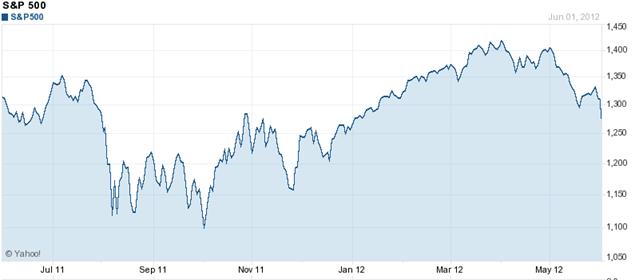

May was a bad month for U.S. stocks. June started out worse, with the S&P500 on Friday down 9% from where it stood at the beginning of May. That puts us back about where we started the year in January, though still significantly above last fall’s lows.

|

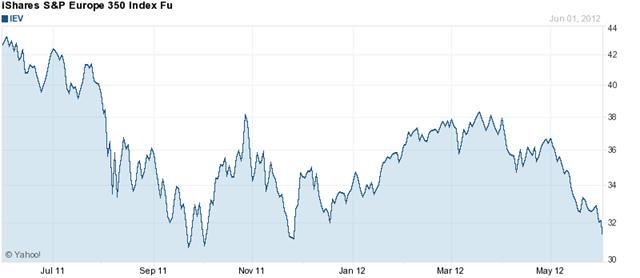

This marks the third time over the last 12 months that we’ve seen close to 10% declines in stock prices within the space of a month. The first was associated with the U.S. debt ceiling debacle last summer, and the second with concerns last fall that European sovereign debt problems would spill over into other European countries. This time Europe again appears to be ground zero.

|

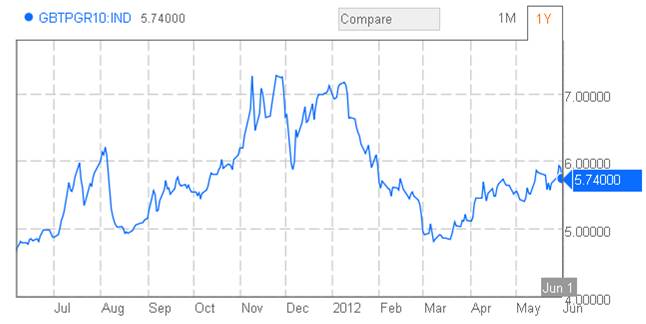

In November, one big concern had been Italy, with the government’s borrowing rate spiking above an unsustainable 7% rate. That rate has been climbing back up since March, but is still below 6%.

|

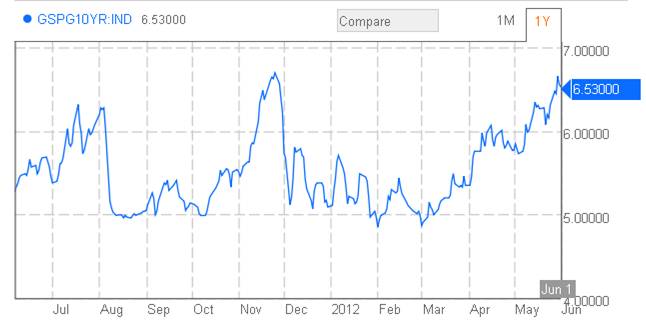

But now Spain, another very important European economy, is again being asked to pay yields very close to the highs last November.

|

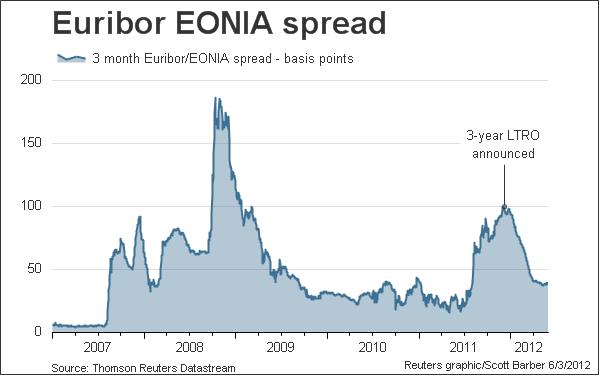

The immediate problems last fall were mitigated by the European Central Bank’s Long-Term Refinancing Operation, which allowed European banks to borrow up to 3 years from the ECB at a 1% interest rate, and which would enable the banks, if they chose, to take on more of the sovereign debt. The

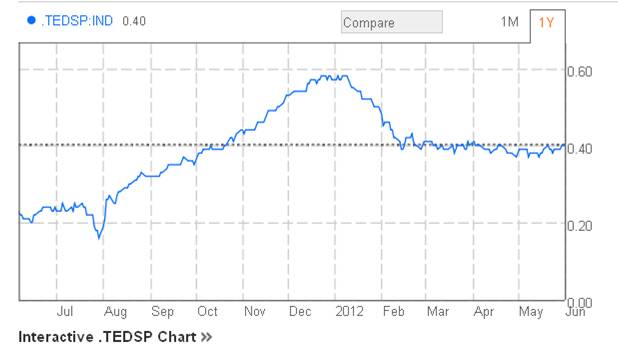

program has been successful in keeping short-term lending rates between European banks modest, as indicated for example by the TED spread, which is the gap between the 3-month interbank borrowing rate on Eurodollars and the 3-month U.S. T-bill rate.

|

The spread between the 3-month and overnight euro borrowing rates also remains moderate.

|

But as Calculated Risk observed in mid April:

The ECB’s LTRO has bought a little bit of time, but if the policymakers stay focused on austerity, they will fail. A key European analyst pointed out last week that essentially all recent sovereign issuance in the periphery has been purchased by in-country banks, and that was related to the LTRO from the ECB. In other words, there is no private market for peripheral sovereign debt. The key analyst concluded: “The EMU (Economic and Monetary Union) is over”.

And if it is over, what does that mean? Dropping out of the euro among other things requires some kind of terms for settlement of contracts, with one possibility being you’re repaid in “Greek euros” no longer trading at par with the major currency. People who lend short-term in euros– whether they are major financial institutions or small-time depositors– may be hesitant to do so when there are doubts about the country remaining in the monetary union. We’re already seeing not a bank run but what PIMCO’s Mohamed El-Erian calls a slower “jog” as depositors take their money out of banks in Greece and Spain. Much of Europe is already in a recession, and significant financial disruptions there would hardly leave the U.S. or emerging economies unscathed.

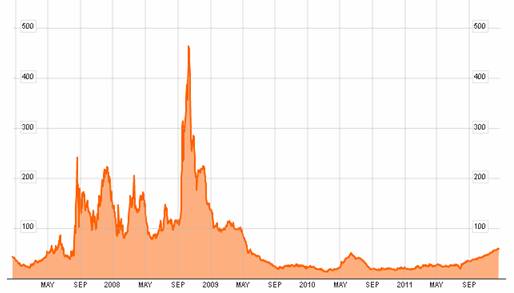

World Bank President Robert Zoellick thinks that this summer is looking like an eerie echo of the months leading up to the Lehman bankruptcy in September 2008, this time with European sovereign debt taking the role of mortgage-backed securities as the asset no longer viewed as safe. But one important difference is that this time the banks are swimming in liquidity. A TED spread at 40 basis points does not look remotely like an echo of early 2008.

< |

I guess we’ll find out how much difference that makes.

I’m not sure about that last comment. The banks are liquid because they have been bailed out in all but name; when directed to raise capital, their only available source was the ECB. And that, oddly, makes an almost circle because the ECB gets funding from governments and that money is now piling up in Germany as it flees Spain – and I assume Italy but at a slower rate – and thus maybe then goes back again but in a much less productive form. Is it really liquidity if it’s already not their own money?

In speaking to one of my Spanish tenants, the degree of worry his family and friends in Barcelona have is very high. Bank lending is gone.

Another oddity of Spain is we can see more nakedly the actual effects on employment of this problem; Spain’s labor policies encourage non-permanent employment (by making permanent employment a contractual position) and so companies quickly shed workers without the usual stickiness. That suggests the degree to which other countries are under-working to keep employment up.

Dr H, I have never been a economically pessimistic as I am today, and I am approaching 70. What makes me pessimistic is the lack of a baseline for all but the oldest generation. I am the child of Midwest depression era parents, and can remember some of the remaining influences on them.

Your article talks about borrowing, but what happens when there are no takers? And, in my pessimism, I can perceive that possibility. Austerity? What does it mean when Govt spending is cut by 40/50/60% due to spending no more than it receives.

People, economists, may be missing the fundamental issue in a world economy that has way too little investment income. Printing more currency just goes to day-to-day subsistence and not to investing.

May just be an old man’s ramblings, but if not…

Here are a couple of stupid government stories:

I was flying out of Philadelphia last night. Hardly anyone at security, and all I had was a carrying was a carry-on, which had my toiletry kit. Oh, those don’t look legal, said TSA. (They were all authorized travel sizes.) And they promptly cleaned me out, $35 of everthing from shaving cream to floss to suntan lotion. I might add that Philadelphia is my home airport. That same toiletry kit has passed through security there more than a dozen times in the past year, and as many times in Houston. Not last night. The genius TSA manager on duty was Lin Oliver.

*****

We are doing some work for DOE. As part of our project, we are looking to do outreach with state levels officials. We technically have the expense budget, but we’re not allowed to spend it on meals for them. So we were going to have a couple of regional summits where people travela few hours and return late in the day. Ordinarily, you’d want to offer them some sort of decent lunch (not out of a box). But we can’t use our expensse budget for that. So I’m not sure we can do the outreach program, or I may have to put it on our own P&L without reimbursement. But I’m not sure that regs even permit that.

So maybe we have no outreach, and we’ll just consume the hours in consulting services, which we are allowed to do. That’s good for us–it’s revenues. But given that we’ve done a really extensivea amount of work, it would be nice to share the lessons learned with the stakeholders. But no.

Stupid government.

The TED spread may not signal a Lehman event currently but looking at the chart it was at similar levels even after Bear Stearns went under/was bought by JPM.

As for what dropping out means, hopefully it means leaving the monetary union but not dismantling free trade or labor mobility within the EU. Several others including Simon Johnson, Ann Pettifor and Chidem Kurdas have commented on this recently. There posts and my thoughts are here: http://bubblesandbusts.blogspot.com/2012/06/abandoning-europes-modern-gold-standard.html

Dr. H, I share CoRevs view and I am only 60 and in the southeast, Atlanta. I used to count hammerhead cranes here as an economic indicator. Now there is only one but there is a smaller one where they are builing an interstate entrance ramp. The ZIRP has had devastating effects and has messed up investment decision making. Comparing marginal investments at 2.5% are investments that should not be made.

Steve Kopits, provide a repast of your choosing and ask the Govt employees to donate what they are comfortable. Give those who are uncomfortable an option to withdraw and find their own lunch, snack, etc. Set the start time and quit worrying.

Reasonable Govt types will pay the per diem amount, so plan accordingly.

Let us see if there is substance behind the new fashionable vocabulary austerity. Let us visit the after math, the new “paradigm” of the “global village” once “liquidity driven” and not made out “Brics”.

In short let us go after the Jansenists of the economy and see if there is a pair trade.

Where is austerity hiding ?

Social

Trust, confidence in the institutions and the public servants must be restored, but only few countries can prevail themselves to have something left at this chapter. Difficult to foresee real gross capital formation if uncertainties abound on the abilities to operate within a long term visibility.The operating costs are high. Going into the Euro area accounts ( ECB statistical warehouse – Rtd Data Consumer Survey – Savings over next 12 months- Chart) Output decreasing by 12%.

Debts private, public and corporate are available through the same.

On government and institutional austerity.

ECB liquidities are lavishly spent for nurturing sticky assets (please see ECB, Data statistical warehouse Reserve maintenance – Required reserves charts and data- back to the level of 1999 around 100 billions Euros against 15 trillion Euros funded assets)add (13.5 trillion Euros in repurchase agreements,MFIs excluding Eurosystem not subject to minimum reserve requirements and Non-MFIs.Please, see (ECB, Data statistical warehouse) banks have ample liquidity resources but they may not have feasible projects to fund.

Austerity is not visible in the government expenditures neither in the gross external debt position. Please see:

ECB statistical warehouse (Debt, participating currency or euro denominated Euro area 17 (fixed composition)

(Please see IMF, SDDS/QEDS Country Data Tables)Country by country of choice.

Empirical data are available,when assessing the negative return of public debts and corporate debts on GDP growth (BIS publication)

Where is the pair trade?

Short of indulgence and long on patience.

There is a slow motion bank run underway in Europe. It is gaining traction. The Dow topped on May 1st. A bear market signal based on market internals got triggered a bit over a week later. The fundamental behind the technical is the euro crisis. It is not coincidence that the results of elections in France and Greece on May 5th foretold a quickening of the pace at which one or more countries would eventually exit the eurozone. Greece first, Spain next. In causal-link fashion this prospect has heightened fears across Europe that local euro-denominated bank deposits might be re-denominated in new domestic currency units and instantly devalued. The element of contagion is like that in the summer of 2007. One poster certainly has it right about circularity. Sovereign paper to banks, from banks to the ECB as collateral for loans, funding from the ECB back to the banks to buy more sovereigns, in an almost comic Krugman-like neo-Keynesian circular dance. “Almost” comic because in reality it is macabre, a dance of the death of the euro and prelude to this next phase of the global crisis of fiat money and unregulated Ponzi repo- and rehypothication financing of toxic assets now encompassing sovereign along with private sector real estate-backed debt within its arms. Flight from the burgeoning euro crisis – not the standard theoretic variables of macroeconomics – is what’s driven the long end of the US bond market the past year. The ECB’s LTROs gave only temporary reprieve. Fundamentals have reasserted themselves as they always do. In this environment, the TED spread has little informational content relative to the market’s valuation of bank stocks, the measure of just how insolvent the European banking system really is. This crisis casts a wide storm band onto Wall Street’s banks, one or more of which could fail as the $700 trillion derivatives market unwinds in the face of impending default events. Any “too big to fail” US bank that does fail will by Dodd-Frank be dismembered in an orderly fashion by the FDIC who did not have such authority at the time of Lehman. Still the shock to the system will be jolting. For the first time in history the fate of an incumbent US president is in the thralls of the European banking system including the insufficiently capitalized ECB. You can fill in the dots yourself. Watch closely the Intrade markets. Alas, conventional beliefs about the economy can be calcified, stubborn things … and so it is that new mustard seeds all too often fall on barren ground.

CoRev –

Yes, we could make it a paying conference. But then it becomes an approvable line item on a bureaucracy by bureaucracy basis. We may go that route.

In the private sector, there are standards. If you invite someone to a workshop, then normally everyone would expect to be fed if the workshop falls into meal hours. It’s really not a big deal.

By contrasnt, I see that government employees are treated like children, idiots or criminals. This treatment arises when units are managed as cost centers. For a cost center, everything is just about reducing cost because revenues aren’t factored in. If you visited a privatized Hungarian company with managers who came of age prior to the transition (ie, ex-communists), this is exactly the behavior you saw. Employees were considered “bad” by construction–even for companies now operating as profit centers.

I can also give you a less pernicious US example. I called up Dell to help install a printer I had bought several years ago on a Dell computer I bought a year ago. They wanted $60. To which I countered that I tend to buy a major item from Dell every year (which is readily visible in their records), so if they value me as a customer, they should do it on a relationship basis. (We would do much more than that for our customers.)

But I was speaking with Tech Support, not Sales. Support doesn’t care whether I buy something or not. So I didn’t get the help, because it wasn’t worth $60 to me. Dell won’t get my next purchase as a result.

The government problems I noted above result from government being a cost center. As such, there is no price put on Type II errors (things we should have done, but didn’t.) No one really cares if stakeholders are integrated into the findings of a study or not. It doesn’t affect anyone’s budget or employment prospects.

I have stated earlier that this problem is remedied by converting government into a “profit” center. For the economy, profit is functionally GDP growth. So if pay is tied to GDP growth at the top (Congress), behavior will also change in the bureaucracies over time.

Steve, maybe I wasn’t clear, but I was not recommending a “paying conference”. In the invitation announce there will be a scheduled luncheon/snack/etc. Then add, that Govt employees need not attend, but if they choose to attend a contribution can/will be collected. Those who travel will be getting perdiem anyway, so they will not have a problem. Local attendees will have to decide to contribute from their personal expenses or go out.

It used to be done all the time, and is not a big thing. Maybe 2slugs has more recent experience.

Steven,

Those are problems that occur in any large organization. Also, they’re not problems from every perspective. The function of certain rules or departments or what have you is to put a check on behaviors or incentives. When you get checked by one of those it’s not a problem, per se.

For example, at the volume of business Dell does and the margins at which Dell can sell, the tradeoff implied – losing some customers who dislike their tech support policy vs paying for a larger support staff to deal with complicated requests that don’t involve defects – is probably favorable. It’s inconvenient for you, sure, but it makes sense for Dell.

As for “things we should have done, but didn’t”, couldn’t you host a series of webinars in lieu of conferences and touch more stakeholders at lower cost?

@Steve Kopits,

As a government employee, a regulator in fact, allow me to just say I appreciate your well-reasoned contribution to the ongoing narrative that believing in the public interest is “stupid” and a waste of taxpayer dollars. Nevertheless, I will keep at my wasteful, in fact dollar-draining, existence in earnest despite your perception of the utopian world view which maximizes a “profit center.”

Hunter, your post is way way wrong.

Cranes mean nothing. Zirp is irrevelant. Nor does it mean much for investment outside the fact we are in a liquidity trap. Zirp is the market rate.

Investment decisions are messed up by globalization and internationalism which you support.

Hi James, great post, thanks ! Glad you turn your eye to Europe, maybe the new Lehman is named Spain ..

I guess Zoellick is right, but Germany will not tolerate euro zone bonds as long as Merkel and Schäuble have a word to say. Germany will prevail in this power struggles, thats my bet.

@S. Kopits : the TSA can be annoying, you are right. My feelings of sympathy for you.

@Steve Kopits:

I imagine some government functions could be privatized. But a big chunk of government service falls under the economic classification of “pure public goods.” If you can figure out how to make those types of service into a profit center, a Nobel Prize awaits you. If you are not familiar with the concept of public goods, you might want to read Samuelson’s text book on public finance, or any good introductory Econ text book will introduce you to the concept, and the difficulties of providing such goods in a private market (see the chapter on “market failures”).

This might be a red letter day…I actually find myself agreeing with CoRev on two different issues. Amazing. Steven Kopits, I think CoRev has it about right. As long as you provide government employees with a real opportunity to pay fair market value for their lunch there shouldn’t be a problem. I’ve even been to places where they just put out an empty coffee can with the cost of the meal. What you or your company does with the money is of no concern to the government worker as long as he or she has an opportunity to pay fair market value. But I think you misunderstand the government’s reasons for discouraging involvement with your outreach program. The government has to be excessively cautious when dealing with private sector firms because any perceived (note…it doesn’t have to be real, just perceived) advantage that one firm gets over its competition oftentimes ends up in court.

But we shouldn’t completely hijack JDH‘s post, so it’s worth throwing in a macroeconomics angle here. Government travel is something that ought to follow a countercyclical policy, but we’re actually following a pro-cyclical policy. The time to send government workers out on the road and filling up airplanes and hotels isn’t during the summer in years of economic recovery. The effect in that case is clear and obvious crowding out. The time for traveling to conferences is in February and when the economy is in a deep funk. We should be spending travel money like mad right now so as to maintain demand. Instead the government is penny pinching at just the wrong time. Now that’s “stupid government.”

I also agree with CoRev‘s pessimism regarding the economy. And more than just the economy. Hungary has just established a fascist-lite regime that seems about ready to kill any remaining democratic institutions. And Greece’s neo-Nazi New Dawn party has a real shot at coming to power…and they came out of nowhere. And Spain is once again flirting with fascism. Maybe Chevy Chase spoke to soon and Generalissimo Franco may not be as dead as we thought. An uneasy resemblance to the late 1930s…and once again Germany is in the thick of it. But we can’t have too much agreement here, so let me say that I don’t understand why CoRev is so despondent about the economy. Two years ago he was demanding austerity, less government spending, lower taxes and less regulation. And that’s exactly what we got. Government spending is down dramatically. Obama has pushed through several tax cuts on top of extending the Bush tax cuts. And the number of pages of government regulations is actually less today than it was in 2008, Fox News notwithstanding. And the same austerity prescription was adopted in Europe with even worse results. Should we intepret CoRev‘s despondency as an apology for voting Tea Party in 2010?

Sean –

I emphatically do not believe working in the public interest is stupid. I believe there is no greater calling than to doing so.

However, without an alignment of incentives right at the top, government tends to become a cost center heavily focused on preventing Type II errors. Regulation can easily become about compliance and not risk-management. (This issue is also relevant in the private sector, I would add.)

Now, having been a banker, I can tell you about regulation. When AIG and Lehman were melting down, we were having instruction in spotting money laundering through large transfers of cash. Investment bankers don’t handle cash at all. Brokers might; bankers don’t–even though we similarly have our Series 7.

So regulators were focused on something entirely trivial while the financial system imploded. That’s my concern.

When the TSA took $35 of toiletries from me, was that risk management? How many white, middle aged executives have brought down jets? To the best of my knowledge, zero. So what is the risk that I pose, from TSA’s perspective? On the order of 1 in a billion, historically speaking. If they take $35 of goods off me, what risk level does that suggest. Probably in the single percents (I could work out the numbers). So TSA, in my case, statistically is over-enforcing by probably six or eight orders of magnitude. There’s no cost/benefit proportionality, no incentive to balance Type I and Type II errors. That’s my beef.

I am not trying to privatize government here.

Rather, as I have earlier stated, the act of voting in itself does not adequately define the agency of the politician. Democracy can be about creating economic growth–which is Jim’s (and my) implicit assumption. But if you’re pessimistic about growth, democracy can also be about dividing the existing resources of the economy. Keep in mind the notion of secular growth is new–maybe 200 years old. For most of history, societies didn’t grow much, so people evolved under circumstances in which dividing up the existing pot was more common. Thus, I am challenging an implicit assumptions of most mainstream economists that democracy pretty much automatically delivers economic growth. Does it? Not so much in Europe or Japan, it would seem. And it most certainly does not create fiscally sustainable economic growth. The US is a huge case in point.

How then, to institutionalize the impetus for sustainable growth? Simple. You pay politicians for producing growth and for minimizing debt. This is not a hard concept. This is not the same as privatization. It does, however, firmly institutionalize sustainable economic growth as the primary function of government. If Merkel wants fiscal control over Europe, this is how you do it. You don’t control the agent, you control the principal. You don’t prescribe policy; you only pay politicians for producing results.

As for public service: The Kopits’s have long been associated with public service. (Google us.) Uncle George was, in fact, the most prominent victim of the proto-fascist regime in Hungary. (See George’s nice overview of that period here: http://www.oecd.org/dataoecd/7/50/48089510.pdf)

Now, I had lunch with George in Freedom Square, in the shadow of the National of Bank of Hungary in 2005, and George previewed some ideas which culminated in the Fiscal Council (a form of oversight now adopted elsewhere).

I expressed my reservations. I know the fascists in Hungary. I know how they think (Hungary being a family affair). George’s approach suffered the weakness that it was built on socially conservative assumptions. It was predicated on the belief that politicians really wanted to ‘do their duty’, and would with just a bit more transparency. I have seen precious little evidence to support this belief in Hungary. I see rather a good bit of corruption, plenty of pettiness, and tremendous factionalism. The ruling party didn’t want transparency; they wanted opacity (Menzie would call it ‘intentional ignorance’). And they got it, in part by defunding the Fiscal Council.

On the other hand, I can tell you there’s not a fascist in the country (save the Prime Minister) who wouldn’t sell out for a $400k bonus payment. If all members of Parliament were paid a material bonus for delivering GDP growth and debt reduction, that’s what would happen. And that’s not compatible with fascism. So it’s easy to rid Hungary of fascism, because it can be done without removing any of the fascists.

Sean had questioned my view of public service, so let me tell you that I only covet two jobs, both in public service. One is “Director of Governance Incentives, Compensation and Enforcement” at the IMF. This position, of course, does not exist. If it did, I would imagine that it could be quite a weighty job, as the person who gets to set the compensation structures of and approve bonus payments for the world’s politicians would be a pretty influential person.

Steven Kopits I never interpreted your comments as being anti-public servant. There are some here who do fell that way, but you’ve generally been pretty complimentary of civil servants. And I also come from a long line of public servants and politicians…hey, I’m part of the LBJ clan. I even share LBJ’s big ears, as my wife likes to remind me.

I see a healthy economy as a necessary but not a sufficient condition for moderate democratic (small “d” democratic) government.

You pay politicians for producing growth and for minimizing debt.

Sometimes you have to incur debt in order to grow the economy, just as the private sector has to borrow in order to expand. There is nothing inherently wrong with government debt as long as it is sustainable. And your really need to distinguish between cyclical deficits and structural deficits. But governments also have to worry about justice as fairness. Governments also have to worry about providing for public goods as well as private goods. One theme that we see over and over again during economic hard times is that some groups try to find scapegoats…typically immigrants. We’re seeing some of that in Europe as well as the US. That’s always been a leading indicator of fascism in the wind.

World Bank President Robert Zoellick thinks that this summer is looking like an eerie echo of the months leading up to the Lehman bankruptcy in September 2008

~~~~~

http://soberlook.com/2012/06/tips-curve-has-inverted.html

The US inflation indexed treasury curve (TIPS curve) has inverted sharply in the short end. The one-year TIPS yield went from negative 2.5% to zero in a matter of four months. The one-year treasury (nominal) yield on the other hand has held fairly steady near zero (between 12bp and 20bp over the past 4 months).

That means that the market is now pricing near zero percent inflation over the next year (down from over 2.6% expected just 4 months ago!) – as near-term inflation expectations collapse. We haven’t seen this since … [fill in the blank].

Also, as it happens, David Glasner:

“what is striking about the recent anomaly in the real term structure of interest rates is the steepness with which the difference between the yields on the 10- and the 5-year TIPS has been falling. The drop seems steeper than any but the one that started around October 6, 2008…”

@2slugbaits : “I’m part of the LBJ clan.” wow, now you are a famous person. LBJ, thats the Vietnam war proponent.

My great-great grandfather is related to a clan named Schicklgruber. One descendant of them, a Maria Anna, had a son named Alois who changed his name from Hiedler to Hitler. Alois named his son Adolf – well, have you ever heard about him ? That was the WWII proponent.