On Thursday the Federal Reserve announced a series of measures that will come to be referred to as a third round of “quantitative easing,” or QE3. Here I review what effects this is intended to have and some of the developments so far.

There are 3 components to the Fed’s plan. The first (announced in June) is a commitment to continue through the end of the year the Fed’s program to replace its short-term Treasuries with longer-term Treasuries. Second, the Fed plans to purchase an additional $40 B each month in agency mortgage-backed securities (MBS). Between these, this will end up taking $85 B in longer-term securities off the market each month through the end of the year. Moreover, the MBS purchases are open-ended, with the Fed saying they will continue unless the labor market improves:

If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of agency mortgage-backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability.

Third, the Fed signaled that it intends to keep interest rates at “exceptionally low levels” through 2015. The new measures thus combine large-scale asset purchases (LSAP) with a declaration of its future intentions, a combination that many of us feel is more likely to be effective than either LSAP or pure announcements of future intentions could be on their own.

Note that, since the Treasury has already assumed fiscal responsibility for the MBS issued by Fannie and Freddie, the LSAP in no way changes the total amount that the federal government owes or is committed to pay to anybody. Instead, it simply takes some long-term federal obligations (such as agency MBS or 10-year Treasury securities) off the market, and replaces them with overnight federal obligations (namely bank deposits with the Fed that have now been created). These Fed deposits have not turned into circulating currency, and are not going to turn into circulating currency, but instead are essentially a very short-term debt instrument of the U.S. government. If you view it that way– a simple change in the maturity structure of outstanding federal obligations– you wouldn’t think it would be that controversial, nor something that’s likely to have huge consequences. That indeed is my view– QE3 shouldn’t be that controversial, and we shouldn’t expect too much of it.

Before getting into details of its effects, let me first review what I think QE3 is intended and able to accomplish. Japan has spent two decades living with deflation and very low inflation. This caused the problems associated with their debt overhang to last much longer than necessary. Moreover, the principal reason people might be concerned about trying to get more monetary stimulus is that it could cause too much inflation. In the case of Japan, it is overwhelmingly clear this should never have been the main concern.

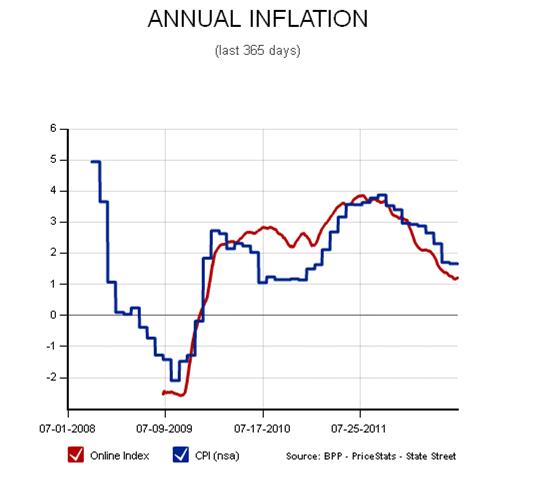

The U.S. has also recently been experiencing inflation below 2%, whether measured by the PCE deflator, CPI, or the Billion Prices Project.

|

|

I would judge QE3 to be a success if it resulted in lower real interest rates and higher expectations of inflation, both of which would slightly encourage additional spending today. What effects from QE3 do we see in the data so far? Thursday’s Fed announcement was anticipated by many of us, with some analysts concluding that Fed Chair Ben Bernanke’s speech at Jackson Hole on August 31 made it pretty clear something like this was coming. Since August 31, the 5-year TIPS yield (a rough immediate measure of an expected real interest rate) has fallen 31 basis points, while the 5-year nominal Treasury (which can be thought of as the real rate plus an expected inflation rate) is up 13 basis points. Together these could be read as an increase in expected inflation over the next 5 years of 44 basis points relative to where it had been on August 31.

|

The ten-year TIPS yield is down 6 basis points, nominal up 32, for a 38-point implied change in the 10-year break-even inflation rate.

|

Here’s a longer-term graph of those break-even inflation rates.

|

Dollar commodity prices are up significantly since August.

Can the Fed’s announcement really do all that? There were similar initial moves following QE1 and QE2, which later were reversed as the market realized that no, this really wasn’t going to turn the U.S. into another Zimbabwe.

Bernanke himself seems to have pretty modest expectations:

The policies that we have undertaken have had real benefits for the economy that they have provided some support, that they have eased financial conditions and helped reduce unemployment. All that being said, monetary policy as I’ve said many times is not panacea, it is not by itself able to solve these problems. We are looking for policymakers in other areas to do their part. We will do our part and we will try to make sure that unemployment moves in the right direction but we can’t solve this problem by ourselves.

That’s my view as well. I think the correct interpretation of QE3 is that the Fed has unambiguously signaled that it’s not going to re-run the Japanese experiment to see what happens when the central bank stands by and watches wages and prices fall even while unemployment remains very high. The Fed can and will keep U.S. inflation from falling much below 2%, and that may help a little. Investors should expect that, and not a whole lot more.

There’s also the apparent effect of quantitative easing upon stock prices to consider:

That boost to stock prices is mainly due to the direct effect of quantitative easing upon long-term interest rates, which were lowered from what they otherwise might have been because of the Fed’s quantitative easing programs. The boost to stock prices arises from the negative relationship between them and long term interest rates.

By contrast, the Fed’s “Operation Twist” had no visible effect upon stock prices while it has run.

Perhaps the real question though is that with long term interest rates already so depressed, which puts more of a floor below today’s long term interest rates, will the Fed’s new QE program produce as large an effect as what it did before?

That’s my view as well. I think the correct interpretation of QE3 is that the Fed has unambiguously signaled that it’s not going to re-run the Japanese experiment to see what happens when the central bank stands by and watches wages and prices fall even while unemployment remains very high. The Fed can and will keep U.S. inflation from falling much below 2%, and that may help a little. Investors should expect that, and not a whole lot more.

From what I can tell the Fed is doing exactly what Japan did; prevent a liquidation of malinvestments and prolong the weakness. There is no way to permit a sustainable recovery until lousy investments are allowed to be washed out and allow resources to flow to those best able to allocate them.

What’s the exit strategy?

The Fed is now the London Whale of the long-term Treasury and MBS markets. How can they possibly sell into a rising rate environment?

It may boil down to how much the market believes the Fed will stay this course. I thought Bernanke did a good job of explaining how and why this developed as a consensus over time. If Romney wins, especially if the GOP sweeps, then we have to consider what the markets would think of a Fed changed by that, perhaps one with a more limited mandate, perhaps one which is less independent. I hope we don’t go there because I can’t see much good happening to the economy if we raise rates or if we commit to keeping inflation at extremely low levels forever. But I mention this because that uncertainty sits on the market.

Another form of uncertainty is taxation and the effect on the budget deficit. If we enact the Romney/Ryan tax cuts, we’ll either see a massive reduction in government – reducing it to a shell – or we’ll see a magic boom unlike whatever has happened in the past or we’ll see a mushrooming deficit. My guess is the last because that has been the traditional approach: cut taxes, let the deficit climb, claim you’re against deficits when running for office again, repeat. While the “tea party” side of the party will push for eradication of everything outside of defense, the reality will be much less, particularly since the big items on the radar – the EPA, Education – don’t actually cost much and they do have constituencies. So if we’re betting on the magic boom, which I fear we are, then we have the uncertainty in the markets of the effect of that not happening. I’ve been saying that if we want to destroy the dollar, this would be the way to do it. Maybe we’ll find out. Life can be interesting.

Before the GSEs were semi-privatized. mortgage guarantees were treated as part of the national debt. Now that they are 100% federally guaranteed they are again part of the national debt that is not on the books. So I understand what Prof. Hamilton is saying about buying a federally guaranteed security.

I have three questions that I hope Jim will answer:

1. Is one of the reasons that the Fed is cranking up purchases of MBS rather than Treasurys that it wants to avoid the impression that it is facilitating the government running huge deficits (which is what Truman wanted the Fed to do, the failure of which led to the Fed’s independence)?

2. Assuming that the Fed continues buying MBS over an extended period of time, in a tail risk scenario where the mortgage market crashes again, would the Fed’s holdings of hundreds of billions in agency MBS rather than Treasurys make any difference to investors’ perceptions of the central bank’s solvency? In other words, are tail risks for MBS different under any situation than for Treasurys? Or are are agency MBS simply stealth Treasurys?

3. If they are no different than Treasurys, what would that make the actual national debt, which means actual federal obligations today, not projected future obligations?

hmm…I think saying the Fed is doing EXACTLY what Japan did is going a little bit too far. First of all, there already has been a substantial liquidation of mal-investment. Secondly, we have not had sustained deflation (where Japan did) which makes the need for liquidation an ongoing cycle.

Still, I agree with the sentiment to some extent, in that there were two other extreme options that they haven’t chosen: 1) allow a quick deflationary bust to clean out all mal-investment quickly or 2) create enough inflation (say 100% over 7 years) to make the majority of home-owners “whole.”

The first option is obviously deflationary and would benefit most those with fully paid real assets and cash on the side lines. The second option is obviously deflationary and would help debtors and hurt pensioners. The problem with the first option (which is what most conservatives call for) is that it more quickly brings about the unpaid liability problem that everyone is trying to put off for as long as possible. I personally still favor the second option of targeting 10% inflation for 7 years – the generation that would get hurt the most in that scenario (pensioners) is also the one who has benefited the most from a logically unsound (due to demographics) plan. The people who would benefit the most would be debtors, particularly middle class young-middle who work and own a house. That demographic has been stressed to the max but nobody really seems to care.

I certainly think more creative strategies could have been found. It seems like a lot of the people who really benefited from the mess were exactly the wrong ones to benefit – e.g. the biggest banks (JPM, Goldman) and individuals who behaved most irresponsibly – e.g. levered the heck out of their house, took $200K cash out of it, bought a bunch of cars, and then walked when the crisis hit.

Another pro-temporary inflation tactic would have been to repeat the Economic Stimulus Act but put it on steroids – instead of 158 billion dollars, make it 1.58 trillion, and instead of using Fed balance sheet to prop up stupid investments to the biggest banks, use it to fund the 1.58 trillion dollar stimulus act. Obviously this would be massively inflationary, at least temporarily because you are creating high powered money, but you could then have let the worst financial offenders just fail – new banks would spring up to replace them, and the Fed largess would be spread evenly to all citizens – roughly 5K per person.

The negative externalities of moderate inflation (a de facto default) are no worse than a literal default. The messiness of an actual default (witness the foreclosure clusterf…, and the brewing unfunded liabilities storm) is much higher than de facto default IMO and makes everybody worse off because we spend so much time and energy fighting over who gets what and when. And yes, of course the US credit rating would have gone down the toilet – but…I’m not so sure I can be convinced that being discouraged from borrowing by painfully high interest rates is a bad thing…it means we have to be a creditor nation for a decade or two – probably be good for our souls.

And this half-cocked slow motion default that we’re currently on track for is probably worst of all – my hypothesis is that it does the best job of further concentrating power and influence.

colonelmoore: I see from your questions that I misspoke. Agency debt is the direct debt that is on the balance sheet of Fannie and Freddie. The MBS are simply guaranteed by Fannie and Freddie, and therefore off-balance-sheet items for Fannie and Freddie. Neither I believe is counted as on balance sheet from the perspective of the federal government.

The point I was trying to communicate with my poor choice of words was that, if the MBS go bad and Fannie and Freddie can’t cover, the outcome is not different from the point of view of the combined Fed-Treasury obligations regardless whether or not the Fed has bought the MBS outright. The one possible contrary scenario would be if legislation like that discussed by Ron Paul and others, which would essentially default on that portion of Treasury debt that is owed to the Fed, were to become law.

As for why the Fed is buying MBS instead of Treasuries, I think the notion is that buying MBS may be slightly more effective in helping keep mortgage borrowing costs low.

Re Vangel : Greenspan/Bernanke have been driving

interest rates down since the mid-1990’s. The results have not been a free lunch : the dot com boom and crash, the housing bubble and crash .

13T$ has been lost in the US alone. In light of this history, I would expect from the economic profession a more measured analysis of the cost/benefit tradeoffs of QE3.

What is the exposure ? How will we unwind? Or is faith the answer ?

So, this is what Keynes meant by the euthanasia of the rentier class. I did not think he was so literal.

Starving retirees to death will also solve the Medicare funding issue without having to do anything like what that nasty Paul Ryan is proposing.

“the Fed has unambiguously signaled that it’s not going to re-run the Japanese experiment”

No, they want to re-run Germany in the 1920s, because that was such a huge success.

Tommorow, my prayer will be that Ben Bernanke’s name not be inscribed the sefer chayim.

Thank you for your answer.

“In 1968, due to fiscal pressures created by the Vietnam War, Lyndon B. Johnson privatized Fannie Mae in order to remove it from the national budget.”

This is from George Mason University.

What was FNMA’s contribution to the national budget? I presume that with Johnson running a deficit FNMA was making hs numbers look worse. If today no one lists the mortgages on budget, what sort of accounting made Johnson unhappy back then?

As for today’s situation, when the government agencies F&F, private now in name only, buy up mortgages and sell them to investors as securities, the government is saying to inveestors that the securities have sufficient cash flow to pay all interest and principal. This cash flow guarantee comes from two sources, the mortgage payments and tax revenues in case mortgage payments fall short.

This seems not to be any different than issuance of Treasurys. In the case of mortgages, the mortgage payments pass through the agencies on their way to investors, topped off if necessary by tax revenues. In the case of Treasuries, taxes, fees. etc. pass through the Treasury on their way to bondholders. This is what I meant by the agency debt being equivalent to Treasurys.

You mentioned one scenario in which there might be an increaes in risk, should Ron Paul’s legislation pass. Let me posit another. The mortgage market turns very bad and the agency debt threatens the solvency of the federal government. As Europe showed, creditors can be made to take a haircut on soverieign debt. If the choice were between a general collapse of federal debt and hiving off agency debt, agency debt might be sacrificed.

And how convenient it would be if the Fed ended up owning a substantial portion of that debt through its endless MBS purchases. We know that the Fed is owned by its member banks, and it was banks that took the haircut in Europe. Since all that GSE debt is off the books anyway, it would look better to be negotiating with the banks through the Fed to take a haircut on that debt rather than negotiating for a haircut on Treasurys. In other words, the question I should have asked you is, is GSE debt pari passu with Treasurys?

Somehow in the final edit I left off that I, not Prof. Hamilton, was unclear in the wording of my initial question. I understood what he was saying.

colonelmoore,

The agency mortgage market is extremely unlikely to turn bad (from credit risk) with Zimbabwe Ben at the printing presses.

Interest rate risk is a far bigger issue.

No one is answering the question, what happens when Fed unwinds the position and a similar contraction takes the credit flow to reduce, which directly impacts the output? Or are we assuming that the protracted balance sheet remains protracted forever? Then what happens when the interest rates harden and what happens to the risks thereof as a range of assets are collaterized? Or am I completely missing something?

Procyon Mukherjee

Thanks Ben, QE3 was already successful, stocks went higher. The only agenda.

QE4, after the election. Next GOP : Now I bet it will be Obama (2nd round, means Ben reloaded), as the other one is a nuthead and currently seen as a risk by the financial industry.

Vangel is exactly correct. The problem with QE3 is that it is designed to monetize the malinvestment which just perpetuates it. Japan did have a problem with deflation but what most do not seem to realize is that there is also a component where previous Japanese monetary expansion created malinvestment that began to deleverage when they entered the bust portion of their business cycle the late 1980s (see Japanese real estate – does that sound familiar). The US is actually following the Japanese model by using both monetary and fiscal policy to prop up malinvestment. This is also very similar to what Hoover did during the Great Depression after the stock market crash.

I know there are a lot of people saying “things are different now” but in truth that is because their theories are being proven wrong but they are assuming it is because “things are different.” In truth we are making the same mistakes that have been made over and over by mercantilist governments for centuries.

Until the malinvested assets are allowed to be acquired by competent businesses that can turn the assets into profitable asstes the malaise will continue. Bankruptcy is a wonderfully cleansing process. The most obvious example of this government intervention mistake is the continuing pain GM and Chrysler are causing our economy.

As the professor recognizes, the purchase of MBS is an act of moving the chairs on the Titanic, but it is more. What this will do is put the malinvestment on the FED balance sheet and insolate it from any write-down to its real value, more perpetuation of malinvestment. While quantitative easing does create malinvestment the primary problem we face today with the economy in the bust phase of the business cycle is the perpetuation of the malinvestment, changing an economic downturn from a depression into a Great Depression.

It is also important to understand the true nature of QE and the Bailouts. This podcast of Neil Barofsky, the former Special Inspector General for the TARP program gives insight into the problems that are usually ignored by Keynesian economists because they don’t fit neatly into a formula. Think about this as you ponder the motivation of Bernanke and the FED.

Esther George, president of the regional Federal Reserve Bank in Kansas City, gets it right.

“Is there anyone not borrowing today or purchasing a house because interest rates aren’t low enough? Do we expect that businesses will hire if their long-term rates are lower?”

Any responses to the opinion piece(page A19) in the 9/17/2012 WSJ, “The Magnitude of the Mess We’re In”, by Shultz, Boskin, Cogan, Meltzer and Taylor?

I see the ghost of Hayek has arrived, just in time to keep Hayek’s reputation for being dead wrong alive. The notion that proponents of easing (opponents of malinvestment thinking) are somehow under the impression that malinvestment thinking was right during the Great Depression, but that “this time is different” is simply misinformed. Hayek was wrong both times.

Now, help me out with the notion that once the Fed owns MBS, “investment” stops reflecting its true value. The house on which the mortgage is taken is still open to being bought and sold and can still be evaluated against comparable homes. Mortgages bundled in the MBS are either current or not. What won’t happen, presumably, is those mortgages changing hands. The mortgage market is pretty big, though, so it’s not going to be all that hard to evaluate Fed-held MBS against the market to have an idea of what they are worth. There will still be price discovery – it’s a big market.

The problem is not that we can’t know what those MBS held by the Fed are worth, as Ricardo suggested. Rather, the “problem” if you want to call it that, is that the Fed is changing the value of the MBS, and so the mortgages in the MBS, and so the physical housing stock.

Or not. The real issue, for those not worshiping at the alter of liquidationism, is whether the Fed will, in fact, be able to influence the supply of mortgages. If not, and if that in turn means that the value of homes does not rise, then the Fed’s effort will have failed.

AS

Any responses to the opinion piece(page A19) in the 9/17/2012 WSJ, “The Magnitude of the Mess We’re In”, by Shultz, Boskin, Cogan, Meltzer and Taylor?

I saw that AS. Here is one small piece. The authors raised several good points.

Did you know that, during the last fiscal year, around three-quarters of the deficit was financed by the Federal Reserve? Foreign governments accounted for most of the rest, as American citizens’ and institutions’ purchases and sales netted to about zero. The Fed now owns one in six dollars of the national debt, the largest percentage of GDP in history, larger than even at the end of World War II.

Governments sell their debt to private banks who in turn sell it to the central bank.

The FED and the ECB are now financing the U.S. government and several EU governments by making electronic deposits in the accounts of the largest private banks in the world.

The global economy is slowing. The U.S. and EU are rapidly approaching stall speed.

It looks to me like several more quarters or years of trying to prop up failure with debt and ‘reserve’ creation.

The exit strategy will get more complicated as the proportion of soverign debt on the central banks’ balance sheets mushrooms along with the reserve balances at the big private banks. QE Infinity – sounds about right.

kharris,

Remind me not to hire you as an appraiser. Let’s see, you are saying since my house was valued at $500K in 2007, the loan I took out should be worth the same today as it was in 2007. On second thought how about just buying my house!!!

Leveraged investor: Yeah, stockmarkets are up. Way to go QE!

Everyone else: Whish I had some money to invest before QE. Now the F’n’ markets are full of leveraged money and I’m still not making anymore.

the romney video can be found at

http://www.youtube.com/watch?v=mUEHpc6JKw8

uncensored.

Anyone,

Why have treasury yields been going up this month?

Is real estate way up?

Are investors following the Fed?

Have we failed to cut spending?

Here is an alternative view on QE-∞ from etfdailynews.com by Chris Martenson:

The Trouble With Printing Money

You miss an important direct effect of QE, the creation of bank deposits ie M2, and some important indirect effects, the devaluation of the dollar and inflation. The records on those are quite clear and can be seen by simply charting monetary base growth vs CPI and DXY. The devaluation-inflation impact shouldn’t be exaggerated, but it shouldn’t be denied or ignored either. The debatable point is whether the inflation is coming only through devaluation raising the price of imports and spurring more export activity, which is where I lean, or if there’s an impact on domestic growth for domestic consumption that was also generating a bit of inflation.