Quick links on sources of job creation, recession probabilities, and alternative ways to access your favorite economic books.

A study by

John Haltiwanger, Ron Jarmin, and Javier Miranda finds that job creation comes not so much from small firms as from new firms.

|

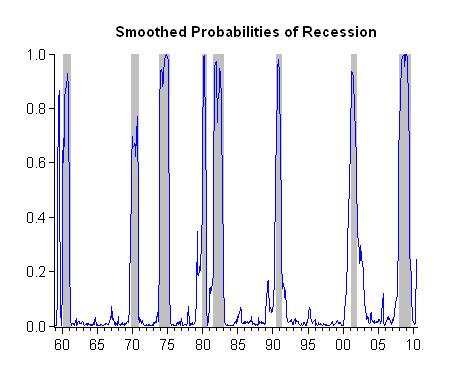

The monthly recession indicator index maintained by U.C. Riverside Professor Marcelle Chauvet

has jumped back up to 25 % after being below 10% for the last 7 months.

|

I finally figured out how you could order Time Series Analysis in Chinese. It seems the Chinese edition was written by Zhan-mu-si Han-mi-er-dun. Or, if you prefer English, it’s still right here.

And, if you’ve been putting off reading

Freakonomics, now you can watch the movie, to be released October 1. Here’s a trailer:

I think there is some misunderstanding on this board about the MMT position that govts (that issue their own currency) are not financially constrained. While it is true that taxes do not fund spending, taxes are necessary for a govt to spend. If a govt tried to buy something making payment using a worthless piece of paper (fiat money), no one would sell the govt anything (would anyone on this board sell me something in exchange for a piece of paper with my picture on it? If so, I could use a new car). But if the govt imposed and enforced a tax that is only payable in the fiat money the govt issued, then the private sector would sell whatever the govt desired in order to get the fiat money to pay the tax. The govt does not need to tax to get the money to buy the good. But without the tax the private sector will not sell the good in exchange for the fiat money. It is now easy to see that the govt must issue (spend) at least enough money for the private sector to pay the tax. And because someone in the private sector will always want to save some money, the govt will have to issue more money than it gets back in taxes (run a deficit). The national debt is nothing more than the “tax credits” the private sector has decided to save over time.

How much money the govt spends is a political decision and should not be based on available money. What to tax is a political and economic decision. How much to tax is an economic decision and should be based on maintaining full employment.

hey moron.

if gold is pretty metal that does nothing…

what do you call a piece of paper with some old dead dude’s visage printed on it?

and what do you call a couple of digital bytes that represent the piece of paper with some old dead dude’s visage printed on it?

Yo, yo!

JDH,

It seems that, in the Chauvet series, a probability over 25% has been a good predictor of a recession. In fact, it is about the only predictive level: anything over has been roughly coincident with a recession’s start, anything below has given false positives. Is that a reasonable conclusion?

David Pearson: I don’t want to read too much into any one indicator. But I agree it’s noteworthy, and so I reported it.

Gold is our best conductor of electricity, but besides that, lately I’ve spent considerable time wishing I had bought all the gold I could with my dead presidents. Ideally back when 300 dead Washingtons got an oz. of gold. But back then I thought Volker’s face was on the back of of the bills, so missed an opportunity.

“Annual Average Rates 1992-2005” -> “job creation comes not so much from small firms as from new firms”

Does that time period not create a horribly misleading picture due to what happened 1997-2000? Of course that time period would show incredible job growth from new forms.

Cedric, Silver is a better conductor than gold.

Silver is actually a better conductor, but gold has the advantage of being non-corrosive.

Not a word on the trailer?

Personally, I may not rush to see it in the theater, but may wait until it makes it’s TV premiere–on CSPAN.

Now, I think these guys are lacking a properly commercial attitude. If they had taken an “R” rating and led with the programmer-turned-prostitute story, the film might have had some legs. But a “G” rated economics film? Boy, that’s a tough market segment.

Referring to Chauvet’s index, note what happened since 1959-60 each time the index rose from the low probability of recession around 0% to where it is today (data through June).

This complies with the near 100% probability of recession the ECRI WLI is indicating (even though the ECRI guys protest too much about the bearish interpretation), which implies the risk of an average 38% decline (SPX 700s) peak to trough for the S&P 500 over the next 9-13 months.

However, historically, the range of peak-to-trough declines for stock prices for years 11-14 of debt-deflationary secular bear markets since the late 18th century in the UK, US, France, and Japan has been 42-68%.

If you, gentle reader, have money you cannot afford to lose, and you will be distressed if you do not break even from here until the late ’10s to mid- to late ’20s, you had better be selling stocks here with both hands. Heck, I’ll lend you my hands if you need them.

No, folks, no recession and bear market here. Move on to the next show, please.

So, here’s what a house foreclosure in Princeton looks like: 8500 sq ft; best of everything, truly over the top; never occupied.

http://www.ntcallaway.com/property/7756748/Princeton_Twp._NJ_08540-4003

Now ‘bank owned’. The original ask was around $2.5 m, as I recall. Now the ask is $1.5 m; I wouldn’t be surprised to see them take $1.3 m–a screaming deal for all you speculators out there. Even today, the replacement cost probably approaches $2 m.

This sort of catastrophic price collapse is new to Princeton. Yes, prices have come down by a good bit, but we didn’t hear about foreclosures and short sales. But this house (and an August short sale just two blocks away) have reset the Princeton real estate bar much, much lower–maybe by 20% in a single month, at least in the high end segment.

This house, I think, illustrates the downside of trying to prop up real estate prices.

This guy in this house (http://www.ntcallaway.com/property/6996484/) can’t sell his house, a full comp to the one above, for anywhere near the asking of $1.9 m (the typical price in this segment). So he’s trapped until the bank-owned house leaves the market.

And this one has been on the market also about two years. Again, it’s fully comparable. http://www.trulia.com/property/1073466482-39-Random-Rd-Princeton-NJ-08540, with an ask of $1.9m. This developer will slowly bleed to death on this house, again, until the foreclosures are finished.

You can see that the ‘bank owned’ house has cut the ask in the market by a solid $500,000 (25%).

The longer the adjustment takes places, the more likely these latter two houses are to end up in foreclosure. If the market clears quickly, then prices are likely to rebound, if not to original levels, then at least above the gutted prices of foreclosed homes. But if these foreclosures come out in dribs and drabs over the next two years, the latter two sellers here are facing a catastrophic situation.

Steven Kopits-

The house in Princeton Township does have one distinction: ITS UGLY!!! To come up to 8500 sqft, the realtor had to add-in the garage floor, the basement, and attic space…..

I’ll bet the only sheathing the house has is rigid foam under the cementitious siding. The original builder would have been far better off spending money on a talented architect than on the granite in the kitchen and the marble in the bath.

When the house comes down to $850K, it’ll sell… to the heavy-equipment salesman from Peoria.

The house is a poster-child for all the excesses of the real estate bubble. Thanks for providing the link, it’s hilarious!

Steven, we know how this story plays out: Japan.

And now Australia, Canada, and China are on the brink of the next and last unreal estate bubbles bursting and bringing down the entire fiat, debt-money, fractional reserve global banking regime.

Oh, what a delusional run it was while it lasted.