Incoming data over the last two weeks paint a consistent picture that the U.S. economy, which had been growing at a disappointingly slow rate, has weakened further.

The national income and product accounts updated last week by the BEA suggested that first quarter GDP growth was even weaker than previously indicated. GDP can be calculated in two ways, by summing up data on either what gets produced or the income generated by that production. Conceptually (and by definition) the two numbers should be exactly the same, but in practice you don’t come up with quite the same number using different methods. Jeremy Nalewaik has argued that the income-based measure of GDP (referred to as gross domestic income, or GDI) may be a slightly better indicator of business cycle turning points. For example, GDI gave a clearer signal than GDP of a weakening economy in 2007. GDI had been showing a little stronger growth than the GDP indicator in early phase of the current recovery (2009:Q4-2010:Q2), but has been signaling weaker growth than GDP for the most recent quarters (2010:Q3-2011:Q1). The latest BEA numbers report that total U.S. real output was growing at a 1.8% annual rate in 2011:Q1 according to the GDP measure but at only a 1.2% rate according to GDI.

|

And the second quarter may be starting out even worse. The National Activity Index maintained by the Federal Reserve Bank of Chicago summarizes a variety of monthly economic indicators. This fell to -0.45 based on indicators of where the economy stood in April. Berge and Jorda (2010) suggested that a reading for this index below -0.72 could signal a new economic recession.

|

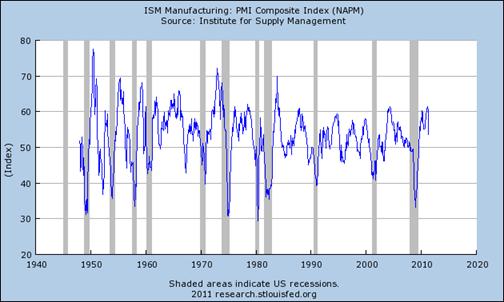

Growth of manufacturing, which had been the economy’s bright spot, seems to have slowed last month, with the ISM manufacturing PMI falling to 53.5 for May. A value above 50 still indicates that more facilities are reporting expansion than are reporting contraction, but this is a much weaker reading than we’ve been getting recently.

|

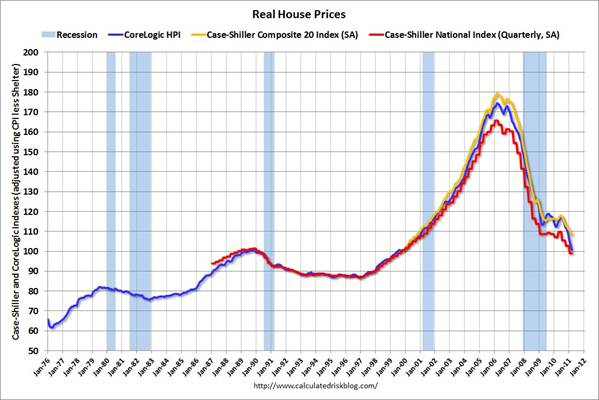

House prices are falling again, draining consumers’ equity and confidence, undermining a potential recovery in residential construction, and potentially threatening new foreclosures.

|

We’ve also been getting some troubling new readings on the employment situation. Although new claims for unemployment insurance declined slightly last week, they have been coming in at a higher rate in May than they did in March or April. And yesterday

ADP estimated that the nation only added 38,000 new private-sector jobs based on the payrolls for 23 million employees that it helps process. Tomorrow’s employment report from the BLS will be particularly important to watch.

|

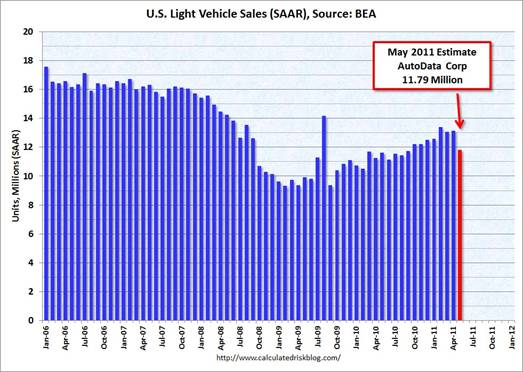

Auto sales also moved down in May. This is a key sector I’ve been watching for evidence that we might see a replay of what happened in 2008:H1, when high gasoline prices clobbered domestic auto sales and contributed to the initial phase of the economic downturn.

|

So far, however, I don’t believe we’re seeing the same pattern. A big decline in sales of domestically manufactured trucks and SUVs led the auto sector down in the spring of 2008, as you can see by comparing the orange and dark blue bars in the graph below. This category was down only 4.5% between May 2010 and May 2011, only slightly more than the 3.9% drop in light vehicle sales overall. One reason is that sales have never come back to the levels of May 2008.

|

Another thing we saw in 2008 was a flight to more fuel-efficient smaller imported cars. But imported cars also fell 3.5% between May 2010 and May 2011, with the supply disruptions from the Japanese earthquake a possible contributing factor.

|

Although I don’t believe that the recent high gasoline prices have produced the same kind of recessionary impulse that they did in 2008, they’re undoubtedly one contributing factor in the recent weakening. Here there’s some good news. I predicted on May 8 that we could see U.S. retail gasoline prices fall by 40 cents a gallon. Since then they’ve come down about 20 cents, and I still think we’ll see a further 20-cent drop in the weeks ahead.

|

|

| San Diego Historical Gas Price Charts Provided by GasBuddy.com |

So far I’m seeing slower growth, but not a new recession.

Update (6/3/2011 at 9:20 a.m.): A reader calls attention to the fact that the Berge-Jorda -0.72 threshold appears to be based on the 3-month moving average of the CFNAI. Although the April CFNAI was -0.45, the 3-month moving average was only -0.12. So the evidence from this indicator is not quite as alarming as the original text above may have suggested.

Another oil supply shock,or speculative price increase of oil, and it will be a new recession. Situation is extremely over-leveraged and unstable. Stocks will fall as well now, further reducing wealth and confidence:

http://saposjoint.net/Forum/viewtopic.php?f=14&t=2626&st=0&sk=t&sd=a&start=180#p31988

The problems we are facing are not due to economic shocks, oil or otherwise. Our problems are political policy problems. As Robert Mundell says, “There are no economic costs with the right policy mix.”

Can’t get another ‘oil’ speculation. Global slowdown has arrived. 1st quarter GDP has no choice but to be revised upwards. The Purchases were made, the BEA missed them as they always do. It is why those numbers change over 5 years.

But the 2nd quarter, we have seen a real slowdown as the global economy slows(a quarter ahead of my prediction). We are seeing it in asset markets right now, except for commodities. They are ALWAYS the last to hold out. When they do, global recession becomes apparent.

We’ll see.

The issue is how the oil prices play out. There are perhaps five scenarios, I think:

1. Oil prices go down

Possibly for a while. Our estimate of China’s carrying capacity for oil is $100-105; that’s still above tolerance levels for the US. So if prices ease, the narrative calls for China and the emerging markets to quickly take up the slack. I don’t see any durable relief on this front, and I don’t see the oil supply improving materially.

2. We get used to high oil prices. But oil is consuming 3% more of GDP than it did two years ago. This is unlikely to hold; so we’re going to be shedding oil consumption at these prices. And if we do get used to it, the Chinese will acclimate even faster. Current oil consumption expenditure is unlikely to sustain.

3. Growth limited to increase in US oil use efficiency. Could be. Need to run some numbers on this compared to China, etc. It should be possible to estimate this analytically. But this depends on a reasonable amount of price elasticity in the demand for oil–something not normally seen historically during times of economic growth.

4. Stop-start growth. The US porpoises between periods of growth and stagnation, but no recession. This is a variant of 3 above, where the oil price is a weight pressing down on a loaded spring of a depressed US economy looking to bounce back. Could be, but again, no real historical precedent for it and it assumes no tipping points.

5. Oil shock and recession. This is the standard means of adjusting. Plenty of historical precedent. The period for such a shock would occur 30-180 days post the increase in oil price. If we put the oil price spike at February, then we’re in recession by September.

Of all these alternatives, the easiest to defend is an oil shock-induced recession.

Dear Jim and Econbrowser readers,

A quick summary:

– Chicago Fed National Activity Index, April release = -0.45. Recession threshold (below which a recession would be called by our rule-of-thumb) = -0.72

– Philadelphia Fed Aruoba, Diebold Scotti Index, May 28 data = -0.06. Recession threshold = -0.80

PMI, May release = 53.5. Recession probability threshold = 44.48

Travis (my coauthor in the Berge and Jorda, 2010 reference above) ran a few recession probability predictions using the components of the leading indicators in the manner described in our paper. The data suggest that, despite the current weakness, the odds of a recession are relatively low (less than 1/3) over the next two years.

Jim,

Do you think it’s possible that we’ll slow down enough to hit “stall speed” like you blogged about last week:

stall speed?

I believe that net energy is proportional to true economic wealth. If the world is producing a fixed amount of energy with higher extraction costs there is not nothing available for increasing wealth except energy efficiency. Oil permeates more of our society than just the gas pump. Look how much energy it takes to make a pair of blue jeans, a PC chip or a hamburger at McDonalds.

I take the opposite tack- we have tried so many economic stimulus gimmicks and nothing has worked- maybe the root of the problem is bigger than either political party or any financial manipulation. We are into diminishing returns on growth. Cheap abundant energy has fueled the past century- lack of energy will lead to collapse in the next.

Richard Koo.

If you don’t know who he is, you’re way behind the curve.

I’m in for Steven Kopits’ scenario number 4.

The difference between now and scenario number 5 is that prices have approached 4% of GDP more gradually, and have not gone over it so long.

We approached but did not breach 4% of GDP in 2006, and had one very weak quarter of GDP (+0.5% iirc). Last year we just nosed 4% of GDP for a few days, and had one quarter of 1.7% GDP. This year we did breach 4% of GDP, but not by much, and I’m guessing not for much longer. I see one or two quarters of extremely weak, and possibly slightly negative GDP over the summer.

BTW, when Oil was at $110+ a barrel, gasoline usage was down nearly 3% for several weeks (similar to late 2007). The YoY comparisons have been improving for 3 weeks in a row. This last week, according to the EIA, gasoline usage was actually up almost 3% compared with last year.

Energy is the master domino in this equation. You cannot print more money than there is energy to back it up, it’s that simple. We live in an infinite growth paradigm which requires growth forever, however, infinite growth collides with finite energy.

Energy only converts in only one direction from usable to unusable; the law of entropy. In every energy transaction some energy is always lost, so you have finite energy and you have a financial paradigm which demands infinite growth, and we are at the point in human history where the infinite growth paradigm collides with something more powerful that money.

We are witnessing social darwinism. As oil became ubiquitous the population hockey sticks. These people exist because of oil so it’s axiomatic that if you take the oil away the population must go away. In all of science there is no case where any population, be it bacteria in a petri dish or caribou on an arctic island, runs into a favorable set of circumstances and their population peaks, it is always followed by an immediate crash once the food has been depleted.

Oil won’t “go away” of course, it will just price spike again, but this time, nobody will be able to afford it.

QE3! QE3! QE3! QE3! QE3! QE3!

Now more than ever.

In the final analysis it is always policy that drives the economy. And there are only two ways to regulate aggregate demand: fiscal and monetary policy.

Fiscal policy is in full retreat as evidenced by the first quarter’s numbers. Government consumption and investment sharank by 5.1% at an annual rate. The discretionary fiscal stimulus is being rapidly withdrawn and has been since last October.

QE2 comes to an end this month and there is no sign of a QE3 (or a more coherent version of “unconventional” monetary stimulus). Thus I logically expect things to be even worse in the second half of the year as they were in the first half.

So why the big surprise? Did you think the economy was being driven by the magical confidence fairies? Duh! (Slaps himself on the forehead.)

“The data suggest that, despite the current weakness, the odds of a recession are relatively low (less than 1/3) over the next two years.”

Yes, but it is not like we have really experienced much of a recovery from 2007-2009.

If It’s Wednesday, It Must Be Belgium

June 1st, 2011

By David Goldman

http://blog.atimes.net/?p=1801

Let’s go through the checklist:

1) There’s huge permanent unemployment;

2) There are no jobs for young people, who end up living with their parents;

3) The banks work under the thumb of the government;

4) Big corporations dominate the economy;

5) Entrepreneurs are few and far between.

… We must be in Belgium. …

… this is NOT, NOT, NOT a business cycle. It’s a transition from a vibrant if error-prone capitalist economy to a sclerotic but stable socialist economy.

That is why there won’t be a double dip recession. There’s no risk to liquidate, no excess labor to fire, no inventories to sell off (except of course in the housing market), no problem financing the enormous government deficit. Remember the bond Armageddon that was supposed to befall us in 2011? Just before 9 a.m., the 10-year note was trading at just 3.01%. That’s because there’s nothing else for bond investors to buy: few corporates, almost no mortgages, no asset-backed securities of other kinds, almost no municipal bonds.

Bank regulation has played a huge role in crushing animal spirits. The regulators always fight the last war, machine-gunning the corpses on the ground to make sure they’re really most sincerely dead.

Negative real earnings growth and workers finally smarting up (or unable to) so that they do not go any further into debt?

It is called a budget.

well, let us print some qe3 money says Ben.

Anyway: as the machine is slowing down, stocks will fall – come on guys, I want to buy !

I go for Steven Kopits scenario 5 due to supply disruption from MENA +possible speculation on oil as stocks are exhaling.

Plus,

Gold short term bubble (July-October) is coming closer :

http://saposjoint.net/Forum/viewtopic.php?f=14&t=2626&start=420#p32823

“Bank regulation has played a huge role in crushing animal spirits”

Banks are not even regulated yet,how could rules be a culprit?

The money velocity, is not reflection of banks regulations but banks risks incentives and the outcome of their past performances.

Velocity of M2 Money Stock (M2V)

http://research.stlouisfed.org/fred2/series/M2V

I am planning a retirement party on January 20, 2013. Hold the date! Federal employees have the next day off so let ‘er rip!

Two opposing views on stimulus:

-The efficacy of stimulus cannot be determined until its expiry. If self-sustaining growth is not achieved, expiry damages confidence. Damaged confidence risks aborting the recovery. This results in long term stop-go growth expectations. The perception of stimulus-dependent, stop-go growth risks sparking long-term sovereign debt service concerns.

-Failure to achieve self-sustaining growth is merely evidence that the stimulus was not large enough. In any case, any stimulus was better none.

Am I correct that oil prices hits GDP twice? Once in forgone production value (the value of oil we don’t produce domestically) and a second time by increased value of imports.

Jim, I’d like to know your views on repeating the mistake of 1937 as explained in

http://libertystreeteconomics.newyorkfed.org/2011/06/commodity-prices-and-the-mistake-of-1937-would-modern-economists-make-the-same-mistake.html

DP-

Not opposing views, but two different supporting views of the stimulus. The opposing view is that the stimulus was a waste of money.

David Pearson

That logic is akin to saying that if you beat yourself over the head with a hammer to make yourself smart, if it doesn’t make you smart, the problem is you didn’t beat yourself hard enough or long enough.

David Pearson,

What is your definition of “self-sustaining growth”?

Rich Berger,

The first view above, which I hold, fits the “waste of money” thesis. Successive failed stimulus attempts (as we’ve had for ten years now) lead to lower trend growth. Lower trend growth makes it impossible to service stimulus-related debts and leads to monetization/inflation fears, which can further damage confidence. The result is a debt “doom loop” that poses a greater risk to the economy than the initial recession.

To stimulus proponents, returning to previous “trend growth” is the holy grail; their actions, ironically, move that trend further and further out of reach.

So what will it take for your (not so) “smiley face” economic indicator to go to an outright frown??

Aaron –

You are correct. Oil’s impact on the economy has both supply and demand aspects. Above I have focused on demand.

However, to the extent that domestic supply can be increased, the impact of high oil prices can be offset, at least in part. Thus, there is a good argument for drill, baby, drill. The argument is not, however, that increased US drilling will lead to lower oil prices. Oil prices are set globally, and I would argue, by China’s carrying capacity (and not by the marginal cost of production). However, higher production domestically means that the oil sector is doing well and that tax revenues are flowing into government coffers. So the economy as a whole will be performing better, even if the energy-consuming bit remains under pressure.

We can see this phenomena in Australia and Canada, which have weathered the recession pretty well. Both are major commodity exporters.

This also explains why the bright spot in employment this past week was Dallas/Fort Worth and why unemployment in North Dakota is in the low single digits. Energy producers are doing well, even as consumers struggle.

DS-

You fooled me – I read the first one as meaning it was bad policy to let the stimulus stop (expiry).

As far as drilling, the higher the price, the greater the impact on GDP. The transportation cost also become a bigger factor, likely causing the big spread JDH noticed a few months ago in domestic and imported light oil.

To me, domestic drilling seems the one of our best economic stimulus options given low growth and high oil prices. It would increase also tax revenue. The fact that we can’t crash the price simply makes effects more certain and offers further support for the policy.

The diffculty is how to make the play pollitically. I think stressing the above points, and suggesting that alternitives will bring the price down in the next fifty years, making hoarding our oil a very risky bet.

I hope Ivars is right about gold correction. I plan on buying some GLD puts this weekend and possibly some oil related puts.

I’m thinking a couple contracts with 3-6 month expiration dates and a couple a year out, hoping to take advantage of small near-term correction a collapse if QE3 becomes obviously untenable and we finally see some policy that will lead to real growth.

My brother has been buying GLD puts. I thought he was way early, but I believe he’s making money.

I’ve been holding off because I don’t think gold will come down to where it is supposed to be until there is a fairly solid recovery. I don’t think that can happen without a sane energy policy (I’m buying puts in the hope that politicians are beginning to realize that).

David Pearson Successive failed stimulus attempts (as we’ve had for ten years now) lead to lower trend growth.

Which is a good argument for making the initial stimulus package large enough to do the job. In early 2009 a lot of us complained that Team Obama was making a huge mistake by settling for what their own calculations showed was a stimulus package that was half the minimum size needed to do the job. But I believe Team Obama probably thought they would get a second bite at the apple. They didn’t count on the GOP and teabaggers being so stupid.

To stimulus proponents, returning to previous “trend growth” is the holy grail; their actions, ironically, move that trend further and further out of reach.

Stimulus proponents believe that growth is trend stationary, but sometimes shocks cause a level shift. These shifts are due to too much demand for financial assets, which eventually causes a drop in aggregate demand in the real goods economy. Policymakers can either allow the economy to gradually return to that trend growth or avoid the needless pain and soak up excess saving to stimulate demand. The Obama folks tried something in-between.

The RBC folks who don’t think growth is trend stationary believe that growth is due to random supply side/technology impulse shocks; i.e., it’s the old Nelson-Plosser unit root argument that we all studied in second semester econometrics as undergrads. I think it’s a little hard to explain current unemployment in an RBC world. If you believe the RBC version of today’s macroeconomic problem, then you probably believe in the Easter Bunny, Santa Claus and Diet Dr. Pepper.

Failing to use stimulus is what will hurt long-run trend growth because capital (both physical and human) will degrade. We need to worry about NET product as much as GROSS product. This is not your garden variety supply shock recession; it’s a financial recession and it will take a very long time to set things right. Realistically we’re probably looking at the rest of the decade, which would be pretty good based on the global history of past financial recessions.

“So far I’m seeing slower growth, but not a new recession”

Hard to get much slower from 2%. That puts us in GHWB terirory. Cue Dana Carvey.

The days of peak cheap oil are over. Prices were cheap as long as the west was able to use most of the world’s production all by itself. Now that the third world wants its fair share of oil and other resources, natural resources will cost more. This means that high rates of GDP improvement in the west are over. Every time the world economy starts to speed up, oil slows it back down.

Further, it follows that high rates of debt can no longer be sustained, because high rates of GDP improvement will not make debt more manageable over time anymore. The current plan to double debt over the next decade may be counter productive in this new environment.

“-Failure to achieve self-sustaining growth is merely evidence that the stimulus was not large enough.”

Ah yes, the More Cowbell version of Keynesian strikes again. If something doesnt work, try 2X of it, after all, its always someone else’s money anyway.

A more empirical view: Boatloads of fiscal stimulus didnt work in Japan in the 1990s and its not working here. Doubling down on a failure = 2X failure.