What accounts for the sharp spike in unemployment during recessions? And why did the unemployment rate recover so slowly after recent recessions? I’ve been looking into these questions with UCSD Ph.D. candidate Hie Joo Ahn, and we’ve just finished a new research paper summarizing some of our findings.

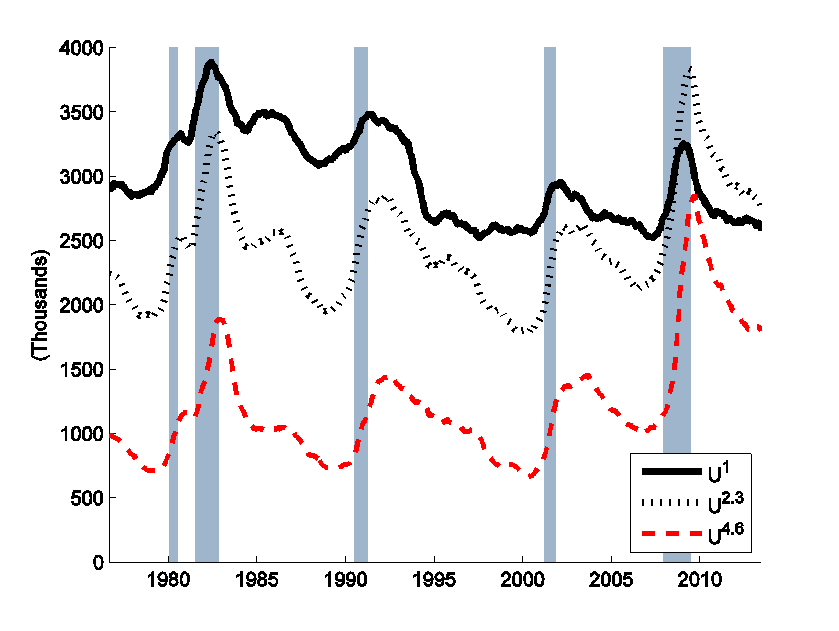

One of the interesting details behind the unemployment numbers reported by the Bureau of Labor Statistics is a question that asks unemployed individuals how long they’ve been looking for work. The graph below plots the number of Americans each month who say they’re newly unemployed (U1), are unemployed and have been looking for 2-3 months (U2.3), and those who have been looking 4-6 months. Note that longer-term unemployment rises more sharply during recessions.

Source: Ahn and Hamilton (2014).

If you’ve been looking for a job for 2-3 months, it means you would have been newly unemployed 1 or 2 months ago. From the average values of (U1) and (U2), you can calculate that on average about half of those who are newly unemployed either found a job or dropped out of the labor force the following month. On the other hand, by comparing (U2.3) with (U4.6), you find that on average something like 63% of those who have been looking for work for 2-3 months will still be looking the following month.

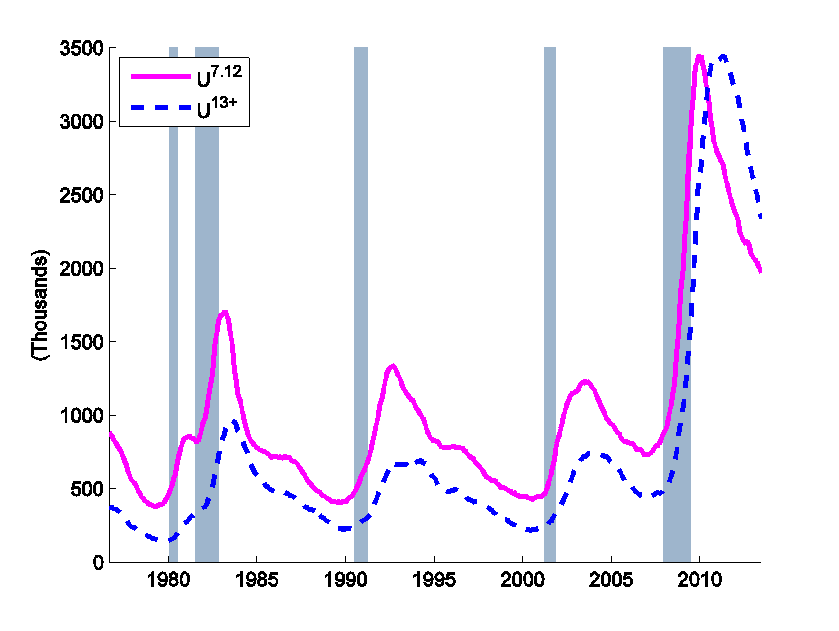

The number of people who have been looking for work for 7-12 months (U7.12) and more than a year (U13+) skyrocketed in the Great Recession, and is still higher than it had been even at the worst point of any previous postwar recession.

Source: Ahn and Hamilton (2014).

Why do people who have been looking for work a longer period have more trouble finding a job? One key possibility we consider is that those individuals started out in different circumstances. For example, workers who are permanently laid off have a harder time finding new jobs than those who quit voluntarily (Bednarzik, 1983; Fujita and Moscarini, 2013). Quitters might have been a big part of the original group of newly unemployed. But if most of them find a new job quickly, they will represent a smaller fraction of the group the longer that the group has been unemployed.

Suppose you divided workers into two groups, which we designate as type H and type L, and conjectured that the number of newly unemployed workers each month represents a mixture of the two types and further that there are differences in the probabilities that each of the two types will be successful in finding jobs. By keeping track of the dynamic accounting identities (somebody who’s been unemployed for 3 months at time t and doesn’t find a job will be unemployed for 4 months at t+1), observations on the 5 variables in the two graphs above are more than enough to determine 4 unknown magnitudes (inflows of type H and type L workers each month and fraction of each type who exit the pool of unemployed each month). Our statistical model also allows for measurement error (the true numbers may be different from those that are reported) and assumes that inflow and outflow probabilities for the two types change smoothly over time. We also use the extra information in the fifth observed variable to allow for the possibility that the process of being unemployed for a longer duration actually changes the individual, even if he or she started out initially just like everyone else.

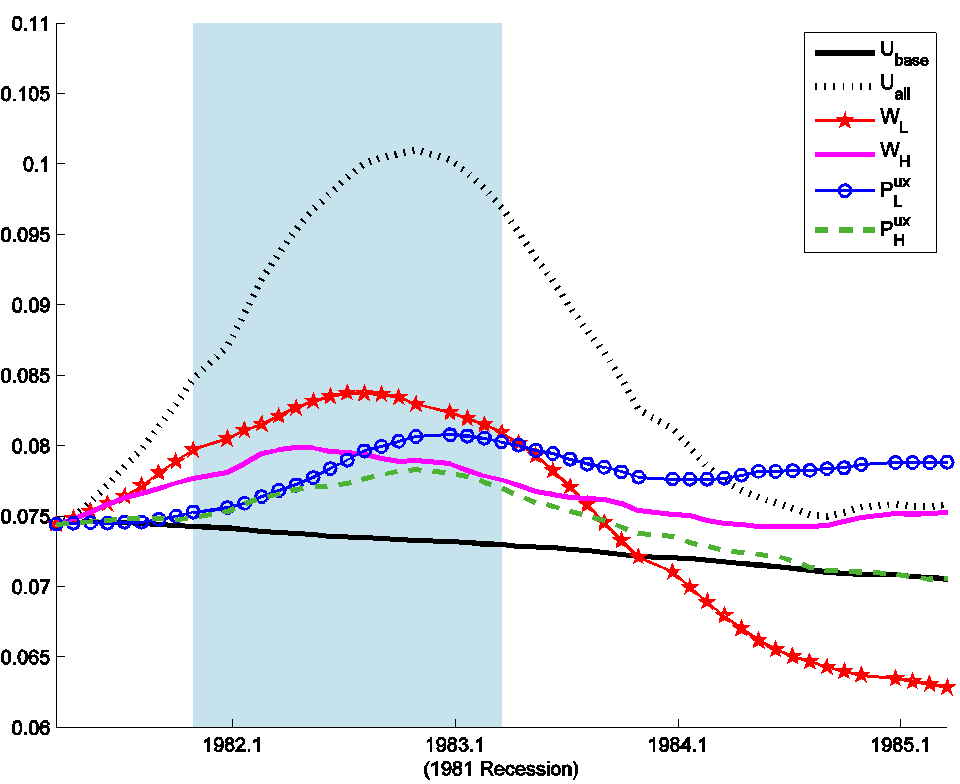

We find that in normal times, 90% of those who are newly unemployed would be characterized as type H, more than half of whom will likely no longer be unemployed the following month. But in most recessions, the single most important development is an increase in the number of newly unemployed type L individuals who end up having a more difficult time finding work. For example, here’s how our model interprets the changes during the recession of 1981-82.

Factors accounting for rise of unemployment in the 1981-82 recession. Solid black: unemployment rate as predicted prior to the recession; red: contribution to unemployment of unanticipated changes in newly unemployed type L workers; fuchsia: contribution of newly unemployed type H workers; blue: contribution to unemployment of unanticipated changes in the probability that type L workers will exit unemployment; green: contribution of changes in probabilities that type H workers will exit unemployment; hatched black: unemployment rate accounted for by unanticipated changes in all four factors together. Source: Ahn and Hamilton (2014).

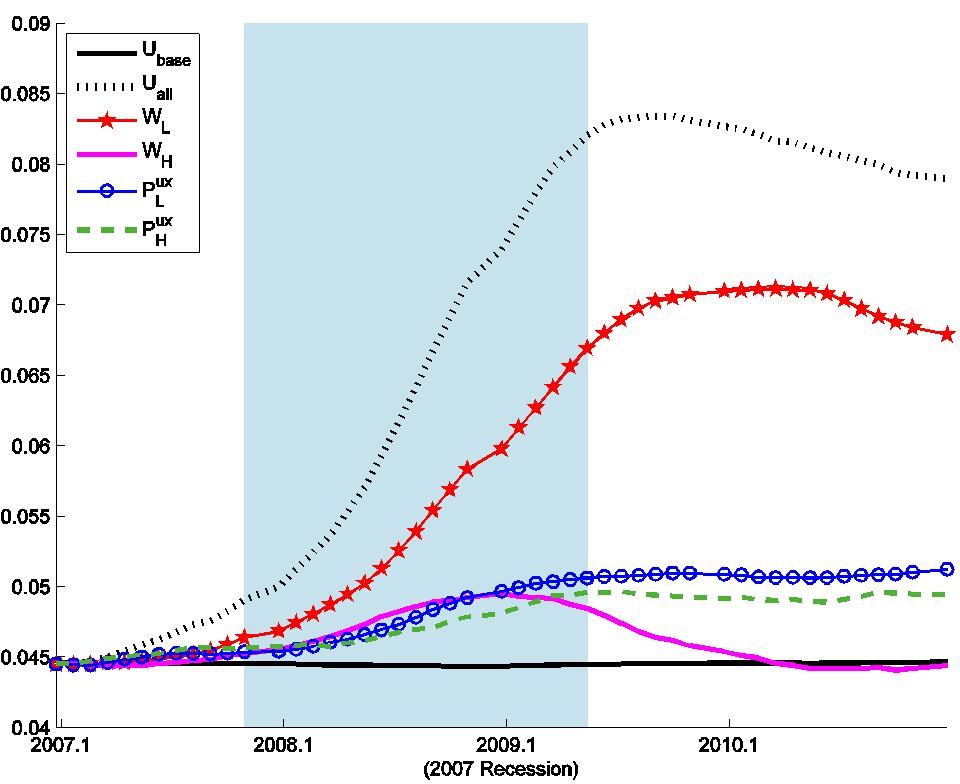

The overwhelming story behind the Great Recession is newly unemployed type L workers.

Source: Ahn and Hamilton (2014).

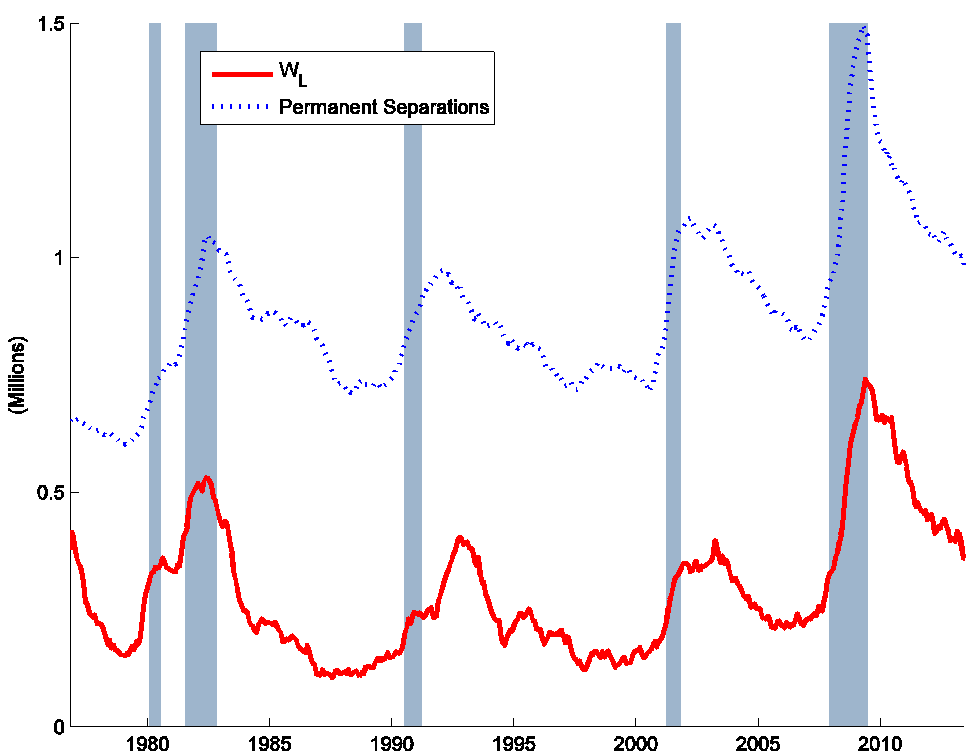

And who are these type L workers? Our statistical model infers these magnitudes solely from the aggregate numbers of Americans who have been looking for work for different amounts of time (the 5 series plotted in Figures 1 and 2 above). But it is very interesting to compare our estimates of the number of newly unemployed type L workers (the red line in the graph below) with separate measures (in blue) of the number of newly unemployed workers who lost their jobs as a result of what was described as a permanent job loss or a temporary job that has now ended. Though the red and blue series were arrived at in completely different ways, they look remarkably similar. Notwithstanding, our series for WL is on average only about half the size of the reported number of permanent separations. The indicated conclusion is that many of those experiencing permanent separations do not wait long before finding new work. Interestingly, Fujita and Moscarini (2013) found that significant numbers of those who initially reported their separations to have been permanent ended up going back to work for their old employer.

Source: Ahn and Hamilton (2014).

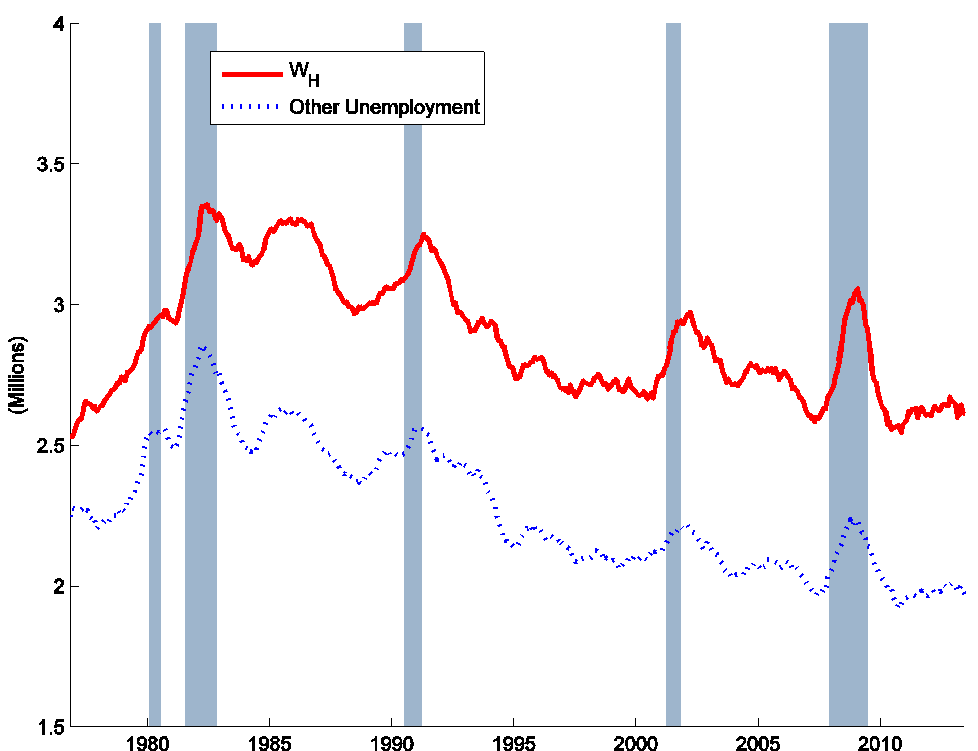

And here is our series for newly unemployed type H workers compared with those who were newly unemployed as a result of temporary layoffs, quits, or entrance to the labor force. Again the red and blue look like practically the same series but plotted on a different scale. Our conclusion is that the single most important difference between our designated type L and type H workers, and single most important feature distinguishing recessions from normal times, is the circumstances under which many people lose their jobs.

Source: Ahn and Hamilton (2014).

We also investigated an additional mechanism that could account for the differences in unemployment exit probabilities implicit in Figures 1 and 2 above, this being the possibility that the experience of being unemployed for a certain period of time actually changes the individual. Kroft, Lange, and Notowidigdo (2012) and Eriksson and Rooth (2014) reported interesting field experiments demonstrating that employers are less interested in hiring those who’ve been unemployed for a longer period of time. My research with Ahn finds evidence of different effects operating over different unemployment durations. If an individual has been unemployed for fewer than 6 months, an additional month of unemployment makes it less likely that the individual will exit unemployment the following month even when we condition on the worker’s type. This is consistent with what we call an “unemployment scarring” interpretation. On the other hand, we find that after 6 months, each additional month of unemployment makes it more likely the individual will exit unemployment, which we refer to as “motivational” effects.

It is interesting that this difference sets in around 6 months, which in normal times would be when unemployment insurance is exhausted. When we allowed potential scarring or motivational effects to be different depending on the eligibility for unemployment insurance that was likely to be in effect at each date, we found a significantly improved fit to the data. During times when most unemployment insurance would have been exhausted after 6 months, we found strong motivational effects beginning after 6 months, whereas during periods of extended eligibility, we failed to find much evidence of motivational effects until after 12 months. For additional supporting evidence, see Fujita (2011) and Farber and Valletta (2013).

If we decompose “unemployment exit” into “took a job” and “left the labor force” does the implication behind the phraseology “motivational effects” hold up? In other words, is the connection with the end of UI dominated by the loss of motivation to search hopelessly for a position, or by the increased financial motivation to accept greater mismatch in position parameters?

benamery21: Indeed we find in the data that many of the long-term unemployed “exit” unemployment by dropping out of the labor force. Discouragement is definitely part of what we intended to refer to by the label “motivational”.

JDH Interesting.

During times when most unemployment insurance would have been exhausted after 6 months, we found strong motivational effects beginning after 6 months, whereas during periods of extended eligibility, we failed to find much evidence of motivational effects until after 12 months.

But if the total number of jobs available is less than the number of people looking for jobs, doesn’t this finding about motivational effects imply that people who still have not exhausted their benefits will be even less likely to find a job? In other words, it’s hard to believe that greater motivation increases the number of jobs available, but it might very well motivate those without benefits to accept employment terms that they would otherwise reject? For example, the unemployed who have exhausted their benefits could be coerced into agreeing to “donate” labor hours as a condition of employment. In other words, does exhausting unemployment benefits increase total employment, or does it just contribute to a race to the bottom for a limited number of jobs?

Also, could there be something like an endogeneity problem here? Extended unemployment benefits are determined state-by-state based on the economic health of the local economy. So states that are in pretty good shape will not get federal funding for extended benefits. So one of the reason people lose their benefits is because the state’s economic position has improved. An improved economic condition makes it more likely that someone will find a job once those benefits are exhausted.

I hope you’ll be kinder to Hie Joo Ahn than you were to poor Cynthia. You made that girl work through all those T-Bill histories for you data base. 🙂

2slugbaits: Presumably some of the individuals end up taking a less desirable position than they were originally hoping for, or, as I discussed with benamery21 above, drop out of the labor force altogether. And you are correct about possible endogeneity– all we are reporting is a correlation, but I think an interesting one.

As for Cynthia, she is now a very successful professor at the University of Chicago who was just elected as a Faculty Research Fellow with NBER, an extremely prestigious recognition. Like Cynthia, Hie Joo is very smart, hard-working, and ambitious, and I expect she too will soon be a very successful and respected professor.

Speaking of “exit”:

https://www.youtube.com/watch?v=PkWPbarTgs0

https://www.youtube.com/watch?v=gY75dw64sqI

How many Millennials and unemployable older Xers and peak Boomers in the bottom 90% have given up on conventional paid employment because they haven’t “found what they’re looking for”, and won’t be able to find it, ever, and have “exited” the dysfunctional hyper-financialized economy and, by necessity, begun adapting to the “sharing economy”, heretofore known as the “underground economy”?

It’s coming down, man, but this time it’s the end game that started 40-45 years ago, the calculus of which the comfortable, self-satisfied next 9% after the top 0.1-1% have yet to recognize and thus be able to model and rationalize why they don’t have to worry. Hint: start worrying just about . . . now; it’s over.

There is no place to hide, so breathe, come clean, and smile; it’s What Is (“no-thing” else): Zen.

Most of that would be Boomers, but imo, their asset buildup was better than people think, coupled with savings from Medicare, create a “hearty” Boomer coalition that doesn’t want jobs and thus drives down the unemployment rate as they live a modest, but decent lifestyle.

Looks like to me, X is about nearing full recovery, before the year is out. “dropping” out of the labor force is always happening, but different cohorts bring different moves in their lives.

I’ve observed this “have enough cash” phenomenon with a significant number of my friends and acquaintances who were in finance. They had made very good wages and bonuses during the pre-2008 period and were in a position not to have to compromise downward after they lost their jobs during the recession. As a result, a number have sat out of the labor market for 4-5 years, and have recently been consuming the remainder of their savings. They’re now downsizing, and many of them are in the 50’s. In a strange way, their savings served them poorly. It allowed them to avoid adjusting quickly to new market conditions, and now they have a big hole in their resumes.

Who said:

“The classical school reconcile this phenomenon with their second postulate by arguing that, while the demand for labour at the existing money-wage may be satisfied before everyone willing to work at this wage is employed, this situation is due to an open or tacit agreement amongst workers not to work for less, and that if labour as a whole would agree to a reduction of money-wages more employment would be forthcoming. If this is the case, such unemployment, though apparently involuntary, is not strictly so, and ought to be included under the above category of ‘voluntary’ unemployment due to the effects of collective bargaining, etc.”

Another quote from a different source:

“Government unemployment insurance and welfare cause unemployment by subsidizing idleness. When a certain behavior is subsidized—in this case not working—we get more of it.”

While it may be just a small contributor to the overall picture, I have wondered about the effect of internet-based background checking and it power to transform people into unemployables. In previous recessions, if one had a questionable criminal background, bad credit, outstanding court orders, etc., you only had to move away, even in the same state, to get a relatively fresh start. In the 1980s, and 90s, criminal background checks were expensive and hardly something needed unless you were applying to a security position, likewise credit checks were unheard of (and fairly unreliable), and if you wanted to find liens you had to physically go to a court house. Now all of that information (and more) is available, competitively priced, from several internet providers; some even archive information so that erasure is impossible. For people who gained their position in let’s say, 1995 and lost it in 2009, it is a brave new world. A past felony conviction, misdemeanors, bankruptcy, garnishments, poor credit scores, are all used as automatic disqualifiers by many employers. Someone who had a criminal history in 1995, but managed to avoid disclosing it to an employer at that time, it must be astounded that after a lengthy employment period, that it becomes something that prevents your employment today.

This proves we need 12 years of unemployement benefits!!!!

-2slugbaits

Dr. M., where I work if you are an internal candidate for a new position you are subject to a new background check, and in the act of posting you acknowledge that this check could turn up something that had previously been missed, and you further agree (should this happen) to withdraw your application for the new position, and to then vacate your current position as well! No hard feelings! Some people are scared shitless to try to advance so they stay stuck where they are. We let several people go last year for this very reason.

But actually I think Steven does have a point. Some of the managers let go during our last round took the opportunity to hang out. Many had worked their entire adult lives without a break.

It has become increasingly harder to start a business, and make it succeed, because of excessive regulations, and federal, state, and local taxes, particularly on higher income workers, who tend to start businesses.

Also, I may add, Corporate America and Wall Street are frowned upon by more Americans. Moreover, it seems, America’s entrepreneurial spirit has been depressed.