Here I relate some interesting new research on how to update economic forecasts with incoming daily data and the latest assessment of where things stand in Europe.

I’ve spent the last week visiting the European Central Bank in Frankfurt and Eurostat in Luxembourg. Europe is becoming a very exciting area for business cycle research, with a lot of bright and energetic people studying the nature of the new economic interactions among the European nations. One of the most interesting papers at the Eurostat conference I attended was by Gabriel Perez-Quiros, my former student who is now a well-known researcher at the Bank of Spain, and Maximo Camacho, one of Gabriel’s former students (which makes Maximo my grandchild, Gabriel says) who is now at the University of Murcia.

Camacho and Perez-Quiros’s paper sets out a state-space representation of the various data that arrive (or fail to arrive) during a given month and how they relate to an unobserved latent variable of interest such as a monthly factor driving euro-area GDP. Given a presumed structure of how each observed variable is related to the unobserved factor, Camacho and Perez-Quiros can then calculate the optimal forecast of quarterly GDP based on any arbitrary subset of the variables, such as the subset that is known as of some day d within a given month.

|

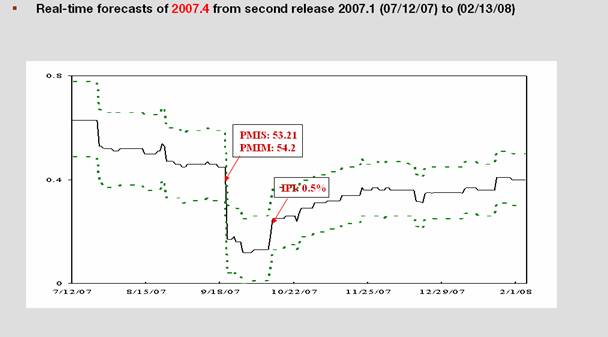

The figure above illustrates how the procedure works in practice. The graph plots what the model expected the growth rate for euro-area real GDP for 2007:Q4 (quoted at a quarterly rate) as new information arrived during the second half of 2007 and beginning of 2008. The most important single piece of news was a bearish euro area purchasing managers index released in September. That signal was partly reversed by a more favorable number for the euro-area industrial production index the next month.

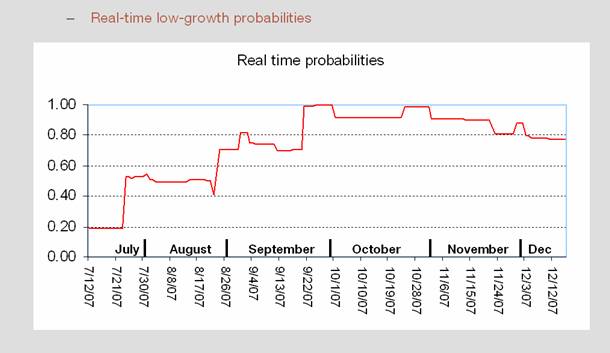

And what does their model say at the moment? It’s pretty confident we’re going to see negative real GDP growth for Europe for 2008:Q3.

They’ve also explored a version of their model with business-cycle phase shifts, along the lines of the multivariate model described in my paper with Marcelle Chauvet, a univariate GDP-based version of which forms the basis for our Econbrowser recession indicator index. Camacho and Perez-Quiros’s model seems to send a clear signal that Europe began its current “growth recession” over a year ago:

|

Technorati Tags: GDP,

European economy,

euro area GDP,

recession,

macroeconomics,

economics

So, can we expect a weaker Euro going forward? I made this bet about 3 weeks ago and got burned, but I think I was right in the medium term.

Daveg, what matters for the euro/dollar exchange rate is the growth rate of Europe relative to the U.S. News of a European recession has been arriving at the same time as news of an American recession, making the implications for the exchange rate unclear.

Dr. Hamilton – do you know if their framework is similar to that taken by Francis Diebold et al here?

Aruoba, Diebold and Scotti, 2008 (http://www.ssc.upenn.edu/~fdiebold/papers/paper77/ADS.pdf)

Both seem to be frameworks for dealing coherently with data arriving at different frequencies.

Robert Bell, the approaches have somewhat different philosophies of the underlying latent structure. Camacho and Perez-Quiros’s method is far simpler to implement.

Daveg and JDH:

Then, of course, there is the question of possible tectonic shifts. Any day now people may start to question whether the U.S. will ever repay its debts, but also whether all of the euro members will stick to the common currency.

JDH: Much obliged.

Professor i hope i will get some answer to this off topic question, but i am dying to know whats going to happen in future.

i have been reading everywhere that now we are heading towards a great depression and not much can be done to make the pain less.

by great depressions, people are predicting that unemployment(official) will shoot up as much as 10%.

housing will fall another 30%(panic sales and foreclosures) and will stay there for 4-5 years.

businesses are going to now start laying off preparing for a long recession and consumers are already maxed out and scared hence they will pull back sharply, sending the consumption on a cliff dive.

but i feel that if the government wanted it can definitely lessen the pain by doing the below:

1. backstop housing by buying and removing from market all default/foreclosure property(will the current bailout plan do it?)

2. FED interest rate lowered to 0.5%, and mortgage interest lowered to 5%(fannie and freddie are gov entities and can loan money infinitely)

3.more benefits given to home buyers to help housing(how about increasing the short term tax break from 7500 to 25000, which can also be financed from IRA or 401k with no penalty)

3.stimulus checks every three months to help consumer income

4.Faciliate interbank lending by being the middle man(use the trust of the government).

5. Massive infrastructure projects to support job.

6. Homeland security is still hiring though.

in other words…fight deflation and debt with inflation to stave off the sharp pain.

i think these are doable….but will they do it?

And so we`re going to see the European Central Bank that will lower the interest rates over the next few months? The market seems quite confident now, pricing a real slowdown of economic activity well underway.