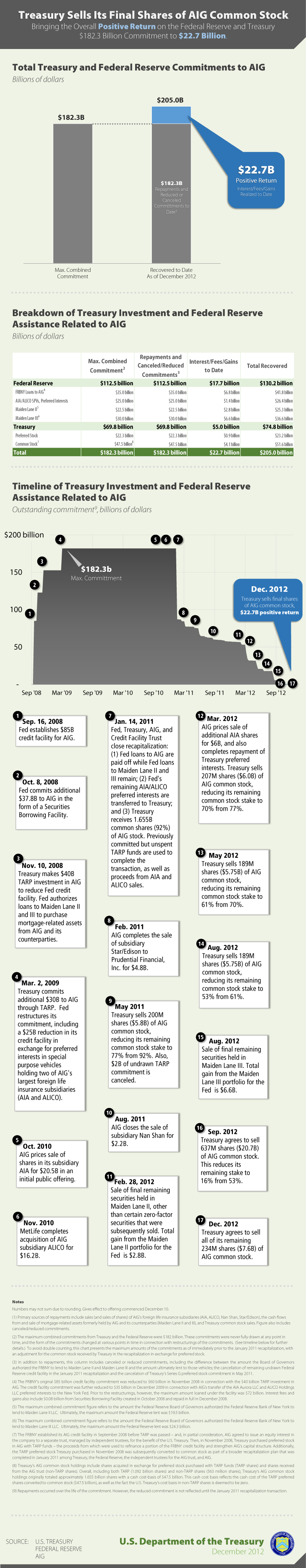

A key player in the financial crisis was insurance giant AIG, which sold a huge volume of credit default swaps supposedly protecting buyers of mortgage-backed securities from losses due to default. But AIG had nowhere near the capital necessary to honor these guarantees when things went bad, and much of AIG’s liabilities ended up being picked up by the Fed and the Treasury. On Tuesday the U.S. Treasury announced that it had sold the last of the common shares in AIG that it had acquired as compensation for its emergency assistance to AIG and reported that the Treasury and the Fed had together earned a profit of $22.7 billion as a result of their assistance to AIG. I was curious to take a look at how this story ended up having a happy ending.

The Treasury’s statement included a table detailing the government commitments and associated profits which I found very confusing and difficult to reconcile with earlier publicly released information. Fortunately, the Treasury’s blog (hat tip: Economist’s View) offered more details. I reproduce their graphic below.

The first two numbered entries in the Treasury’s timeline above evidently refer to the Fed’s September 16, 2008 statement that it stood willing to lend up to $85B to AIG, and subsequent October 8 statement that it was willing to commit an additional $37.8 B. The subsequent H.4.1 releases of the Fed’s assets and liabilities showed direct credit extended by the Fed to AIG (blue region in the graph below) to have been $28 B as of September 17, 2008 and to have grown from there each week to reach a maximum of $90.3 B on October 22.

|

The figure above highlights several major restructurings of the Fed’s AIG holdings. The first occurred in November and December of 2008, when the Fed established Maiden Lane II and III. Maiden II bought MBS held by AIG while Maiden III was to “purchase multi-sector collateralized debt obligations on which the Financial Products Group of AIG has written credit default swap contracts.” The Federal Reserve Bank of New York reports that Maiden II and III were established with $19.5 B and $24.3 B, respectively, borrowed from FRBNY. The credit that the Fed had initially extended directly to AIG (the blue region in the graph above) was reduced by an amount very nearly equal to the new capital infused into Maiden Lane II and III (brick and yellow), with the result that the sum of the three was fairly steady from November 2008 through December 2009. It is not clear to me from the H41 accounts how the capital infusion from the Treasury of $40 B in November of 2008 was used to reduce the Fed’s exposure. One possibility is that there may have been some other categories of exposure or loss which the Treasury money helped cover. Perhaps some of the securities pledged by AIG as collateral for the initial loans could be replaced by higher quality assets underlying Maiden II and III thanks to the Treasury’s new capital, so that the money effectively went to cover an unrealized earlier loss on the Fed’s balance sheet. I welcome instruction from knowledgeable readers who may know the correct answer to this.

The second restructuring occurred in December 2009 with the creation of AIA Aurora LLC and ALICO Holdings LLC. The Fed’s statement at the time said these were “created to directly or indirectly hold all of the outstanding common stock of American International Assurance Company Ltd. (AIA) and American Life Insurance Company (ALICO), two life insurance subsidiaries of AIG.” The Fed valued these assets (turquoise in the graph above) initially at $25 B, a move that coincided with a $25 B reduction in credit directly extended to AIG, so that again the sum of the four categories in fact remained fairly steady from November 2008 through January 2011.

The third major restructuring occurred on Jan 14, 2011, when the Fed retired the AIG loans and closed its AIA/ALICO positions, with the following explanation:

The cash proceeds from certain asset dispositions, specifically the

initial public offering of AIA Group Limited (AIA) and the sale of American Life Insurance Company (ALICO), were used first to repay in full the credit extended to AIG by the FRBNY under the revolving credit facility (AIG loan), including accrued interest and fees, and then to redeem a portion of the FRBNY’s preferred interests in ALICO Holdings LLC taken earlier by the FRBNY in satisfaction of a portion of the AIG loan. The remaining FRBNY preferred interests in ALICO Holdings LLC and AIA Aurora LLC, valued at approximately $20 billion, were purchased by AIG through a draw on the Treasury’s Series F preferred stock commitment and then transferred by AIG to the Treasury as consideration for the draw on the available Series F funds.

Here is the first place where I can clearly understand from looking at the Fed’s publicly reported balance sheet how the Treasury infusion of capital resulted in a reduction of the Fed’s exposure.

The key question in my mind was what was the market price that the Fed received when it disposed of the assets held by Maiden II and III. The Federal Reserve Bank of New York two weeks ago released details on purchase and sale prices of all assets held by Maiden III. That spreadsheet shows how Maiden III netted the Fed $6.64 B in excess of funds initially committed by the Fed. This number, when added to the $2.85 B earlier reported to have resulted from Maiden II is consistent with the $9.5 B combined profit claimed for Maiden II and III in the Treasury table reproduced above. Although the summary as reported by the Treasury puzzled me, the details provided in the Fed spreadsheets persuaded me that the bottom line has been accurately described.

I am surmising that the drop in interest rates and rise in equity prices since the fall of 2008 are important factors in accounting for how the government was able to come out ahead financially as a result of these transactions.

That these operations ultimately resulted in a profit rather than a loss for taxpayers is welcome news. As events turned out, the bailout of AIG proved not to be money just poured down a hole.

Of course, insurance services provided by the government were worth substantially more than the profit received. Reforms are needed to compensate the public for the risk to which financial sector actors expose us…

Quick and dirty math: About 12% return over about let say three years to be charitable… somewhere in the neighborhood of 4% annual. Seeing the RFR was around 0 during the time, was 4% a large enough risk premium?

http://dealbreaker.com/2012/12/aigs-remaining-bailout-reduced-to-rounding-error/

Assuming that the “profit” is real, we must turn to Bastiat to understand why this is so foolish.

What were the other opportunities that were missed because this money was used to honor loses paid out on financial error of the investment banks? Had AIG been allowed to fail there is a good chance that some of the investment banks would have taken heavy losses also. Debt would have been written down and the losses recorded. The deleveraging would have been almost immediate. There would have been a recession because of the bad investments the investment banks made, and the whole thing would have been over quickly. As with the recession of 1920-21, we would have quickly recovered and assets would have been producing quickly. In 1920-21 within 18 months the economy had returned to full production.

As it is we have faced a situation like 1929. We have been paying for AIG for 4 years and we are still paying for the other errors made by the investment banks. The only ones to profit from these transactions are those in the 1%, actualy 0.1% who covered their losses and padded their bonuses.

It is disingenuous to say the taxpayers made a profit because the profit will cover the excessive spending by the political class to their crony capitalist buddies.

The FED’s profit is taken from the productive economy just as the AIG payments to the investment banks were taken from the productive economy. The investments that could have been made are gone forever. We have lost a generation of producing assets just as we did in the Great Depression all to cover the failure and skimming by the 0.1%.

If a thief pays his mortgage then sells his home pays the theft back with 4% interest then pockets the difference, is he a noble person?

Bastiat asks us to look at the seen and the unseen. What are the opportunity costs?

Great! Should we do it all over again tomorrow and make some real money? Scale it up and pay off the debt? 😉

All very Gorton.

@Ricardo,

I agree with you sentiments that it was really unfortunate that many investment banks unfairly profited from the AIG bailout, but I disagree with your alternative. Your alternative of debt being written down, losses being recorded and deleveraging occurring is bankruptcy, which was the option chosen for Lehman Brothers. And how did Lehman Brothers work out?

You mention that we’ve been paying for 4 years for errors of investment banks. I agree with you that the investment banks made the errors, and we’ve been paying for 4 years, but it’s not because of the AIG bailout. We’ve been paying for 4 years because the errors were compounded by the uncontrolled bankruptcy of Lehman Brothers.

Hank Paulson at the time said they had no choice but to let Lehman Brothers go, and that the costs would have been too high to save LEH. But the bailout of AIG makes a mockery out of these words — the Fed’s actions prevented a very bad situation from becoming worse, and the Fed did it without taking a loss. Why wasn’t LEH bailed out in a similar fashion?

Clearly the investment banks got a very sweet deal from the AIG bailout, but I can’t help but argue that bailout was a far better choice than the alternative (being bankruptcy).

The AIG bailout was a good thing — letting Lehman’s go was a huge mistake.

Shouldn’t the special “notice” that the

IRS issued for AIG, worth $17.7 billion in

reduced corporate income tax, be noted when

discussing the net gain or loss to the US

Treasury on the bailout? The notice allowed

AIG to carry is gigantic financial crisis net operating loss into future years to offset against earnings when calculating tax liability. Ordinarily,if a company is taken over, as AIG certainly was, it looses the right to carry over losses incurred by previous owners.

(source)

Hard to believe that this could also cover the bailout of the AIG credit default swaps. That money is just a dead loss liability — $14 billion in cash given to Goldman Sachs alone. AIG had written $450 billion in CDS to 25 different institutions. The bailout provided 100% payouts on bonds that defaulted.

From memory, Econbrowser dealt with the amount of MBS purchased by the Federal Reserve Bank

An exposure of 1.2 trillion USD, it could be a situation where the derivatives would then look alike the underlying assets, that is to write the primary functions and this order.

From memory Econbrowser/ Bloomberg showed interest in in the MBS held by Credit Suisse bonus fund and associated return .From the same, the interest rates and currencies swaps with European Central Banks may have pacified the adamant potential sellers of comparable assets. The global exposure of many institutional punters on credit default swaps was threatening the preservation of the payment system.

Then voilà,compliance with the economic law of supply and demand and prices located at the intersection of the curves.The effect are large enough to shore up the accounts of AIG and subsequently its share price.

Still there is so much to be done with the Central Banks balance sheets carrying 18 trillion USD assets and so much to be contemplated when looking at the OCC report on derivatives.

“That these operations ultimately resulted in a profit rather than a loss for taxpayers is welcome news. As events turned out, the bailout of AIG proved not to be money just poured down a hole.”

What bailout? I see an investment, and a decent one. I don’t see any bailout.

Kosta,

The problem was not that Lehman was allowed to go bankrupt. The problem was that earlier Bear Stearns was bailed out. That added to Lehman’s recklessness because they assumed if their gamble did not pan-out they would be bailed out too, a clear and extreme case of moral hazard. Below is an excerpt of something I wrote in February 2010 about the timeline of TARP and the subsequent economic crash.

Bailouts drove 2008 deficit. How much has repayment kept recent deficits down?

@ Ricardo — I have two broad comments, one about moral hazard and the second about the damage caused by the Lehman bankruptcy.

Regarding the damage caused by the Lehman bankruptcy, the economic record is clear that up to September 2008 the US economy was struggling but tying to recover, whilst the fourth quarter of 2008 was dreadful with GDP contracting at a 9% annualized rate. What changed? Clearly the most profound difference was the Lehman bankruptcy and the subsequent freezing of the credit markets. Some people have claimed that the crash of 2008 was caused by political uncertainty over TARP; I don’t think those arguments are compelling and in any case TARP was a response to the Lehman bankruptcy.

I’m not sure that your argument based on the sample of DJIA data and events is compelling, particularly as you are missing one crucial event. On Thursday Sept 18, 2008, four days after Paulson let Lehaman go bankrupt, and two days after Bernanke used the Fed to bail out AIG), Paulson and Bernanke called an emergency meeting with congressional leaders, told them the world was ending, and got preliminary approval for a massive bailout which eventually became TARP. On that day, the stock markets were crashing in response to the Lehman bankruptcy but once news leaked out about the meeting and then with Paulson’s announcement of the bailout, the markets rallied.

Looking at the DJIA

Friday, Sept 12 Close, before Lehman goes bankrupt

DJIA closes at 11,421.99

Thurs, Sept 18 Low, before news leaks out of the impending bailout

DJIA low 10,459.44 — a drop of 8.4% from Friday’s close

Friday, Sept 18 Close, after Paulson announces that a bailout will happen

DJIA close 11,388.44 — a rally of 8.9% from Thursday’s low

The record clearly shows that the markets were collapsing after Lehman’s bankruptcy — and this prompted Bernanke to bail out AIG and Paulson to beg congressional leaders for a massive amount of money. We can discuss what happened in October as TARP, a direct response to the Lehman bankruptcy, struggled to be passed, but I think the Q4 GDP growth of -9% annualized says it all. The Lehman bankruptcy caused a huge amount of damage to the economy.

Regarding your initial claim that the problem was caused by the earlier Bear Stearns bailout leading to Lehman’s recklessness: I know where you are going with that and I agree that there is a moral hazard problem, but I categorically disagree that the Bear Stearns bailout led to the Lehman bankruptcy. Quite frankly, what happened to Lehman was baked in the cake well before Bear Stearns got bailed out — the reckless risks were built up over years, decades, and the moral hazard created by the Bear Stearns bailout played no role in the remaining events of 2008 (well, other than making it politically too difficult for Paulson to do the right thing and bail out/take over Lehman).

In deference to your moral hazard argument, I do agree that going forward there is a serious risk that the bankers will be reckless knowing that they will be bailed out like AIG was. But regarding Lehman — Bear Stearns did not play a role.

The record from the events of 2008 is clear. Government bailouts can be done without causing losses to tax payers. We can debate whether the returns are reasonable, or fair, but losses can be avoided. It is also clear that letting a large financial institution go into uncontrolled bankruptcy causes massive amounts of damage to the economy. While there is a moral hazard problem, the case remains that LEH could have easily been bailed out like AIG, and the damage to the economy would have been greatly attenuated.

Regarding the moral hazard problem, perhaps we should focus our attentions on ensuring that in the future, if (when) another bailout happens, that the people being irresponsible are held more accountable for the risks they took. Mind you, both Jimmy Cayne and Hank Greenberg, the CEOs of Bears and AIG respectively while the risks were taken, lost most of their personal fortunes when their companies were bailed out, but Joe Cassano, person at AIG most responsible for its failure, walked away with hundreds of millions of dollars.

One person who I would like to see held accountable is Johnny Mack, the CEO of Morgan Stanley, who received a stealth bailout from the Fed in the Fall of 2008 without being held at all accountable. That’s the action which troubles me from the moral hazard perspective.

Missing in the sequence of events the pari passu situation of the creditors of Lehman, namely who were the banks providing for the inter banks loans.

The autopsy revealed that JP Morgan had been jockeying for position and accumulating assets securities when lending shorter and shorter maturities.

Voilà, that is how the plug was pulled and how few banks and other creditors had to go for a complete write off when others did not.

The implications are multiple

Is the capitalist system so intact,that a bank may on its sole authority decide for account of the banking system and other creditors?

Is lending long term maturities to weak debtors the best practice?

When is a statement of accounts accurate?

@Kosta. quite interesting what you know.

John Mack has never been Paulsons friend, but he has a strong position at the China Investment Corporation, thats the fund managing some of the PRC foreign excchange reserves : Mack will be the last to be held accountable, but your moral hazard perspective is really appreciated.

Kosta,

We are in total agreement on the big dogs at the investment banks walking away with millions and billions.

We are not in agreement on the economic meltdown.

If you scenario was correct the market should have recovered after the House voted for TARP. Just the opposite happened. In the three days of trading sessions after TARP passed the House and was almost immediately signed by Bush the markets crashed almost 10%. That is a funny way for the market to say TARP was salvation.

TARP did not cause that horrible economic problems, that came from massive government interventions in the housing market. But TARP was the signal that the dam had broken and investors ran for their lives.

I actually think we are an impasse because we come to different conclusions looking at the same data. The one thing that is indisputable is that the most massive bailouts in US history have not corrected the economic problems. I think you would say they kept things from getting worse, but I don’t want to put words in your mouth. I would say they prevented recovery and things couldn’t have gotten much worse.

@Ricardo, I’m sorry, I probably did not make myself clear enough. I am not arguing that TARP was the solution to the fiscal crisis (although I did argue that the TARP announcement was sufficient to drive up the markets post Lehman bankruptcy for two days). What I am arguing is that a rescue of Lehman Brothers a la AIG would have been much more preferable than the uncontrolled bankruptcy that did happen. (I’m using rescue to differentiate from the TARP bailout).

What the resolution of the AIG rescue proves is that the gov’t could have intervened and taken control of Lehman without losing taxpayer dollars. If you recall, one of the excuses for Paulson not rescuing Lehman was that they could not justify put taxpayer dollars into that black hole. The AIG experience shows that the taxpayer investment could have been recovered.

There is a second argument for letting Lehman go which is moral hazard. I am of the position that avoiding the collapse of Fall 2008 is more important than the moral hazard concern.

Another place where we differ isn’t TARP. Rather it’s my belief that if Lehman had been rescued (like AIG or like Bear Stearns), rather than left to die followed by TARP a month later, there would not have been a crash. That’s my claim.

I also claim that given the evidence that rescues can be launched without costing taxpayers money, that in the future, avoiding a crash like fall 2008 outweighs the moral hazard problem.

What needs to be fixed is the accountability of the traders and management at the banks, not an aversion to bailouts.

Isn’t the story here that AIG did have the assets to honor its obligations, but that they were illiquid. That the govt. then provided that liquidity.

Given that it was also the govt’s idea to advantage Mortgage Backed Securities (through the Basel Accords) that provided the incentives, and that it was also the govt’s idea to encourage loans to less than strong borrowers (through the GSE Act of 1992, HUD’s Best Practices Initiative and the amendments to the CRA in 1995, the Clinton Housing programs) to encourage home ownership, it seems almost fair that the govt clean up the mess it created.

Btw, I seem to remember that the bailout of Lehman failed because the British govt wouldn’t acquiesce in it.

@ Patrick

The GSE Act, HUD and the CRA amendments were not the primary cause of the 2008 financial crisis. The subprime mortgages, the epicentre of the crisis, were originated by private institutions. Lehman Brothers (and the other investment banks) did not fail because of GSE mortgages, it failed because of subprime.

About the failed Lehman rescue, Lehman Brothers was a US bank holding bad US loans. The British gov’t insisted that the US Treasury provide guarantees for those loans before allowing the deal to go through (guarantees similar to what JP Morgan for taking over Bear Stearns). Given that the British would have had to bail out Barclays if the deal went sour (or if Lehman held more bad debt that known), you really can’t blame them for wanting those guarantees. It was an US problem, the US should have cleaned it up.

‘The GSE Act, HUD and the CRA amendments were not the primary cause of the 2008 financial crisis. The subprime mortgages, the epicentre of the crisis, were originated by private institutions.’

Depends on what you mean by ‘the primary cause’ (Scott Sumner makes a strong cause that was overly tight monetary policy). Now the sine qua non, that they clearly were.

The private institutions were refusing to make ‘subprime’ loans. That was the govt (actually the community organizations) gripe. The Boston Fed still has their infamous pamphlet “Closing the Gap” up on their website, explaining just what they expected private institutions to do to avoid charges of racial discrimination in home loans.

Without the government assault on the mortgage industry this would not have happened.

Kosta,

If our goal is to enrich the government then I understand where you are coming from. I will grant you that there is no business that can compete with the unlimited power of the government to set prices of the factors of production and to create monopolies and then compel consumption. So, yes, the government can always make a profit. Recall that the government engineered the absorption of Bear Stearns, dissolved Lehman Brothers, purchased AIG, and set the price for Merrill then forced BoA to buy it at their specificed price.

For me the goal is to generate a recovery in the private sector to restore growth and employment. Government intervention distorts price signals, wastes resources, and distorts consumer consumption. Normal economic signals become less reliable also wasting resources. Bankruptcy has a very important role in properly redistributing resources from inefficient and failed management to productive enterprises. When the government short-circuits this control it forces wealth into unproductive usage.

Paulson essentially destroyed 3 of Goldman’s previous competition. That is how established businesses use government to protect their interests.

@ Patrick

I don’t think your analysis would hold up to a careful analysis. There were private subprime lenders in the 1990, and in fact many of these lenders were unscrupulous, got shut down, but returned in the 2000s to fuel the financial crisis. Also, your original argument implicated the GSE’s, but these organizations were banned from subprime in the early 2000s, and lost market share during the housing bubble. So how can you blame the GSE’s for causing the crisis?

I’m quite skeptical of explanations of the financial crisis which identify pamphlets published in 1993 as major contributing factors but ignore the fraudulent behaviour of the originate-and-distribute subprime lenders of the 2000s, the corrupt practices of assigning AAA ratings by the credit rating agencies, and the foolish level of risk accepted by the bankers throughout the financial industry (like AIG in this story).

About Sumner, I’m not sure he argues convincingly that it was overly tight monetary policy in the Fall of 2008 that caused the financial crisis, although he does argue profusely. But even if we accept Sumner’s claim that overly tight monetary policy Q4 2008 (or maybe H2) caused the crash, why was monetary policy too tight? Was is because the Fed suddenly jacked up rates like Volker in the early 1980s? Or was it because the “required” interest rate all of a sudden plummeted and the Fed took too long to respond? For Sumner’s story to work, something had to happen which the Fed failed to properly respond to. Well that something was Lehman going bankrupt.

@Ricardo – there are pros and cons to government action, just as there are pros and cons to market systems. For instance, a major problem with markets is that they often yield very undesireable results and require government intervention to operate properly. Heresy you say as I claim the requirement of government intervention. But this is accepted by everyone. A totally unregulated market can, and often does, turn into a monopoly. Everyone agrees that monopolies are normally very bad, and what do we do? We get the government to intervene to prevent their formation and force their breakup when needed.

Given this evidence, I just don’t understand why people think it is at all controversial that governments need to intervene to ensure that markets function properly.

Going back to the crash of Q4 2008, it’s pretty clear that the markets broke down and that they couldn’t clear themselves. In fact, I would argue that the markets are still broken and can’t clear themselves — how else can you explain a negative interest rates without acknowledging the markets are not functioning properly.

We all agree that in cases of monopolies when the markets aren’t functioning properly, the gov’t should intervene. So why do we have this problem acknowledging that in Q4 2008 the markets stop functioning and gov’t intervention was needed?

If I recall correctly, the bailout did not involve the AIG shareholders being written down to zero (which would, with only government shareholding left, have amounted to nationalisation), as was surely reasonable in the case of such a complete collapse. So the US government could have made even more money and done more to reduce moral hazard, had nationalisation been considered acceptable. And Lehman should have been nationalised too; allowing an uncontrolled default was crazy.

Kosta, it would take a book to respond to all the misunderstandings in your response, but;

‘Also, your original argument implicated the GSE’s, but these organizations were banned from subprime in the early 2000s…’

I can only laugh. Where did you get that, from Paul Krugman?

‘…and lost market share during the housing bubble.’

They lost market share because of the accounting scandals.

‘So how can you blame the GSE’s for causing the crisis?’

I didn’t, I blamed the govt for responding to the community organizers who spent 15 years (from 1977) harassing the GSEs into expanding into subprime (broadly defined). That was a small part of the mortgage loan market until the legislation of the early to mid 1990s. Eventually it became about half. Which never would have happened without the govt. virtually mandating it.

Kosta,

My challenge to you is to name one monopoly that did not have government involvement to create the monopoly. You have proven to be a very thoughtful person so I ask you to answer this carefully. Monopolies, other than with some rare natural resources, simply do not arise in a free market.

You wrote: “Going back to the crash of Q4 2008, it’s pretty clear that the markets broke down and that they couldn’t clear themselves. In fact, I would argue that the markets are still broken and can’t clear themselves — how else can you explain a negative interest rates without acknowledging the markets are not functioning properly.

I agree that the market signals are broken, but you and I differ as to the cause. The markets have been distorted by government intervention usually for a perceived social purpose.

To use your example, a market rate of interest would never be negative. You can only have a negative interest rate if the government intervenes. This is because in an unhampered market those lending money would never lend at a rate where they would have to pay the borrower. It is simply illogical in a free market. Think about it. Only the government would pay someone to borrow in an effort to stimulate. A lender could care less about stimulating. He wants to make money.

You ask, “We all agree that in cases of monopolies when the markets aren’t functioning properly, the gov’t should intervene. So why do we have this problem acknowledging that in Q4 2008 the markets stop functioning and gov’t intervention was needed?” No, we don’t all agree because the monopolies that caused the problems were created by government. (See my question above.) Government intervention in 2008 was an attempt by government to correct problems created by government.

This is standard operating procedure for government. It perceives a problem. To correct the perceived problem government action creates a bigger problem. Rather than solve the new problem by ending the previous government intervention the government compounds the problem by additional intervention. The best way to correct problems caused by government intervention is to end the intervention not compound it with additional intervention.

A little thought problem for you. The claim by government is that they know better what the market signals should be than the traders who are making the trades know in a free environment. How can you measure if this is true? Obviously, you must ask the traders. But by intervening the government by definition makes on trader better off and the other worse off. Now, if that is the case and if there is a free market, the trade will not take place because the trader who loses will not enter into the trade. But the government can force the trade. Once again we must ask how can you measure if this is a better trade? What has happened is called crony capitalism, government intervention benefits one trader at the expense of another. You may object to the analysis but if both traders benefit there would be no need for government intervention.

Yes, each of the traders is attempting to trade to his benefit, but no trade will take place unless both perceive to gain. Government intervention by definition places a wedge in the trade and gives preferential treatment.

Only Progressives have the hubris to believe that they know more than free traders.

@Patrick,

As you point out, the GSE’s lost market share [in part] because of the accounting scandals. These scandals resulted in restrictions being put on the GSEs. In effect, they were banned from certain activities in the subprime market. Thank you for providing a source for my “banned” statement.

How is it relevant that community organizers encouraged GSEs to expand their affordable housing

goals? GSE mortgages performed significantly better than private label mortgages in the housing crisis. As you also pointed out, the GSE’s lost market share during the housing boom. So not only were there less GSE mortgages, but they did not default at anywhere close to the rate of private label mortgages. Yet, somehow, these mortgages were the primary cause? I don’t get your logic.

Lastly, Paul Krugman is a prof at Princeton and has won a Nobel prize. He has more credibility than you and I put together. The fact that you would use Krugman as a put-down speaks volumes to you pre-conceptions and ability to have an honest debate.

@Ricardo

Let me be clear, I am arguing for a mixed economy which includes free markets when appropriate and gov’t intervention when free markets fail. Now I claim that the vast majority of people who think about economies accept that economies must be mixed. Where people differ is the degree to which the gov’t is involved in the economy.

Putting aside monopolies for a moment, it is clear that free markets can not function without property rights. Gov’t is needed to enforce those property rights. So at least on that level, gov’t is needed.

Regarding your monopoly question, well, since every market system requires a gov’t (to at least enforce property rights), it is impossible to find a monopoly that somehow operated without gov’t involvement. But more to the point, monopolies that come into being on their own invariably exert influence over the gov’t to become the monopoly or maintain the monopoly. How about Rockefeller’s Standard Oil as an example of a monopoly? I don’t know much about Standard Oil, but I do know Rockefeller used unfair business practices to establish his monopoly. I would not be surprised if during that period, Rockefeller lobbied the U.S. gov’t to aid the expansion of his business.

I do accept your point about monopolies — what I stated is correct in theory, but in practice, finding a good example of the market breaking down on its own by forming a monopoly is difficult.

However, gov’t intervention is still required for the proper functioning of markets at least to deal with issues of externalities, or issues with public goods. Or are you going to take the position that free markets can regulate themselves in all circumstances?

About negative interest rates, I disagree with your claim that they only occur due to gov’t intervention. They also occur when people/institutions are afraid of losing their capital but need to put their money somewhere. In these circumstances, the lenders are willing to lend to safe borrowers (i.e. U.S. gov’t) at negative rats. This is what happened after Lehman Brothers went bankrupt. Institutions were afraid to deal with each other, for fear of losing their capital, so they buy U.S. Treasuries at negative yields (in real terms, and occasionally in nominal terms).

Moreover, negative real interest rates still persist for the U.S., U.K. and Germany. This is not a product of gov’t induced distortions. Rather this is the result of institutions being afraid to invest anywhere else but in these safe gov’ts, which drives down the rates to negative levels (in real terms). Mind you I suppose you could counter by noting the Fed and BOE own a lot of gov’t debt, driving down rates. But is this also true for Germany? I don’t think the ECB has purchased German Bunds.

These negative real rates are an excellent example of the market not being able to clear itself. They should not exist in a properly functioning market, we agree on that. I think the point we’re stuck on, and the point we’ll have to agree to disagree, is on why the rates became negative.

I agree with you that the gov’t action causes distortions, and moreover that in many cases these distortions are unproductive (in some cases, such as externalities, they are necessary). However, in Q4 2008 the rates became negative because Lehman Brothers failed and market participants ran for cover investing only in safe assets, driving the rates for safe assets to negative levels in real terms. This flight to quality also drove down the price of risky assets. Given that risky assets were on most participants’s balance sheets, this led to institutions become less solvent and more risky which only increased the flight to quality.

This is the market breaking down by itself, not because of gov’t induced distortions, but because market participants have become overly risk adverse. That is my thesis.

I’m happy to discuss with you what caused this market failure, or what potential cures there are for this situation, but there’s probably not much point unless we agree on the nature of this market failure. Do you agree that the market broke down because market participants fled for quality? Or should we agree to disagree at this point?

Really, nobody mentions that AIGs losses were limited by all of the other housing interventions?

AIG makes giant bets that housing will not crash.

Housing crashes.

The government takes over AIG (private bankers, OK you go with that).

The government invests trillions in propping up the economy by holding rates low (90 pct correlation 10year UST vs 30 year mortgage), directly stimulating first time home buyers, banning forclosures, absorbing 4 years of GSE losses and running a refi program for underwater borrowers…

Nobody thinks those factors had any effect on the result of AIGs bad bets?

We like to calculate the “full cost” of things we do not like, and calculate the technical cost of things we do. Surprise, the UST likes its own decisions.

Let’s look at China. China sold Agencies, Implicitly Guaranteed, and bought Treasuries, Explicitly Guaranteed. Now, they did this, atnpreaply, after the way that Fannie/Freddie was bailed out, and Lehman was allowed to fail, and WaMu was seized. China immediately stated that they had previously believed that these implicit investments were really explicit. After they heard that we might haircut the bondholder’s of banks, they stated this point even louder, and threatened negative consequences.My answer, and Geithner’s, was to guarantee everything. Explicitly. Now, were there any negative consequences to China’s shift from Agencies to Treasuries? In my opinion, there were. For one thing, it was part of a massive deflationary flight to safety that almost led to Debt-Deflation. Had that occurred, unemployment could have doubled, from these current levels. The point is that no one knows.If the question is whether or not these banks are guaranteed, the answer is yes. See, we deregulated, but also guaranteed, these big banks. Does that remind you at all of the S & L Crisis, which was a bipartisan foul up, which is why it never really came up in the 1988 election. Neither party could get an advantage from the issue.The Federal Government will never allow Debt-Deflation, or a serious threat of it. That reality, combined with the fact that we have a Lender of Last Resort, the Fed, and, now, the Treasury and FDIC as well, mean that we will always have guarantees going forward. The answer, then, needs to be regulation. Since I’m no big fan of regulators, I prefer Narrow/Limited Banking on the one hand, and an insured Investment Industry, on the other. Either self-insured, or by government. This part of my view is very close to Gorton’s view.Without these kind of changes, we’ll be back here again soon. I’m sorry to have such a jaded view of regulators, but these foul ups just keep coming. Hence,although I used to favor Bagehot on Steroids, meaning a very tough regulator, I just can’t seem to believe in that possibility any longer.