I guess now we know that the Fed has the tools to prevent deflation.

Recent research by Ke Tang and Wei Xiong documents that the correlation between the price changes of different commodities has been increasing over time. Here for example is the correlation between the changes in oil and copper prices. These two prices were essentially uncorrelated in 2001. Back then, in a week when oil prices went up, the price of copper was just as likely to go up as down. Over the last few years, however, the two prices have been much more likely to move together.

|

The recent positive correlation of course does not mean that an increase in the price of oil is what’s causing the price of copper to go up. Instead, it just signifies that there are some common factors affecting the two markets in a similar way.

Another changing correlation over time is that between commodity prices and the exchange rate. Here for example is the correlation between the weekly change in the dollar price of oil and the weekly change in the number of dollars you’d need to buy one euro. In 2001, the correlation was actually negative for a while, because news of a weakening U.S. economy would cause both the dollar to depreciate and the dollar price of oil to fall. In recent years, however, the correlation is positive and quite strong. In the year ended September 1, a 1% depreciation of the dollar would typically be associated with a 1.3% increase in the dollar price of oil or copper.

|

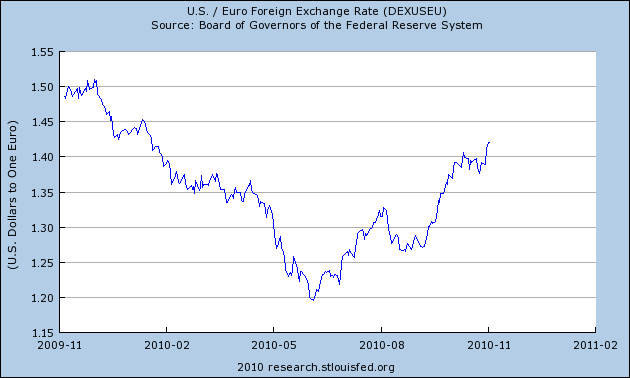

The dollar strengthened against the euro with last spring’s sovereign debt concerns, but has slid back dramatically since this summer. My view is that the anticipation of the Fed’s latest quantitative easing measures has been a key factor in that slide.

|

It’s interesting to look at how big an increase in commodity prices we would have expected given the size of the dollar depreciation and given the size of the recent correlation. It turns out that the recent run-up in oil prices is no mystery, given the magnitude of the dollar depreciation.

|

Ditto for copper prices. Note that the path for “predicted prices” in these two graphs is identical, since both are driven by the same realized exchange rate path.

|

I feel that there is a pretty strong case for interpreting the recent surge in commodity prices as a monetary phenomenon. Now that we know there’s a response when the Fed pushes the QE pedal, the question is how far to go.

My view has been that the Fed needs to prevent a repeat of Japan’s deflationary experience of the 1990s, but that it also needs to watch commodity prices as an early indicator that it’s gone far enough in that objective. In terms of concrete advice, I would worry about the potential for the policy to do more harm than good if it results in the price of oil moving above $90 a barrel.

And we’re uncomfortably close to that point already.

We see the same thing in stock prices – the decline in prices from April 2010 up to September 2010 corresponds is very much correlated with the timing of the end of QE1 (in March-April 2010) with the credible expectation that the Fed would initiate QE 2 beginning at the end of August 2010.

Professor,

Oil over $90/bbl would be normal considering the current value of our currency. Expect oil in the $90 range before the end of next year and if QE2 is not offset by tax cuts or other supply side policy changes expect oil to be pushing (or above $100 by the end of next year).

I suppose this means that you diagree with Prof. Krugman on this question then.

tyaresun: Right.

The Fed can “watch commodity prices,” but it is unlikely to do anything about them as long as unemployment remains high.

Exit from stimulus requires success in creating sustained real growth. Are you suggesting the Fed might scale back or abandon QE2 at a 9.5% unemployment rate? This seems highly unlikely. How would markets react? I suspect they would be quite upset indeed…

The point is that once Bernanke starts writing editorials extolling the virtues of the wealth effect, he is “on the hook” for the market’s direction. Any large decline in stock prices, and ensuing rise in unemployment, would be blamed on a Fed policy “error”.

JDH: I’m wondering what you think of this research on forex rates and commodity prices in the context of current commodity price run-ups.

http://www.voxeu.org/index.php?q=node/1631

I am not sure whether the series are cointegrated or whether there is a causal or merely forecasting effect, but presumably there is some transmission mechanism at work here.

Where does the $90 a barrel comes from? Is it derived from some sort of model on the impact of oil price on consumption or investment?

Robert Bell: Regardless of whether the series are cointegrated, the correlation between changes over a given fixed time interval is always a well defined concept and is what all of the analysis above uses.

I have never understood the logic behind core CPI as a measure of inflation. It excludes food and fuel from the index because they are volatile.

Isn’t that precisely the wrong reason. Shouldn’t the most volatile sectors of the economy be the first to feel pressure from inflation?

If I were looking for signs of inflation I would look in food fuel. And there they are. It worries me that Bernanke has not acknowledged their existence.

http://bpp.mit.edu/daily-price-indexes/?country=USA

Will Commodity inflation lead to consumer inflation?

I do not think so with still so much private debt in the system.

Check out Billion Prices Project. It is real time data of prices for different countries including USA that are…

Statistics updated every day

-5 million individual items

-70 countries

-Started in October of 2007

-Supermarkets, electronics, apparel, furniture, real estate, and more

http://bpp.mit.edu/

As you can see Ricardo, the fluctuations in the price of oil over the past year (move your cursor over the “1y” button) make your predictions (hunches or calculations) seem a little tame.

No question oil is an important commodity, but I wonder if there aren’t others that are overlooked here.

Food prices, (like oil, too volatile to count in the CPI we are told), seem to be moving up and the commodities associated with non-discretionary consumer good?

With inflating (but of course unrecognized) food prices we get declining discretionary spending…so a step over that little deflationary hurdle, “the price will be lower tomorrow, so wait.” to “no price will be low enough, so forget it.” This splains why I am not shopping for the Bugatti.

Hard to believe that the current compilation, ~1-2% inflation, in an economy that is 70% consumer spending, spending tied to house prices, prices now falling…is tied to reality.

On the ground, it feels (and appears…and sounds and smells) like deflation, you know?

Tis a variant of NoHousingBubbleHere maybe…or maybe the continuing denial.

The FED can indeed generate some extra inflation in the price of scarce resources. What it can’t do is trigger inflation in resources that are not scarce: mainly real estate, and labor.

Surely you have to take some interest, James, in the pronounced changes observed in extraction rates for both Copper and Oil the past 10 years. Correlation between price and those rates is both strong, and sustained. Correlation is even further enhanced when one introduces declining resource quality, in particular declining ore grades of copper, and the notable introduction of non-conventional oil into the broader supply of conventional oil.

No question that reflationary policy in the current phase (Q3 2007 – Q3 2010) has enhanced USD denominated prices for commodities. But, how successful would this have been without the geological constraints for both copper and oil which are, by the way, quite well established now in the data.

G

If the Fin Mins of of 2nd tier nations make direct purchases of dollars on the forex exchange, as they are threatening to do, this will drive the value of the dollar back up. Consequently, assuming that the oil producers continue to manipulate supply, the price of oil should go back down, and the oil producers have been clear about what they see as a fair price, a price which was at $70. per barrel when the dollar was about 10% (?) higher than it is now.

So, inflation concerns would thereby shift to currency monetization from 2nd tier currencies. Guido Mantega has said that Brazil will do whatever is necessary to keep the real from further appreciation. And similar statements are coming out of Asia daily. It would seem then, that a more interesting question might have to do with whether Bernanke & Co. are planning to spread the reserve currency responsibilities across a wider range of currencies. This because dollars would need to be removed from the global economy to accommodate the influx of reals, wons, bahts, ruppees, yuans and etc.

Rafael,

Gold is a good proxy for commodity prices. A rule of thumb for oil to gold that has been true for about 100 years is that an ounce of gold will run roughly 15 times a bbl of oil. The ratio right now is about 16:1 because gold has run up faster than oil. Oil demand is also dragging the price down slightly. Demand will not have a lasting effect because the producers will adjust their supply. A gold price of $1,350 in a perfect world would imply an oil price of $90/bbl. Gold is around $1,400 and climbing so there is significant monetary pressure for oil to be above $90/bbl.

Oil at $100 next year is dependent on whether the FED controls the money supply. Indications are that the FED will continue to expand the money supply driving gold toward $1,500 and oil toward $100/bbl.

i have to say, in spite of my respect for your erudition, prof. hamilton, i disagree entirely with your conclusion.

that *anticipation* of QE might have fueled a speculative rally which predominantly flows into commodities thanks to reflexivity — that i think we can agree on.

that QE *itself* is an inflationary phenomena remains totally unevidenced — to the contrary, observe core inflation readings in the context of QE1 and QE lite, please!

you’re taking a speculative leveraged flows into notoriously volatile raw inputs and end-of-the-capital-structure financial instruments and from that construing that a fed measure *that hasn’t begun yet* causes inflation? color me bemused.

i think it far closer to the truth to say that the fed plans to exchange some very-cash-like assets out of the private sector and replace them with cash itself. that very minimally alters the character of net private sector financial assets, and should not be expected to do much of anything — as indeed QE has in the past rarely if ever accomplished much of note outside of a liquidity crisis. if wall street wants to take the anticipation of QE as an excuse to flood speculators with call money, taking advantage of popular misconceptions of what QE is and what it can do to create standard-issue speculative demand for assets, that’s another thing entirely.

Were you also confident that $150 oil was inflationary? Wages lead inflation. Not speculative bets in markets.

Adjust commodities prices for the US$, as well as adjust the US$ for the US$- and CPI-adjusted price of gold.

You will find that (1) basis ’73, the US$-adjusted CRB Index is near the lows of the past 25-35 years; and (2) since the nominal price bottom in gold in ’99 and ’01, the US$ has fallen 80%+ in adjusted gold price terms, which is a bit short of the similar decline in the fiat digital debt-money US$ at the nominal gold price peak in ’80. A currency depreciation of this scale is about as bad as it gets in relative purchasing power terms to the historic yellow relic.

Moreover, take a look at the trade-weighted broad US$ index, which is trending around par after having been ~30% above par at the early ’00s high. There has been, nor will there occur a “US$ crash”; it has already happened, and gold is spectacularly overpriced and levered to the Moon.

Similarly, and not coincidentally, the trade-weighted US$ index of other trading partners is 27-28% above par, or approximately the level below par for the US$ index for major currencies (with the broad index splitting the difference, by definition).

The trade-weighted US$ is above par for countries where US supranational firms are investing tens of billions of US$’s in their subsidiaries and contract producers to produce goods for the US market and intra-Asia and the rest of the world; therefore, trade and capital flows and the demand for US$’s is relatively high versus the Eurozone and Japan where comparative trade flows have fallen over time (Japanese and European auto and parts production having moved to the US, for example).

Moreover, the US firm-induced faster growth of Asia means faster growth of demand for US$-denominated commodities, which require Asian firms and central banks to accumulate US$’s to buy commodities.

Additionally, the massive tens of billions of US$’s invested and deposited in Chinese banks by US firms over the past 10-15 years necessarily requires the PBoC to accumulate US gov’t and agency paper against reserves on behalf of supranational US firms that are unable to directly convert US$’s to Yuan to shift US$’s elsewhere throughout Asia, back to the US, or elsewhere.

And given that China’s money supply is growing at more than 2 and as much as 3 times real GDP growth, creating the greatest credit and fixed investment bubble to GDP in world history, were the Yuan to be convertible it would be collapsing from the flood gates of credit having been opened by Chinese state-run banks in the past 2-3 years.

Given the virtual GDP PPP, global peak oil production having occurred in ’05-’08, and oil consumption and import parity between the three major global trading blocs, the long-term trend is for major fiat currencies to trend around par with one another.

As debt deflation continues and global trade slows inexorably hereafter from structural resource constraints and limit bounds from heavy debt service vs. trend GDP growth rates, the trade-weighted US$ index for major currencies will trend toward par (from 72-73 today), the broad index continue to trend around par, and the other trading partners index will decline to par, with US$ repatriation by large US firms occurring with falling commodities prices coincident with global deflationary recession and stock bear markets.

The central bank cannot print abundant supplies of scarce resources, particularly cheap oil. Neither can central banks encourage the creation of more fiat digital debt-money bank deposits at infinite terms and compounding interest in perpetuity to resolve the burden on the private sector of excessive existing levels of debt and debt service costs on the bottom 80-90% of households.

Only one solution ever exists at the debt-deflationary Schumpeterian depression phase of the Long Wave Trough: a reduction in public and private debt to a level that can be supported by a sustained level of net energy per capita, which in turn can support a sustainable level of labor product, production, and capital replacement; but that level is far below the 3-3.5% real growth and 5-7% nominal growth we have come to perceive as “normal” with the abundance of cheap liquid fossil fuels since the mid- to late 19th century.

Plentiful supplies of cheap liquid fossil fuels over the past 100-150 years have conditioned us to delude ourselves into believing that Nature is a subset of the economy when the precise converse is the inescapable fact. Fiat debt-money can only grow in excess of wages, production, and physical plant and equipment only as long as available net energy allows it; we passed this critical point in the mid- to late ’00s, and hereafter private real growth per capita is impossible, and any nation-state or regional growth will occur at the expense of other areas.

Therefore, the growth of the Anglo-American imperial trade regime, i.e., “globalization”, is over, although most of us do not yet know it. China-Asia’s growth is largely derivative of massive US FDI and trade and capital flows to and within Asia. Once global growth again resumes its decline and a deflationary trajectory, China-Asia will crash.

Stock prices are discounting 4-5% nominal growth and 2-3% real growth; but 0-0.5% growth is likely the best that will occur, requiring a scale of asset deflation/liquidation and wealth consumption over the next 2-3 to 6-9 years few of us can imagine possible.

I am confident that $4.00/gal gas was inflationary. Falling back to $2.33 was deflationary.

gaius marius, and others: My concern is not so much inflation as Fed-induced changes in relative prices.

What government, in the entirety of human history has ever failed to inflate a paper currency. I’ll give you a hint, the answer is Z-E-R-O.

Every single paper currency in the history of the human race has ended in hyperinflation. There are ZERO, absolutely ZERO exceptions. Every single one in the history of the entire human race.

Commidities are priced in dollars. Starting around 2001 our Fed, Treasury and gov’t took on a weak dollar policy. Thus, of course QE and any other weak dollar policy will lead to increases in commidity prices as the dollar, for which its priced in, falls. Furthermore, weak dollar policy shifts captial into inflation safe-havens like gold and oil thus creating demand/supply disequilbrium and further increasing commodity value.

(First visit, very nice post).

I think that the Fed making it easier to change prices in the recent “unexpected” inflation is actually an advantage.

Those that go up relatively more clearly indicate the areas where additional productive investment can lead to higher ROI, and more sustainable jobs. In fact, it’s not knowing or being able to guess where the future “above average” demand growth is going to come from that is a major factor is stopping businesses from investing or employing more folks in that unknown area.

What other way can the nominal price of housing rise so that only an “acceptable” number of homebuyer mortgages go into default?

Yet to be seen. As people see non-discretionary prices rise and feel priced out of adequate returns on investments, they’ll need to save more. They reduce consumption and switch to inferior goods. There’ll be Giffen behavior and further drive for liquidity.

We may end up with deflation because of QE.

My guess is it will do more harm than good for oil above $70 a barrel.

“I suppose this means that you diagree with Prof. Krugman on this question then.”

I thought Krugman’s point was that global QE, with little change in exchange rates, would not raise the relative price of commodities. To see who is right, we may need to wait until the euro collapses under pressure of under-priced Chimerican traded goods.

Rwn, the fall to 2.33 was a correction.

JDH,

If we look at rising commodity prices alongside dollar depreciation (since last summer), isn’t the simplest explanation strong demand from developing nations?

Also, you said that you were worried about “Fed-induced changes in relative prices.” Doesn’t this concern implicitly assume that the market currently has the relative distribution of prices right and that any deviation would distort output? I suppose it’s possible that the current distribution of relative prices has it about right, but quite honestly I’m not sure I’d want to bet the recovery on it. Afterall, misleading price signals in the housing market are what got us into this mess, so I’m a bit leery of assuming the market always gets relative prices right. I think a better gauge of when the Fed’s gone far enough would be to wait and see when further Fed loosening results in inflation, but no measurable increase in output. I really don’t care if inflation surges to 8% if it’s accompanied by 5% real GDP growth. We can deal with 8% inflation later. That’s a problem we know how to fix. The only value that I see in looking at commodity prices is if those prices are also signals that additional inflation will not result in increased output. That could be true, but it’s not an argument that I’ve seen fleshed out anywhere.

In other words, if commodity price rises are an early warning of another asset bubble, then it might be time to take away the punch bowl. But if commodity prices are rising because of strong demand from developing countries, then this ought to be a good news story. Nice post. Gets the old gears grinding.

“The point is that once Bernanke starts writing editorials extolling the virtues of the wealth effect, he is “on the hook” for the market’s direction. Any large decline in stock prices, and ensuing rise in unemployment, would be blamed on a Fed policy ‘error’.”

It seems clear a major goal of the Fed is to hold up overvalued asset prices. That was especially evident from Ben’s response to the SocGen scandal.

That would be the same ‘wealth effect’ that helped induce U.S. consumers to profligacy that was reduced only when the apparent wealth was deflated to more realistic values. This policy of doing what pleases the people temporarily, rather than what benefits them longer term is getting old. Ben voted with Alan 100% of the time when a similar strategy was employed after the dotcom bust. Of course, in the long run, we are all dead, but unfortunately, many of us are still alive and now reapng the consequences of those earlier policies.

“we know there’s a response when the Fed pushes the QE pedal”

Several researchers have published on the subject of QE and concluded that it has no impact. The researchers include: the Bank of Japan, Galbraith, Bezemer & Gardiner, Congdon, Ritholtz, and others. So JDH, where is your data and your analysis – or are you just an apologist and cheerleader for the Fed? If you are an apologist, you should inform your university and your students that your comments on monetary policy are not based on fact, and you don’t bother to compare your statements to other economic researchers. In short, inform them that you don’t follow the scientific method in the area of monetary policy.

Then there’s your statement that “the Fed has the tools to prevent deflation”. Since you may not follow the scientific method in the area of monetary policy, let me inform you that deflation is defined as a decline in the general price level. Your information on copper, oil, and Euro$ has nothing to do with general price levels. Or is this another example of monetary comments that are not based on fact?

JDH: I meant the relationship of forex rates and commodity prices, not the relationship between commodity prices, and whether or not the recent action in such prices is also distorting exchange rates as well, and whether or not that matters.

Funny, I thought QE was ineffective in a liquidity trap. 😛

Well said JDH. It isn’t possible for the FED to buy $600 billion in bonds without distorting relative prices. They are essentially creating the fiction that there exists $600 billion more savings–that IS what bonds should be bought with–than actually exists.

They are rendering the co-ordination of investment & savings impossible. They are causing over-investment (relative to actual savings), reflected by inflated prices of investment goods such as raw material. They are also fostering speculation in those inflating goods by destroying low risks investment alternatives like CDs.

slugs,

In regards to this: “I really don’t care if inflation surges to 8% if it’s accompanied by 5% real GDP growth. We can deal with 8% inflation later.”

Are you suggesting here, in this national period of wishful-thinking, that you can envision sustained real GDP growth of 5% from our service-based economy. Is there a precedent that suggests any such possibility?

And I don’t understand how so many smart people can repeatedly use the term ‘inflation’, without making a distinction between ‘price’ inflation, and ‘wage’ inflation. There is currently a paradox involved where wage inflation comes in conflict with the necessity of increasing exports. How does a nation with less than competitive labor costs, that have already been stagnant for decades, have wage inflation while becoming more competitive globally. I don’t mean to single you out on this, but it does get a little astray at times.

The rise in the dollar price of internationally traded commodities is best understood as a fall in the relative value of domestic production inputs. What is happening to the dollar price of Chinese labor and Indian real estate? Capital is fleeing the US economy and flooding into developing countries. The dollar-based global economy is experiencing a high rate of inflation.

But the fed targets core CPI which is heavily weighted towards goods and services with a high domestic content – specifically excluding food and energy which are largely traded internationally.

If commodity prices are up primarily due to QE, producers will not invest in more production. There will be no additional real growth.

Hard to see how higher commodity prices are a good thing for the economy. Higher input prices means lower profit margins and reduced sales (except for commodity producers). Great, that’s really going to help.

Don’t just look at commodities, look at stock prices. Same story – stock prices up since QE2 was signalled.

QE leads to asset-price inflation. Bernanke’s justification for QE2 was that, by increasing asset prices, the rest of the economy would benefit. This is trickle-down economics at its worst. Why would a progressive economist believe in trickle-down economics?

Macro, by looking at aggregates, can implitly make an assumption of uniformity when such is not the case. Inflation does not have to uniformly affect all prices. Inflation in commodities does not mean that there is or will be inflation in wages. With QE, asset prices are going up, not wages; there is inflation in assets, none in wages. The rich, who own assets, are doing well, by QE; everyone else is not.

Why on Earth would a progressive economist support QE? I just don’t get it.

Professor,

One week… and the evidence is in on the relationship between QE2 and commodity prices?? One week and we can draw our economic conclusion between on the relationship between QE2 and inflation?? You can’t be serious…

Beside, this post completely miss the point when it says the Fed wants to “create” inflation”. The Fed wants to increase economic growth, which may lead to a “trend” level of inflation, but the FEd does not want to increase inflation everything else remaining the same as this would be an absolute disaster for the economy. Imagine paying way more for gasoline, food, utility etc while your personnal income stays the same. How would you feel about that? Not so great I think. And yes, the Fed knows it quite well. Framing the debate in term of the “Fed wants to create inflation” completely miss the point.

Finally, do you see a contradiction between your previous posts indicating that QE could have a small decreasing effect on longer term interest rates and your current assessment to the effect that the Fed is creating inflation? How could longer term treasury yields decrease if the Fed is creating huge inflation with QE? Am I missing something or there is a flagrant contradiction in your logic?

Qc: You refer to one week of evidence, yet the graphs above you compare two months actual with predicted. You say “this post entirely misses the point when it says the Fed wants to ‘create inflation'” (quotation marks yours). The word “create” and the word “inflation” appear nowhere in the text. I discussed nominal versus real interest rates at length here

Your style of argumentation gets a little old.

They are essentially creating the fiction that there exists $600 billion more savings–that IS what bonds should be bought with–than actually exists.

i disagree! those bonds are both a debt and an asset — they represent the government’s obligation and private sector savings. so does cash. the difference is minimal (particularly in a market with a healthy repo mechanism.) that’s why there is no inflationary impact and precious little distortion.

again, don’t confuse a speculative balance sheet expansion in stocks, junk debt and commodities with something the fed does. if QE distorted prices much, the japanese would have discovered as much.

The rise in the dollar price of internationally traded commodities is best understood as a fall in the relative value of domestic production inputs. What is happening to the dollar price of Chinese labor and Indian real estate? Capital is fleeing the US economy and flooding into developing countries. The dollar-based global economy is experiencing a high rate of inflation.

i would argue, mr williams, that it is ZIRP and not QE that we’re seeing the effects of here — that is, the united states has become the home of global carry trade trade funding. as it’s become cheaper to fund in the US, the yen has come under persistent upward pressure as yen-funded trades are unwound and dollar-funded trades are put on, weakening USD.

in other words, this is a standard-issue carry-trade-funded speculative inflation cycle. and it will come a cropper as all do, indifferently to QE.

I agree re: oil and industrial metals.

However, recent increases in grains and softs have been more driven by supply issues.

Calmo,

On oil understand that it is pulled out of the ground and does not really have a shelf life. While it is consummed, it is not like food that is both subject to the elements and to spoiling. This makes it more stable than such commodities as food.

But oil is not as stable as gold for example because gold is not destroyed in its use. Almost all the gold ever mined is still in circulation in some form. But that said both react to changes in currency. Becuase of the nature of oil production it has a slight lag behind gold in price changes. For this reason you can use the price of gold to make judgements about the direction the oil price will move. You cannot get right down to the minute or day but you can develop trends.

But our monetary authorities would have you believe that the value of the currency has no impact on oil prices. Professor Hamilton has done a good job of demonstrating that there is a connection between the currency value and the price of oil.

Professor,

You are right, I should have used your direct quotation:

“I feel that there is a pretty strong case for interpreting the recent surge in commodity prices as a monetary phenomenon.”

So the Fed “creating inflation” is not a direct quote, but would you argue that it was totally misleading relative to what you said in your post?

I do not dispute that my style of argumentation may get a little old… I might just be afterall an old guy because I refuse to live in a gold standard economic framework of “crowding out”, “money printing”, “currency dabasement”, “precious capital leaving the country through the current account deficit”, “US Government running out of money”, etc.

Almost everything we learned in economics in Universities is gold-standard era economic thinking… and it took me a while to unlearn these things. I would urge you to read stuff coming out from the Department of Economics of the University of Missouri-Kansas City (Wray, Kelton, Black, Forstarter) to learn more about non-gold standard macroeconomics.

or instead of my blather, this:

http://www.creditwritedowns.com/2010/11/just-what-is-bernanke-up-to.html

Let me see, cost of eating, shelter, clothing, electricity, oil and gas is up big. Hmmm? Discretionary spending? With what? The Fed is good at electing Republicans! We might say the Fed has caused a deflationary spiral in terms of Dems left in D.C. and Statehouse! LOL

This far out after the oil shock, the economy, especially its commodity planners, have a fairly direct connect between oil flows and American consumer constraints. The core rate excludes the very thing that the economy is intensely focused on, gas lines! So the economy is training itself to contract in synchrony upon restrictions in energy flows. What is normally a two step process has become a one step process, but the Fed is unaware of this.

Another commodities inflation chart…US Inflation Rate for Commodities

Given the response to QE2, cam you estimate the contribution QE1 to oil?

Based on what I see from the specs open interest this rise in commodity prices is no different than in the summer of 2008. The illusion of of something happening due to QE2 has led to huge speculation in commodity prices. After implementing higher margin requirement (which they did not do in 2008 for some strange reason) prices fall….if this was real demand lead prices would not have fallen. This is pure speculation whichs leads to higher risk in extrapolating higher prices in the future when actual demand outside of speculation is not rising.

Qc — “So the Fed ‘creating inflation’ is not a direct quote, but would you argue that it was totally misleading relative to what you said in your post?”

Your quote above misses the point. Increasing prices for commodities appears to be a result of QE2. However, it is not correct to call this “inflation”. As I understand it, the professor’s point here is that we have some evidence that QE2 impacts RELATIVE prices. Clearly wages are not up, housing costs are down, etc.

Inflation is not the only bad thing that can come from QE2 or other forms of monetary expansion. And one bad thing would be increasing relative prices of commodities. At some point, even if inflation, broadly measured, does not appear, distortions in the economy in the form of changing relative prices may be the signal that further monetary expansion will be more harmful than helpful. And that seems to be the case right now.

anon It’s possible that anticipation of QE2 helped push up copper prices; but it’s also possible that Chinese demand over the last 3 months pushed it up as well. And today we read that prices for copper, lead, zinc, nickel, aluminum and tin all plunged today on concerns about a falling off in Chinese demand.

http://www.bloomberg.com/news/2010-11-12/copper-declines-from-record-price-on-speculation-china-will-increase-rates.html

JDH’s chart begins 1 September, which presumably corresponds to the time when the Fed started to talk seriously about the prospect of a QE2 action. The problem is that by early September copper prices were already 2 months into a rather steady price increase. So if QE2 explains the rise after 1 September, what explains the rise that began in mid-summer? Well, one obvious candidate might be the dollar depreciation, which also began in mid-summer. In other words, I don’t have a problem with the claim that dollar depreciation explains the price rise in commodities like copper; but what’s less convincing is anything suggesting that the dollar depreciation that began in July is the result of QE2 speculation. I think you could make that case if the dollar depreciation and commodity price rises both began in (say) October; but the turning point was in July. That just seems too early to be plausibly explained by QE2 speculation.

BTW, it might just be a coincidence, but Obama’s in South Korea for a trade talk that’s going badly. Meanwhile the Pentagon gets a Wednesday morning briefing from the industrial base analysts outlining strategic concerns across the US industrial base about not being able to meet production targets because suppliers are unable to procure key commodities because China has been gobbling up every contract in sight. And it’s not just metals contracts. Then the next day China hints at a drop in future demand.

Anon,

But if QE increase commodity prices and does not have any other effect, why would we ever want QE in the first place? Paying less for gasolines and food would be much better than paying more everything else remaining the same.

I know mainstream economists would respond that the goal of QE is not to increase commodity prices per se, but rather to decrease real interest rates -through its effect on inflation- so to encourage people to consume. I am sorry but no consumers think this way. Inflation expectations run currently at close to 3% according to suvey making expected real interest rate extremely low, but consumers are still in debt repayment mode, not in leveraging mode. This is a good thing at the invidiual level, but it has a disastrous effect at the macro level. This is precisely why the government has to offset debt reduction by the private sector through deficit spending (mostly done anyway through the automatic stabilisers).

As for my view about QE, you can safely hit the snooze button. QE is just like swapping T-Bills for longer term bonds. Would anyone make a big fuss if the Government would decide to replace longer term bonds in circulation with T-Bills? Likely not. In fact, we would likely not even heard of it. We should welcome QE exactly the same way.

gaius marius,

What you state is clearly wrong. There is tremendous inflation in the price of investment goods: stocks, bonds, raw materials. Ask yourself why these things are so inflated in price relative to consumer goods.

You are remarkably confused to imply that when the gov’t borrows money that the Fed creates out of thin air private savings are created.