American energy consumption is dropping. But will falling gasoline prices reverse that trend?

From today’s the Wall Street Journal:

|

Consumers are buying fewer sport-utility vehicles and more energy-saving washing machines. Some trucking companies have rejiggered their engines to max out at lower speeds. Gridlock is easing in California. Americans drove 966 million fewer miles in May than they did a year earlier, a 3.7% decline, according to the Transportation Department.

With shipping costs surging, companies are rethinking overseas production, slimming down packaging and retooling distribution networks. Yogurt maker Stonyfield Farm is only sending out fully loaded delivery trucks. Procter & Gamble Co. is filling smaller bottles with more-powerful laundry detergent. Locally made products, from beets to beer, are becoming a more attractive choice.

“Four-dollar gas is the best marketing tool I have,” says Betsy Kachmar, assistant general manager of Fort Wayne Public Transportation Corp. in Indiana. Bus ridership in that city was up 16% in the first half of this year, compared with the year-ago period. Mass-transit ridership nationwide rose 3.4% in the first quarter, according to the American Public Transportation Association.

Also today the Energy Information Administration reported:

Preliminary data indicates that global consumption rose by roughly 500,000 barrels per day (bbl/d) during the first half of 2008 compared with year-earlier levels, as a 1.3-million bbl/d rise in consumption outside of the Organization for Economic Cooperation and Development (OECD) was partially countered by an 800,000 bbl/d drop in U.S. consumption compared with year-earlier levels. The decline in U.S. consumption in the first half of 2008, reflecting slower economic growth and the impact of high prices, was the largest half-year consumption decline in volume terms in the last 26 years, when, in the first half of 1982, consumption dropped by nearly 800,000 bbl/d….

During the first 5 months of 2008, [U.S.] petroleum consumption fell by an average of almost 900,000 bbl/d from the same period in 2007. During June and July, the year-over-year declines narrowed to just over 400,000 bbl/d.

|

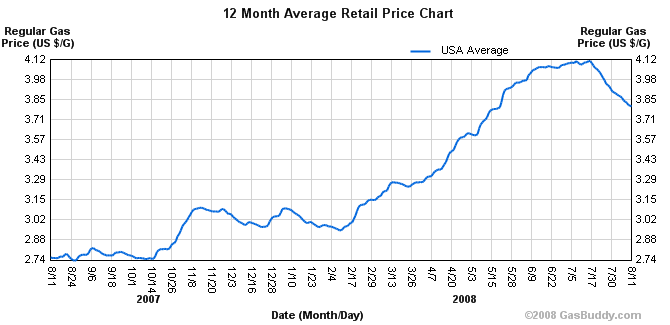

But with oil prices now coming down even faster than they went up, is that all going to be reversed? None of the changes above were easy for people to make, and I don’t expect them to reverse those steps that easily either. Although the price of gasoline today is less than it was a few weeks ago, it’s still much higher than it had been at the time you purchased your last car. As consumers replace older models, they’re invariably going to continue to substitute into more fuel-efficient vehicles even if oil prices continue to decline. In addition, there was a mentality in 2005 that what looked like high gasoline prices at the time ($3 a gallon) were only temporary. I expect an opposite perception could have set in today– even if gasoline prices go lower for a few months, consumers know they could go back up and nobody wants to be permanently stuck owing the big gasoline bills they remember from this summer.

On top of which, that energy conservation was in my opinion one key cause of the most recent price declines. With demand from China booming and world production stagnant, the key question was how high did the price of oil have to rise to bring about a significant drop in U.S. consumption?

And now we know the answer.

|

Technorati Tags: oil,

oil prices,

oil demand

economics

I have long advocated adding $2.00/gal. to the US gas tax to push the retail price to this level. I feel vindicated.

People have infamously short memories. Besides, the current recession could very well have caused a decline in petroleum usage even without the commodity inflation we’ve been seeing. So who knows. But I’m guessing this relief will be relatively short-lived.

And if I’m wrong, public transportation is going to hit a breaking point much sooner than anyone ever thought.

This cool summer has been great. I’ve used may A/C for probably barely more than a week total, and it wasn’t running most of the time. I am, however, scared for the upcoming winter. It already feels like it is becoming fall and some trees show hints of changing.

Fat Man, I feel your feeling of vindication is premature at best and almost certainly unjustified.

The best way for a relatively painless digestion of higher prices is to go two steps forward, one step backwards, two steps forward….

The decline merely gets us mack to the prices of May, which were record highs at the time. Now, those prices seem like a relief. This is a good way to make long-term adjustments.

Actually, the NOAH population weighted cooling days index is running higher in 2008 than in 2007.

In the second quarter it was 131 this years vs 126 last year.In July, 2008 it was 339 as compared to 319 in July 2007.

Fat Man, what belief was vindicated? I look at it this way: All through, say, 1997-2005, as people debated how to handle global warming, and especially, how much of an oil tax would be needed to get people’s behavior, imagine if you proposed a HUGE tax.

“Why, this tax is so high, it will make people pay $120/barrel for oil.”

You would have been laughed out of the room. Yet we’ve had $120/barrel oil, and, not surprisingly, it didn’t suddenly bring America to a standstill. A nice try, though.

I’m gonna backup Fatman here, I don’t know what the right amount of tax is, but I believe a large tax could/would have been great for the country, and the current reactions to high prices lends evidence to support that statement.

Silas Barta: Just because the proposer of such a tax might be laughed out of the room does not mean that it is an ill conceived proposal. Of course $120 oil didn’t bring america to a standstill, nor does anybody, as far as i know, desire to bring america to a standstill. The goal here is a gradual shift, reducing the amount of petroleum the country consumes. It appears that current price levels are achieving that. If the process had begun 10 years ago we could be using much less fuel now, paying much less to foreign producers for oil, etc.

I continue to disagree. I don’think we are reacting to the current price so much as the variability. After the 70s, efficiency continued to improve despite falling prices. Knowing that prices can change, and that it really hurts when they go up, is all the incentive we need. Continued pressure will only hurt things (though significant price reduction could cause people to divest from some new technology development).

Didn’t $120 oil bring us to a standstill? Same GDP, bigger population. And, you don’t get the same product out of less imputs without major innovation. We drive much less, use slightly less fuel, and believe we produced more. Doesn’t make sense.

What the Energy Information Administration tells us is that while US consumption is declining the consumption in the rest of the world is increasing (JDH has reported the same info). What this seems to indicate is that the recent fall in the price of oil is not being driven by a reduction in world consumption.

So if the decline is not consumption driven is it supply driven? Not exactly. Supply is about the same.

So what is different? First President Bush has removed his opposition to offshore oil exploration and is actually talking seriously about opening drilling, the Republicans seem to like this as an election issue and so are holding a show in the House chambers that are giving the impression that they are serious about bringing it before the people, and finally the polls show that the people of states such as Florida that were opposed to offshore drilling have now changed their opinions. A majority of Americans want to drill new wells to increase the supply.

Speculators see that new sources of oil may be coming on line and rather than get caught by an increased supply and a falling price are driving the price down now by getting out of their long positions. The market is anticipating a fall in price and so is the price is falling.

If this does not materialize. If the Democrats are successful preventing new supply coming on line, the Republicans cave, and the market sees that supplies will remain tight falling prices could come to a screeching halt and could even begin to rise again. But this will probably not happen until after the November election.

Spencer, source and methodology please, a quick search wasn’t usefull.

Quick glance of EIA data doesn’t show much increase in energy consumption, but it only has first quarter 08, implying same or slightly less heating days. I saw NY data, they looked warmer this year.

From EIA June 2008 to 2007

Not very representative of the 24 hour period and I’m more concerned how much time my house gets above the low 70s and I’m there, thats when I start cooling.

I cant understand why consumption in FSU will increase only by 200k barrels per day while car sales in the region is above 50% yoy.

Data Point: Oil Demand

Higher prices mean lower demand: that's elementary economics. And rising oil prices should cut demand

I too picked up on the fact that ROW consumption of oil increased as US consumption declined.

This makes a lot of sense. The Chinese and Indians use very little oil per person. The key to their future prosperity is for them to use a lot more oil per person.

In a world where oil production is stagnant or declining, an increase in oil use per person in China almost by definition has to come from a decrease in oil use per person from someone in the US.

And the Chinese outnumber us 4 to 1, and the Indians outnumber us 3 to 1. So their per capita usage has a much higher multiplier than ours does.

You have to figure that, long term, oil prices are going to be high by the standards of the last ten years (oil at $10 to $145 a barrel). Maybe not $145 a barrel, but certainly a lot higher than $10, or $30, or even $80 a barrel.

DickF: I seriously doubt that oil prices are falling because the US may or may not add less than 1% to world supply, 5 or 10 years from now. The world’s oil system has about 2 months of supply as inventory (excluding strategic reserves). That’s enough for anticipated near-term events (weeks or a few months from now) to affect current prices — if Iran rattles the sabers convincingly, those with physical oil in inventory will be less inclined to part with it. But no one is drawing down their inventories in the anticipation that they can be refilled more cheaply in 2015.

Rather, economic indicators are suggesting that the recession will be both broader (Europe and Asia have not decoupled as well as some thought) and longer (housing, credit, and employment figures are still bad) than most people thought a few months ago.

“We drive much less, use slightly less fuel, and believe we produced more. Doesn’t make sense.”

Unless you consider the possibility that people might be carpooling, cycling, or using public transport.

“After the 70s, efficiency continued to improve despite falling prices.”

That’s not what I remember about the relationship between real prices and fleet efficiency (not just passenger car) between ~1988 and 2000. IIRC, prices fell while the efficiency stayed flat. Before and after that period, prices up, efficiency up. People respond to incentives and trade off at the margin.

lilnev,

Oil speculation is not a short term situation. You are talking current production. If oil exploration is opened up prices will decline before the first well is drilled because forward looking speculation. You have listened to too much Democrat spin and not thinking logically. What would you do if you were invested in a commodity the was expected to increase in supply relative to demand over the next 10 years? If you say nothing I would suggest that you not get in this business.

Conside the idea that Iran making noise causes such a huge spike in oil prices along side Russia invading Georgia and the potential decline in these oil sources. Iran is still rattling and now Russia has joined them but the price of oil is still falling. Hmmmmmmm!

I do agree with you that Europe is having more trouble than the main stream expected, but those of us who follow supply side principles have seen the European problem coming for some time. If you get more into the details of the European problem you will see that much of it is coming from France and Germany. Those two countries have changed toward more pro-growth administrations but their polilcies as weak as they are will take some time to have an impact on Europe.

A (Brief?) Sigh of Relief

With inflation hitting a 17-year high (subscription required) and foreign economic growth tanking (subscription