On Saturday I commented on whether

rising oil prices threaten the economic recovery. Here are some quick links to perspectives from other observers.

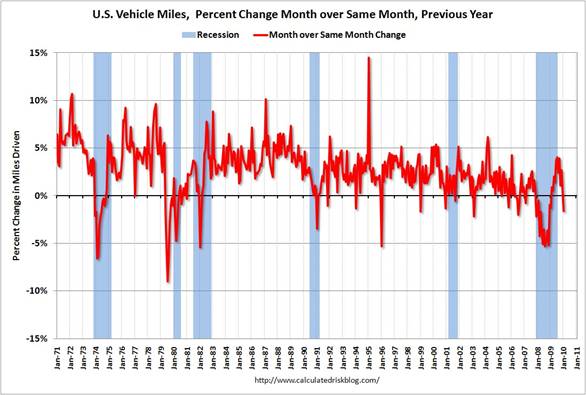

Bill McBride shares my conclusion that the recent rise in oil prices is not enough to cause a double-dip recession, though if vehicle miles driven continue to decline, he says that would make him more concerned.

|

New Deal Democrat links to a number of other analyses, including Steve Kopits’ view that the U.S. runs into problems whenever our crude oil expenditures exceed 4% of GDP. Here is a graph I produced similar to Steve’s. Eighty-five dollar oil is about the point at which the 4% threshold would again get crossed.

|

I’ve often looked instead at consumption expenditures on energy goods and services as a percentage of total personal consumption spending. Here is an update of that graph that includes the February data, which brought the share up to 5.9%.

|

And it’s always worth listening to what Tim Duy has to say. Tim’s view is that despite oil prices and other worries, the economic recovery looks to him to be sustainable.

Deutsche Bank Energy Analyst Adam Sieminski argued at the Energy Information Administration conference in Washington last week that 5-6% of global GDP is the tipping point.

http://www.eia.doe.gov/conference/2010/session5/sieminski.pdf

JDH wrote:

New Deal Democrat links to a number of other analyses, including Steve Kopits’ view that the U.S. runs into problems whenever our crude oil expenditures exceed 4% of GDP. Here is a graph I produced similar to Steve’s. Eighty-five dollar oil is about the point at which the 4% threshold would again get crossed.

Is this because of the relative high price of oil or a relatively low or declining level of GDP? As inflation sends the price of oil up and contraction brings GDP down it seems that this conclusion could be a confusion of cause and effect. The measure of oil as a percentage of GDP actually gives us nothing but a ratio. It does not give us cause. I think you will find that the economy (GDP) is distressed long before oil reaches 4% of GDP.

An interesting analysis is to look at the share of personal consumption expenditures on both autos and energy. As spending on energy rises, spending on autos fall. It is almost a direct one-to-one relationship.

As Jim indicates in the respective chart above, the US has tended to enter recession when crude oil consumption exceeds approximately 4% of GDP. However, it is not clear whether this threshold also applies during the periods of economic recovery (as opposed to at the end of a business cycle). Can an economy sustain a higher oil price when entering a new business cycle? An autopsy on post-1973 and post-1979 period could be instructive. It doesn’t feel right now like the US is headed back into recession at current oil prices, which are pretty close to the 4% threshold.

However, it is not clear whether US oil consumption can grow at current prices. The March EIA data were pretty weak on the consumption side, with inventories growing across the board. This may be due purely to seasonal factors. Time will tell, but the historical data suggest that the US reduces crude oil expenditure when it exceeds the 4% threshold, and I think the evidence suggests this reality remains unchanged. At current oil prices, US consumption seems unlikely to grow materially.

If so, then this constitutes just one more constraint on recovery; that is, jobs must be recovered without using more oil in aggregate. In other words, we face an oil-less recovery. The specific, quantitive relationship between oil prices and growth in employment is not clear to me; this topic would be worthy of a bit of analysis in its own right as the administration contemplates energy and economic policy in a world of high-priced oil.

You are assuming a real recovery.

How about the following facts:

85% of earnings gains are in the financial sector.

Mortgage asset extend and pretend lets home “owners” live for free and spend their income.

Asset valuations and writedowns: at least 2.000 billions are still missing. Accounting standards have let the banks play an extend and pretend game.

Credit, which has been available to oil consumers for decades, is now not there anymore.

Add government spending. Add the deficit which makes spending unsustainable. Gov would have to raise taxes like mad (like it did in 1933).

Raising taxes would imply crass capital controls.

We are going nowhere. Except, maybe, straight to hell.

;-))

The economy and the stock market are loosely connected, so a related matter is looking at the effect of oil and other commodity prices on profit margins.

Adam Parker at Bernstein wrote an interesting note suggesting that 2009 improvements in profit margins were at least partly due to temporary decreases in commodity prices and labor costs (as well as other effects). He suggests that the recent run-up in commodities is likely to show current profit expectations are too high. The study is available in the “Long Room” at the Financial Times (free registration required):

http://discussions.ft.com/longroom/files/attachment/b/e/bestofbernsteinq2.pdf

Sure, in isolation, oil prices, while high, look to be palatable.

However, as long-term interest rates are now rising — and should Greece pull down the EU/IMF loans next week, as it now appears that they might, sovereign interest rates should restart their move north — one cannot look at oil prices in isolation.

Federal stimulus effects wearing off; state and local belt tightening now underway; interest rates moving up –> falling consumption –> resumed falls in employment –> falling GDP –> we’ll rise above the various ratio threshholds this fall and winter.

With other mitigating factors (slow/poor housing), depressed access to capital and now increasing energy prices, can we now call this a real recovery?

I think you should probably be looking at the big picture. Brent crude is currently $2.30 above WTI, This means that Europe is willing to pay more for lower grades of crude than we are and this is showing up in the U.S. import data from EIA.

http://tonto.eia.doe.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=wttntus2&f=4

The flow of Oil coming into the U.S. is falling off a cliff, while world production has stayed the same since about 2005. This can only mean one thing, that world oil exports are being diverted somewhere else, probably China.

We simply do not have enough oil available at a reasonable price in the U.S. to build any kind of sustainable recovery.

If China plans to revalue the yuan, wouldn’t it make sense for them to wait until after the revaluation and use fewer yuan to buy dollar denominated oil?

By my calculations the amount of nominal dollars being spent on oil in the US is at its highest level since September 2008. This despite oil consumption being about 5% lower than the level of two years ago.

It appears to be a trend – spending more for less oil – that is likely to continue, unless consumption in the emerging markets slows down. Definitely a headwind for the US economy.

Your views on this topic are really interesting and worth a read. Crude oil fell as on speculation the commoditys climb high has outpaced a recovery in global demand.

JDH, a new chart of miles driven is out, and February is down again to -2.9%. Of course, February 2009 was a pretty rough month itself. Your thoughts would be interesting as a follow up, but my quick observation is that every time we have been this low, we have been in recession.

Seems to me sustained high oil prices will drive capital investment and a shift in consumer durable goods buying. And that suggests a shift from dollars shipped overseas for burning to dollars spent in the US being thrown at workers.

For those consumers who have deferred buying a new car for two years, they are more likely to buy a high mileage vehicle. Even cars from foreign automakers are very likely to involve US manufacturing labor.

For building heated with oil and propane, the high costs of fuel make switch to ground source heat pumps, and for industry with a need for industrial heat, cogen, have a much more favorable payback, especially with tax incentives. A big part of the costs of these investments is installation specific labor.

Residential energy efficiencies become more likely if states come up with programs to promote them, although local dealers and installers can create their own market in conjunction with energy suppliers.

(I remember the 70s and early 80s when lots of homeowners were converting from electric heat in NH, built when Seabrook nuclear was going to produce cheap power.)

Add in solar water heating to augment hot water and heating, more insulation, more efficient appliances. That is consumption that has actual cost savings that increase over time.

The question to be answered is “Are Americans willing to return to capitalism?”

Those who argue high energy costs will limit growth are those who argue Americans refuse to be capitalists, instead looking only for free lunch of cheap consumption with no sacrifices to achieve much better life in the future.