Here I comment on some recent developments affecting the prices of WTI, Brent, and gasoline.

West Texas Intermediate is a particular grade of crude oil whose price is usually quoted in terms of delivery in Cushing, Oklahoma. Brent is a very similar crude from Europe’s North Sea. As similar products, you’d expect them to sell for close to the same price, and up until 2010 they usually did. But an increase in production in Canada and the central U.S. combined with a decrease in U.S. consumption has led to a surplus of oil in the central U.S. This overwhelmed existing infrastructure for cheap transportation of crude from Cushing to the coast, causing a big spread to develop between the prices of WTI and Brent.

|

The Seaway Pipeline last month

completed a capacity upgrade to move 400,000 b/d from Cushing down to the Gulf, though there have been some initial additional temporary infrastructure challenges with processing that new flow at the receiving end. The Gulf Coast portion of TransCanada’s Keystone Pipeline Project is expected to be moving an additional 700,000 b/d from Cushing to the Gulf by the end of this year. That’s going to happen regardless of whether President Obama decides to approve the separate northern portions of the Keystone Project, though political

and legal obstacles could still slow completion of the Gulf Coast portion as well.

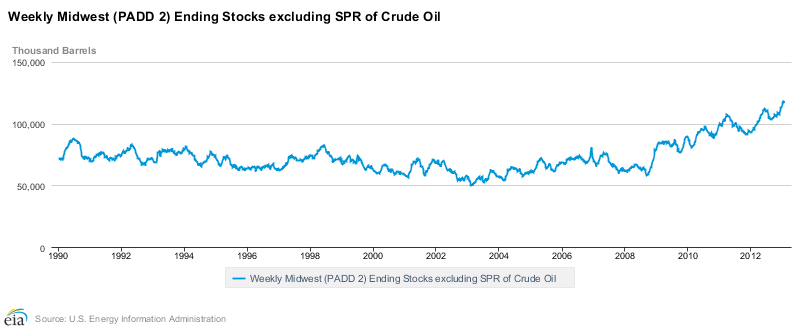

Eliminating the Brent-WTI price differential would require that any arbitrageur could buy another barrel in Cushing and transport that additional barrel to the Coast at low cost. We’re still a long way from that. We need not only to balance current flows of supply and demand, but also to work down the inventory of oil that has piled up in Cushing. Commercial crude oil inventories in PADD2, the oil district including Oklahoma, today are 50 million barrels higher than they were in 2008.

|

Until we reach that point of having the logistical ability to transport easily as many barrels as desired out of Cushing, the only way for the Brent-WTI price gap to close is if the extra supply delivered to the coast is enough to actually bring down the world price. We may reach that point if we had capacity to move both the daily new flow and all the existing pool, but we’re not there yet.

In the mean time, up to this point we have had adequate infrastructure to refine the oil domestically and transport the refined products (which move through separate pipelines from the crude) to the coast. That means the Law of One Price is much closer to holding for refined products, with U.S. refiners buying the cheap WTI, and shipping the refined product for sale throughout the world. Indeed, as Mark Perry noted, fuel oil and petroleum products were the two top U.S. exports in 2012, contributing $117B to GDP.

The average retail price of gasoline in the United States historically has tracked the price of crude oil pretty closely, with each $1/barrel increase in the price of crude oil showing up as a 2.5-cent increase in the retail price of a gallon of gasoline. But the fact that the U.S. can sell refined petroleum markets at the world price means that for purposes of using that rule of thumb today, you’d want to look at the price of Brent rather than the price of WTI.

|

This winter the U.S. retail gasoline price fell significantly below the value predicted on the basis of this historical relation. It’s caught partly back up over recent weeks, though still has a ways to go. Based on a current Brent price of $118.66/barrel, you’d expect an average retail gasoline price of $3.80/gallon. With the current price only $3.59, we’ve got another 20 cents to go.

|

|

| New Jersey Historical Gas Price Charts Provided by GasBuddy.com |

Professor Hamilton,

Is there a specific reason you start your analysis in 2000 rather than 1990? I notice that a regression relationship of oil prices to gas prices is not quite at “tight” if data is used back to 1990. Also, I notice that as oil approaches a price of about $128/barrel, the price of gas starts to wander down away from the linear trend line. Are these questions worthy of comments for amateur econometric enthusiasts?

Thanks,

AS

Thanks JDH!

One small comment: Shipping more oil out of Cushing will unlikely bring down the world price but rather push western North American prices up closer to global prices.

Here is what I do not understand about this.

Why are we (US) exporting crude or refined products and then turning around and importing crude/refined products from the Middle East?

Is the producer buying crude from Crude from Cushing at WTI prices? If so, why would they transport outside US and incur all those shipping charges when they could make a mint by turning around and selling the same product at home (US) based on Brent prices (this is assuming other crude products follow the same pricing structure as gas)?

Are we exporting gasoline too?

Obviously, I am missing something here. An explanation would be greatly appreciated.

Rob: Many of the U.S. refineries are on the coasts. We don’t have enough pipelines to carry the crude oil from the central U.S. to the coasts, so those refineries have to pay the Brent cost to import expensive oil from overseas.

We do have separate pipelines that can carry gasoline from the central U.S. to the coasts. So what the Midwest refineries do is buy the U.S. crude at WTI price, ship the gasoline to the coast where it goes on a tanker for export at the world price.

The reason we have enough pipelines to carry the gasoline but not enough to carry the crude is because the system was set up under very different assumptions about supply and demand for crude and products and we have taken too long in building the infrastructure that would be appropriate for the new realities.

“Ten of the 11 recessions in the United States since World War II have been preceded by an increase in oil prices. Does the recent surge in oil prices mean we should be looking for recession number 12?”

J. Hamilton

JDH: Thanks…that was very helpful and also very frustrating.

So let me take a wild guess…

If we built the piplines we now need, we could employ lots of people and, once completed, lower the energy costs of the entire population.

But, we are not doing this because of politics.

I am sure that is oversimplified…

Rob, I like your comment. It does seem as if putting in the needed pipelines would only benefit our country through increased employment, greater supply and hopefully lower prices. Since this is a political issue, I assume that as you said we are over simplifying. However, I wish someone would explain why our thinking is off.

“But, we are not doing this because of politics.”

I would say there is a bountiful stew of legal and property issues associated with construction of transnational pipelines, and the requisite centralized effort to make such a project happen is probably not held by any single player in the private sector.

That’s a longer version of “You’re probably right.”

Here is an EIA link to the most recent (four week running average) supply data:

http://www.eia.gov/dnav/pet/pet_sum_sndw_dcus_nus_4.htm

The EIA shows (for the most recent four week running average) that we produced 7.0 mbpd of crude oil (Crude + Condensate) and we (net) imported 7.7 mbpd of crude oil, which were combined into a input of 14.4 mbpd of crude oil into US refineries (because of inventory changes, the sum of imports + production does not exactly match input). So, US crude oil production is currently accounting for about half of the crude oil feedstock required by US refineries.

If we look at total net imports (total liquids), we (net) imported 6.7 mbpd. Net total imports were basically 7.7 mbpd of net crude oil imports less 1.0 mbpd of net product exports = 6.7 mbpd of net total liquids imports.

Regarding Oil Prices

After falling somewhat, the latest Bloomberg data put the WTI crack spread back up at about $30 per barrel, and the Brent crack spread at about $12, a difference of $18, which is quite similar to the current gap between the WTI price and Brent price ($20).

The crack spread is the gross profit per barrel that refiners make from buying and refining a barrel of crude oil.

The bottom line is that US Mid-Continent refiners are paying WTI prices for crude, but basically charging product prices which are much more closely linked to Brent, as evidence by the $18 difference in crack spreads.

IMO, when Mid-Continent producers get improved pipeline access to coastal markets, the price they get for crude will go up, and the crack spread will go down, but I don’t think that consumers will see any real difference.

IMO, the macro trend continues to be that net oil importing OECD countries are gradually being shut out of the global market for exported oil, as developing countries, led by China, consume an increasing share of a declining post-2005 volume of Global Net Exports of oil.

Some major net exporters, e.g., Canada, are showing increasing net exports, primarily as a result of increasing production from unconventional sources.

However, Canadian net oil exports should be put in the context of regional data, and combined net oil exports from the seven major net exporters in the Americas in 2004 (Canada, Mexico, Venezuela, Colombia, Argentina, Ecuador and Trinidad & Tobago) fell from 6.1 mbpd in 2004 to 5.1 mbpd in 2011 (BP, total petroleum liquids). In other words, rising Canadian net oil exports have so far only served to slow the post-2004 regional decline in Western Hemisphere net oil exports.

And of course, many people believe rising production from shale resources around the world will result in an indefinite increase in global crude oil production, which perhaps might offset the ongoing post-2005 decline in Global and Available Net Exports. However, it seems unlikely to me that a production base with a steady increase in underlying decline rates, and with thousands and thousands of shale oil wells quickly headed toward striper well status (10 bpd or less), will be able make a material long term difference in the global net export situation, especially in the context of rising demand in the developing countries. In addition, operating costs in most other prospective shale plays around the globe are higher, and frequently much than in the US Lower 48.

I have frequently used the Titanic metaphor. The Titanic hit the iceberg at 11:40 P.M. on the evening of April 14, 1912. At midnight, only a handful of people on the ship knew that it would sink, but that did not mean that the ship was not sinking. The Titanic’s pumps helped, but they could not fully offset the flow of seawater into the ship. In my opinion, rising US crude oil production is to the ongoing decline in Global and Available Net Exports as the Titanic’s pumps were to the flood of incoming seawater, i.e., the Titanic’s pumps made an incremental difference, but not a material difference.

Looking at the chart correlating Brent crude and U.S. retail gasoline prices, gasoline price deviations above the value predicted seem to happen in summer months whereas deviations below the trend predicted seem to occur in winter months. Could this be related to summer and winter refinery formulation changes? Summer blends are typically scheduled to begin in March, so perhaps we will return to the predicted values by then.

Extremely interesting! JDH: Yours is the most cogent explanation of this phenomenon I’ve seen. Might I say that if you were to strive for this kind of deeply researched and compactly written result in all things, you would rise to the level of a Stephen Jobs. Rob: Your words, while on the right track, give away your thought process. “But, we are not doing this because of politics.” The plural we ought not even have to be thought of in regard to moving a project like this forward. I say “ought”. For if it is the economically sustainable thing to do, the market ought to do the job. If I will not grant pipeline right-a-way on my property, my neighbor surely will. Once removed then, it is all levels of government including Federal who put their finger in the pie to take away some of the fruit. We elect these people. What is happening is government intrusion, and I’m hardly talking about reasonable permitting.

Mary Kaplan: A very sagacious continuation of the thread. Your request is: I wish then someone would explain why our thinking is off. This gets us to the core, and by induction to much of what is wrong with America. It is not so easy to formulate the answer to this. But be sure it is beyond economics. I do not know the name of the sphere in which it resides. So grant me the liberty of calling it the sphere of the grassroots. Simply put, if the public were informed in a way I judge you have been by Jim Hamilton’s explanation, they wouldn’t stand for it. Not one moment. The necessary permits would be granted pronto or heads would fly, those of elected officials and unelected bureaucrats alike. Hence we come to where Harry Truman’s buck stops. The grassroots must become informed; all will then follow in due course, on this and every other issue facing America.

I have tried here to plant a new thought. People are not stupid. But for self-serving reasons all, neither the economics profession, nor the media, nor politicians who want only to retain office, nor corporate behemoths who are in it for the money, nor sundry others are aiding the vital task of informing the public of the whole story, pro and con. Vested interests, each have a thumb in the sugarplum pie, and do their best to keep the public uninformed. Who amongst the elites running this country is that honest man Diogenes was searching for?

Why are we (US) exporting crude or refined products and then turning around and importing crude/refined products from the Middle East?

Is the producer buying crude from Crude from Cushing at WTI prices? If so, why would they transport outside US and incur all those shipping charges when they could make a mint by turning around and selling the same product at home (US) based on Brent prices (this is assuming other crude products follow the same pricing structure as gas)?

With a constrained oil supply, China has bid away US consumption, which has fallen by about 3 mbpd since its peak in 2005.

This has created surplus refining capacity in the US. Such capacity may be dispatched one of two ways. First, it can be idled, a trend which we have seen particularly on the US East Coast.

Alternatively, the refinery can be re-purposed to serve the export market, and about 2.8 mbpd of refined products are exported daily, up about 2 mbpd from 2005 levels (when the oil supply stalled).

Thus, in very broad terms, US oil consumption has fallen by 3 mbpd, and exports have risen 2 mbpd.

Using US spare capacity for export makes sense because in some cases it’s cheaper, even with transport costs, than building a new refinery in, say, Latin America.

Over time, however, US refining capacity is likely to erode. But for now, a portion of otherwise unneeded US refining capacity has found a new lease on life serving export markets.

I was speaking to a senior energy lobbyist in DC earlier this week. He was blunt: “What’s the incentive for Obama to approve Keystone? Do his supporters want that? He’s certainly not running for re-election. My take: If he wanted to approve Keystone, he would have done it before the election, when it had the maximal electoral impact. If he didn’t do it then, why would he do it now? Keystone’s not going to get built under the Obama administration.”

Steven Kopits That lobbyist’s clients deserve a refund. Obama held the southern leg of the pipeline as a negotiating chip and cashed it in when he needed it…and not one day sooner. Why give away something for nothing? I think you’ll find the same is true with the northern leg of the pipeline. Obama will be facing some very tough battles and he controls something that the GOP wants very badly. We know how this is going to play out. The pipeline will be slightly re-routed around sensitive aquifer points, but ultimately it will be approved.

Oil is only valuable because it’s a cheaper energy storage solution than the other options for now.

As Bush was fond of saying, oil is a matter of national security. The time that it takes for the finite supply of domestic oil to be exhausted to the degree that it would hamper the military’s ability to defend the nation needs to be balanced against the time and cost requirements to transition to alternative energy storage solutions. Fertilizer production is also petroleum dependent.

Maybe the profit to be made 5 years from now without Keystone will be overall greater than with Keystone.

Maybe defending and feeding the nation is more important than short term profits.

Slugs –

If you’re interested in jobs, then you build Keystone. It’s not a chip, it’s an opportunity. If you don’t care about jobs, then why build Keystone? The portion under question here is the part linked to Canada.

Senior Republican energy staffers I have spoken to have taken the view that there is a 60/40 chance the pipeline is approved, with a 50% or better chance it is approved with such conditions that it is litigated to death. That gives us a net 80/20 chance it’s not built under the Obama administration.

So the optimists on the Republican side give it about net 20/80 chance of Keystone being built under Obama; the pessimists view the probability as approaching zero.

I don’t have a horse in this race. Just telling you what I have heard.

2slugsObama held the southern leg of the pipeline as a negotiating chip and cashed it in when he needed it…and not one day sooner. Why give away something for nothing?

And OH MY, how the left does howl and whine when the right uses this tactic. 🙂

Steven Kopits Your first mistake was in talking to Republican staffers. My experience has been that all staffers are dumb as fenceposts, but GOP staffers especially so. That wasn’t always true back in the day of career staffers; but today being a staffer is just a pit stop on the way to a lobbying job.

The jobs from the Keystone pipeline are important, but should not be the only public policy goal. I’m part of the LBJ clan so I see something like Keystone as a chip begging to be cashed at just the right moment.

Slugs –

The staffers and lobbyists I talk to are all sharp as knives, but you’re right, they are just about all Republicans.

Interestingly, I have offered to present to Democrats, and indeed, my macro oil and gas presentation is quite popular with the renewables crowd. (I am to go-to guy for AWEA on the impact of oil and gas on renewables.) At the Center for American Progress, however, I couldn’t get past the receptionist. You’ll recall Podesta and Browner’s article against Alaskan drilling–this is a reflection of their search for data, I suppose.

I’ve also offered more than once to present to Democratic staffers. I’ve no bites so far.

But I am trying. I am scheduled to present to DOE / EIA analysts on supply-constrained forecasting, and I am more than happy to address any Democratic group willing to entertain me.

At the end of the day, the data doesn’t care about your ideology, your preconceptions or your mood affiliation. We develop models and see if they fit the data, whether they represent a coherent narrative, and whether they continue to do so over time. If they do, then we continue to use them. If not, we modify or discard them. Right now, our models of oil demand and prices are the best in the business.

Oh, and by the way, don’t imagine that Republicans are always that thrilled with what I have to say. I try to interpret that data in the way that seems to make the most sense to me, but there is both room for disagreement and sometimes the wish that the data said something it doesn’t.

I see this crack spread becoming a vicious cycle. The longer the spread persists, the more ex-NA producers will scale back their production to only their lowest cost wells, which in turn pushes crude prices up. But any Brent price increase will likely increases WTI price too, leading to more production in NA. I don’t see this crack spread narrowing anytime soon unless there is a sudden drop in global oil demand. In fact, I think the crack spread will only increase, leading to shut down of some projects. I think the big integrated oil companies with global footprint will invariably hurt by this.

I was coming actually more from a discussion, whether gasoline prices in Germany are competitive market prices, and some socialists /population wanting to control them.

You can predict the prices actually pretty good from New York prices for Brent and Euro, but after a number of refineries closed in Central Europe in the last 3 years, there was an interesting effect from March to October 2012, the price delta between incoming and retail prices went up by 7%, when the former petroplus went bankrupt and off production, until the liquidator sold it to a russian investor.

I actually believe that you can see at least half of this effect in a similar delta for the US market, but the data need more remarks.

Since I do not have any financial interest in this, I can share the analysis with people interested in.

Whatever the russian and german government agree on, has impact on your market too.