The new news looks to me like the same old news.

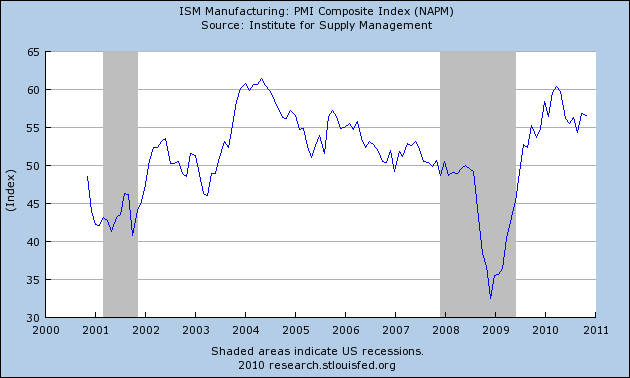

The brightest economic indicators continue to come from surveys of managers. The ISM manufacturing PMI held up at 56.6 for November. Any reading above 50 signifies that more responders reported improving conditions than reported deterioration, and a reading this high suggests manufacturing continues to do quite well. ISM nonmanufacturing PMI was also at a very healthy 55.

.

|

U.S. auto sales for November were up 16.8% from a year ago, sustaining the kinds of year-over-year gains that we saw over the previous two months, but still stuck at a level far below what we used to think of as normal.

|

A more troubling important economic summary is the Chicago Fed National Activity Index. Its 3-month average continued its recent slide, falling to -0.46 for October.

|

The Bureau of Economic Analysis revised up its estimate of third quarter real GDP growth from the 2.0% annual rate initially reported to a revised estimate of 2.5%. On the other hand, the revised data also give us the first look at gross domestic income, whose difference from GDP represents a pure statistical discrepancy. The real GDI growth for 2010:Q3 is estimated at a more modest 1.6%. Personally I favor using an average of the reported GDP and GDI growth rates, which leaves us about where we thought we were with a 2.1% real growth rate. Growth rates in that neighborhood can easily be associated with a rising rather than a falling unemployment rate, since new job creation is probably not fast enough to keep up with a growing population.

|

And unfortunately that was also the message from Friday’s very disappointing labor report from BLS, whose establishment survey implied that seasonally adjusted nonfarm payrolls increased by an anemic 39,000 jobs in November. The separate and somewhat noisier household survey was even more troubling, suggesting that 173,000 fewer Americans were working in November compared to October, bringing the unemployment rate up to 9.8%. Payrolls processed by ADP added to a mixed picture with a cheerier estimate of a net gain of 93,000 in private-sector employment. Whatever you make of this, it certainly provides no confirmation of the notion that we have turned the corner in terms of employment growth.

Altogether, I think this leaves us where we’ve been for some time now– the economy is growing, but painfully slowly.

JDH: what does the EconBrowser recession indicator say these days?

Thanks,

Robert

Robert Bell: 9.1%, still clearly in recovery phase.

The household survey adjusted to the same coverage as the establishment survey suggests about the same employment gain. See http://www.bls.gov/web/empsit/ces_cps_trends.pdf

I think DJIA is at its highest for many years to come, 4-5 at least. It can be that Ireland budget, or some other event, or lack of such, will start to drag it down next week. Some correlation exists between the DJIA and economy, namely, the wealth factor.

I sold ALL the stocks I owned this last week. The deco-operation phase of the world after too much cooperation and imitation that was essential in creating the bubble only begins now, when continued cooperative (supportive) action starts to create local problems and weigh on peoples patience and resolve.

There are also no leaders in the world, or of the world, who would be able to push the cooperation forcibly through when domestic policies shout for protectionism, in all forms.

E.g. China can not afford middle class,since that will destroy rule of Party-hence, they have to take a step back, like Stalin did in 1929 with the end of New Economic Policies just as Great Depression started. Same will happen again, this time in China, and over few times longer period of time. The Chinese middle class assets will be nationalized within next 10 years.

In light of this data implying the risk of a second dip recession, the Republican plan is to cut unemployment benefits and to give tax cuts to millionaires. Oh, yeah, and at the same time saying that we need tax cuts because of high deficits.

Republicans are fools and idiots and have no place in rational public discourse. Anyone calling themselves a Republican should be deeply ashamed. Republicans have leapt off the cliff into irrationality and insanity.

Republicans winning the house stalled job creation. Unemployment will be up past 10% in a few months. Since Obama will cave on the tax cuts, at least they won’t be able to blame it on a tax hike although they’ll probably claim it was not making them permanent that caused unemployment to rise.

Core inflation & housing may turn a month earlier (in JAN):

2010 jan ….. 0.54

feb ….. 0.52

mar ….. 0.53

apr ….. 0.54

may ….. 0.53

jun ….. 0.5

jul ….. 0.48

aug ….. 0.49

sep ….. 0.51

oct ….. 0.47

nov ….. 0.41

dec ….. 0.31

2011 jan ….. 0.19

feb ….. 0.13

mar ….. 0.12

E.g., the 13 week SA m1 % change (as shown by the WSJ “Market Data Center”) is increasing @ 14.8%.

Ivars, you’re quite likely correct. It was once an anathema to the Chinese against which they tried to inoculate themselves, but the self-congratulatory urban professional middle-class Chinese 30- and 40-somethings have been smitten by the virus of debt as wealth, imagining themselves as western rentier-oligarchs who get rich by creating nothing but debt for the rest of society, while still being able to afford coal, oil, and iron ore to enjoy the western auto- and oil-based economy at the twilight of the Oil Age; it ain’t gonna happen.

China is developing a collective fever brought on by an acute case of faster-than-exponential money, debt, and fixed investment growth destined to implode and result in the greatest crash in world history.

China is a four-letter word: SELL!!!

I think the big decrease in jobs from October to November might be partly due to the seasonal adjustment. The last two years saw retailers put off a lot of the holiday hiring that usually occurs in October until November. October’s number was probably exaggerated a little high and Novembers a little low.

Also, I think the automakers eased up on production some in November, you can see that in auto rail car loadings and it might explain why the NY Fed manufacturing index was so much worse than the others (there are a lot of auto suppliers in upstate NY.)

Prof. Hamilton, see the link below:

http://imperialeconomics.blogspot.com/2010/12/us-real-private-gdp-real-private-final.html

The situation is even worse for real private final sales after oil consumption as a share of private final sales when accounting for debt service as a share of disposable income for the bottom 80% of US households.

Since the early to mid-’00s (Peak Oil), the US has effectively lost ~25-30% in real terms (33-38% per capita) of its purchasing power of investment and household income and consumption. You think that’s bad? Well, we will lose 50% by decade’s end at the current rate of post-Peak Oil and post-’00 trend rate of capital wealth consumption, i.e., debt-deflationary depression.

Most Americans and e-CON-omists are unaware that real private GDP has not grown since ’02; adjust for the cost of oil consumption to private GDP, and the US private sector is where it was in ’99-’00.

Note, however, that real private final sales (less inventories) after oil consumption has not grown since ’96-’07, while it is down 2.2%/yr. since ’98 (~3.1% per capita), which is roughly the equivalent of the trend rate of decline of US domestic oil production since ’85.

Yet, during the same period total gov’t spending has grown $2.7 trillion, rising from 30% of nominal GDP and 44% of private GDP to a debilitating 36% and 56% today.

While e-CON-omists and politicians debate the merits (or relevance) of this or that arcane policy prescriptions at the margin of futility and emerging insolvency, the real private sector has not grown in 10-13 years, and the situation will only worsen with the ongoing Long-Wave debt-deflationary regime, exacerbated by the peak Boomer demographic drag effects and long-term structural constraints associated with Peak Oil.

China faces an even worse situation per capita from Peak Oil and eventually from the drag effects of peak Chinese demographics hereafter.

Good luck Ivars.

Trouble with being long is the potential for another lost decade.

Trouble with being all out is inflation risk.

Trouble with betting against the market is timing and the cost of carrying an inverse position.

Is gold in a bubble? Its the question of the last few years.

JDH,

I’d really like to see a trendline on your last graph. Can we get one or maybe two, one pre-WWII and one post-WWII?

Dustin

The Phily Fed’s ADS index is also stuck in mildly negative territory.

http://www.philadelphiafed.org/research-and-data/real-time-center/business-conditions-index/

JDH,

Nevermind, I found such a pic. Only his midpoint is 1983. http://econintersect.com/wordpress/wp-content/uploads/2010/12/gdp-decline.png

Dustin

According to K Rogoff C Reinhard sovereign debts statistical history, economic recoveries took place at the public debts picks, not during the debts build up.

When looking at the ECB statistical data warehouse,government deficits are increasing in debts stocks whilst decreasing in flows.

Government deficits

http://sdw.ecb.europa.eu/home.do?chart=t1.10

Governments debts as a percentage of GDP

http://sdw.ecb.europa.eu/home.do?chart=t1.11

One may wonder where will be the tax revenues.Please look at the contribution of the real estates taxes and revenues for countries relying on capital gains taxes.

Reading the hereunder report from the IMF is hardly giving credit to “The hell is paved with good intention”

Please see the benefit for Ireland,and all countries in the fast lane when it comes to extended home ownership P22.Assets prices distortion to incomes and revenues do abound,and so did the warnings.

IMF House price developments in Europe: A comparison

http://www.imf.org/external/pubs/ft/wp/2008/wp08211.pdf

Hi KevinM

I have no problem with inflation as I am personally net mortgage debtor, so if I have cash, I can pay that debt off. It has 2,5% floating rate, so if inflation picks up, the rate will go up as well.

Gold-according to the super-exponential way it has been growing last 10 years, it has to have a correction soon- perhaps as soon as some extra instability in the world political situation will stabilize USD, e.g. if EUR will continue to be punished by political events like Irish budget vote etc. Or another terrorist attack. Or North Korea. As the world decooperates, USD gets stronger, so gold might loose its status as there will be no real inflation in USD anytime soon.

Nemesis

I am sure ( I have lived in the USSR , in Latvia for 27 years so I understand the system inside+all the info available now) that Stalin’s drive to nationalize and eradicate middle class in 1929-1930 and industrialize peasants in 1930-1933 was in DIRECT response to the Great Recession as he intuitively or rationally understood the need to gear up military production and power of the USSR as the world was falling apart ( deco-operating).

The only way to do that in communist regime is establish a tyranny, dictatorship.

I bet China will be forced to head the same way, or give up Communist party power in coming 10 years. Willing to guess what will happen?

So its not only SELL, its also NOT OVER INVEST in high technology advanced manufacturing plants and computer software producers and subsidiaries there. Take into account it all may be confiscated rather smoothly, and turned into military technique producing assets.

Sell soap and detergents to China, that’s fine. But with cars etc, be careful.

Many think of the Great Depression in terms of depth, but what made the Great Depression “great” was the length and inability of the economy to recover.

Welcome to the second Great Depression. Economic decline can actually on go so far and then subsistence takes over. In a modern society that can be at a higher level than simply starvation. Our economy has fallen about as far as it can without starvation (not to rule that out) so economic policies that pile up excess reserves and send commodities through the roof while maintaining stagnant growth seem to cry out for “hope and change” from what we are being force fed today.

@Posted by: Nemesis at December 5, 2010 04:55 PM

“China is a four-letter word: SELL!!!”

Hi, thats alright, I want to buy. Lenovo ISIN: HK0992009065, pls. sell this.

Johannes

Larry-

That’s pretty funny. Using that logic, I could attribute the sharp rise in unemployment to Obama’s election. As you recall, in November 2008, the unemployment rate (seasonally adjusted) was 7.0%. By October 2009, he managed to get it up to 10% and he has managed to keep it high since then. But that would be the wrong analysis, because it is/was Bush’s fault.

Jim – Nothing like a little pessimism to bring out the gloomsters. I suspect that the unemployment rate could be brought down by hiring these workers to crank out dismal forecasts. There’s probably an unmet need that they could satisfy.

Time for me to apologize for misspelling,Mrs Reinhart family name,having for sole excuse to have quoted her work and K Rogoff so often.

Deficit Commission Report:

http://www.fiscalcommission.gov/sites/fiscalcommission.gov/files/documents/TheMomentofTruth12_1_2010.pdf

Anyone care to do an analysis?

Steve,

The commission report is white wash. They cut benefits and call tax deductions “spending.” Beyond that there report is not worth the electrons it is printed with. They certainly did not earn their big salaries.

A few reactions to the tax cut deal by Obama and the Republicans. Mostly favorable.

http://economistsview.typepad.com/economistsview/2010/12/a-few-reactions-to-the-tax-cut-agreement.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+EconomistsView+%28Economist%27s+View+%28EconomistsView%29%29

Personally, I would prefer that we take our medicine. Business is ready to go–headcount is lean, cash is in the bank, profits are solid–but there is lingering uncertainty about future taxes and spending. Although a deficit reduction package would hurt, it would give the business community confidence in the future.