Is this as good as it gets? For the time being at least, it seems to be.

The Chicago Fed national Activity Index fell from -0.04 in January to -0.64 in February, leaving it well above the recession trough, but still below the normal or trend value of zero.

|

A negative value for this index is not that uncommon during an expansion, but not what we’d like to be seeing at this point, either.

|

The Aruoba-Diebold-Scotti Business Conditions Index is also up significantly from its recent trough, but has been trending back down into negative territory with the last few weeks’ data on new claims for unemployment insurance.

|

Again, a negative reading is not that unusual, but not what we want to be seeing.

|

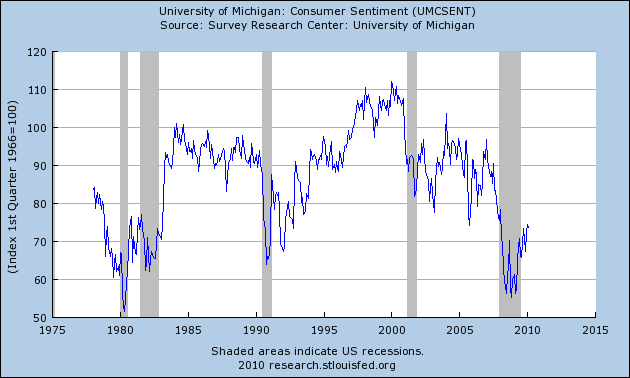

Consumer sentiment has rebounded from its low point of the recession, but is still floundering at very low levels.

|

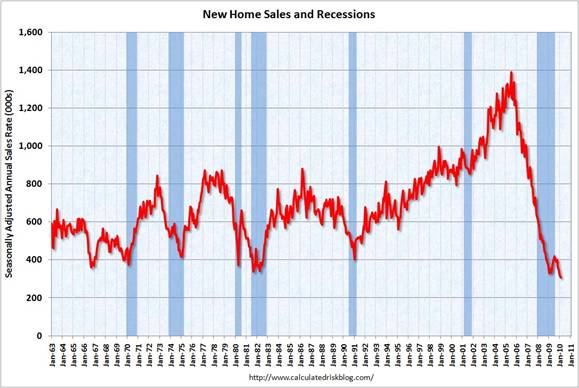

The same could be said of autos. And seasonally adjusted new home sales in February were at the lowest level since the series began in 1963.

|

And for the rest of the year? Bill McBride ([1], [2]) is predicting sluggish and choppy growth– in other words, more of the same.

Weather in February (the East Coast snowstorms in particular) probably pushed many of the February numbers down, so I wouldn’t get too worried about the recovery until we see some more March data.

“so I wouldn’t get too worried about the recovery”

This “recovery” is being driven by fiscal stimulus and inventory correction. These factors will negatively impact GDP in the second half.

I’ve been wondering when someone is going to come up with a bubble adjusted(downward) expectation for “recovery”. If we are going to use 2005-2006 as the baseline for GDP and employment, then we have set the bar way to high.

There is a link between autos and housing booms in my seat of the pants estimation. One enables the purchase of the other. But GM says they have downsized their estimate of annual US auto demand from 15M units to 12M units.

I would think that economists should gone-size their “output gap” calculations to account for autos, auto parts, real estate agents, loan brokers, housing and commercial real estate construction.

I can’t remember now if it was JDH or Menzi who posted charts breaking down unemployment into industry segments (banking, manufacturing and construction, if I recall correctly). The data was a little surprising in that it showed a larger percentage job loss in manufacturing than in the sectors intuitively impacted by the bubble bursting. But it would be interesting to see the manufacturing data broken down further into auto vs non-auto job losses if it exists in that form.

As usual I have been hearing that the US needs to create a new industry to replace the ones that disappeared somewhere. This go around I hear it’s bio-tech and nano-tech, but I think only the upper quartile of Menza club members need apply, and mastering quantum physics and DNA engineering is beyond the reach of even the most capable Wall Street quant. (tho I’m quite sure real estate agents would accept the offer , if asked)

As for New Home Sales. As one can see from the graphic, it hasn’t happened before, since the start of the data recording, that New Home Sales fell back to or fell below the low of a recession only shortly after the recession had ended and without having a new recession. New home sales always went up significantly starting with the end of a recession followed by a sustained recovery. What does this mean? I see following possibilities: 1. the recession actually didn’t end in summer 2009; 2. we have already been heading to a new recession starting not so many months from here; 3. This time it’s different, it’s a statistical outlier.

Which one is it?

rc

The growth curve for Europe looks alike P3 ECB monthly bulletin March, the main issues remain why should major growth be expected when constraints are still in place?

Current accounts,public debts,financial institutions accounts.. (not to be expected to reach a plateau before 2013 should primary deficits flows not be reduced before)

IMF or P Rogoff /C Reinhard statistical models have shown recoveries to be taking place at debts picks and not before.The same bulletin is prompt to add a caveat to growth forecast that is a potential public debts turmoil in the financial markets.One has to assume that only large population economy would be the catalyst for such a turmoil.Choices are abundant for those having structural imbalances.

As an aside it is interesting to read the equities profits expectations P41,the non financial profits to be behind P48 and loans contraction to be added to the pleas of the real economy.

“Which one is it?”

It might be and artifact from the gov’t home credit. Without it, no spike and no falloff after the spike. Instead, we might have seen a bottom form and the start of a recovery by now.

I haven’t figured out how to make fancy plots, nor quite how to represent my current interest, but I suggest marking tax hikes and tax cuts on your graphs like the nber business cycle determinations are. I think adding government investment spending (infrastructure, R&D, war, disaster response) changes would also be instructive.

In my efforts so far, I find tax hikes most frequently come at the end of a recession, and tax cuts at the beginning, which raises the question of causality. But if the Congress can anticipate the business cycle months in advance in order to cut taxes the month the recession begins, and hike taxes two-three months before employment growth begins, why can’t the economists and policy makers at the Fed, nber, etc so actions can be taken to stave off or reduce the depth of recessions.

The hypothesis I have is that taxes are cut when the mood of the nation is “free lunch,” so the economy is driven by the short term easy money, while tax hikes come when everyone realizes there are no free lunches and the only way to a better future is sacrifice and lots of hard work and investment.

What exactly is a “textbook recovery”?

David: See this and

this.

mulp,

cactus at the Angry Bear blog has done work that addresses the link between tax policy changes and growth. In general, the link is not a strong one. More generally, responsible fiscal policy, rather than tax cuts or hikes, seems to be associated with good economic growth. That leaves the direction of causation open to question, though there is a good chance causation runs in both directions. That work has been rounded up into a book:

http://www.amazon.com/gp/product/1579128351?ie=UTF8&tag=angr0b-20&linkCode=as2&camp=1789&creative=9325&creativeASIN=1579128351%20color:%20FF0033

The question has been raised about the “reality” of the end of recession. I think asking that question may lead us down an unproductive path. “Recession” is whatever NBER says it is, and they won’t say for some time yet. The motive for the question, though, seems likely to lead us in a very useful direction. What caused the rebound in output (if there has, in fact, been a rebound – GDI data so far say there has not)? Typical leaders in a rebound are housing and vehicle sales, and they aren’t leading. The end of inventory shedding is also a very common spur to growth early in an expansion, and we have seen a good bit of that. The rationale for government stimulus is to fill the gap left by private demand, and with housing and cars not filling their traditional role, fiscal policy could potentially play a larger role in this expansion than is normal. Credit expansion is usually associated with recovery, and we aren’t seeing that, either. Credit expansion fuels expansion in business and household spending – there’s that problem with cars and houses again – so if there is to be much expansion while banks are on vacation, it will probably have to rely on fiscal policy. Monetary policy is hampered when banks don’t expand lending in response to expanded base money growth.

So yes, the expansion so far is due mostly to restocking and fiscal expansion. The issue that faces policy makers is whether to continue to fill the gap till private demand growth broadens, or to pull back. We don’t know when the Fed will pull back, though it will stop shoveling next week. Fiscal policy makers seem set on more small measures, but a number of them, to top up the ARRA.

I was taking a look at new home starts and sales. The figures aren’t so hot, in fact they’re pretty awful even when seasonally adjusted.

How much of that is due to the weather this year? I hope it just means that March/April will look that much better.

Chris,

Mortgages applications for purchase are near the lowest level in 13 years, lower than at any point so far in the housing slump. There are distortions in mortgage applications data, so comparisons between periods are tricky, but “lowest so far in the housing slump” doesn’t look all that good. Until there is a pick-up in mortgage activity, don’t look for sales to improve much.

Related to the last couple comments: Alan Greenspan says it is has bottomed.

http://www.cnbc.com/id/36030810

The recent moves on the Treasury market are interesting, and demonstrate well what happens when the Fed’s de facto policy stance turns, as it has in the past two weeks. Reserves shrank >$40b in the past two weekly reporting periods, as a result of smaller MBS purchases and deposits into the Treasury supplementary account.

Tom,

PIMCO has been sounding the warning call for a re-pricing in bonds. Bill Gross was on CNBC yesterday with a dour outlook for his portfolio. Odd thing was in February he added substantial positions in his Total Return Fund (now $200B+) that he manages personally. But they were in the lower to mid duration end. But what’s a bond manager to do?

I’m patiently waiting in cash to see if there is such a thing as “bond vigilantes”. After being treated like Santa Claus for so long, a chance to be visited by the Tooth Fairy sounds really good.

We are sure to get some odd event risk as we go along however.

PIIGS are making dollars (and short end Treasuries) look good, China tensions pushing the other way, and everyone is wondering how long Japan and Britain can do their levitating act.

Almost makes me want to transfer my account to Australia, but the Aussie buck is way up, so I’d be buying at the top, and the Chinese just announced a trade DEFICIT for March, indicating that maybe they don’t need to do so much iron ore biz with the Aussies anymore.

So I’m just frozen in my confused state of mind with the ole nest egg sitting idle in my Canadian-American broker account (TD Ameritrade), who has “swept” it into the Canadian-American banking division to do who knows what with it.

Here is a more sophisticated view of something new going on, from Morgan Stanley via Zero hedge.

The 10 year swap spread just went negative.

Here’s the article to read about what they think that means.

http://www.zerohedge.com/article/more-meets-bottom-line-are-banks-getting-crushed-due-negative-swap-spreads-and-190-trillion-