Quick summaries of a few items of interest.

Flat tax. Here’s the view of Princeton Professor Alan Blinder:

The flat tax is typically marketed as a way to achieve drastic tax simplification– something virtually everyone favors, at least in the abstract. But what a flat tax would actually achieve is a drastic reduction in tax progressivity….

Figuring out your taxable income can be quite an effort. But once that is done, most taxpayers just look up their tax bill on an IRS-provided table. Those with incomes above $100,000 must perform a simple calculation that involves multiplying two numbers together and adding a third. A flat tax with an exemption would require precisely the same sort of calculation. The net reduction in complexity? Zero.

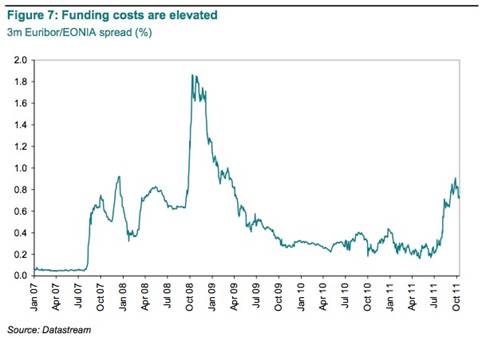

Financial instability. Felix Salmon suggests we focus on the spread between the euro interbank 3-month lending rate as measured by Euribor and the euro interbank overnight rate. That measure raises more concern than does the TED spread.

|

And… two more from Mark Thoma, who misses nothing. INSEAD Professor Antonio Fatas finds some reasons for optimism about Italy, and Liberty Street Economics has a nice review of the history of Treasury debt management.

That is a really super outstanding graph on the Euribor spread. Does that update daily???? Response from either host would be appreciated.

I’ve started on Menzie’s book. I’m a slow reader but I’m lapping up every morsel of knowledge like a stray dog ona T-bone steak.

Political calculation (http://politicalcalculations.blogspot.com/) has an interesting graph showing the volatility of the tax base when segmented.The most reliable contributors belong to the top 50% gross income earners.Not avaricious of advises,the US constitution is called to support any initiative from the congress when dealing with money transfers to the states.

http://politicalcalculations.blogspot.com/2011/11/whose-income-should-you-tax.html

Should reader be willing to get familiar with the wonders of the base 10,and the magic of birds names (http://politicalcalculations.blogspot.com/2011/11/111111-creepy-number-day.html)

Tax simplification is a multi step process.

1) Get rid of deductions, exemptions, and credits, which have multiplied over the past 25 years.

2) Do something about capital gains and dividend taxes. It would REALLY simplify things if they were just outright eliminated. It is a PAIN is the you know what to calculate capital gains on stocks when you dollar cost average them.

3) If you got rid of dividend and capital gains taxes, you could get rid of 401(k)s and all the other tax advantaged savings vehicles, which would simplify things.

I agree that a flat tax isn’t MUCH simpler than a progressive tax, but it is simpler. It is kind of like an interest-only mortgage, the payment on which you can almost do in your head, unlike a traditional mortgage, which requires a financial calculator, at least.

How a post on oil with it at about $100.

Interestingly, maybe the single best leading-concurrent indicator of oil prices, the CRB: raw

industrials index is flat to down while oil is rebounding.

With Europe weakening and US demand flat to down while Libya is coming back on line it sure does not look like oil is being driven by fundamental demand and supply.

OT Comment 2:

This, from The Economist:

Though yields on its bonds have soared alarmingly, Italy has not had to seek a bail-out (not yet anyway). And in an attempt to ensure it does not succumb, bringing down the euro with it, it has been placed under a special preventive regime—placed on probation to ensure it implements the many promises it made to carry out reforms designed to promote growth and balance the budget by 2013.

The polite fiction is that Italy has “invited” this monitoring, but nobody makes any secret of the fact that the government of Silvio Berlusconi has a problem with “credibility”.

Now, why is the word “invite” in quotations marks? Why wouldn’t the Italian government seek external help to maximize GDP growth and minimize debt? Corporations do this all the time, in many cases, with multiple consulting teams on multiple projects. So why doesn’t Berlusconi seek assistance? What is he maximizing? What is his objective function?

We often argue about correct policy, but I’ll confess I am more interested in creating demand for policy. There is no demand in Italy, it would seem. And this was exactly my experience in Hungary. Those guys monitoring Italy are pushing on a string, politically speaking.

And why? Of course, we know why. Because the political system is not incentivizing leadership to maximize prosperity over the long run. So if I’m trying to turn Italy around, the very first thing I want to do is create an incentive for long-term prosperity. And we know how to do that in the private sector (and in government in Singapore). We pay for performance. If the EU or IMF is even remotely interested in creating self-sustaining growth in Italy, that would be the first thing you do. A consultant with three months’ experience at McKinsey could tell you that.

“Figuring out your taxable income can be quite an effort. But once that is done, most taxpayers just look up their tax bill on an IRS-provided table.”

This statement is stunning in its deceptiveness. The entire complexity of the tax code is in its disparate treatement of income and exemptions. The flat tax does away with most of this complexity, which means that the IRS and the Congress get out of the business of determining which expenditures are worthy.

I cannot read the rest of the article since it is behind the WSJ paywall, but with this poor start why bother? For those interested in a better treatment, read Alan Rabushka’s “The Flat Tax”.

Below is Dan Mitchell’s response to Blinder’s article on the flat tax. It is less what Blinder said that what he left out. Probably the best aspect of the flat tax is it totally changes the existing tax system and eliminates double taxation.

http://danieljmitchell.wordpress.com/2011/11/14/alan-blinders-accidental-case-for-the-flat-tax/

I do not favor a flat tax for many reasons. However, I must assume that Dr. Blinder either does not do his own taxes, or he leads a Walden Pond life. The IRS estimates that if all you have is a single W-2 it will take half of an hour to fill out the basic form. However, once one gets into multiple schedules it can easily take several hours. So even simplifying tax reporting benefits the wealthy more than poor. Nonetheless, I believe that a tax code overhaul is overdue. The “loopholes” that have been created since 1986 are astounding. Additionally, for those who believe in the ‘confidence’ issue, a tax code overhaul would tell business people that this is what they must deal with for ten years. That kind of certainty would stop many of the business people I know from complaining and sitting on their investable money.

“Figuring out your taxable income can be quite an effort. But once that is done, most taxpayers just look up their tax bill on an IRS-provided table. Those with incomes above $100,000 must perform a simple calculation that involves multiplying two numbers together and adding a third. A flat tax with an exemption would require precisely the same sort of calculation. The net reduction in complexity? Zero.”

Dr. Binder is either joking or he has never done his own taxes. The complexity has nothing to do with the final calculation. The complexity is getting to the final calculation and, presuming a flat tax with an exemption is based on total gross income without deductions, getting there is far simpler… and less likely to have caused all manner of illegal or legal manipulations in the process.

You may not agree with the flat tax for a number of reasons, but complexity is certainly not one of them.

http://hallofrecord.blogspot.com/2010/05/taxed-flat.html

A past edition of Income Tax Fundamentals by Whittenburg provides the following statements that may give the reasons why the income tax code will never be simplified. “Many people believe that the sole purpose of the income tax system is to raise revenue to operate the government. This belief is not accurate. The income tax is used also as a tool of economic and social policies. Realizing that, the beginning tax student can better understand why and how the tax law has become so complex”. Congress will never give-up the power to get votes by using taxes to do social engineering.

Rich Berger: This statement is stunning in its deceptiveness. The entire complexity of the tax code is in its disparate treatement of income and exemptions.

JLR: I must assume that Dr. Blinder either does not do his own taxes, or he leads a Walden Pond life.

Bruce Hall: Dr. Binder is either joking or he has never done his own taxes. The complexity has nothing to do with the final calculation.

I am just stunned by the lack of reading comprehension or else, perhaps, it is willful ignorance due to addiction to conservative dogma.

Blinder is making exactly the same point as the statements above. All of the complexity is in the determination of income. Exactly zero of that complexity has to do with flatness or progressiveness of tax rates. He is in favor of simplicity in calculating income. This has absolutely nothing to do with a flat tax rate.

The simplest tax system of all would be to treat all income exactly the same — dividends, capital gains and earned income. You just take your W-2 and 1099s and add it up. Look up your tax in the progressive tax table and you are done, all in a few minutes. Nothing to do with a flat tax.

The flat tax is just an excuse for reducing taxes on the rich and uses complexity as a smokescreen to confuse the unintelligent. From the comments here, this appears to be an effective strategy.

The spread between various members of the EU and Germany is also telling. Contagion is entering the market’s psyche. Spain is being pushed to the front now and higher yields are hinting at potential capital flight and liquidity problems on the horizon.

http://www.cnbc.com/id/45335025

Tax reform is inherently cyclical, but not in the business cycle sense. Politicians sell tax code changes for various sorts of bribes. Once there are so many exemptions and exclusions that there isn’t much left to sell, they pass a “tax reform” that repeals the changes. Then they sell them again.

The amazing thing is that so few people seem to catch on.