I wanted to follow up on Menzie’s recent observations about what’s been happening to the supply and demand for money.

These discussions are sometimes conducted in terms of the following equation:

Here M is a measure of the money supply, V its velocity, and nominal GDP is written as the product of the overall price level (P) with real GDP (Y). We have direct measurements on nominal GDP. And once we agree on a definition of the money supply (no trivial matter), we have a number for M. But where do we come up with data on this concept of the velocity of money, V?

The answer is, we don’t have independent measures of the velocity of money. So if people talk about velocity as something they could measure, they’re just referring to the value of V that makes the above equation true. That is, we measure the velocity of money from

As alluded to above, different people come up with different answers for how we should measure the money supply. One measure is M1, whose key components include currency held by the public and checkable deposits. Another measure is the monetary base, which is currency held by both banks and the public plus deposits banks hold in their accounts with the Federal Reserve. So we could use M1 as the value for M in the above equation, and call the resulting value for V the “velocity of M1”. Or we could put the monetary base in for M, and call the resulting V the “velocity of the monetary base”. You get the idea– use your favorite M to get your favorite V.

Arnold Kling, for example, proposed that we might use for M the quantity of marbles.

Which perhaps sounds a little silly. Even if there’s no particular relation between the quantity of marbles and the stuff we care about (inflation and real GDP), you could still go ahead and use the equation above to define the velocity of marbles. But what you’d find is that when marbles go up, the marble velocity goes down, and it makes no difference for output or inflation.

OK, so let’s look at the velocity of M1. It turns out to look a lot like you’d expect the velocity of marbles to behave– when M1 goes up, the velocity of M1 goes down by an almost exactly offsetting amount. Here’s an update of a graph that I presented a year ago:

|

So maybe we’d be better off using the monetary base as our value for “M”? I don’t think so.

|

Obviously the interest in an equation like MV = PY comes not from using it as a definition of V for some arbitrary choice of M. Instead there must be some kind of behavioral idea, such as that there is some desired value of M1, or monetary base, or marbles, that people want to hold. Suppose it was the case that to a first approximation, this desired quantity was essentially proportional to nominal GDP. If that were true, we would see the graphs of V above behaving roughly as constants instead of simply tracking the inverse of whatever happens to M.

Now, I think it is true that, in normal times, nominal GDP is one of the most important determinants of the demand for M1 or the monetary base. In the absence of other factors changing these demands, there certainly is a connection between money growth and inflation, and you do find a correlation if you look at much longer horizons than the quarterly changes plotted above.

But conditions at the moment are far from normal. In particular, something quite remarkable has happened to the demand for the monetary base. In the current environment, banks have shown themselves to be indifferent between holding reserves (a risk-free way to earn a modest interest rate from the Fed) and making other uses of overnight funds. For this reason, the demand for reserves, and with it the demand for the monetary base, has ballooned without any corresponding changes in output or inflation.

Some people felt I was making a sophistic distinction in emphasizing that the Fed is creating reserves as opposed to printing money ([1], [2]). But I maintain this is a critical distinction. The demand for reserves has increased by a trillion dollars since 2008. The demand for currency held by the public has not. The supply of reserves could therefore increase a trillion dollars without causing inflation. The quantity of currency held by the public could not.

Now, the time will come when banks do see something better to do with these reserves, at which point the Fed will need to take appropriate measures in response, namely a combination of raising the interest rate paid on reserves and selling off some of the assets the Fed has been accumulating. This is of course a key long-term story that we will all be following with interest.

But someone who insists that inflation (P) must go up just because the monetary base (M) has risen may have lost their marbles.

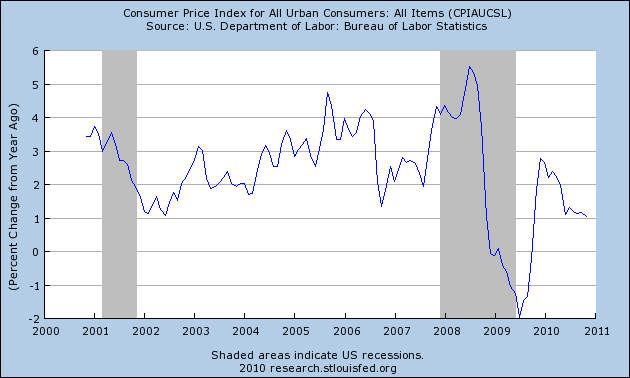

|

My metaphor for what Bernanke has done is to fly his helicopter full of money around over the city, but never drop it. As we can see a helicopter fly over is quite different than a helicopter drop.

Perhaps Reserves should be excluded from M altogether? My impression is that even in ‘normal’ times banks don’t really lend out reserves, but make loans then look for reserves. Also, does one see the same non-relationship with M2 or the defunct M3? Again, my impression was one does not.

James,

While I agree with all that you have said I still have concerns on exactly how the unwind part of this experiment will play out. And I’m wondering if you have any particular insights on that matter.

The way I see it, when banks finally decide they don’t want to hold reserves and would rather hold loans, the ideal situation is one in which the Fed sells back the loans it has accumulated. If that’s at or above the purchase price, then we’re all happy. If they end up taking a hair-cut, then there we’ll likely see the difference between the purchase and sale price end up in the money supply. Do you agree with that assessment?

I specifically have my eye on the 1 trillion in MBS that the Fed is currently holding. With such a large denomination, it won’t take an exceptionally large hair-cut to drastically affect the money supply (currently M1 is at 1.8 trillion). Do we have any idea on the purchase price and the market value (rather than the face value) of these securities to get some idea on the likelihood of such a hair-cut

If consumers had some regularity about their purchases, then we could take the median purchase of a consumer at the median retail outlet to be the definition of the fastest and smallest money transaction. How accurate a definition is this? For WalMart it is the essence of their business about which they build their entire network. Dollar Tree, another of my examples.

WalMart might pose the reverse question. Does goods distribution necessarily produce a reliable and regular definition of the retail transaction, hence, a money definition? My opinion, obviously, is that a stable retail definition of the median purchase must exist if the economy is stable.

As to the distinction between currency and reserves, I do not think that one can be maintained.

If I buy something and write a check to pay for it, no use of currency (Federal Reserve Notes) is involved. But, when the check is deposited by the seller in his bank account, that bank then sends it to my bank. My bank then debits my account and forwards payment to seller’s bank.

That payment must be made be made by offsetting debits and credits at a bank where both my bank and sellers bank (or their intermediaries) have accounts. The Federal Reserve Banks are those banks, and the reserves are the balances in the accounts of the member banks.

Furthermore, banks that need currency obtain currency from Federal Reserve Banks by withdrawing funds from their reserve accounts. That increases currency and reduces reserves.

If banks have too much currency on hand, they deposit it in their accounts at their Federal Reserve Banks which turns currency into reserves.

In either direction currency and reserves can be freely substituted.

“the supply and demand for money”

Pure Keynesianism. However, the liquidity preference curve is a false doctrine. I.e., the Keynesian training of the FED’s technical staff advised that interest was the price of money, not the price of loan-funds. The FED’s technical staff therefore decided that the money supply could be controlled through the manipulation of the FFR. Thus Greenspan validated the colossal money flows advancing thru the economy. I.e., Greenspan NEVER “tightened” monetary policy.

When Bernanke took over, he continued to tighten monetary policy despite Bear Sterns collapsed, never “easing” until Lehman Brothers declared bankruptcy. I.e. Bernanke tightened for 29 consecutive months driving the economy into a depression. Bernanke then attempted to cover up his error.

After coming out of Bernanke’s hole, long-term money flows (aggregate monetary purchasing power), are now shrinking. The evidence is seen in the recent figures for core CPI & housing.

But the future holds the ultimate inflation. IORs can be used to peg interest rates for much longer periods of time as compared to pegging the FFR, thus exacerbating monetary policy errors. We know that the crux of the FED’s problem has been the assumption that it could manage the money supply thru the monetary transmission mechanism (interest rates). It has repeatedly failed since 1965.

The real problem here is not money supply or velocity, but aggregate debt/asset ratios. When asset prices fall and debt levels don’t, you get caught in this vortex of uncertainty that we’re currently living in, where no one knows really who’s solvent, what asset prices will be tomorrow, hence how much credit risk to take, etc. etc.

To put it simplistically, there are two ways to go here. Either we inflate such that asset prices rise to saner levels with regards to debt, or we start deflating/defaulting on/modifying (pick your nomenclature) the debt. The former risks currency wars and unpredictable inflation effects, while the latter causes reprehensible unfairness, like what’s happened with the banks.

This is why when the crisis hit, my first thought was “this is going to be an unbelievable and unpredictable nightmare unless we let the Citi’s etc. fail, make sure people are fed, and let the banking system rebuild on top of a more conservative and regulated foundation.” I had confidence that the clever laid-off from Wall St. could very entrepreneurially start the next banking system on much better grounds in not a ton of time, with help from gov’t.

It’s really not a moral issue, it’s the fact that the long adjustment I think is going to do much more damage than a short but very painful adjustment would have done. The problem with the long adjustment is it brings moral hazard at a calamitous level, and the wealth disparties that are building are getting downright dangerous. It doesn’t take long without being able to pay for food before you’re willing to take up arms. So instead of a short painful period of bread lines and employment projects and banking startups, we’re seeing the real unweaving of a once great nation.

It’s striking to watch as those who have and are informed rape and pillage the weaker and less knowledgable. Now that the “our first and only priority is tax cuts for billionaires” Republicans have their hooks in the gov’t coffers, one wonders what will be the result as they succeed in taking Social Security and Medicare into their greedy privatised hands. It’s a miracle there’s not armed rebellion now with the state of health care. I will watch rapt what goes in in a decade or so.

I’ll be watching from another country, that’s for sure.

I once read

Many years ago, in a previous millennium, I took introduction to economics at the U of Chicago. I was privileged to hear Milton Friedman explain monetary economics at that time. Back then, Mr. Friedman said that V is exogenous to the system. and is based on the banking system and social habits.

Since that time, a lot has changed. The banking system has assumed a completely different configuration than it had 45 years ago. E.g., there were no interstate branch systems back then. Money market accounts were invented. Credit cards expanded greatly and debit cards have become nearly universal. Then there are the revolutions in communication and computation.

I would argue that V is not only mutable, but, in an inflationary environment, it could increase quickly and exponentially. This means that if there are excess reserves and currency in existence, and inflation is perceived to be a problem, increasing V could turn it into hyper-inflation in a heartbeat.

I think the quantity of excess reserves in the system is a source of risk in the system. I would prefer it if the Fed were to begin immediately to reduce that risk by beginning to drain the excess.

This is silly. How can you talk about his subject and not mention interest on excess reserves (instituted on 10/6/2008)? 0.25% when 1, 3, and 6 month T-bills as well as almost all corporate paper is paying less is a lot of money and a lot of incentive to just hold cash. This must rank as one of the least imformative blog postings on this subject ever.

Mark A. Sadowski: I attributed banks’ demand for reserves in part because they are “a risk-free way to earn a modest interest rate from the Fed”, and describe the Fed’s plan for maintaining that demand to be “raising the interest rate paid on reserves”.

And so when you assert that I do “not mention interest on excess reserves”, you are making an error.

JDH,

If those buried phrases are your defense of what is to me evident obfuscation I’m extremely dissapointed. I’ll still treasure your textbook however.

Mark A. Sadowski: “buried”? Your hostile insistence on misunderstanding what I wrote is most puzzling.

JDH,

It’s not puzzling unless you chose to make it so. I don’t think the huge expansion of the monetary base after the institution of interest on excess reserves (10/6/2008) is just a coincidence. I don’t think you do either. Please, just be honest about it.

The fact that the Federal Reserve began paying interest reserves for the first time in its 97 year history on that date is a key fact. You skipped it assuming your readers are familiar with it. At least I hope that’s the case.

“Back then, Mr. Friedman said that V is exogenous to the system. and is based on the banking system and social habits.”

Great, now we get somewhere. Notice that V seemed to jump to a specific point after the crash. I do not see how, in those short few months of crashing, that Ben and the bankers could have coordinated those bankruptcies and landed both M and V at some precise point.

I made this comment a couple posts back but it’s relevant here as well and I tend to think an imnportant point.

A zero correlation between money growth and inflation is exactly what you’d expect if your data came from an economy where the Fed was stabilizing inflation.

Increases in money growth would be endogenous reactions of the fed to accomodate increased demand, decreases in money supply growth would be endogenous fed responses to decreased demand.

This data implies that the Fed has generally been doing a pretty good job.

Isn’t the crux here the different uses of the word “money”? The base money referred to, and inferences about velocity, and about inflation or deflation are about money as the means of exchange. But the trillion dollars the banks are sitting on is money as debt – a reserve against being poisoned by their own toxic derivatives.

Banks and others issue credit, which becomes the means of exchange. GPD measures are a third thing – money as unit of accounting. Some things have costs but not prices (that is, are not exchanged). At the moment there is a lot of money (unit of account) tied up in underwater mortgages and other potentially bad debts. Banks fear this could be translated into losses (money as debt), so they pile up money as credit. Whether this affects money as means of exchange would depend on the linkages – it’s not automatic.

Banks will use the reserves to speculate on commodities like in early 2008. I think it has started already, and will result in oil , coke, metals, etc. price spikes in early 2011 that has nothing to do with real demand/supply development. Tankers full of oil floating somewhere.

So what would the appropriate FED measures be? Core inflation will be almost intact, volatile energy and gasoline prices will drive people mad and tank the USA economy.

FED will raise rates, and people and companies which have never received cheap rates from banks anyway as they did not lend, will get the high rates again, as a welcome plus to speculative commodity bubble they will have to pay for from THEIR expensive reserves.

Mark, You have argued that (a) the equation isn’t particularly useful in the real world and (b) that its implication for inflation doesn’t hold true if all the extra money is simply parked in the central bank.

However, (a) just because a quantity is impossible to measure (e.g. quantum gravity waves) that doesn’t mean it doesn’t exist and (b) a car parked indefinitely in a garage sooner or later ceases to be a car, in a useful sense. The same applies to money; it must move, or have velocity, if it is to remain relevant to reality. So the central bankers have a tricky problem either leave them there forever and see the real value of those reserves decline to zero as they become part of the furniture rather than an active part of the economy or take more risks with them.

If they do the latter, it will inevitably be inflationary as the ratio of available money to assests will go up. This is the normal solution as the inflation is useful to diminish the government debt (and a government debt instrument is essentially what fiat money is). However, this time the numbers are so huge (although not yet at German Weimar levels) that it is difficult to see how that inflation can be kept under control without decades of sluggish nominal growth and real decline against Asia – which will in turn create new and potentially much more severe financial and geo-political problems.

SAN FRANCISCO (MarketWatch) — A single trader holds up to 90% of the copper in London Metal Exchange warehouses, the Wall Street Journal reported late Tuesday.

The news came after copper prices hit a record and other commodities surged. Read about metal gains here.

The London Metal Exchange reported Tuesday that the trader holds 80% to 90% of the copper in its stockpiles, which is equal to about half of all the exchange-registered supply of the metal in the world, the Journal said. The position is worth about $3 billion, it added.

Last month, the LME reported that a single holder owned more than 50% of the exchange’s copper. People familiar with the matter at the time said J.P. Morgan Chase was the holder, the WSJ reported.

Friedman flunked money & central banking. His favorite equation only balances by accident.

“there certainly is a connection between money growth and inflation, and you do find a correlation if you look at much longer horizons than the quarterly changes plotted above”

Monetarist guidelines incorporate both the volume of money and its rate of turnover. It should be obvious that the extent of money’s impact on prices and the economy is measured by money flows, not the stock of money. If the transactions velocity of money were a constant, it would not matter. But money turnover has varied from 13 in 1945 to 525 in 1996.

And the correlation between money flows (aggregate monetary purchasing power) and nominal gDp is better than suggested by “much longer horizons”. It is, in fact, highly correlated – on a monthly basis (indeed far higher than the “quarterly changes plotted”).

This analysis is supported by 2 independent time series which virtually mirror one another. It is inviolate & sacrosanct. It is the GOSPEL.

Just a thought:

I think QE is executed through primary dealers? Are there any primary dealers who do not have reserve accounts at the Fed? Or are there bank owned primary dealers whose dealer function is disconnected from the banks own reserve management operations?

The reason I ask is that to the degree either of these is true, I think it’s more difficult to argue that the reserve effect of QE is directly linked to the demand for bank reserves.

Interesting to go through rough permutations within:

V = PY/M.

Increasing prices P,leaving the real GDP Y as constant,the same for the money supply M,would increase the money velocity?

How to deal with prices stickiness?

Sometimes formula are not democratic.

Jeff: I agree that these are the key concerns. Of course the Fed is earning a big profit from the trade at the moment, which ideally would be retained as equity against the contingency you describe, but instead is simply flowing back to the Treasury.

Walter Sobchak: Indeed it is extremely easy to transform reserves into any number of other assets, but that does not make them identical assets. When I refer to the “demand for monetary base”, I am talking specifically about the willingness of banks to hold these balances overnight with the Fed. This is an entirely different question from the ways in which this asset gets transferred between banks during the day.

Mark A. Sadowski: Of course interest on reserves played a key role in the ballooning of the monetary base. This is what I believe, this is what I said, and this is what I think any reader of what I wrote would understand.

I still do not understand what inspires the comments you have been making here. Please note that the first half of the piece is about the behavior of the velocity of M1 over the period from 1980 to 2010.

JDH,

I don’t disagree with your larger point that in the short run the velocity of monetary aggregates is volatile. It’s the key reason why nobody who hasn’t lost their marbles argues in favor of aggregate targeting anymore.

But the recent and novel IOER policy is the main culprit in the huge decline in monetary base velocity we’ve seen since. Were it not for IOER I suspect we would see a lot more “bang for the buck” as it were. It’s a point that deserves to be made explicitly and repeatedly.

JKH: Not all primary dealers have accounts with the Fed. Instead, they have an account with another bank, and they ask the Fed to credit the reserves to that bank’s account with the Fed, and thereby get credit in the dealer’s account with that correspondent bank. It all has the same net effect on the system, as explained by this note from FRB NY: “This structure works because the primary dealers have accounts at clearing banks, which are depository institutions. So when the Fed sends and receives funds from the dealer’s account at its clearing bank, this action adds or drains reserves to the banking system.”

Scary Biscuits,

I’m not worried a bit about inflation. Trimmed mean PCE has risen 0.8% in the past year. And the current estimates of the US output gap put it at about one trillion dollars at an annual rate. Unleashing those currently inert reserves would end up mostly as real growth long before inflation rises to a level that would be of any real concern.

In any case whose afraid of a little inflation? I lived through 14% yoy CPI inflation in the early 1980s and the world didn’t come to an end. (In fact, come to think of it, in my case it’s probably the major cause of my modest real estate wealth.)

I’m much more concerned with the record period of 9% unemployment we’ve had (19 months so far) with a seemingly unending number more on the way (the SPF is forecasting it will still be above 9% a year from now).

JDH:

Yes, the equation of exchange is just an accounting identity and yes there are different velocities for each measure of the money supply. However, there are still some important insights the equation of exchange and the figures you draw from it provide.

Consider, for example, your M1 growth and M1 velocity growth figures. They begins in the 1980s and go through the present. Most of this time is the “Great Moderation” period when the Fed did a relatively good job stabilizing the growth of aggregate spending or NGDP. Thus, one would expect the changes in the money supply to offset changes in velocity. The Fed was doing its job. The near symmetry in your figures are a testament to this success. Now go look at the 1960-1979 period. The symmetry is missing.

Also, note that there are other points in your M1 and M1 velocity figures where the symmetry is missing. They all occur during recessions. For example, see the late 2008-early 2009 period. These are cases where the Fed failed to stabilize NGDP.

I’d say these figures based on the equation of exchange are filled with many insightful treasures.

“Of course interest on reserves played a key role in the ballooning of the monetary base.”

I think it is the other way around. The ballooning of the monetary base caused the Fed to begin paying IOR in order to push down the M1 money multiplier to prevent a run away growth in the money supply. They ended up driving down the money multiplier too much.

The monetary base ballooned because the Fed used it to purchase MBS.

http://www.zerohedge.com/article/crude-market-perspectives-wti-passes-90

Pretending that those “excess reserves” are actually excess reserves and not a way to stabilize TBTF bank balance sheets is what leads, people (e.g., Jeff at 6:48pm yesterday) to a mistaken apprehension of what will happen when “the trade unwinds.” I hope to live long enough to see it do so, but that’s not the way to bet.

That said, I’ve always taken M to be money that is in circulation; excess reserves (generally functionally equivalent to zero) are not circulating. (Whether they are leeching tax dollars in support of poorly-managed institutions that have been able to avoid changing that management or their practices is, of course, another issue.)

“We have direct measurements on nominal GDP. And once we agree on a definition of the money supply (no trivial matter), we have a number for M.”

Shouldn’t M be the amount of medium of exchange? That would be currency plus ALL demand deposits (including those of the shadow banking system), making it somewhere in the 50 trillion’s.

Get Rid of the Fed: I’m not sure which assets or liabilities of the shadow banking system you are construing to be a medium of exchange. The primary activity for which the shadow banking system was notorious was issuing commercial paper that was used to purchase mortgage-backed securities. For a number such as $50 trillion you are perhaps talking about the notional value of derivatives such as credit-default swaps, for which again I see no argument for counting as a medium of exchange.

Is there a “MV = PY” for financial assets too?

Get Rid of the Fed: If you can do it with marbles, you can do it with anything. But what does it mean?

I was referring to the fed’s Flow of Funds. The way it was explained to me is/was:

35,859.3 for Total Domestic nonfinancial sectors

14,445.0 for Domestic financial sectors

2076.2 for Foreign

Those numbers are in the billions. Add those together along with CURRCIR from the St Louis FRED and maybe the intergov’t holdings of debt (because under Federal Gov’t in the Flow of Funds it says only 9055.6). I believe that is somewhere in the 50 trillion’s.

I’m a bit late to this party but I wanted to comment on “The demand for currency held by the public has not [increased]. The supply of reserves could therefore increase a trillion dollars without causing inflation. The quantity of currency held by the public could not.”

At the 100-200 billion dollar level this is certainly not true, and suggests that it may not be true at the trillion dollar level either. Currency In Circulation (see FRED graph link below) surged about 10% in late 2008 and another 10% since, for a total post-crash growth of $160 billion dollars. “Demand for Currency” from the public can be driven by myriad causes (backed by a variety of anecdotal and statistical data) including (a) an increase in cash-only (“untaxed”, “black market”) transactions, (b) households deprived of credit using cash rather than debit cards, and (c) households holding extra cash at home (rather than in a bank) as a reserve against banking/credit issues. It seems plausible that up to $3000 in additional cash per household (a typical monthly budget) might be needed in a future low-credit environment, which would require 1/3 of a trillion dollars in circulating currency, and yet not be inflationary.

For reference, consider a chart of WCURCIR at FRED Graphs

It means just because more medium of exchange is created it does not mean it goes into the real economy. It can go into financial asset speculation (or even possibly saved or out thru the trade deficit).

(1)“households” sold over $200 billion corporate equities annualized in Q3. (2) the “household” sector was the biggest seller of corporate bonds selling an annualized $541 billion of paper in Q3.

That’s called tapping your savings. That’s not called hoarding. It is evidence that the transactions velocity of funds has increased, & not decreased (as the liquidity preference curve & the demand for money doctrines would both advise).

To the Keynesian economists on the FED’s research staff, the transactions velocity (an independent exogenous force acting on prices) was a statistical stepchild, it is income velocity that matters.

Income velocity is calculated by dividing nominal gDp for a given period by the average volume of money (for the same period). A decline in the income velocity of money is supposed to suggest that the FED initiate an expansive or less contractive monetary policy this signal could be right – by sheer accident.

Nominal gDp is determined by the volume of goods & services coming on the market relative to the actual (transactions) flow of money. Any increase in transactions velocity, since it will tend to cause nominal gDp to rise, will give the income velocity economists false signals. This is true even though both the volume of money & transactions velocity tend to move in the same direction.

The effect on money flows & nominal gDp of an increase in both money & transactions velocity is obviously greater than an increase in either money or transactions velocity. Consequently income velocity declines. Given these circumstances it is a tighter money policy that is probably needed, not the easier policy the income velocity economists would probably recommend.

Income velocity merely tells us that a given volume of money will have to turn over a certain number of times to finance a given volume of nominal gDp. Income velocity provides no assistance in explaining inflation.

Mr Sadowski,

I keep a reference of my favorite blog entries by Prof Hamilton. I think the below link covers your concerns regarding this post, which, as a regular reader, I thought adequately addressed.

https://econbrowser.com/archives/2009/07/looking_for_an.html

“(1)“households” sold over $200 billion corporate equities annualized in Q3. (2) the “household” sector was the biggest seller of corporate bonds selling an annualized $541 billion of paper in Q3.

That’s called tapping your savings. That’s not called hoarding.”

Is it better to call that losing your retirement?

Friedman’s “high powered money” has never been a base for the expansion of new money & credit. An expansion of the public’s holdings of currency will cause a multiple contraction of bank credit and checking accounts (relative to the increase in currency outflows from the banks) ceteris paribus.

Furthermore currency has no expansion coefficient. And any expansion of the non-bank public’s holdings of currency merely changes the composition (but not the total volume) of the money supply.

There is a shift out of demand deposits, NOW or ATS accounts, into currency. But this shift does reduce member bank legal reserves by an equal, or approximately equal, amount.

Rob,

No, I’m afraid it doesn’t excuse JDH at all.

I taught an upper level undergraduate experimental course on monetary policy this semester. I was horrified to discover at the beginning of the semester that not one of my students was familiar with the institution of the IOER on 10/6/2008 and its relationship to the tremendous runup in the monetary base.

Last night my brother came over my house and we had a long chat about the economics profession. He’s pizza deliverer by trade but I consider him a very bright and an extremely well informed person. The conclusion of our conversation was essentially that economists have not only failed to educate the general public about monetary issues they have failed to even adequately educate the lower levels of their own profession about monetary policy.

We must speak clearly, simply and often about such issues until everyone understands what is involved.

M2 plus institutional money funds and large time deposits is now at 132% of private GDP (total GDP less total gov’t spending, including transfers) or a velocity of 0.76, the lowest since the 1930s and converging with that of Japan in ’00.

http://imperialeconomics.blogspot.com/2010/12/it-is-happening-here-but-bernanke-does.html

US Bank loans/monetary base is 3.3 (down from ~8-9 in ’08), which is likewise where Japan was in ’00-’01 (during the Nikkei crash of 65%).

US excess reserves/monetary base is 47% or twice the level of Japan during ’01-’06.

The BOJ more than doubled the monetary base and increased free reserves 2,100 times, even as loans and other bank asset value fell 85% from ’97 to ’03-’04.

As a result of the BOJ pumping of reserves, M1 grow at double-digit rates for 5-6 years; however, M2 grew at just 2-3% as a result of the collapse in bank lending and bank runs. M2 would have grown even more slowly or contracted had it not been for Japanese liquidation of financial assets and gov’t borrowing and spending at 5-6% of GDP (10% of private GDP).

We are following Japan very closely; however, the Fed is breaking the central and the gov’t busting the fiscal budget wide open sooner and to a greater degree than did the Japan from the Asian Crisis to the ’00-’03 meltdown. We will be no more successful than were the Japanese, and we will arrive at fiscal insolvency, where the Japanese are today, sooner than the late ’10s or early ’20s.

Yes, “it” is happening here, but you are not supposed to know it or respond with the prudent deflationary mindset, i.e., increasing risk aversion and liquidity preference.

“We are following Japan very closely;” …

except the USA has a trade deficit?

The problem here is that these equations are rife with assumptions that are known to be untrue.

For example, they assume a “lumped-equivalent” model applies and thus elements can be separable and independent. And if you are using a fluid analogy, this is like assuming “laminar flow”.

It also assumes that d/dt isn’t part of the effect (despite “using” the term velocity!!) – that you can represent things that are actually differential equations with simplistic algebraic forms.

Of course this is the central conceit of neoliberal economics: that everything is linear and algebraic, and that when you aggregate up, nothing changes in either direction (top down or bottom up).

And it’s 100% wrong. In very trivial ways. This is why no one in the neoliberal realms predicted the recent crash. The models are simply incapable of predicting anything like that.

JG wrote:

“This is why no one in the neoliberal realms predicted the recent crash. The models are simply incapable of predicting anything like that.”

Rubbish.

I predicted all of this in 2005. The problem is with people who think that macro is BS when they only know micro. Learn both and then see if what you think you know is still true.

It’s actually considerably simpler than you think.

Mark A. Sadowski:

The Swiss National Bank does not pay interest on reserves. Excess reserves at the SNB have nevertheless evolved very similarly to those in the US (see here: http://www.snb.ch/en/iabout/stat/statpub/statmon/stats/statmon).

“The models are simply incapable of predicting anything like that”

The FED stopped publishing the G.6 because its manager Ed Fry retired, plus its custodians didn’t know the difference between liquid assets & the money supply. Upon its scheduled review, the custodians never polled the subscribers to find out how they used the series. But by using rates-of-change, as opposed to absolutes, one could always identify the economy’s direction.

The crash you say couldn’t be predicted, was simply the result of 29 consecutive months of negative figures for the rate-of-change in money flows (the debit series mirror). That’s called driving the economy into a depression. Bernanke’s excessively tight money policy had an inevitable conclusion.

first you are making a monumental mistake… a mistake that the monetarist have been making, which has led to the disasterous situation we are in now.

The equation is MxV = PxQ where Q is ANYTHING, bonds stocks ets,,,anything we spend money on…its not real income Y, also P is the price of everyting not the CPI or other measures of inflation…this P is UNMEASURABLE since it covers EVERYTHING! Now V in theory is a constant… if you measure it diferent than a constant…then its not the constant that is at fault…its your way of measuring it!..end of story!

JDH,

My question was slightly rhetorical in that I did suspect/assume not all primary dealers have accounts with the Fed (although the interpretation of Goldman and Morgan Stanley would be more interesting now than before). That said, it would be interesting to see a list of the haves and have not primary dealers in this regard.

In that “have not” situation, I find it odd to think of it in terms of the “demand for reserves”. A dealer without an account at the Fed doesn’t really care about the effect of his QE transaction on banking system reserves. The bank reserve effect is really a by-product of whatever is driving such a dealer to participate in a QE transaction (as you noted in the second part of your response).

A bank selling bonds from its own portfolio on the other hand will definitely incorporate the reserve effect into its portfolio strategy.

How do you differentiate between these two situations, when assessing the banking system’s “demand for reserves”, or do you? I’ve always found the demand function concept to be an ambiguous one in this sense.

Professor,

An excellent post!!

I also once believed that the excess reserves were caused by the FED paying interest on the reserves, but after looking back at the Great Depression it was interesting to discover that exactly the same thing happened then with reserves as is happening now.

When Hoover attempted to increase the money supply the injected money went to bank reserves, and later when the FDR administration attempted the same thing again the money went into excess reserves.

You are correct that something different is going on but to understand it you have to look at all of the economy not just the money supply. Velocity by definition includes the economic actors. When these economic actors are already mortgaged to the point where they cannot take on more debt and businesses are afraid to expand or are facing insolvency, injecting more money in the banking system for loans is pointless. The actors are not playing the game and so there is no need for more play money. And the Keynesian idea that government spending will fill the gap has been totally debunked by recent events (and by the Great Depression if you look at it a second time with unbiased eyes.)

You seem to blame the banks for not loaning the money out but that seems misguided. The whole business of a bank is based on returns from loans. Even at our current low rate banks could loan money out at a higher interest rate than the FED is paying. They are not lending because borrowers do not qualify, and potentially qualified borrowers are not borrowing. The problem is that due to excessive debt, economic contraction, and economic uncertainty, no one will borrow. Until the fiscal environment changes to revive private sector production more money in the system is like pouring water on a drowned man.

If inflation is too much money chasing too few goods then that excess money floating around in the system (excess bank reserves) just ain’t doing any chasing.

The “equation of exchange” P=MV/T embodies the truistic relationship between money flows & the aggregate value of all monetary transactions. P represents the unit prices of all transactions; T, the number of “units” of all transactions; M, the volume of means-of-payment money; V, the transactions rate of money flows; & MV, the volume of money flows.

While the usefulness of the equations is somewhat diminished by the impossibility of quantifying P & T, the validity of the equation is not. There is evidence to prove rates-of-change in nominal gDp can serve as a proxy figure for rates-of-change in all transactions. I.e., the proof is in the pudding.

Barbara Sutter,

True, excess reserves have risen at both the SNB and the Fed but the scale of the increase different in magnitude (and the reason is IOER).

1) Excess reserves at the SNB went from about 2 billion CHF in 2007 to about 40 billion in 2008 and peaked at 76 billion in May of 2010 before falling to 26 billion in September.

2) Excess reserves at the Fed went from about 2 billion USD in August 2008 (about the level they had been for months) to about 797 billion in January 2009. They peaked at 1.16 trillion in February 2010 before falling to 972 billion in November.

I don’t consider a 13 fold increase to be “comparable” to a 436 fold increase.

Ricardo,

It wasn’t exactly the same during the Great Depression. Excess reserves did increase from 70 million dollars in 1929 to 1280 million in 1935 but that’s only an 18 fold increase. The difference is IOER.

Corrections:

1)The SNB actually held 37 billion CHF in excess reserves in 2008 not 40 billion. I was going by memory.

2) “436 fold” should read 486 fold of course. I’m not normally that innumerate.

Of course the exchange equation is correct. As long as you run it in the right direction.

Jim, you brought out the money side of your audience with this blog; great job.

What about the real side. Are (inelastic) consumer’s oil expenditures as a proportion of their budget going to at least ditch the recovery next year? Or send it back into the ditch?

An injection of base money must go through a “monetary transmission mechanism” to affect GDP=PQ. If the transmission mechanism – tm – is operating smoothly as in normal times, additional base money passes through relatively quickly to PQ. If the tm is broken, the V in MV=PQ will fall in rough proportion to the injection of base money and PQ will be affected only marginally.

The tm is broken. The primary break is at the point of regulatory capital requirements on the banking system operating on bankers’ willingness to lend given all the uncertainty about the true value of the toxic assets (MBS) and other assets (commercial loans) in their portfolios. Regulators have tightened up on capital requirements via the exhortations of on-the-spot bank examiners (slamming the barn door even tighter now that the horse is gone). Banks as a whole are letting assets run off to boost their capital-to-asset ratios to comply with regulatory requirements that are restrictive to the system and completely upside down from what should be done in the current environment. That is, banks are not making loans out of survival behavior dictated by overly harsh regulations in line with orders coming down from the very top (Fed Board of Governors and the head of the FDIC).

V will rise, the wound to the tm will heal, and GDP=PQ will pick up when either (a) enough time measured in years transpires or (b) regulators are directed by Congress to reduce the effective de facto capital ratios (arguably around 11%) at prudential well-run banks (the vast majority) so that the bank capital ratio is no longer the main operative constraint on bank lending as it manifestly is at present. Fixing the tm would mostly boost real GDP=Q in the early stages because presently the economy has so much excess capacity and is so far below potential.

Parenthetically, economic theory misses this. The IS-LM model wrongly posits that interest rates are at the heart of the monetary transmission mechanism. It was clear years ago that interest rates are a thin reed to build a model on. There is much more to the very important tm than just interest rates.

Anything off the subject and away from the above line of reasoning is of secondary or tertiary importance. That is, interest on bank reserves is a red herring and of little consequence to what is happening to V at the present time. It is the broken transmission mechanism in the sense described above that is the problem. Close on the heels of the broken tm is the anti-business climate spawned and perpetuated by the 111th Congress and the first two years of the Obama administration.

JBH,

You wrote:

“The tm is broken.”

Yeah, when you hand me the printing press and I can’t deliver you a decreased value in the dollar by the day’s end I’ll believe it.

There are bound banks (banks with legal reserve & reserve-ratio restrictions) & non-bound banks (banks that satisfy their reserve requirements entirely thru their applied vault cash-i.e., thru their liquidity reserves). The division amongst the banks having & not having restrictions is largely driven by the size of the banks. This is analogous to the member/non-member bank argument: pre-DIDMCA where the percentage dropped to 65%.

Money creation is a “system” process; no bank or minority group of banks (from an asset standpoint) can expand credit (create money), significantly faster than the majority group are expanding. In other words, if the bound banks hold 70 per cent of total bank assets the FED, through controlling the legal reserves of the bound banks – can control the expansion of total bank credit, bound & not bound.

Given the bracket creep provided by the low-reserve tranche & exemption amounts (since 1982); plus the authority (Financial Services Regulatory Relief Act of 2006), to “lower reserve requirements on all transaction deposits (applied to deposits above a certain threshold level) to as low as zero percent, from their previous minimum top marginal requirement ratio of eight percent” (in October 2011); the volume of required reserves is headed much lower.

Theoretically, once the non-bound banks percentage of total banking system assets reaches 50 percent, it will be impossible for the FED to control the money supply thru legal reserve management. That’s when IORs completely take over as the FOMC’s primary operating tool.

But they are unprepared (by St. Louis FED V.P.):

(1) “We don’t have money market models accurate enough to let us track the linkage between interest movements and reserves (and the monetary base!) Until then, there will be slippage among the various concepts.”

(2) “…the Fisher equation and its implied spread between nominal market rates and “real” rates. Every economics class has taught about the Fisher equation for decades. But, of course, there are open issues — which maturity of nominal rate to use? And which price deflator? Some folks would use an overnight rate, some a 90 day rate, some a government rate, some a private sector rate, some would use the 10-year bond rate, etc”

(3) “All monetary policymakers now understand what the academics call “Taylor’s Rule” (due to John Taylor) — when inflation increases and market interest rates rise with that inflation, the central bank must increase its target rate by more than the increase in market yields — else, the central bank is just keeping abreast of the market and not leaning against the inflation. If such a rule is approximately correct, then it should also moderate the growth of the base and reserves (which of course are feeding the inflation). It would be a useful task to build such an empirical model and demonstrate how the process works, but I’m not aware of anyone doing so”

The FED can’t control the velocity nor the volume of money via the interest rate channel.

JBH and flow5:

What you say is true… interest rates are no longer the primary mechanism to control money, primarily because sweep accounts are now permitted and reserve requirements have been diluted since 1990. See http://www.ny.frb.org/research/epr/02v08n1/0205benn/0205benn.html

Bankers are not fools however, the smart ones know that the pendulum will swing back, with more conservative reserve requirements; and the non-performing RE and business loans will have to be properly accounted for. Consequently, banks are hoarding assets and shrinking their loan books. Washington politicians may think that total US debt/GDP of 375% is OK, but I guarantee that the FED and commercial bankers are out to shrink that ratio ASAP.

I anticipate that if the banking reserve loopholes are eliminated by stronger international regulation, that the interest rate channel will regain its efficacy in controlling credit availability.

How do you ‘unprint’ money? It appears to me that you can’t quickly ‘unprint’ money that’s been ‘printed.’ You can ‘freeze’ its use via higher capital requirements or interest rates but once you’ve stuffed bank’s capital fresh off the digital press it’s going to stay there: In cash or in bills/bonds–no difference.

And once it begins to be used, a lot of things in a lot of areas are going to go up in dollar terms.

At a 10:1 rate? Possibly very fast.

Sounds like timing will have to be very, very good. If not, it’s going to be a tumultuous few years ahead.

Even given the slightly skewed $75b POMO schedule additions, short-term money flows peak in JAN. And long-term money flows should bottom in FEB-MAR. Stocks are thus scheduled for a pull-back.

beezer: How do you ‘unprint’ money?

You unprint money using the same mechanism by which the Fed prints money. The Fed bought treasury bonds and credited the sellers with “printed” electronic money in their accounts. To unprint money the Fed sells their treasury bonds and removes money from the buyers accounts to pay for them.

Mark Sadowski,

Thanks for pointing out the increase in bank reserves during the Great Depression. Take a look at the increase in bank reserves immediately after Hoover created the RCF not the average after 1929. Also understand that the excess reserves are a factor of excess money creation. The Reconstruction Finance Corporation spent $1.5 billion in 1932, $1.8 billion in 1933, and $1.8 billion in 1934, then cut back in money creation after it didn’t work.

But that said it is not the magnitude but the mechanism that you should think about. Were there huge excess reserves before the money creation?

Ricaro,

The recovery from the GD was swift after the nominal anchor was changed (the dollar was devalued in 1933). Any effort to expand the money supply prior to that was handcuffed (fettered) by the gold standard.

Sure, excess reserves expanded during that period but they don’t anywhere match the magnitude the current increase. But more importantly, we don’t have the excuse of a gold standard anymore.

Let us unfetter our minds.

The chief difference between the GD & today is that during the GD there was an insufficient volume of governement debt to prime the pump.

Today, we now actually have a central bank. It is called the Federal Reserve Bank of New York. An amendment to the Federal Reserve Act in 1933 established The Federal Open-Market Committee and gave it the power to control Total Reserve Bank Credit. The Fed can now buy an unlimited volume of earning assets. (With the federal debt at over 12 trillion, and expanding, and billions of dollars of “eligible paper” available, the term “unlimited” is not an exaggeration in terms of any potential needs of the Fed.) In the process of buying Treasury Bills etc., new Inter-Bank Demand Deposits (IBDDs) are created. These deposits can be cashed by the banks into Federal Reserve Notes, without limit, on a dollar-to-dollar basis.

Unprint money. Easy. You just write off debt.

The hard question is “whose debt?”.

MZM is somewhat better, or at least freer, of some of the distortions of the AMB and M1.

M2 is also viable.

In times of quantitative easing the shorter the money supply measure the more distorted the metrics will be.

Unprinting money. I will also try that one.

The Fed prints money by losing in the market, and unprints by winning in the market. With that definition, unprinting is a bit harder.

But velocity of money does have a physical definition. The number of transactions per dollar. Why not use a statistical sample to estimate the velocity?

The definition of velocity also suggests a simple answer to the question of which monetary aggregate to use. If you’re only concerned with transactions that are made in currency, then m1 is appropriate, if you think transactions made in other measures of value should also be measured, then using m1 is a mistake. When you do the dimensional analysis you’ll find that the units come out wrong.

Another way to look at this is to note that your measure of GDP and prices will fix your monetary aggregate. If you measure GDP as goods purchased in prices denominated by x, then your monetary Aggregate must be the total quantity of x.

For example, If I’m measuring GDP using the income method, I’ll probably count direct deposits to savings accounts amongst the total domestic income. This means I’ll need to use a measure of monetary supply that includes savings deposits. Thus, I can’t use m1.

In other words, Using m1 to create a result that better fits your expectations is probably a mistake. There is either a flaw in your theory or in your expectations.

With regard to the money supply, maybe a bit off topic, but a quick question…

I continue to hear everybody in the media including financial correspondents talk about the Fed and “printing money”. Conversely, Ben Bernanke recently appeared on 60 minutes to attempt to explain what the Fed is doing and how it’s doing it. During this interview, Dr. Bernanke stated that the Fed “is not” printing money for QE2. He said the money is coming directly from it’s balance sheet of reserves if I remember correctly. Can anybody elaborate on this? Is he telling the truth? If so, why does everybody continue to say the Fed is printing more money for QE2? Doesn’t anybody else hear these opposing statements?

Scott: I agree with Bernanke. The number of dollar bills that have been physically printed is a tiny fraction of the expansions associated with QE1 or QE2. I have more details than you may care to read about this here. As for why so many people refer to this as “printing money”, it is because they do not recognize an important distinction between Federal Reserve deposits and currency. You will find ongoing debates on this topic on the current thread as well as here.

Scott,

If you’re not sure if the Fed is printing money or not perhaps that’s because Bernanke essentially just contradicted himself.

Twenty-one months earlier, on the very same show (60 Minutes), with the very same interviewer, Bernanke was quoted as saying:

“Asked if it’s tax money the Fed is spending, Bernanke said, “It’s not tax money. The banks have accounts with the Fed, much the same way that you have an account in a commercial bank. So, to lend to a bank, we simply use the computer to mark up the size of the account that they have with the Fed. It’s much more akin to printing money than it is to borrowing.”

“You’ve been printing money?” Pelley asked.

“Well, effectively,” Bernanke said. “And we need to do that, because our economy is very weak and inflation is very low. When the economy begins to recover, that will be the time that we need to unwind those programs, raise interest rates, reduce the money supply, and make sure that we have a recovery that does not involve inflation.””

Of course, the only difference between now and then is that then the Fed was buying corporate assets and now it’s buying government bonds.

Watch Jon Stewart make light of the obvious contradiction:

http://www.thedailyshow.com/watch/tue-december-7-2010/the-big-bank-theory

So, I too agree with Bernanke (the one of 21 months ago). The Fed is (effectively) printing money. The distinction between reserves and currency is one without a difference.

P.S. And if the Fed isn’t printing money why did the USGGBE10 (a measure of long run inflation expectations) bottom out at 1.57% the trading day before Bernanke’s Jackson Hole speech (August 25th) and since has risen to about 2.3%? (And note that, it would appear the Fed’s goal is to maintain long run inflation expectations in that range.)

If people are selling assets so that real prices are falling, it behooves others to sell, too, before the price has fallen even more (with additional selling then causing prices to fall even more, etc.) This inefficiency (from too much selling) prevents real wages from increasing as prices are falling, because inefficiency decreases the marginal product of labor.

Furthermore, increasingly less specialization by companies, as companies bring production of more of their product “in-house” (because of increasing uncertainty about the behavior of others) makes it inefficient for other companies to maintain *their* level of specialization because their specialized services are no longer needed when other companies are specializing less. So everyone transacts too infrequently for a given money supply per time, leading to increasing liquidity demand, precisely as prices are falling.

In addition to inefficiency created by too much selling, this inefficiency (caused by too little specialization in production) also decreases the marginal product of labor, so ultimately even if wages could change instantaneously, wage rates fall as prices fall, but real wages are even *less* because of increasing inefficiency in the economy. Since wages are usually “sticky” unemployment ensues.

Attempting to solve the problem by infusing money does very little because what is actually happening is that people are selling inefficiently too much relative to buying and specializing too little in producing things, relative to wanting to rely on others to produce aspects of their product. Both lead to real inefficiency in the economy that no short-term endogenous behavior of economic agents will remedy, if they act in their individual self interest. It leads to falling asset prices and greater inefficiency in production, and lower real wages and unemployment.

Only known and predictable increases in demand, for example exogenous governmental spending on goods and services, solves escalating problems like this. And when the economy grows again, of course this increase in government involvement should logically decrease, if at all possible. But what should remain is tighter controls on lending by banks, when people begin buying more than selling and specializing too much rather than producing things “in-house”.

Changing money supply, by creating greater banking reserves or not, will not effectively change people’s rational self-interested behavior. And it is this behavior that leads to collective deflations, decreasing specialization, decreasing marginal product of labor, increasing unemployment, and increasing liquidity demand for the economy as a whole.

SCOTT – “During this interview, Dr. Bernanke stated that the Fed “is not” printing money for QE2. He said the money is coming directly from it’s balance sheet of reserves if I remember correctly. Can anybody elaborate on this? Is he telling the truth? If so, why does everybody continue to say the Fed is printing more money for QE2? Doesn’t anybody else hear these opposing statements?

—

Here’s my answer – Bernanke’s interview occurred in late 2010 and he was accurate in a wonkish sort of way.

During QE1, which ended in early 2010, a main way in which the FED was paying for its MBS/GSE paper purchases was by crediting the bank reserve accounts held at the FED. That was why the level of so called excess reserves had such a huge run up. Crediting reserve accounts could be viewed as a form of ‘printing.’

At the end of QE 1 there was a small draw down in the reserves. Later, the FED began buying Treasury paper under QE2. For the year 2010 as a whole, the FED did not pay for the expansion of its balance sheet assets by the same ‘printing’ of reserves mechanism as under QE 1. Instead, the FED borrowed the money from the Treasury under the Supplemental Finance Program.

If you look at the FED’s 4.1 report for Jan. 6, 2011, you’ll see that for all of 2010, the Fed’s balance sheet (asset side) expanded by about $195bn. This was paid for by a $195 expansion of borrowings from the Treasury under the SFP.

So, in late 2010, when he gave the interview, Bernanke could be technically correct is saying that the FED was not expanding its balance sheet by printing (either currency or keypunching an expansion of bank reserves). They were borrowing it from the Treasury (ie, not printing).

More recently (see Fed’s Feb 9 balance sheet), the FED has resorted to ‘reserve printing’ not just to pay for QE 2 purchases, but to pay back the SFP and cover payments from the Treasury’s operating checking account at the FED. So, today, Bernanke couldn’t accurately make the same ‘we’re not printing’ statement.

But, back when he gave the interview he could say that and be, within his wonkish world, correct.

MARK SADOWSKI: If you’re not sure if the Fed is printing money or not perhaps that’s because Bernanke essentially just contradicted himself.

Twenty-one months earlier, on the very same show (60 Minutes), with the very same interviewer, Bernanke was quoted as saying:

“Asked if it’s tax money the Fed is spending, Bernanke said, “It’s not tax money. The banks have accounts with the Fed, much the same way that you have an account in a commercial bank. So, to lend to a bank, we simply use the computer to mark up the size of the account that they have with the Fed. It’s much more akin to printing money than it is to borrowing.”

“You’ve been printing money?” Pelley asked.

“Well, effectively,” Bernanke said.

—

He did not contradict himself. He was talking about what they were doing at two different points in time.

In the earlier interview he was talking about QE via expansion of reserves. So, he was accurate in saying that was a form of printing.

In the late 2010 interview they hadn’t been engaged in reserve expansion as a way to conduct QE. For the year, reserves were largely flat, but the nearly $200 bn expansion of the asset side of the balance sheet was achieved by borrowing from the Treasury under SFP. Note that Bernanke himself draws the distinction between effectively printing (crediting bank reserves) and borrowing in the earlier interview.