July auto sales might be viewed as the first solid indicator of an improving U.S. economy. But what does it really tell us?

|

| Category | Month-to-month growth |

|---|---|

| domestic cars | 20.1% |

| imported cars | 21.7% |

| domestic trucks | 8.3% |

| imported trucks | 24.5% |

| all light vehicles | 16.1% |

Americans bought 995,000 light vehicles in July, a 16% increase over June and the best monthly report since August 2008. Domestically manufactured light trucks (which includes SUVs) lost market share but still achieved an 8% monthly sales gain. Sales of domestic cars, imported cars, and imported light trucks were all up more than 20% month to month.

|

|

If we’d seen these kinds of numbers in the absence of the cash for clunkers incentives, I would have viewed it as a strong suggestion that the economic recovery has begun. As is, I’m left wondering, and fundamentally not knowing, whether the auto figures signal the shift we’ve all been watching for, or sales stolen from September and October and delivered to July.

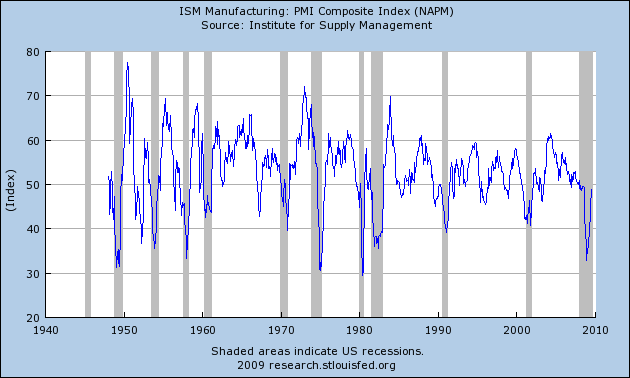

Another favorable indicator came from yesterday’s Manufacturing ISM Report On Business, whose July index was back up to 48.9. That’s still shy of the 50% point at which there would be as many establishments reporting things are getting better as say they are getting worse. But it’s much better than the very low readings we’d been getting previously.

|

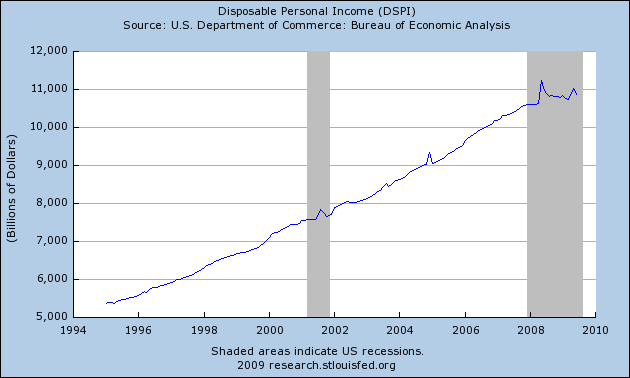

On the other hand, disposable personal income, which had been trending up the past few months, dipped back down again in June.

|

So I wish we had something else besides the auto numbers that would indicate that things have started to get better rather than simply reassuring us that things are getting worse more slowly than they used to be. I’ll be watching Thursday’s unemployment claims and Friday’s employment report with unusual interest this week. But Phil Rothman, like other forecasters, is predicting we lost another 350,000 jobs in July, or two to three times the number we’d need to add each month just to keep the unemployment rate from rising.

Re: The ISM report

The Production component is at 57.9%. And new orders is at 55.3%.

The recession is over. I think you should flip the little frowny face to at least something like this: http://img38.imageshack.us/img38/3053/samemoticon.gif

You don’t want to be late.

‘Cash for clunkers’ was a total waste. It is better to let these phase-outs happen naturally.

Why not a ‘cash for old PCs’ program? Trade in your old PC for a rebate on a new upgrade!! The tech industry is not riddled with unions and government cronyism the way autos are.

If PCs are a stupid idea, how is it that doing the same for cars is not?

Is the decline in DPI in June mainly payback for the stimulus-related gains in April & May? I believe the release said nominal PI x stimulus was down 0.1% in June after being flat in May (so still not good news).

At least while we continue to go “bumpty bump” at these low levels for a while, we won’t be using as much gas.

We’ve got that going for us.

Have you looked for an analogy to the post 9/11 car deals that spurred new car sales for a short period on 0% financing deals?

“If PCs are a stupid idea, how is it that doing the same for cars is not? ”

PC’s don’t consume oil.

I wonder whether some of the July bounce in car sales may have been in part postponements from June, in addition to frontloading from later months. People may have been waiting on DOT to issue the rules for the clunkers rebates. The cash-for-clunkers (CFC) bounce for July might also be overstated since people shopping earlier in the month may have postponed purchases in anticipation of the CFC program, which was only available the last few days of July. I suspect not all of those early July shoppers managed to squeeze their purchases into those few eligible July days and will be buying in August.

“If PCs are a stupid idea, how is it that doing the same for cars is not? ”

I think many states offer tax incentives for people to buy more energy efficient appliances and have been doing so for a number of years.

Not to mention the tax incentives in purchasing renewable power sources for your home.

JDH,

Can you explain how these improvements in the rate of change for things such as auto sales or house sales, along with month over month improvements in ISM or leading indicators impact quarterly GDP numbers?

For example, if the composite leading indicators are improving, but still far below their peak, what does that mean for GDP, which is also below peak? Does it imply growth?

I have a hard time believing our GDP per capita is improving when we as a nation are producing, earning and trading less than we did 18 months ago.

Anon said:

“”If PCs are a stupid idea, how is it that doing the same for cars is not? ”

PC’s don’t consume oil.”

PCs are made of oil, and consumer electricity, which in many areas is a product of oil.

The comment here is running along the lines of “I don’t like it, so it’s bad.” I’m not sure keeping our national obsession with cars alive is the right answer, any more than keeping the power elite in the financial industry tapped into Treasury is a good idea. But I really don’t see much value in “I don’t like it, so it’s bad” cluttering up comments.

I am actually a bit surprised that the consensus number jobs lost in July is 350,000, considering it was 467,000 in June. Just curious what people here think may account for the substantial improvement in this number (the rising stock market cannot be having that much of an effect, can it?)

James, you better follow CR in this matter:

http://www.calculatedriskblog.com/2009/08/ism-non-manufacturing-index-shows.html

Keys are RI and PCE : No recovery yet.

The end of cliff diving is not the same as green shoots.

Thanks for a great post. I have not been able to figure out the great news behind the government giving people money to buy cars and those people going and buying cars.

Thought I was missing a secret sauce formula there somewhere

MikeR: New home sales and new auto sales both contribute directly to GDP. As long as these get no worse than they were in 2009:Q2, the growth of GDP for Q3 would be better than it was in Q2. I think both are likely to be better than Q2, so will make a positive contribution to Q3. The question is what other components will do. Index of Leading Indicators and ISM are indicators only, and don’t directly figure in GDP.

jturner: Although I know a lot of people use this terminology, if 350,000 fewer people were working in July than in June, I would not characterize that as an “improvement.”

John Lee Hooker: I believe that CR and I are on exactly the same page at the moment.

Professor,

I agree with your skepticism and your reasons.

To add to those the minefields that are out there are freightening.

Will congress allow the Bush tax cuts to expire? That will in essence be a huge tax increase right in the middle of a serious contraction. Even if only those for incomes above $250k are allowed to expire that is a huge tax increase. With this tax bracket already paying most of teh taxes additional tax increases will have the smart players changing income for non-taxable assets. The result will be a huge decline in those making over $250k with a resulting decrease in government revenue. The way things are going this is almost a sure disaster.

Any health care bill is going to increase economic costs just as government revenues are declining. Anyone who has done the math knows that the rich cannot pay the bills. The Democrat congress has painted themselves into a corner and cannot implement pro-growth policies without totally changing their direction. This will not happen.

Cap-and-trade is till hanging out there and will be an economic disaster if the Senate follows the House. Obama will sign it no matter how bad it is.

I heard that the latest auction of t-bill was a disaster. This is just a hint of what is to come. No matter many times Geithner, or Hillary Clinton, or Pelosi, or anyone else begs China, Japan, or the UAE to buy t-bills they are not going to throw money down a toilet.

The deficit is out of control. Something will have to happen to pay government bills. We might be able to handle this with economic growth but the Democrats in change do not know how to generate growth. Or those who do, like Christine Romer, are so wrapped up in the Obama foolishness that they will have no influence either willfully or overwhelmed by politics. [As and aside, I predict that Christina Romer will be the first casualty of the Obama administration. I believe she will finally just not be able to take it any more.]

Card check could destroy the labor market. Increased union control of labor through intimidation will significantly raise labor costs and drive up unemployment.

As a matter of fact as I go down the list I do not see one thing that is positive for the future right now. We are in a sad situation.

JDH,

Thanks for that explanation. If wages are sticky in the short run, could not we have a much smaller GDP once the market clears at a lower wage?

I suppose people do not change their behavior much during a short two quarter recession. But what happens when the recession is much longer than expected?

For example, the auto industry infrastructure has capacity to build 16 to 17 million cars a year. When sales dip, say to 10 million, managers temporarily shut down factories and GDP declines. In the short term they do not permanently close factories. After an extended period, managers begin to realize that the new normal may be 13 to 14 million cars and they scrap capacity and fire furloughed workers. 13 million car sales is a huge improvement from 10 million but GDP could continue to fall due to the second order effects of a permenant loss of jobs and capacity (unless these are redeployed successfully).

11 million cars is the low level junk rate so 11 million sales are needed to maintain vehicles numbers.

Likewise 300-400K homes are demolished each year.

If car sales “green shoot” to 11 million consistently, we maintain vehicle units and millions of jobs are not needed in the automotive supply chain.

Same analogy holds for houses.

Looking for derivatives in these numbers is akin to the Titanic and Bizmarck bouncing on the ocean floor while the public waits for the refloat.

It is interesting to me the the greenest shoots are seen in the sectors that have seen the most government intervention – banks and autos.

So much for Reagan’s theory that government is the problem. In this millennium, government is the solution.

Now if we could only get government to focus its attention on jobs creation, the shoots would be abloom all over the land.

“PC’s don’t consume oil.”

No, but they do consume coal. I’m not sure that’s much better, though it improves the trade figures a bit.

I would say fewer Americans are employed building computers, computers and their components are built overseas more, the computer industry is smaller than the auto industry, fewer Americans own computers (still true?), and the government didn’t just buy two bankrupt computer makers.

I agree with GK that government trade-in subsidies aren’t the best idea, but when you’re desperate to help constituents…

I think the fact that Subaru sales were up 30% says a lot about the economy. People don’t buy Subarus for their ability to haul a boat or motorhome, their acceleration, or for “in-your-face” styling. They buy them because they’re economical, good value, and a solid if slightly staid choice. Just the thing if you’ve decided frugality is in but you don’t want a matchbox car.

With autos as an indicator, maybe we will see a cause and an effect reversed this time.

I am wondering about how is the simple regression model on initial unemployment claims, which you introduced, performing.

It’s doubtful that the Cash for Clunkers program, a short term stimulus, can affect longer-term trends materializing in the US economy. This theme – whether short-term government stimulus – can affect the long-term trajectory of our economy – is extremely relevant now.

It can be observed in the Fed’s quantitative easing programs as well. The Fed’s objectives in injecting newly created money into the economy through asset purchases was to drive down yields (encourage borrowing) and expand the money supply (encourage spending).

It’s doubtful that Q.E, a short term stimulus, can affect long-term, secular trends of the economy. The financial crisis seems to have marked a new era in which the savings rate will increase and deleveraging will prove to be a secular. I suspect the futility of Q.E will be common to the Cash for Clunkers program.

http://www.thesevenscholars.com

I agree wholeheartedly with Jay. All of the government measures are designed to help in the short run, and seem to ignore the long term consequences and potential dangers of such policies.

The difficult aspect of this is trying to protect and grow one’s investments in such a volatile and uncertain economic environment. It seems that the asset class which should benefit most is gold, because it is the one commodity that is both an inflation hedge and a safe haven, as well as not nearly as dependent on global demand, as opposed to oil and other commodities. And while gold has held up very well over the past couple years compared to most other assets, to me it is surprising that it has yet to sustain over the key $1,000 level.