Higher oil prices slowed the economy in the first half of this year. But I don’t expect things to get a whole lot worse.

|

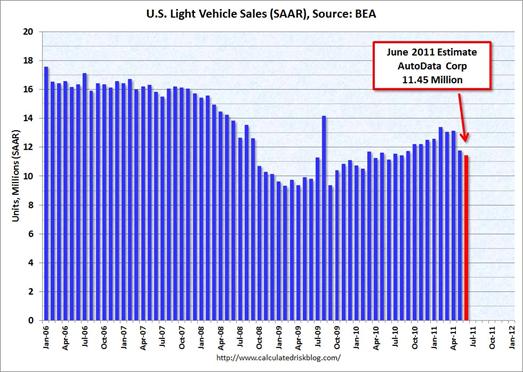

One of the first places that higher oil prices can affect the economy is through auto sales. The number of light vehicles sold in the United States in June was 6.9% higher than June of last year. But June 2010 was weak relative to 2010:Q2-Q3, and the last two months clearly signal some softness in auto sales, with oil prices likely one contributing factor.

|

However, this is quite different from the rapid flight from domestically manufactured vehicles that we saw in 2008. Hardest hit at the moment are Toyota, Honda, and Isuzu, whose year-over-year U.S. sales were down more than 20%. Supply problems in Japan are presumably an important factor.

Furthermore, the recent declines in oil prices should make the third quarter a little easier than the second. It’s worth emphasizing, however, that the lower gasoline prices that consumers are currently enjoying have nothing at all to do with the strategic petroleum reserve drawdown announced two weeks ago. In fact, crude prices at the moment are back about where they were before the SPR announcement. Amazingly (but I suppose predictably), some commentators are claiming this proves the market is all driven by speculation.

|

Americans are now seeing lower gasoline prices not because of the SPR release, but instead as the result of more fundamental developments I commented on two months ago, whose implications have finally worked their way through to retail gasoline prices.

|

|

| San Diego Historical Gas Price Charts Provided by GasBuddy.com |

And so if nothing else goes wrong– quite a big if, I know– the economy should do better in the second half than the first.

But, but, but…inventory problems due to Japan’s earthquake have made a huge dent in sales, to the point that I’m not sure this analysis makes any sense. The effect of gasoline prices on auto sales would be completely masked by the inventory problem. Identifying oil prices as a “contributing factor” without mentioning the inventory problem misses the forest, while looking for a tree you can’t actually find.

Superb post (again) JDH.

kharris: A couple of questions. Are cars on the lot fabricated pre-Japanese Tsunami or post? Are US car consumers that brand loyal that they will buy only one brand and not others? That possibility strikes me as unlikely.

Professor,

Gold appears to have found a trading range around $1,500. That would signal that oil would trade normally in the $95-100 range. I do agree with you that stability at this range should mean that the latter half of the year will be better.

Business can deal with inflation and deflation but it cannot deal with uncertainty. It appears that, contrary to the breast beating over the debt ceiling, congress has taken a breath from intervening in business. So there seems to be more stability in both the monetary and fiscal worlds.

Professor,

I stumbled on this information about GM

Widening GM Truck Supply Looks Like 2008 Again. It looks like GS’s inventory is growing to be a problems.

I think my take on this is a bit darker than yours. To me, it looks like SAAR light vehicle sales fell off a cliff in May. If I follow the trend of recovery, June vehicle sales should have been running at a cc 13.4 m pace; instead they were at 11.45, nearly 2 m vehicles down from trend. So the graph suggests the economy hit some sort of wall in May, and oil prices reflect this as well.

Now where from here? Maybe we’re porpoising. As oil prices ease, the economy finds an updraft. But if it does, will not oil price pressures resume? I think they might.

I buy the concept of the porpoising effect. Until the U.S. let’s the other oil producers know we are going to open up the spigot and quit choking domestic production, the American consumer will continue to have to cut back on oil use anytime the price is above $2.75. At $3.50 the economy is darn near stagnant, at $4.00 it dives. We all know this is game to slowly get us off the oil and into the alternatives. Not sure yet whether it is going to work. I actually like the change to electric, but with the prices going up so fast by the utility companies I wonder if electricity will be able to compete. We are shutting down a large number of coal fired plants, why if we will need more?

US consumption has falled by 2M bpd, and all liquid production has increased. Net imports have fallen by about 1/3 from their peak, reducing roughly proportionately the impact of high prices on the US economy.