Via Mark Thoma and Arnold Kling, the Federal Reserve Bank of Minneapolis published an interview with Stanford Professor Robert Hall. The interview is terrific not just because Bob is a very smart guy, but also because interviewer Douglas Clement did a great job choosing the right questions. The whole thing’s worth reading, but I wanted to focus today on Bob’s comments on the role of financial frictions in the crisis and policy options to address them.

Here’s what Bob said on the topic in the interview:

I would distinguish between conventional monetary policy which sets the interest rate and this kind of financial intervention of buying what appear to be undervalued private securities. Issuing what appear to be overvalued public securities and trading them for undervalued private securities, at least under some conditions and some models, is the right thing to do….

There’s a picture that would help tell the story. It’s completely compelling. This graph shows what’s happened during the crisis to the interest rates faced by private decision makers: households and businesses. There’s been no systematic decline in those interest rates, especially those that control home building, purchases of cars and other consumer durables, and business investment. So although government interest rates for claims like Treasury notes fell quite a bit during the crisis, the same is not true for private interest rates.

Source: Federal Reserve Bank of Minneapolis.

Bob continued:

Between those rates is some kind of friction, and what this means is that even though the Fed has driven the interest rate that it controls to zero, it hasn’t had that much effect on reducing borrowing costs to individuals and businesses. The result is it hasn’t transmitted the stimulus to where stimulus is needed, namely, private spending….

So to get spending stimulated you need to provide incentive for private decision makers to reverse the adverse effects that the crisis has had by delivering lower interest rates. So far, that’s just not happened. The only interest rate that has declined by a meaningful amount is the conventional mortgage rate. But if you look at BAA bonds or auto loans or just across the board– there are half a dozen rates in this picture– they just haven’t declined. So there hasn’t been a stimulus to spending.

The mechanism we describe in our textbooks about how expansionary policy can take over by lowering interest rates and cure the recession is just not operating, and that seems to be very central to the reason that the crisis has resulted in an extended period of slack.

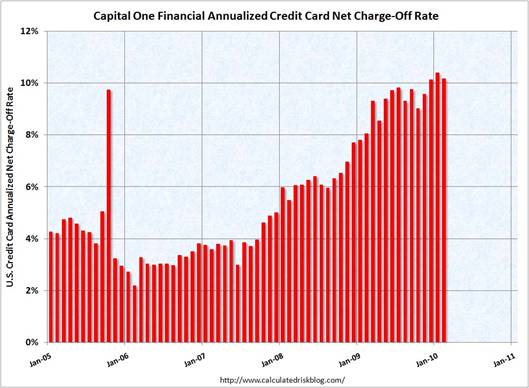

The graph Bob presented above shows the spread between an average credit-card interest rate and 10-year Treasury debt increasing by about 200 basis points during the crisis. Is that more than it should have been? Banks’ annualized credit-card charge-off rates were up about 400 basis points at their peak.

|

If by “financial frictions” Bob means that creditors were less willing to lend because their fears of not being repaid had gone up, then yes, financial frictions played a fundamental role in the crisis. But the reference to undervalued assets suggests that Bob may instead be thinking of financial frictions as something that prevented private lenders from extending loans that they really should have been making.

I’m currently working on a research project with a student to try to measure changes in the pricing of risk during the crisis as one way to sort out which of these two interpretations may be the correct one. As we ponder how to do that, let me ask for assistance from our readers. Can any of you tell me why Bob Hall, or anyone else, should be persuaded that risky assets such as credit-card debt, Baa-rated bonds, and asset-backed commercial paper were significantly undervalued as of February 2009?

Interest is not the only profit being earned on credit card lending. When chargeoffs are high it is because delinquencies are high, and delinquencies drive fees. Also, ATM fees (ludicrously high) and merchant fees increased during the crisis. Also, the spread between cost of funds and the 10 year rate went the other direction.

Dear Professor Hamilton,

You say:

‘If by “financial frictions” Bob means that creditors were less willing to lend because their fears of not being repaid had gone up, then yes, financial frictions played a fundamental role in the crisis. But the reference to undervalued assets suggests that Bob may instead be thinking of financial frictions as something that prevented private lenders from extending loans that they really should have been making.’

We have seen several periods during my adult life during which the Fed appears to have deliberately increased bank sector profits by providing very cheap money that was re-lent to private or public borrowers at significantly higher rates. As your question indicates, this suggests that ordinary competitive considerations between banks would argue that the cost of the subsequent loans made by the banks with their ultra-cheap funding should fall as many different banks seek to employ this capital windfall. However, this expected behavior is not what we have seen in several historical examples of this phenomena. One explanation that you don’t seem to be considering is that banking may be much more cartelized and far less competitive than one would expect (with much price signalling going back and forth between ostensible ‘competitors’) and that competitive considerations may not rule bank decision-making on loan pricing if the regulators will tolerate far more profitable collusive, oligopolistic pricing.

In all, this raises a more interesting question: how ‘efficient’ was the entire TARP mechanism? Was propping up the existing banking industry really very economically useful, given the subsequent reduction in lending we’ve seen from that sector? (If lending isn’t expanding, isn’t the financial sector essentially sucking money out of the ‘real economy’ via interest and principal payments from borrowers? How useful is that in our current situation?!!) Wouldn’t it have made more sense to have set up additional channels to funnel credit directly to consumers, rather than through ‘deadweight’ financial institutions? I notice that when the large corporate borrowing market froze up exactly such mechanisms were put in place.

JH, great article. I will wait for your findings re: pricing risk. The differences in interest rates and the chart of defaults (150% increase) are intriguing. Has the Obama policy impacted the credit card rates?

Thanks.

It’s easy to imagine a bank mispricing the risk on a certain loan, or even the market mispricing a class like BAA bonds for a period. That’s how Bill Gross can out-perform the market.

But the odds of an economist at Stanford, or the Fed, being able to more accurately price the risk, and thereby ascertain the level of “friction”, are zilch.

This whole discussion begs the question of whether credit growth is being inhibited by rates. The evidence of that would seem to be a little scarce.

Look at mortgages, where rates have fallen to ultra-low levels in the last few weeks. Sure, refinancings are up, but net new mortgage lending is falling.

In small business surveys, final demand is cited as the primary problem. Access to credit is a few levels down.

No BAA rated company is going to decide on whether to upgrade a plant based on whether it can borrow at 7% versus 6%. If the demand is there, they will upgrade the plant.

The demand isn’t there.

Perfect subject

Are all assets spectrum included and not only sovereign bonds?.

Is global liquidity and availability neutralized or included as a given component?

May I suggest if possible this study to cover more than the last 15 years period.I suspect your conclusion could be surprising,when it comes to compare risk assessment and assets pricing and pricing mechanism (including the assets pricing through derivatives).

I am looking forward to read your project.

The first thing I thought of as I read Bob’s thoughts were that an increase in risk premium’s swamped any downward pull on interest rates related to fed policy. I assumed his ‘undervalued’ claim was from the perspective that rates ‘should’ be lower, therefore prices ‘should’ be higher. In that context, the securities are undervalued, but the impact of time-varying risk premia is ignored.

I think the better way to approach the subject is in terms of opportunity cost. Lenders can borrow short term at rates approaching 0% and buy ‘riskless’ short term treasury securities and earn a certain return (with inflation near 0%). The alternative is lending to a risky counterparty. If the FED were to tighten toward the the short term T-rate then banks would be forced to look elsewhere for returns. As a result, loans to risky counterparties (HH’s and firms) would increas.

If my conjecture is accurate, then the FED faces a confounding situation in which tightening will release excess reservers into the economy, increase the growth rate of M, and lead to inflation.

I think the consensus is that risk was under-priced across the board before the crisis, and the increased spreads reflect appropriately higher risk premia.

The only spread that has decreased in the chart is for mortgages, and those have government guarantees that pretty much eliminate credit risk. The other major risk for mortgages is prepayment risk, and that may have declined as the recovery looks more and more anemic. Or it may be due to Fed purchases of RMBS. Certainly the Fed must think so, else why buy them?

It is possible for the price of paid by consumers to be “rational” considering the possibility that the loan will not be repaid and for the following comment by Professor Hall to be valid.

“The mechanism we describe in our textbooks about how expansionary policy can take over by lowering interest rates and cure the recession is just not operating, and that seems to be very central to the reason that the crisis has resulted in an extended period of slack”.

Professor Hall is explaining why the stimulus did not expand the private sector. I think he is on to something. As Bob notes, the price of loans is only one factor influencing investment – and apparently a small factor given the cash position of many firms – both financial and non-financial.

Looking at the chart Prof. Hamilton provided, the credit card industry has some more work to do in reducing charge off rates.

My favorite data point from the crisis is ABS backed by US govt backed student loans. The securities pay a short term floating rate coupon and are largely free of default risk due to the federal guarantee of the collateral, so the theoretical yield should be close to that of short-term government debt. In practice, the securities would typically trade at a few basis points above LIBOR. At the height of the crisis, even the very safest tranches traded at 100-200 bp above LIBOR, which was trading several hundred bp above Treasury.

During the crisis, the yields on Ginnie MBS and Fannie/Freddie Debt and MBS are also hard to explain using standard models (at least until the Fed started making purchases).

One could argue that the leveraged players were responsible for ensuring efficient pricing of all financial assets. When their solvency was called into question, they lost access to cheap credit needed to maintain their trades and all markets prices fell into disarray.

Bob in MA has apparently identified the essence of what Hall was saying – claiming that some private assets were “undervalued” during the credit crunch means knowing that they would appreciate. That was, in fact, a fairly standard claim being made by Treasury and Fed officials, as well as by some market participants, during the grimmest days of the credit crunch.

Beyond that, Bob in MA runs into a conceptual problem, which appears to be the result of bias. Bob claims that Bill Gross can out-guess the market, but that college professors cannot. If identifying undervalued assets is possible, then that may be why Gross performs the way he does (when he does), but unless we believe in magic or divine intervention, it is hard to see why the reality of the situation is that some guy named Gross can do something that is impossible for some guy named Hall to do.

Far more interesting, by the way, would be if Hall were claiming that he has a tool or a set of tools (watch for math here) which allow him to identify assets that are priced well away from their fundamental value.

capital flows were going after bigger returns than cards, bonds, and paper. The demand for these were less than the demand for big returns on securitized stuff at 30 to 1 leverage. “the talent goes where the money is”

To the extent that credit card interest rates are representative of “interest rates paid by private decision makers” isn’t that in and of itself a large economic problem in the broader sense. It is tantamount to saying that at least a plurality of private decision makers are economic chumps, possibly due to poor financial understanding or poor economic self control.

Lame excuses for ineffective policies.

Stubbornly high retail lending rates are not “market frictions” or “sticky prices”. Bank managers are not reluctantly dragging their feet as (maniupulated) market conditions push them to decrease rates. Bank managers are setting rates according to the incentives of the (manipulated) marketplace.

The reason that monetary stimulus has not increased non-mortgage retail credit availability is that the Fed is paying interest on reserves, in order to avoid potentially highly inflationary increases in commercial bank money. There is no way to increase overall credit without increasing commercial bank money. The Fed simply made a choice to focus on preventing a collapse in mortgage availability, without increasing overall credit availability.

In addition, the government’s increased issuance of government bonds hogged credit availability away from the retail sector (and also from the corporate sector, especially companies too small to issue bonds).

It looks like the “lumpiness” of the investment decision might be negatively correlated with the downward responsiveness of the interest rate. For example, business investment tends to be notoriously “lumpy” (this also causes problems with applications of Tobin’s “q”), meaning that business capital investment tends to come in spits and sputters rather than being evenly spread out across time. But consumption credit is much smoother across time, suggesting that credit demand less elastic.

Here Here for Tom!

Of course the FED and the Treasury have manipulated the banking system to prop-up mortgage securities and bank balance sheets…. However, the fundamental problem remains: Bank leverage has increased to unsustainable levels in recent decades. Capital reserve requirements have declined system-wide due to Basel I and II, combined with fictional accounting facilitated by FASB.

With the decline in the RE market, collateral and bank asset values have declined. For banks in America, this means that loan books have to shrink. Banks are not competing to sell loans because they are in no position to do so.

To answer your question: Because they stubbornly refuse to believe markets failed well before the collapse, allowing unusustainble imbalances to grow until they couldn’t anymore.

This graph puzzles me. The only thing I see changing over the period as a whole is that consumer debt is riskier. The decline in margins on mortgages seems to be some combination of riskier mortgages not being made and a quasi-government subsidy (Fed purchases of Fannie and Freddie mortgages) that should reduce rates on the mortgages tha are made.

Risk Premium > RoI –> No borrowing

This may be another way of stating what others have stated.

If Mr. Market expected deflation, then two things would be happening. One, he would be hoarding cash and Treasurys. Two, he would require more interest on private loans to cover the increase in the real value of the loan principal. The higher rate would help fulfill the expectation by reducing loan volume and the money supply.

Perhaps some of the difference in Treasury and private rates can also be explained by the carry trade.

During the recent crisis, risk of principle not being repaid went up. Perceived risk went up even more. That effect was as strong or stronger than the decline in borrowing costs for the retail lenders. I think it’s just that simple.

How can we prove that? That’s harder. Maybe if you can calculate aggregate reserves against losses for the credit card industry or the mortgate industry…

Risky assets WERE very much undervalued in February 2009, especially financial assets traded on exchanges, like stocks and bonds. The reason for that is simple: the failure of LEH and the fears about the banking sector had caused a liquidity contraction which exacerbated an already developing recession. By liquidity, I mean the availability of trade credit for businesses (banks werent lending or rolling CP) and the interbank market and margin lending markets (which are the essence of the money multiplier) for banks and broker dealers. In short, neither commercial bank (conventional banking system) nor investment bank (shadow banking system) liabilities were growing, and were in fact contracting. The anti-business rhetoric of the new Obama administration in its early days (put on hold in March 09 and then revived in April 10 w SEC v GS) and the unclear outlook for a stimulus bill had only made things worse. As such, the demand for financial assets was at its nadir and the demand for 2yr Treasuries was at its highs (not quite the post LEH highs when investors bought Ts with a negative return, in effect paying the government to take their cash!) The FED changed that by buying over a trillion of all kinds of crappy assets from the banks, thus providing the liquidity necessary for banks and broker dealers to re-engage in the interbank and prime brokerage lending markets. It was in mid April 09 when it became clear to market participants that the liquidity picture was improving, and market hit its lows and then all financially traded assets rebounded very strongly for the rest of 2009. So the “money multiplier” is working for capital market participants (usually larger businesses), but it still is yet to work for smaller businesses which depend more on bank credit, especially from smaller banks. But more important that CapOne’s charge off data (which is a good proxy for the middle class consumer; I owuld use Amex charge off data for the more affluent), I believe is the loan ddemand and charge off data for CIT (a business which specializes in lending to small businesses with no access to the capital markets). What is interesting in their data is the very poor demand for business loans — and that is missing in the interview with Bob Hall. Business does not WANT the money — which makes some sense given the huge uncertainty on their costs (taxes, healthcare, regulation) and their end market demand (unemployment and consumer sentiment). Demand for loans will return when federal and state governments provide clarity on not raising taxes, deal with budget problems through caps on medicare and medicaid, spend stimulus money on the infrastructure for which it was intended and not as transfer payments to states so they do not restructure their unionized workforces, and the general anti business rhetoric changes. Geithner’s Kudlow interview yesterday was a good start, as was Obama’s trade policy speech.

Region: Perhaps we could start with monetary policy. What is your broad view of the Feds efforts over the past few years to stem the crisis using unconventional monetary policy and strategies?

Hall: First of all, I believe you should think of the Fed as simply part of the federal government when it comes to the financial side of its interventions. If you look at how the federal government responded initially, it was the Treasury that was providing the funds. Of course, TARP [Troubled Asset Relief Program] was there using the taxpayers money without involvement of the Fed. Also, early in the crisis Treasury deposited hundreds of billions of dollars at the Fed, which the Fed then used to buy assets. So there the Fed was just an agent of the Treasury. It was as if the Treasury took its funds to a broker.

Eventually, the Treasury was impeded from doing that by the federal debt limit. But the debt limit doesnt apply to funds borrowed by the Fed, so it then started borrowing large amounts from banks by issuing reserves. That is what caused all the confusion about thinking this was somehow part of conventional monetary policy.

I would distinguish between conventional monetary policy which sets the interest rate and this kind of financial intervention of buying what appear to be undervalued private securities. Issuing what appear to be overvalued public securities and trading them for undervalued private securities, at least under some conditions and some models, is the right thing to do. In my mind, it doesnt make a big difference whether its done by the Federal Reserve, the Treasury or some other federal agency.

I am amazed at how easily we become seduced by procedure and throw away our rights and the rule of law. The exchange above was the very first exchange in the article. Note that first Hall not only admits but makes a point of noting that the FED is part of the government. The FED was created as an independent bank to get around the Constitutional restrictions on the government printing money. Today we just take government creation of money as fact. We are so far removed from the economic wisdom of the Founders of the Constitution that even the strongest fiscal conservative doesn’t even question the constitutionality of this “part of the federal government.”

The second amazing thing is that Hall openly admits that the Treasury used the FED to violate federal law concerning the debt limit. Essentially the FED has no oversight and no one controls it. The FED can do what ever it wants and collusion betweent the FED and Treasury takes away the power and thwarts the intention of the Constitutional Founders that the House of Representatives was to control money and expenditures.

This was one of the most important elements of the creation of our Constitution, but as with so many other insights, the intentions and wisdom of our Founding Fathers has been abandoned and abandoned so severely that violating a debt limit law passed by congress doesn’t even raise an eyebrow.

RicardoZ: “Issuing what appear to be overvalued public securities and trading them for undervalued private securities, at least under some conditions and some models, is the right thing to do.”

This seems guaranteed to cost the taxpayer money, unless one thinks the Fed was making more astute investments than the private sector actors on the other side of those trades. But the Fed has other considerations besides profit maximization, so this seems highly unlikely.

At the risk of straying off topic, here is what the Constitution says about Congress and money.

Section. 8.

The Congress shall have Power …

To coin Money, regulate the Value thereof, and of foreign Coin…

Where the Constitution bans certain actions it is quite explicit, as in the following:

No Soldier shall, in time of peace be quartered in any house, without the consent of the Owner, nor in time of war, but in a manner to be prescribed by law.

I see nothing in the section on money akin to Amendment III, which lays down clear markers for acceptable and unacceptable behavior. If on the other hand you were to say that offloading money creation to the Fed allows Congress to avoid taking responsibility, just as Johnson offloading federal mortgage insurance to Fannie Mae took insured mortgages off the federal budget, you’ll get no argument from me. I only object to reading into the Constitution things that aren’t there. This is a common practice for activists of both extremes. The document is not that hard to read and understand but so few bother.

So I guess the point of my original post was that the data you graph doesn’t show the full interest rate for credit cards, only the nominal interest rate. When fees are included to produce an effective interest rate (consumer cost of money), I think your observation of a 200bp rise (compared to a 400bp change in chargeoffs) may be less sound.