I certainly agree that the most important factor holding back employment growth at the moment is low demand for firms’ products and services. But I disagree with those who suggest that this is the only factor.

Paul Krugman declared last week:

Businesses aren’t hiring because of poor sales, period, end of story.

The statement that businesses aren’t hiring is simply false. According to the Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey, the U.S. private sector hired 3.9 million new workers every month, on average, over the first 7 months of 2010.

But if that’s true, then why isn’t total employment booming? The answer is that, according to the same JOLTS data, some 3.8 million workers quit or lost their jobs each month on average during Jan-July. The difference between gross new hires and gross separations was only enough to add about 100,000 net new private-sector jobs each month. There are some discrepancies between the extent of net job creation implied by the JOLTS data and the number inferred from other sources such as the BLS establishment survey. But the fact that small changes in net employment figures mask a dynamic economy in which there are huge gross changes in employment status for individuals and firms is quite indisputable.

For the establishments that are hiring millions of new workers every month, what factors went into their decision, and what would have to change to persuade them to hire more? I believe the correct answer is that the firms compared the benefits of hiring new workers against the costs, and decided it made sense to bring some 3.9 million new people on board each month, but no more.

And why no more than that? Paul’s answer is based on

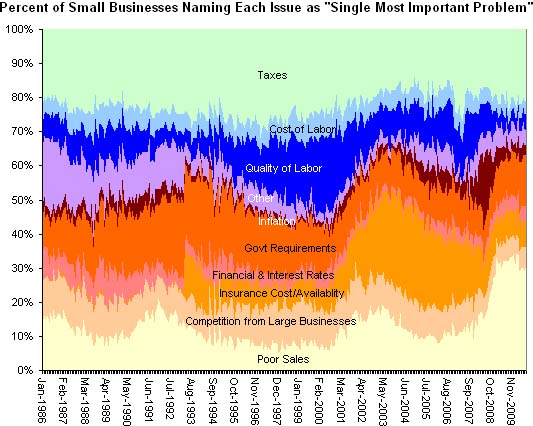

Catherine Rampell’s observation that there has been a significant increase since 2007 in the fraction of small businesses reporting poor sales as their biggest single problem.

|

But Russ Roberts isn’t convinced.

It’s also worth pointing out that “biggest problem” doesn’t mean that the second or third problems aren’t important or aren’t really close to as important as the biggest. In fact,

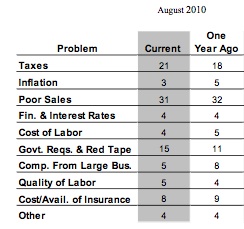

if you look at just the latest data from the NFIB rather than the distracting previous three decades, you see this:

Source: Cafe Hayek.

Yes, 31% of respondents do say that sales are their “biggest problem.” That number hasn’t budged much over the last year. But two numbers have changed a bit more than that– 21% of respondents list taxes as their biggest problem up from 18% a year ago. And 15% list government regulations and red tape as their biggest problem, up from 11%. In fact, if there had been one category called “Taxes and Government Regulations” it might have been seen as the biggest problem, listed by 36% of respondents, up from 29% in the year before and surpassing sales as the biggest problem.

I agree with Paul that a low level of demand is the most important factor holding back employment growth. But I think it may be a mistake to conclude from that fact that aggregate demand management is the only tool available to address the problem.

Bigger than all of these issues is the issue of technological change. There’s not much that American labor can do that machines and foreign labor can’t do cheaper.

We’re coming off of a housing bubble that artificially stimulated demand for labor-intensive industries: construction, real estate, and mortgage banking. I don’t envision vast new labor-intensive industries rising up to replace all those jobs.

Add to that the fact that the consumer is maxed out in debt and we have a recipe for a very long period of sluggish growth with persistently high unemployment.

Keynesian prescriptions for indefinitely increasing deficit spending are not helping and will only push us faster toward a fiscal crisis a la Greece.

Fed balance sheet expansion isn’t working either, as it only creates asset bubbles, not employment.

I don’t have the answers either, but extreme Keynesian deficits and Fed bubble-blowing are clearly not going to work. We need our finest economic minds to start thinking more creatively. I am fairly certain that dollar devaluation will be part of the solution, both to ease the consumer, bank, and government balance sheet problem, and to make U.S. labor more competitive with capital and with foreign labor and help the trade deficit.

See Rise of the Machines and Devaluation is the only way out.

Just because it’s a problem doesn’t mean that addressing it will be stimulative, or that addressing it will stimulate the economy in the short run. “Taxes”? What does that mean? Too high? Income or Excise or Payroll? Does it affect employment or just profitability? And so on…

Most of this survey is pretty meaningless when it comes to drafting actual policy. You might as well study sunspots.

Picking up Russ’ point – the costs of sustaining individuals on a firm’s payroll, above and beyond their take-home pay, have been increasing over the last several years, and are expected to continue increasing.

The biggest question is how much, which is only now starting to be answered, especially with respect to health insurance costs where insurers are now soliciting state insurance boards for substantial rate increases. (This is also why the survey data shows such a spike for “government requirements” beginning around March 2010.)

I can confirm that the introduction of health care legislation with a high likelihood of passage in Congress last November directly affected employee retention decisions – the chart in that post was most recently updated here.

Libertarians. As crazy as ever. Looking at 1 year ago is an obvious case of cherry-picking the sample. From the looks of it, if one looked at 10,11,12,13,14,15 month ago, the “results” would’ve been all over the place.

Calling past three decades ‘distracting’ is just plain stupid.

We should probably just assume business will always list taxes near the top of the list, because they really don’t think of taxes as a cost of doing business. It’s more of an impediment to profitability and competiveness.

And every larger business I ever worked for added payroll taxes into the employee cost per head, and even mentioned once and a while how expensive we really are with bennies, but now I hear payroll taxes are taxes too, so they talk out of both sides of their mouth.

The low level of demand is one of the factor responsible for high unemployment data. The other factors which may influence the net increase in new jobs are to focus on more manufacturing activities, increase in export of manufactured goods/services, diversion of excess funds from defence to economic development. Focus on primary financial services should be more than derivative products engineering, this step will certainly reduce job searation ,if not gross increase. Non-economic factors like attitudinal change is required for creation of more job.

Looking at the chart tells me that small business concerns are like the tides: they go in and out on a regular basis.

Poor sales will directly affect the employment of factors of production. But taxes and government regulations may not. And if taxes and regulations are fairly enacted across all firms, the effect on production is even less.

This doesn’t even look at the positive effects of regulations on externalities and the increase in demand that can result. As for taxes, well they aren’t even high enough to pay the bills now are they? That limits any benefit from lowering the total tax burden rather severely.

So yes, lack of demand does loom larger for employment than any other complaint out there.

Russ Roberts’ position seems a little silly. If taxes stood in the way of hiring, why did the period of their highest ranking correspond with the period of greatest hiring, the 1990s?

“I believe the correct answer is that the firms compared the benefits of hiring new workers against the costs, and decided it made sense to bring some 3.9 million new people on board each month, but no more.”

Doesn’t it seem likely that the vast majority of those hires were to replace separations? The question is, how many real job slots were created. And with 10% unemployment, net job creation is probably a good measure.

I think Krugman’s right. Remember how all the unemployed (regular and extended) were getting that extra $25/week? The latest extension of extended benefits nixed that. That was $100 month X 9 million receiving benefits, $900m/month.

That one small part of one spending bill was the equivalent of a one-time loss of 300,000 jobs.

What tax/regulation could you rescind that would get you that much bang for the buck?

W.C. Varones,

“I don’t have the answers either, but extreme Keynesian deficits and Fed bubble-blowing are clearly not going to work. We need our finest economic minds to start thinking more creatively.”

Here they are, giving it their best shot. This would be a really funny article, if it weren’t so sad….

http://finance.yahoo.com/banking-budgeting/article/110719/how-to-fix-the-economy-an-expert-panel

Have we ever had a period in our history in which a significant number of people used a non-productive asset like housing to finance a standard of living beyond what would normally be expected? It seems that a vast number of people repeatedly refinanced their homes and used the money to take vacations, buy consumer items and in general over stimulate demand for almost everything. Given this past excessive demand, we now seem to be in a state of “equilibrium” far below a few years ago. Is the US condemned to a lower standard of living due to increased world competition? Have we lived in a “fool’s paradise” after WWII since we were the only economy standing at war’s end? A few comments and questions from the “nickel seats” as one contributor said.

Peak Baby Boomer demographic drag effects and the composition of household spending are structural factors underlying the “new normal”.

The composition of household spending is shifting from growth-oriented high-GDP-multipler spending for housing, autos, durables, and child rearing to maintenance/subsistence, low-multiplier spending for property taxes, house maintenance, insurance premia, out-of-pocket spending for medical services and medications, and utilities.

Moreover, the composition of the labor force is becoming increasingly feminized, if you will, as the fastest growing sectors, education and health care services, are composed of 80-85% female employees, even as the labor force participation rate for males age 24-54 continues a mutli-decade decline to under 90%. If the pattern of the 1930s to WW II and that of Japan from the early ’90s to date repeats, males under age 30-35 and over age 50-55 will suffer the highest rates of labor force dislocation, unemployment, underemployment, and loss of occupational continuity.

Thus, as structural demographic drag effects bear down on the US labor force and economy, and males experience lower participation rates and higher unemployment and underemployment, females will become increasingly relied upon by households and by underemployed, unemployed, or retired males to bear a larger financial burden as the debt-deflationary depression persists well into the end of the decade and early ’20s.

That females do most of the discretionary household spending, the increasing share of females’ after-tax incomes required for household subsistence will further reduce discretionary expenditures for meals out, travel, gifts, apparel, jewelry, etc.

Considering past cycles, employment takes awhile to move. Generally 2 things need to happen:

1.GDP needs to catch its previous peak

2.GDP need to run .5% quarterly to produce job growth.

The fact there are signs of growth in the private sector in the 3rd quarter, suggests past GDP figures were to low and need to be revised higher. The recession for now, is over.

Taxes and regulations always rank high. If you download the NFIB report, you can see that they are around their historic level as a concern. The concern for regulations was very high in the mid-90s. Krugman’s graph shows it as well.

“Distracting” prior decades? Sounds suspiciously like “doesn’t fit my story” prior decades. What do we know from a single periods responses? Not exactly diddly, but maybe pretty close to diddly.

Then, interestingly enough, you quote Roberts, who thinks it’s a good idea to compare the latest level of tax and regulation complaints to prior periods. Imagine, a guy from Cafe Hayek who finds a way to claim that government is the problem. Who’d have thought?

The biggest increase among the categories from the period around the beginning of the recession is in “poor sales”. There has been no campaign to make “poor sales” the issue. Far smaller increases can be seen more recently in “taxes” and “regulation” and there have been campaigns to vilify taxes and regulation. There certainly are things other than demand that are a problem, but falling into the rhetorical web of the “Club for Growth” and the baggers is almost funny if it weren’t so appalling. Get a clue.

And, oh, by the way, why are you saying inane things about the JOLT report? The same point about the JOLT report you are making now could have been made, with slightly less advantageous results, at the depths of the recession. The fact that there are millions of jobs turning over every month does NOT tell you what you want to know about the labor market. There are ALWAYS millions of jobs turning over in the US labor market. Until this post, I would have assumed that you know that all of the big-4 series in the JOLT report remain below normal in the latest report. If you don’t know that, you don’t know enough about these data to be commenting on them.

Picture, for those who care, provided by Calculated Risk. Sheesh.

http://calculatedriskimages.blogspot.com/2010/09/job-openings-and-labor-turnover-survey.html

I agree with Joe above. Also, it looks some categories dove when the financial crisis hit, indicating that this tracks general views and not necessarily considered opinions of business challenges; also there has been a rebound to a higher normal in govt reg throughout the recovery, reflecting the resurgent anti-government views of elites in that period as is well documented in the news media. Russ Roberts – distracted by history – reason enough to ignore what he says, but I read it and it is ridiculous (insert ridicule here).

Small businesses’ perceived problems shift with both political and economic winds. Three recent features in the graph make this evident. 1) After the election of 2006, taxation as the perceived primary problem increased quite dramatically, then fell off once fright over the democratic electoral victories had receded. 2) After January 2009, though Obama had not conspicuously increased taxes, fulmination over the as yet imperceptible waves of his invisible hand certainly drove concern over taxes upwards. It might be useful to subject these perceptions to a reality check against tax incidence for small business, before asserting that demand is not the end of the story. 3) It must also be pointed out that primary concern over “government regulation” increased stunningly as the 2009 stimulus bill went into effect. Most likely, businesses were “primarily concerned” over filling in the paperwork for contracts they wished to compete for!

So, “taxes,” as a problem, out of the mouths of businesspeople: a joke, unless you care to demonstrate otherwise. “Regulations,” in the current context: a proxy for effective demand, the same problem indicated by “poor sales.”

Lack of effective demand is not the entire problem. We must add the refusal by businesses to invest, a behavior quite unlikely to change until after the election. Until then, businesses will simply keep hands in pockets, not the first time palpable threats of deadly inaction have been deployed to move electorates.

The threat of the US being taxulated to death is real. The strangulating growth of bureaucracy in Japan over the last 25 years is a cautionary tale.

Yet I think there are more important counter-arguments against Krugman’s great desire to manipulate ‘aggregate demand’.

Karl smith notes that the bottom category “poor sales” and unemployment move in lockstep.

http://modeledbehavior.com/2010/09/15/the-gdp-factory-and-the-small-business-survey/

This sure supports Krugman’s point.

And I’ll posit that to the extent the stated importance of taxes and regulation in this subjective evaluation means anything (not a point I’m willing to concede: 11 to 15 and 18 to 21 are little more than noise in the data, with no actual tax or regulation changes to cite) simply reflects influence from the widespread ignorance of anti-tax teabag populism.

http://www.forbes.com/2010/03/18/tea-party-ignorant-taxes-opinions-columnists-bruce-bartlett.html

Plus what Joe and Kharris said.

This post is a failure.

JzB

Steve Keen: Deleveraging with a twist.”

The NFIB survey is worth looking at, but remember that the baker isn’t always an expert on making sandwiches. For example, the business owners typically think they pay the taxes that are, in fact, passed on to workers or consumers. The biggest problem in the economy may not be that which the small business owners think is the biggest.

The bank has been confiscating purchasing power, and lending it back to citizens. This has led to too much debt to be serviced out of debased income. Once debt reaches this point, printing more debt does not lead to more demand. There are not enough credit worthy borrowers left to borrow all of the additional debt the bank is printing. The public sector can borrow the new debt being printed for awhile, but public sector debt will eventually reach the point where it cannot be serviced out of tax receipts.

The printing-debt-to-moderate-recessions strategy trades a few small recessions for one big one in the future. The reset point is drawing near, although public debt can ramp up for awhile yet. As Rogoff/Reinhart have shown, ramping up public debt comes at a cost. There is also a cost for ramping up private debt. The cost is a reset period after the great moderation.

Am I to believe taxes and regulations are most often way down the list of business concerns?

I think you’d get a similar response from plain old people who don’t own businesses. No matter what time period you care to choose. The difference between business owners and just regular folks would be the number one concern today. For business the phone’s not ringing. For regular folks the paycheck’s not coming in.

The financial sector profit growth is again outperforming all other sectors in Q2 2010

http://seekingalpha.com/article/215821-s-p-500-earnings-scorecard-by-sector-q2-2010

From above earnings tables, readers may draw all sets of conclusions on employment and savings.

One may then be expecting to read promptly,the best Banks stress tests that is, 90 180 360 days debit interest amounts unpaid.

Loans and syndicated loans restructured with differed repayments schedules.

I think the question that needs to be asked is how can prices be brought down to the point where consumers can afford to express their demand.

Or, how can income be freed up so that consumers can express demand. I see it being tied up in two places 1) Interest and 2) Taxes.

Has anyone paid attention to the fact that taxes have gotten steadily lower over the past 50 years, while the economy has simultaneously been grinding down? Taxes have never been lower in my aging mother’s life-time. Meanwhile, GDP growth has been slumping since the 80’s, when tax cutting became really serious business.

Anyone who thinks taxes are the problem ought to pay a visit to the 60’s – best economic performance ever, with taxation massively higher than now.

Sometime we ought to put facts ahead of ideology.

JzB

“Sometime we ought to put facts ahead of ideology.”

We’ll wait for you to follow your own prescription …

Anonymous,

‘You need to put some money where your mouth is’.

Do you have something to refute what jazzbumpa claimed about the 1960s. If not you will simply continue to be guilty of what you’re accusing jazzbumpa of being guilty of… He did however provide some support for his argument. So that leaves you as the hypocrite without ‘any’ “facts”. A more foolish comment than yours would be difficult to make.

JDH: I don’t know whether you will be insulted, flattered, both or neither, but while I was reading this article I forgot which blog I was read and starting thinking “I like the way Tyler rejects single factor explanation, and instead thinks through more carefully and considers other perspectives”. Then I read your byline at the bottom and realized “Wait – I’m at EconBrowser, not Marginal Revolution”. In any case, nice analysis.

Mayber we are placing too much emphasis on small business. It’s true that small business creates a majority of jobs but they also destroy a majority of jobs. The majority of ‘lasting jobs’ are created by larger firms. So, it might be equally relevant to survey HR managers in larger firms rather than small business owners.

Plus what Joe, Kharris and JzB said.

“This post is a failure.”

JDH states:

“But I disagree with those who suggest that this is the only factor.”

OK, so what are those other factors?

Well, you cite Russ Roberts as follows:

“In fact, if you look at just the latest data from the NFIB rather than the distracting previous three decades, you see this: . . . Yes, 31% of respondents do say that sales are their “biggest problem.” That number hasn’t budged much over the last year. But two numbers have changed a bit more than that– 21% of respondents list taxes as their biggest problem up from 18% a year ago. And 15% list government regulations and red tape as their biggest problem, up from 11%. In fact, if there had been one category called “Taxes and Government Regulations” it might have been seen as the biggest problem, listed by 36% of respondents, up from 29% in the year before and surpassing sales as the biggest problem.”

Let’s unpack this. To echo kharris, take this line:

“if you look at just the latest data from the NFIB rather than the distracting previous three decades . . . .”

Um, that should have sent the red flag skyward, no?

As for the rest of the “argument”, take a look at this post from Karl Smith, paying special attention to the graph:

http://modeledbehavior.com/2010/09/17/sales-vs-labor-quality/

So, what jumps out over the period 1986-2010?

Taxes? Nope.

Interest rates and finance? Nope.

Labor Quality? Yes — in that it’s not a reported problem since the recession began.

Sales? Uhh, yes. Resoundingly. Emphatically.

Regulations (Govt. Requirements)? Not graphed by Smith, but . . . . looks pretty steady.

So, Russ Roberts and Cafe Hayek support your point how? Is the sophistry he/they employ not abundantly obvious to you?

Not to pile on too much, but for a smart guy, you seem very unaware of your personal belief/political blinders, JDH.

This reminds me of the period of 2005-2007 where you missed the housing/credit bubble, e.g.:

https://econbrowser.com/archives/2005/06/the_great_housi.html

If people aren’t buying enough things, the problem is that they’re idiots who need to be brought in line with policies that force them to spend.

The problem can’t possibly be that stuff isn’t being produced at a price that justifies buying it.

If we crank up spending, then we will have a good economy, regardless of whether people like the junk that they’re being forced to purchase.

There, do I sound like an economist now?

I suppose it’s clear enough what businesses mean by “government regulation and red tape” but it’s not at all clear to me how businesses think higher taxes are holding back employment growth. Or do they mean that they are holding off on capital investments waiting to see if another investment tax credit comes along? If so, then shouldn’t they be criticizing the GOP for stalling those kinds of tax cuts?

My sense is that businesses don’t really know what they mean…whining about taxes being the reason for sluggish employment is just some unfocused lashing out at government. Businessmen are not in the habit of blaming themselves or their business models for bad times, and this is especially true of small businessmen who tend to become emotionally invested in their businesses. So if they can’t get a loan they tell themselves that it’s because of TARP or big government gobbling up private savings with big deficits even though the 10 yr is 2.72%. It never occurs to them that maybe their business model is a bad risk in a weak economy. And God forbid that they would ever actually stop to fact check things to see if taxes really are as high as they imagine them to be. I have no doubt that many small businessmen honestly believe taxes are a major reason for not hiring, but I suspect that this only tells us about a businessman’s ability to fool himself and not so much about why employment growth is so slow.

Jazbumpa makes an excellent point.

Maybe higher taxes lead to MORE PRODUCTIVE uses of money.

Money sitting in T-Bills in your rich person’s account,

vs.

Money invested in the economy as roads, bridges, septic systems, clean water, mass transit systems, leading to a higher multiplier effect: Leading to More Jobs and More Wealth in the overall economy, which shores up Stock Market Valuations as well.

Mike,

I think you have it close to right but… bubbles are not possible unless investment flows outpace incomes. So it is not so much that higher taxes lead “to more productive uses of money”, it is instead a matter of equilibrium between investment flows and incomes. Wages simply need to rise in pace with growth once equilibrium is established.

Reading this post without knowing the author, I would never have guessed it was written by JDH. Many of the criticisms are obvious. I guess we can all have an off day.

Yep, while Roubini, Calculated Risk, Stephen Roach, Dean Baker, Robert Shiller, … were sounding the alarm about the run-away housing market as early as late 2003 and the unsustainable credit bubble, yours truly here, although residing in the bubble suburb of San Diego, never saw it coming until it was too late. This is one of the reason why economists and their profession took much of the blame for the collapse. Everyone was enjoying his/her own Koolaid. I came to this blog and other economic blogs as I began searching for more balance economic analyses, after the astonishment of how the US market recovered very quickly after the tech bubble burst and the immediate policy-induced inflation of another asset class in housing, in hope of fair, accurate and apolitical presentation of our economy. And I have been very disappointed since with Econbrowser. What I have been most amazed about the last decade of observing our economic discourses through the blogosphere is how these smart professionals have become so blinded by their ideology. I learned quickly the ideological bents in the writings of the blogs I visited. My daily must-read, balanced and neutral, is by Calculated Risk, not an economist, but rather a seasoned and retired CEO. Much to be learned there.

One thing that strikes me looking at the picture is the small percentage assigned to finance and interest rates. Seems to imply that further monetary loosening would not be of much help.

The survey you cite is a very poor guide to hiring decisions, which reflect estimations of future conditions as well as current conditions. Large businesses and the lenders that fund small business understand the implications of high private and public indebtedness and the inevitability of deficit reduction and interest rate increases.

Jazbumpa, Mike Rino, et al:

Federal tax receipts were about 18% of GDP during the 60s–roughly the same as the present decade. Those high rates apparently didn’t hit that many people, no doubt due to a plethora of tax avoidance strategies.

State taxes are drastically higher in my state than they were in the 60s.

As for regulation, it took the inventor of the light bulb 3 days to get a patent. The average patent today takes 3 years!

US Treasury fact sheet:

Prior to, and in many circles even after the 1981 tax cut, the prevailing view was that tax policy is most effective in modulating aggregate demand whenever demand and supply become mismatched, i.e. whenever the economy went in to recession or became “over-heated”. The 1981 tax cut represented a new way of looking at tax policy, though it was in fact a return to a more traditional, or neoclassical, economic perspective. The essential idea was that taxes have their first and primary effect on the economic incentives facing individuals and businesses. Thus, the tax rate on the last dollar earned, i.e. the marginal dollar, is much more important to economic activity than the tax rate facing the first dollar earned or than the average tax rate. By reducing marginal tax rates it was believed the natural forces of economic growth would be less restrained. The most productive individuals would then shift more of their energies to productive activities rather than leisure and businesses would take advantage of many more now profitable opportunities. It was also thought that reducing marginal tax rates would significantly expand the tax base as individuals shifted more of their income and activities into taxable forms and out of tax-exempt forms.

The 1981 tax cut actually represented two departures from previous tax policy philosophies, one explicit and intended and the second by implication. The first change was the new focus on marginal tax rates and incentives as the key factors in how the tax system affects economic activity. The second policy departure was the de facto shift away from income taxation and toward taxing consumption. Accelerated cost recovery was one manifestation of this shift on the business side, but the individual side also saw a significant shift in the enactment of various provisions to reduce the multiple taxation of individual saving. The Individual Retirement Account, for example, was enacted in 1981.

I might be simple-minded, but I think there is a simple explanation for small business to offer a wider array of r”single most important problem” question. Bias based on experience, politics, and poor information, for example, would influence answers, wouldn’t it? Doesn’t it all boil down to costs of production versus returns? You could have a negative tax rate, for example, and a smart business would not hire if it thought it would lose money. Business might feel pressured by regulation, competition, taxes, etc, but it all really comes down to whether the economy will support growth and profits, right? And that requires demand. Which would support Krugman’s position.

As a commercial landlord for a very long time, I see lots of small businesses. I have spent a ridiculous amount of time discussing how their businesses work with the owners, managers, etc.

The problem is sales. It is sometimes cost, but then mainly when it’s a sudden rise in the cost of a product because that can’t be passed on to the customer – because small businesses can’t do that to their customers so they eat lower margins.

If you are selling, life is good. If you are selling, you hire. If you aren’t moving products (or services like hair cuts), then you cut back hours, work more yourself, open longer hours, fall behind on your rent, slow pay utilities, etc.

There is so much nonsense spouted by people who look at aggregate data and aren’t connected to the business world or who extrapolate wildly from one experience and one observation (which they’ve likely heard from someone else).

In the many years of being a landlord renting to small businesses, I’ve seen one reason and one reason ONLY for business failure. That’s called lousy sales. (I’m not counting retirements, stupidity that approaches insanity, theft by a partner or drug addiction because those are one off events.) It’s kind of freaking obvious when you collect the rents every month, every year, good times and bad.

Now if you ask small businesses what they are worried about, they say a bunch of things. They complain about social security taxes. They complain about how much free stuff the cops take as comped meals or sodas and bags of chips. They complain (a lot) about the difficulty of getting workers who will be as good and as devoted as they are to the business – which I’ve teased them about for years because they want someone to do for them for little money just because they want that.

I don’t understand why economists can’t distinguish between what’s said on a survey and what actually drives a business’ results. In all but a few cases, that boils down to three things: sales, costs of goods sold and service. Good clerks at a hardware store generate sales because they generate repeats.

There is always a section of business that is doing reasonably well, even in lousy areas where the economy sucks. They might then complain more about taxes or red tape – which is almost always local, not federal. They focus on that because they’re doing ok.

The sheer stupidity of the argument I keep reading is that you seem to expect that unless 100% of business complain about sales then sales are somehow not the problem. You clearly don’t understand actual business – and you’re less bad than 90+%. If 1/3 are worried about sales, that means a lot of businesses are in trouble. That’s a huge percentage. That’s like 3 times what it is in decent times and that’s the point: you see 3 times as many businesses in trouble now as you do when times are good. Not great, just good times generate about 10% sales worry. A 3fold increase is immense.

Just try collecting the rent every month. You hear over and over and over and over and over how bad business is or how bad it is for that guy and that guy but he’s doing ok and I’m making my bills but nothing more, have had to cut back employee hours because I can’t pay them, working more myself. Get it? 1/3 of small business is in deep doodoo because their sales suck. That’s an enormous number of businesses.

Why is this so hard for academic economists to understand? If you are making it, then you worry about lots of things. If you aren’t, then you worry about sales. Some people will always worry about taxes, about quality of help, about whatever because they’re making ends meet and are at least doing well enough that sales aren’t making them shut the doors. This isn’t difficult stuff. I’m sorry. But my word it shows the absolute disconnect between academia and the real world.

As an addition to my rant about sales, do you not understand what “government regulation” means for small business? The implication is that it’s federal red tape, but businesses most deal with federal rules through tax payment and then the rest is state and local. What are these rules? Some are licensing, like licenses for cosmetologists in many states. One can argue that but it’s state, not federal. Others are more onerous but look at them more closely and you have to wonder if the argument about “red tape” isn’t just a red herring. Many businesses deal with caustic chemicals – hairdressers, pet stores, hardware stores, auto parts places. They have to dispose of them responsibly – or they dump them in the drain. Let me tell you, when you rent to a Chinese restaurant, make sure they pay for grease removal because that stuff will be poured into the drains and then into the sewers and the entire system can clog, requiring digging up pipes and massive repairs. Is it really too much regulation to require cleaners to dispose of chemicals safely? Do you want that stuff dumped in the back or down the drain? Along with disposal come handling requirements, which often means certifications. Again, is that really red tape? Ever seen a grease fire in a restaurant? Ever had one flash over and consume the stores next door? All that is mandated inspection, mandated disposal procedures and that red tape means very few of the huge fires that used to destroy buildings and many fewer deaths, including of firefighters. So yeah there is a lot of government for business but I doubt that many people would want to get rid of it if they looked at what it is instead of being told it’s just “red tape.”

The problem, Jonathan, is what is causing the lack of sales. People’s incomes are already over committed. When prices went up, they borrowed for a while, expecting that thier incomes would rise or the prices of their expenses would fall back to normal. Neither happened.

Too much income is committed to paying interest, so debts cannot be paid down fast enough to free up income for more spending.

I suspect that the readers here failed to consider the broader implications of this post and so this thread turned-out somewhat disjointed. What Dr. Krugman is doing though is shoring-up his argument regarding larger stimulus’ in general, and, that of late regarding more stimulus. If the reader connects this statement: “Businesses aren’t hiring because of poor sales, period, end of story”, to his recent arguments regarding his opinions related to whether the current unemployment is structural or cyclical… It becomes increasingly apparent that Dr. Krugman is busy covering his ass as the evidence for structural unemployment overwhelms his assertions of cyclical unemployment being the correct assessment.

Dr. Krugman’s role in the misguided stimulus-fund distribution is being revealed on a daily basis and he is choosing to play-up certain aspects of the conversation while down-playing others. So if the reader can incorporate the broader implications of what is currently unfolding in the analysis of the underlying dynamics of unemployment, then the reader should be better able to appreciate what JDH has added here to the larger concerns of our economic circumstances. This post does in fact add an important piece to the puzzle for those who would appreciate having all of the pieces.

For anyone interested in the structural/cyclical argument that is unfolding, see ‘Structural Impediments’ on ‘The Conscience of a Liberal’, and, in that post Krugman uses the analysis from Mike Konczal’s ‘Rortybomb’ (see comments). Dean Baker also ran a post on the same subject yesterday although it seems that he has removed that post from his site today. In all three cases the analysis is/was based on a flawed methodology that I questioned, in all 3 instances, but without any responses other than Baker’s removal of any and all evidence of his wishful-thinking-motivated analysis.

What all this boils down to is that structural unemployment is impossible to detect without analysis that is focused on local job markets but the analysis that is being presented by the Keynesian faithful is based on comparing sectors mostly (national), with, some very vague references to occupations. A focus on occupations would of course be apt although only on a basis of comparison between cosmopolitan or local job markets. The post on ‘Rortybomb’ is revealing enough for anyone on a time budget: Rortybomb,

The Stagnating Labor Market, 2: What Can the Employed Tell Us About the Unemployed?

In response to aaron, yeah, too much debt is a big problem. Personal income didn’t budge over the decade – except for the top – if you don’t count home equity loans. Of course that’s a problem and remember that the GOP passed the GWBush tax cuts by using a trick that let them not cut spending to match the revenue losses. (That’s why they expire.) They are the party of fiscal irresponsibility.

But debt speaks to aggregate demand and what I see among tenants is a failure of demand. Some are themselves over-leveraged – notably the chains, because they had credit to expand. But the chains can walk from most leases because they have the leverage to get “go dark” clauses and many, if not most of the newer leases have early opt-outs that limit long term rental exposure. An actual small business has no choice but to scrimp and save or shut the doors.

Some of the antipathy to taxation is because they are looking for a handout. They don’t call it that, but what they want is to pay less because they’re making less. They are in fact paying less because they’re making less – because taxes are paid on income, not on receipts – but when you’re working extra hours and cutting every corner then you want every penny you can find. To be blunt, they complain a lot about paying taxes for workers, meaning social security, medicare and unemployment (which is still mostly state set). So keep in mind that when businesses are complaining about taxes, they often mean those taxes that the general public is in favor of. There’s a great hunk of hooey about taxes but much of it comes from conflating income tax (which you don’t pay if you don’t have income) and social welfare taxes that the public vastly supports. We aren’t going to eliminate the social security tax, so some businesses will always complain.

Interesting comments on chains. Here in Rochester MI, an affluent suburb of Detroit, a couple high end chain restaurants recently closed shop and are being replaced. I don’t know whether there are changes in ownership. A Tom’s Oyster bar closed and Andiamos. What is strange is that both seem to be being replaced with tex/mex style restaurants. TOB openend in 2007, A had been there since 99.

I question the usefulness of this focus on domestic employment.

We have a domestic market. Companies can choose to sell to it with a domestic employment base or an outsourced employment base.

They are choosing to increase their use of an outsourced employment base.

If you do not factor that into an analysis of why companies are not hiring domestically, your analysis is woefully incomplete – and even misleading.

“new reports show that during the recession American companies ramped up investment overseas for plants and new hires, as well as research and development — even as they cut back domestically.

Foreign subsidiaries of U.S. corporations increased their spending on research and development by more than 7% in 2008 from the previous year, pushing the total to nearly $37 billion. But these same multinational companies sliced R&D expenditures in the U.S. that year 2.2% to $199 billion, Commerce Department data showed.

A similar but less dramatic difference was evident in hiring: Employment at these overseas units rose 1% in 2008 — and a stunning 15% in China — but was down 2% for the U.S. elements of the 2,200 multinational firms the Commerce Department studied.”

link

http://www.latimes.com/business/la-fi-economy-rd-20100913,0,3957503,full.story

Dunno, but slow job creation could be due to administration focus on the wrong sector. Wat’cha think? 1st comment from this article: http://rogerpielkejr.blogspot.com/2010/09/free-trade-and-green-jobs.html

“It hasn’t gone un-noticed, particularly by those in Congress. When Stimulous II came along, notably absent was any aditional subsidies for green energy. There was an article on this subject in the Washington Times (I realize not an exceptional source but worth a read.) http://www.washingtontimes.com/news/2010/sep/9/green-jobs-no-longer-golden-in-stimulus/print/

Here is an interesting excerpt:

“The Department of Energy estimated that 82,000 jobs have been created and has acknowledged that as much as 80 percent of some green programs, including $2.3 billion of manufacturing tax credits, went to foreign firms that employed workers primarily in countries including China, South Korea and Spain, rather than in the United States.

Peter Morici, a business professor at the University of Maryland, said much of the green stimulus funding was “squandered….””

RE: Poor sales: what are the customers buying that they cannot afford to buy Main Street’s products?

Energy is one cost that spills across all categories. The customer who can afford to buy the more expensive diesel fuel or gasoline cannot afford to buy the Jet Ski or vacation. High fuel costs accumulate across the entire business spectrum, putting pressure first on businesses that require cheap fuel to enable purchases of their goods and services.

Hiring IS taking place but the returns on labor are far less than what took place twenty or so. Pushing jobs offshore is a hedge against rising energy costs as the cheaper labor plus shipping cost less than very expensive US labor plus a little less shipping.

Self- defeating as firing workers is firing customers at the same time.

Bryce –

Your last comment ( September 20, 2010 07:57 PM) is profoundly irrelevant. Taxes/GPD wanders in a cluster near 18%. If interested, you can do some homework here.

http://jazzbumpa.blogspot.com/2010/02/republicans-all-wrong-all-time-pt-7.html#more

It’s an essentially meaningless data artifact. Taxes are a function of GDP – they are not independent variables.

Re: patents. Take a look at the number of patent applications (lots) and the number of patent examiners (few.) The patent office is understaffed. This is not an over-regulation or big government problem. There is significantly less regulation now than at even the midpoint of the Clinton admin.

Also, you might note that regulation – like taxation – has greatly decreased, going back at least to Carter. Since then GDP growth has trailed down.

And I can back that up with data.

http://jazzbumpa.blogspot.com/2010/05/republicans-all-wrong-all-time-post-ww.html

Unless your ideology trumps facts and data.

JzB

CoRev “…went to foreign firms that employed workers primarily in countries including China, South Korea and Spain, rather than in the United States.”

I think the news article was misleading. The implication is that green stimulus dollars are not going towards employing US workers. This is just wrong. For example, the Spanish company Acciona is one of the biggies in wind turbines. Yes, stimulus dollars go to a Spanish company and that Spanish company hires lots of non-American workers at its Spanish plants….so to that extent the article is correct; however, Acciona also employs a lot of US workers as well, and those workers are largely in the midwest. Ever see those huge blades rolling down the interstate? Those are made in the midwest by American workers. You wouldn’t know that if all you knew about Spanish wind turbine jobs is what you learned from the Washington Times.

What is the most important factor holding back employment growth? The conventional answer is that it is the low demand for firms’ products and services. But what underlies that?

I believe the most important factor holding back employment growth lies in the outdated market paradigm (or process), which has not been adequate for this stage of the Modern Information Age. It has aggravated the employment condition for middle- and lower-income workers.

Please see the following post – Saving the world economy: Overcoming an Economic Sisyphean Task – Or, the True Path Back to Economic Prosperity http://savingtheworldeconomy.blogspot.com/2010/09/overcoming-economic-si…

Low demand is a contributor, but what about the consistent increases in productivity as a factor? With more efficiency per worker, less need to hire more.