Some are greeting Friday’s employment report as an all-clear signal. But my advice is, keep your helmet on– they’re still shooting real bullets out there.

Let’s start with the good news. I first called attention to the favorable turn in new claims for unemployment insurance on April 9, noting that in each of the previous 6 recessions, an economic recovery began within 8 weeks of the peak in new claims. On May 7, I concluded we had enough statistical evidence to predict with 85% confidence that new claims for unemployment insurance had indeed peaked at the beginning of April. Although there was some concern as to whether

seasonal adjustment could be confounding the July readings, it’s pretty clear now that the substantial decline in new claims is the real deal.

|

And many cheered Friday’s BLS release showing that nonfarm payroll employment fell by 247,000 workers in July, the smallest drop since August, 2008. But the problem is, if a traditional economic recovery had actually begun in June (8 weeks after the April peak in claims), the number of people with jobs should have increased in July rather than fallen by another quarter million.

| Period | Change in employment |

|---|---|

| Oct 70 to Jan 71 | +0.61% |

| Feb 75 to May 75 | -0.34% |

| Jun 80 to Sep 80 | +0.28% |

| Oct 82 to Jan 83 | -0.00% |

| Apr 91 to Jul 91 | +0.07% |

| Nov 01 to Feb 02 | -0.12% |

| Apr 09 to Jul 09 | -0.75% |

To put this in perspective, I took a look at where nonfarm payroll employment stood relative to where it had been at the time of the peak in unemployment claims for the current and each of the previous 6 episodes. I calculated the percentage change (measured as the change in the logarithm) in nonfarm payrolls between the month of the claims peak and the value 3 months later. To make sure we are looking at something comparable to the current real-time data available, in each case I used the figures as they would have actually been reported at the time (for example, the 2002 numbers come from the March 8, 2002 BLS release as reported by ALFRED). The current episode, in which employment has fallen by 0.75% since the April peak in new claims, is a clear outlier, even relative to the “jobless recoveries” of 1991 and 2002. President Obama had it exactly right when he declared, “As far as I’m concerned, we will not have a true recovery as long as we’re losing jobs.”

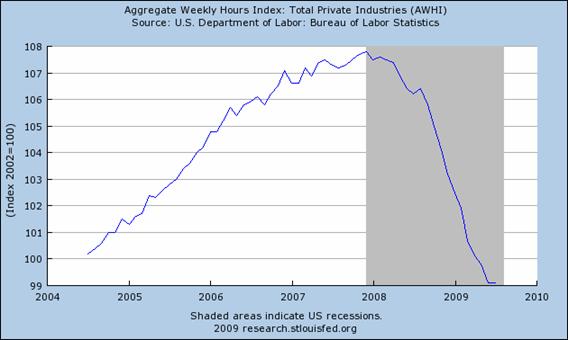

Jeff Frankel is cheered that the BLS index of the total number of hours worked held steady in July. That’s better news than if hours were still dropping, to be sure, but it’s far from enough to convince anybody that the tide has really turned if they weren’t already sold on the conclusion; see also Dean Baker on that ever-pesky seasonal adjustment issue.

|

Perhaps the loudest cheering over the BLS report was because the unemployment rate improved from 9.5% in June to 9.4% in July. But let’s look at how the net flows behind that calculation break down. The BLS only counts you as “unemployed” if you both (1) don’t have a job and (2) have taken active steps within the last 4 weeks to try to find a job. According to the household survey from which the unemployment rate is constructed, there were 155,000 Americans on net who quit or lost their jobs in July but didn’t immediately look for a new job, so those people newly without jobs don’t contribute positively to a higher unemployment rate. And 267,000 Americans who reported themselves to be unemployed in June still weren’t working in July but had also stopped actively looking for a job, so they’re no longer counted as unemployed. That last development is the reason the unemployment rate went down. But given the current environment, it’s hardly appropriate to interpret the fact that many people have simply stopped looking for jobs as reflecting an improving economy. Unless we get much better employment reports in September and October than we did in August, the unemployment rate is sure to climb back up.

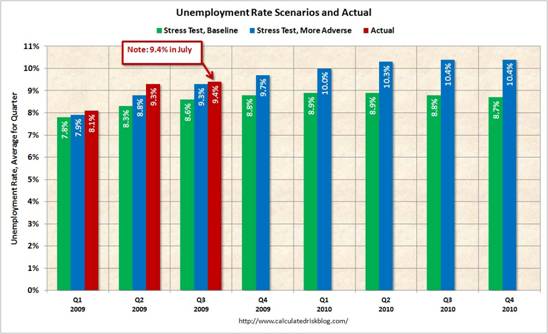

Rising unemployment could mean more foreclosures and bankruptcies, putting new stress on financial institutions. Calculated Risk notes that even the increases we’ve already seen put us above the “more adverse scenario” from the recent stress tests.

|

So party if you feel like it. The popular meme that the recession is now over could ultimately prove to be correct.

But it’s by no means guaranteed.

There will be more evidence this week when we find out that industrial production increased in July and has likely reached bottom. I think there is far more evidence than not that the recession is over.

“- they’re still shooting real bullets out there.”

James, agreement.

In this case I think Jeffrey Frankel is probably right and Dean Baker is unnecessarily nitpicking. The seasonal adjustment only changes the average workweek in manufacturing by 0.1 hours. Since manufacturing is now a relatively small sector in the economy, this will have a neglible effect on the overall workweek and aggregate hours. It’s a safe bet that productivity was up in July, so overall output likely rose. I’m willing to predict that the NBER will eventually call June as the last month of contraction when all is said and done (19 months is long enough). Thus we are witnessing the beginnings of the much expected jobloss recovery (the second one this decade).

Looking at the economy from a seat in industry, one has to ask, where will the new jobs come from? What sector will need new workers at productive labor?

The government and the government-subsidized seem the only growth sector obvious. Health care has a long term secular increase and maybe the defeat of the government takeover will allow the market to serve our citizens’ needs.

The population has re-discovered the virtues of frugality so personal spending is not likely to jump. The housing and financial sectors have overhang.

Low interest rates can be helpful, especially for infrastructure, but long term demand slump will temper massive investments, and hence jobs, there.

Anyone with a prediction?

Now it is down to optimism/pessimism in available information from opinion leaders. After 2 years of pessimism, I think optimists will get louder and louder and drive the recovery as soon as they conquer critical amount of information space.

With internet availability today, this will happen faster than in any previous recession despite the unemployment numbers.My belief is that the depth of this recession was clearly internet (information availability) driven as well – a fad.

There is no recovery by itself, it is realized by people and groups of people who has certain views about near term future. They follow certain new fad (fashion of how near term future may look).

The recession is likely not over. One in every nine people in America is on food stamps, foreclosures are still at or very near peak rates, commercial real estate financing is teetering on the verge of a significant correction, and this is the of year that municipalities conduct their tax claim sales for unpaid municipal property taxes. The unemployment rate may well have dropped all of one-tenth of one percent because of the number of people who are no longer eligible to collect benefits, and therefore are no longer counted as ‘unemployed’.

“Recessions” are not solely a function of the of the number of people working or not working.

Ken Sturz,

Whether or not you’re collecting unemployment benefits has no bearing on whether or not you’re counted as unemployed.

@Ken Sturz,

I’m not disagreeing with what you are saying in general but the following statement bears correction, because it is a missconception I keep reading over and over again:

“The unemployment rate may well have dropped all of one-tenth of one percent because of the number of people who are no longer eligible to collect benefits, and therefore are no longer counted as ‘unemployed’.”

To be counted as unemployed you merely must respond to the household survey by saying that you have no job but that you are looking for work. Whether you are receiving unemployment benefits or not is irrelevant (in fact less than half of the unemployed are receiving unemployment benefits). Actually the main reason the unemployment rate dropped last month, and this is perhaps equally disturbing, is that about half a million people gave up looking for work.

JDH, This may be a technical point, but you talk about seasonally adjusted unemployment data as if they reflected reality directly rather than a transformation of reality. In the unadjusted data the number of unemployed rose in July. So rather than say that people stopped looking for jobs, we should say that people who were expected to start looking for jobs didn’t do so. One doesn’t have to go out on much of a limb to hazard a guess as to who those people might be. I would suppose that, during a severe recession, students who might otherwise have been looking for jobs would have decided months ago to plan for some other type of summer activity. So in my view, the drop in unemployment tells us little one way or the other about the condition of today’s labor market and more about how the labor market was perceived during the spring.

Energy and related fields will provide employment. I speak to oil and gas strategy directors as a routine part of my work, and virtually all of them are reporting an improving environment. As one said to me, “We are moving from defense to offense.”

This is good news and bad news. With peak oil, the productivity of incremental oil production declines. For example, according to a May presentation from Baker Hughes, a leading drilling company, the top five oil field services companies (Baker Hughes, Halliburton, Schlumberger, Weatherford, BJ Services, NOV) added some 112,000 jobs during 2004-2008, an increase of 64%. These companies dominate oil field services across the globe. And by how much did these 112,000 new employees add to production? Not much, about 1 mbpd to the oil supply (maybe 2%, albeit with better results in natural gas). In other words, the incremental productivity of these employees appears to be declining, even as their sophistication and cost are growing.

So we expect energy and commodities to add employment, a significant portion of that in the high tech engineering and information systems areas. This struggle to maintain current energy production may crowd out other activities, and that’s mostly bad news, even if it supports employment.

Mr. Kopits,

I am glad to hear that other sub-sectors of energy business are also growing. We’ve choked off essential energy developments for too long.

As a nuclear engineer I could have added that our business of building new nuclear power plants is going very well. We are adding many new jobs but nuclear is such a small slice of the energy business that nuclear alone won’t make a dent in the unemployment numbers. Plus, we need highly specialized workers.

Professor Hamilton had a post a week or two ago about the folly of claiming “green jobs” were some great benefit to the economy.

A GDP that is solely based on consumption (~70%) and government spending (~30%), unemployment can’t be a lagging indicator: who’s going to buy things and pay taxes? Revolving credit(not housing) has lead us out of every recession since ’70 and now it’s in the negative for the first time since it was recorded…government is insolvent…and you know there’s a real problem when savings rate hits into positive numbers and economists start talking about the “paradox of thrift”, well, that can’t be good…Yeah, it’s just a recession, as the value of the dollar devalues and the interest on bonds begins to sky rocket because the Feds aren’t printing up enough money to buy them back fast enough…but hey, green shoots–oh, participation rate of the Employment situation went down, 400k Americans have just disappeared as far as the BLS is concerned (and the 150k add to the work force every month?)…but, hey, it’s only a recession (for now); give it another six months.

I think lagging indicator (as the unemployment rate higher during recovery) is not yet come.

There is still a tread in unemployment rate but i believe the economy is in recovery now.

Because most view the economy from a demand side model everyone is assuming that this is just a “normal business cycle” that is larger than normal(?) What is not discussed or even recognized is that the current deficit and government spending programs plus the plans to increase sending on such things as expanding unemployment insurance are going to require sources of government revenue. This could come from taxes, inflation, borrowing, or economic growth.

What we are seeing is our government rushing headlong into the prohibitive range of the Laffer curve. It seems pretty clear that a mix of the first three will be the plan of action.

But we should know by now that increasing taxes while the economy is in the prohibitive range of the Laffer curve will reduce not increase tax revenue. Strike one.

Inflation is already putting pressure and limiting the options of the FED and if it finally explodes we could face a huge stagflation greater the that of Jimmy Carter. Strike two.

The most recent Treasury auction was a disaster. The FED seemed to be the only buyer. To sell Treasury debt will require higher interest rates even as the FED forces down the FFR. Strike three.

So what does that mean. Growth is out!

No matter what the graphs, equations, and historical analysis say the policies of our government are pushing us to greater and greater unemployment.

Service sector employment is almost ten times manufacturing employment and the average work week in the service sector also expanded last month for the first time since last August.

Maybe the BLS should change the format of the report to show the work week in services in the summary as well as in manufacturing. The current practice of just highlighting manufacturing hours is really an old economy tradition that should be changed. Now you have to dig way down in the report to get this info so reporters and commentators do not see it on a timely basis.

JDH,

Thank you for this post. This is exactly the analysis I was looking for in some of my previous comments on your employment related posts.

A simple one factor model of real GDP:

% change in real GDP = a + b * (% change in jobs)

The t-stat on b is positive and significant.

Residuals from this model suggest that GDP growth stays negative in Q3.

Because this is autocorrelated time series data, this model violates assumptions of OLS. But the point remains.

There is a great deal of well founded pessimism about the likelihood of a rapid V shaped recovery from this recession. High unemployment and depressed income levels make a rebound in residential construction, retail sales and business investment unlikely.

Returning to the 64.3% employment/population ratio of 1999-2000 would necessitate an 11+ percent increase in private sector employment in just two years (or a 13% increase in three years). A challenge for sure, but not impossible. Four times in the last 70 years, private sector employment has grown by more than 11 percent in just 24 months. Three of them were war related: entry into World War 2, demobilization after WW2 and entry into the Korean War. The peace time example was from January 1977 to January 1979 when private employment rose 11.5 percent. This two year period also set a 50 year record for percentage increase in total hours worked in the non-farm economy and for increases in the employment-population ratio.

What caused such remarkable growth in 1977 and 1978? Answer: a generous TEMPORARY Federal tax credit for increases in employment above 102 percent of the firm’s 1976 level of employment.

The Democratic Congress elected in 1976 arrived in Washington at a time of high unemployment, anemic (3.4% during 1976) employment growth and rising inflation due to the quadrupling of world oil prices in 1973-74. It responded with a temporary New Jobs Tax Credit (NJTC) for 1977 and 1978 that lowered the marginal cost of expanding a firm’s workforce by roughly 15 percent on average (more for low wage and high turnover firms). Despite foot dragging by the IRS, one third of the nation’s private employers received NJTC credits that lowered their 1978 taxes by $3.1 billion. By the final quarter of 1978, capacity utilization had spiked, real output had increased 15 percent and unemployment had dropped from 7.8 to 5.9 percent.

The expiration of the NJTC at the end of 1978 did not unravel these effects. During the next 12 months, output and employment continued to grow albeit at a slower pace and the employment-population ratio and unemployment rate were stable.

The later 1980 and 1982-83 recessions were caused by the 160% increase in oil prices precipitated by the Iranian revolution & the Iran/Iraq war and the Federal Reserve response to inflationary consequences of the oil shock.

http://digitalcommons.ilr.cornell.edu/articles/184/

The leading edge of the Boomer generation is now 62. They can now take early retirement through Social Security.

Where is the next boom going to come from? Who knows. But it is a fact that lots of Boomers are retiring, voluntarily or not. Their replacements have to come from somewhere.

How many of the 155k workers who dropped out of the labor force were 62 year old Boomers? I know of 1 for a fact, my old man retired as of Aug 1st.

It is my opinion that the reduction in the amount of workers applying for unemployment is only 1/2 of the issue. Simply, most of these workers whose unemployment benefits have expired have not found new work and they remain unemployed. Additionally, there are hundreds of thousands of formerly self-employed workers that are not entitled to unemployment benefits such as real estate brokers, attorneys, builders, home improvement companies, landscapers, interior designers, financial service professionals, etc. These workers are not factored into the unemployment statistics and are earning little, if any income. They are surviving on their savings, checking, retirement and overdraft accounts and will be for several more years.

The difference between the conditions now and in the past make it likely the real bullets will last for some time.

a)the reflexive nature of markets (i.e. stock market anticipation of recovery will actually create the recovery itself) won’t work when there is large divergence in social equity. Basically 40% or so % of population is broke, unable to borrow against their homes etc. to keep up with positional goods consumption and won’t participate in the bear market stock rally. As GDP is 70% consumer spending, the only thing keeping it going is the trading of future obligations (government TALP, TALF, clunkers, etc.) for current consumption, all at risk to dollar/bonds.

b)the longer this lasts, the worse the coming energy crunch will be. 1)low prices on average favor marginal production in only the cheapest of areas, most of which are not in US, 2)in any future recovery a higher % of ENERGY will be spent to get energy than in the past, leaving less for consumer/etc. and 3)non-energy inputs are starting to be limiting (see nuclear plant shutdowns due to low rivers), 4)a large % of energy infrastructure (rigs, pipelines, etc.) is in need of rebuilding, which is another resource cost)

But social equity is the key thing folks are missing. Capitalism – the rules, the system, etc. only work if everyone feels as if they have a chance – leverage, credit and imported oil have camoflaged the increasing wealth disparity – without some new technological breakthrough or energy surplus, the debts we have incurred to keep this system from breaking won’t be repaid.

Finally, I think the DJIA will be increasingly disconnected as a valid marker for the health of our system – too many games being played, and too many traditional participants asking ‘what is a dollar worth’, etc.

I don’t expect a recovery.

So, should we think about the recession probably being over this quarter, or should we think that we have reached the first “V” bottom in a “W” recession scenario? And how can we possibly tell the difference?

“Energy and related fields will provide employment. I speak to oil and gas strategy directors as a routine part of my work, and virtually all of them are reporting an improving environment. As one said to me, “We are moving from defense to offense.”

Steve,

Actually the employment situation in the Oil & Gas services industry is quite dire, particularly in North America, where gas driven drilling activity has collapsed. It is similar to ’86 with many of the smaller companies on the ropes or going out of business. I estimate that at least 1 in 3 have lost their job since the beginning of the year.

You are correct that it will recover but it will probably take another year before significant re-hiring takes place. There is another factor not well understood and that is the secondary jobs that Oil & Gas services provides…countess diners, motels, gas stations, and heavy hauling trucks and associated equipment are needed by the industry when active. The layoffs of motel & diner staff across oil & gas producing regions may not be identified statistically as Oil & Gas related. Oil & Gas workers need to eat and sleep and the collapse that we have seen this year has a huge knock on effect in many remote regions – countless small towns across middle America are now hurting.

I agree with Buzzcut wrote “there are hundreds of thousands of formerly self-employed workers that are not entitled to unemployment benefits such as real estate brokers, attorneys, builders, home improvement companies, landscapers, interior designers, financial service professionals, etc. These workers are not factored into the unemployment statistics and are earning little, if any income.”

Its true but there is no way to measure that group

I have high confidence that the statistics will be gamed to show a recovery, when it’s politically required, because the recovery won’t show up until it’s politically conjured into existence.

A real recovery won’t be coming, because this is a permanent structure change. Get used to being able to earn less income.

I think the upcoming Christmas shopping season will be the real test of whether we have truly bottomed. That is the key season when the volume of consume-or-save decision-making spikes. On one hand, Americans are highly resistant to cutting back consumption – they won’t increase savings as much as rational economists think they should. On the other hand, the job market definitely won’t bottom before Christmas, and the financial markets’ recent “easing”-driven exuberance could bust and crash.

So what was the cost of temporarily halting our economic crash? Oh something like an additional $5 Trillion dollars in debt has been added to the economy. The funny thing about debt…is that it does not go away unless you are paying against it at a faster rate than the interest accrues.

The US is in no better shape than GM was when it declared it’s financial troubles over 3 years ago because it was able to go into the debt markets and borrow enough long term money to paper over its short term obligations. But at the time, it was clear to anyone with a brain that GM was doomed, because its debt service was growing faster than its profit could be expected (by anyone who does not believe in the tooth fairy) to grow.

The US as a whole is now in the exact same situation. The private sector was undergoing debt saturation…so Uncle Sam stepped in and shifted a ton of debt to the public sector…but the most growth that can be expected by any rational person is far below the rate of growth in our debt service.

We have thrown everything we have at this…and the best we can do is postpone the inevitable and complete collapse. You can not borrow your way to prosperity.

From 1938 to 1992…debt to GDP in the US averaged 160%. We are currently at 380% and skyrocketing. Meanwhile, morons in economic circles…and morons here proclaim the worst is over by curve fitting. Don’t you all see that it is curve fitting that got us here?

Anybody else worried about the “deflationary spiral” in Japan? How can a recovery be in progress with this sort of action going on?

See http://www.rte.ie/business/2009/0828/japan.html