The Bureau of Labor Statistics reported yesterday that the unemployment rate has fallen from 9.8% in November to 9.0% in January, as big a two-month drop as we’ve seen in the last 50 years (hooray!). But in the same report, BLS indicated that their seasonally adjusted estimate of the number of Americans employed on nonfarm payrolls increased in January by an anemic 36,000 (oh dear!). Reconciling the very contradictory claims is even harder than usual, but I’ll give it a try.

We can start with the fact that the two numbers come from two different surveys and are measuring different things. The unemployment rate comes from a survey of households, and counts someone as employed if they did any work at all as a paid employee or worked in their own business during the surveyed week, and also people who have a regular job but missed work due to temporary factors such as illness or bad weather. The nonfarm payrolls, on the other hand, come from surveys of establishments themselves. If bad weather caused someone to miss work for a two-week payroll period that included the 12th of the month, that person would not be counted as employed according to the establishment survey. Rebecca Wilder notes that Nomura economists accurately predicted prior to the BLS release that weather distortions would cause the reported nonfarm payroll gain to come in well below 56,000. The same Nomura report noted:

In one of the largest first reported declines on record, the BLS in its February 7, 1996 report calculated that non-farm payrolls FELL by 201,000 from the previous month. The outsized decline hit both manufacturing (-72,000) and services (141,000) but the construction industry registered a net job gain of 13,000. At the time, the BLS blamed the big winter storm for skewing the job loss and a month later reported that payrolls surged by 705,000 in February after a revised drop of 188,000 in January.

But even if we stick to just the household survey, there is still some serious reconciliation required. We can start with the fact that the household survey reports a value for the civilian noninstitutional population for January that was 185,000 lower than the value for December. Obviously that’s not what really happened, and

here’s the explanation:

BLS introduces the annual population control adjustments into the CPS estimates beginning with the January data. The adjustment can either increase or decrease the population level, depending on whether the latest information indicates the population estimates have trended too high or low. Conceptually, the population control adjustments represent the cumulative over- or under-estimation of the population since the last decennial census point.

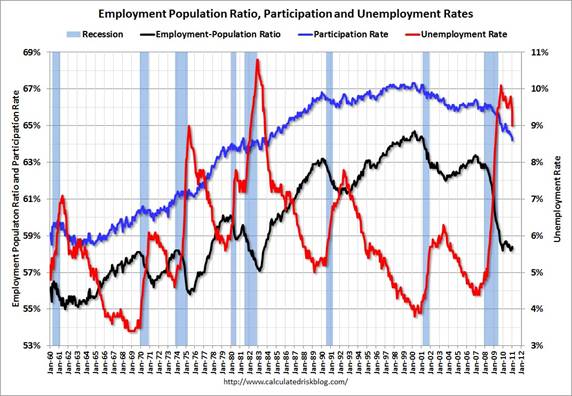

That makes the December-to-January comparison of any of the household survey magnitudes a bit problematic. But, as Rebecca also notes, Table C in the BLS report suggests that one might just subtract the population control effects from the published December-to-January change in employment to arrive at an implied net gain in employment of 589,000 jobs according to the household survey (hooray again!). Declining participation rates have been one factor in earlier improvements in the reported unemployment rate. But it looks reasonable to me to interpret the further improvements in January as indicating real progress.

Here’s my bottom line: if you had concluded (and I had) from recent sales data and manager surveys that we’re finally seeing the economy growing solidly, there’s nothing in the latest jobs report to persuade you otherwise.

For other reactions, please check out

Free Exchange,

Zero Hedge,

Curious Capitalist,

Calculated Risk ([1],

[2]),

and WSJ Real Time Economics ([1],

[2]).

|

as i commented on rebecca’s post: over the past year we’ve only added back 1.1 million of the 8.4 million jobs that were lost during the recession; however, just to create jobs to make up for the increase in the population, we should be adding 1.5 million jobs a year; thus at the rate jobs are being added in this “recovery”, the labor force participation rate will continue to shrink, and we’ll never get out of this hole…

thats not good news…

with all due respect, but you are taking all statistical data as a true and honest representation of reality, probably you brush off hedonical and substitute adjustments concerning CPI as immaterial as well.

just because they call it unemployment rate, it does not mean it is such, i myself was surpized to find out that flour has about 18% wheat, packed sugar about 20% sugar substance, it was not really so 20 years ago…

0.8% drop in the unemployment rate all the while new jobs do not even keep up with the workforce growth? it is a shame that this is probably the most important gauge of economic activity, yet is turned into such a poor quality farce.

OK, 900,000 jobs in two months is not trivial and it is movement in the right direction. But to put things in perspective, even taking into account the population correction factor, roughly 40% of the 0.8 points drop in the unemployment rate in the last two months was due to people leaving the labor force. So I’m not quite ready to break out the champagne just yet. Let’s see what next month’s numbers look like. But if the economy is finally turning the corner there’s only one credible reason: QE2.

Mark A. Sadowski if the economy is finally turning the corner there’s only one credible reason: QE2.

While I support QE2 and think it will have a positive effect on the economy, I can’t quite swallow QE2 be large enough to qualify as a “credible reason” for the possible turnaround. I’m sure it helped, but I don’t think any of the models predicted anything more than a modest bump in GDP from QE2. What’s not explained is the transmission mechanism from GDP growth to job growth. My own pet theory is that job growth is probably related to the fact that businesses are starting to worry about wringing out too much productivity from the current workforce. Businesses that count on the kinds of labor productivity growth that we’ve seen over the last couple of years are businesses that are putting themselves at risk over the longer run. Businesses are sitting on a lot of excess capital equipment and buildings, but skeleton work forces to operate that capital. If you want to employ all that idle capital, then you better hire now when the hirings good.

Think it belongs here:

from http://www.zerohedge.com

“Courtesy of today’s full year revision announced by the BLS, and a granular sort by John Poehling, we have discovered that while revisions added a whopping 55k jobs in the years 2006-2008, NFPs have now been revised to remove 538k jobs in the 2009-2010 period. In other words, based on data revisions, under President Obama, America has suddenly created over half a million jobs less (even if all of them are part time) simply due to statistical adjustments. We won’t even go into analyzing just how much worse the S&P would be trading if all those monthly “upside” NFP reports had reflected true and not completely fudged numbers. At an average 22.4K downward monthly revision for every single monthly NFP report in the past two years, we are 100% confident that not even Iosif Vissarionovich Bernanke would be able to offset the market plunge that would ensue each and every of the past 24 months… if fundamentals were ever to be remotely meaningful again, of course. ”

In normal statistical measurments, mistakes tend to happen to both directions of the reported results. In the USA monthly non-farm payrolls reports, the statistically improbable shift has always happened in one direction, to overstate the numbers of jobs added.

# of absolute jobs in the economy: 12/2010 – 130.7 million; 01/2011 – 130.2 million

Where did the 500K go?

9% unemployment? This is a function of participation in the labor rate. Less participation (1.5 million) better numbers.

65 million bread winner jobs. 6.6 million lost in the great recession; 200K lost since the recession officially ended eleven months ago.

The US Economy is not producing the jobs it had done in the past.

Einstein’s definition of Insanity: “The definition of insanity is doing the same thing over and over again and expecting different results”.

QE2 meets Einstein’s definition. QE2 has proven one thing: printing money to create jobs does not work. Printing money creates bubbles, inflation and ultimately adds to our debt.

40 billion in nominal GDP per month. While we’re issuing 125 billion dollars of bonds per month.

Two words: Good luck.

Maybe this has been debunked, but I was under the impression that the household survey did a better job of picking up small business employment compared to the establishment survey.

I also recall reading that banks are beginning to loosen credit a bit for small business.

Didn’t the household survey and establishment survery also diverge around the last turning point in employment (the peak)?

Lots of “if I recall correctly” there, so I may be off the mark.

Babinich printing money to create jobs does not work. Printing money creates bubbles, inflation and ultimately adds to our debt.

Correct me if I’m wrong, but I don’t believe anyone is “printing money” to support QE2.

And how exactly does either QE2 or printing money add to our debt? The very small downside risk of QE2 is that it might, if badly mishandled, generate more inflation. But again, how does inflation add to our debt? Seems to me that inflation reduces the real burden of debt for debtors, and it’s debtors who are asymmetrically constrained right now. A little bit of inflation is certainly preferable to contined disinflation or, worse yet, deflation.

It seems that Tunisians and Egyptians (as well as savers or people who live from salaries) are not so happy about little inflation.

Little exported inflation creates worldwide political instability which in turn increases both commodity (notably oil) prices and keeps the value of USD artificially high.

So in the end, and not so long from the start of QE2 “little” inflation returns to the USA in the form of higher priced imports and less exports, keeping trade balance in extreme negative, which slows growth and thus increases the need to borrow more or print more (government borrowing from FED is printing, is this not obvious?).

Technical ( long term response of markets to shocks) view on 2011-2012, double dip and oil prices:

http://saposjoint.net/Forum/viewtopic.php?f=14&t=2626

Ivars Okay, let’s see if I got this right. Commodity food prices are rising not because of negative supply shocks over the last two years of bad harvests; and not because of positive demand shocks from rebounding growth in developing countries; but because the Fed decided to deposit a few electrons is some bank reserve accounts in exchange for longer term securities. Is that your theory? And you don’t feel at all embarrassed about posting crackpot economics to a well regarded blog that is read by many formidable economists? Thanks for clearing all that up.

I follow these numbers because monetary lags never vary, & money flows currently “provide the best available single indicator” of business activity:

2010 jan ……. 0.13 ……. 0.538

….. feb ……. 0.056 ……. 0.507

….. mar ……. 0.072 ……. 0.558

….. apr ……. 0.056 ……. 0.552

….. may ……. 0.067 ……. 0.477

….. jun ……. 0.038 ……. 0.474

….. jul ……. 0.078 ……. 0.499

….. aug ……. 0.031 ……. 0.49

….. sep ……. 0.045 ……. 0.542

….. oct ……. -0.01 ……. 0.386

….. nov ……. 0.041 ……. 0.321

….. dec ……. 0.099 ……. 0.32

2011 jan ……. 0.079 ……. 0.144

….. feb ……. 0.091 ……. 0.232

….. mar ……. 0.13 ……. 0.321

….. apr ……. 0.1 ……. 0.232

….. may ……. 0.111 ……. 0.203

===============

Short-term monetary flows (MVt) our means-of-payment money X’s its transactions rate-of-turnover (the proxy for real output -1st column of #’s), has turned up sharply. Money flows are going to approach, if not set, millenia records, in the 1st & 2nd qtrs of 2011.

Long-term monetary flows (the proxy for inflation – core cpi & housing prices-2nd column of #’s) has bottomed in JAN.

Treasury Market Support, the FED’s informal mandate, is waning.

I think the data is headed in the right direction but I think it is less positive than you do. We are at least starting to add more jobs which we need to do at a minimum to offset the natural increase in our population. That said, the real issue is that even if we make some progress on the jobs front (which we will) our labor force is not a perfect match for our desired skill sets. There are new jobs being created for Apple app developers or web 2.0 companies, etc. but our labor force needs to morph and get retooled/reeducated if we are to hope to get back to full levels of employment someday. I fear the reality is that we will have higher sustained employment for some time and the miserable housing situation is compounding the problem by making us much less able to move to new opportunities as we were able to do in our country historically.

Anyway, good point on the positive news, but we cannot let some positive data points take us away from the fact that we have substantial work to do if we want to get back to trend. – Adrian Meli

Of course QE2 means “printing money”. Thank God! We need mmore money to be printed each and every day until the economy recovers. Oh, I realize some of you are bum#$%^s. That is to say people who only believe in “sructural” explanations.

It must be nice to live in fairy wonder land without any empiricism.

+36,000 on consensus estimates of +146,000 cannot be described as anything other than very weak. The only reason the U3 fell is because of the large number of people leaving the labor force. From Jan. 2010 to Jan 2011, the civilian pop. grew by 1,872,000, yet the labor force dropped by 167,000. Those not in the labor force rose by 2,094,000 over the year (2,292,000 NSA), and 319,000 people dropped out of the labor force from Dec 2010 to Jan. 2011 alone. The number of people not in the labor force, but who want a job rose by 498,000 (535,000 NSA) from Jan 2010 to Jan 2011. This is not a good thing. Even worse is the fact that almost none of this is the baby boomers retiring. The participation rate for the 55 and over crowd is still continuing to increase, while the participation rate of the 20-24 and 25-34 year olds is declining, and the 16-19 year olds is tanking.

2slugbaits:

“Okay, let’s see if I got this right. Commodity food prices are rising not because of negative supply shocks over the last two years of bad harvests; and not because of positive demand shocks from rebounding growth in developing countries; but because the Fed decided to deposit a few electrons is some bank reserve accounts in exchange for longer term securities. Is that your theory? ”

Yes, export of inflation via speculation and capital flows combined with too high dollar value as safe heaven.

“Corn prices – and with them, the price of meat – are set to explode if the latest import estimates from China are correct. The US Grain Council, the industry body, said late on Thursday that it has received information pointing to Chinese imports as high as 9m tonnes in 2011-12, up from 1.3m in 2010-11.” Why is this a concern? Because “the US Department of Agriculture, which compiles benchmark estimates of supply, demand and stocks, forecast Chinese imports at just 1m tonnes in 2011-12.” In other words, the whole forecast supply-demand equilibrium is about to be torn to shreds. And all this excludes the impact of neverending liquidity by the one and only, which will only make the speculative approach to surging corn relentless.

You cannot point to table C and simply remove population controls and somehow imply there was a 598,000 number of employed people increase in Janaury. Why? Because the noncivilian population number is a cumulative error. Employed is derived from this and it’s clear there is a huge cumulative error, so subtract off the population control adjustments, that very error is in that new employed person calculation from Decmeber change.

http://www.economicpopulist.org/content/unemployment-90-january-2011-only-36000-jobs

Also, with the adjustments it is not 1.1 million payroll increases, it’s 984 thousand from 01/10-01/11

http://www.economicpopulist.org/content/exercises-reader-january-2011-unemployment-report

@2slugbaits

it is apparent that you are familiar with economic theory and totally clueless about economic reality.

when the fed monetizes debt to the tune of 2 trillion thus far and extending loans against money bad investments, it increases the funds available to speculate in other asset classes and funds the gov’t debt indirectly by letting banks skim it. that is printing money: you sell a mortgage loan worth 50-60 cents for a dollar, the difference that the fed adds to it is newly minted money. then everything else trades at the price the fed would buy it, not at the price a sane investor would.

on the economy issue: we are long past the time when debtors are tangiable businesses with assets and earnings power to repay debt. today’s debtors are banks and households that simply roll over debt. they cannot create anything for themselves, their assets do not generate earnings barring the effects of money printing. these can only live off the earnings of real businesses that produce. real businesses have been disappearing for some 20 years and with this ultimately the ability of the economy to recover. and to say it to an academic layman like you: the economy is ‘the thing where you move stuff’, not ‘the thing where you shuffle money’.

baychev My objection to the phrase “printing money” is that it conjures up all kinds of images of Helicopter Ben throwing out rolls of cash to frantic citizens, flooding the economy with lots of cash. Now such a scenario would lead to inflation; but that doesn’t describe what the Fed is actually doing. The Fed is creating monetary base in the form of electrons, but those electrons are easily “recallable” in a way that cash on the street cannot be recalled. It is possible that the Fed could be seized with a sudden bout of extreme incompetence and we could end up with some inflation from QE2, but this strikes me as a bit implausible. The Fed is in a position to reverse QE2 anytime inflation looks to become a problem…and so far I don’t see any evidence that core inflation is a problem.

And the argument that QE2 is causing food prices to rise in developing countries is over the top. JDH and others did a lot of work on the potential impact of QE2 and perhaps I misunderstood all of their papers, but my interpretation was that QE2 would likely have a positive but weak effect on output, and if the output response was weak I don’t quite see how the effect on inflation could be anything other than weak as well.

Frankly, your post seems to be a rant against easy money policies during normal times, but it doesn’t really fit with the current reality of disinflation, ambiguous signals on job growth and corporations sitting on trillions in cash.

But I’m glad you think I’m familiar with economic theory because I am not an economist.

The household survey that BLS publishes in the A tables does not smooth over the population adjustments. They do publish a smoothed series, however, they just don’t feature. It’s on their web page somewhere (I get it through Haver).

@2slugbaits

i am not sure you understood my last point: money does not influence the economy’s path, it is by definition as well a medium of exchange, not a form of consumption. more money can only impact the ‘consumption’ of banks which are generally speculating and lending others to speculate, not to invest or buy houses, these take simply too long to bring results and cannot be called as easily as a margin account. this is what most academics just don’t get, we do not have a classic economy but a paper based economy.

the fed is smart enough to hand out money only to chosen groups, the unemployed tens of millions are getting only as much as needed to survive. surely that causes some inflation but not much and certainly not the desired by benito inflation, because unemployment checks do not leave much for discretionary spending.

the fed can NOT reverse its policies easily, contrary to what you are thinking. every ‘investor’ that they enticed to buy long dated bonds at yeilds of 2-4% is in a very precarious situation, that is pension funds to be precise. most are badly unfunded anyways, hit them with another 10-20% losses on 30-50% of their ‘investments’ and the picture becomes ugly. you have gov’t spending as well: at record high and funded with extremely short dated issues, nevertheless interest expenses will spike up by a few hundred billion in case of 1-2% interest rate increase. housing as well cannot take much higher rates given the oversupply and lack of income. then you have the much loved banks: what happens to their junk ‘holdings’ when interest rates go up? what happens to equities in a rising interest rate environment?

the fed is a hostage of its own mistakes, there is absolutely no EASY way out, there is a very painful way out though, through bankruptcy, because thus far we have been only kicking the can down the road and icomes have not been growing, only the money mass has been.

and something you may not be clear on as well: when the fed creates ‘easy electrons’, they go predominantly where electrons do: on the electronic exchanges. that pushesh up commodity prices the world over, where governments are robbing their people as well by devaluing (vietnam) or fixing exchange rates(you name as many as you want) and these people are consuming more or less only food and fuel and the pain is very visible. it is not only the fed that hurts them though.

2slugbaits –

In the real world, price levels for goods and services in the USA will have to decline substantially before America can compete industrially with Asia. Such an adjustment can not occur through inflation.

Inflation is the grease that allows our banking system to continue operating as a fraudulant shell game, protecting encumbered banks and failed securities. Failure to liquidate bad debt will substantially lengthen the time period that America spends in recession and/or stagflation. Ultimately, the only people that will benefit from “Quantitative Easing” are the people too rich to care about our nation, or too old to care about the future.