufficient equity had been accumulated, borrowers were often able to refinance, avoiding the increased payments associated with the reset in the rate on the original mortgages. However, when declining affordability finally began to take its toll on the demand for homes and thus on house prices, borrowers could no longer rely on home-price appreciation to build equity; they were accordingly unable to refinance and found themselves locked into their subprime ARM contracts. Many of these borrowers found it difficult to make payments at even the introductory rate, much less at the higher post-adjustment rate. The result, as I have already noted, has been rising delinquencies and foreclosures, which will have adverse effects for communities and the broader economy as well as for the borrowers themselves….

Investors’ loss of confidence was not restricted to securities related to subprime mortgages but extended to other key asset classes. Notably, the secondary market for private-label securities backed by prime jumbo mortgages has also contracted, and issuance of such securities has dwindled. Even though default rates on prime jumbo mortgages have remained very low, the experience with subprime mortgages has evidently made investors more sensitive to the risks associated with other housing-related assets as well. Other types of assets that have seen a cooling of investor interest include loans for commercial real estate projects and so-called leveraged loans, which are used to finance mergers and leveraged buyouts.

While Bernanke acknowledges that the premise behind the subprime teaser loans was flawed, he is not yet ready to say the same thing about other asset classes such as the prime jumbo loans. But surely the same assumptions about real estate price increases that figured into the willingness of borrowers and lenders to engage in the former were also a factor in the latter. And to the extent that unwise subprime lending was a factor driving real estate prices up, we’re now going to see price declines, possibly quite large, that will surely affect default rates well outside of the subprime ARM teaser class.

The primary problem that Bernanke identifies as coming from this situation is that credit is now drying up for everybody:

Unfortunately, at this point, the market is not discriminating to any significant degree between good and bad nonprime loans, and few new loans are being made.

Bernanke then described what the Fed has done and plans to do further about this.

Although the TAF [term auction facility] and other liquidity-related actions appear to have had some positive effects, such measures alone cannot fully address fundamental concerns about credit quality and valuation, nor do these actions relax the balance sheet constraints on financial institutions. Hence, they cannot eliminate the financial restraints affecting the broader economy. Monetary policy (that is, the management of the short-term interest rate) is the Fed’s best tool for pursuing our macroeconomic objectives, namely to promote maximum sustainable employment and price stability….

In light of recent changes in the outlook for and the risks to growth, additional policy easing may well be necessary. The Committee will, of course, be carefully evaluating incoming information bearing on the economic outlook. Based on that evaluation, and consistent with our dual mandate, we stand ready to take substantive additional action as needed to support growth and to provide adequate insurance against downside risks.

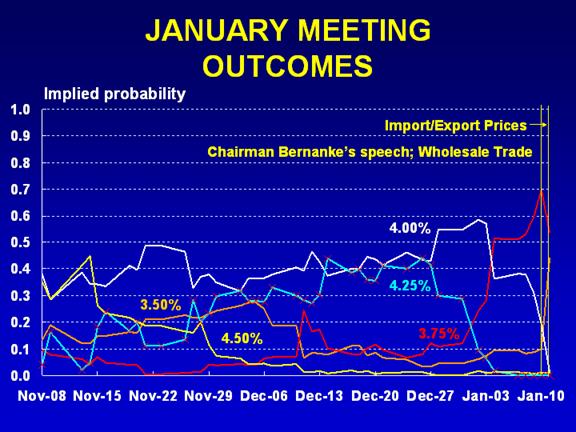

And just what would a “substantive” action look like? A week before Bernanke’s speech, indications of a weakening economy had persuaded Fed funds futures traders that at the end-of-January FOMC meeting the Fed would cut at least 25 basis points from the current 4.25% target and more likely move down to 3.75%. But after Bernanke’s remarks, the expected interest rate implied by the CBOT February contract has fallen to 3.65%, suggesting a significant chance of a cut all the way to 3.5%, or a 75-basis-point cut in a single meeting.

|

The Federal Reserve Bank of Cleveland’s calculation of the probabilities of different meeting outcomes based on option rather than futures prices gives the same answer:

|

I’d be surprised if the Fed does go all the way to 3.5% in a single step. But if it does, let me repeat my caution that this cannot be something that equity markets should cheer. Although Bernanke’s speech describes the problems in calm and objective detail, if he’s actually contemplating a 75-basis-point cut, he has to be worried. Very worried.

Technorati Tags: macroeconomics,

economics,

Federal Reserve,

subprime,

interest rates,

fed funds rate,

fed funds futures,

Bernanke

Given that the ECB is holding the line on its interest rates, and of course the falling dollar has stimulated our exports, but are none of these folks concerned that an even more precipitously falling dollar would aggravate the problem of high dollar prices of imported oil, which is further exacerbating the US current account deficit, not to mention generating those well-known, supply-side stagflationary effects?

Check out Brad DeLong’s blog for a critique of what Ben Stein recently wrote. Ben on 10/21/2007 was saying he did not need monetary stimulus at all. Of course, we got some already but now Ben has decided that the FED is behind the curve.

I say 50 basis points, down to 3.75%.

The next move will be 25 basis points in March (or whenever the next meeting is).

I think we all agree that getting down to 3% by June is the outcome. What the steps are in between is far less important.

Engaging post JDH, not hysterical and not stone-walled (truly a delicate little task to perform given present conditions) [not to fear, I’ve caved-in to the hysterical side in advance…this bein the few pebbles of my stonewall left.]

I think your collected assessment of

“Bernanke’s speech describes the problems in calm and objective detail…” esp here where BB states:

“However, when declining affordability finally began to take its toll on the demand for homes and thus on house prices, borrowers could no longer rely on home-price appreciation to build equity…”

is put to the test (not only my somewhat hysterical bleat). I swear I’m not the only one who remembers the Fed declaring there was no housing bubble…that wages were growing somewhat, that affordability was a manageable issue…that the economy was growing and financial instruments and the disintermediation of risk were propelling homeownership to record levels.

But sadly, only the public relations were propelled to record levels…and from such heights, I do fear the worst as the job dislocations (consumer expectations) start to mount.

Ok, there tis: the hysteria.

The problem with bubbles is that they can only be recognized in retrospect. Now, of course after the fact you can find any number of people who were correctly predicting the bubble at the time, but you can also find such predictions even when things don’t turn out to be bubbles, so this doesn’t help. There doesn’t seem to be any systematic way to identify bubbles in progress.

The Los Angeles Times had an article today about this problem, including proposals for a special Government Bubble Board that would recognize bubbles and send out warnings when they happen:

http://www.latimes.com/news/nationworld/nation/la-na-econ13jan13,0,1109812.story

Unfortunately the story did not include any specifics about how this marvelous task will be accomplished, although there were no shortage of people agreeing that it was a fine idea. I for one would like to have seen a demonstration of the power of this proposal by identifying the bubbles that we are in right now, the ones that the market has not yet recognized. Oil is at an all-time high: is that a speculative bubble? Gold a bubble? Suddenly the question becomes a lot harder when faced with a real world situation without the benefit of hindsight!

At the cost of waxing philosophical, my personal view is that there is no such thing as a bubble other than as a pattern that can be identified retrospectively. Three or four years ago there was no fact of the matter as to whether or not we were in a real estate bubble. The universe splits constantly and the future is uncertain. In some universes there was a real estate crash while in others, things calmed down more gently. We experience just one of many possible futures that branched out from circumstances that we now look back on as the height of a bubble. In other futures, it was no bubble at all. The same is true for oil and gold today. In some futures their prices stay up, in others their prices fall. Whether these commodities are in a speculative bubble is not something that falls into the domain of factual questions.

“The problem with bubbles is that they can only be recognized in retrospect. Now, of course after the fact you can find any number of people who were correctly predicting the bubble at the time, but you can also find such predictions even when things don’t turn out to be bubbles, so this doesn’t help. ”

Reminds one of the joke about the economist having predicted 3 out of the last 0 housing downturns.

One of the stated purposes by the Fed for the TAF is to eliminate the stigma of borrowing from the discount window. In addition, the Fed will not disclose the identities of the banks who borrow by means of the auction. Isn’t transparency required for the effective operation of free markets? Why is the Fed cooperating in the concealment of the financial condition of the banks? Don’t shareholders and depositors deserve to know what is really going on?

eurodollar futures already pricing in below 3% by september.

looks to me like we’ll be going all the way back to 1%, especially when the inflationists realise they’ve been looking the wrong way and suddenly see DEFLATION around the corner.

“Economic View: So We Thought. But Then Again …”

by Tyler Cowen in the NYTimes on January 13, 2008:

ITS NOT JUST THE LENDERS There has been plenty of talk about predatory lending, but predatory borrowing may have been the bigger problem. As much as 70 percent of recent early payment defaults had fraudulent misrepresentations on their original loan applications, according to one recent study. The research was done by BasePoint Analytics, which helps banks and lenders identify fraudulent transactions; the study looked at more than three million loans from 1997 to 2006, with a majority from 2005 to 2006. Applications with misrepresentations were also five times as likely to go into default.

Many of the frauds were simple rather than ingenious. In some cases, borrowers who were asked to state their incomes just lied, sometimes reporting five times actual income; other borrowers falsified income documents by using computers. Too often, mortgage originators and middlemen looked the other way rather than slowing down the process or insisting on adequate documentation of income and assets. As long as housing prices kept rising, it didnt seem to matter.

In other words, many of the people now losing their homes committed fraud. And when a mortgage goes into default in its first year, the chance is high that there was fraud in the initial application, especially because unemployment in general has been low during the last two years.

Good post, Professor. Thanks for bringing to the fore the unvoiced parallel concern on Alt-A and prime loans.

Barkley, I agree with your concerns. Every time BB opens his mouth, oil goes up.

I disagree, Hal, that you cannot see bubbles real-time. Prof. Shiller’s book, ‘Irrational Exuberance,’ taught me that simple metrics (for stocks, price to dividends, for homes, price to rent) reveal bubbles. I heeded his (and others’) teachings, and have profitably been a renter since ’04 (after having owned and sold three California homes). The wide deviation of home price from the historical price-to-rent ratio here in SoCal, when combined with flat real incomes, was too obvious for even me to ignore.

Hal writes, “…you can also find such predictions even when things don’t turn out to be bubbles, so this doesn’t help.”

No one was talking or writing about a housing bubble back in the late ’80s or the ’90s, because there was none. Bubble talk did not begin until the bubble was clearly underway.

Well written and thoughtful. Thank you for the interpretation!

There is a very easy way to identify a bubble in progress, as Bernard Baruch captured in his story of the shoeshine boy. When every conversation, after some few minutes, and even between strangers, turns to an asset class that would not normally be of great interest, it is in a bubble. This was certainly true of dotcom stocks in 1999 and 2000, and equally true of housing prices in 2004 and 2005. I don’t recall any recent uncontrollable tendency for every conversation within my circle of acquaintances to touch on gold or oil prices. I conclude neither is yet in a bubble. If I find myself listening to strangers at parties discuss the net gold weight of their family heirlooms, it will be time to sell.

JDH,

In his famous 2002 “deflation” speech, Bernanke argues that there is reason to cut interest rates more aggressively than normal when “inflation is already low”, and “economic fundamentals suddenly deteriorate”. He further cites a number of academic studies that bolster this thesis.

Are either of the two above “conditions” prevalent today? Clearly, inflation is not now “already low”. It is EXPECTED to fall (according to Fed forecasts), but that is not the same thing. Secondly, the economic fundamentals, in the form of a housing crash and its attendant impact on the financial sector, have been developing for many, many months. Of course BB can argue we just NOTICED that the fundamentals are deteriorating, but again, its not the same thing as saying they are deteriorating “suddenly”.

So do those academic studies BB cited in 2002 still support the slashing of rates “more aggressively than normal”?

Well, I guess he’s called “helicopter Ben” by many in the blogosphere for a reason. If we can go by the relevant Fed speech, he’ll surely try to avoid the slightest risk of a liquidity trap at any and all cost. The trouble is, this time around, that cost will be far higher than in the 1970s, because of far higher dependence on particular imports that are highly visible and therefore psychologically important.

The appearance of price stability in the USA is highly dependent on the sort of imported goods that are found at the big box stores – and on the cost of oil products, posted in colorful numbers on every major street corner and some minor ones. Every time Ben slashes rates and pours liquidity in with a fire hose, real inflation – not this nonsensical “core inflation” that excludes anything that’s going up – will be driven further skyward by oil-product prices whose rise is already markedly accelerated by a tanking dollar. At the rate this seems to be going, it will make the 1970s look like a walk in the park.

Oh, please, don’t get me started: the unnecessary negative real fed funds rate advocated by BB in late 2002 and 2003 is one of the main reasons that we are in this mess today.

Two points

1) I understand that views held within the Fed carry extra weight, but that can be carried too far. Views held within the Fed do have implications for policy, but they are often treated as if they are new information about the state of the economy itself. People essentially let the Fed tell them what is going on in the economy. The Fed assessment of the economic outlook is often no better than median estimates of professional economists.

I point this out in reference to “let me repeat my caution that this cannot be something that equity markets should cheer.” Only if we assume that the world changes just because the Fed’s assessments of the world has changed does that quoted passage make sense. The world was the way it was, and the Fed’s changed attitude toward it improves the odds of rising (not-falling-so-much) nominal asset prices. The outlook for stocks objectively improves in the face of Fed easing, as long as we are not facing spiraling inflation.

2) The Fed began easing right about the time that private forecasters began making steady, significant downward revisions to their GDP forecasts for 2008 (another suggestion that the Fed is not revealing special knowledge by changing its own economic outlook). Bernanke made his speech last week just after Bloomberg released fresh survey results showing another downward revision, and the WSJ was just about to do so. The Fed may not be led by pricing in money markets, but Fed officials have come pretty close to admitting, through constant reference to “private forecasts” that they allow themselves to be led by what professional economists think. There seems to be a substantial number of private economists (including some Fed Presdents) who think it is too late to head off whatever will happen in H1. Will that also affect Fed policy and if so, how?

Well, as of this second the yield on the 10 YEAR!!! T-Bill is 3.78%.

So what do YOU think the overnight rate should be? Less than 3.75%, presumably.

We need a yield CURVE, not a flatline.

What is the ultimate outcome of entering into an extended (or permanent) situation in which the (real) real after-tax return on any maturity of T paper is negative?

What is the ultimate outcome of entering into an extended (or permanent) situation in which you consume in excess of what you produce and cover the deficit by selling off your inherited assets to your suppliers and pushers?

Does the combination of the two circumstances ever lead to prosperity? Has it ever? Anywhere?

esb,

I’m not sure that your first proposition has every been tested. It assumes that investors are willing to invest at a real loss over an extended period. Two things, it seems to me, account for long-end after-tax yields below inflation. (Keeping in mind that not all yields are taxed as they are earned – think IRA, 401(k).) One is that investors at the long end need to beat long-term inflation, not today’s inflation. The other is that, unless investors have a hair-trigger in choosing between saving and spending, they are really shopping for risk-adjusted return among available instruments. If a big pool of assets suddenly looks much worse than it did, there will be a short-term premium on safer assets. Returns below zero for a while are better than no returns.

Point being, I’m not sure we need to ask ourselves your first question, because you are asking about a implication of conditions which are likely to prove short in duration persisting in the longer term. Ain’t gonna happen.

esb

kharris has accurately commented on your first idea (for all I know) and I wish to comment on your second. I believe you are right on in implying that no country can live beyond its means in perpetuity. A country could THINK they could (“deficits don’t matter”) but the fact of the matter is eventually the folks who are taking what are essentially counterfeit $$ for their products are going to get tired of it. (Not unlike, perhaps, those folks who get tired of accepting less than zero returns on other investments) and start sending those bucks home. Oh that’s right, they already are at CIT and Merrill Lynch, etc. The Japenese bought Rockefeller Ctr and Pebble Beach in the last go round. I suspect we may lose a lot more “inherited assets” before this over – and we may not get them back.

One of the stated purposes by the Fed for the TAF is to eliminate the stigma of borrowing from the discount window. In addition, the Fed will not disclose the identities of the banks who borrow by means of the auction. Isn’t transparency required for the effective operation of free markets? Why is the Fed cooperating in the concealment of the financial condition of the banks? Don’t shareholders and depositors deserve to know what is really going on?

(1) Identities of the borrowers is not disclosed via the discount window either. (Both TAF and the discount window break borrowing down by district.)

(2) The TAF is restricted to banks that the Fed judges are in good condition. So while shareholders and depositors would certainly like to know who is borrowing, the Fed is not shielding any insolvent banks.

(3) While I realize that the above is intended as a reductio arguument aimed at embarrassing free market doctrinaires, I don’t think it does a particularly good job at undermining the logic of the TAF (or monetary policy in general).

Re return on T bills. In the 1970s the real before tax return on one year t-bills was negative in 6 years (interest rate computed as return on discounted T-bills purchased at auction at the begining of the year; cpi inflation for same year). Marginal tax rates were considerably higher in the 1970s and there were negative real after tax rates for at least two additional years of the 1970s. So real negative returns can be quite persistent in the stagflation environment.

I have been commenting about the Fed’s actions for several years.

First as they were raising interest rates:

February 3, 2006 “Go back to 1999-2000 and see what the Fed did. They are following the same pattern for 2005-06. If it ain’t broke, the Fed will fix it… and good!”

Then when rates had reached 5.25% and Bernanke was mulling more rate hikes:

July 21, 2007 “My guess is that if there is an interest rate change, a cut is more likely than an increase.”

Then when it seemed a rate cut was probable:

August 11, 2007 “I suspect that within 6 months the Federal Reserve will be forced to lower interest rates before housing becomes a black hole.”

September 11, 2007 “It only means that the overall process has flaws guaranteeing it will be slow in responding to changes in the economy… and tend to over-react as a result.”

September 18, 2007 “I think a 4% rate is really what is needed to turn the economy back on the right course.”

Then after very minor steps by the Fed:

October 25, 2007 “How long will it be before I will be able to write: “The Federal Reserve lowered its lending rate to 4% in response to the collapse of the U.S. housing market and massive numbers of foreclosures that threaten the banking and mortgage sectors.””

And recently:

January 7, 2008 “The real problem now is that consumers can’t rescue the economy and manufacturing, which is already weakening, will continue to weaken. We’ve gutted the forces that could avoid a downturn. The question is not whether there will be a recession, but can it be dampened sufficiently so that it is very short.”

All along, the Fed has been reluctant to see the obvious and, by taking its own good time, has ensured that the cuts it makes now… way too late… have to be greater than the cuts that would have taken a lot of pressure off the system had they been done in a timely manner… OR IF THE FED HADN’T BEEN SO AGGRESSIVE IN RAISING RATES IN THE FIRST PLACE.

It’s not whether rates are at historical levels or not. It is the relative change in rates from the time that a large number of ARMs and home equity loans were taken out. The change could have been from 6% to 10%. The effect is the same: the increasing cost of the loans made them unaffordable.

The Fed precipitated the run on ARMs and home equity loans by making them too cheap (which also allowed home prices to rise too quickly). The Fed’s reversal of those rates left people with loans that were too costly and homes that could not be sold for nearly the same price at which they were purchase.

February 3, 2006 “Go back to 1999-2000 and see what the Fed did. They are following the same pattern for 2005-06. If it ain’t broke, the Fed will fix it… and good!”

nobody said: “Identities of the borrowers is not disclosed via the discount window either.”

Bernanke said “banks may be reluctant to use the window, fearing that markets will draw adverse inferences about their financial condition and access to private sources of funding–the so-called stigma problem,” implying that the anonymity of the TAF was a benefit.

If the discount window is anonymous, how could there be a stigma? And why should the Fed be protecting banks from adverse inferences. Isn’t hiding adverse inferences part of how we got into this mess?

Bernanke trusted the market when it was bubbling before. Now he doesn’t trust it when it’s tight with credit. Seems like he is biased. Seems like he is probably on the take from Goldman just like Sec Treas and the rest of the looters. Pole smokers.

Thanks Dr. Hamilton:

I agree that if the Fed dropped too much all at once, the markets would perceive that move as an unknown Fed worry vs. a welcomed boost of stimulus to the economy and financial market expectations.

In my view, the Fed does have a role to play in this current round of economic and financial market worry, which really reduces down to the US residential real estate correction/recession. However, investors should not be looking at the Fed for every solution and I must quote Robert Rubin – the former Secretary of the Treasury – where he stated that “people put way too much emphasis on the Fed and interest rate watching.”

To my mind, the Fed’s key role at present is to maintain a high degree of consumer confidence through Fed speak that does in fact properly articulate the macro economics at present. That is, the Fed should stop using its past inflation worry rhetoric at present as the reality is that a slowing economy is putting downward pressure on prices and inflation expectations do in fact remain ‘well contained’ as the Fed finally noted in a recent statement.

Looking forward , however, say into the third-quarter and beyond, it is more reasonable to revisit the inflation expectation concerns given the high degree of stimulus that has been pumped into financial markets from the Fed; Bank of England; Euro central bank; Bank of Canada, and Swiss central bank.

Thus, we can expect some slowing going forward but also look forward to a nice upward turn in the spring/early summer months. In addition, I am also of the view that the Democrats are going to get into the White House – likely Hillary Clinton – and that stock prices (S&P 500) from 1929 to the end of 2004 have performed better under Democrats than Republicans (large cap stocks produced a 14.94 percent average annual return under Democrats vs. 8.02 percent for Republicans and Small Caps produced even better returns) , which makes me feel very optimistic about what is coming for equity prices going forward. Finally, real estate investors too like to earn excess returns and to that end I also expect a large capital shift out of that segment of the economy into equities and t-bills are not attractive at present nor are bonds outside of a very short-term capital gain. Accordingly, the financial tire kickers do not have much to complain about if they stretch their horizons out beyond the immediate economic quarter….

Wrong Kirby.

so if we go to 3% interest rate in june – what will a 30 year mortgage rate be 5%? Lower?!

“so if we go to 3% interest rate in june – what will a 30 year mortgage rate be 5%? Lower?!”

Agency products should have a 4 handle.

Will the FED be able to stop at 3, though?

Japan’s ZIRP took 3 year ARM’s down to .5%-1%.

Fixed rate’s average 2.4%

Thanks Sandman.

Your perspective provides excess returns in the market, which I am very thankful for.

The data will dictate the direction and in time we will revisit this post.

Excellent post, very insightful.

This is a great site, thank you for the analysis.

http://naybob.blogspot.com/2008/01/largest-market-declines-since-2001.html

Jim and Menzie,

Bennie and the Ink Jets will cut 50 or more at this meeting and many more…

after tomorrows global tidal wave (Ambac downgrade) slams the stock market.