Several other new indicators confirm the message from the Q2 GDP report: the U.S. economy continues to grow, but at a discouragingly slow rate.

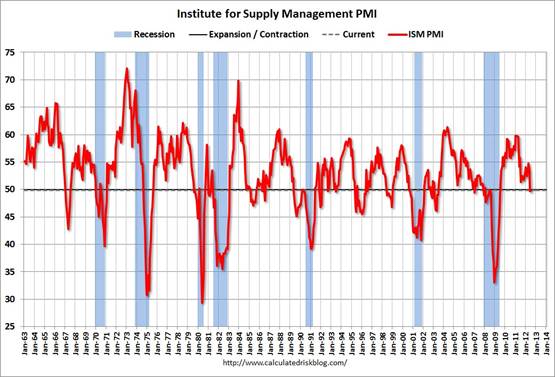

Perhaps the most disturbing release last week was the ISM manufacturing survey, whose July index of 49.8 indicated that reports of contractions outnumbered expansions in manufacturing for the second month in a row. But fortunately, there were some other indicators also released last week suggesting things weren’t universally that weak.

|

Autos continue to sell reasonably well, by recent standards anyway. Sales of cars manufactured in North America were up almost 19% from last year and close to July 2007 levels.

|

Domestic light truck sales were up less than 3% year-over-year, but still down 15% from July 2007. I view the stronger sales of the smaller cars as something that’s healthy over the longer run for the U.S. economy, raising hope that the domestic manufacturers can continue to compete in an era of much higher oil prices than we saw five years ago.

|

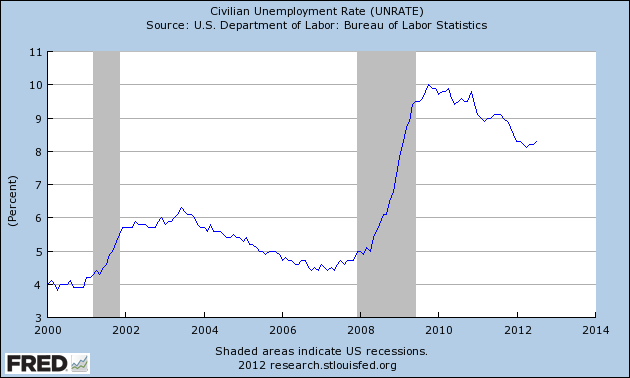

And then we have Friday’s employment report, which showed a seasonally adjusted increase in July over June of 163,000 in the number of Americans on nonfarm payrolls. On the other hand, the separate BLS household survey showed a 195,000 monthly drop in the number of working Americans. There’s a lot of noise and other confounding factors in either of these estimates. It’s perhaps more meaningful to look at the growth in the seasonally adjusted numbers over the last six months, which averaged 131,000 per month according to the establishment survey and 97,000 according to the household. That’s enough to provide jobs for new entrants into the labor force, but not enough to make any progress with the unemployment rate, which ended July at the same 8.3% rate at which we started the year.

|

If nearly all economists failed to recognize the bubble dynamics of late, how could they possibly be expected to understand the dynamics of ‘job churn’ over a period of decades? To begin with, machines have been eliminating jobs at an accelerating pace going back hundreds of years, and here we are in the midst of an unprecedented experiment that assumes a service-based economy will allow a solution to the Triffin Dilemma. But of course, this assumption relies on an ever expanding share of global growth to afford the US economy an ever expanding amount of inefficiency.

Chances are, a combination of asset bubbles and imperialist gains have been hiding a job shortfall in the US for decades. The welfare of humankind has, after-all, been made reliant on the Marginal Utility Theory, and it is nothing more than an assumption which justifies non-productive rent seeking.

Before answering the question “Is this as good as it gets?” we first have to answer the question “Are we doing all that we can?” And I think the answer to that question is “No.” Congress is worse than useless…it’s a positive impediment and will be until the clueless Tea Party types are thrown out of office. The Treasury cannot compel its insubordinate agency directors to follow orders. And the Fed seems hell bent on sending conflicting signals all in the name of pretending that they want to be clear.

This theory of trying to achieve full employment from below the trend just isn’t working. We need a period of overshooting the growth trend, and that necessarily means accepting some risk of inflation.

The auto sales numbers over the past several years are exaggerated, because GM counts a movement of a car or truck from the factory to the dealer as a sale. So if we take out the percentage of those GM sales which has really just been inventory accumulation, we’d get a different picture. GM inventories have been at all time record levels for most months over the past two years, even higher than in 2005 when sales to customers were far higher.

I agree with slugs. I used to think the Tea Party types had good intentions. However, the more I hear them speak, the more I realize that not only do they not know much about economics, they really don’t want to learn anything about economics, either. “The government spends too much” even though total govt. has been a drag on GDP and most of the deficit is due to transfer payments and low tax receipts because of the weak economy. “The Fed keeps debasing the currency and causing inflation” even though CPI is below 2% and interest rates are at record lows.

A couple of summers ago there was talk of an infrastructure bank where the gov’t would help finance basic infrastructure projects like roads and bridges. If we can come up with a way to ensure the projects are selected based on need and not cronyism, I’d be all for that. The work needs to get done sooner rather than later, the economy could use a boost, and as I said, interest rates are ridiculously low. There’s no time like now to do some spring repairs.

But, but that’s socialism!

There is a common belief that government can do or should do a lot to increase GDP and employment. Whenever I mention that people who took on unsustainable debt burdens are now rebalancing their finances, and that druing this process GDP will not grow much over the short term, I hear all sorts of comments as to why this is not so or why I don’t understand labor economics or whatever. In other words, I am not one of The Experts. Quoting Schecter Poultry v. U.S., “I’m not an economist, but I am an economizer.”

No matter who is to blame for how we got here, people will go on paying down their debts and saving more, and this will subtract from GDP. They will do it no matter what government does.

As for employment, it is hard for a business looking at flat sales and the turmoil in Europe to justify increasing capital expenditures or hiring new employees. They know that the lack of capital investment will hurt them in the end and laying off employees means wasting all of the training and know-how that was built up over the years. So businesses are not happy, even if avoiding long-term investment increases short-term profits.

When the consumer feels confident that he or she has enough savings and a low enough level of debt to weather shorms, then spending will resume. It won’t happen before, no matter what a president or central banker says or does. Neither Democrats nor Republicans have the solution, and the Fed already admits to beling relatively powerless. Only one party has a winning formula – the Party of Time.

The conceit of humans is that they have answers to every situation. The probability that they have the answer is the inverse of the confidence with which they state their case. This goes for the utopian free marketers as well as the statists. And when both sides hotly argue that theirs is the correect ansewr, the probability increases that there is no good solution.

There was as a key driver to this crisis and still is, a heavy reliance on the contribution of the Central Banks which stand with 18 trillions $ purchase of assets (BIS annual report), that is almost 50% of the cumulative Europe, US GDP.

Those are 18 trillions $ that the private sector cannot absorb through assets purchases, capital loss recognition or trough prices that are dissuasive. At the outset, western economies had structural problems and now structural and financial handicaps.

Reading the last IMF evaluation, hopes revolve around housing, capital appreciation through equities markets (United States: IMF Sees Tepid Recovery from Crisis), potential purchase of few more financial assets,balancing the current accounts, a to be resolved fiscal cliff.

What is the real rate of GDP deflator?

The bank misallocated the economy into inefficiency by printing too much in the past. This problem cannot be fixed by the bank printing too much now. Misallocated capital has been lost from the system, and will take years for the private sector to rebuild. Misallocating additional capital by printing too much just postpones the return to prosperity.

Its time to do something sensible, instead of pretending that printing is a magic fix for everything.

2slug: “Congress is worse than useless…it’s a positive impediment….”

An impediment to wasteful, increased spending and dubious “investments” that have no long-term value, but a definite long-term liability.

There is enough waste/fraud in the Federal system to fund all of the “good intentions” of the liberal wing… but you know what they say about good intentions.

Meanwhile, Harry Reid is “worried” about Romney’s tax returns because he never heard of an IRS audit, while simultaneously shilling for a Chinese solar firm closely connected to his son.

We really need to have more trust in the government to do the right thing.

Glad to hear it isn’t all GB’s fault now that we’re 3-1/2 years into Obama reign. Now it’s the Tea Party’s fault. Just won’t let Obama have more “summers of recovery” and “shovel ready jobs.”

Bleh!

There are over 300 bills that have passed the House that the OWS-supporting, “dirty liar” Sen. Harry Reid is not allowing to come to the floor of the Senate. Slug, tell me again who is standing in the way of recovery?

All US auto producers have always counted a car delivered to a dealer as a sale.

Why do you think it is a new development or a distortion?

Is government spending the answer to economic growth? Macroeconomic texts seem to push and justify government spending when the economy is down, but is Arthur Laffer right or wrong in his opinion as reported in today’s WSJ that stimulus spending is a negative and not a positive. If he is wrong why is he wrong?

Some more charts from John Taylor putting the weakness of the current recovery in perspective. Could this have anything to do with the misguided policies of the Obama regime? Did the “cures” actually make matters worse?

Rich Berger, the correct was broken, but here is the post link:

http://johnbtaylorsblog.blogspot.com/2012/08/its-still-recovery-in-name-only-real.html

It would be worthwhile to go to the home page and read several of the earlier posts.

Trying to argue that an increase in government purchases actually decreases GDP is pretty silly in this environment of low interest rates and a lack of demand.

Arguing whether the multiplier is larger or smaller than unity is more reasonable, but in terms of infrastructure spending like I am envisioning, it’s somewhat beside the point. Many roads and bridges and sewers are crumbling and need to be replaced. Why not do it when borrowing costs as well as materials and labor costs are low? Buy low, sell high.

Data series should always be introduced as leading, coincident, or lagging (to GDP or some other macro variable).

Some data series have no meaningful proven correlation with GDP anyway.

Furthermore, just looking at a few data series isn’t useful. It’s confusing. Data series need to be taken together and over time to see if there is anything of meaning in them.

We are Japan.

Brian: “Why not do it when borrowing costs as well as materials and labor costs are low? Buy low, sell high.”

The problem you may not have noticed is that the debt simply accumulates so that excess debt at a point in time accumulates excessively forever and eventually drains more from the budget each year… excessively so as interest rates eventually go up.

Oh, I forgot, we just tax more the top 5% who pay 44% of the total taxes. That’ll fix things good.

Bruce Hall Brian is right. There are plenty of public projects that we have to do anyway. It’s not a question of whether we do them, only a question of when we do them. It makes a lot more sense to do those kinds of things when there is slack in the economy and interest rates are low. There are thousands of highways and bridges that need repair. Water and sewer systems are in big trouble…some of them are almost 150 years old and showing their age. The electricity grid needs to be overhauled. There’s no shortage of things that we need to do.

I suspect that like a lot of folks in the Tea Party demographic the real reason you are opposed to infrastructure projects is that those project will bring you taxes but you won’t live to see the benefits. It’s the greedy geezer syndrome. This is really the first time in history that society has had to confront the problem of four or five living generations competing with each other all at the same time. It’s a problem that Japan hasn’t figured out and I don’t think we’re doing much better.

The problem you may not have noticed is that the debt simply accumulates

The flow of benefits also continue to accumulate. And the debt does not always accumulate. There was a time when voters demanded responsible politicians. In any event, as Richard Armey and Grover Norquist both admitted on the record, all of their talk about debt and deficits is just a smokescreen to get lower tax rates. If it comes down to lowering the deficit or lowering taxes, Armey and Norquist will take lowering taxes every time.

the top 5% who pay 44% of the total taxes.

Where did you get this nonsense? That’s not even close to being true.

2slugs speaks truth. The top 5% pay closer to 60%.

2slug:

“Where did you get this nonsense? That’s not even close to being true.” see chart: http://politicalmathblog.com/?p=1735

“The flow of benefits also continue to accumulate. And the debt does not always accumulate.” Agreed, but debt has not accumulated like this for a very long time.

“…you won’t live to see the benefits. It’s the greedy geezer syndrome.” Actually, it is the concerned grandfather syndrome… the recognition of the enormous future problems the wild-ass spending is going to cause. Can you spell Europe?

Suggest, as did Rich Berger, that you consider other opinions such as John B. Taylor’s. But that’s unlikely, I know.

Corev

There’s a lot that he doesn’t know. Furthermore there’s a lot that he knows that isn’t true.

Bruce Hall & CoRev: Partial credit.

CoRev is closer in that the top 5% pay 58.6% of income taxes (as of 2009)[http://www.irs.gov/pub/irs-soi/09in01etr.xls]. Individual taxes make up ~42% of government revenue (source: OMB.gov)…i.e. the top 5% contribute less than 25% of total revenue.

I’m not quite sure the point of the political rhetoric (Not only Mr. Hall, but other posters) that is just a regurgitation of some 24 hour news feed. While refreshing to read the spirited debates on this blog (credit to Menzie, JDH, Steven Kopits, and other regular commentators) IMHO, I offer a bit of stylistic advice:

1. If you give numbers, list the source of the underlying data, a lot of readers on this blog are very well informed and trying to ‘massage’ the data to fit your rhetoric makes you look ill informed and weakens your argument.

2.Try to keep these two questions in mind: What’s your point? How does this further the economic discourse on this website?

Jacob:

“If you give numbers, list the source of the underlying data, a lot of readers on this blog are very well informed and trying to ‘massage’ the data to fit your rhetoric makes you look ill informed and weakens your argument.”

I’ll presume you did not follow the entire comment thread so I’ll repeat:

Rich Berger, the correct was broken, but here is the post link:

http://johnbtaylorsblog.blogspot.com/2012/08/its-still-recovery-in-name-only-real.html

It would be worthwhile to go to the home page and read several of the earlier posts.

I found the following paper interesting:

THE SOURCES OF GOVERNMENT REVENUE

The Nazi treasuries received their income both from sources usually

accessible to governments and from extraordinary sources. Revenue

was derived from taxation, administrative income, income from public

property and increase in debt – the normal channels through

which part of the national income is directed to public authorities.

In addition, the Nazi government secured considerable amounts

through “voluntary” and involuntary contributions – a conglomeration

of fees, levies, collections and contributions of all kinds imposed

upon the population both of Germany and the occupied

territories. Finally, the governments of invaded countries were made

to pay huge amounts to cover the “cost of occupation.”

As far as the system of taxation and the different types of administrative

income are concerned, the Nazi government did not make

any novel or startling departure. It kept these measures within the

limits of well-established practices of public finance. Since we are

not concerned in this study with a detailed analysis of the German

financial apparatus, we shall limit ourselves to describing merely

the changes in the system of taxation introduced by the Nazis. We

shall want to deal in somewhat greater detail with the methods and

techniques which they applied in increasing the public debt and in

raising funds through all kinds of “contributions” and fees. In this

they were really original and inventive.

TAXATION

The German Tax System at the Beginning of 1933

The tax system existing toward the end of the Weimar Republic

was based mainly upon the so-called Erzherger Tax Reform of

1919-20. This reform transferred significant tax powers from the

states to the Reich and established a centralized tax policy. The

Reich, previously dependent chiefly upon customs and excise duties,

acquired authority to levy taxes on income and property (wage

tax, income tax, property tax) as well as many taxes on trade (turnover

tax, transportation tax, motor vehicle tax, land purchase tax,

etc.). State and local authorities for the most part retained only

taxes on real estate (land and building tax) and gross business receipts

(business tax). To these were added a few small consumption

taxes (taxes on meat, beverages, etc.) and,

http://www.nber.org/chapters/c9478.pdf

———————————————

The point is… that the building of an empire is costly and complicated. In fact, something seemingly simple, like parking tickets or the fees for parking, or the costs of lottery tickets for those poor souls who desperately need hope, can be a tax. Then too, while those who seem to be paying a large share of taxes may actually be on the receiving end of taxes. For example, some beach communities in SoCal offer parking passes to wealthy residents, while charging very exorbitant fees to those who typically live in the much poorer inland areas. The thing is, those in power serve themselves and their own kind. And the methods used are too complicated to cover in any format which is shorter than a medium-sized book. But… when the rich are getting richer, while the poor are getting poorer, well… obviously, when wages are considered, which is integral to this subject, the rich are not paying their share of the cost. To make this even more telling, it is wise to remember which group, in this empire building effort, is most likely to make contributions on the battlefields of the past, present, and of the future.

Everyone likes to look at economic data to try and explain things or persuade people. I suggest that we look at the behaviors that are changing because of gov’t policies.

When you have almost half of wage earners paying no income taxes, 99 weeks of unemployment benefits, 40 million people receiving food stamps, etc., behaviors change.

In just two generations we went from a nation of savers who sacrificed for the betterment of their country, families and neighbors, to a nation of debtors who want more and more from their country and neighbors.

My observation is that beginning in the 1960’s federal government policies unleashed a wave of.behavior changes that are now unsustainable as too many people want and too few are willing to save.

In short with these policies the answer is yes.

I think when you take out the post-crisis inventory rebuild, the flukes of weather, the flukes of quarterly measurement, and the flukes of attempted seasonal adjustment, and a couple policy flukes like cash for clunkers and up-front amortization that brought forward demand, you get a very flat growth picture since early in 2010. We are in a ~1.5% growth rate rut.

But this is also more or less what democracy ordered up. A greater fiscal stimulus might have produced temporarily faster growth, but I think with much waste and bringing forward demand that would be subtracted from growth later when the stimulus was withdrawn, for a worse outcome in the long run. Less stimulus would have brought a deeper recession, with deeper falls in asset prices and real wages, and I think then faster, more sound recovery. Americans didn’t want either of those alternatives badly enough to make them happen. So we have what we have.

“The flow of benefits also continue to accumulate. And the debt does not always accumulate.”

“Agreed, but debt has not accumulated like this for a very long time.”

The debt has essentially accumulated for major economies virtually without skipping a beat since Nixon left the gold standard in 1971. At the time, currencies were pegged to the dollar, which was pegged to gold. Governments worldwide have not been able to restrain themselves since we left it.

Tom has an unusually balanced and sound viewpoint.

My comparison to the Nazi tax ploys is however more interesting. So there!

Bruce Hall and CoRev Actually, you shouldn’t get any credit. I was expecting that you’d step in it. Bruce Hall specifically referred to TOTAL taxes, not just federal income taxes. What abut FICA and Medicare taxes? What about state and local income taxes? What about state and local sales taxes? What about property taxes? What about gasoline taxes? What about excise taxes on stuff like tires, cell phone minutes and airline tickets? What about tariffs? What about tobacco and alcohol taxes? These are all things that hit low income folks pretty hard. And since your candidate believes corporations are people, shouldn’t you have included corporate taxes as well? What’s going on here is that your class bias is showing. In your world it’s the federal income tax that gets your attention, so you tend to ignore the FICA tax…hey, you’re retired! You need some diversity training.

Also, if you want to understand the tax burden, then you need to quit thinking like an accountant and start thinking like an economist. For example, an accountant thinks that businesses pay half the FICA tax and all of unemployment insurance. An economist understands the concept of “tax incidence” and knows that labor actually pays almost all of those two taxes.

http://en.wikipedia.org/wiki/Tax_incidence

Infrastructure Bank?

Is there anything to prevent today, the much loved and respected Governor and equally loved legislature from going before their adoring citizens and raising any amount of taxes for pouring more concrete? No.

Is there any shortage of money sloshing around the world, desperate for decent return to be had for some worthy public progect? No.

So why yet another layer, organization when any state can call on money.

Oh, trust. The citizens, abused for decades , who know their governments, and their personal financial state won’t support these projects( Boston’s Big Pig, estimate 2-3 billion, now 25 billion and counting and decaying )

But hey, enough with democracy, lets have a supra elite shall we.