Quick links to a few items I found of interest.

The Obama administration has delayed a decision on the Keystone XL pipeline until after March.

Now there are two private companies in the race to make commercial use of asteroids.

Doug Mataconis summarizes the House proposal to temporarily ignore the debt ceiling this way:

the House plan would essentially make the debt ceiling meaningless for more than three months. Presumably, they are doing it this way so that legislators who support it could still say, albeit with a limited amount of credibility, that they didn’t vote to raise the debt ceiling…. in some sense, the GOP is essentially conceding the argument of those who have advocated getting rid of the Debt Ceiling altogether.

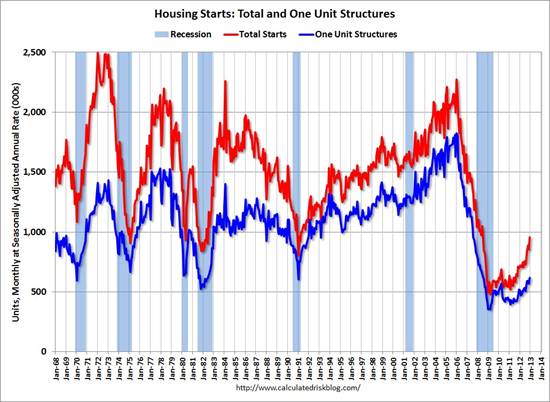

Bill McBride looks at household balance sheet repair and the housing rebound and declares, “the future’s so bright, I gotta wear shades.”

|

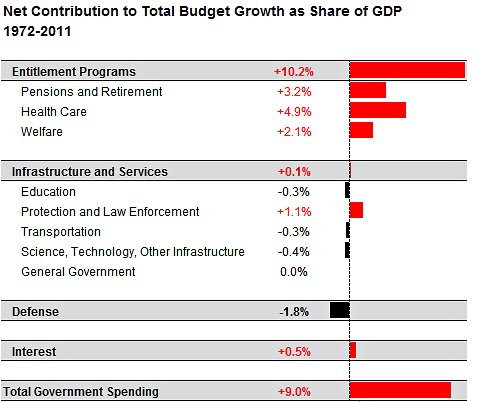

Nate Silver offers this graphic summarizing changes in federal, state, and local government spending over the last 40 years.

|

Well now, if Mr. McBride would show those household debt levels including allocated govt debt, then we’d have a clearer picture, wouldn’t we?

The 538 piece is excellent. Straight-forward analysis, minimal spin.

While defense spending as a percent of GDP is down from where it was in the late Vietnam era, it’s a good idea to keep in mind that today’s defense spending is a completely different animal from your grandfather’s defense spending forty years ago. Forty years ago military personnel costs constituted over 37% of defense spending…at that at a time when much of the military was still full of draftees who had not yet completed their obligations. What would the personnel costs have been if those draftees had been paid market wages in an all-volunteer military? We can get a good idea by comparing personnel costs in the mid to late 70s with personnel costs in the early 70s. Almost doubled overnight. Today’s military is very capital intensive. Even with high pay today’s personnel costs only account for 22% of national defense costs. The military of yesteryear was labor intensive and mainly drew from the labor pool. Today’s military sucks capital investment and R&D talent from the civilian sector. Which military represents a greater burden on future GDP growth? You decide.

Also, should we charge the cost of veterans care to defense spending or to entitlement spending? Forty years ago a GI who suffered severe trauma and wounds was likely to die on the battlefield. That was a loss for the GI and his family, but for the green eyeshade types there were no further costs. The good news is that today’s GI is very likely to survive even the most horrendous wounds that would have killed a soldier forty years ago. The bad news is that society will have to pay an ongoing bill. Shouldn’t we charge VA costs to defense spending rather than to entitlement transfers?

And here I thought the commercial use of steroids was a major achievement.

Steve K,

Clearer? No. McBride has offered one debt aggregate. You want him to use a different aggregate. In either case, only one series would be on view, so there would be no more detail, and so no more clarity.

It might serve a polemic purpose to blur the distinction between public sector debt and household debt, but it would not provide greater clarity. We might better combine household debt and corporate debt – at least they are both forms of private debt.

on the household balance sheet repair:

“During the last five years, U.S. individuals have walked away from a staggering $585 billion in mortgages, credit card debts and other personal loans. That works out at about $6,000 per household…

According to the Federal Reserve, U.S. household debt peaked five years ago at a gigantic $13.8 trillion. Since then it has declined to $12.9 trillion — a decline of about 7%.”

Steve Kopits:

What would be the point of allocating government debt to households? Don’t corporations pay taxes as well?

Remember, net debt levels in the economy as a whole will always amount to zero. It matters very much how that debt is distributed.

Someone forward the last link to Menzie. Last I heard he still thinks the budget problems are largely cyclical.

RJS, we are all deadbeats now. My biggest source of junk mail and junk calls is collectors looking for the folks who used to have my various phone numbers or own or rent my various homes.

Interesting project the exploitation of asteroids but the round trip must be expensive Looking at the chemical classification of the asteroids few are of immediate interest , the said silicaeous holding nickel, iron and magnesium silicates. The bright asteroids are as well of industrial interest, pure nickel and iron.

Now that astraunomists, technicians, engineers, physicists, have made it possible, this project needs to amortize their meal plans.

Start listing the main chemicals components on a derivatives exchange (free of charge just a little margin) prime pump the price of nickel, iron, magnesium silicates etc

Start listing asteroids and claim property and property rights

Implications: Go long all the asteroids in the classification S-types M-types

Go long nickel iron magnesium silicates.etc

Start lobbying BIS for an exclusion of derivatives in the balance sheets .

Start lobbying the central banks for discounting the commercial papers linked to the commercial projects. Ensure they provide enough liquidities to « the system« .

If and when every sub sets are in place,then claim for bonuses

Bloomberg

“Deutsche Bank Trader Fired Over Rate-Rigging Loses $53 Million bonus”

As regards debt and McBride:

The government has dramatically leveraged up even as households have modestly reduced their debt levels. This increased government debt has not yet translated into material “debt servicing” for US households, but it surely will. As a result, I don’t think that we can really be unabashedly enthusastic for the household outlook when additional calls on household income for government debt service are still likely. Put another way, I think we might broadly agree that the US without its large debt overhang would be in better shape than with it.

There are a number of means to allocate debt back to households, for example, simple per capita, by income cut, or via corporate impact. But at some point, US government debt is essentially owed by US households.

Consequently, I don’t think you have really have a full picture without considering both household and government debt.

Steven Kopits How exactly do you propose that households deleverage debt without finding an outlet for their savings??? It would be great if the private sector businesses wanted to absorb that household saving, but private sector businesses are sitting on almost $2T in cash in US banks and almost $4T in near cash in overseas accounts. So again, how exactly do you propose that they deleverage if the government doesn’t borrow? Or are you of the “stuff it in a mattress” school of economics?

2slugbaits,

Households will have to make due with what they have. They’ll continue to service their debt to more sustainable levels before they can start saving. Some will struggle more than others. It isn’t the responsibility of private-sector businesses in better fiscal positions to invest if they are going to get receive modest returns at best due to low interest rates and poor tax incentives.

One can argue that the large financial institutions bare a social responsibility to forgive debt or maybe government to provide a meager stimulus to relieve the pain. But, that is highly unlikely now that we see the economy start to recover towards the later half of this year.

The only problem here is that the people are wanting short-term solutions vs. long-term sustainability. Time is the cost of deleveraging. These cycles last 5-10 years and we’ve only gone through 3 so far. In your solution, who do you propose will “pay”? Because someone has to make the sacrifice if you want to see more tangible results.