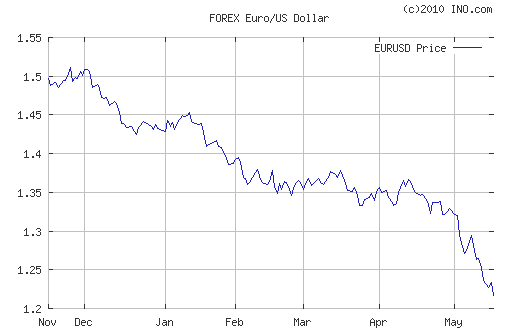

Since mid-April, the euro has depreciated 10% against the U.S. dollar and European stocks have lost 17% of their value. But markets aren’t acting as though the problems will be confined to Europe.

|

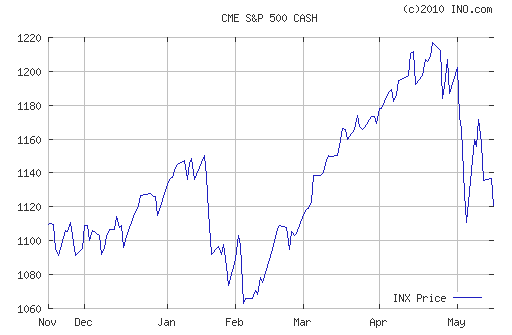

Since April 15, the S&P500 index of U.S. stock prices and Japan’s Nikkei 225 are both down about 8%. China’s SSE is down 18%, presumably weighed down by domestic concerns in addition to any reaction to developments in Europe.

|

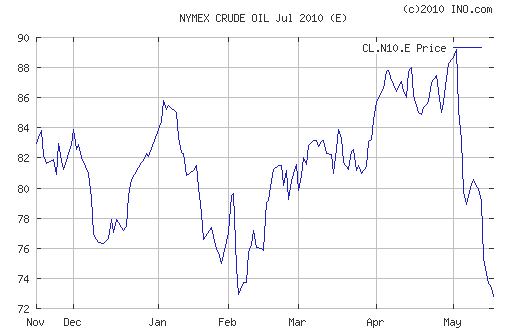

The dollar prices of aluminum, copper, and oil are each down 16-19% as well.

|

|

|

The curious thing is that those last four graphs all look the same. Which suggests to my simple mind that recent market moves have a common driving factor.

The natural explanation would seem to be that markets have interpreted developments over the last month as bad news in terms of the quantities of basic raw materials that global customers will want to buy and in terms of the profits that companies around the world can expect to earn.

Such concerns would have to come not just from the fact that the European countries forced into budget austerity measures are going to be buying less. Worries about sovereign debt could translate into a reduced willingness to lend to any number of private borrowers in a potential replay of the credit crunch that brought the world economy crashing down in the fall of 2008.

So far such concerns have not had a major effect on banks’ borrowing costs. The TED spread has climbed 15 basis points since April 15, but is still nowhere near the levels we saw during the dramatic credit events of 2008.

|

Moreover, the declines in stock market values and commodity prices since April have only served to reverse the gains in March. So perhaps it’s most accurate to describe developments so far not as a conviction that we’re on the verge of replaying events of 2008, but simply as a realization that the global economic recovery is not as strong as it appeared to be just a month ago.

But the news coming next out of Europe and China will be watched with great interest by the rest of the world.

Regarding oil. Its curious that European demand worries do not seem to be affecting the Brent oil prices as much as WTI oil prices. I have the feeling the larger rout in US-centric WTI futures reflects a large unwinding of speculative positions.

Professor Hamilton

The axiom is the word “markets” when they are and were no markets at prices matching incomes,revenues actual not even expected.The risks are not factored,but the liquidities are continuously in demand to nurture either a price of the past or a realized risk.The states made the markets,the states keep the markets,corporate strategies were a public vote and the failure a public debt (see the outstanding real estates loans in the books of the Spanish banks as a percentage of its GDP,see the external outstanding exposure of the UK banks as a percentage of its GDP). Remember that a bank has obligation to declare to its Central bank of domicile its outstanding loans and guarantees exposure naming debtors entities and by sector when overstepping a percentage of its owned funds.That is to provide a clear understanding of their exposures (same in USA).

What should have been private sectors matters has now naturally turned as governments routine.

Yes. Oddly enough, “officialdom” has just gotten around to getting “better than we expected just 3 months ago” into the standard text, and now are are facing worse than we expected just a month ago. That is, after all, what a mess does to the data – never quite what you expected.

Interesting fact, but an old one: that asset prices are more highly correlated across countries than economic fundamentals (GDP, consumption, whatever). True of equity returns, short rates, lots of other stuff. Standard interpretation is that it has more to do with pricing than cash flows.

nice review, i dont have an answer either whether europe could w china derail the world, but for now think not?

commodity prices make me most nervous, but hard to sort out lower future demand vs dollar strength and expectation of more?

For all the hysteria about the declining euro, is it not the case that it is still somewhat overvalued relative to the dollar on PPP? A bit more of a decline is probably not a bad thing.

Excellent post, James.

Until recently part of the perceived strength of the recovery was based on the assumption that the dollar would depreciate and ease the US debt burden and boost US exports. The GIIPS issues have of course caused the dollar to rise instead and so it seems that the outlook adjusted accordingly. That outlook being adjusted downward by the realization that the shortfall in global aggregate demand has been obscured more than what was previously known by bubbles and unsustainable debt levels.

Barkley,

Blasphemy!!

But of course you are right. None of the inflationists were concerned when the dollar was losing value against the euro after it first floated at parity. But a declining value against gold indicates real depreciation of the euro. That could bring on problems.

BR: “For all the hysteria about the declining euro, is it not the case that it is still somewhat overvalued relative to the dollar on PPP? A bit more of a decline is probably not a bad thing.”

It probably is not far off its PPP value now. PPP has to be measured using VAT-inclusive prices, which fools some observers (including the Economist’s Big Mac index). The euro is coming off artificial highs created, in part, by BB’s interventions (swap agreements), which may be used again.

Now wait just a minute. The dollar price of a whole bunch of things is declining and you call that evidence that the global recovery might not be all that strong? The right term for this is “deflation”, and like Scott Sumner says, it’s a pretty clear sign that money is too tight.

In addition to the economic “wake-up calls” that you mention, the prices of equities and physical commodities have been over valued recently. Though folks who cling to MPT would say the it is not possible for these things to be over valued for long periods in an open market, some other folks know that MPT is not supported by evidence – take equities in 2008 and 2009 as an example. So far the movement down in equities can be pretty well explained by an adjustment to more reasonable, but still high-side values. If/when sovereign debt, the solvency of banks holding that debt and Round 2 of US mortgage defaults becomes more clear to more people, we are likely to see larger moves in all the charts.

Of course it could just be everyone, all at once, is becoming afflicted with the macro horror that the last 18 months have been nothing but a global liquidity driven, stimulus driven, stockpiling driven illusion?

What about this idea: Europe buys goods from China and China loans to the United States. If the European economies crumble after the dissolution of the Euro in Greece, then China loses more customers, and has problems lending the U.S. money. Without China, the U.S. will print print print. The markets are right – the problems aren’t confined to Europe. Greece is a foreboding of what is to come to the United States – only the U.S. will have it much worse.

It’s not just falling commodity prices and equity prices. TIPs spreads have fallen sharply in the past month and ten year bond yields in the core eurozone countries (Austria, Belgium, Finland, France, Germany, Luxembourg, Netherlands and Sweden) are down about 70 basis points since last June and about 30 basis points in just the last three weeks. For example the German 10-year bond was trading at only 2.78% today. All of these are signs of falling inflation expectation due to an increase in the demand for money without an accomodation in supply by the central banks.

Correction: Sweden of course is not in the eurozone. Must be premature senility.

Cedric Regula:

Probably, they’re right.

Zacharia Granville:

Agree that how the imbalances within the euro zone (with a German super surplus) are resolved may be a harbinger of what is to come from the China-U.S. imbalance. Not sure how you got there, though.

Cedric,

Why go back only 18 months? The “macro horror” goes back about 35 years. If the ‘latest’ original idea of ‘globalization’ is scrutinized as it was initially presented, the concept was systemically flawed and ‘papered-over’ from the start.

It took the USA about 140 years to overcome its disadvantage regarding labor costs and then, in the 1920s, the US was finally competitive with European manufacturers. Consider how precious those historical circumstances were and then consider how willing US citizens might have been to share that ‘demographic dividend’ with foreign investors. In other words the global economy has been conceptualized on a theory that was conceived from wishful thinking. Had there been some sacrifices made to develop poor nations so as to assure balanced growth in the long-term, things would have probably worked out. But the net-flows have been from poor to rich all along. How can that succeed?

Ms. Ray,

Actually, I don’t think globalization is all that new. The flow has always been from poor to rich. That’s how you can tell them apart. The Ethiopians probably took advantage of the Egyptians, until the Egyptians figured out how to turn the tables.

But I think the Chinese have figured out how to turn the tables. But it takes a lot more than just cheap unskilled labor to do that.

But like you say, in the US I think we have gone to the monetary and fiscal stimulus well too often in the last 35 years. Being the world’s trade and reserve currency gives us a lot of inertia.

I imagine that everyone agrees that the worldwide problem has been debt-financed overproduction in a variety of sectors and countries. While the causes can be argued over, the unquestioned outcome is that a whole lot of loans worldwide will eventually be written down.

The balancing act of the central banks and governments is to prevent this from turning into a deflationary rout without damaging their own balance sheets beyond repair. The jumpiness of financial markets may be due to fear that public institutions have at last bitten off more than they can chew.

Prof. Pettis has an excellent article on trade implication of the euro crisis on China. It also points to a way for China to use it’s dollar reserve to help the world adjust to the current global imbalance.

http://mpettis.com/2010/05/don%E2%80%99t-misread-the-trade-implications-of-the-euro-crisis-for-china/

Following up on Prof. Pettis’ view, I have the following thoughts. Please let me know what you think.

China should use it’s dollar reserve to buy euro. China should not devalue the RMB. Devaluing the RMB will only widen the imbalance within Europe and make the situation worse for the world.

Today, China and many developing countries have huge foreign reserves denominated in dollar. The key issue to note is this accumulation of dollar is grossly in excess of the proportion of trade surplus with the US. China didn’t just export to the US. China exported to the whole world and US is only a fraction of the total export. In other words, a few years ago China and other countries did have a choice to evenly diversify into other currencies besides the dollar but did not.

After the Asian financial criss of 1997, many central banks piled into the dollar because dollar is the dominate currency used for trade and US treasury is considered the world safest investment. Unfortunately, when everyone crowds into a safe investment and drive up the price, the investment, very predictably, becomes unsafe. In 2004-2008, high treasury bond price means low interest rate. The low US treasury interest rate drives down mortgage rate and fueled the biggest housing bubble in the last one hundred years. While the US treasury did not default, the prices of most other assets and the world’s economy collapsed. The various developing countries’ preference for dollar also unfairly weakened the US export while strengthened European export.

Today the euro is weak. Tomorrow it will be the dollar. The euro zone’s over all debt level and spending level are both much healthier than the US. In deed the European Central Bank has historically been much more vigilant about controlling inflation than the US Federal Reserve.

Public debt as % of GDP for 2010

Eurozone ~84%

US 98%

Fiscal deficit as percent of GDP:

Eurozone 6.9

US 12%

China and many developing countries are still holding huge excess of dollar reserve. The Euro, on the other hand, has depreciated 20%. Now is an excellent opportunity for China and other developing countries to buy low (euro) and sell high (dollar). It will significantly help stabilize the euro and the troubled European financial markets. In the long run, buy low sell high out of dollar and into euro is also the best way to safe guard the wealth created by the people of these nations. Lastly, will also give time to US and China to correct their own imbalances.

Here is professor pettis’ analysis of what China can do with its reserve:

http://mpettis.com/2010/02/what-the-pboc-cannot-do-with-its-reserves/

and my comment at the time:

http://mpettis.com/2010/02/what-the-pboc-cannot-do-with-its-reserves/#comment-5079

China should not devalue the RMB. It will only make the imbalance in Europe worse. Today, China is no longer a significant trade surplus country. China’s trade imbalance with the world has been correcting for more than a year.

http://4.bp.blogspot.com/_K3ry7Q_rEB4/S-e3g6JjOsI/AAAAAAAAAeU/J3QMqFLSUqc/s1600/10maychintrade.bmp

On the other hand, German’s huge trade surplus is soaring as the euro slumps.

http://www.eubusiness.com/news-eu/germany-economy.4ln

Quite frankly, I find Germany’s self righteous finger wagging suffocating. Germany itself is part of the causes of today’s global imbalance.

China devalue the RMB will only encourage Germany and other surplus countries. It will exacerbate the global imbalance and Europe’s imbalance.

In summary, China and other nations with excess dollar reserve should forcefully rotate their holding into the euro. Europe, US, China, and the world economy will all benefit.

Cedric: “. . .the Chinese have figured out how to turn the tables.” I’ve never met anyone who lives here (or spent time here) who believes that. Maybe you have to stand ‘way back to see clearly; or maybe it just aint so.

There are many reasons for the sharp equity market retreats in the US and Asia, but I think the most important ones are that money managers are naturally jumpy when they have been riding a liquidity-driven bull market for more than a year, and that globally we have now almost exhausted the potential for further stimulus and bailouts. Only the US still has a bit of that juice left, and one can already hear the calls starting for renewed “quantitative easing”.

Tom,

And it’s really annoying when the loudest calls come from Wall Street.

Qingdao,

Well, maybe I exaggerate, but China has caught up to Japan as the second largest economy (with many more people, of course) and has more millionaires than the US.

Mark A. Sadowski wrote: “All of these are signs of falling inflation expectation due to an increase in the demand for money without an accomodation in supply by the central banks.”

Makes good sense though I doubt many on the street see it that way. A higher demand for money should drive up real interest rates, and that is the opposite of what is happening. Higher transaction velocity rates could also temper any deflationary pressures.

Seems to me that inflation expectations are decreasing because many see lower capacity utilization rates going forward. Fixed income yields are also declining as folks flock to relative safety.

Even gold company values are shrinking.

So where is all this sidelined cash eventually end up? Will the markets be rocketing back up by early June?

Are the markets more worried about the Greek fiscal tragedy or the Gulf oil tragedy? The BP Gulf oil spill points to higher real oil prices going forward.

I think international trade is more important than usually credited. BB helped engineer a dollar drop with swaps that helped push the euro to over $150, and helped bring about a 3% improvement in GDP (relative to what it would otherwise have been) by reducing the U.S. CA deficit by that amount. At the time, I recall BB saying the euro appreciation was warranted on grounds the euro area had a trade surplus. Europe was hurt by this strain (part of which came from a diversion of Asian exports from the U.S. to Europe). Now, we may be hurt by the after effects. But BB is up to his old tricks, having started a new swaps strategy.

Whatever happened to “Liquidity Trap”?

James

LIBOR has moved up quite sharply (3 month LIBOR) so the banks are hurting (since this is the rate at which ‘risk free’ banks lend and borrow from each other in the London market, but is widely used as a global benchmark).

Given the level of state support for banks which effectively makes them ‘risk free’ this is worrying.

In the last month, European ADRs have lost about 17% (Greek ADRs, by the way, have lost only 18%), the Euro 10%, & US stocks 10%. So Euro-denominated European stocks (w/ ADRs) have gained slightly vs. US stocks overall. The European “slide” has been largely confined to the Euro, which at approx. $1.25 should be nearing PPP. The US markets received fabulous earnings reports & forecasted earnings growth in the Jan-Feb earnings season w/ virtually no stock pickup but an actual decline in mid-Feb. So the bulls were out of gas in mid-Jan. They rallied again in Mar from the Feb pullback but did so primarily in those small caps that still had bargain basement valuations. IMHO events in Europe in the last month have had almost nothing to do with stock movements or in relative stock movements between the European Zone vs. US stocks. They were simply the excuse perma-bears needed for selling & the story Jan. bulls told themselves for not buying when they knew they wouldn’t anyway. European events did (legitimately) affect the Euro, since they presage a its potential unraveling. It is very often–not always, but very often–a mistake to consider broad stock movements at any time to reflect anything other than investor mood du jour. News reports are merely the straws they grab onto for rationalizations. When bullish they ignore bad news and when bearish they ignore good news.