The U.S. Federal Reserve, European Central Bank, and central banks of Canada, England, Japan, and Switzerland today announced a coordinated monetary action that could provide added assistance to interbank lending in the event of a further deterioration in global financial markets. Here I offer some thoughts on what the action signifies.

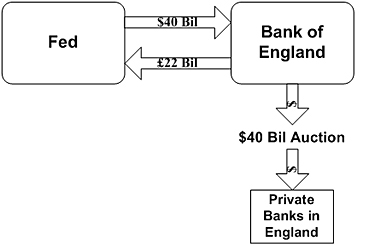

First, a little background. U.S. monetary policy has gone through two distinct phases in trying to deal with the economic and financial challenges since 2008. The first phase was intended to address the breakdown of what in normal times were very liquid markets for short-term interbank loans or commercial paper. One of the tools that the Fed used for this purpose was the Term Auction Facility, which was created in December 2007 to provide an additional channel for U.S. banks to borrow from the Fed. The Fed lent almost $500 billion through the TAF in March of 2009, but the TAF has not been used since April 2010. Another emergency tool was the Commercial Paper Lending Facility, which began operations in October 2008 and lent as much as $350 billion in January 2009 before being closed in February 2010. A third tool used during the height of the crisis was currency swap agreements. As an example of how these work, the Federal Reserve might give the Bank of England 40 billion dollars in exchange for 22 billion pounds, with an agreement to swap the currencies back at some future agreed date. In the mean time, the Bank of England could use the funds to extend dollar-denominated loans to banks in the U.K. This might help ease some of the pressure on the interbank Eurodollar lending rates as reflected for example in high term LIBOR rates.

|

The Federal Reserve’s holdings of currency swaps reached almost $600 billion in December 2008, though since January 2010 have been less than a few billion.

Measures like the Term Auction Facility, Commercial Paper Lending Facility, and currency swaps were phased out because liquidity returned to these markets and the facilities were no longer needed. Over the last two years, the Fed has instead been in a second phase of actions, purchasing huge volumes of mortgage-backed securities and longer term Treasury securities in an effort to keep longer term interest rates low.

The Fed’s announcement today indicates a renewed concern that financial conditions could again deteriorate and measures like those used in the fall of 2008 could again be needed. The basic concern is that losses on sovereign debt loans could put banks in jeopardy, and uncertainty about the situation could significantly disrupt financial markets. The TED spread, which measures the difference between the yield on 3-month interbank loans of Eurodollars and the U.S. T-bill rate, has been climbing back up, though it is still far below values seen in 2008. Currency swap operations like the one described in the schematic above could be used to respond to further pressures on this spread.

But, as I mentioned last weekend, even more dramatic are the spreads on term interbank loans denominated in euros. Thus there is a new feature to the coordinated central bank measures announced today:

As a contingency measure, these central banks have also agreed to establish temporary bilateral liquidity swap arrangements so that liquidity can be provided in each jurisdiction in any of their currencies should market conditions so warrant. At present, there is no need to offer liquidity in non-domestic currencies other than the U.S. dollar, but the central banks judge it prudent to make the necessary arrangements so that liquidity support operations could be put into place quickly should the need arise.

An accompanying document from the Federal Reserve adds these details:

These swap lines are being implemented as a contingency measure, so that central banks can offer liquidity in foreign currencies if market conditions warrant such actions. These lines provide the Federal Reserve with the same ability to provide foreign currency, should the need arise, as foreign central banks currently have through the existing dollar swap lines with the Federal Reserve to provide dollar liquidity in their jurisdictions….

There has not been a decision to activate the foreign currency liquidity facilities. If the Federal Reserve were to decide to offer liquidity in foreign currencies to U.S. financial institutions, the details of the operations would be determined at that time in light of the prevailing circumstances.

If the Fed decides to open a new Term Auction Facility, this time for extending euro-denominated loans to U.S. banks, it will once again find itself needing to distinguish between the problems of solvency and liquidity. No action by a central bank can solve the problem of a debt that’s not going to be repaid. But central banks can help avoid the added economic damage that is caused when markets for all loans, good or bad, get disrupted by the uncertainty. In the fall of 2008, the Fed successfully figured out how to navigate that fine line. Let’s hope they have the wisdom to do so this time as well.

Or better yet, let’s hope the new facilities don’t need to be used at all.

At this rate, central bank fiat digital debt-money reserve crediting will result in first the Fed’s balance sheet matching total US gov’t spending and then the entire US GDP.

We need to construct and test some models to predict the number of riots that will occur per month for each Fed print batch and incremental increase in the price of oil above $100 and the price of gold above $2,000.

As prices rise and the number of riots and participants increase, the Fed could credit a few hundreds of billions of dollars more until a frictionless share of the rioters were hired as armed thugs to crack the heads of the remaining unemployed/underemployed/unemployable rioters.

To ensure a surplus of the terrified and enraged, price inflation should be sufficiently high to wipe out effective purchasing power of the bottom 90-99% of US households, especially Boomers trying to subsist on Social Security and 0% interest rates on meager savings. Grandma and grandma should NOT be exempt from terror and rage manifesting in various degrees of cranial compression activities. We’re all in this together, so elder Boomers need to put their heads together and participate in putting people back to work and in the hospital.

Hollywood should be encouraged to produce reality shows showing the activities and sell advertising for cars, gasoline, i-thingies, fast food, home security systems, and worthless junk made by slave labor in SE Asia.

The more heads cracked, the more requiring “health care” services, already at 17% of GDP, which would prevent price deflation and “stimulate” further uneconomic activity.

To mitigate some of the effects of soaring gasoline prices, long lines at gas stations, and violence among the impatient drivers and drive-by opportunists, the Fed could print as many fiat digital debt-money energy credit cards as required.

The more energy inflation that occurs, the more reported nominal GDP and retail sales will rise owing to gasoline sales, keeping the eCONomists happy and proclaiming policy success, the more riots there will be, and the more skull-cracking thugs who will be hired.

In the larger context, high labor market underutilization is essential to uneconomic policy success over time.

Moreover, it is imperative that one measure of ongoing policy success be increasing fear, anger, resentment, envy, and inclination to violence among the prole masses, which in turn implies that “consumer lack-of-confidence” surveys should be constructed and actively promoted, including weekly surveys broadcast every 8 mins. 24/7 on CNN, CNBS, and Fox Noise.

A comfortable prole population is a danger to the primacy of the rentier-oligarchic militarist-imperialist corporate-state.

JDH wrote:

In the fall of 2008, the Fed successfully figured out how to navigate that fine line. Let’s hope they have the wisdom to do so this time as well.

In the fall of 2008 we had one of the greatest crashes in our nation’s history. Saying that the FED was successful during his time is like praising Custer for his magnificant charge. The fall of 2008 is a lesson in command economy incompetence.

Now multiply that times the whole world – as this new initiative seems to do – and what do your get? Oh my, the inmates really are running the asylum

Dick: Colorful, but I see no evidence in support of your claims.

re: Dick

That was pretty hysterical.

I imagine you’re the type that complains about how much less the dollar buys today versus the good ol’ days in 1893 while totally ignoring real wage growth.

The root of the problem seems to be the process of borrowing short and lending long. Traditional banks take in deposits and use fractional banking to make loans. However, the ‘investment’ banking model does not rely on deposits. In contrast, it relies on borrowed funds.

Consider that the mortgage crisis blew up when sources of short term funds, e.g. pension funds, other banks, money market funds, etc, stopped lending short term funds to the investment banks. The investment banking business model as expressed by Lehman, Bear, etc ceased to function.

It appears that the same situation is playing out in Europe. Suppliers of short term funds, (see above), are refusing to supply funds.

In both cases the central bank steps in and supplies the short term funds.

What is the end game? Can the central banks supply enough short term liquidity to get the investment banking industry safely to the other side of this economic chasm?

It seems to me that if we want to minimize the systemic threat that investment banking poses, we needs to go back to a more traditional form of banking.

nick, real wage growth?! Yeah, I’ll take some of that! BTW, real wages are falling yoy at this point, which has coincided with “bananas” in the past.

As for real wages/incomes, the typical 20 to 34 year-old American male today receives 40% of the income of his generational predecessor in the early 1970s, adjusting for higher payroll taxes and the actual cost of living, which includes the much higher cost of housing and consumer debt service as a share of after-tax income in the early 1970s.

And that same all-American dude has a negative net wealth and virtually no chance whatsoever of accumulating any financial capital wealth in his lifetime.

He’s the future, and it’s so bright I can’t face it, not even with shades.

But he can still live at home with his underemployed, antidepressant-sucking, divorcee Boomer mother house squatter and her alcoholic boyfriends, sleep on the couch, play Xbox, surf porn, and sell drugs to eat at 7-Eleven.

And that’s all the more incentive for him to swear of marriage, having children, and going into debt for a “dead pledge”, as he can’t afford orgasms with live females or any of it, which will help reduce the population of hungry, enraged proles and keep the GDP per capita from falling as much as it otherwise would.

It’s mourning in America. The best days are behind us, and thank goodness for that. Being optimistic is a lot of work for the post-Boomer set, or for any of us, for that matter.

Life is nasty, brutish, and short. Keep you head down, aim low, and shoot blanks.

Besides, too much “education” and employment encourages setting goals, having hope, and raising one’s expectations for future material well-being and that of a partner and offspring. Let the Chinese, Indians, Brazilians, Egyptians, Tunisians, and Libyans get all excited about that stuff.

We Americans don’t need all that. We need reasons to quit, and we’re getting what we need from US corporations offshoring, real wages falling, banksters foreclosing, central banksters debasing the currency, gov’t spending growth accounting for all GDP growth over a decade, and politicians and Wall-Streeters plundering any measly savings left or anything of tangible value not nailed down.

What more than that could we hope for to justify quitting the system?

They need to take the Fed’s hand out of the taxpayers’ pockets.

Ben helped create the current European crisis, which is partly the result of his dollar-trashing policies (QE did nothing more and nothing less) and the yuan peg, which brought the full weight of export-your-unemployment policies of Chimerica to bear on the slender back of Europe. The immediate problem is one of short-term liquidity, but the longer term problem is over-indebtedness, which more liquidity does nothing to solve. More AD for the euro area might help, but there is none being offered – instead, what is offered is just more loans from China (and now the U.S.) to keep the euro overvalued and take AD from them.

it will once again find itself needing to distinguish between the problems of solvency and liquidity. No action by a central bank can solve the problem of a debt that’s not going to be repaid.

Well, that’s the real problem. How many of these false rallies do we have to witness before people understand that what we’re really talking about is a solvency issue. The way to “solve” an insolvency problem is by introducing a little bit of inflation as debt relief.

If you appreciate the rant-as-an-art form, @Dick has got it goin on…

Otherwise, meh.

…..and who said “bail BONDSman” was just for malfactors!!!….. : )

what is not clear to me is what happens if the Euro collapses: normally these currency swaps are seen as risk free because the ECB guarantees payment. If there is no Euro, no ECB, who repays these? Has the Fed just become the lender of last resort for a castrated central bank ?

Thanks James for your well-balanced post, a nice read.

The eurozone will have to split up, and MerkelSarkozy are preparing for this scenario.

.

risky

.

Chaotic and dynamic systems tend to react .?..

now thats the question.

Strange liquidities and liquidities traps.

The institutional money funds in the USA,have grown from 0 in 1985 to less than 400 billion usd in 1995 to 2.5 trillion usd in 2010

The long recession is looking like the great depression,not enough first grade paper to be used as collateral.At the time of the great depression using the treasury bills as a substitute for grade A paper was the remedy,but now too many governments bonds may spoil the markets.

Money velocity M1 is quiet high on historical comparison

Velocity of M1 Money Stock (M1V) calculated as percentage of quaterly GDP.

http://research.stlouisfed.org/fred2/series/M1V

M2 velocity is quiet low and to a level met in 1960 (difficult to find what happens in 1960 ????????)

http://research.stlouisfed.org/fred2/series/M2V

The commercial paper outstanding is scarce less than 1% of GDP.

Commercial Paper Outstanding (COMPOUT)

http://research.stlouisfed.org/fred2/series/COMPOUT

The resolution will be trough assets sales and assets prices.

Slug,

I started reading your post above and was shocked. I read, “Well, that’s the real problem. How many of these false rallies do we have to witness before people understand that what we’re really talking about is a solvency issue.” My first thought was,” Wow, maybe slug does get it.”

Then you continued,”The way to “solve” an insolvency problem is by introducing a little bit of inflation as debt relief.” And my thoughts went to “leave it to slug to ruin a good thing.”

Slug, you don’t make debts go away by simply changing the currency the debt is to be paid in. Slug, you need to broaden your thinking to see that money is a medium of exchange, but people actually live on goods and services. If you do something to destroy the production of goods and services just to reduce some financial burden you have only made things worse.

Your idea about a little bit of inflation is like the thief who justifies his theft by saying the company has a lot more goods so they won’t miss what he has stolen.

Slug, a “little bit” of inflation takes a “little bit” of food out of the mouths of every person who uses your inflating currency. Rather than allow a few individuals to fail you suggest we socialize their failure and leave them to continue their economic destruction. Your little bit of inflation is a little be of the Chinese water torture. A little bit of poison is still poison.

Good post.

Let me quote a note by a friend (with some small edits) that sets this in perspective.

…Currency swap lines do not solve any solvency problem…they are not inflationary…the Fed has no immediate currency risk in a swap and it has no credit risk. Accomodation anticipates a run out of euros into dollars. The risk to the Fed is that the ECB would default on its repurchase contract and the Fed would be stuck with worthess Euro’s.

I read the move as planning for catastrophe…a stragey of preparing to ammortize catastrophe as long as possible to give banks some chance of dumping sovereign debt and reducing inevitable carnage. The mechanism addresses problems that CLS and BIS would have in overnight clearing where some banks might not meet liquidity reserves for clearing transactions without the ability to get dollars from the ECB…they will pledge questionable sovereign debt for dollar loans from the ECB in order to clear overnight transactions avoiding default. The ECB takes the credit risk and the currency risk and Fed provides the dollars…The Fed risk is failure of the ECB.

But this does nothing to address the crises of excess debt and no growth in the PIIGS and now the core ECB as outside creditors abandon euro credit markets.

Just an observation regarding the shifting political landscape — The crisis will have to become more severe before the ‘never waste a crisis’ crowd will be able to acheive the level of political consolidation they desire. It’s clear that each systemic risk event is being used as an opportunity to centralize Western governance. That is, to shift power to the federal government in the U.S. and to the EU governing body in Europe. I think it’s a good time to re-balance the portfoliio and put less weight on equities.

The actions taken have virtually no significance other than signaling, and the question at hand is whether taxpayers will be burdened with the losses, or whether creditors will. That is why equities were so ecstatic, because if taxpayers take the burden, the over-leveraged financial sector can pretend to have positive value.

The sovereign debt problems are multiplied, because we did not use the last crisis to enforce meaningful reforms in financial sector leverage. The only figure I have respect for in this saga is Mervyn King (certainly not Bernanke, who is no better than Greenspan), so when he said there is a very real danger of systemic failure, especially by European banks, I found it very alarming.

The main part of the action was about advancing funding for Eurozone banks. The plan last announced said they needed to raise capital and added they would have government back-stopping if they couldn’t do this. That of course meant they wouldn’t be able to raise funds. To over-simplify, their funding sources, notably US money markets, started to dry up out of fear and so liquidity became a solvency problem. The good news is this shows the central banks, at least now Trichet is gone, can recognize when things are about to go really sour.

A note about Ricardo’s first comment above. Fascinating – to be said in Mr. Spock voice. The markets were deregulated, controls were eliminated, regulators were removed, private ratings agencies were co-opted by money, all based on the gospel of self-regulation according to market principles and yet the failure becomes one of command control. If so, it is a failure through not exerting control.. My favorite remark remains that by the then head of the SEC, a long-time GOP SoCal congressman, who said something on the order of “self-regulation has proved to be ineffective.”

You wrote about the TED spread a few years back. Any ideas why the Eur-USD basis swap is so much greater than the TED spread in this current “crisis”?

Ignore my post. I noticed you commented on it in your linked post. Cheers. Thanks for you interesting post!

Prof. Hamilton explained what the central banks were doing in a precise, concise manner. His intent this time was not to address the bigger issues although he is certainly aware of them and has commented about them on other occasions.

Most econobloggers have axes to grind or are carrying water for some political party. It is refreshing that one just wants to explain economics and finance to average folks.

Jonathan,

Your comment is typical of central planners. They spend years fashioning regulations – only the uninformed do not undertstand that banks are the most highly regulated industry in the US – then when one or two regulations are revised to give a slight opening to allow free market discipline, howls are sent up about deregulation. Even Keynes recognized that his system would opperate better under a totalitarian or Fascist system as he expressly stated in the preface to his German addition of The General Theory. Regulation is the totalitarian’s ploy to justify his assuming control.

Ricardo banks are the most highly regulated industry in the US

But “shadow banks” are not well regulated, and it was the shadow banking system that was at the heart of the Great Recession.

We tried unregulated, free-wheeling investment back in the wild west days of the 19th century. It didn’t work out so well…unless you were a crook. For a British perspective on the American experience with the free market try reading Dickens’ “Martin Chuzzlewit.”

Slug,

Rather than fictional anecdotes from the novelist Dickens perhaps you should read the work of economists, especially the work of Lawrence White, Associate Professor of Economics, University of Georgia, on the Scottish banking system.