If you’re prone to worry about where the economy’s headed, last week’s developments weren’t very reassuring.

On Tuesday, the Bureau of Economic Analysis revised its estimate of third-quarter real GDP growth down from the initially reported 2.5% annual rate to a new figure of 2.0%. That revision in itself is not particularly scary, since it mostly came from the fact that inventories were drawn down even more than originally estimated– real final sales still grew at a decent 3.6% annual rate for the third quarter. But more troubling is the fact that Tuesday’s figures also gave us the first reading on an alternative measure of third-quarter GDP that is based on a calculation of the total income being earned. This measure, gross domestic income, is conceptually equivalent to GDP but indicated only 0.4% annual real growth for 2011:Q3. Fed economist Jeremy Nalewaik maintains that GDI can give a slightly better early warning of a business cycle turning point. One reasonable procedure is to go with the average of the GDI and GDP growth rates, which gives an anemic 1.2% annual real economic growth rate for the third quarter.

|

With further inventory declines not anticipated, you might reasonably expect the U.S. growth rate to pick up, if you could ignore the problems brewing in Europe. Problem is, it’s getting pretty hard to ignore those problems. Two weeks after the market briefly cheered Italy’s reforms, the yield on their 10-year government debt is back above 7%.

|

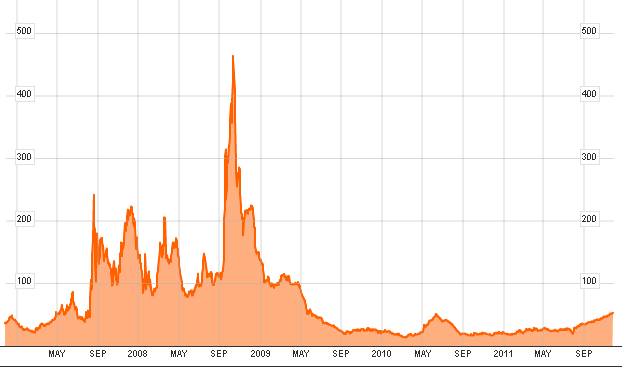

The Ted spread continues to edge up and is back above 50 basis points. This measures the difference between 3-month Libor (a rate at which banks lend Eurodollars to each other) and the 3-month U.S. T-bill rate. The gap indicates a modest increase in concerns about lending to European banks, though still nowhere near the level in the fall of 2008.

|

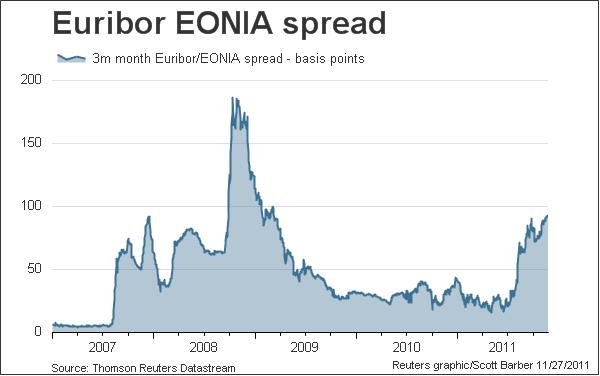

But if a bank wants to borrow in euros rather than Eurodollars, it pays a stiffer premium, as indicated by the spread between the 3-month Euribor and overnight EONIA rates.

|

That difference between the euro and Eurodollar risk premium is interesting. One interpretation is that the Fed has done an adequate job of keeping the interbank market liquid, while the ECB has not. Another possibility is that the European bank to which you lend may still be there in 3 months, but the euro itself– who knows?

In any case, the resurgence of spreads on sovereign and interbank debt is an unwelcome development for any global denizen.

We don’t live in the world. We live in the USA. The place where presidential candidates can talk about changing regimes in Iran like we have a magic wand. Euro debt problems? It’s all Barney Frank’s fault.

The eurozone really has only days to avoid collapse:

http://www.ft.com/intl/cms/s/0/d9a299a8-1760-11e1-b00e-00144feabdc0.html#axzz1exkBe9jj

Excerpt:

Last week, the crisis reached a new qualitative stage. With the spectacular flop of the German bond auction and the alarming rise in short-term rates in Spain and Italy, the government bond market across the eurozone has ceased to function.

The banking sector, too, is broken. Important parts of the eurozone economy are cut off from credit. The eurozone is now subject to a run by global investors, and a quiet bank run among its citizens . . .

Italy’s disastrous bond auction on Friday tells us time is running out. The eurozone has 10 days at most.

“We don’t live in the world. We live in the USA.”

Um….no. Did you notice that you’re on the internet? and that non-residents of the US of A have access to it? and that some readers (heck, some contributors!) are not, in fact, Americans?

Reading above prices and interest rates could drive more optimistic thoughts,such as markets or whoever is making those markets have more of a logic frame.

The beatification of the public debts and of their representatives has come to an end.

(Quaterly external debt SDDS/QEDS Country Data as supplied by the Imf, Bis, world bank).

Since current accounts deficits are increasing and not decreasing, risks factors are reflected in sovereign interest rates,financial markets may acheive more than social gatherings around the subject.Persistent, are the antiquated thoughts of using a bazooka, when in their great sciences the Central banks have been using the cold fusion.

If not convinced please see the expansion of the CBs balance sheets where the Bank of England seems to be the most advanced on the topic of cold fusion.The fire walls remain to be tested.How true are government expenses,when unwilling to recognize their registered domestic banks losses and seemingly leaving the judgment to the markets,that may explain why central banks are the end beneficiaries of the banks cash surplus.

Correlatively banks profits are fed by the CBs and depositors gracious trust, more spectacular are the US banks profits.Banks are looking better than their economies and their net profits more than dubious (Dexia is an example of a late loss unrecovery).The US banks profits are defying above trivial law as they exhibit a magic profitability in an economic downtrend

cycle.Different public strategies, several readings but one conclusion spread out to few Bloomberg articles and ECB data:

Bloomberg

“JPMorgan Credit Swaps Show Bank’s Record Profits Fail to Impress’

“China’s Biggest Banks Post Record Profit as BofA, RBS … ”

“No Profit Recession in Europe”

ECB data ware house

Inflation rate (HICP) in Europe 3% ( http://sdw.ecb.europa.eu/home.do?chart=t1.1)

Unemployment rate (as a % of labour force) 10.25% (http://sdw.ecb.europa.eu/home.do?chart=t1.6)

In summary not much of a drama, few pensioners at the club de Paris,none of the members are among them.

http://www.clubdeparis.org/en/

http://www.clubdeparis.org/sections/communication/rapport-annuel-d/2010-rapport-annuel/downloadFile/file/Rapport_annuel-Annual_Report_2010.pdf

UK billions usd 2010Q3 2010Q4 2011Q1 2011Q2

Gross.External.Debt.Position 9,684,129 9,714,330 9,821,575 9,836,421

What if the lessons learned from the great depression were to be completed and in need to be expanded,liquidity expansion,low and lower interest rates,boosting the equities markets,jacking up the commodities markets,forceful countries bilateral trades,and yet what about the debts private,corporate,public?

What about the structural weaknesses,production of goods,services?

Who cares about useless GDP reports. They are revised over so many times, while the original numbers are lost as meaning. If you want a better source of current economic indictors, you can find them.

This is a area where less is more.

Worries will persist for years. At some point, you need to accept the credit boom isn’t coming back. Maybe then, people can begin to move on.

Total world petroleum production per capita since Peak Oil commenced in ’05 has decelerated from 2% to -0.6%, reducing growth of petroleum supply by a cumulative per-capita rate of 14-15% in 6 years.

At the trend rates of petroleum production and population, assuming to decline in production, extrapolating to ’20-’30, cumulative loss of growth of supply of per-capita petroleum production will reach 33-50% over the 9-19 years hence.

In terms of loss of growth of supply of crude and total petroleum, the world is at a similar juncture as the US was in the mid-’70s, a few years after peak crude oil production in ’70 and the onset of deindustrialization and financialization of the US economy and society.

The US, Europe, and Japan had the luxury in the ’70s of the US producing 9Mbbl/day of crude oil (5Mbbl/day today), a demographic tailwind, low debt/GDP, and the price of oil averaging in the $20s-$30s/bbl.

Today, total public and private debt levels to GDP around the world are at or near unsustainable levels; the price of oil is at $100; demographic headwinds are bearing down on the US, Japan, EU, and soon China; and the 10-yr. real GDP per capita for the US, Japan, and EU is decelerating rapidly toward 0% and eventually negative.

Central banks cannot print nor can gov’ts borrow and spend cheap petroleum into existence at abundant supplies to permit continuing growth of real GDP per capita.

Whether we choose to admit it or not, growth of real GDP per capita (and by extension gov’t taxing, borrowing, and spending) is over with Peak Oil, falling net energy and oil exports, and population exceeding carrying capacity. There are no viable textbook policy prescriptions for what we face on a global scale from Peak Oil, population overshoot, and the global net energy per capita descent.

The high-tech, high-energy, net energy-dense social and uneconomic system we have constructed during the peak-Oil Age era of the past 40-100+ years is not sustainable and thus not viable. No politician, CEO, eCONomist, Wall St. shill, and financial media money honey can tell us the truth and keep his or her job.

The system in the US is the definition of high-entropy waste, and it costs the bottom 90% of households 50% of US income and 85% of financial wealth going to the top 10% of households to sustain the woefully wasteful, unsustainable system of predatory parasitism by the top 0.1-0.4% rentier elite and their parasitic gov’t enablers.

Parasites in Nature inhabit small, specialized niches, which limit their potentially debilitating effect on the overall ecosystem and across species. However, the English-speaking world and beyond became long ago infected by rentier predatory parasitism to such an extent that the ecological host and its sub-set eCONomy are at grave risk. Few understand that they have become like prey consumers and livestock to the predatory rentier top 0.1-0.4%.

JDH, can you start a new topic on the today’s coordinated central bank action? I, and I am sure many others, would be interested to hear your thoughts. Thanks!

tj: Your wish is my command.