Quick links to a few items I found interesting.

Pierre-Olivier Gourinchas and Maurice Obstfeld discuss their recent research on using leverage rates to predict financial crises.

Here are the percentages of 58 economics bloggers surveyed by the Kauffman Foundation who were in favor or opposed to a half-dozen specific policy proposals.

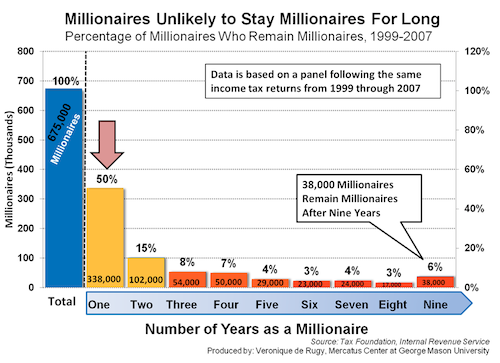

Veronique de Rugy (hat tip: Political Calculations) finds that only half the people who file tax returns with over a million dollars in income still have over a million dollars in income the next year, and only 20% stay in the millionaire category for longer than 4 years.

Megan McArdle??? Five percent of the respondents were lawyers??? Interesting that only slightly less than half the respondents were academic economists. Most were M.B.As, investors, journalists and entrepreneurial economists. By that standard even I could have posed as a potential econ blogger. Still, could have been worse; at least I didn’t see Stephen Moore’s name on the list.

Another excellent link: Bill Gross on the zero bound and the death of credit.

Duration risk and flatness at the zero-bound, to make the simple point, can freeze and trap liquidity by convincing investors to hold cash as opposed to extend credit.

Where else can one go, however? We can’t put $100 trillion of credit in a system-wide mattress, can we? Of course not, but we can move in that direction by delevering and refusing to extend maturities and duration. Recent central bank behavior, including that of the U.S. Fed, provides assurances that short and intermediate yields will not change, and therefore bond prices are not likely threatened on the downside. Still, zero-bound money may kill as opposed to create credit. Developed economies where these low yields reside may suffer accordingly. It may as well, induce inflationary distortions that give a rise to commodities and gold as store of value alternatives when there is little value left in paper.

On the millionaire thing:

I see per Political Calculations that this “study” elects to dispense with the “traditional definition” of a millionaire as someone with a million dollars in assets. Instead, it defines “millionaire” as someone reporting at least million dollars of taxable annual income in a given year. Why this change should be considered remotely valid, I have no idea (other than for purposes of building a bogus meme, of course).

According to this analysis, if over 5 years you had annual incomes of 900k, 1050k, 950k, 950k, and 950k, you would be reported as a “vanished millionaire.” This is ridiculous. Alternate heading for the post, perhaps: “Year-to-year, net incomes for high earners marginally fluctuate around an aribitrarily selected cutoff point.” How shocking! De Rugy actually tries to characterize this as evidence of “substantial downward income mobility.” Eh?

Alternatively, given that at this income level the “million-plus-bump” for a given year is likely to be in the form of bonus or capital gains income, you might title the post: “Half of all individuals whose asset- and income-distribution structure obliges them to report income in excess of a million dollars in a given year are not so obliged again the next year, and only 1 in 5 is obliged to do so again with 4 years.” Your tax code (and the best tax accounting talent a millionaire’s money can buy) at work!

So this is what they do over at the Mercatus Center, huh? Wow.

These financial crisis are always carrying smoking guns,but they never shoot the right sheriffs.

IMF

“The timing of asset recoveries will depend on the speed of the economic and financial recovery. Past experience indicates that the bulk of asset recovery takes place only after economic and financial recovery firms up demand and stabilizes asset prices. For example, Sweden achieved a recovery rate of 94 percent after only 5 years following the1991 crisis, while Japan had recovered only 1 percent of assets after 5 years following the 1991 crisis,(by 2008, the recovery rate for Japan reached 54 percent)” In the recovery one should always take into account the bubble my neighbour absorption capacity.

The symptomatic of this crisis have been well covered (available for free and instantly through Google)

The Evolution of the US Financial Industry from 1860 to 2007: Theory and Evidence.

Thomas Philippon†

New York University, NBER, CEPR

Where are the sheriffs, with well defined constitutional obligations and available data resources?

The central banks and all to be recalled supra national and national bodies.Since this paper is addressing the prevention model,the data as a bulk should be available in the frequent and regular reporting of the banking industry to the central banks.They are numerous and cover exposure by entities as a percentage of their capital,exposure by sectors,treasury and currencies mismatching.

In an interesting paper BIS is redirecting thoughts on the obligations of the central banks

Central banking post-crisis: What compass for uncharted waters?

by Claudio Borio

Monetary and Economic Department

September 2011

The data mining is to be made with or within the central banks.It should not require too much work to extrapolate trends and compare them to incomes sources of incomes.Banque De France used to provide an extensive data coverage of not only the corporate debtors and their funding and sources of funding,branch of industries comparison.

Are the financial crisis ineluctable,they are but they can be mitigated and cushioned.They certainly do not need to be jeopardizing the whole world economies.

A fallacy that has to be promptly put to an end banks do not wish to lend,banks have no money to lend,banks have no capacity left,as they are supplied for political and convenience purpose.

Who thinks 20% is small?

Darryl: Taxes are based on income, not wealth, so if you want to “raise the tax on millionaires” you’re necessarily using the definition here. And if you use an annual income of $1 M to determine who you want to tax more, half the people you’re targeting this year won’t be in the same group next year.

Did Bill Gross just discover Keynes’ “liquidity trap”?

JDH – Thanks for providing the link to the Gourinchas-Obstfeld article in VOXEU. Too bad that the authors (in figure 4) dimensioned the probability of a financial system failure in LOG terms rather than an easily understood percentage, and that you didn’t post the graph in your blog… Figure 4 clearly shows that insufficient bank reserves/GDP results in very high probability of a banking crisis.

JDH-The period 1999-2007 wasn’t exactly a stable income period, especially during the boom of 1999-2000. What that chart really shows is that there are a lot of one-off millionaires when people cash in capital gains (50%). Some people might get lucky twice and that covers two-thirds of the “millionaires”. However, the stable group is really the top third who are making more than a million 50% of the time, which is probably strongly correlated with market performance and base wealth. So there are really 200,000 millionaire earners, with some churn. That most people in the millionaire category are transient doesn’t negate the policy proposal to target those people for higher marginal tax rates.

Re the millionaire thing 2:

This seems like a verbal quibble on the term “millionaire tax.”

Let us be more specific and say that what we would like to see is “a tax on individuals who persistently and consistently report incomes in excess of $1m a year.” We will call this group “real millionaires.”

In order to raise taxes on this group, we must set a tax rate transition point at $1m of income per year. This will have the effect of temporarily and intermittently capturing additional tax on a small amount of marginal income from individuals whose incomes temporarily and intermittently exceed $1m a year. We will call this group “windfall millionaires.”

Based on de Rugy’s data, in any given year a much larger number of “windfall millionaires” will be paying additional taxes compared to the number of “real millionaires.” However, in any year, and year-to-year, the total tax collected from “real millionaires” will be much, much more than the total amount collected from “windfall millionaires,” since the average income of the average “real millionaire” is certainly much, much higher.

This distinction between “real millionaires” and “windfall millionaires” is a subtlety to be considered in any proposed “millionaire tax.” But is it unexpected? Does it seem unfair? Is it incompatible with any reasonable-minded person’s definition of the nature, purpose and effect of a “millionaire tax”?

Insofar as the answer is “no” to all these questions, I would say that de Rugy’s study is extremely weak tea. But more than this, de Rugy is representing this data as showing “substantial downward income mobility” at the millionaire level. It does nothing of the kind. Since there is nothing in her study about how far over or under the millionaire level the average income moves, or how much is due to tax management effects, the study establishes no general trend in “downward income mobility” even among “windfall millionaires.” To suggest that it does looks to me more like a political rather than a scholarly judgment.

Where the study IS interesting is the extent to which it suggests that tax-management effects come into play once income moves into the $1m range. Do millionaires get smarter at dodging taxes the longer they are millionaires? But that is fundamentally a question about the effectiveness of tax administration, not who is, or ought to be, formally subject to any given tax.

JDH said: Taxes are based on income, not wealth

True enough, at least if we’re talking about federal taxes. But I think this invites an interesting policy discussion. There’s a policy proposal from some academic economists floating around right arguing that instead of raising income taxes on both earned and unearned income, perhaps the federal government should consider a wealth tax along the lines of state property taxes. The rationale is that if someone gets a windfall (say a one year in five chance of earning a million dollars), that million dollars could be invested in stocks and bonds earning taxable income, or it could be “invested” in something that earns a nontaxable benefit or utility flow that is greater than the after tax utility flow from dividends and bonds. An example would be deciding to enjoy the utility flow of a beach house rather than the utility flow of bond coupons. Notice that raising the tax rate on unearned income actually makes this disparity worse.

In the case of the occassional millionaire this suggests that the utility stream of even a transitory income spike could be longlived and significantly higher than what is captured in IRS data.

In the old anti-capitalist days of high growth and soak the rich, they had form 1040 G for income averaging. If you had a big increase in income, you could average with your earlier earnings and pay in a lower bracket. This was great for authors, inventors,real estate agents and the like who might hungry for years, then make a big chunk of change. I believe there was an eight year averaging window. I even saved a bit with this when I moved out of academia and got a real job, though my new job never gave me quite the same income bump again.